-

Posts

7,527 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by Arkady

-

-

- Popular Post

3 hours ago, sas_cars said:Any change will be good as the current IM has already been the worse which could happen to the citizenship and PR applications

At least, if he does nothing, he is not the worst in recent memory. Thaksin's first IM Purachai signed nothing but rejected a lot of applications for PR out of hand for no particular reason other than he disliked foreigners (despite being a NZ PR himself) and knocked back a lot of citizenship applications to SB for recchecking, costing them around 3 years extra wait. One of the rejected PR applicants, as Swiss guy, sued in the Administrative Court because he knew he was perfectly well qualified but lost the case a few years later on the grounds that the minister is allowed to use his discretion for any reason. Thaksin got rid of Purachai after a year or two because he became too popular and thus became a threat to Thaksin. The Swiss guy would have done better to wait it out and reapply after Purachai got dinged.

-

2

2

-

1

1

-

1

1

-

On 5/1/2025 at 6:11 PM, GarryP said:

Had that been proposed by any other person in the government, I would have thought it a good idea. However, I would not trust Anutin as far as I could throw him and on top of that, there have been a number of instances where he has come across as xenophobic (to put it sort of politely). Not really the person you would want in control of establishing a new PR and citizenship policy.

Good point. If it were a proposal to put all of this under the BOI like the LTR visas which was done deliberately to bypass the dead weight and corruption of Immigration police and potentially other corrupt government agencies, it might be great. It is rather huge and unwieldy in that it needs offices nationwide for regular visas and WPs and smells of a power grab for personal reaons. A small office under the BOI or similar to take care of PR and citizenship only would be better.

-

1

1

-

1

1

-

-

On 5/2/2025 at 6:26 PM, scorecard said:

Here's a twist.

An old buddy from Oz has just completed the 2 years back in Oz to get the OAP and portability. He worked in LOS for around 18 years with WP for the same employer but WP expired after he left Thailand and went back to Oz.

Now soon back to LOS and a job all arranged with a similar employer, with WP.

He's found an agent to investigate whether he'll need to now complete 3 years with WP with same employer (starting soon as per paragraph just above).

Agent spoke to someone in Gov't. connected to PR matters (I don't know who) who advised 'more WPs not needed, the existing 18 years of WPs will very likely be accepted as proof of WPs'. (Taxes all paid).

My understanding was that PR applicants has to hold a WP at time of application and had to prove they had held the same WP for current and 3 preceding years.

Comments appreciated.

Sorry to say but I think the chances of this working are about as close to zero as you could get. There are many of this type of agent around who try to give false hopes, so you will hire them and then change their phone number and disappear. Like the one that was taking fees off farang retirees with a story that they had opened up a new PR category for foreigners who had been on retirement or marriage visas for 10 years. Vaporized after collected enough cash from the gullible.

There is no substitute for going down to CW and asking them or even calling them. They provide a free service.

-

1

1

-

-

4 hours ago, onthemoon said:

This is one thing where I agree with Anutin. I had discussions with different govt people about PR and citizenship and the whole inefficiency of the processes, but nobody wants to put energy into changing it as there are many Ministries and Departments involved, and they would have to coordinate and convince. With everything in one department, we would have somebody to talk to.

There is definitely a logic to combining PR and citizenship and putting the initial processing of applications in the same department that does the later processing. That is what the Prayudh government attempted to do with citizenship and the first Thaksin government attempted to do combining PR and citizenship. The Thaksin government attempt met fierce resistance from the police but we never found out why the Prayudh government attempt failed or why the revised citizenship ministerial regulations were never implemented. However, putting all of Immigration and WPs into the same department nationwide as well would be a huge undertaking.

Since everything to do with PR and citizenship always gets harder, I am suspicious that any changes would be for the worse for applicants.

-

There are reports in the media that Anutin is making a play to consolidate all Immigration matters including PR, work permits and citizenship. The Post ran with it today but this Thai post in the Standard, whatever that may be, is a bit more detailed. https://www.facebook.com/thestandardth/posts/update-กระทรวงมหาดไทยจ่อตั้งกรมกิจการคนเข้าเมือง-กรมใหม่ดูแลคนเข้าเมืองทั้งระบบว/1028475329411810/ . It seems a big power grab that would take a lot of functions away from the police and the Labour Ministry and probably increase government costs considerably as well as, no doubt, make everything harder for foreigners, if it ever comes to pass, even though consolidation would be rational and ought to simplify things. Everything might also move out of town to Lam Lukka or somewhere for Bangkok residents. I am sure the police and Labour Ministry will resist as far as possible. It would be a big wipe out for the police which is directly under the PM's office. It seems to call for a new Immigration Act which has not been amended since 1979 I think. Here is a google translate.

UPDATE: The Ministry of Interior is preparing to establish the Department of Immigration, a new department to oversee the entire immigration system. Today (April 29), it was reported that Anutin Charnvirakul, Deputy Prime Minister and Minister of Interior, wrote a letter to the Chairman of the Immigration Review Committee, chaired by the Permanent Secretary of the Ministry of Interior, in late 2024 to propose the establishment of a subcommittee to establish the Department of Immigration. Because the Ministry of Interior has missions related to security, taking care of the happiness and well-being of the people from birth to death, both Thais and foreigners, as well as missions regarding various rights under other laws resulting from traveling in and out of the Kingdom, such as applying for residence in the Kingdom, applying for work permits, applying for Thai nationality/losing Thai nationality, and applying to have a name in the population register. In addition, an important document from 2017 that was recently disclosed states that the Cabinet had resolved on January 10, 2017 that the Ministry of Interior would be the main host in considering and proposing guidelines for integrating missions related to immigration, with the Office of the Council of State (the committee 😎) being the new legislative body called ‘Immigration Act’ to officially support the establishment of the ‘Department of Immigration’ A letter from the Office of the Secretariat to the Cabinet signed by Thiraphong Wongsiwawilas, Deputy Secretary-General to the Cabinet, stated that this new law is urgently needed because the current immigration management system is scattered among several agencies, including the Ministry of Interior, the Royal Thai Police, the Ministry of Foreign Affairs, and the Ministry of Labor, which results in duplication and lack of unity. The document also lists three important guidelines: 1. Agree in principle to combine immigration-related missions from several agencies under a single agency, with the Ministry of Interior as the center. 2. Have the Ministry of Interior draft a new Immigration Act and coordinate with relevant agencies, including the Council of State, to obtain a comprehensive and systematic law. 3. Agree in principle to establish the Department of Immigration and have the State Enterprise Policy Committee and the Office of the Civil Service Commission (OCSC) jointly consider the format and guidelines for establishing this new department systematically. Although this project began in 2017, there has only been clear progress in the current government. Under the push of Anutin Charnvirakul, Deputy Prime Minister and Minister of Interior, it is expected that the Department of Immigration will become an important cog in the government's drive for a comprehensive population management system and may affect structural changes in the Immigration Bureau (IB) and the Department of Employment in the future. .

-

There are reports in the media that Anutin is making a play to consolidate all Immigration matters including PR, work permits and citizenship. The Post ran with it today but this Thai post in the Standard, whatever that may be, is a bit more detailed. https://www.facebook.com/thestandardth/posts/update-กระทรวงมหาดไทยจ่อตั้งกรมกิจการคนเข้าเมือง-กรมใหม่ดูแลคนเข้าเมืองทั้งระบบว/1028475329411810/ . It seems a big power grab that would take a lot of functions away from the police and the Labour Ministry and probably increase government costs considerably as well as, no doubt, make everything harder for foreigners, if it ever comes to pass, even though consolidation would be rational and ought to simplify things. Everything might also move out of town to Lam Lukka or somewhere for Bangkok residents. I am sure the police and Labour Ministry will resist as far as possible. It would be a big wipe out for the police which is directly under the PM's office. It seems to call for a new Immigration Act which has not been amended since 1979 I think. Here is a google translate.

UPDATE: The Ministry of Interior is preparing to establish the Department of Immigration, a new department to oversee the entire immigration system. Today (April 29), it was reported that Anutin Charnvirakul, Deputy Prime Minister and Minister of Interior, wrote a letter to the Chairman of the Immigration Review Committee, chaired by the Permanent Secretary of the Ministry of Interior, in late 2024 to propose the establishment of a subcommittee to establish the Department of Immigration. Because the Ministry of Interior has missions related to security, taking care of the happiness and well-being of the people from birth to death, both Thais and foreigners, as well as missions regarding various rights under other laws resulting from traveling in and out of the Kingdom, such as applying for residence in the Kingdom, applying for work permits, applying for Thai nationality/losing Thai nationality, and applying to have a name in the population register. In addition, an important document from 2017 that was recently disclosed states that the Cabinet had resolved on January 10, 2017 that the Ministry of Interior would be the main host in considering and proposing guidelines for integrating missions related to immigration, with the Office of the Council of State (the committee 😎) being the new legislative body called ‘Immigration Act’ to officially support the establishment of the ‘Department of Immigration’ A letter from the Office of the Secretariat to the Cabinet signed by Thiraphong Wongsiwawilas, Deputy Secretary-General to the Cabinet, stated that this new law is urgently needed because the current immigration management system is scattered among several agencies, including the Ministry of Interior, the Royal Thai Police, the Ministry of Foreign Affairs, and the Ministry of Labor, which results in duplication and lack of unity. The document also lists three important guidelines: 1. Agree in principle to combine immigration-related missions from several agencies under a single agency, with the Ministry of Interior as the center. 2. Have the Ministry of Interior draft a new Immigration Act and coordinate with relevant agencies, including the Council of State, to obtain a comprehensive and systematic law. 3. Agree in principle to establish the Department of Immigration and have the State Enterprise Policy Committee and the Office of the Civil Service Commission (OCSC) jointly consider the format and guidelines for establishing this new department systematically. Although this project began in 2017, there has only been clear progress in the current government. Under the push of Anutin Charnvirakul, Deputy Prime Minister and Minister of Interior, it is expected that the Department of Immigration will become an important cog in the government's drive for a comprehensive population management system and may affect structural changes in the Immigration Bureau (IB) and the Department of Employment in the future. .

-

1

1

-

1

1

-

-

Many PRs are wondering if they really need to fill in the TDAC before arriving in Thailand. Since it replaces the TM6 arrival card that PRs didn't have to complete, it seems illogical for them to complete the TM6's replacement. However, there is no specific exclusion for PRs in any of the stuff put out by Immigration who have often completely forgotten about PRs when important new regulations are put out, During COVID they allowed people with WPs to come back to Thailand but left PRs without WPs stranded until enough people complained. When they introduced multi-entry visas for NON-Bs they forgot to include PRs in the order and we had to continue buying re-entry visas one by one for another year, until someone got around to issuing a new order.

This website seems to require PRs to complete the TDAC https://tdac.in.th/#who-must-submit . If you scroll down you will find this:

2. Personal Information

- Date of birth

- Occupation

- Gender

- Visa number (if applicable)

-

Country of residence

Long-term or permanent foreign residents in Thailand are advised to select 'Thailand' under 'Country of Residence', which will be available once the system is activated.

- City/State of residence

- Phone number

It is hard to know by foreign permanent residents they mean genuine PRs or other long-term foreign residents, including those on some of the new fangled, costly long-term visas introduced by the Prayudh government with weird names like digital nomad visas. However, taken at face value it looks as if PRs do have to comply, even though there is no logic to this, given that they are, well, permanent residents who didn't have to complete TM6s and have blue tabien baans showing where they live, even if they and the majority of the Thai population mat not live at their registered addresses. Perhaps when they realise the pointlessness of this, in a year or more's time they will issue an order exempting PRs but I am not holding my breath. On the other hand it seems pretty easy to fill in the form and "Kingdom of Thailand" is indeed on the menu of countries of residents on the form.

For those unable to fill it in, there is a limited assisted service. So PRs who feel they shouldn't fill it in, can use the assisted service, if they are told they should have filled it in. Anyway it seems you can fill it in any time within 72 hours of arrival. So you should be able to do it in front of the Immigration counter.

For PRs who are travelling in May and are uncertain, it might be an idea to ask the advise of the IO who stamps you out at the airport when you leave.

-

1

1

-

I applied about the same time as Scorecard when we thought it was really difficult but it was actually much easier (and much less expensive) than it became only a few years later. I used the business category which I can also confirm is the most widely used category and the least hassle. The poster who said it is difficult may have confused it with the investment category which is more difficult because the business you have invested in needs to undergo detailed scrutiny in addition to yourself and you still need a WP. So business owners are advised to apply under the business category and save the trouble.

The category where everyone seems to get rejected out of hand, is the humanitarian category for those who have a Thai wife and/or kids but are not working in Thailand. With a Thai spouse they may be able to make the minimum income requirement using the spouse's income. This category may have been added with good intentions but the reality is that your application will be rejected out of hand by the good folk at CW, if you attempt to apply under this category without also having a WP which is in the list of required documents for the category. Someone reported in this thread that he went to CW with a Thai lawyer who forced them to accept his application without a WP on the grounds that the regulations do not specifically require one (other than on the checklist) and it is after all a humanitarian category. The lawyer did manage to get them to take his application with ill grace but we he never posted again, leading to the suspicion that his application went into the circular file at CW,

I had 7 years of WP when I applied like Scorecard because in the absence of threads like this one I didn't have a clue how to apply or what the requirements were until I really looked into it. There was a lot of misleading information around and people variously said you need 5 years or 10 years with a WP, neither of which was true. It was officiallly 3 years and I am not sure, if 7 years' WP were required unofficially. It was certainly not true that you had to be with the same company for 7 years or even 3 years. A colleague of mine had to change companies because we shut down our business entity and entered into a jv with a Thai company. He applied after less than a year with the same company and got his PR. Another colleague tried to apply in about 2015 but was told they had just introduced a requirement to be with the same company for one year and was told to re-apply the next year, if still with the same company. Some time after that they introduced the requirement for 3 years with the same company which is the current requirement.

In the 90s before the xenophobic Thaksin regime put the blight on PR and citizenship applications and slowed everything down, Immigration undertook to approve all successful applications before re-opening the window for the next year's batch and were generally able to achieve this. There was 3 batches of PR approvals in March, September and December after 3 meetings of the Committee for PR, I was in the December batch which was nearly 12 months after I applied. A friend who was very proud of his wife's senior police connections was approved in the June batch only 6 months after he applied. My approval was signed by the outgoing PM and interior minister who had just dissolved parliament but made a point of clearing his desk at the Interior Ministry before he went. Sadly hat seems a bygone age now. Today we hear nothing but reports new measures needed to combat foreign criminals living in Thailand.

-

2

2

-

-

- Popular Post

- Popular Post

On 2/20/2025 at 9:36 AM, onthemoon said:True. Actually, the ID for PR holders should have another colour, as pink IDs are associated with migrant workers. Also, foreigners with non-B and without PR can get the pink ID now.

And the White Book has no meaning anymore since the introduction of computers at immigration (see auto-gates: no stamp).

And the brownish-red Police Book has no meaning since the police use computers, and since the pink IDs have been introduced.

These books are just a waste of money. I wonder why they don't just streamline it and do away with those books. They don't even need to be replaced with anything - all data is in the computers already. Priority for PR holders or not, this is government money that can be saved.

Just my idea to help the Thai government.

It would be in everyone's interest to issue a smart card for PRs but who knows, if they will ever get around to doing this. The concept behind the red book when it was introduced following the first Immigration Act in 1927 was that it should act an alien ID document to help control the Chinese community who were difficult for Thai police and other authorities to track and many were believed to be involved with triad criminal organisations. So it was ahead of its time to issue foreigners with ID docs they were supposed to carry everywhere because Thai citizens didn't get ID cards until after the first census of, I think, 1954. Perhaps they still have substantial stocks of the red book blanks printed in 1927 they need to use up.

If they issued smart cards for ID, it would follow that the red books would have to be scrapped and pulped or burned, regardless of how much stock they still have. Smart cards are issued by DOPA at district offices. So the section at CW that does nothing by issue red books would be redundant. So would the alien registration officer in each police station in Bangkok and maybe qutie upcountry whose job is just to sit there waiting for aliens to come in to have new books issued or renew old ones. Of course district offices would not need to add any staff. They are already issuing pink cards to PRs anyway. So it would be a big staff saving and cracking of iron rice bowls of indolent civil servants that the police would fight tooth and nail to prevent or delay, since it is inevitable that it will happen one day. Add to that the blue and white books that have been made redundant by immigration e-gates and another entire section of Pol Snr Sgt Majs at CW would be forced to play with their phones all day without interruption by the occasional PR.

Now they have other types of long term visa, they may as well issue smart cards for them too. Indeed they could issue an ID card for NON-B visas too and stop giving expats the ridiculous pink non-smart cards that state the holder is not allowed to go out his district without permission of the district officer.

If this were a private company, all this would have been done decades ago.

-

2

2

-

1

1

-

I tried to upload the Nationality Act, as requested about but it seems that AN no longer accepts Pdf or Word files for uploading which makes it difficult. I don't have a link on hand but there are plenty online. One thing to be wary of is that you need the 1965 Nationality Act, as amended up to 2008. There was also an amendment act in 2012 but I don't think any of it was relevant to naturalisation, although there was important stuff for those born in the Kingdom after 1992 and displaced Thais from neighboring countries, whose ancestors lost Thai nationality in the after the bits of neighboring countries seized by Thailand under Japanese auspices in WW2 were taken back by the European powers after the war.

Re digital WPs. Has anyone used one to apply for citizenship yet. Do you get a print out that you can keep for your records. This would certainly be an issue for anyone changing jobs in the 3 year qualifying period. Previous legislation allowed you to keep the cancelled hard copy version. I did this by quoting the Working of Aliens Act at them and they gave it to me with very bad grace. But that law was superseded by a Royal Decree of Prayut's.

-

1

1

-

-

10 hours ago, onthemoon said:

I have no doubt about that, I'd be interested to see the original, so I can check whether this applies at time of application or through the whole process until citizenship is granted.

When I was applying SB showed me a Korean guy's naturalisation certificate that was about to be presented and I asked how it took. She had a quick look in the file and said "11 years" with some embarrassment.

-

1

1

-

-

On 9/17/2024 at 5:15 PM, onthemoon said:

They asked for the WP, but we don't know what would happen if you say you have retired in the meantime. After all, the process is taking very long. Is there a regulation stating that you have to have a WP during the whole process, including oath and finally picking up the result? Or until when? I would hope the regulation - when scrutinised - should say that you have to have one at time of application.

If you go to the interview and tell them, or they somehow find out, that you have retired since you applied, that will be the end of your citizenship application. It would also be the end, if they found out you had been unemployed for a bit, since you applied, and were back in work but with a gap in your WP. I know this for a fact because I had the experience of sitting down at the MOI with the head of the nationality section as she thumbed through my old and new WPs to check there was no gap. When she had finished, she said, "I am so glad that was all in order, Khun Arkady, because, if I had found a discrepancy, I would have regretfully had to reject your application."

The problem is that the Act requires you to have an occupation and they interpret this as an ongoing requirement until your approval is published in the RG. However, there are unlikely to be checks after the interview, Even at the oath swearing SB has not historically been strict on WPs, although they do ask for copies and maybe the original. In that kind of situation best to say the WP is with your HR dept because the are changing the name of the company (actually happened to me) or something.

The reason SB give for the strictness over remaining in employment is because the requirement for an occupation is in the Nationality Act. Yes the length of time you have to wait for an interview these days makes it seem unfair but this is Thailand and it looks like they are getting stricter in enforcing this than in the past.

-

2

2

-

-

On 9/7/2024 at 2:14 PM, Lorry said:

Dr Google is NOT recommended for anything.

And in this specific case, relying on Dr Google can easily kill you.

Many people take regular medications they really, really need, but which cannot be combined with Paxlovid. So a doctor has to decide how to handle this: reduce or stop the regular medication for a while? Monitor the patient closely? Don't use Paxlovid?

That's an important point. You need to stop statins, such as Lipitor, while taking it or the side effects can be quite serious and there may be other common meds that clash with it. My brother-in-law was not allowed to take Paxlovid at all due to the cancer medication he was on and couldn't stop. He was given Molnupiravir instead.

-

- Popular Post

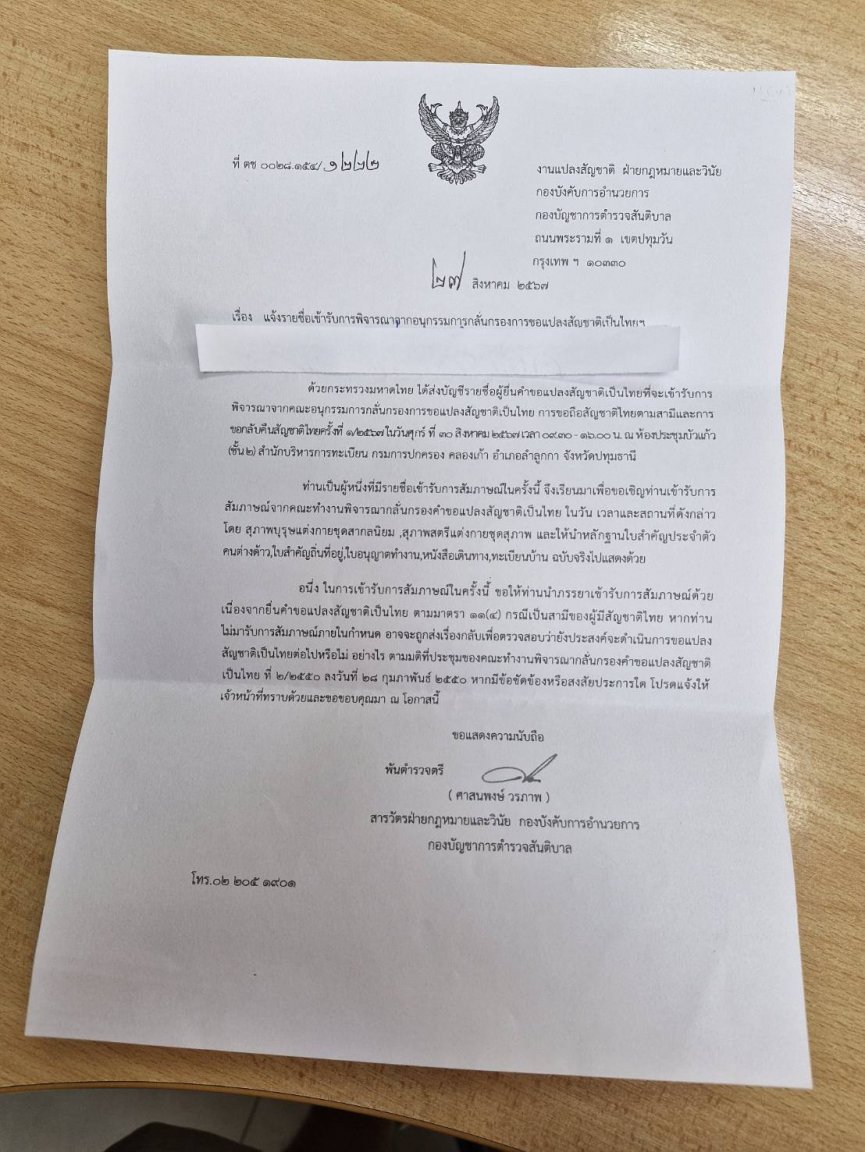

On 9/1/2024 at 10:14 AM, saakura said:Thank you and yes, the news is correct. On 29th Aug, I got a call from SB asking if I still remember having applied for citizenship and if I could attend the MOI committee meeting the next morning. He further asked me if I was still working at the same job and staying in the same residence. An official invitation was sent by email (attached here) asking to carry original PR, WP, Thabien Baan and PP.

Upon reaching next morning, they only asked for a copy of my WP and tax submissions for 2023 (which I did not have and explained that it was not mentioned in the letter. They accepted to receive it by email but no mention of it was made again and I did not ask). The interview itself lasted about 7 minutes with very general banter about work, family, hobbies, food etc. Thank you for all the support and I will update any further developments.Excellent news that they have resumed interviews at long last.

The bad news is they are asking for tax returns and WPs at the meeting. That will sink people who have ceased working before the interview. That has always been a significant risk.

-

1

1

-

1

1

-

1

1

-

On 9/3/2024 at 5:45 PM, GarryP said:

The pink card must be relatively new as I never had one when I applied.

I don't think you need a pink card to apply. Some going back a year or so offered copies of his pink card and they refused to take it. As far as a I know it it something that district offices are obliged to issue under the Civil Registration Act but there is no law saying foreigners have to have one.

-

On 9/4/2024 at 11:21 AM, Lorry said:

Thx for posting.

I hope you are doing fine.

I know that ARI clinic in the parking lot of Samitivej Sukhumvit.

May I ask what time of the day you went there and how fast (or slow) things went there? Did they do PCR or ATK?

I am asking because I just had a not so good experience at another private hospital, not too far from there by taxi, where things went very slow.

BTW I can confirm that Paxlovid is available at Samitivej, for the price quoted by Arkady, 24,960.

I went to the ARI clinic at Samitivej Sukhumvit about 10.00 am. I was out about 40 minutes latter. They gave me an ATK test. A PCR test was available but the results take about 4 hours. I might have had that and other tests done, if the ATK was negative but it was positive.

The chest X-ray showed signs of incipient pneumonia. So the doctor told me to come back for a follow up X-ray 5 days later by which time my lungs were back to what they were before. I felt completely better by then in all aspects except that I still had mild sore throat.

I now realise that my insurance with AXA UK will not cover the entire cost of the drugs, as there is a cap of GBP 500 a year for OPD drugs. I think it was still worth it because I have no way of knowing how sick I would have been without the Paxlovid and it did seem to clear things up in 24 hours. It might have been the same without it but better not take the risk, I think. The other medication I was given was an antihistamine, Pseudoephedrine decongestant (only available in hospitals since 2012), bronchdilating medicine to dissolve in water, codeine for cough suppression (also only available in hospitals) and paracetamol for fever.

My experience with Paxlovid was a lot better than when I took it in 2022. It did seem to work then but I got the famous but milder rebound symptoms after about 2 weeks. That time I tested positive for 21 days vs only 5 days this time.

Apparently Paxlovid is available in pharmacies like Siam Drug. I don't know their price but it should be cheaper than in hospitals.

-

1

1

-

1

1

-

-

2 hours ago, saakura said:

Same with me, the process with SB to MOI took just a few months and I also had the NIA interview at their rented co-working space in some Bangkok Soi during the Covid lockdown. Whichever party rules the Interior Ministry gets to appoint their cronies or shuffle all the provincial governors and disburse central budget funds to the provinces. Thereby gaining enormous political clout. So Anuthin will fight to keep it.

There are many reasons why the MOI is a sought after prize, both financial and political. The ministry is involved in organizing elections.

-

1

1

-

-

On 8/17/2024 at 11:20 AM, saakura said:

Thank you @Arkady for your comforting last few lines. I am waiting patiently since 2020 but getting apprehensive with the latest political developments. I hope some mob or the other does not come out on the streets yet again.

Seems like Ung Ing is going to take about 3 weeks to form a cabinet and claims she will start afresh rather than stick with the Srettha choices. I still think Anutin is in a strong position with the second largest party and will bargain hard to keep the Interior which is, after all, regarded as the prize ministry. But we'll have to wait and see what happens.

Mobs don't necessarily slow things down. The red shirts were occupying Ratchprasong in front of National Police HQ during my application with SB and the NIA called me for interview at McDonalds Ratchprasong which was being used for R&R by senior red shirt figures, some of whom I recognized. It was only possible to get there on the BTS, as the roads were blocked. It didn't slow things down a bit. The police worked as normal iwith the racket of the loudspeakers in front of their HQ and my application was forwarded to the MOI within three months of starting the process with SB. Delays only happened at the MOI.

-

1

1

-

-

- Popular Post

I expect we have all been watching the political pantomime over the past couple of days with amazement and wondering what it might mean for citizenship applications. I doubt the minister will sign any approvals while he is in caretaker minister status but that probably won't make any difference, as there is no evidence that he has signed any, since taking over the job. Since the new PM has already been voted in, I don't think there will be much delay in appointing a new cabinet and getting their Royal endorsements, so they can officially start work. Media reports suggests there will not be much change from the Srettha cabinet and, if true, that would suggest things are already pretty much agreed and there will be minimum horse trading and delays.

Since Anutin seems to have gained clout over Thaksin and Pheua Thai during the course of the Srettha government, I would expect him to retain the Interior Ministry which is a very powerful portfolio that he obviously liked and would want to retain. If that's the case, then there is likely to be little change in the current snail like speed of processing applications beyond the SB level. If it is someone new, we will have to wait and see what is his approach to citizenship and what sort of priority he places on it. If it's any consolation, there have been several slow periods in the last couple of decades but they never last for ever. Sooner or later the logjam breaks and things start moving again.

-

1

1

-

2

2

-

- Popular Post

On 7/25/2024 at 4:01 PM, thaiowl said:I applied for PR in 2007 and eventually got it in 2012. I was thinking about applying for citizenship but didn't bother in the end. Don't need to own land/business and am retired, so no need to work. In hindsight, I should have applied for citizenship and not bothered with PR.

You should not feel so bad because you could not have applied for citizenship based on marriage in 2007. The Nationality Act was only amended to allow for that in 2008 and it was not well known that this was possible until 2010. SB admitted to me that the MOI didn't like that amendment and instructed them not to give any information about it, unless people knew and specifically asked. It is a matter of timing. If you had been making the decision a few years later, it would have been a no brainer to apply for citizenship but in 2007, PR was your only option.

-

2

2

-

1

1

-

1

1

-

- Popular Post

I tested positive for COVID in Bangkok yesterday. I had two days of mild symptoms, no fever and negative tests. The second day it got better and I thought it was a common cold. Then I woke up in the night feeling really bad with fever, terrible headache, sinus pain, worsening cough and runny nose and unable to eat anything. I went to Samitivej Sukhumvit and found they had set up a COVID clinic in the car park with a chest X-Ray facility in the car park. There were several other patients there. The doctor prescribed Paxlovid which I accepted and the cost was 24,960 baht which is reasonable at least, if compared to the US and Bamrungrad prices. I have taken three doses of Pax now and feel almost better already 24 hours later. It might not have been the Pax. On the other hand I might have continued to deteriorate without it. Luckily my UK insurance will pay as I called them in the traffic jam on the way to the hospital.

For my previous dose of COVID in 2022 I was in the US and was given Pax free as a foreigner at a CVS branch, as that was government policy at that time. That time I took it about 12 hours after symptoms started and never felt really ill at all, although I had a vaccine three weeks earlier. I haven't had a vaccine now since Jan 2023.

My feeling is that Paxlovid is worth it for oldies and other high risk people, although it is a tough decision, if you don't have insurance that will cover it. If you get seriously ill and have to hospitalized, it will cost into the hundreds of thousands of baht.

-

1

1

-

1

1

-

2

2

-

- Popular Post

In Vang Vieng in Laos there have been many tourist deaths caused by the mixture of tubing and alcohol. I expect the same is true in Pai but reporting is suppressed.

-

1

1

-

5

5

-

1

1

-

1

1

-

23 hours ago, saakura said:

Oh wow, thanks. I did not know that there is a big & small MOI Committee.

The big committee meetings are contingent on the little committee meetings and usually take place quite soon afterwards. I expect they would have organized things so that a big committee meeting was held to clear the last little committee approvals under the previous government, as they could guess a new government might stonewall them and they have gone to the trouble of interviewing them. However, that is just my guess work. If that was done, there is no need for big committee meetings at this point. Unfortunately the minister can stonewall applicants already approved by the big committee under the previous government indefinitely. It says in the Nationality Act that it is up to his discretion. I expect the logjam will break eventually. It is unusual for nothing to move forward at all under a particular government but it can be precious little.

-

2

2

-

-

- Popular Post

On 7/6/2024 at 9:51 AM, onthemoon said:I was with a bunch of Germans last night before the football match, and a discussion about Thai citizenship came up. These rumours are floating around, and I wonder whether anyone can confirm or deny:

1.) According to a new regulation about acquiring Thai citizenship, 5 years PR is not required anymore if applying on basis of business. Only a work permit showing that you have worked here for 5 years is required.

2.) For Germans only: With the new citizenship law in Germany that started last week, Germans don't need to apply to keep the German nationality before getting the Thai nationality. Dual citizenship is now automatically and officially allowed.

I have my doubts on both of these and am looking forward to comments. Thanks.

There has definitely been no new regulation issued regarding citizenship since the current regulations were issued in 1967. New regulations were drafted in 2022 but have never been issued and they didn't include the provision you mention. Superficially it looks theoretically possible to do because the Nationality Act specifies 5 years' "residence" but not PR. However, the intent behind that wording when the current act was issued in 1965 was clearly PR. This is because it would not have been possible to accumulate 5 years' residence, while working in the Kingdom, without PR at that time. There were no NON-B visas or marriage extensions then. There was only PR and visas of a maximum of 3 months. You could do business on a 3 month visa, as there were no WPs, but you would have had to keep leaving the country and coming back to apply for another 3 month visa which would not have counted as continuous residence. No one would have tried because it was so easy to get PR in those days. I doubt this would be changed within the life of the current Nationality Act and don't see why any bureaucrats or politicians would have an interest in making such a change. When the act was amended in 2008 to allow men with Thai wives to skip PR, it was a big deal and was resisted by the MOI, which successfully diluted the original bill that would have allowed foreign males to get nationality without working in Thailand to have parity with foreign females married to Thais. But in that case there were Thai women's rights advocating for Thai women to get equal rights for their foreign husbands and the bill was sponsored by a lady Democrat party MP. Who would push for those without Thai spouses to get nationality without PR? Getting PR first is a very normal requirement for citizenship in developed countries, including countries with large scale immigration. Thai police would be very unhappy about this, as it would put their PR sections at Immigration virtually out of business, except for those from countries that prohibit dual citizenship.

I see you have already answered the question about Germans who are now liberated from the former racist law aimed at preventing Turkish guest workers and their families from obtaining German citizenship. Very sad for Thais living in Germany who were forced to renounced their Thai nationality to obtain German nationality, as there seems to be no easy way to recover it. Under Section 23 of the Nationality Act Thai women who got German nationality through marriage can apply to recover Thai nationality but they need to submit divorce papers. Section 24 seems to say that other former Thais may also apply to recover Thai nationality but it must be done within two years of reaching the age of majority. I am not sure about this section but I guess it refers to children of Chinese immigrants who got Thai nationality through birth in the Kingdom but lost it for some reason, perhaps because they went to study in China for more than 5 years. Anyway I am guessing it is redundant today.

-

1

1

-

1

1

-

1

1

Question regarding condo purchase with spouse (both foreigners)

in Real Estate, Housing, House and Land Ownership

Posted

I agree it makes sense to do whatever is necessary to put both names on the chanote for the condo. That way, in the event of one of you predeceasing the other, the surviving spouse only needs to transfer half of the property. That would reduce the amount of tax and fees at the land office. There is a reduced rate of tax for transfers to direct family, as in the case of inheritances, but I do not think it applies to foreigners. I transferred a half share in my house from my Thai wife to myself when I obtained Thai citizenship but was told at the Land Office the reduced rate didn't apply to me because I was not Thai at the time the property was purchased in the wife's name. So I had to pay the full rate on half the appraised value of the land and house which annoyed me but nothing could be done about that. I came across the same regulation in a Land Office in another province later on which confirmed that this nonsensical regulation does exist.

The reduced rate not being applicable to foreigners would make it more worthwhile to have both names on the chanote.