Mike Teavee

-

Posts

4,306 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by Mike Teavee

-

-

Yes, you can make an online appointment here... http://203.151.166.132/immigrant_queue/booking/ but reports seems to suggest that these aren't making much difference at MTT due to it being so quiet (though I would imagine that has/will change with the upcoming formal deadline of 26th September to get it done, Immigration requested they be done before 31st August, i.e. yesterday).

Seems you can only make 1 appointment per passport number so if you have multiple business to do (e.g. 90 day report + extension + re-entry permit) then you might have to pick which one to make the appointment for.

-

9 hours ago, pauleddy said:

I'm confused. I have lived and worked (and rested) in Bangkok for 16 years but I did work in the NHS and teaching since the 1970s. The DWP online tells me I have 32 complete years but I may top up to 35 years. As I was working for the state for over 30 years, are these top-ups Type 3 or Type 2?

Which is the best one to have?

I am also confused because 4 people have now told me not to top-up for the years before 2017--but The DWP shows that I have about 10 or 12 missing years (here?) and seem to be inviting me to pay 750 gbp for each of the years (total 9.000 pounds I estimate). However, the DWP says that the maximum I can ever get is 175 quid pw. So is it true that paying 9,000 is "dead money" and I should only pay the 3 years seemingly "on offer", which will be 2100 pounds. It seems that doing this will lift me from 155 pounds to 175 pounds, so I am "in profit" after 3 years or so.

I dont know why they say I can pay back 9,000 for many years away, but by paying 2100 gbp I can get the max pension possible.

Is it in case I have a social guilt complex?

Eddy

I believe the rules were changed so if you were close to retirement age you could back pay up to 10 years NI but I can't find the definitive rules around this, closest I could find is https://www.gov.uk/voluntary-national-insurance-contributions/deadlines#:~:text=You can usually pay voluntary,is 5 April each year.&text=You have until 5 April,ago%2C depending on your age.

Normally it is 6 years + the current Tax Year

Speak to HMRC https://www.gov.uk/government/organisations/hm-revenue-customs/contact/national-insurance-enquiries-for-employees-and-individuals and make sure to explain to them that you were working in Thailand for the years that you want to back pay, they should let you repay this at Class 2 rates which are currently 12 - 15GBP per month (Class 3 is 15.30 GBP per week)

I can think of no good reason, besides being a good citizen but you've done that by years of service in the NHS ???? why you would pay more than the 35 years as you wont see any (non-karmic) rewards for it ????

Do note that government (e.g. NHS) pensions have some different rules so again, best to check with them.

It's up to you whether you tell them that you're living here now & plan to remain here once you get to State Pension age as this would mean your pension will be frozen at the rate you 1st get it, for me it was worth becoming non-UK resident for tax purposes as soon as possible & the tax position on private pensions (I believe it's zero tax, at most it's 20%) make it worth more to me than the annual pension increase.

-

3 hours ago, Dene16 said:

I don't know how you have done that as it's approx £800 for each year you want to pay for.

As people have already noted just go to the government website and it will tell you all you need to know.

I have 36 years contributions but was contracted out so i would not receive the full government pension

However due to the changes when the earnings related part of the pension was abolished i can now work another 6 years so as to still get a full pension

I retired at 50 so it's unlikely to happen but i could get a part time job and as long as i earn approx £7500 in any one year that qualifies me for that year

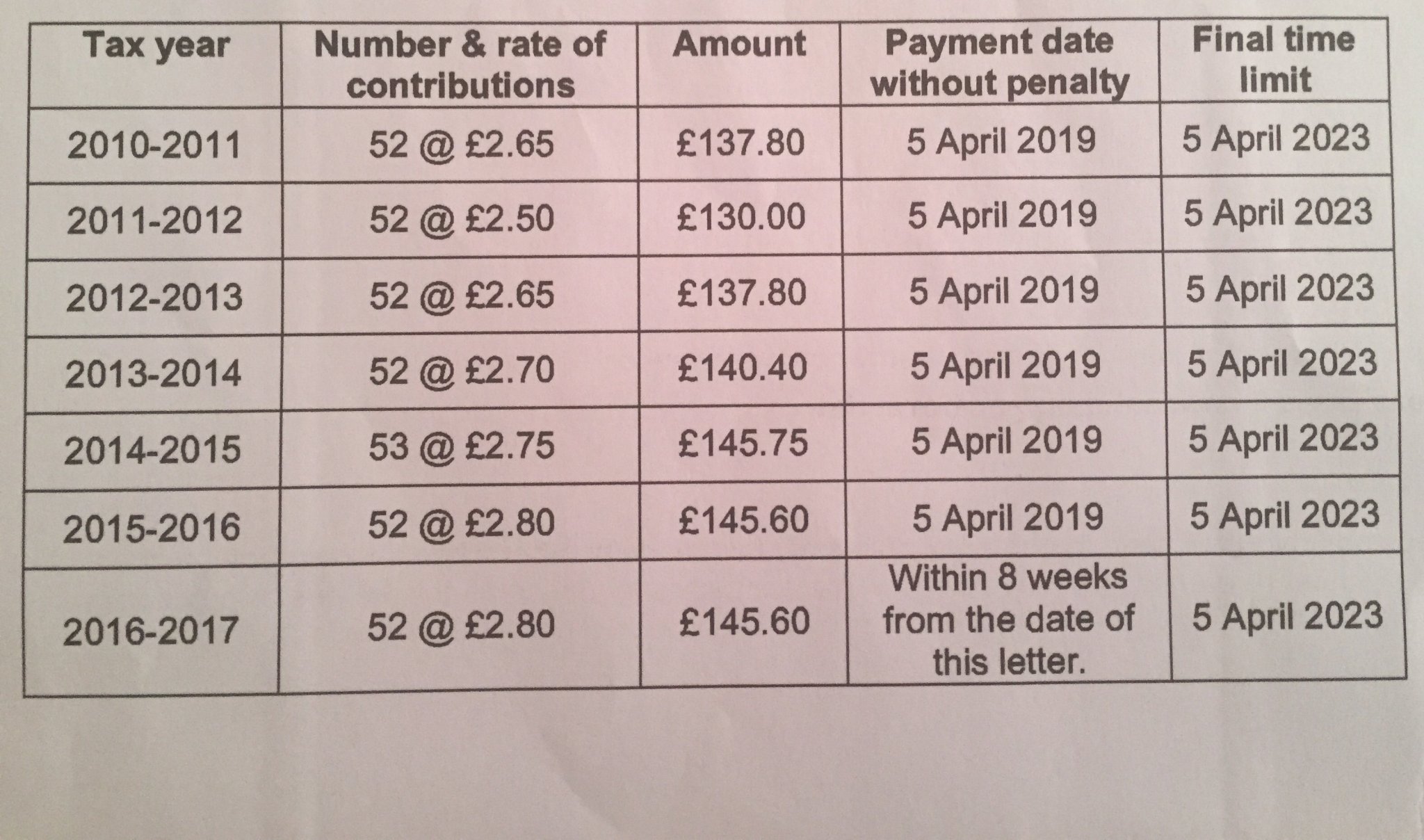

As mentioned I was working in Singapore so was allowed to pay at the Class 2 rates, here's the actual quotation from HMRC...

Very good point about being contracted out, maybe it was just a coincidence that I also needed an extra 6 years (It's now 4, hopefully 3 when I clear a 50p under pay) & I'd happened to have back paid 6 years before April 2016 when the rules changed but there are accounts in the press of people who have back paid & it's not counted, e.g. This guy back paid 2,500 (which would have been approximately what I would have paid at Class 3) https://www.thisismoney.co.uk/money/pensions/article-6928583/Saver-buys-ups-count-DONT-improve-state-pension.html & it didn't increase his pension

Edit: You don't need a job to pay AVCs, so why don't you just continue to pay for another 6 years (I'm 54, retired & that's what I'm doing, albeit I'm still paying at the Class 2 rate of 12 - 15 GBP pm, but I would still do it at Class 3 rates, as long as you live to be 71 you'll be in profit)

-

4 hours ago, bkk6060 said:

The UK sure seems to give their retirees the shaft.

A US pension with some of the years mentioned would be over 2,000 pounds a month.

Seems like a joke of a pension what is the UK doing with all that money?

I don't know about the US but in the UK whether you've never work at all & are on Social Security benefits OR earn a very large salary, your state pension will be exactly the same (You obviously pay more into the Scheme if you're on a large salary, but this doesn't make a jot of difference unless for any reason you have a break in employment & stop paying NI, then your're probably not eligible for Social Security so end up with gaps in your payments & a lower amount... ).

But the good thing is both our state & private pensions are tax free if we live abroad... I'm happy to take the frozen pension as long as the government doesn't get any tax from my private pension ????

-

4 hours ago, skorp13 said:

I just did a new retirement visa 3 weeks ago, am i supposed to do a 90 day check in after 3 weeks? If so thanks for the notice!

I'm assuming you already had a Visa & have extended it (Not got a new visa) if so your extension has nothing to do with your 90 day report, so the only thing that matters is did you enter Thailand (doubtful) or do a 90 day report less than 90 days ago...

If the answer is no, then you're late on your report so go as soon as you can.

-

2 hours ago, garet said:

I sent my 90 day reporting documents by post more than 3 weeks ago and still haven't gotten any notification back. It's never taken this long before. I assume that is my responsibility and I'll have to go in person and pay the 2000 k fine even though I sent it more than 2 weeks in advance of my reporting day.

If you have evidence of you mailing your report & them receiving it (EMS?) then you should be ok, but go sooner rather than later

-

On 8/10/2020 at 1:24 PM, giddyup said:

Who sells a preloaded Android box at Tukcom?

PM me (I did post their details in another thread but it got deleted) if you want details of the guys that I bought my 2 Minix boxes from (I had 1 in Singapore & 1 in Bangkok, both are still going strong after 5 years & 2 years).

They also run a help forum & a FileLinked site where you can download things like Cinema HD (one of my favourite streaming apps along with TItanium)... But if you just want the app, Google something like "Best Filelinked sites for watching TV" there's loads of places where you can download it from.

-

- Popular Post

- Popular Post

32 minutes ago, baansgr said:Pattaya prices are down 50%, BKK will surely follow if not by more.

Wow, do you have any examples of property being down by 50%?

-

3

3

-

2

2

-

On 8/27/2020 at 3:02 PM, Scot123 said:

I think it is quite smug of those who think using an agent is legal just because it's what they do so must be legal. Wake up! It's illegal!!! You are required to do your visa in person plus having money put into your account to fraudulently show the requirements again is illegal. The clampdown will come it just takes one man at the top to take over a bit like Big Joke then all the tears. All this nonsense of "I do it for convenience" What tosh! Paying 15-20k every year for 30 minutes in an immigration office having your documents checked..... Tears before bedtime......

Again... It's nonsense to suggest that everybody using an Agent is somehow doing something illegal, there are lots of us who use Agents just for the convenience...

My agent charges 7,000 THB on top of the 1,900 extension fee and for that they:-

- Complete all the paperwork & do the photocopies (including map to Condo)

- Book the appointment

- Drive me to CW

- Escort me to the Bank to get the letter stating I have the funds in my account (which I obviously have to sign-for) & the passbook updated

- Get a photocopy of the updated bank book

- Hangs around the correct desk while I have a seat

At this point I

- Sit with the officer checking the documents & sign anything extra that needs to be signed

- Have my Photo taken

- Take all my documents to the Immigration Officer who does the Visa

Once this has been done the Immigration Officer takes my passport & bank book to the chief immigration officer & I leave it with my agent to collect once it's been fully approved (Or I could sit & wait 1-2 hours & collect them myself), then I collect them from their office whilst on my way to lunch a couple of days later.

Absolutely nothing illegal or shady about it, you're just paying 7K for the convenience of having somebody do all of the running around for you & for you to be in/out of CW in 30 minutes (including the time to get the Bank Letter).

Edit: Should add that I've been told the agent I use will turn you away if you don't meet the requirements & the 1st time I used them they seemed pretty adamant that I needed to have the 800K in the bank, I don't know what would have happened if I'd have wanted to use the income route as I never asked.

-

1 hour ago, Andrew Dwyer said:

Basically, class 3 is the regular employed payment while class 2 is for self employed.

Here’s a link for the finer details:

Class 2 is also for people working outside of the UK (I don't know if you can claim it retrospectively if you're no longer working but looking to pay for years when you were).

-

41 minutes ago, Tagged said:

Well, it is a time for everything, and Im sure you will finely one day see it, when you are ready. This is not a movie without dept or brilliance, it is an intelligent well thought, perfect made and put together in a hysterical comedy, but not without an darker side to it. We can laough of the scenes, but troughout the history it have been a bloody abusing state of mind with the religon in hand.

Because of all of the small talks, small details, it is worth to see two and three times. As I said, when you are ready

And once you've watched it, you'll be on to Monty Python & the Holy Grail... The scene with the Black Knight had me crying with laughter (though I was stoned at the time)...

-

1

1

-

1

1

-

-

22 minutes ago, Jackson B said:

At CW today, the staff had no idea about the "free stamp". IO said not to listen to the embassy. No need to get stamp if applying for non-im visa.

I thought you had to go to MTT for short term extensions nowadays so could it be that you went to the wrong place

[I know CW should know all of the rules but it's possible]

-

21 minutes ago, AbeNormal said:

The agent charge for 90 day report in Pattaya is 100baht

Normally it's 374.50 but this wasn't an ordinary 90 day report as it was my 1st ever (I normally leave Thailand at least once every 90 days) & I didn't report on the due date (19th May) so the options at CW are to do it yourself or have an agent do it for me... I chose the latter as I wasn't 100% sure whether it needed to be done before I could do my extension (which I was doing 2 days later).

Besides, getting from Pattaya to Jomtien Soi 5 (10 THB on the Baht Bus?) is a lot different than getting from On Nut to MTT (5-600 THB in a taxi or 230-250 THB for BTS/Taxi... Obviously that's one way)

-

1

1

-

-

25 minutes ago, NanLaew said:

My understanding that regardless of family status, shared rooms are not allowed in SQ or ASQ.

It's also my understanding that all the other passengers that were on the same repatriation flight will be re-tested and possibly have their quarantine extended too.

There's an interesting Readers Submission on Stickman this week from a guy who went through ASQ & he said that families were allowed to stay in the same room...

I think it's OK to post excepts/links from Stickman on here...

"Oh and talking about the rumour that Thai / Farang couples are being separated in some hotels, there is none of that here. In fact the room next to me has a Western man with his Thai wife."

"The farang / Thai couples, being a western woman with a Thai man or the other way around, they are all in the same room as far as I can tell. The Stickman reader who said that a friend with his family had to stay in adjacent rooms with a connecting door might be more down to the family size? I have a king-sized and a queen-sized bed in my room so a couple with a child would work fine; any more would not."

-

1

1

-

-

7 minutes ago, ubonjoe said:

That is only a infographic and it is not a official doucment.

This from the official immigration notification.

"(1) Aliens whose residency report is due under 90 day period, may report their residency in

person or by assigning a person or via registered mail or electronic means.

(2) Aliens whose residency report is due on 26 March 2020 onwards and has not reported

within prescribed period, may report their residency in person or by assigning a personor via registered mail or electronic meansfrom 1 August 2020 to 31 August 2020;"There is nothing that states it is mandatory and no mention of fines.

It's from the official immigration website so I'd say it's a little more official than say something a newspaper put together.

I recall seeing a post where CW had removed the "registered mail or electronic means" options & know from experience that my options were to turn up in person or pay an agent 1,500 THB to do it for me (I chose the latter & didn't get the red stamp in my passport but don't know if the 2 are connected).

As for not getting fined... We'll no doubt see in the coming weeks, but I know where I'd put my money ????

-

2

2

-

-

6 minutes ago, jackdd said:

Even ubonjoe is saying this news is incorrect, so why does Thaivisa share it?

It's not incorrect, per the pic in the OP, Thailand Immigration did set 31st August as the deadline for doing any reports that you missed (they're also insisting you turn up in person or authorise somebody to do it for you at CW).

The fact that the Ministerial order says 26th September doesn't detract from the fact that Thai Immigration set this as their deadline so it's a lottery as to whether you get fined for late reporting between now & 26th September but you might want to go with that option of visiting a temple if you're relying on not being fined.

-

1 hour ago, Andycoops said:

I took a gap year from employment after 25 years of working so my state pension is around 15 GBP a week less than the full amount according to the forecast I got in March.

The amount to pay in to make up the full amount is absurd and so not worth it.

It maybe for some people who have larger gaps.

I don't think you'd lose 15 GBP (more like 5GBP calculated as 175 / 35 * 34) for 1 missing year but Class 3 contributions are approx 15.30 GBP per week so it would only take 1 year for you to get your money back, after that you'd be in profit, if it is only 5 GBP it takes between 3-4 years to be in profit.

If you can pay Class 2 it's 12-15 GBP per month so you'd be in profit in no time.

-

1 minute ago, Jack Hna said:

A polish person or a poll?

It's irrelevant it's a win in either case but if the automatic monthly extensions are put in place for a period of 6-12 months then that's a better option.

Just nah on the other stuff. Nah.

Very droll (or should that be drole)?

I'm more than 50% certain there won't be an automatic extension & people will have take some action in order to extend their stay but I'm even more confident that anybody who wants to extend their stay (& wasn't on overstay at 26th March) will be able to find a way...

I just think it's more useful to talk about how they do this than come out with blanket statements saying there will definitely be a 4 month extension [There won't be]

And come on, that Frankie Boyle Joke is almost as funny as the "My Dad wants me to sign-up to be an organ donor... There's a man after my own heart"

-

1

1

-

-

30 minutes ago, Leaver said:

If he is in Chiang Mai, I'm pretty sure he's closer to a garden than you are. ????

Lol, was going to say exactly the same thing ????

-

6 hours ago, Ventenio said:

99% they will extend it. Nothing will change, and the risk of covid coming here is significant if they open the country up. they won't kick out people without opening up the country. that makes no sense (OK, maybe now 80%).

IF IF there is a vaccine and whatever, the country will open up and you will go to Laos and get a visa....whatever.

if you kick out tens of thousands or a hundred thousand people.... SOME will end up getting covid and die. it seems like a lose-lose to kick out people.

1900 a month, every month. if someone gets kicked out, i would hopefully assume they would never, ever come back.

not a good business model.

You're contradicting yourself... You're saying they will extend the Amnesty & then go on to say 1,900 (paid for formal Extension) every month.

Which is it?

-

- Popular Post

- Popular Post

17 hours ago, Daithi85 said:Amnesty will be extended or an option to apply for 30 day extensions will be made available.with the American Embassy now giving out letters again something has obviously changed.there is no way people will be thrown out on the 26th Imagine the bad publicity.????????????????

The US Embassy giving out letters suggests that people will be thrown out on the 26th September unless they do something about it.

Immigration have been very clear in saying that you either sort your permission to stay situation out or leave & the US Embassy is now saying to get a stamp to take yourself up to the 26th September & either get a long term extension or a 30 day extension using the letter that they're sending out automatically (within minutes of requesting)...

I can only see bad publicity (Thailand IO made a laughing stock off) if Thailand says "Yeah, we know you couldn't be ar5ed to extend your permission to stay despite having 6 months to do so, but we take it all back & please stay as long as you like"

If you're sat there doing nothing because you're expecting an automatic extension, at least pack the essentials before it's too late...

-

3

3

-

1

1

-

5 hours ago, BritManToo said:

Would point out not all of us live in small rooms, some of us even have gardens to sit in.

Not to mention the beach, you can always sit on the beach and watch the sea.

Aren't you in Chiang Mai??? - I only ask because I'm in Bangkok but pretty sure I'm much closer to the beach than you are ????

-

9 hours ago, JacksSmirkingRevenge said:

I feel the amnesty will be extended until 2021. No borders are opening by Sept. 26. Not much will have changed since they announced the amnesty extension. It's the same as it was. And no borders open.

The US embassy has issued an email to say that it's citizens should go to Immigration & get a Stamp to update their permission to stay until 26th September & then either a long term visa OR a 30 day extension (their letter seems to support this) OR leave...

So things are very much not the same as they were, obviously it's up-2-you if you choose to bury your head in the sand & believe they are...

-

2 hours ago, pauleddy said:

If I want to be paid into Barclays Bank Bournemouth, do I still need to do the "long form"? Somebody has suggested that payment into the UK bank is far simpler to arrange.

I use my Barclays card here a lot, and I suffer the 220b penalty every time. But having it paid to the SCB bank here would, I suppose, incur Thai bank rates so is is swings and roundabouts? Yes I do intend to stay here in LOS.

Eddy

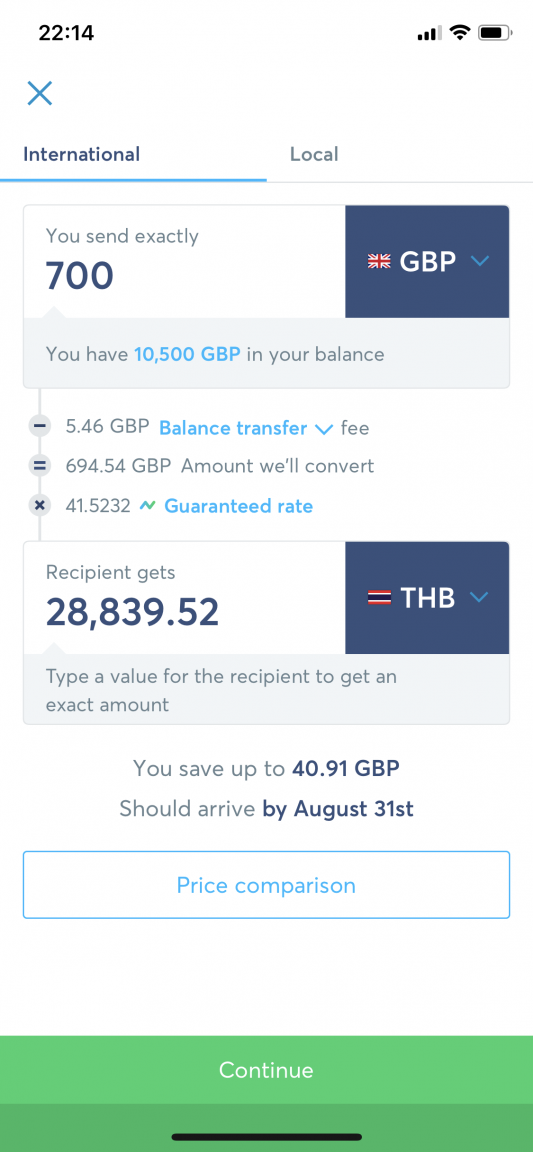

If I remember correctly it's 220THB for the Thai Bank + 2.35 (or is it 2.65)% + a flat fee of £1.99 per transaction, get yourself a Thai bank account & use Transferwise or get a Transferwise Borderless Account/Card & it's 220 THB for the Thai Bank + 2% on everything over £200 per month.

Plus transferring money to Thailand via TW will get you a better rate than you'll get from Barclays (Will update this post with an example)

What’s your gut feeling on if they will extend the amnesty

in Thai Visas, Residency, and Work Permits

Posted

I haven't seen a report saying that the UK is issuing letters, but this suggests that they will if you have a valid reason... https://www.gov.uk/guidance/notarial-and-documentary-services-guide-for-thailand#covid-19-visa-extension-applications--support-letter

However note the point...

"The British Embassy will not be issuing a visa extension letter to British Nationals here on short-term visas who can travel to their country of residence."