JohnnyBD

Advanced Member-

Posts

625 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by JohnnyBD

-

The US Senate passed President Donald Trump's "One Big Beautiful Bill" Act (OBBBA), and it was passed by the US House of Representatives on Thursday. It is headed to Mr Trump's desk to be signed on July 4th. The bill includes an excise tax of 1% on remittances to foreign countries by non-US citizens. The new provision excludes transfers from US bank accounts, as well as debit and credit cards issued in the US. The tax would apply if cash, a money transfer order, cashier's check or similar is used to transfer funds. From what I read, US citizens would be exempt from this new tax.

-

SWIFT-WISE Breakeven?

JohnnyBD replied to NoDisplayName's topic in Jobs, Economy, Banking, Business, Investments

Chase has always posted immediately. I went for a smoke afterwards, so it was probably 20 min before I got back to my room to check the transaction. The 220B refund will post the next day. -

SWIFT-WISE Breakeven?

JohnnyBD replied to NoDisplayName's topic in Jobs, Economy, Banking, Business, Investments

Thnaks for the heads up. Just got money from SCB ATM downstairs. I checked my bank acct, and it was 32.47 using my Chase debit card. The 220B fee is reimbursed by Chase. -

SWIFT-WISE Breakeven?

JohnnyBD replied to NoDisplayName's topic in Jobs, Economy, Banking, Business, Investments

Just my opinion, but I don't think one can make a true apples-to-apples comparison, because SWIFT transfers normally post the next day. If the rates go up overnight by just .10, one could potentially get about 6,000 baht more with SWIFT using your example. Of course, if rates drop overnight, one could end up worse. That's why I send $ to my USD acct, and then watch. As long as the rates are going up, I wait until my Thai bank adjusts their rates higher, and then I keep watching, and if spot rates drop during the day, I will convert to THB before my Thai bank adjusts their rate lower. My Thai bank only adjusts their rate 3 to 4 times per day, so I usually have time to react. Most of the time, I can do just as good or better using SWIFT, as my previously posted real-life transaction shows. Most probably prefer Wise because it works better for them, and especially for those who want the money quickly. There's always a risk with SWIFT because the rates could fall by the time the conversion is done, but SWIFT works well for me. Good luck... -

SWIFT-WISE Breakeven?

JohnnyBD replied to NoDisplayName's topic in Jobs, Economy, Banking, Business, Investments

i was using the earlier 13:55 price. He's using 32.30 rate in example. That rate is not correct. -

SWIFT-WISE Breakeven?

JohnnyBD replied to NoDisplayName's topic in Jobs, Economy, Banking, Business, Investments

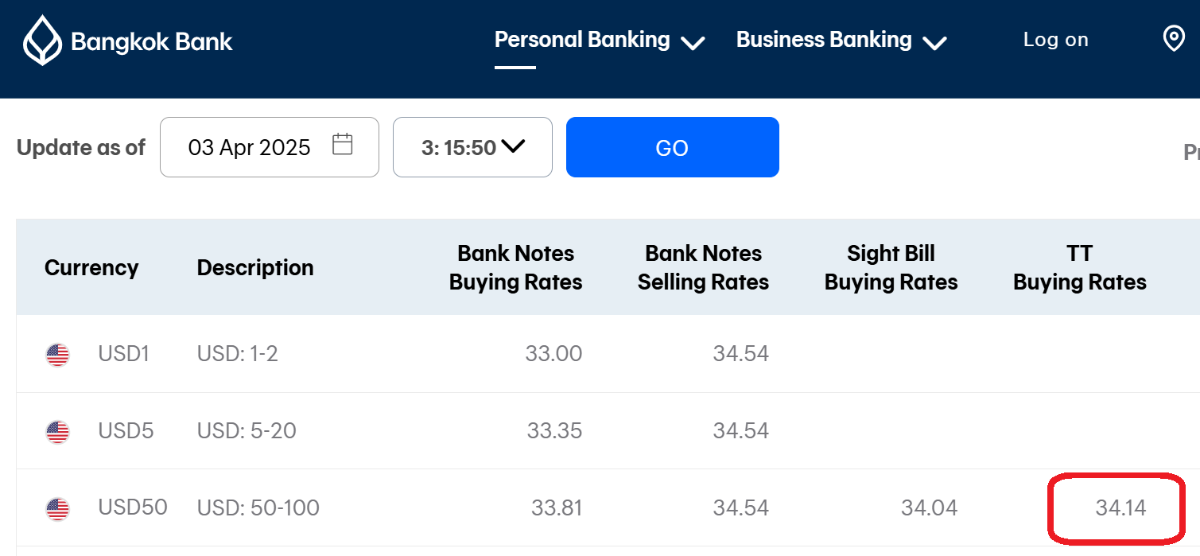

The Bangkok Bank TT Buying Rate on June 20 is showing 32.70, not 32.30. I get the TT Buying Rate when I convert to THB. Where did you get rhe 32.30 rate from? -

SWIFT-WISE Breakeven?

JohnnyBD replied to NoDisplayName's topic in Jobs, Economy, Banking, Business, Investments

-

It's a sad fact, but many people working and/or retired are living "hand to mouth" or "paycheck to paycheck" with very little or no savings. In those cases, it would be wise to have a credit card to use in case of an emergency where you need to pay for something immediately. A significant portion of Americans are living paycheck to paycheck, meaning they rely on their next paycheck to cover their current expenses. While the exact percentage varies depending on the survey and how "paycheck to paycheck" is defined, recent reports suggest that a majority of Americans, potentially over 60%, are experiencing this financial strain.

-

Foreigner Tax Requirements

JohnnyBD replied to PatThaiM's topic in Jobs, Economy, Banking, Business, Investments

I think he mean's Trump's "Big Beautiful Bill". A tax bill currently working it's way through the US Congress. -

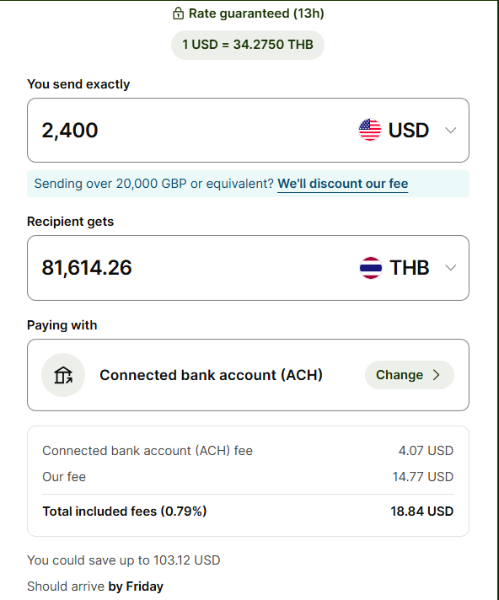

I can understand why those sending their pension every month may need it quickly when they are counting on it for living expenses. I have never needed money in seconds, so I guess that's why I didn't understand. I have never experienced a 4 to 5 day delay in wire transfers either. For example, I recently made two wire transfers, one to Bangkok Bank for $2,400 minus $6.00 incoming fee, it arrived the next day, and the other was to SCB for $3,700 minus $9.25 incoming fee, it arrived the same day. My US bank doesn't change me an outgoing fee, so I find it just as cost effective to use wire transfers and send to my USD accts, then convert whenever I want.

-

I must have hit a sore nerve for someone who down thumbed my question. I still don't understand why someone cannot keep enough in their Thai bank to use for every day use, then send more money with a next day arrival. I guess I will never understand how some people manage their money where they need to get it from overseas in seconds.

-

I always wanted to ask, why do some people need ultra-fast Wise transfers to their Thai bank accts? I'm just trying to understand why some say they need money from overseas in seconds vs. next day arrival. One could simply use their Thai bank ATM card to get money, and when their balance starts to get low, they could just send more money. Is it because some people let their bank balances get too low before sending money? Just asking...

-

Why can't you sch a wire transfer online from your US bank? Why was it so hard like pulling teeth? Many banks & brokerage firms let you sch wire transfers online. I wire USD from Chase to Bangkok Bank whenever I need. Chase doesn't charge me an outgoing fee. BBL charges min 200b, max 500b, so a $2,400 xfer costs me ~ $6.00. I leave the $ in my USD acct and convert when I get a good exchange rate. It takes 1 day for the wire transfer to arrive. If i need money in seconds, i just get it from my THB acct at ATM, or I use my Chase debit card. The 220b ATM fee is reimbursed by Chase. Most here probably use Wise.

-

Kasikorn bank joint account

JohnnyBD replied to anchadian's topic in Jobs, Economy, Banking, Business, Investments

Just so you know, UOB allowed us to have a joint THB acct with separate debit cards. We can access the joint acct using the app from either of our phones, and we have separate logins for web-based banking. We also have a joint SCB acct with 1 debit card & a bank book. SCB wouldn't allow us to access the joint acct on either of our phones. I cancelled my THB acct, hoping they would let me put the joint acct on my phone, but they wouldn't allow it. We just consider it to be our ultra-safe savings acct, since it has no online access. We never asked Kasikorn about a joint acct, but I'm pretty sure you can get one. I don't know if they will give you separate debit cards. Better to just go in the bank and ask. -

I am a little disappointed in SCB. I can't do any online banking with them anymore. I have only a joint THB acct and USD acct, and they only allow me to see my USD acct. I have to go into bank to convert to THB acct. They will not put my joint acct on the app. I had a THB acct, but didn't need it so I closed it. Too many accts to keep track of and report to US gov't.

-

It does for me! Curious or what? Let me post my full sentence that you butchered up: Also, SCB does not have internet banking anymore, but they still have the app for banking transactions. Let me clarify and make it very simple for you. SCB doesn't have web-based banking anymore, they only have the phone app-based banking. Many people use general terms like internet banking to mean web-based banking, and not phone app-based banking. Many people also say they have a retirement visa, when what they really have is an extension of their original Non-O 90-day visa. Most people know what those general terms mean, so they don't make annoying comments like your's above. And, yes taking partial sentences or paragraphs sometimes do change the meaning, just like your comment above. I hope I made it simple enough for you.

-

Krungsri's internet banking option to access one's account using the bank's website will be going away. The only option left will be to use Krungsri's app, same as SCB. UOB & Bangkok Bank still allow customers to use both options, the website access (without app) and using the phone app. Those are two separate options, but they both use the internet. Do you agree?

-

Did you get a tax clearance certificate or just a receipt showing you filed and paid taxes? I haven't read about any foreigners being stopped from leaving the country. Maybe the old law requiring a tax clearance certificate was for those who actually worked in Thailand, and not really for foreigners who just remitted money from overseas.