4myr

Member-

Posts

183 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by 4myr

-

i want to share this video with you. The question and answer starting at 1.52.30 is telling. The American advisor having offices in SE Asia said that it can take years before Thai RD have put in place the working procedures in place to make it happen. Earlier in this video he told that his Bangkok office is discussing with Thai RD about one tax credit case for a client for 15 months and the case is still not resolved. On the other hand in his answer he said that the clearest regulations are the double tax treaties, because Thai RD have to adhere to these. Can you imagine - 15 months about a tax credit from a DTA, which is supposed to be the clearest regulation.

-

Any feedback on my current tax filing strategy at the moment is welcome. About how I see it at the moment: - still 5-6 months till end 2024, and no real new and practical direction from Thai RD or from this forum gained - my income are director fees, no pension yet, and capital gains on property in home country. According to my tax treaty, no tax credits allowed for these income, but tax exemptions yes. This is confirmed by Dutch tax consultants. - in April I gauged my local RD office incl the lawyer at that office. They wrongly advice me to apply tax credits for my income and that I cannot apply tax exemption according to my Dutch tax treaty - I wrote an email to the lawyers dept of Thai RD in Bangkok to ask for clarifications, no answer. - Dutch RD will not deliver a tax certificate, as Thai RD asked in their English online leaflet. It is not part of their service. Around Q3 2025 a final tax assessment report will be provided on tax year 2024. - i asked 4 tax consultants on tax filing of tax exempted income. One gave a clear yes that they can file tax for me without paying tax. A second one needs to talk to RD officer, before it can commit. Both hover around 30k fee. My current tax filing strategy. This is a moving target as new info comes: - I'll stay tax resident and not escape the 180 day rule, as paying tax consultant is cheaper and more convenient. PS. capital gains on property is not yet taxed in my home country - the first few years I'll file tax the easy stuff by myself: pre-2024 savings and income. Advantage is I have pre-2024 records at hand, due to the lag of reporting by Dutch RD - if ww income is not yet introduced, I'll hire a tax consultant to file tax wrt to tax exempted income. The more remitted, the cheaper the fee per baht remitted

-

DIY solar system - how to sell electricity to PEA

4myr replied to 4myr's topic in Alternative/Renewable Energy Forum

@sathornlover well, never a boring time in Thailand ;). May I ask which PEA province this is? When we visited the PEA desk to ask about how the billing and crediting would occur, they said we had a choice of 2 [debit & credit separately] or 1 aggregated monthly bill. Have you checked the PEA smart app? There you can see your monthly bills. I don't know if they will report credit bills as well. -

DIY solar system - how to sell electricity to PEA

4myr replied to 4myr's topic in Alternative/Renewable Energy Forum

just got a call again from PEA. Still a few weeks waiting before inspection. The government is also out of money. They announced that the program has been stopped for new applicants. -

SIM router with weak RSRP signal - where to buy antenna to fix this?

4myr replied to 4myr's topic in Mobile Devices and Apps

thanks for the links. If they advertise 25-28dbi gain and a 4.9 review then you wonder. Band 40 is 2300 Mhz is what I need. Also out of range of these antenna's. -

SIM router with weak RSRP signal - where to buy antenna to fix this?

4myr replied to 4myr's topic in Mobile Devices and Apps

Any links you can share with me? I built my own from readily available components on internet, Aliexpress and Shopee: 1) the router - a Raspberry Pi4B initially, 8 months ago I moved to a miniPC with N100 cpu. More capable with fan, power adapter included and more ports than a Pi 5. Overkill at the moment, but the box is more quiet and looks nicer than the Pi. 2) router software - Openwrt 23.5 with LTE modules added like signal info, LTE failover, internet detector and to remove LTE buffer bloat 3) the LTE modem is a Fibocom L850-GL card, which I inserted in a usb adapter card within a black box and 2 antenna's. This modem achieves the 3 CA's if the signal reception is excellent. I also bought the more powerful L860 with 4 antenna's, however with speeds below 100mbps and no line of sight I put it on a shelf somewhere. I'll use it when I move to BKK or Chiang Mai. -

I use a SIM router for my internet at home. First I used DTAC at band 1. Since last year I use NT mobile at band 40. I live in a rural area. Between the cell tower and my house is about 500 meters. The signal is obstructed by a few houses and more by coconut trees. Both DTAC and NT mobile use the same cell tower. Difference is only the band - DTAC on 1 vs NT on 40. I use a LTE modem with 2 stick antenna's which hang against the window. There is no line of sight. With DTAC on band 1 I never had connectivity issues. DTAC provides me consistently between 5-15 mbps. The contract is maxed at 15 Mbps. While with NT I have a few times per month signal issues. The RSPR then is between -120 to -110db. Intermittently the modem tells me I lose connection. The overall strenght is below 40%. On good days the overall strenght is above 60%. Then I get on band 40 3 CA aggregations with speeds of around 50 mbps. After the takeover by True of DTAC the 1 year internet sims increased by price dramatically. NT mobile is the only provider that keeps its price below 1,000B. I have configured my router in failover mode with my phone connected by usb to the router, in case such a bad day happen. Most of the antenna's advertised in Shopee/Lazada is crap. On youtube I see a British guy making his own LTE biquad antenna which can be finetuned on the band frequency. I'm not that skilled. I wonder if someone can advice me a good antenna I can buy that can solve this issue.

-

DIY solar system - how to sell electricity to PEA

4myr replied to 4myr's topic in Alternative/Renewable Energy Forum

well well after more than 6 months signing of the contract at PEA Phetchaburi my gf got a call from the head of that department that we can start to sign another document. This document contains pictures of my solar system. The guy that is helping us came by with a drone to make a picture of the panels. he came with an rcbo breaker that i need to replace. it seemed that the requirements have changed as 9 months ago when he inspected the situation was ok. i had to ask a chaang climb up the roof to make pictures of the label on the back of the panel. so the document with pictures have been sent back to phetchaburi. no queue anymore to process. they will compare the pictures with the specs stated in the contract. if no issues we’ll get a call from the same team to inspect and test. they will not look into the grounding rod BTW my neighbor who had his 5kw system installed by a company in Ayuthaya, finally the company did not help him to sell to PEA as promised and included in the installation. The company should know. He has 10 panels of 550Wp which is above the requirements of max 5kWp, so any request to sell would have been rejected. -

so i’ve asked 3 tax consultants on a quote to help me do a tax filing on tax exempted income according to the DTA. One referred me to their paid consultancy service without even looking briefly into the case. One said to come back end of this year when they expect RD will come with an updated PD90 form. They expect that this form will be provided with fill in details regarding tax credits and tax exemptions. Hmm.. The third one was more realistic at least to me. Needs to speak coming months with RD on their interpretation of tax treaties related to his customers’ cases. Then he can base his tax filing assessments. He confirmed my worries eg RD have their own interpretations of tax treaties, appeals wrt treaties are a waste of time

-

Almost 2 months have passed since I was actively researching. In this time no real new practical information come out from the TRD to make up a remittance plan, but to wait and see and go with the flow. I'll call a few renowned tax agents whether they're willing to help me to convince TRD office and file taxes so that I'll receive the Dutch DTA tax exemptions (director fees, profit house sale abroad) I deserve for the next couple of years until my retirement. From retirement on no exemptions can be had, only tax credits. So no impact on extra taxation expected. Then I expect the world to change in terms of world income taxation and DTA changes.

-

For anyone wanting confirmation from Central TRD Legal dept about DTA exemptions and tax credits, you can direct your specific questions to [email protected]. I got this email address by calling the Legal dept of Central TRD, that is published on the rd website.

-

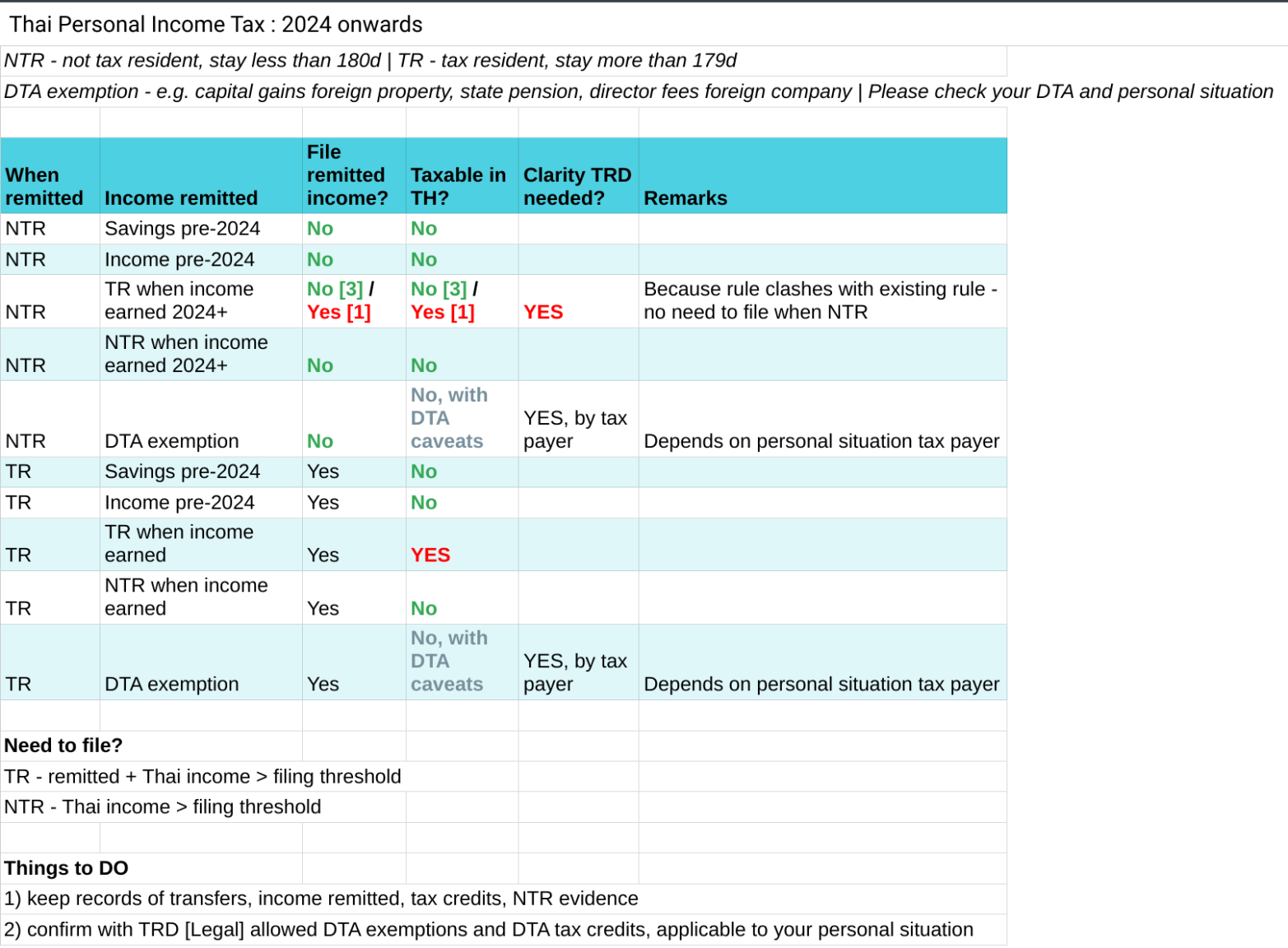

Thanks for this English link! It answers my case clearly. According to this TRD leaflet, my case is the 2nd 1st of the table, so ANSWER should be NO YES! Unfortunately this leaflet is one-sided on the DTA: 1) does not mention exemptions, if permitted in DTA 2) only mention tax credits, if permitted in DTA On evidence of tax credits, "Tax Payment Certificate issued by foreign tax authority is recommended." I was not even aware that my country's RD issues such certificates.

-

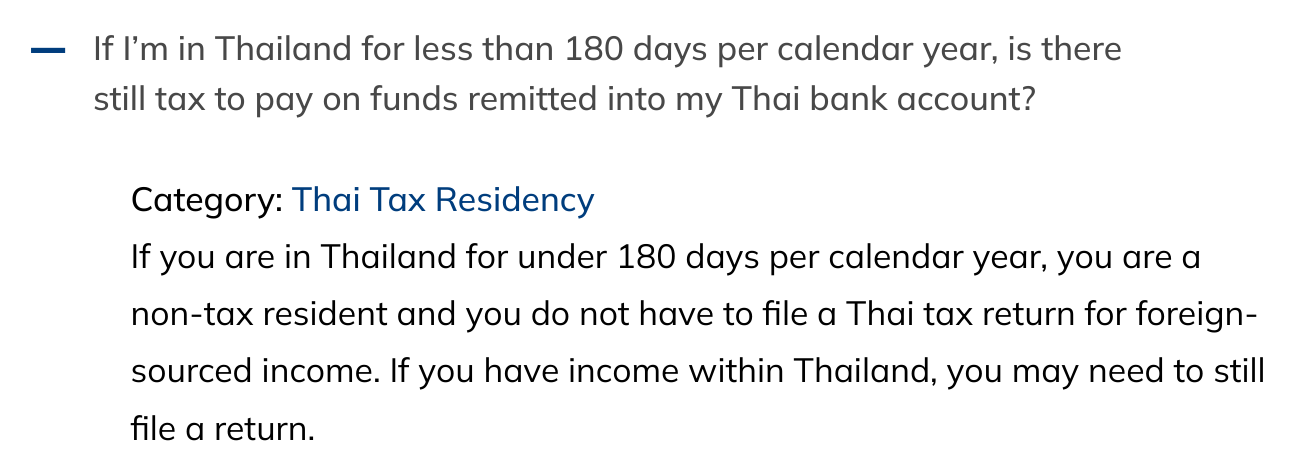

because CC 1161 is in line with a written FAQ question 1 from TRD [only in Thai language available], I have to agree reluctantly with CC 1161. On the other hand the owner of the expat tax filing service company has very good contact with TRD people in Bangkok. I can't understand why he is wrong in this: "If you are in Thailand for under 180 days per calendar year, you are a non-tax resident and you do not have to file a Thai tax return for foreign-sourced income. If you have income within Thailand, you may need to still file a return." Above is in line with https://www.rd.go.th/english/6045.html - "A non-resident is, however, subject to tax only on income from sources in Thailand.” However this statement is more generic than the specific FAQ question 1 case.

-

Here an update of my discovery of what the new tax rules should be. I consulted TRD call center [1161 or 1111], Dutch tax experts and a new expat tax filing service company, with an excellent Q&A database. Case: In 2024 I am tax resident, and I earn 2M baht. In 2025, I am not tax resident, and I transfer the 2M baht, which was earned in 2024. Q1 - do I need to file tax for 2025? Answers: CC 1161 - yes | CC 1111 - no | expat filing service - no | Prachuap office - no Q2 - do I need to pay tax for 2025? Answers: CC 1161 - yes | CC 1111 - no | expat filing service - no | Prachuap office - no CC 1161 answers in accordance to FAQ question #1. What matters is whether the income was earned in a year that you were tax resident. If yes, then you need to file tax, even though you were not tax resident in the year you transferred the income. Double tax agreement [DTA] Netherlands. There are exemptions listed in clause 23.5, for which these income types are not taxable in Thailand. For example, capital gains on property in NL [14.1]. And director fees [16.2] Answer CC 1161: cannot answer. I am not a lawyer. Answer tax office: not exempted, only tax credit can be applied. Answer DTA expert: exempted, however [also stated in DTA 23.5], if you transfer other income sources in the same tax year that you transfer the exempted income [e.g. profit of the property], these other income sources will be put in a higher tax bracket. The tax bracket is calculated as if the profit is not being exempted. Bottom line - only transfer the profit then you don't need to pay tax The DTA also states/limits the tax credits that are allowed. For the NL DTA these are clauses 23.6 and 23.7. Answer tax office: payroll tax paid in NL, can be used as tax credit Answer DTA expert: Payroll tax is not stated in 23.6 or 23.7, so it cannot be used as tax credit

-

Well a tax expert of the Dutch DTA says that DTA should be leading [PWC's quote]. So this small provincial tax office of mine is wrong. As I read UK's DTA 23.3 it has a more open clause that any UK income source for which tax was paid, can be used as a tax credit. The Dutch clauses 23.6 and 23.7 limits/refers to only a few income sources as allowed to be used as a tax credit

-

On the topic of foreign tax credits, anyone can shine a light on these 2 quotes of two consulting firms I found. My question: what is common practice right now? Or are there different practices in the land? From my first visit at my local tax office in Prachuap, my local tax officer offered me foreign tax credit on paid payroll tax. While my country's DTA does not mention payroll tax for which a tax credit is permitted. Yes I understand that my local tax officer is hardly knowledgable of the contents of DTA, But I assume she got some general instruction from higher management, that already paid tax abroad, without any distinction, can be applied as a tax credit. https://www.lorenz-partners.com/taxation-on-foreign-dividend-under-thai-law/ https://taxsummaries.pwc.com/thailand/individual/foreign-tax-relief-and-tax-treaties "Foreign taxes cannot be taken as a credit against Thai taxes unless permitted under a double tax treaty (DTT)."

-

same thoughts here. If I do like this, I can stay away from TRD for 2-3 years without any foreseeable risks in case they audit me. During this period TRD staff hopefully will be better prepared with a uniform and documented way of taxing remittance income, including taking care of DTA exemptions. In this period Thailand will also likely sign the new 2023 Netherlands DTA.

-

thanks! I see that the Thai version of PND90 pdf form is different and has an extra category "Other" under item 3.6. I retrieved both English and Thai forms from the RD site. So only the online form has reference to RC 40(g). I searched the Revenue code for "tax credit". It only refers to the Thai context in Section 47Bis, and is not related to foreign paid taxes. I assume for 2024 they will update the forms.

-

Would like some feedback on my tax filing example according to the Simple Tax Guide. I am filing for tax resident year 2025 using this PD90 form. In 2024 I was not tax resident. I will remit all [assessable and exempted] income cases I can possibly have in 2025, just for the sake of this example. I never filed a tax return in Thailand before. Income Excluded from PD90 According to STG, I can exclude all exempted income of RD ruling P161/2566 and DTA exemptions as assessable income, so I will not declare them in PD90, but I will keep records for audit purposes: all earnings before 2024 all savings before 2024 I was not tax resident in 2024, so all earnings of 2024 I can exclude, i.e. capital gains on sold stocks in 2024, director’s fee 2024, state & company pension 2024, dividend 2024 my NL DTA exempted income from tax resident years, i.e.: director’s fee of 2024/2025 state pension of 2024/2025 sold property in NL with profit in 2025 and remitted principal and profit in 2025 Income declared in PD90 item 1 / salary, wage, pension: company pension 2025 [paid NL tax 30%] item 3.3 [dividend from foreign company] - dividend 2025 [paid NL tax 25%] item 3.x / capital gains sold stocks - where I can declare gains of sold stocks in 2025? [no NL tax paid] item 7 / income from business or sale property: not declared sold house 2025, because exempted item 8 / income from sale property: not declared sold house 2025, because exempted item 11 / tax computation 11.12 / total tax payable 11.13 / Less: is this the place where I can declare my total foreign tax credits from items 1 and 3.3? Record keeping for audit purposes Record keeping not described in STG. 2025 / all foreign sourced Wise transfers to my thai bank accounts. Wise also reports exchange rate pre-2023 / 2023 / 2024 / 2025 - all exempted earnings, e.g. director fee or state pension statement, deed transfer 2025 of sold house, company registry extract with names of directors, annual bank statements, buy / sale receipts on sold stocks in 2024 / spreadsheet profit calculation, dividend in 2024, optional tax assessments NL-RD 2023 / 2024 / 2025 non tax residency 2024: I will not use eGates of Suvarnabhumi so I collect all passport stamps, reminder emails 90-day reporting, 90-day reports, boarding passes exit /entry Thailand 2025 assessable income company pension statement of 2025 [tax credit] dividend statement of 2025 [tax credit] tax assessment NL-RD 2025 [accrued tax credits] buy / sale receipts on sold stocks in 2025, spreadsheet profit calculation

-

Avoidance is I'm afraid not possible if you're a tax resident. However you can bring in money which are exempted in the P161/2566 ruling, e.g. earnings before 2024, or for which you have a tax credit evidence available. I was watching back a TRD legal expert called Khun Nathanan Junprateepchai talking to the Swiss ambassador that the Swiss pensioners should not worry, as he referred to the Swiss DTA that Swiss pensions will not be taxed in Thailand. Compare that to the position of his colleagues in my local office.

-

Recalling back to the meeting I tend to agree with you. All tax officers in the meeting were only referring stuff from the Revenue Code, as if an international agreement like a DTA does not have any meaning, even to the lawyer in the room, while it should supersede national law. Unfortunately for any law abiding tax resident, it's easier, cheaper and less frustrating not to escalate to RD headoffice/court, but to use the legit escape routes available in their tax rules, to achieve the same result as applying the DTA.