-

Posts

2,586 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by RSD1

-

Or it could go the other way. People could stop buying from stores and just buy online because they don't want the hassle of all the paperwork required to buy from a legitimate shop in the future. I assume the online vendors will still operate rogue, the same way they do now. Anyway, no need to do anything for at least 60 days. You can still buy whatever you want from any store at the moment without any restrictions. No point to even get a card at this point. 60 days from now, the whole thing could still be waffling around or even scrapped, with no requirements for a card or prescription ever needed. So it's best to just watch and wait to see what happens. The information from the shop that I posted above only requires an ID card at the moment to purchase from them going forward. But I assume many of those shops around Sukhumvit probably aren't requiring anything yet at all, especially street stalls.

-

Yes, more or less. You need to get a medical use card first for 500 Baht and then pay 200 Baht more for the prescription. The photos I posted above shows samples of both items. As stated, sleep disorder is all that is required to get the card and prescription. Then renew the prescription for a 30 day period whenever you want to buy more cannabis. Otherwise, no need to renew the prescription if no plans to buy more. And just keep a valid card at all times and renew the card once a year for 500 Baht to avoid any problems.

-

More information from a shop that I am familiar with (Thai translation of their message into English): "I was just informed that the government is now giving 2 months until August 31st for people to prepare for the changes. Customers must bring their herbal prescription card going forward to buy at the store. Right now, just your ID card is enough to purchase cannabis, if it is not yet convenient for you to go and get your herbal prescription card." There is information below that they also shared from a clinic that is offering the Medical Marijuana Use card. Apparently the cost is 500 Baht for the card, plus a 200 Baht fee for the prescription. Total is 700 Baht. The card is valid for one year, but the 200 Baht prescription is only valid for one month and needs to be renewed once it expires after 30 days. But if you don't plan to buy cannabis every month then you only need to renew the prescription whenever you plan to buy more cannabis. The clinic below will also issue the prescription renewals online I believe so that a visit to the clinic is not required to renew the monthly prescription. Apparently they will also issue a card and prescription to anyone that states that they have sleeping disorders. 📌 ขึ้นทะเบียนผู้ป่วยกัญชาทางการแพทย์ 💻ออนไลน์ Telemedicine Consultant ☑️ขึ้นทะเบียนออกใบรับรองแพทย์ 3 เดือน “ฟรี” ถึงวันที่ 4 ก.ค. 2568 เฉพาะเข้ามาทำที่คลินิกเท่านั้น 1. บัตรสมาร์ทการ์ดผู้ป่วยกัญชาทางการแพทย์ 1 ปี พกพาสะดวก จะลิ้งค์ข้อมูลของคลนิกและตรวจสอบประวัติการป่วยการใช้กัญชาผ่านเจ้าหน้าที่ หรือใช้แทนใบรับรองแพทย์แบบกระดาษ (กรณีไม่จำเป็นต้องใช้แบบกระดาษ) 2. ใบรับรองผู้ป่วยกัญชาทางการแพทย์ เพื่อยืนยันการเป็นผู้ป่วยใช้เพื่อรักษา (กรณีจำเป็นใช้แบบกระดาษเพื่อยืนยันบริษัทหรือสถานที่ทำงานที่ร้องขอเอกสาร) 3. ใบสั่งจ่ายสมุนไพรควบคุม (กัญชา) จากแพทย์ เพื่อซื้อช่อดอก 30 กรัม/เดือน จากร้านจำหน่าย หรือสถานพยาบาลที่ได้รับอนุญาตเท่านั้น ➖➖➖➖➖➖➖➖➖➖ ✔️ทำออนไลน์กรอกข้อมูลทำประวัติที่นี่ : https://forms.gle/xJXArVGiXAUfY3T59 ✔️ตรวจสอบการอัพเดทรายชื่อที่นี่ : https://docs.google.com/document/d/13Ivs1Vt1vHHO0cvcoX_y8RClP1o3dvmF/edit?usp=drivesdk&ouid=116125976538520321934&rtpof=true&sd=true ✔️ติดต่อเจ้าหน้าที่หรือสอบถามที่นี่ : https://lin.ee/q3d429a ✔️แผนที่คลินิก : Maps ; https://maps.app.goo.gl/1MMwMwnFXzvtobaS7?g_st=ic ➖➖➖➖➖➖➖➖➖➖ 🚫 คำเตือน : ระวังมิจฉาชีพ 🚫 👉🏻ให้กรอกจากลิงค์ที่แอดมินส่งให้เท่านั้น ห้ามกรอกจากลิงค์บุคคลภายนอกเด็ดขาด หากกรอกจากลิงค์บุคคลอื่นทางพิสิษฐ์สหคลินิกไทย-จีน จะไม่รับผิดชอบทุกกรณี 👩🏻💼ติดต่อสอบถามได้ที่ พิสิษฐ์สหคลินิกไทยจีน(ปทุมธานี) เปิดบริการ 9:00-17:00 น.(ปิดทุกวันอังคาร) Tel : 0619185592, 0966819481 Line ID : @phisitclinic

-

https://www.bangkokpost.com/thailand/general/3058697/thai-cannabis-industry-thrown-into-chaos-as-government-aims-to-recriminalise-weed Thai cannabis industry thrown into chaos New rules are political revenge and public will pay, says vendor in Khaosan PUBLISHED : 26 Jun 2025 at 17:26 WRITER: Bloomberg News Three years after becoming the first Asian nation to decriminalise cannabis, Thailand is poised to reverse course amid political turmoil and now requires a prescription to buy cannabis at any of the 10,000-18,000 dispensaries that have sprung up since 2022. The new rules have thrown the fledgling industry into chaos and sparked criticism from pro-cannabis activists, who championed liberalisation as a way to boost Thailand’s wellness and tourism sectors. Dispensaries must now sell only cannabis produced by farms that have obtained the “Good Agricultural and Collection Practices” certifications issued by the government, and amounts are capped at a 30-day supply per customer. The latest regulations, which went into effect Thursday, followed a pledge by Prime Minister Paetongtarn Shinawatra’s ruling Pheu Thai Party to toughen the country’s drug policy and limit the use of cannabis for only medical purposes. That promise came just days after the second-largest bloc in the government coalition, the pro-weed Bhumjaithai Party, left to join the opposition after a dispute over a cabinet seat. Compliance costs will put further strain on dispensaries, which have already been struggling with high competition and fewer-than-expected foreign tourists the past year, said Rattapon Sanrak, owner of Highland Cafe, a dispensary in Bangkok’s backpacker-heavy Khaosan district. “These moves are political revenge, but it’s the public who’ll pay,” Mr Rattapon said. “The majority of farms in the country are not yet certified by the government. And the products that don’t comply with the regulations that are in the pipeline will have nowhere to go but underground.” Public Health Minister Somsak Thepsutin said earlier this week that the government plans to put cannabis back on the country’s list of illegal narcotics — it is currently classified as a “controlled herb.” And over the next several weeks, new rules will be drafted to require every dispensary to have a doctor on site as part of licensing criteria, he said. Many businesses said they were blindsided by the abrupt rollout of the new rules, which were published on Wednesday night with no grace period. Numerous enterprises shut their doors on Thursday while they decided next steps. Some entrepreneurs said they are mulling a class-action lawsuit to at least delay the new requirements. An advocacy group named Writing Thailand’s Cannabis Future urged people to protest at the Public Health Ministry on July 7. The group said the new regulations will not halt the recreational use of weed, but lead to the sales of fake medical prescriptions. “A medical certificate can absolutely be bought,” said Prasitchai Nunual, the group’s secretary-general. “Permission slips given by so-called established experts will lead to corruption and prescriptions that don’t reflect any medical reality.” The University of the Thai Chamber of Commerce (UTCC) estimated the domestic cannabis industry at 28 billion baht (US$865 million) in 2022 after decriminalisation went into effect, adding that it had potential to reach 43 billion baht in 2025.

-

I just learned that the shop I usually buy from was closed yesterday, but then they sent a text this morning saying they’ll be open for business today as usual. However, in their message, they stated that customers won’t be allowed to smoke in the shop like before. Normally, you can sample any of their strains right there in the store before buying, but that’s off the table now, I guess. They also included a screenshot of a LINE chat that a vendor had with their local district public health office. As far as I know, the new regulations have already been published in the Royal Gazette, so it seems the information in the chat might already be outdated. Here’s an English translation of the short chat exchange they shared with me (note that there’s no date or time shown on the chat, so it’s unclear exactly when it took place). Chat translation: Provincial Public Health Office: Hi Vendor: Hello, I would like to ask about the measures for cannabis shops. Are they still allowed to open for business as usual? PPHO: The shop can still open because we have to wait for the announcement in the Royal Gazette first. Vendor: Thank you PPHO: If there is any further announcement, the vendor will be notified. Vendor: The buyer does not need a prescription from a doctor, is that correct? PPHO: Now you can still do it as before. Vendor: Thank you

-

I went out and did a quick and dirty late-night recce around Sukhumvit, and it’s definitely low-season, but the weed scene is still rolling like nothing changed with the law yet. Every shop I passed around Soi 4, Soi 11, you name it, was wide open for business. The scent of weed out on the street also wafted by here and there. Plenty of street stalls were hawking their weed-wares right on the main drag near Soi 7. Maybe one rented shop close to Soi 5 looked like it had shuttered, but I believe that happened before the law changed a day ago. Hard to say if this is the calm before the storm that will shut down thousands of weed shops or if it will roll on like it is now with business as usual.

-

I think from here on out we’re going to see business continue as usual, but with an even greater shift toward online sales as the industry moves back underground. High-rent retail shops catering to tourists will likely start closing, but online sales will carry on, probably without requiring any medical certificates. Many sellers already use services like Flash or the Thai postal service for delivery, though I suspect we’ll see a move toward private courier companies instead, as a way to minimize any legal exposure from online sales. The shop I buy from can deliver anywhere in Bangkok within a couple of hours using Grab or LaLaMove. I don’t think local delivery through motorcycle messengers like this will ever become an issue, since the packages are picked up and dropped off quickly within about an hour and without ever passing through a facility where inspections can take place. Of course, there will eventually be some effort by the government to enforce the new laws and carry out inspections, but that will likely focus on retail shops. Even then, enforcement is going to be a major challenge. How many shops can they realistically visit to inspect to see if they are really checking customers for medical certificates? There are over 10,000 retail shops and only 365 days in a year.

-

Yes, that’s correct, it seems the new laws already took effect as of yesterday in the Gazette. However, based on this document alone, it doesn’t appear that cannabis has been reclassified as a criminal narcotic. So, for now, it doesn’t seem like possession is a criminal offense in the way it used to be. That said, a separate ruling from the Narcotics Board could still be forthcoming, since the classification of controlled substances isn’t handled by the Public Health Ministry, as far as I know. From the way this reads, most of the regulatory pressure will likely fall on sellers rather than buyers. At this point, it doesn’t seem like simply possessing cannabis is now suddenly a crime. Hence, the issue would arise for sellers who distribute it without a prescription. That’s how it sounds for now. Of course, smoking it in public might be a bigger problem than it already was before since that would also fall under recreational use, which is now technically prohibited.

-

Has cannabis been re-classified as a narcotic? The provided document, titled “Controlled Herbal Medicine (Cannabis) B.E. 2568,” does not mention the reclassification of cannabis as a narcotic. Instead, it focuses on regulating cannabis, specifically its flower parts, as a controlled herbal medicine under the framework of the Pharmaceutical Act B.E. 2542 (1999) and related regulations. Here are the key points relevant to your question: • The document updates the previous 2022 announcement (“Controlled Herbal Medicine (Cannabis) B.E. 2565”) and designates cannabis flower parts as a smunphai khapkhum (สมุนไพรควบคุม), or controlled herbal medicine, rather than reclassifying it as a narcotic. • The authority for this regulation is derived from Sections 4, 44, and 45 (3), (4), (5), and (6) of the Act for the Protection and Promotion of Traditional Thai Medicine B.E. 2542, which deals with herbal medicines and their controlled use, not the narcotic classification under the Narcotics Control Act B.E. 2522 (1979) or its amendments. • The intent, as stated in the preamble, is to adjust regulations to prevent misuse, support research and economic benefits, and align with current circumstances, without any reference to shifting cannabis into the narcotic category. Conclusion: There is no indication in this document that cannabis is being reclassified as a narcotic. It remains categorized as a controlled herbal medicine, with strict regulations on its use, sale, and distribution, primarily for medical and research purposes. If a reclassification to a narcotic status were intended, it would likely involve a different legal framework (e.g., the Narcotics Control Act) and explicit language, which is absent here.

-

Updated Conclusion: • The document does not use the exact phrase “cannabis can only be consumed for medical use,” but the combination of the 30-day prescription limit for medical purposes, the ban on smoking except for treatment, and the extensive restrictions on sales and advertising effectively restricts its use to medical and research contexts. Recreational use appears to be implicitly prohibited rather than explicitly stated as such. • A doctor’s certificate (prescription) is required for individuals to purchase cannabis for medical use, as outlined in Clause 4 (last paragraph), but the document primarily regulates licensed entities rather than mandating this for all purchases.

-

Thanks, yes, the link worked perfectly. Looks like this was published in the Gazette. Here is a summary of the key points of that document in English. It doesn't say anything about medical use only or requiring a doctors certificate to buy it or consume it. It does say people buying it for medical use are limited to a 30 day supply, but it doesn't say how much that amounts to either. This document is an official announcement from the Ministry of Public Health of Thailand, published in the Royal Gazette on June 25, 2025 (B.E. 2568). Titled “Controlled Herbal Medicine (Cannabis) B.E. 2568,” it updates the previous 2022 announcement regarding the classification of cannabis as a controlled herbal medicine. The key points include: • Cannabis, specifically its flower parts, is designated as a controlled herbal medicine. • Activities such as research, export, sale, or commercial processing of cannabis require a license under strict conditions, including detailed reporting on sources, usage, and quantities. • Sales are restricted to licensed entities, with prohibitions on selling for smoking (except by specific healthcare professionals for treatment), through vending machines or online platforms, and in places like temples, dormitories, parks, zoos, and amusement parks. • Advertising of cannabis for commercial purposes is banned. • Licensed activities must adhere to certified cultivation and harvesting standards, and prescriptions for medical use are limited to a 30-day supply. The announcement, signed by Public Health Minister Somsak Thepsutin on June 23, 2025, takes effect the day after its publication and replaces the 2022 regulation.

-

Unfortunately, the resolution of the file is to low to be able to read the text. Can you either copy and paste the text in Thai into a post or just summarize anything important that's different from what they published before? And is this something that was published in the gazette or is this just another letter from the health minister?

-

These visits were conducted when? Assume just in Sukhumvit area in Bangkok? Anyway, as far as I know, nothing has officially changed yet since the new restrictions from the health ministry haven’t been published in the gazette. So for now, I wouldn’t expect stores or shops to change the way they’re doing business.

-

I picked up some more supply today from the retail shop I usually buy from. Business as usual. They were a bit busy while I was there, so I didn’t get a chance to really chat like I normally would. But I did briefly ask if they’d seen that new document from the health ministry. One of them said, “Yeah, we’ve seen it. It’s going to require doctor’s notes,” and that was it. End of discussion. They didn’t seem too concerned, and I didn’t want to make a big deal out of it, so I dropped it after that. I’m not even sure if they’ll end up requiring doctor’s notes for their regular customers in the future or not.

-

Saw these: https://www.itv.com/news/2025-06-24/thailand-to-ban-recreational-cannabis-three-years-after-decriminalisation https://www.straitstimes.com/asia/se-asia/thailand-set-to-make-non-medical-weed-illegal-again-after-political-turmoil https://www.bangkokpost.com/thailand/politics/3056840/somsak-signs-order-requiring-doctors-prescription-for-cannabis

-

New injectable HIV prevention drug hailed as milestone

RSD1 replied to RSD1's topic in Health and Medicine

Consistency is often the biggest issue with daily medication regimens. People either forget to take it or mistakenly think they already have. Sometimes they run out and delay refilling for a week or two. There are just too many ways a daily routine can break down. With other medications, missing a dose here or there might not be critical, but with this one, consistency is everything if you want to maintain proper protection. -

Why do most people NOT smoke weed even though it's legal?

RSD1 replied to JoseThailand's topic in Thailand Cannabis Forum

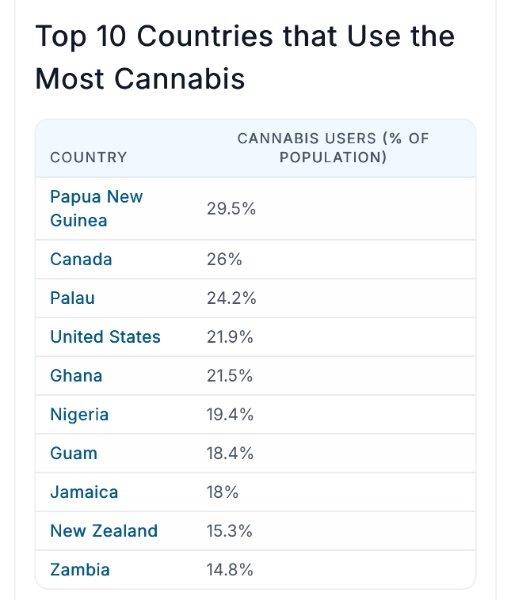

The percentage of the population in Thailand that now uses cannabis after it was decriminalized is at around 10% and some estimates have it even higher. So it's not a small number. There are also quite a few countries where the usage is near to or above 20% of the population, including countries like the US and Canada. https://worldpopulationreview.com/country-rankings/cannabis-use-by-country -

New injectable HIV prevention drug hailed as milestone

RSD1 replied to RSD1's topic in Health and Medicine

There’s also a generic version of Descovy available in Thailand at about the same price. The real issue with all these once a day meds, or even the shot every two months, is consistency. It's not just a cost issue. Many can afford it. But people either forget or get lazy with it over time, which defeats the whole purpose. That’s how they slowly drift back into high risk situations, thinking they’re protected when they’re really not. The idea now is that a shot only needed twice a year, like this new one, might finally give people better long-term protection. -

Just approved by the US FDA two days ago. Two shots a year and you're done. 99% effective protection. Based on the last link, sounds like Thailand could be on the list to get it quickly. https://lovefoundation.or.th/en/lenacapavir-prep-shot/# https://pharmaphorum.com/news/gilead-strikes-deal-expand-hiv-drug-access-120-countries

-

I don't know. I've always used the 10ML bottle for convenience. But I've dealt with those individual eyedrop disposable type things in the past and I always found them too much work. But no need to worry about it if you like what you're using. Everyone is different.

-

Current research suggests that cannabis does not typically cause direct liver damage in healthy individuals when used in moderate amounts. In Healthy People — Studies so far have not shown clear evidence that occasional or moderate cannabis use causes liver damage. The liver metabolizes THC (the main psychoactive compound in cannabis), but for most healthy users, this does not appear to lead to liver injury. In People with Liver Disease — In individuals who already have liver conditions, such as hepatitis C or fatty liver disease, heavy cannabis use may worsen liver fibrosis (scarring), though the evidence is mixed. Some studies have suggested possible associations between cannabis use and faster progression of liver fibrosis, especially in people with hepatitis C. Others have found no clear link. With Other Substances — Combining cannabis with alcohol or other liver-toxic substances raises risks. Alcohol is clearly toxic to the liver, and using both together may increase strain on the liver. CBD (Cannabidiol) — High doses of CBD (a non-psychoactive component of cannabis) have been associated with liver enzyme elevations in some studies, especially at very high doses used in medical trials. Regular low doses don’t usually pose a liver risk, but large amounts might, especially in people on medications that affect the liver. Summary — For healthy individuals using cannabis moderately, liver damage is not commonly reported. For those with existing liver issues or those consuming heavy amounts (especially with alcohol), risks may increase.

-

Almost everything is toxic at high enough levels, even water and food can kill you if you overdo it. Just saying something is toxic doesn’t actually mean anything unless you look at the dose and the real-world effect. The difference is that alcohol and cigarettes are toxic even at low levels and it is well-documented as a cause of long-term physical harm. Cannabis isn’t in the same category. And as for being “fogged up,” that might be your experience, but plenty of people use cannabis to enhance creativity, focus, and even productivity. Being high on cannabis doesn’t strip you of motor control or basic judgment the way being drunk does. Ever seen someone try to drive or operate any kind of vehicle drunk? Total impairment. Deadly in fact. Cannabis doesn’t work like that, especially in moderation and with the non-smoking forms. So yeah, if the world switched to cannabis instead of booze and cigarettes, we’d all be a lot better off.

-

I honestly don’t know why anyone even wastes time focusing on these negative studies about cannabis use. The percentage of people who die from cardiovascular issues linked to cannabis is microscopic. Meanwhile, cigarettes and alcohol pose an exponentially greater risk of high blood pressure, heart disease, lung disease, liver disease and stroke, and yet most people in the world regularly consume one or both without a second thought. The reality is, if everyone ditched alcohol and cigarettes and switched to cannabis, especially non-smoking forms, the world would be far better off and in many more ways than one. Think about it. How many people die every year because of drunk drivers? How many suffer from pulmonary problems caused by secondhand cigarette smoke? People aren’t just destroying themselves with alcohol and cigarettes, they’re taking others down with them too. *Edited*