oznomad

-

Posts

321 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Posts posted by oznomad

-

-

23 hours ago, SPREX said:

SPREX.

I will say it, as nobody else seems to have.

Thanks for finding and posting the data. ????

-

8 hours ago, alex8912 said:

Hmmm are you the OP???

My advise was to the OP.

A thousand pardons Alex.

I was blissfully unaware that anybody else, apart from the OP, reading a comment was ineligible to respond.

-

1

1

-

-

2 hours ago, alex8912 said:

I’m surprised no one said use an easy to get METV. If you plan to do even a little travel outside Thailand plan it for 60 days or a few days less after your first entry. You can extend the first 60 days by 30 but why bother doing that. Then come back after a few days or even one day somewhere else and repeat. You get 60 days entry each time. It’s so easy and I’m getting my 5 th one this fall. I spend 1/2 the year in Thailand and then work about 6 months in the states. No stupid 90 day reports or putting 800k in a Thai bank ever. The paperwork is super easy and you just mail it to the Embassy or consulate that covers you a couple weeks before you arrive. If you don’t stay here for 6 months In a row then maybe the other option is better. Since I leave after each 60 day entry I never do a TM30 also a waste and hassle. Great way to see other parts of Asia as well.

I cant work out the METV.

Thai embassy in Canberra website says 6 months max.

VISA TYPE

New Fee

(Australian Dollar)

(per entry / transaction / request)

Transit

- Single entry / validity of 3 months

- Double entries / validity of 3 months

45 AUD

90 AUD

Tourist

- Single entry / validity of 3 months

- Multiple entries / validity of 6 months

55 AUD

275 AUD

Non-Immigrant

- Single entry / validity of 3 months

- Multiple entries / validity of 12 months

110 AUD

275 AUD

Diplomatic / Official / Courtesy

Gratis

Currently on OA. I like to travel and 60 days max would be fine.

Want to spend 6 months here each year for tax residency. Obviously doesnt have to be in one block.

Single. No Non- imm O fits me.

Renting condo on 12 mth lease, which I intend renewing.

Hot tips please.

-

If anyone reading this has the ear of the decision makers, here is another point to consider.

An OA multiple entry visa obviously allows the holder to come and go as they please.

Lets say they spend 6 months in Thailand.

Any compulsory Thai insurance policy would be of no use for half it's, paid for, life and would only benefit the insurance company, not the visa holder.

-

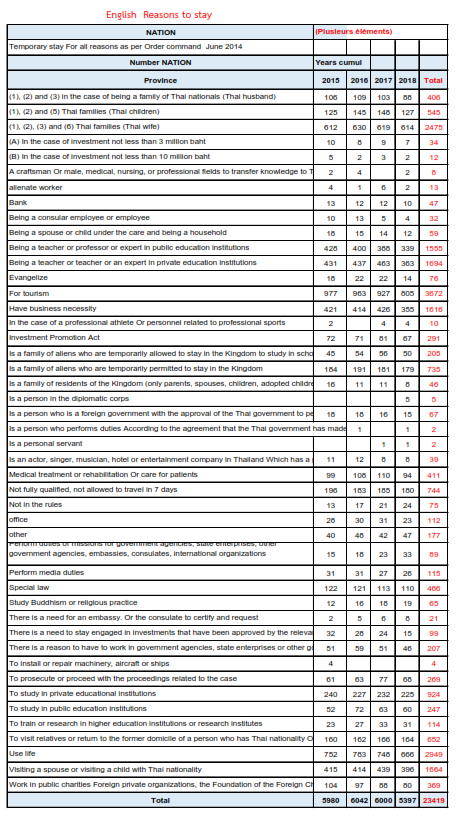

60% of respondents spend less that the 65k baht that apparently we need to survive on.

-

1

1

-

1

1

-

-

21 hours ago, ubonjoe said:

Not sure what you writing about doing.

You could go back to your home country and apply for a new OA long stay visa every year if you wanted to. But you can get a total stay of 2 years from a OA visa if used correctly.

Ubonjoe, have you heard of this raising any issues? Being seen as a 'hack'?

-

On 4/11/2019 at 1:59 PM, madmen said:

Just wondering what these are about ? no pension is a bit steep and all those deposits are permanent

1. With Pension - 50 years old and above - the required time deposit is US$10,000.00 plus a monthly pension of US$800.00 for a single applicant and US$1,000 for couple.

2. Without Pension

- 35 to 49 years old - US$50,000.00 time deposit

- 50 years old and above - US$20,000.00 time deposit

- Former Filipino Citizens (at least 35 years old, regardless of the number of dependents - US$1,500.00)

- Ambassadors of Foreign Countries who served and retired in the Philippines, current and former staff members of international organizations including ADB (at least 50 years old) - US$1,500.00

That last one (Ambassadors etc) also includes ex-military, but not all countries.

It's a pretty good plan B, or A. Ongoing costs for this group is just $10 USD per year.

-

On 3/9/2019 at 2:23 PM, farangx said:

And I am wondering if I get a bank letter here (seasoned 800k 3 months), get a medical certificate here, and other relevant paperwork here before I fly home and use them to apply for an OA. Will the embassy except these doco especially they are all in Thai? My purpose is to reduce the time spent back home running around gathering info.

Also watching for an answer.

-

5 minutes ago, Rod the Sod said:

Oznomad, first go to your local Tax Office and register for tax (take passport, Blue Book etc.) and they give you a number. The tax year runs Jan 1 - Dec 31 and so before end March go and ask to complete a tax return taking your Tax Number with you. If you are late they charge you TB200 penalty. They will probably complete it for you. If you are reclaiming withholding tax on Bank deposit interest you need a certificate from your Bank beforehand (just ask them for it). After two weeks you receive your tax refund. So that is your tax registration and return completed. Now armed with a copy of your tax return (duly stamped and signed by the Tax Office to show it is legit) and usual ID/Blue Book papers you go to the Department that issues Tax Residency Letters. I asked the first tax officer and he gave me the details for my area (if you are in Wattana BKK I can let you know these). The only other thing you need do is photocopy your passport pages and highlight the entry and exit stamps. You need to show that you have been in Thailand for 181 days (I think or thereabouts), so I created a table in "Word" that showed them the dates and I cross referenced to the photocopy stamp pages. They were happy that I had taken away the hard work for them and was told to return 2 weeks later. I claimed Tax Residency letters for 2017 and 2018 and on the due date, there they were. Without these you cannot claim tax back under double taxation laws so well worth the small amount of effort involved. Good luck. Let me know if you need to know anything else. RtS

A most excellent post. Thanks Rod. I am in Jomtien. We can safely assume that the rules will be different here but it's a great starting point. Cheers.

-

21 minutes ago, Rod the Sod said:

Actually it gets even better than that.

I have no earned income coming into Thailand so I am not liable to complete a tax return nor register for tax. But I do....

Why? Firstly, I can reclaim the withholding tax on my 800k Time Deposit (currently worth TB1,800p.a.). Secondly I feel that I have done everything I can to make my presence known to the authorities with nothing to hide, but thirdly, and most importantly, I can get Tax Residence letters from Thailand which I use to reclaim withholding tax on dividend income from Switzerland (currently worth circa TB100k p.a.).

The Tax man did look at me rather strange when I volunteered to complete previous years tax returns and pay the late lodgement penalty even though I had no tax to pay, but he did see my logic in doing it to get the Residency Letters.

Hope it helps someone out there....RtS

Hi. What did you do to get a Tax Residence letter, and presumably a tax number? Searching this site and googling hasnt given me any results. Thanks.

-

10 minutes ago, garzhe said:

Actually the 2017/18 rates are not quite that bad

Income Band Rate Notes 0 – 150,000 Exempt 150,000 – 300,000 5% New Tax Rate 300,000 – 500,000 10% 500,000 – 750,000 15% New Tax Rate 750,000 – 1,000,000 20% 1,000,000 – 2,000,000 25% New Tax Rate 2,000,000 – 4,000,000 30% 4,000,001 and Up 35% New Tax Rate (Reduced from 37%) Grab your salt and pepper - there is more 'seasoning' to be done.

If your pension is brought into Thailand in the year it was paid, it is taxable in Thailand.

If seasoned for a year and brought in the next, calendar, year it is tax exempt.

-

1

1

-

How can I extend my 2 month tourist visa???

in Thai Visas, Residency, and Work Permits

Posted

????????????

To take the OP a further step, would a 60 day Tourist Visa, extended 30 days, be feasible twice a year?

How about a 30 day visa exemption thrown in the mix as well?

Ostensibly to spend 6 months-ish a year here.