JohnnyBD

Advanced Member-

Posts

631 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by JohnnyBD

-

Just curious, Why do you think people need to report a Gov't pension that's exempt or pre-2024 remittances or any other non-assessable income on their tax returns? I'm just trying to understand where you are getting this from, that everyone needs to report the above mentioned monies on a tax return. Is a tax firm telling you this, or is it just your opinion?

-

Just curious. How would you claim a Tax Exemption from the TRD after reporting a Gov't pension on a tax return when there's no place on the tax return to claim an exemption for that income? Would you also report your pre-2024 remittances or other non-assessable income on your tax return? If so, where & how would you claim an exemption for that income? Maybe it would be better not to report a Gov't pension or pre-2024 income or any income that is non-assessable on a tax return, that way you won't have to argue with them about whether it's taxable or not. By the way, which tax firm is advising you? Or, are you winging it yourself?

-

Just so I'm clear on things. Aren't we supposed to self-determine whether the monies we remit are assessable & reportable according to the rules? And, if we remit only non-assessable monies such as; pre-2024 monies, or US Social Security which is supposed to be only taxable by the US (as per the USA-THA DTA), then we should not need to file a tax return or pay taxes on those monies. Is that correct? Also, if one is a LTR-WP visa holder, then all monies remitted are supposed to be tax exempt as per Royal Decree, so one should not need to file a tax return or pay tax on any monies remitted. Is that correct?

-

Just so I'm clear on things. Aren't we supposed to self-determine whether monies we remit are assessable or not? And, if we remit only non-assessable monies such as; US Social Security or pre-2024 monies, then we should not need to file a tax return or pay taxes on those monies. Is that correct? Also, if one is a LTR-WP visa holder, then all monies remitted are supposed to be tax exempt as per Royal Decree, so one should not need to file a tax return or pay tax on any monies remitted. Is that correct? It appears some people are saying one should file a tax return and report all monies remitted, even if those monies are non-assessable, not taxable as per DTA, or exempted by Royal Decree.

-

Your situation is unfortunate, but I do not feel it's a bad omen for the rest of us. You're the only LTR-WP visa holder that I know of that had a problem. I did receive an email from BOI stating all my remitted income will be exempt, so I feel comfortable not filing a tax return. I hope you have better luck next year.

-

Our UOB joint THB acct shows up on my phone app, on my wife's phone app, and on both of our internet banking user accts. Our SCB joint acct does not show up on either of our phone apps. We asked and they said only our individual accts can show up on our phone apps. They do not have internet banking anymore.

-

To OP, It sounds like you are sending small amounts ($100 USD) using SWIFT, and your bank is charging an outgoing wire transfer fee of $30 or more. Kasikorn charges an incoming wire fee of 500 baht, so that can get really expensive if you're sending small amounts. Better to send a larger amount to Kasikorn and use the money, then when your balance starts to get low, send more. Many foreigners in Thaialnd use Wise to send money from their home country, and it seems to work well for them. I get money in Thailand in two ways. 1. I wire USD from my US Chase Bank (no wire fees due to my relationship), to my USD account with Bangkok Bank. I convert it to my THB account whenever I'm ready. Bangkok Bank charges min. 200B, max 500B incoming fee at .0025. So, if I send $2,400 USD, Bangkok Bank charges me $6.00. Chase doesn't charge me anything. My wire transfer take 1 day to post, but that's not a big deal because I keep enough to live on, so I don't have to rush to send money. I could send USD directly to my THB account, and let Bangkok Bank convert it automatically when they get it, but I prefer to watch the rates and convert it myself. 2. I watch the MC & Visa exchange rates, and get THB from the ATM using my Chase debit card. There's a 220B ATM fee for each transaction, but Chase reimburses me for the 220B fee. I also select NO, Continue Without Conversion" so that the Thai bank doesn't charge me their 5.5% conversion fee. That way I get the best exchange rate. Good luck...

-

If your SIM is registered in your wife's name, that's acceptable as per the rules UOB sent me. We went to the bank with my passport, marriage certificate, wife's ID & AIS bill and we signed some forms before April 25th. I opened accts with SCB & Bangkok Bank last year, and they must have made us sign the forms then because we never received any notices from them.

-

More Wise issues

JohnnyBD replied to CallumWK's topic in Jobs, Economy, Banking, Business, Investments

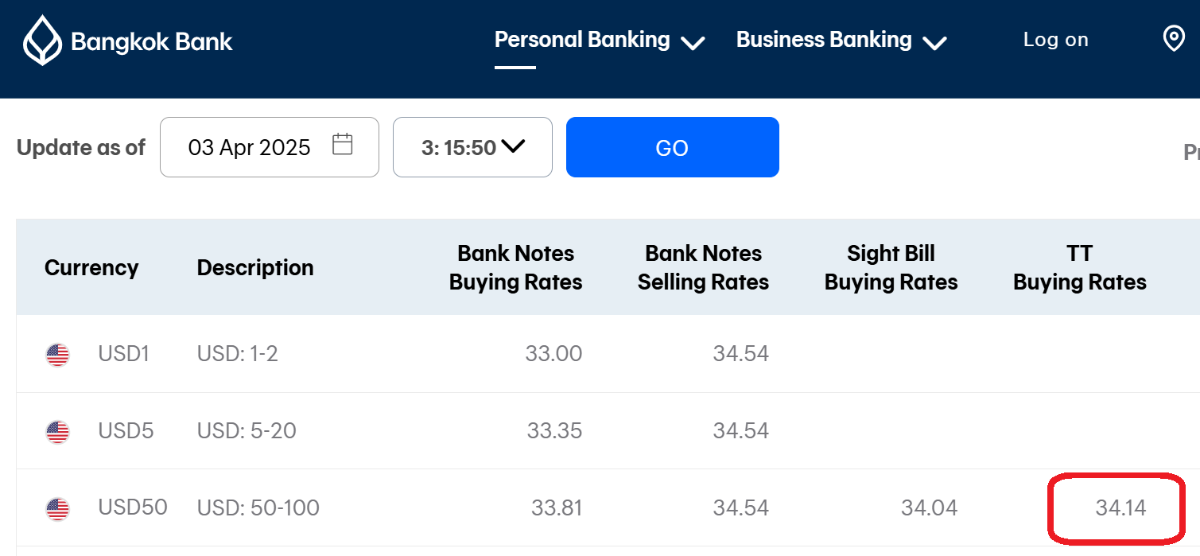

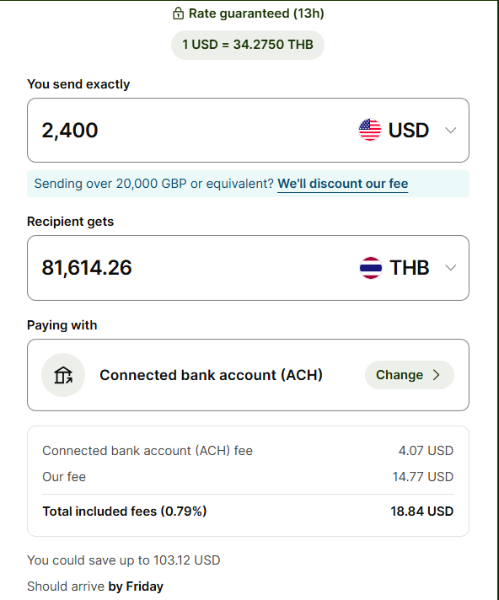

Made $2,400 USD xfer via SWIFT (no outgoing fee with Chase Bank due to my relationship) to Bangkok Bank minus .0025 incoming fee of $6.00 = $2,394 converted at 34.14 = 81,731 THB. Most US banks charge an outgoing wire fee of $35 to $75 USD, which would make Wise a better choice. I just use SWIFT since I pay no outgoing fees. Wise was 81,614 -

Dear Drjack54, No insults intended, but I always wondered how many people % wise live in Thailand on ST visas doing border runs or flights in & out, and for what reasons. Maybe under 50 who don't qualify for retirement, or not married to a Thai so don't qualify for marriage. One guy told me he's been here 8 years on every different ST visa while doing border bounces, etc., but he just received the 5-yr DTV on a company he just made up. ST = short-term

-

Thanks for the very detailed explanation. So, all US citizens are required to report and pay taxes on Traditional IRA taxable distributions on their US tax returns if they exceed their deductions, subject to credit for taxes paid in Thailand. Someone seemed to suggest that one could notify the IRS that they are a Thai tax resident and then would not have to report those distributions on their US tax return. That doesn't seem correct.

-

Jim, could you pleasd comment on how Traditional IRA distributions will be reported to each country. For example; Case 1: John, a US citizen, takes a $30k IRA distribution in 2024, and remits it to Thailand in 2024. John reports it on IRS 1040 tax return as normal, but he also files 1116 and claims a credit for taxes paid in Thailand, thereby reducing his US tax bill. Cases 2: John, a US citizen, takes a $12k IRA distribution in 2024, and remits it to Thailand in 2024. John reports it on IRS 1040 tax return as normal, but he cannot claim a credit even though he filed a Thai tax return, because he didn't pay any taxes in Thailand due to his deductions and allowances. Would this be how it would work?