Everything posted by JohnnyBD

-

American wants to marry a Thai national. What are the legal steps

Just one more thing. If one files US tax returns as MFJ (married filing joint), the income tax savings can be pretty substantial depending on one's income. In my case, the MFJ tax brackets, the married standard deduction, and the married qualified dividend tax brackets allowed me to save about $10,000 in US taxes every year compared to if I had filed as single. I've been filing MFJ since 2017, so the tax savings were substantial.

-

FATCA COMMON REPORTING STANDARD - Information required - SMS received

The SMS you received refers to both FATCA & CRS. FATCA is for US citizens. CRS is for other countries (citizens) which includes Oz & Thailand. FATCA and CRS are international tax compliance standards requiring financial institutions to report customer account information to tax authorities to combat tax evasion. FATCA (U.S. law) focuses on identifying U.S. persons with foreign accounts, while CRS (global standard) covers residents of participating countries, allowing for automatic exchange of information The United States does not participate in the OECD's Common Reporting Standard (CRS) for the automatic exchange of financial account information. Instead, the U.S. relies on its own legal framework, the Foreign Account Tax Compliance Act (FATCA), which requires foreign financial institutions to report data on U.S. persons directly to the IRS

-

Bank - to -Bank transfers for Visa based on Marriage.

Just so everyone knows, Citibank Thailand was bought by UOB, and all Citibank TH accounts (mine included) were transferred over to UOB Thailand on April 19, 2024.

-

American wants to marry a Thai national. What are the legal steps

I think they just changed the Free File Fillable Forms online filing, so if somone checks the box for "treating NRA spouse as US resident", one cannot use FFFF filing anymore. I decided to mail my return this time and submit another NRA spouse declaration even though it was not required. I have a small refund, so I included my bank information for direct deposit. My wife got her ITIN when we filed our first joint return in 2017 with our original NRA spouse declaration. We filed online successfully using the IRS FFFF program from 2020 to 2024. This is the first year that we had a problem filing with IRS FFFF program because they added the check box on the 1040 for "treating NRA spouse as US resident". It's not a problem for me. I already mailed my tax return in. I will try again next year, and if I cannot file with IRS FFFF program, I will use an online tax service. Thanks for the discussion...

-

American wants to marry a Thai national. What are the legal steps

No, we live in Thailand. I left the box blank "on living in US more than half the year" and I also tried by checking it, but the FFFF system didn't let me file in either case. I got the same rejection. I use my US mailing address on my tax return because that's where I want my mail to go. Did you check the box for treating your nonresident alien spouse as a US resident? According to the rules, once the NRA spouse declaration is made on the first joint tax filing, it doesn't have to be made again. I never had to submit another declaration from 2018 thru 2023 when filing online. They just messed up the FFFF for me. I just need to switch to another online tax filing service for next year.

-

American wants to marry a Thai national. What are the legal steps

-

American wants to marry a Thai national. What are the legal steps

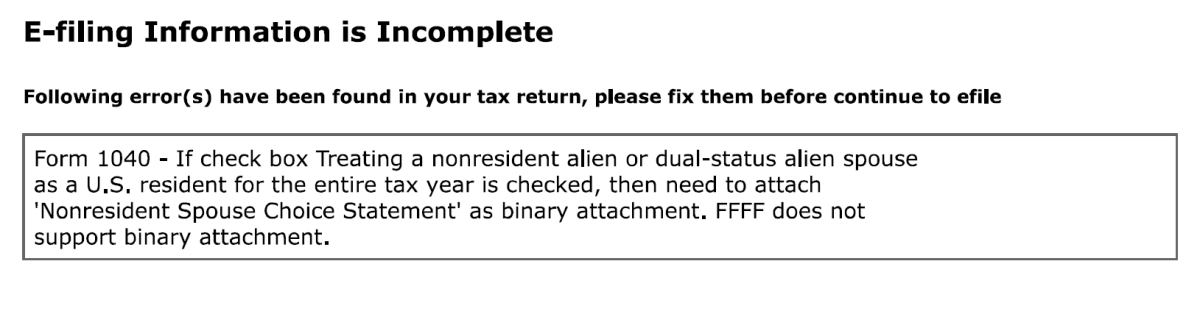

Thanks. I see that you used "e-file.com" to file your tax return. I will give it a test try to see if it lets me file, and what it says about the NRA spouse check box. Below is the rejection notice I received when trying to use the Free File Fillable Forms online. Enough about taxes...

-

American wants to marry a Thai national. What are the legal steps

I agree. I have to file because all of my income is reported to the IRS with 1099s. When I first moved here, some Americans laughed at me for saying I still file US tax returns. They told me they didn't. I guess their income was below the income requirements for filing, or their income was from non-reported cash sources.

-

American wants to marry a Thai national. What are the legal steps

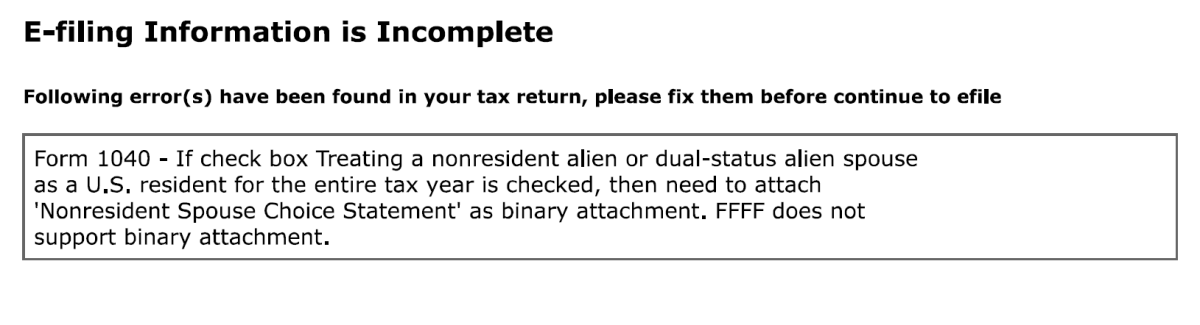

Are you using the IRS Free File or the IRS Free File Fillable Forms program? I use the Free File Fillable Forms. I can't use the IRS Free File. It sounds like you are not checking that new box on the 1040 for those filing joint with a nonresident alien spouse. When I checked the box, the FFFF told me to attach a NRA spouse declaration and file by mail. It appears the FFFF doesn't allow attachments anymore. Last year, when I checked the box, it let me attach my declaration. The NRA spouse check box first appeared on the 2024 1040 tax form. The box never appeared before 2024. This year, there is also a new box to check if you have lived in the US for more than half the year. See snippet I have been filing using the E-File online system for the past several years. My wife has an ITIN, and we use my US address.

-

American wants to marry a Thai national. What are the legal steps

I've been using thr IRS E-File online filing for the past several years, but this year the 1040 has a new check box for married filing joint with a nonresidrnt alien spouse and when the box is checked, the system requires one to attach a NRA spouse declaration to their tax return and the E-file online system would not accept any attachments, so we had to mail our tax return in. Last year, the system allowed us to attach our NRA spouse declaration, but not this year.

-

Signing over land to your wife - documents required?

I believe the key point, if a foreigner pays the developer or landowner directly and the property is going into the wife's name, then a document needs to be signed and given to the land office. If the foreigner transfers the funds to the wife's bank acct, and the wife pays the developer or landowner from her bank acct, then no document is required. My wife recently purchased 2 condos in her name with funds I gave her, and the developer told us what I wrote above. So, i transferred the funds to my wife's bank acct, then she paid the developer from her bank acct. I didn't have to sign any forms. I was out of the picture.

-

American wants to marry a Thai national. What are the legal steps

Just to make a few points, US social security & military pensions are not taxable in Thailand when remitted as per the US/THA DTA. You can read more about Thai income taxes on this forum (see link below). As you probably know, US citizens are required to file US tax returns unless their income is less than the standard deductions even if they live overseas. If you wish to file as MFJ (married filing joint) to take advantage of the higher married standard deductions, you will need to attach W-7 form to your tax return to get an ITIN number for your wife, and you will need to attach a signed Declaration Statement stating that you and your wife elect to treat her (nonresident alien spouse) as a US resident for the purpose of filing joint US tax returns. We started filing joint tax returns in 2017. We had to mail in our first tax return, but we were able to file online after that. This year, the IRS Free File Fillable Forms system would not let us file online. We had to mail in our US tax return and include a newly signed Declaration Statement. There's a new check box on the 1040 tax form for nonresident alien spouses. It appears to me the IRS is tightening up on nonresident alien tax filings. Introduction to Personal Income Tax in Thailand - Page 44 - Jobs, Economy, Banking, Business, Investments - Thailand News and Discussion Forum | ASEANNOW

-

Alert. Received a visit from the Local police because I am American.

I guess I'm one of the lucky ones. I've never had a home visit. 3 years on retirement, 5 years on marriage and the last 2 years on LTR visa.

-

Maximum.amount to withdraw with foreign card

Just curious, what is the card-issuing bank for your Mastercard? I have Citibank, BOA, Chase, Capital One & Barclays credit cards, and they charge foreign transaction fees for ATM withdrawals. Capital One & Barclays do not charge fees on foreign purchases. I've never tried a cash advance counter withdrawal with any of my cards, so I don't know what the fee would be. I use my Chase & Fidelity debit cards for ATM withdrawals. They have no fees, and they both refund the 250 baht ATM fee.

-

American wants to marry a Thai national. What are the legal steps

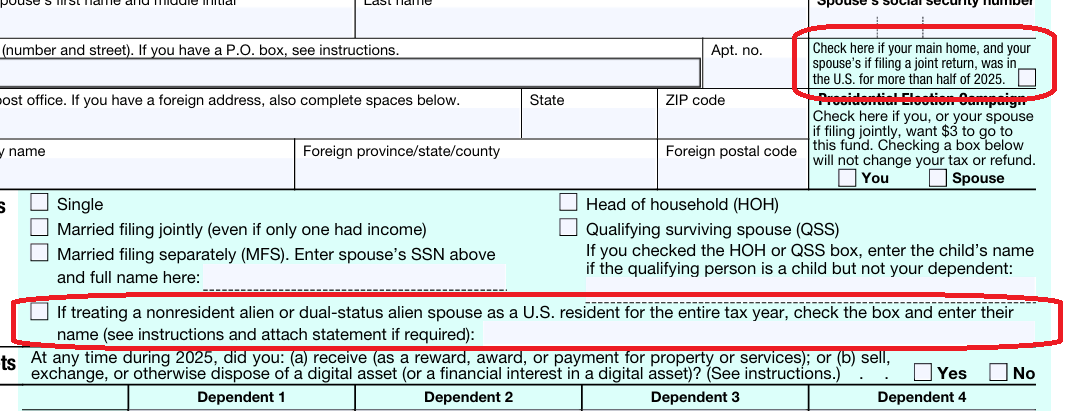

What papers are you referring to that's in Japanese? You need your US passport & "Single Status" form notarized by US embassy stating you are free to marry. Your Thai girlfiriend needs her Thai house book, her DL or passport & "Certification of Family Status" form stating she is free to marry. The one highlighted is the one I used. You may want to download the latest list on Embassy website. My list is old.

-

American wants to marry a Thai national. What are the legal steps

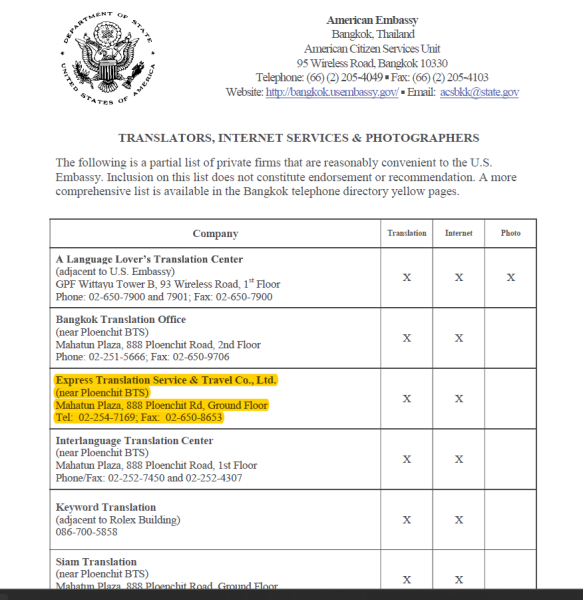

I found the easiest way to get married in Thailand is to use one of the Translation Service providers on the US Embassy's approved list. I used Express Translations near the US embassy in Bangkok. They did everything. They told me what docs I needed, they translated them into English & Thai, got the docs stamped at MFA, scheduled the marriage appt at Amphur, and then took us there to get married.

-

American wants to marry a Thai national. What are the legal steps

If you want to file US tax return as married filing joint MFJ, she will need to apply for a ITIN number by attaching a W-7 form to the US tax return and a statement declaring that she be treated as a US tax resident. The Green Card does not come into play with regard to getting married.

-

65,000 monthly income must be in Thai bank for a 'retirement' visa?

Are you serious? Just pay an agent to do everything for you.

-

Maximum.amount to withdraw with foreign card

I just looked back at my bank transactions. I was able to get 30k per transaction in Oct 2025 from the Kasikorn ATM in Emquartier mall at Phrom Phong in Bangkok using my US Chase Bank foreign debit card. SCB will only give me 20k per transaction. My debit card limit is $2,000 per day at non-Chase ATMs, so I can get about 60k per day.

-

Maximum.amount to withdraw with foreign card

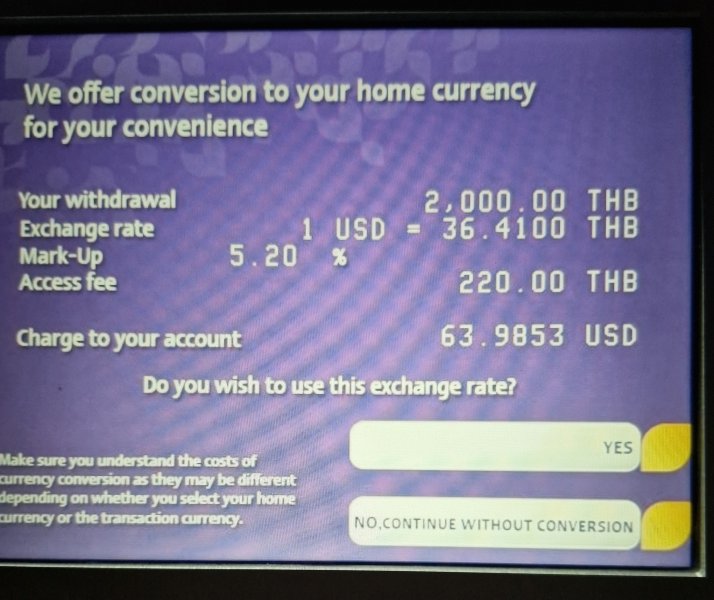

No, that was a pic I took in June 2024 for someone on the forum who didn't know what the "No, continue without conversion" button meant. That person complained about having to pay the extra 5.20% charge plus the 220 baht fee. So, I went down to the lobby of my condo and took a pic to show him.

-

Maximum.amount to withdraw with foreign card

SCB & Kasikorn should have an option to "Continue without conversion" because I've used that option every time I got money. I use my Chase Bank debit card. Chase does not charge me any fees and they also refund the 250 baht ATM fee due to my relationship level. See bottom right of screen.

-

Maximum.amount to withdraw with foreign card

Are you selecting to let the Thai bank ATM make the conversion? If so, they usually charge about 5.5% which equals about 1,100 baht extra plus the 250 baht ATM fee. If you select "NO, continue without conversion", then you should get the best outcome.

-

LTR Visa is Now available for Long Term Residency

Normally, one would use their official 2025 tax return and brokerage firm's tax forms to show their capital gains. But, as you said, you are not going to report any capital gains on your UK tax return, and it doesn't sound like your brokerage firm will be issuing any tax forms either. You are in a unique situation of trying to prove your unreported capital gains without any official documentation. You could consult with one of LTR's approved visa firms about your situation. Or, you could email BOI directly on what types of documentation they would accept. Good luck...

-

Bangkok Bank Are At It Again!

That appears to be the policy of many if not all Thai banks. I don't know who sets that policy, the banks or the gov't. I've had USD accts here since 2016, but I only wire what I need, so I will never need to send any USD back overseas.

-

LTR Visa is Now available for Long Term Residency

I received my LTR-WP visa in July 2024. I submitted 1 year (2023) tax return, my pension verification letter, pension 1099-R form for 2023 & insurance certificate. They also asked me to upload my marriage docs (I don't know why).