Lacessit

-

Posts

24,214 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Posts posted by Lacessit

-

-

- Popular Post

- Popular Post

20 hours ago, milesinnz said:"none of those beach front properties on the oceans could be insured"... some coastal property regions are becoming uninsurable in New Zealand.. but then in your world, maybe Thailand won't be affected by rising sea levels.. but if you ever did any research on these sorts of subjects, then you would know that sea level rise is a very slow but progressive fact... - it is the storms surges that are causing the most damage... not just going out and finding the sea level has gone up a few mm....

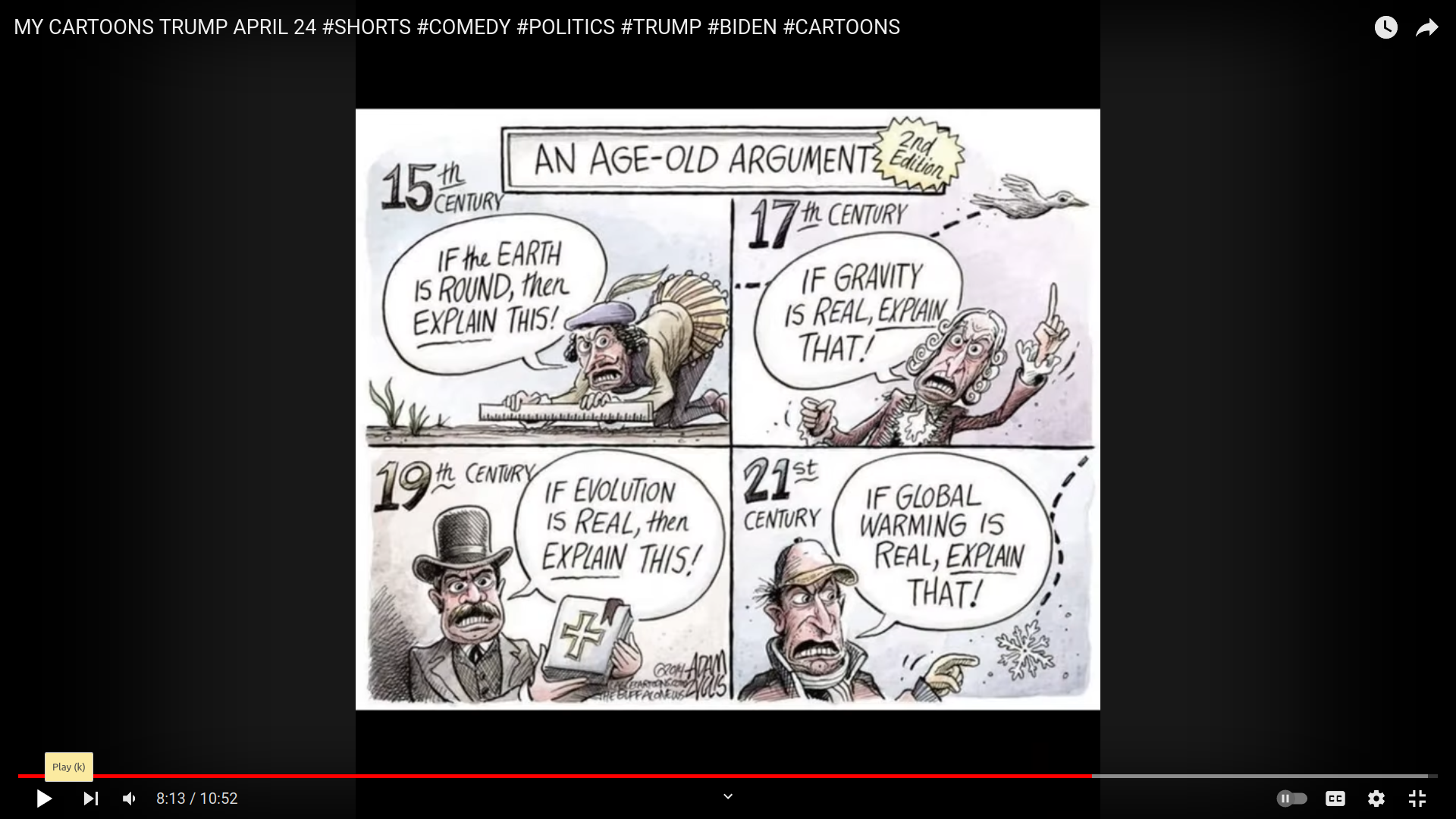

None of the climate deniers have any training in thermodynamics, which is why they keep making posts out of touch with reality.

Insurance companies are well aware of increased risk due to climate change. My son's house insurance premiums ( high bushfire and wind risk ) have doubled over the last two years.

The Second Law of Thermodynamics says the extra heat arising from increased CO2 levels in the atmosphere has to go somewhere. It goes into the oceans, they get warmer. Icebergs and glaciers melt faster.

The First Law of Thermodynamics says all forms of energy are interchangeable. Heat gets converted into kinetic energy, in the form of storms. The hotter it is, the more intense the storm. Hurricanes, typhoons and cyclones. Ask any meteorologist.

As far as Thailand goes, it will probably get hotter. Increased bushfire risk, and don't buy Bangkok property.

-

3

3

-

1

1

-

1

1

-

On 4/25/2024 at 8:29 PM, scorecard said:

And/or regularly brings from abroad large supplies of basic foodstuffs all available at many outlets in LOS. Often same bad or equivalent quality local manufacture.

Seen this many times. Recall one farang wife who brought massive supplies of very size of ziplock bags from the US. And a Brit guy who brought suitcases of meat pies in cans from the UK.

It's actually illegal to bring any meat products into Thailand, although I suppose being canned might make a difference.

I bring in lots of Vegemite, basil pesto - anything non-perishable that is expensive in Thailand.

-

1 minute ago, paddypower said:

I'd equate not filing as the equivalent to doing 120 on the hi-way. enjoyable and minimal risk (except for keeping one foot near the brake).

There are signposts on highways that tell me what speed I should not exceed.

I have yet to see a sign post that says I must file a tax return in Thailand.

OTOH, there have been several posts where pensioners like myself have been told by Thai tax officials they don't need a TFN, let alone file a return.

Let them come for me, I am not going to make life easy for them.

-

1

1

-

1

1

-

-

I am wondering who wrote the OP, possibly a MAGA supporter who made it past primary school.

-

2

2

-

-

- Popular Post

- Popular Post

1 hour ago, Mike Lister said:Nobody suggested you were/are evading tax. But posting threads and asking questions about tax evasion on AN Forum is against the rules, which is why the thread was closed.

How each member chooses to address the issue of tax in Thailand is their own very personal choice. I personally would not adopt your approach because I am more risk averse. I wouldn't want to do nothing and then several years hence, have an IO ask for my tax ID. After I'd satisfied the IO's request I' would have potentially opened myself to scrutiny by the TRD who is perhaps beginning to wonder why I've been in country fir so many years and only now obtaining a tax ID, what ever has he been doing for the past X years they might wonder. But that's just me, others mileage may vary.

The TRD could wonder all they want, it would take years for me to convert my savings into Thai baht and there would be proof every step of the way. Meantime, my pension payments can accumulate in an Australian account away from prying eyes.

I am risk averse too, my policy is to give ANY government department as little information as possible. Giving them data is like feeding piranhas.

-

1

1

-

1

1

-

1

1

-

49 minutes ago, save the frogs said:

There are plenty of hard shell cases that are designed with carry-on dimensions.

There are some that are even smaller than maximum carry on size.

Again, please explain why someone should be more concerned about your belongings than their own.

If you know everyone else has a hard shell and you have fragile stuff, buy a hard shell.

I am not the poster you are arguing with over the issue of damage to fragile items.

Having said that, I fail to see why my luggage choices should be dictated by the lack of consideration of others.

There are also plenty of oversize hard shell cases with wheels being stowed in overhead lockers, which is a contradiction. Why does something supposed to be carried need wheels?

Either you have not flown for a while, or you just don't want to see what is staring you in the face.

-

1

1

-

2

2

-

-

Just now, save the frogs said:

No actually YOU are missing the point.

The entire POINT of hard shell cases is to protect fragile items.

If you have fragile items, then get a hard shell.

OR ... you can wrap it in bubble wrap.

But YOU are missing the whole point if you expect your opponents to bring soft shell suitcases not to damage YOUR crap.

How many hard shell cases would fit in the frame at every gate? My answer is damn few.

-

1

1

-

1

1

-

-

- Popular Post

- Popular Post

8 hours ago, CharlieH said:I always favored the scales method, where the passenger stands on a scale with ALL their luggage etc and are charged per total weight of everything including them, not individual parts of it.

IMO us bigger guys are discriminated against enough by having to shoehorn ourselves into seats designed to maximize airline profit, and minimize leg room. Although I do agree obese people should not be taking up the seat space of others.

What's next, BMI and skinfold testing?

-

1

1

-

2

2

-

9 hours ago, Prubangboy said:

Yeah, mystifying. Like a generic donut freely available at any Central Mall.

The power of branding -huge with our Chinese friends.

Also: Toberone chocolate bar -ever knowingly bought outside of Duty Free?

I tried a Krispy Kreme - once. It seemed to be an amalgam of fat, carbohydrate, and sugar.

Duty Free nowadays appears to be an oxymoron, everything in there is too expensive.

I don't drink, smoke, or use perfume, so I am a poor target.

-

2

2

-

-

7 hours ago, G_Money said:

I used to fly business class on the company dime, and when prices were reasonable pre-COVID. Even in business class, there were still people with outsize cabin luggage. Perhaps they did not want to wait at a carousel.

Don't worry, the probability of me actually having to bare my bum is vanishingly small.

-

2

2

-

-

- Popular Post

- Popular Post

6 hours ago, GammaGlobulin said:So, are you claiming that midgets should be boarded last?

Or, are you suggesting that the overhead bins be lowered for Asians?

What?

There is a frame at every gate for measuring luggage size. If the luggage does not fit that frame, send the person back to check-in to have the case put into hold luggage, and pay for it.

I am happy to help midgets if, IMO, their stuff in the overhead locker is a reasonable size. Small people with luggage nearly as big as themselves can go screw.

-

1

1

-

1

1

-

4

4

-

3 hours ago, Mike Lister said:

A member asked in another thread (now unfortunately closed):

"please explain how the Thai tax authorities can differentiate between income and savings in an Australian bank account".

The answer is, they can't and they won't, it's not their role to do that, that's your job!

YOU have to declare on a tax return, exactly what the funds represent, savings or income. If you say savings, and only you know, you must be prepared to prove that fact with documentation, if subsequently asked. @Lacessit

I have taken screenshots of every asset in Australia as at 31/12/2023, as proof of savings.

I don't have to declare anything on a tax return if I don't have a Thai tax number.

Until an IO tells me I need one to get my extension, or someone posts to that effect, I see no reason to get one.

Statements I am evading tax appear to be arguing in a circle.

-

1

1

-

1

1

-

-

- Popular Post

- Popular Post

1 minute ago, stoner said:i love these 2 scenarios as well.

1 - good morning passengers we will start boarding flight f2....they can't even finish announcing it and the majority of people stand up and line up.

2 - plane lands the wheels stop and instantly most stand up grab their bag and literally try to get up the rows to get out. ahhh the door isn't even connected yet never mind open.

If I am picking up hold luggage, I wait seated until nearly everyone has left the plane. I've never had the situation where my luggage beats me to the carousel.

I am usually last aboard, or close to it. No plane can take off when there is hold luggage aboard, and no corresponding passenger.

-

1

1

-

4

4

-

I don't know how many Russians are fleeing. However, it does make sense to stay away from a situation where they could be scooped up, and sent to a meat grinder with inadequate equipment and training. I'd be doing the same.

-

1

1

-

1

1

-

-

- Popular Post

- Popular Post

5 minutes ago, stoner said:i had the joy of being sat next to a monster of a man from toyko to toronto last week - 12 hour flight. he took up about 25 percent of my seat. one positive was the plane was 777 so i had plenty of leg room.

How about the ones who cannot possibly give up a nanosecond of posting on social media, after being told repeatedly by cabin staff to shut down their phone/tablet/ laptop during takeoff and landing.

-

1

1

-

2

2

-

6

6

-

- Popular Post

- Popular Post

1 minute ago, Bill97 said:Who are they ?

If you need to ask that question, perhaps you are not one of them.

-

6

6

-

10 minutes ago, Mike Lister said:

A couple of points.

The first is that there is no indication whatsoever that Thai banks will woth hold tax on international transfers, I think that is a one in a million chance of happening!

Secondly, please don't discuss ways to evade tax in Thailand or the thread will have to be closed.

Kerry Packer once famously said anyone who does not minimize their tax needs their head read.

If I am bringing in AUD 5300 in savings to Thailand, please explain why that is income, and taxable.

Also please explain how the Thai tax authorities can differentiate between income and savings in an Australian bank account.

-

1

1

-

-

- Popular Post

- Popular Post

1 minute ago, AreYouGerman said:It's the airline's responsibility, not yours. So, if they allow these small trolleys as carry-on, it will be used. If they don't check the size and weight (but they usually do with normal airlines) you should take it up with the airline. Good luck.

if you are getting fed up with other people's luggage, just travel business as we normal people do.

I am not aware of business class being available on domestic flights within Thailand.

Normal people prefer to spend their money on things less ephemeral than business class big-noting.

-

4

4

-

2

2

-

1

1

-

1

1

-

5

5

-

- Popular Post

- Popular Post

27 minutes ago, stoner said:not just the oversize carry on but the number of items they are bringing on a plane.

their big carry on. then their secondary (which is supposed to be a handbag etc) then an extra bag from duty free and the donuts you mentioned on top of that.

most of what people use as carry on now would never fit into the steel box at the check in. but as you say nothing is done about it.

would you like some peanuts sir ?

Very happy to be back here, I left Melbourne when it was 13 C, not counting windchill.

Hoping to survive a plague carrier seated next to me, who coughed continuously from Melbourne to Singapore. The Singapore - Bangkok leg had a howling infant a few seats away. The joys of air travel.

-

5

5

-

1

1

-

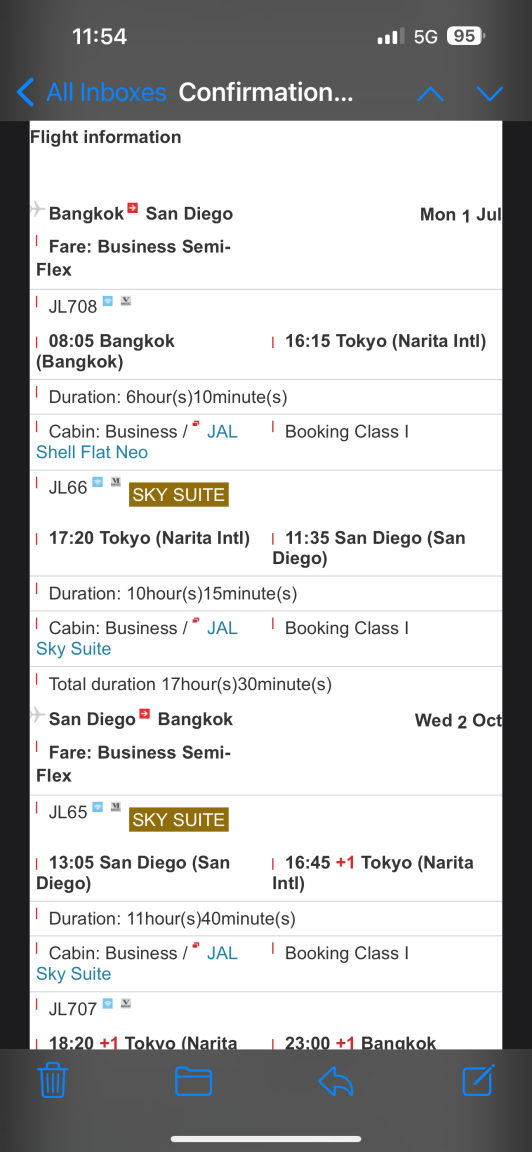

I recently brought $5300 in cash { AUD } from Australia to Thailand, to be converted into baht when needed.

It got me to thinking there is a way around the new personal tax regulations in Thailand, not that they are set in stone as yet.

I have an Australian bank account, in which my age pension accumulates. I transfer by WISE every 4 - 6 months for living expenses.

Those transfers may be taxed as they occur by Thai banks in the future, being classed as income.

What if I had a trusted relative or friend who could send me cash by registered post instead, and I converted said cash to baht here?

As I have said before, when governments make up stupid rules, people look for ways to circumvent them.

-

1

1

-

-

- Popular Post

- Popular Post

I guess everyone has seen people of all nationalities who are too cheap to purchase hold luggage, and instead have rigid suitcases which can barely fit into overhead lockers. If they all meet airline specifications for carry-on luggage, I will bare my bum in Times Square.

Or the ones who have the carry-on, then add a couple of large Krispy Kreme boxes. Eat s##t and die.

It's obvious the airlines do nothing to discourage the practice, even with items which are manifestly way over volume and weight restrictions.

I am wondering when someone is going to be turned into a paraplegic by being hit with an oversize, overweight item tumbling onto their head from an overhead locker. And what excuses the airline will have.

It also slows down the boarding and disembarkation processes, when most five foot Asians can't even reach the lip of the lockers.

Being six foot, I used to help. Now I think, stew in your own juice.

-

3

3

-

4

4

-

4

4

-

1

1

-

3

3

-

3

3

-

7

7

-

This is only the first bar in the cage being erected around Trump by the prosecutors.

If it was illegal to have affairs or employ hookers, there would be a lot more people in jail.

The real meat is in where the hush money came from.

-

I have just transitioned from 13 C in Melbourne to 38 C in Chiang Rai, my aircon is set on 27 C.

I am quite comfortable, thank you.

The lass in the bikini is too young and too meaty for my taste.

My nose, penis etc. are entirely my own business.

-

Carry-on madness

in Thailand Travel Forum

Posted

They are a status symbol, same as a Mercedes or Patek Philippe. Cheaper alternatives do the job just as well, it's more about image.