- Popular Post

-

Posts

2,195 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by partington

-

-

- Popular Post

- Popular Post

6 hours ago, AsianAtHeart said:The spike protein is the part of the virus that allows it to enter cells, an essential preliminary to the virus replicating itself. The virus releases its RNA genome which uses the host cells' machinery to synthesise around 20 structural and accessory proteins, and copies of the RNA genome itself which are then assembled within the cell into thousands of virus copies, which are released into the body to infect other cells.

The symptoms of the disease ["toxicity" ] are caused by the body's immune and inflammatory systems attacking the respiratory cells which have been infected and creating a cell-destroying and organ-disrupting inflammation in the lungs and upper respiratory system, as well as the destruction of these cells by the virus itself.

It is not yet fully understood what causes the rare clotting disorders in some people, but it has been observed that in these people an autoantibody to a platelet clotting factor is almost always found, suggesting in these people an antibody to their own platelets has somehow been evoked. Research suggests this is linked to the adenovirus vector used in some vaccines and not the spike protein they produce

The spike protein by itself is harmless - this is the whole point of vaccination - it creates an immune response through the injection of something which doesn't cause a disease!

-

1

1

-

1

1

-

1

1

-

- Popular Post

7 hours ago, fvw53 said:Be careful because you could become resistant to our last line of defence.

People don't become resistant to antibiotics.

This is a continual misunderstanding: it is not the PERSON that becomes resistant, it is the actual bacteria or pathogenic organisms causing the problems that become resistant.

-

3

3

-

4 hours ago, Kenny202 said:

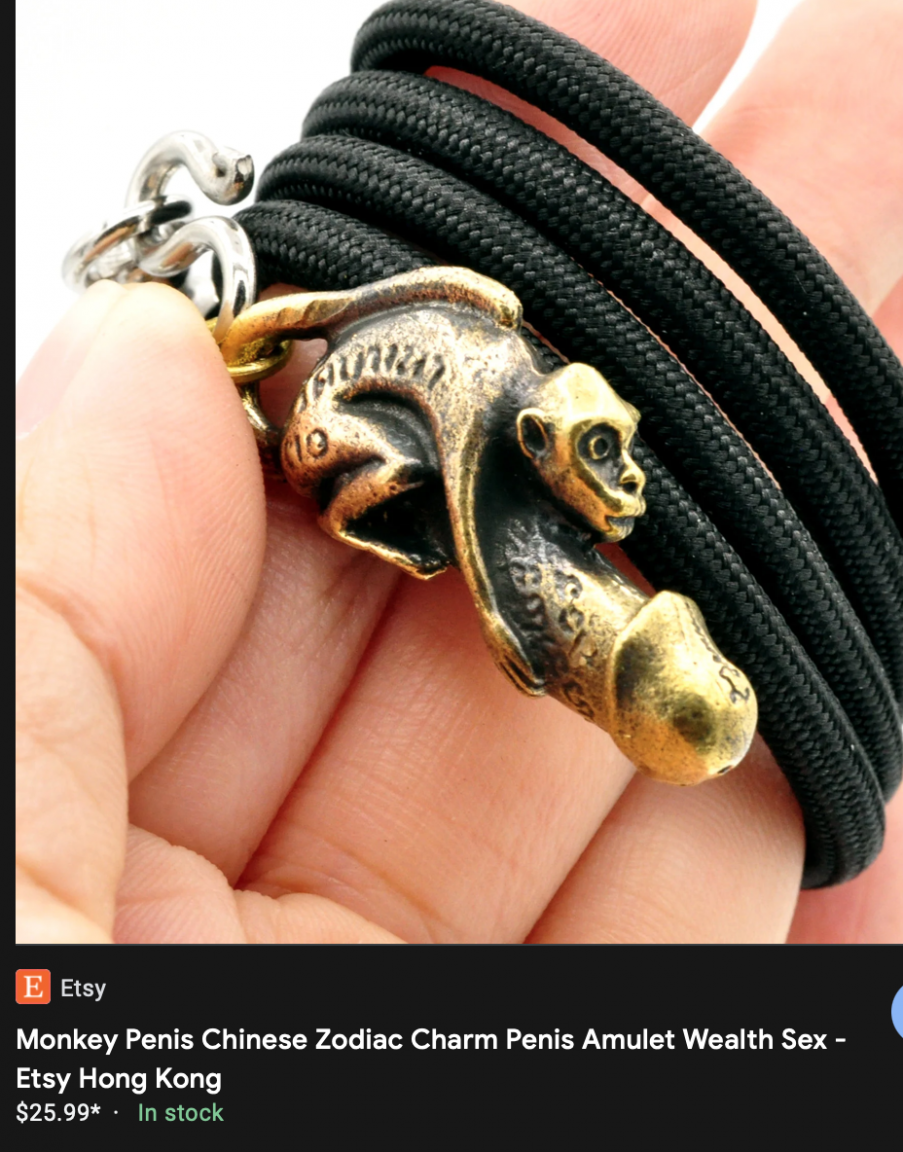

I dunno if it's real or not. I tend to agree with others it is a form of brain washing by the perpetrator and the rest is done in the mind of the victim. I did have some experience myself, not so much in any consequences of such actions but a girl I lived with her for sometime left a little "care" package in my safe. Consisted of a little brass figurine of some sort of monster riding a penis...a few either tarot or temple cards....a gnarled old tooth and strands of hair weaved into a small donut shape. Must have been there for at least 2 years after she left, I never noticed it. The girl in question was a total lunatic. train wreck of a life but heard her tell peoples fortunes on several occasions and she was eerily correct. She was always talking about other women doing black magic with me after we split. Was a huge thing for her, something she talked about often. Like I said I am not sure it brough me any bad luck etc, not that I have had a great deal of that since coming to live in Thailand. Took photos of the items and promptly threw the lot in the bin. My girl showed some of her relatives the photos and they reeled back in horror.....said I should have taken the stuff to the temple and had it properly destroyed by the monks.

This is a simple variation of a Chinese Zodiac charm available on market stalls in Hong Kong and elsewhere (even Etsy) and F all to do with "black magic"!!

-

- Popular Post

- Popular Post

1 hour ago, talahtnut said:Free speech banned, and one can be arrested for a Tweet that

someone finds offensive.

Please post the proof of someone being arrested for a Tweet that "someone finds offensive" - otherwise I accuse you of making this up.

EDIT : ok I'm wrong I just found a case -my apologies. At least I admitted it!

-

2

2

-

1

1

-

5

5

-

- Popular Post

- Popular Post

1 hour ago, BangkokReady said:So they're saying not to take antivirals because they believe that taking them will cause covid to return later?

No they are definitely not saying that! The point of antiviral treatment is to prevent vulnerable people being hospitalised with severe symptoms, and it has been shown to achieve this effectively.

They are saying that in a small number of patients (1-2%) treated with the antivirals to the point where symptoms and antigen tests are negative, the symptoms and antigen tests return to positive a few days later.

The reasons are being actively researched but have not been found to be due to development of drug resistance or new infection. The most likely hypothesis is that the virus has not been exposed to a high enough concentration of the drug for long enough to completely inhibit all replication of the virus. This could be due to some people metabolising and so eliminating the drug faster than others.

If this is the case, a higher dose administered for longer could resolve the problem.

-

2

2

-

7

7

-

27 minutes ago, Seppius said:

What really constitutes "living" here. You are given in most cases 90 days' permission to stay.

How long would you need to be here before the UK Gov decides? you could just be taking a year's break . UK home address and pension into UK bank important I would think, 10% rise coming next April

This is not a matter of any doubt at all, and a question that no-one needs to ask since the UK government has published a step by step flow diagram of the residence test rules which enable everyone to work out whether the UK government consider them resident or not.

The test is clear (though not simple) and it does not concern itself at all with whether any other country considers you tax resident. Here it is, just do it and you will know:

-

1

1

-

-

- Popular Post

- Popular Post

4 hours ago, brobro2424 said:If you are living full time in Thailand, you become uk-non-resident the moment you left UK. It is none of the UK's business where you are. Generally speaking if you don't live there and aren't using their government services, you should not be paying tax there.

Apply for an NT tax code via https://www.gov.uk/government/publications/income-tax-leaving-the-uk-getting-your-tax-right-p85

From what I've seen you will only successfully get a Thai tax code if you are actually going to start paying tax in Thailand. There is no need to do this. Thailand is not trying to tax foreigners on money coming from outside Thailand (in general).

I'm sure you will want more proof than just the above, but I'm trying to point you in the right direction. Its a grey area I've spent many hours looking into and have discussed with 5 or 6 international tax advisors, albeit not specifically pension-related. I'd be interested in replies to the contrary.

Just to reiterate what has already been said: nearly everything in this post is completely incorrect and needs to be ignored.

1. You are NOT UK non-resident the moment you leave the UK - there is a residence test guide here which you can apply to find out. It never works out that you are non resident the day you leave. https://www.gov.uk/government/publications/rdr3-statutory-residence-test-srt/guidance-note-for-statutory-residence-test-srt-rdr3

2. Even if you actually do eventually qualify as a UK non-resident, money that arises in the UK including UK state pension, rental income and so on IS completely taxable, and this has nothing to do with whether you "use services" or not! You are still entitled to a personal tax allowance so if your UK arising income does not exceed this you won't actually owe tax, but if it did, you would!

3. You can easily get a Thai tax number without paying tax in Thailand, I did myself and many others here have also reported this. Often banks abroad ask for a tax number . I myself got a Thai TIN for this purpose alone.

Nothing is "grey" about this at all.

-

7

7

-

1

1

-

- Popular Post

- Popular Post

4 hours ago, yang123 said:^^ ???? My passport was not clipped when I submitted a renewal request earlier this week.

Mr Muddle is indeed in a muddle.

Your passport is not clipped when you first apply.

Mine wasn't when I renewed at VFS until they handed me the new one.

-

3

3

-

34 minutes ago, samtam said:

You do need to pay 4 years if you have not yet paid anything for tax year 2021-2022.

It would be worth clicking on the "details" section for years 2015-2016 (? maybe won't count to increase pension), 2016-2017, 2017-2018 (earlier years won't count) to see if it says you can make up the shortfall by paying any of these years, as it is just possible they may be cheaper, so it might be worth choosing these years to pay instead of the later ones .

I would definitely get confirmation from DWP on what you plan to do, in case I am wrong!

Added in edit: specifically I may be wrong about paying for the year 2015 to 2016 - this may not actually increase your pension.

As far as I can see paying for these 4 years at ~£3270 will earn you about £1100 extra each year you are paid a pension, so it will only be 3 years into your pension before you break even and everything after is pure profit.

-

2

2

-

-

- Popular Post

- Popular Post

18 minutes ago, samtam said:This is what mine says:

however, this then follows:

Do you have the same? The "what follows" means I have to contribute to attain the forecast, although I think I will not get the current full pension, which is GBP179.60, even if I make further contributions. If I don't make any further contributions, then I don't know what I get.

No -the current full pension is £185.15 per week as your "what follows" states.

If you don't make any further contributions at all you will get £163.99 per week as your "what follows" states.

Each year you contribute currently earns you an extra £5.29 per week.

So if you pay NIC for the last year (the year ending April 2022) you will earn £163.99 + £5.29 = £169.28, as your "what follows" states.

You can earn the maximum - £185.15 - by paying for another three previous years on top of that ie £169.28 + (3 X £5.29) = £185.15.

It's very clear.

-

3

3

-

30 minutes ago, samtam said:

OK, got it. I will find out how many years I need to pay.

Just confused why contributions jump from 30 years to 35 years to 40 years.

Firstly pay a lot of attention to chickenlegs posts, as you can end up paying for years that will not increase your pension at all even though they are unpaid years.

Usually these are any years before 2015.

Why it changed for you from 30 to 35 to 40 is roughly this:

Before 2015 the maximum number of years you needed to contribute for a full pension was 30. I was paying mine (voluntary contributions) by direct debit. When it got to 30 years [in about 2012] they said you have enough, and stopped taking my direct debit.

BUT in 2015 they changed the number of years needed for a full pension to 35. So now to get a full pension I had to pay 5 more years - I fell into the transition period group. [Anyone starting work after 2015 just has to pay 35 years, but people in the transition group can pay more years than 35 if necessary to get the full pension.]

However the new pension rules for transition people meant that they started from a "basic starting amount" earned by 30 years' contributions, which could then be added to by paying more years.

if you had already paid the full 30 years' contributions before 2015 [that would have entitled you to a full pension before 2015], then even if you had unpaid years before 2015, paying for them would not add anything, because you had already reached your basic starting amount.

Instead you have to pay years after that to reach the full pension. Each extra year you pay for adds about £4.50 per week to your pension. For transition people sometimes getting to the maximum current pension amount requires more than 5 years, given that 5 years only adds £22.50 (figures very rough can't remember exactly) to your weekly amount. Therefore transition people, but no-one else, are allowed to pay more than 35 years NICS if it brings them to the maximum current amount, so that they don't lose out if 5 years isn't enough to reach that amount.

-

1

1

-

-

I do not believe this.

I find it impossible to believe any intramuscular injection is undetectable by any normal human. Only if they are so drunk already that they are semi-conscious could this even be conceivable.

I think this is a popular urban myth and drugging is 99%-100% oral, by drink spiking. However once these myths get into the news and social media they are adopted as likely explanations for any unusual experiences and become a positive feedback loop.

Or you might have received a Covid vaccination unawares while sitting at a bar...

https://www.psychologytoday.com/gb/blog/its-catching/202202/the-british-needle-spiking-panic

Psychology Today:

KEY POINTS

- Claims of syringe attacks on British women may be an urban myth.

- Despite over 1300 'attacks' in the past 6 months, there is yet to be a single confirmed case or conviction.

- To inject someone with a needle at a nightclub while out with friends - and without anyone realizing -defies credulity.

-

1

1

-

On 7/5/2022 at 1:23 AM, Everyman said:

Unless you are moving huge amounts of money, they’re not going to care. They’ll just be drowning themselves in data.

This statement is completely baseless!

The CRS allows countries in which you have tax residence to find income that you may be trying to hide by stashing it abroad.

For retired expats the major point of the CRS is so the country you are FROM can tax you, if you still have tax residence there as well. The US is the only developed country that taxes on the basis of citizenship rather than residence - all others do not tax non-residents on money they earn outside the country.

Thus someone with a tax residence in the UK who, say, lives in Thailand six months of the year and earns money there could hide it from the UK tax authorities by stashing it in a Thai bank and not declare it on their tax return. The CRS will take this evasion option away.

As Thailand do not, for example, currently tax money earned abroad but not brought into the country in the year it was earned (let's call these savings), the mere information from the UK via CRS that you earn a UK pension will not suddenly render you eligible for taxation of that pension unless they can prove the money you bring in is the current year's money.

This is so difficult to do and easy to avoid it would be unlikely to be implemented in my opinion.

-

1

1

-

1

1

-

-

1 hour ago, Gaccha said:

This drug appears to almost solve that. It converts the alcohol before it is converted into acetic acid by the liver, avoiding most of the damage to the body.

Of course, this won't prevent drunks from being complete pratts.

The metabolic product of ethanol that causes most of the damage within the body is actually acetaldehyde rather than acetic acid.

That aside, this 'drug' is actually a preparation of bacteria which the subjects took for an entire week before drinking. This introduces a population of bacteria into the gut that can metabolise some of the alcohol into carbon dioxide and water before it is absorbed into the body.

However the subjects in the study were only given 0.3 g alcohol per kg body weight, which is a tiny amount, equivalent to a 75kg man drinking a single pint of lager. Blood alcohol concentrations were therefore tiny even to start with, and dropped about 50-70% in those pre-treated for one week with the bacteria.

To me this looks unlikely to have any effect on a major binge drinking session. If these bacteria can only metabolise about half the alcohol in a pint of beer they are unlikely to have any significant effect at all on someone who drinks enough to get a hangover. In effect they convert drinking say six pints of beer into drinking five and a half pints. This could be three pints if the bacteria are able to sustain the same rate of conversion however fast you drink -but this does not appear to have been demonstrated in the publication.

Further studies necessary I think...

Ref to paper: https://pubmed.ncbi.nlm.nih.gov/35769391/

-

1

1

-

-

- Popular Post

- Popular Post

27 minutes ago, g man said:After reviewing the attached report, maybe you can make a more informed decision about taking the mRNA injection.

Summary key points:

mRNA Covid vaccines offer essentially no defense against Omicron only months after a booster shot, according to a major new study from British researchers.

Both antibody and T-cell protection are nearly non-existent, according to what the British researchers discovered.

In an even more worrisome development, when vaccinated but previously uninfected people suffer breakthrough Omicron infections, their T-cell response is biased toward earlier versions of Sars-Cov-2 - not to the Omicron variant that has actually infected them.

In other words, the mRNA shots appear to permanently wrongfoot the immune systems of people who receive and bias them toward producing T-cells to attack variants that no longer exist - even though they never were infected with those variants at all.

Despite the disappointing ability of the Omicron variant to evade immunity resulting from pre-infection by the original variants, and by vaccination against the alpha variant, this paper repeats, and gives references to, the factual observation that vaccination continues to show significant efficacy against symptomatic disease.

It is therefore still both valuable and sensible to be vaccinated even in the age of Omicron!

Direct quote from paper cited:

"The case for vaccine-mediated immune preconditioning as key mediator of the attenu-ated phenotype is complex: while functional neutralization by vaccine-primed sera is considerably blunted against B.1.1.529 (Omicron), three-dose vaccination efficacy against symptomatic disease holds up, in the 50-70% range (6–8)

Here are the reference so you can confirm this:

6. S. Collie, J. Champion, H. Moultrie, L.-G. Bekker, G. Gray, Effectiveness of BNT162b2 vaccine against omicron variant in South Africa. N. Engl. J. Med.386, 494–496(2022). doi:10.1056/NEJMc2119270 Medline

7. H. F. Tseng, B. K. Ackerson, Y. Luo, L. S. Sy, C. A. Talarico, Y. Tian, K. J. Bruxvoort, J. E. Tubert, A. Florea, J. H. Ku, G. S. Lee, S. K. Choi, H. S. Takhar, M. Aragones, L. Qian, Effectiveness of mRNA-1273 against SARS-CoV-2 Omicron and Delta variants. Nat. Med.28, 1063–1071 (2022). doi:10.1038/s41591-022-01753-yMedline

8. N. Andrews, J. Stowe, F. Kirsebom, S. Toffa, T. Rickeard, E. Gallagher, C. Gower, M.Kall, N. Groves, A. M. O’Connell, D. Simons, P. B. Blomquist, A. Zaidi, S. Nash, N.Iwani Binti Abdul Aziz, S. Thelwall, G. Dabrera, R. Myers, G. Amirthalingam, S. Gharbia, J. C. Barrett, R. Elson, S. N. Ladhani, N. Ferguson, M. Zambon, C. N. J.Campbell, K. Brown, S. Hopkins, M. Chand, M. Ramsay, J. Lopez Bernal, Covid-19 vaccine effectiveness against the omicron (B.1.1.529) variant. N. Engl. J. Med.386, 1532–1546 ( 2022). doi:10.1056/NEJMoa2119451 Medline while <deleted>nctional neutralization by vaccine-primed sera is considerably blunted against B.1.1.529 (Omicron), three-dose vaccination efficacy against symptomatic disease holds up, in the 50-70% range (6–8).

-

2

2

-

1

1

-

- Popular Post

- Popular Post

34 minutes ago, g man said:On Friday June 17, the journal Andrology published a peer-reviewed paper showing large decreases in sperm counts among men after the second dose of Pfizer’s mRNA Covid jab.

Based on counts from men who donated sperm to three fertility clinics in Israel, this finding is devastating - medically and politically.

https://onlinelibrary.wiley.com/doi/10.1111/andr.13209

Be informed at all times.

https://www.reuters.com/article/factcheck-coronavirus-fertility-idUSL1N2T01TQ

It's not remotely devastating in any way, because it was only 15% and disappeared within three months in everyone studied.

There is no estimate of how a 15% reduction in sperm number would even affect fertility, if at all.

-

2

2

-

1

1

-

- Popular Post

- Popular Post

Because their resting, non-exercising blood pressure is usually extremely low as a result of exercise. Fitness has the effect of lowering blood pressure in the - much longer -non exercising periods .

The blood pressure increase during exercise is the natural adaption of the body to exercise mode, and is necessary to supply oxygen to the muscles faster.

People with clinically high blood pressure exhibit this at rest, which is decidedly abnormal and not episodic but continuous. The harm caused by this kind of high blood pressure results from cumulative damage over very long periods to blood vessels and other organs.

-

4

4

-

On 6/4/2022 at 2:18 AM, placeholder said:

A Ukrainian investigative team called Proekt found a very ingenious way to look into the credibility of these rumors. Because the couldn't access intelligence reports, instead they started tracking doctors because hospital records are public. They found that teams of doctors specializing in cancer would be periodically called away and would show up in whatever locale Putin happened to be.

Anyway, the information is offered in great detail. Just follow the link:

I dunno- the whole thing seems dumb and untrustworthy with stupid graphics, curlicued fonts, childish layout and pictures...not like responsible journalism at all. It's hard to check the actual truth of most of the claims made here independently.

Ukrainians have a vested interest in believing Putin will die soon, and I hope he does, but this does not convince me.

-

1 hour ago, Loiner said:

Get on with Boris. First the bill and then make as many changes to the NIP as necessary.

It's already enraging the EU and Ireland so it must be the best option for the UK. That it will incense the Lib/Lab/Rejoin pact is a fantastic bonus, as is anything that sours EU relations and stymies their plot.

You seem nice.

-

- Popular Post

- Popular Post

The production of acetaldehyde happens naturally every time you drink alcohol. It is the normal way the body metabolises alcohol. There is no real scientific evidence that eating durian has any effect on this process.

The amount of extra acetaldehyde you would take in from eating foods that contain natural acetaldehyde in small amounts, ripe fruits, cheese and so on is trivially small compared to the acetaldehyde your body can make after drinking alcohol in large amounts.

This university doctor is making the logical mistake "post hoc ergo propter hoc", that is if one event happens after another event you falsely assume the first event caused the second. [I ate a muffin, then three hours later I broke my leg, so eating muffins causes your legs to break.]

Without scientific evidence this university doctor's statement is just an un-evidenced assertion, based on his cultural assumptions. What would have been his diagnosis if the same woman came in with these symptoms without having eaten Durian and why would he think none of those possibilities applied in this case? How did he ascertain the woman wasn't having a seizure from natural causes? How did he try?

Illogical, incomplete and unscientific thinking.

-

6

6

-

Just to point out "tax residency" in any country is not determined by whether you owe any tax or have any income in that country, but by a set of more or less simple regulations mostly determined by the amount of time you spend in that country in a year. It defines whether you are considered resident.

Whether you owe tax or not is completely irrelevant to determining tax residency!

Moreover your tax residency in one country, say country X, is not affected in the slightest by whether you are considered a tax resident of country Y. The laws of country Y don't apply in country X and vice versa, so country Y's views cannot determine country X's views.

You can be tax resident in two or more countries and you cannot argue that because country Y considers you a tax resident, that proves you are not a tax resident in country X. If you meet the legal definition of tax residence in country X then you are a tax resident of country X as well.

-

1

1

-

-

- Popular Post

- Popular Post

Just a general point I have to say, people - arguing for or against vaccinations, whatever - should learn the simple scientific principle that your experiences and those of two or three people you happen to know tell you nothing at all about the truth and have no evidentiary value.

Thinking it does is as absurd if I said to you " I can't understand how Labor won the election because me and my two closest friends, and my mother-in-law, all voted Liberal!"

The experiences of a couple of people tell you nothing, whether you know them or not, and whether you are one of them or not!

The truth is learned by statistical analysis of what happens in a very large sample of people, large enough to be a fair representation of the entire population you are studying. Only this counts, and only this is evidence. This applies to every conclusion you ever draw, about anything under the sun!

EDIT: just noticed that arithai12 made the same point, with even better examples, a few posts up. I'll leave mine anyway as it bears repeating ????

-

2

2

-

1

1

-

- Popular Post

- Popular Post

On 5/22/2022 at 4:05 PM, rumak said:If people want to believe their symptoms "would have been much worse without getting the shots".. well, i don't know why they think that. ( more postings of "sources" from the vax lovers to follow)

In the face of carefully performed clinical studies contradicting your preferred belief you just declare you will ignore their findings.

Your opinion isn't worth a thing because it is based on emotion not evidence. Putting inverted commas around the word sources doesn't render those sources invalid, it makes your nonsensical statements invalid.

The evidence that vaccinations have reduced deaths and hospitalisations from COVID in every country in the world where they have been used is absolutely overwhelming. Just one recent study out of very many:

https://pubmed.ncbi.nlm.nih.gov/33985964/

Effectiveness of the Pfizer-BioNTech and Oxford-AstraZeneca vaccines on covid-19 related symptoms, hospital admissions, and mortality in older adults in England: test negative case-control study Bernal, J.L. et al British Medical Journal . 2021 May 13;373:n1088.doi: 10.1136/bmj.n1088.

"Combined with the effect against symptomatic disease, a single dose of either vaccine was about 80% effective at preventing admission to hospital with covid-19 and a single dose of BNT162b2 was 85% effective at preventing death with covid-19."

Evidence can be read, evaluated and confirmed by further studies. Unevidenced assertions from random internet posters can be safely ignored.

-

9

9

-

4

4

-

You are using the wrong terms. The "validity" of a visa refers to the period during which you are allowed to use it to enter the country. This is a separate issue from the permission to stay period which is attached to the visa entry.

So: an OA visa obtained on, say, 1st November 2021 is valid for 1 year, that is, it can be used to enter the country on any day between 1st November 2021 and 1st November 2022.

Each time you enter the country between those two dates you are given a one year permission to stay. So if you enter on 1st November 2022 you are given permission to stay until November 1st 2023.

The only reason you would need a re-entry permit is if you leave the country again after 1st November 2022. This is because, although you have been given permission to stay until 1st November 2023, your visa (permission to enter the country) is invalid any time after 1st November 2022.

So to be allowed to re-enter the country any time after 1st November 2022 with that one year permission to stay until 1st November 2023 you have been given kept intact, you need a permission to enter the country that replaces the visa. This is called a "re-entry permit", and allows you to enter and stay until 1st November 2023.

You need insurance for the whole period of your stay as far as I am aware.

-

1

1

-

.png.5fdc9beda0b16cc7ae0fbf6a7b03fad4.png)

.png.204fc4499adc080eb6d312d3daeef042.png)

.png.cfc1c0dcd179bd506282209e925d16ed.png)

.png.c5ad6b20141f19fbcc00ba642aadb842.png)

Nine-year-old in Phuket claims to suffer sustained severe hair loss after receiving a Covid-19 vaccine, Public Health office says not to jump to conclusions

in Phuket News

Posted

What you are describing is one part of the immune response to most intact disease pathogens infecting cells.

If Covid-19 virus proteins are expressed by cells as a result of infection and ongoing disease, and those cells are targeted and destroyed by T-cells, why is this not also the beginning of autoimmune disease? And then why doesn't every pathogen triggering T-cell phagocytosis cause autoimmune disease?

The mRNA and DNA in vaccines are not stable, and are only transiently expressed for a matter of days, unlike replicating viruses, which can persist for weeks, multiplying thousands and millions of fold.

Why do you then think that this transient expression is more likely to produce autoimmune responses than infection by the actual pathogen itself?