Etaoin Shrdlu

-

Posts

1,625 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Posts posted by Etaoin Shrdlu

-

-

2 hours ago, shortstop said:

I didn't want to cause confusion by asking theoretical questions to the bank about other matters yesterday but I am curious if Thai banks would deposit my personal check made out to myself in this manner.

A couple of years ago a family member mailed me a check. I took it to Bangkok Bank's headquarters on Silom where I had brought SSA checks for deposit. BBL would not accept a personal check. I don't know if this is still the case or if other banks have the same policy.

-

1

1

-

-

5 minutes ago, JimGant said:

No, do the math before you decide there's too much bother. I would imagine the preponderance of US/Thai marriages would benefit from the ITIN option.

Jim, I agree. I think there is another advantage for having the spouse get an ITIN and file jointly and one that may affect some on this forum. I think that married filing separately while living with one's spouse changes the base for calculating whether Social Security benefits are taxed and at what rate. Do you know if this is correct?

-

1 hour ago, andy said:

Be aware that getting her an ITIN will result in her being put on US tax radar for life and this includes any bank accounts or other assets that may trigger FACTA/FBAR. You probably want to pass on that unless you REALLY need that extra deduction. You also may want to consider the potential advantages of having a spouse who is not subject to US taxes...but I won't go into further detail about that ????

I don't think the election to have a non-resident alien spouse file jointly triggers FBAR requirements for the non-resident alien's financial accounts. I recall looking into this many years ago and came to the same conclusion as described in this article:

https://us-tax.org/2018/10/17/married-to-a-non-us-spouse-filing-your-fbar-and-form-8938/

Filing jointly does seem to trigger the need to file 8938 however the thresholds for filing for those living abroad and meeting the presence or resident test are fairly high, so check to see if this is necessary. Also, Citibank's branch here in Thailand is not considered a foreign financial institution, so keeping money in Citibank Thailand may obviate the need to file 8938 in some cases. Here's the IRS guidance:

https://www.irs.gov/instructions/i8938#idm140161186211248

The IRS page below looks like it states that If married to a non-resident alien and the election to file a joint return is not made, the only status available unless qualifying for head of household is married filing separately. The income threshold for reporting as MFS is $5.

-

18 minutes ago, UKresonant said:

So in respect to a new application for an OA visa in a Home Country at an RTE. Is the RTE on thin ice by providing a "courtesy" link to insurance that is not authorised to be sold in the overseas country, combined with the form for an overseas insurer to sign, knowing that technically, they can't legally comply with (iaw with a Thai Cabinet resolution).....Whilst the RTE is saying the insurance is compulsory for the application! Then there is the issue of the Thai Policy T&Cs, which may have a clause that says the policy , shall not be appropriate unless you have resided in Thailand for 6 months out of 12.

Any way how does that help in anyway with the unpaid hospital bills, as it would appear they are individual policies, not a mutual medical fund pool.

Please don't mistake my attempt at describing certain insurance regulations as I understand them with a defense of this scheme and all issues arising from it and how the various parties interact with it. I have no particular insight into the motivations of those who put it together, nor do I wish to try to defend the pricing or coverage of the policies themselves. My comments were intended to be much narrower in scope.

-

2

2

-

-

1 hour ago, sathornlover said:

Very good point but:

As a registered foreigner I normally have access to all the insurances under the same conditions as the citizens of the country and usually in most countries no special prices are charged for foreigners in the state health facilities ....I agree that the three-tiered pricing allowed by the government at state health facilities does not put the government in a good light and seems driven largely by xenophobia, especially as it also applies to foreigners working here and paying full social insurance premiums and taxes through their employer.

I don't have much knowledge of how countries with well-developed state-subsidized healthcare systems treat foreigners, so I can't offer much of a comment on that topic.

-

1

1

-

-

- Popular Post

- Popular Post

2 minutes ago, Peter Denis said:Thanks again for an insightful response.

It explains why Thai Immigration when you are already in country and have to meet the Thai insurance requirement re the 400K/40K health-insurance (when applying for the 1-year extension for reason of retirement based on your original Non Imm O-A Visa), ONLY allow Thai IO-approved insurance.

Yes, the need for Thai insurance for those already present in Thailand is primarily driven by regulatory issues and not some nefarious intent on the part of the Immigration Department or necessarily insurers themselves. In fact, I believe this scheme was pushed by the hospital industry due to the perception that resident foreigners were skipping off without paying.

I don't think the current scheme for retirees is a particularly big money spinner for insurers. It is not a particularly large demographic and it is not very desirable due to the age of most retirees. I suspect that the hospitals probably pushed for higher limits, particularly inpatient, but insurers pushed back and this is the result. 400k is not very meaningful for a major illness, so I think it is a compromise.

-

2

2

-

1

1

-

- Popular Post

- Popular Post

1 hour ago, Peter Denis said:That's interesting information which I was not aware of.

However, those rules you mention seem only to apply when needing insurance for Immigration purposes when in Thailand (limited to Thai IO-approved TGIA-associated insurers only).

1 - When being abroad and wanting to re-enter Thailand, the Thai insurers are all too happy to sell you their Thai insurance (e.g. the mandatory insurance when wanting to re-enter on a Non Imm O-A Visa, STV or currently also the Non Imm O Visa for reason of retirement). For the Non Imm O-A application you can make use of foreign/international insurance, but the requirement that such foreign/international insurance needs to be accompanied by the specific Foreign Insurance Certificate form filled-in/signed by your foreign insurer (and it referring to Thai legislation, which foreign insurers are not familiar with and therefore are reluctant to fill-in) drives applicants towards Thai insurance policies. And the STV application in many countries ONLY accepts Thai insurance.

Note: And to meet the currently required 100.000 US $ covid-19 insurance, you have the option to subscribe to foreign/international insurance, but also to the TGIA covid-19 only Thai insurance.

>>> So it looks that the legislation you are mentioning is Thailand only rule to keep out 'foreign insurance competition' while Thai insurers can freely peddle their products/services abroad.

2 - I strongly doubt that if you do not need the insurance for Immigration purposes, that you would not be able to subscribe to foreign/international insurance EVEN when you are in Thailand.

I bought many times foreign travel-insurance 'on the fly' when being in Thailand, and I understand that some Thai insurance brokers also do provide foreign/international policies when they provide better value than their Thai counterparts (which by the way, is almost always the case).

Thailand's insurance regulations are not much different than many other countries' regulations in that they restrict or prohibit the sale of insurance products by insurers not licensed by the local regulator in the country in which the purchaser resides.

Note that the Thai insurance regulations apply to insurance companies and not policyholders or individuals. This is common and it is because insurance regulators usually don't have the authority to prohibit what consumers may do, only insurance companies.

I am aware of foreign insurers selling products into the Thai market without being licensed here. There does not seem to be much enforcement effort since it would be difficult, but technically it is not allowed and as a result it is unlikely that these insurance policies would be acceptable for statutory insurance requirements. I also think such sales are focused mostly on the expatriate community. It might be different if foreign insurers were selling to Thais in a meaningful way.

It seems that the Immigration Department and the OIC are presuming that foreign insurance purchased for the purpose of entering Thailand for the first time, or re-entering from abroad, was purchased by the foreigner while abroad and therefore the foreign insurer is not contravening Thai regulations. They are also probably assuming that the foreigner's home country has similar restrictions on cross-border insurance sales and are therefore not forcing foreigners to buy Thai insurance products in these instances. As you stated, they do require insurers to sign off on the document you mentioned, which will of course be a non-starter in many cases.

Thai insurers are probably not prohibited from selling across borders by the Thai regulator. Such prohibitions would come from the regulator in the other country. Whether a Thai insurer would be willing to do so would depend upon its own business considerations and risk tolerance. It could open up a Thai insurer to litigation in another country, including from a disgruntled policyholder, which is probably something it would wish to avoid.

Thai insurance tends to be expensive and not very broad in coverage compared with what is available elsewhere. This is due to the particular nature of the Thai insurance market and its relatively small size, especially given the large number of insurers active here. Insurance penetration, especially health insurance, is very low among the Thai populace, so none of them get any economies of scale or the benefit of the law of large numbers.

-

2

2

-

2

2

-

1 hour ago, jayboy said:

Out of interest, is it the case that insurance is restricted to the approved Thai insurance companies? If not,I would have thought that since Marjf has full cover from BUPA, all that would be needed is a confirmation -with certified translation if nececessary - from the company that there is appropriate cover.

I'm probably missing something..

Thailand restricts the sale of insurance to the Thai public (Thai public is anyone physically in Thailand) to insurers that are licensed by the Office of the Insurance Commissioner. When you apply for your visa overseas, you are not yet part of the Thai public, so you can purchase insurance from a non-Thai insurer and satisfy the requirement. Once you are physically present in Thailand, it is not allowed under Thai regulations for a foreign insurer to sell insurance to you. It would be difficult to imagine the Immigration Department allowing people to satisfy a government insurance requirement with insurance from a foreign insurer that is technically not allowed to sell to you, especially with the OIC aware of the insurance requirement.

Almost all countries have similar regulations restricting cross-border insurance sales and Thai insurers are probably not permitted by your home country's regulator to sell you insurance while you are in your home country. That's why Thai insurers require a Thai address when taking out a policy.

-

1

1

-

1

1

-

-

On 2/27/2021 at 3:34 PM, JimmyJ said:

The Chase app does not demand Location access?

I assume you keep a USA phone #.

?

When I visited the US a couple of years ago I opened an account with Chase using my Thai address and phone number. I use the Chase banking app to deposit the odd check that I receive without any issues with respect to geofencing. Chase even mailed checks and a debit card to me directly here in Thailand after opening the account. Chase did not require a US phone number or address.

-

2

2

-

-

3 minutes ago, Airalee said:

This is the issue for me. I did an expensive gut renovation on a brand new condo and couldn’t find anything in the policy that would cover me for the upgrades. There was also a cap on many personal belongings such as electronics which if I remember correctly was capped at ฿30,000.

The upgrades should be insurable under most condo policies. Your receipts from the contractor(s) along with supporting descriptions of the work they performed can be used to prove your ownership in the upgrades and their cost or value. The values of those items should be included in the sum insured under the policy as fixtures, improvements and betterments or whatever relevant category is provided on the insurance proposal form. I would suggest you also make a detailed list including corresponding values of everything you intend to insure and submit it with your completed application. Write a cover letter referring to the list and the application when submitting them and keep copies of everything. Ask your broker or insurer to confirm that they are going to cover everything you've declared for the sums you've submitted.

There is typically either a cap or an exclusion for certain items such as jewelry, electronics, artwork and other valuable items. It is often possible to insure these items, or to insure them for higher limits, but you will need to itemize them and provide values for them. You'll also want to be prepared to provide receipts or appraisals for valuable items in the event you have a claim as you'll be asked to prove both ownership and the value. Photos of insured items can help, too. Insuring electronics can be problematic because they become obsolete very quickly and many insurers don't offer full replacement value for them.

I suggest you contact a local insurance broker who can give you proper advice as to your options and how to make sure you insure everything you want in the manner you wish.

Get everything in writing.

-

1

1

-

-

When my wife got her B2 visa in 2018, the interviewer was more interested in seeing my passport than the documents my wife brought to the interview. We did not know that this would be in important item and she did not have it at the interview, but it seems that you are aware that the interviewer may want to know about your ties to Thailand as well.

Best of luck.

-

1

1

-

-

On 2/14/2021 at 9:42 AM, steve2112 said:

has anyone got a USA B2 visa for TGF/wife/spouse recently? we got one for my wife about 12 years ago so expired now and need a new one. anything special going on with the app/embassy visit in covid times?

thx

Had a similar situation a few years ago. Last time my wife went to the US was close to twenty years before her most recent application and she could not find her old passport with the US visa. The interviewer was actually more interested in seeing my passport, but I had not realized that this would be the case so my wife did not have it with her. In the end it did not matter and she was approved quickly, but you might wish to make sure your wife has yours when she goes for the interview. It should be a piece of cake if she has her old passport with the old visa in it however.

-

2 hours ago, stiggy23 said:

Thanks guys, I got a quote from Chubb and Axa. I have heard of Axa but not of Chubb, is Chubb any good ?

Chubb has long had a reputation of being a premium brand insurer with a reputation for good service and good attitude towards paying claims. Chubb was purchased by ACE about five years ago and I do not know to what extent the Chubb corporate culture survived the merger. Chubb tended to be a bit more expensive than other insurers, but perhaps only when comparing premium alone and not coverage, service and claims-paying attitude. In my opinion, Chubb will likely still be one of the better choices in this market.

My suggestion would be to engage a good insurance broker who can give you advice on coverage and insurer service and help you compare in detail and not just premium cost. A good broker can also tell you whether Chubb's service and attitude are as good as they were in the past.

-

5 hours ago, DogNo1 said:

I have a rather special situation. My paid financial advisor is located in NYC and does all of my trading from there. I have no financial activity from Bangkok or Tokyo other than making wire transfers from my cash management account to my account at Bangkok Bank. I planned this very carefully because there is a 50% inheritance tax on all of your financial assets held in Japan when you die.

Interesting.

Another quirk for US expats in Europe: I was told by my NYC-based financial advisor that in order to comply with EU regulations (I'm not sure if it was country-specific) some EU residents with regular US brokerage accounts would have to change them to be discretionary accounts so as to avoid the issue of cross-border securities trade and advice. In other words, the broker/FA would initiate all trades without the expressed consent of the account holder.

-

As topt has said, it is best to contact a good local insurance broker and then read carefully the policy wording and ask questions.

One issue that a landlord needs to discuss with their broker and fully understand is the length of time that a condo unit can remain unoccupied before coverage is suspended and what, exactly, constitutes unoccupied. With the exception of buildings that are in high demand, it is not unusual for a condo to be without a tenant for months at a time. Some policies only cover for 30 or 45 days without someone actually residing in the unit.

-

1

1

-

-

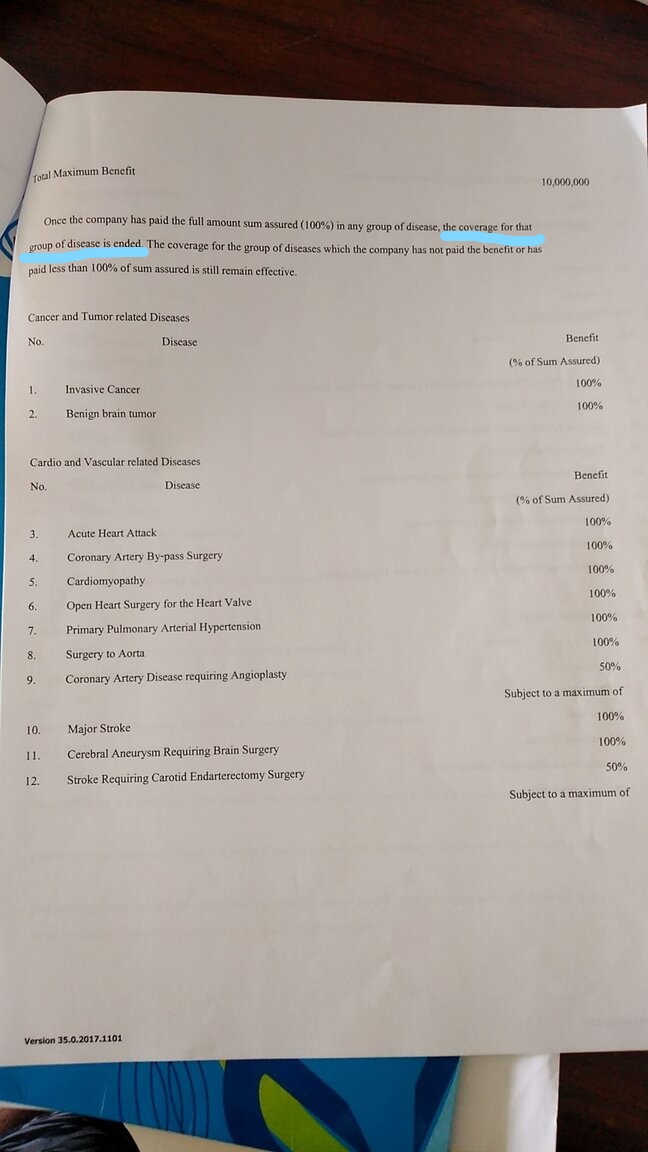

8 hours ago, villageidiotY2K said:

The policy has sub-limits for groups of diseases, but the pages posted don't seem to state whether these are annual or lifetime limits. If they are annual limits, they could get reinstated at renewal, but I suspect they are lifetime limits as that is how I think most medical insurance policies work. You should be able to find somewhere in the policy whether these are annual or lifetime limits.

I don't think there is any Thai regulation prohibiting the use of lifetime limits and I also don't think that exhausting a lifetime limit is the same thing as having an element of coverage removed, but you should ask a good local insurance broker about this.

-

2 hours ago, Peter Denis said:

That is probably true in Thailand, and to a lesser degree in USA.

But in most European countries insurance is strictly regulated - as it is in the public interest - and such shenanigans would not be allowed.

Yes, I should have qualified this to refer to Thailand. Other markets often have better protections for policyholders. I don't think there is any regulatory bar to non-renewal or substantial premium increases here. The US is a patchwork of regulation as it is done at the state level, so some states may have relatively good protections and others not.

-

1

1

-

-

27 minutes ago, bojo said:

My premium dropped by nearly half when i opted for a high excess, This was 50 000b. At the time I figured that i really only needed insurance for something really serious that was going to cost the earth and my agent advised this. Any smaller bills, like 'as an out patient' for example, I would cover myself.... This has saved me loads over the years...................Consider asking an/your insurance agent............

This is a very prudent approach. There is no point in simply trading baht or dollars with your insurer for minor things. Save your premium money for real risk transfer. Take a high deductible if you can absorb the day-to-day costs of medical care.

-

A number of Thai insurers offer coverage for condo owners, including not only coverage for the contents but also premises liability insurance. I think some offer to cover maids and servants under a personal accident extension that replicates the benefits (or better) that would normally be provided if the maid were eligible for Thai workers compensation insurance.

One issue to be aware of, and you should discuss with your broker or insurance company, is how to cover the portions of your condo for which you have risk of loss but were included in the purchase price of the unit. This can include your unit's sanitary fixtures, aircons, internal plumbing and wiring, false ceilings and the like. It will be difficult to get the developer to provide you with values for these items and sometimes is is expedient just to declare the purchase price of the unit plus any furniture and fixtures you bought separately. Then there's the issue of your personal belongings which may fall into another category and need to be declared separately.

The building itself will be insured by the condo's juristic entity and I think you will actually get a separate bill for this item.

-

It looks like the pages you posted refer to the initial waiting period for a number of diseases. Most insurers will put waiting periods on cover for certain diseases to prevent people from taking out a policy when they suspect or know they have a disease. It is the waiting period that is waived for these diseases when the policy is renewed. This does not mean that an insurer can't put a limit on how much or how often they will cover a disease or condition.

Bear in mind that an insurer can non-renew a policy at any time, or simply jack up premiums, so with commercial insurance there is never a guarantee of continued, full, affordable, coverage.

-

6 hours ago, villageidiotY2K said:

Oh and does anyone know how do thais cover themselves when they turn to wrinkled raisins?

Any Thai citizen can register and seek treatment at government hospitals for free or nearly so. Those who worked in the formal sector can maintain cover in retirement through the social security scheme for very modest premiums. The very wealthy just pay out of pocket. The issue of old age and lack of commercial insurance options is mostly a problem for foreigners, especially those whose extensions of stay require proof of insurance. For those older foreigners whose extension does not require insurance, it may be an option to register at a government hospital and set aside funds for medical care. Government hospitals are much less expensive than private ones and the care is good, although wait times can be long and the ambience is a bit industrial.

-

1 hour ago, DogNo1 said:

The address I have registered with Fidelity is my Japanese address. I have had no problems. I wire $2300 monthly to my Bangkok Bank account for no fee at all.

For a while I had two non-US addresses. My broker was fine with the other non-US address, but would not keep my account open without severe restrictions if I used my Thai address. I was told that the broker did not have sufficient business in Thailand to warrant going to the trouble of getting a license here. Either they obtained a license in the other country due to greater business volume or the other country did not have very restrictive laws regarding selling securities and giving financial advice across borders. I guess it depends upon what country you use for your address, amount you have with your broker, licensing laws and business volume. Lots of moving parts.

-

1

1

-

-

1 hour ago, DFPhuket said:

I've learned that some banks (Capital One and Vanguard) apparently use a geo-fence and only allow check deposits via the app if you're phone is in the US. If you have a VPN and connect with a US site you could probably get around that requirement.

A VPN will change your internet IP address, but it won't change the location info that the cell connection provides and i think many banks use the cell connection for location info. Might have to turn off the cell connection and rely upon wifi alone for this to work. It will depend on your bank's security protocols. Worth a try in any event.

-

I received a slightly greater refund than was calculated by my tax preparation software and reported on my 2019 1040 and I am fairly sure the difference is interest being paid by the IRS due to processing delays, especially since I did not receive a letter from the IRS explaining the difference and my form, which I sent by registered mail in March, was not processed until August. The funds were directly deposited to a US bank, so I did not receive a check with the interest amount stated on it. There is no notation on the online bank transaction detail referring to interest and I have not received a 1099-INT from the IRS although the amount was slightly above the $10 threshold. I am assuming the 1099-INT from the IRS may have gotten lost in the mail and I will report the amount on my 2020 1040. Has anyone else either received a 1099-INT for this interest payment or is missing one?

.png.3b3332cc2256ad0edbc2fe9404feeef0.png)

Latest Stimulus Bill Passed

in Home Country Forum

Posted

No, it isn't cheating and it isn't fraud. If congress wanted to claw these payments back for those who subsequently filed returns with higher AGI they would have made provisions for that, or made the payment taxable for 2021. So far, they haven't.

It also works the other way. Those who had income above the threshold if their 2018 returns were used for the first stimulus payment, but whose AGI fell below for 2019 but whose returns were not processed due to Covid delays before the cutoff in August last year, missed the first payment. If these people's AGI is too high in 2020, they can't claim the credit on their 2020 1040.