Klonko

-

Posts

323 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by Klonko

-

-

12 hours ago, NedR69 said:

I wear Klim Lattitude top and bottom plus gloves. All goretex. Expensive, but one of the best on the market.

Comfortable at 35-40 °C (95-104 °F)?

-

If funds, which are not constituting assessable income under Thai tax law, are held in segregated accounts, such accounts may still earn interest which constitutes assessable income under Thai tax law if remitted to Thailand, unless Thai RD unexpectedly applies FIFO-accounting.

While the interest probably does not result in Thai tax payable, the obligation to file tax returns in Thailand remains in place, possibly requiring certified translation of relevant documents. To get rid of the filing obligation, segregated accounts must not generate any income.

However, even if only non assessable income is remitted to Thailand, Thai RD may start an inquiry into the remittances and certified translation of the relevant documents may need to be provided.

As of now, the only way to minimise any hassle with Thai RD is to transfer funds to Thailand while not being tax resident.

My hope for generally excluding foreign retirement pensions from assessable income is limited.

-

1

1

-

1

1

-

-

After 3 years deliberation, I have bought a Honda Goldwing for long distance two up touring in Thailand. Please refrain from comments such as too big for the Mae Hong Son loop. I have been riding Goldwing for years in Europe on small mountain roads.

In Europe, I wear a 3/4 helmet with face shield and well vented GoreTex textile gear, which gets hot above 32 C°. In Thailand, I am looking for gear supporting comfortable 6 hours daily driving time.

What is your experience with protective gear riding in hot humid weather in Thailand? The Goldwing fairing provides some wind protection and I wonder how much hot air is heating me up through mesh gear. Would breathable textile (no GoreTex) with no mesh be generally better? In any case, I would also wear a cooling long base layer.

Most riders of large touring bikes in Thailand seem to wear full face or cross helmets. Apart from safety considerations, are full face helmets cooler in sunny hot weather?

-

1

1

-

-

23 hours ago, KhunLA said:

... PlugShare and vendor apps give you all the info you need.

Gmaps is slowly catching, but a poor source for CS station location or info.

Hardly use Plugshare but Apple Maps (CarPlay) which contains almost all CS stations.

-

1

1

-

-

- Popular Post

- Popular Post

1 hour ago, Felt 35 said:If Thailand has a tax agreement with another country, they must follow the agreement and cannot for their own benefit change it until a possible new agreement is in place and it takes a long time to renegotiate tax agreements.

Felt

Good luck explaining your tax return and account statements, possibly containing taxed and untaxed funds, from your home country to your local Thai RD officer.

-

2

2

-

1

1

-

1 hour ago, Ben Zioner said:

So, since @NONG CHOK lives off savings he needs only a proof that these savings were earned while he wasn't tax resident in Thailand. If he doesn't transfer interest earned, that is.

I haven't seen any information with respect to the method (LIFO, FIFO, average) Thai RD will apply. May be even Thai RD does not know, or local RD officer will decide situatively.

-

1 hour ago, Puccini said:

Correction:

Anyone who stays in Thailand for over 180 days is a TAX RESIDENT of Thailand (ie a resident for the purpose of taxation)

Over 179 days.

-

1

1

-

-

- Popular Post

- Popular Post

1 hour ago, retiree said:Nevertheless, I would assume that there will be guidelines and "safe harbor" rules for showing the source of funds remitted to Thailand (and whether or not they are assessable and taxable), just as there are in every tax jurisdiction in the world.

We may have to wait a long time until such guidelines are issued, or practice is decided by local RD. Segregated accounts not containing any income or gain may help. It can be very difficulty to prove the non taxable source of funds with certified translation. This is one of the reasons I am not going the DTA route.

-

2

2

-

2

2

-

1

1

-

Chartering planes instead of buying first class tickets.

-

1

1

-

-

23 minutes ago, Hornell said:

"I spent time this morning, reading back through some of the posts in this thread and was struck by how much disinformation, inaccurate information and general negative slant there is. The subject of the thread is taxation in Thailand yet it has become a vent for anything and everything about Thailand that people don't like, unreasonably so."

Absolutely right! I have never read so much waffle and rubbish. Close the thread, Admin!I beg to disagree. There is a lot of misinformation in this thread, but it is the only place with a wide discussion of possible issues which may need to be addressed. First I asked my tax lawyer for advice with respect to my personal situation, but the answer was too generic. Then I asked my tax lawyer very specific questions, which also have been raised in this thread, and got specific answers thereto. Based thereon, I structured a workable setup for my situation.

-

1

1

-

1

1

-

-

18 minutes ago, Mike Lister said:

The currency interest aspect is a red herring. Few people would invest in THB for the interest rate on cash but they would invest for the exchange rate appreciation and/or the security of having sufficient cash on hand to avoid future exchange rate angst, THB is very volatile.

-

8 hours ago, stat said:

Do not forget that you lose interest while your money does not earn income in TH instaead of 5% in USD funds

0.5-1.5% interest forsaken in my home currency over 3-5 years better than 10% tax rate in Thailand.

-

22 hours ago, K2938 said:

So what would you consider to be the "safest" banks in Thailand from a fraud/bankruptcy risk point of view?

I worry more about cyber risk if I transfer this (non tax resident) year a few millions THB to Thailand.

-

1

1

-

-

10 hours ago, firefly17 said:

If sending money over from UK property sale, I take it this is ok (after Jan)? I take it its not classed as income.

AFAIK gains from property sale qualify as income under Thai tax law. I do wonder if it was possible to segregate the initial property investment amount in a separate account and transfer from such account as existing wealth in order to avoid DTA hassle.

-

1

1

-

-

32 minutes ago, jphasia said:

The validity of the international Thai DP is 1 year only.

The validity of my international Thai DP from 2023 is 3 years (Chonburi)

-

1

1

-

-

- Popular Post

- Popular Post

DTA tax credits on transferred foreign taxed income must be provable with certified translation of foreign RD tax assessment. If such documentation is not possible in time, full Thai tax is payable first and refund of DTA tax credit possible later on. I am still waiting for my foreign RD tax assessment for 2020.

Because my foreign taxed income is not tax exempt in Thailand under DTA, I have given up on the DTA route and will use transfer of segregated foreign funds not qualifying as income, gifts to my wife and sporadically non-Thai tax residency.

This setup is compliant with Thai tax law even if there will not be favourable clarifications for foreign retirees being tax resident in Thailand.

-

2

2

-

1

1

-

-

44 minutes ago, Mike Lister said:

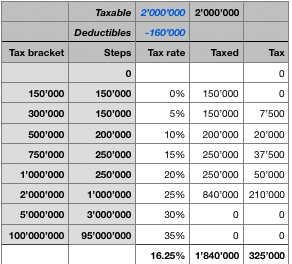

Here's Thailand tax calculator, a salary of 2 mill per year attracts tax at 16%

Mea maxima culpa, my calculation was using the wrong bracket and resulted in too low tax rates. My 5% become 7.8%.

Following corrected table consistent with UOB:

-

1

1

-

-

2 hours ago, retiree said:

Note that the IRS 709 form verifying the gift is not filed until the next year. In my opinion, when the money enters Thailand it is still the husbands. If it is assessable, and if he is resident in that year, then it is taxable to the husband (subject to DTA).

Do I understand you correctly, that the money is as long the husband's money as long it has not been assessed for IRS? In my home country, I do not incur any tax on gifts to my wife regardless of my tax domicile and ownership passes to my wife when money is credited to her account. Question remains if Thai RD can require gifts to be transferred from a Thai account.

2 hours ago, retiree said:What? I was very much looking forward to the no-show job and no-show wife that Klonko might provide me to test his contention. Let's not be hasty here.

Sorry, I wait for my tax lawyer's response before I would send monthly gifts of < THB 100k to my wife, who is not required to file taxes. If the tax issues are not clarified in due time, I may leave two weeks earlier for Christmas in my home country and transfer the money for two to three years living expenses this year under the 179 days rule.

-

12 minutes ago, Dogmatix said:

How does option C (paying 5% tax) work?

Cf.:

18 hours ago, Klonko said:Splitting living expenses 50/50% payments to my account and gifts to my wife, gifts for larger purchases in the name of my wife and forgetting DTA (100% offset). Allows for THB 2.44m living expenses.

Calculated on THB 2.44m, tax rate is 2.5% (5% on THB 1.22m taxable income).

-

2 hours ago, retiree said:

In my opinion, the only circumstance under which he can transfer to his wife without one of them being liable for taxes is if either a) it wasn't assessable income for him, or b) he wasn't a tax resident when his assessable income was remitted to Thailand. .

Could you please substantiate this assumption. I agree it will be most probably tax evasion if 100% of joint living expenses are financed by gift or the gifted amount is transferred back to the husband's Thai account. However, supporting the non working wife up to ≈ 50% of joint living expenses and enabling her to finance her share of living expenses from her own account is hardly tax evasion and I have found nothing to the contrary.

-

2

2

-

-

23 minutes ago, K2938 said:

What is your plan C with 5% tax or is this just what it comes out for you if you were taxed?

Splitting living expenses 50/50% payments to my account and gifts to my wife, gifts for larger purchases in the name of my wife and forgetting DTA (100% offset). Allows for THB 2.44m living expenses.

-

1

1

-

-

36 minutes ago, moogradod said:

I am actually scared to do that. My problem is not my own tax - easy peasy even on the considerably high state pension I get (but below 1.8 m - have to give a portion to my divorced first wife). But I never understood why they do not approach my Thai wife which transfers between her accounts amounts far above 2m per year (for example to optimize risk and she recently bought a house). From all interest 15% withholding tax is deducted. So if I file so must she even if the interest earned per year might not be much after the deductioons (I actually never calculated it, but will do so tomorrow) and I am uncertain what this could mean (only in the case something goes really pear shaped with the new regulations - money I gifted her was always done under strict observance of the tax laws at the time, some even while she was not tax resident). And then there is still the risk that the IO wants proof of payment. Maybe not now, but maybe in 3 years. Even worse. So I more and more conclude that I have to file a tax return already for 2023. Need to find a good tax accountant (as well because of the language barrier). My wife does not understand these matters and can translate but probably not really make sense all the time.

While I am flying under the radar as plan A, I have retained a Thai tax lawyer (recommended by my home country tax lawyer) to get professional assessment of my personal situation and have plan B (DTA), C (paying 5% tax) and D (179 days) ready. Flying under the radar is fine as long as I am able to land safely.

-

1

1

-

1

1

-

-

23 minutes ago, moogradod said:

Does your "turnover" include incoming plus outgoing financial transactions ?.And then it depends how far back this will be. Before we moved here we did transfer many millions to Thailand - but all in strict observance with the tax laws at the time - I needed more than 1 year to clarify that. In the last few years I have no more income over 1.8m per calender year but occasionally I transferred money to my wife to one of her more than 15 bank accounts - for example as a gift when she bought a new car - which was over 1.8 m. but this is many years ago, when my account saldo was far more than it is now. We both have only very few transactions, this includes ATM and supporting the family. The biggest joke would be if they would make my poor Thai Farmer family make a tax return because of the support we send them. But I not really think that this would happen - just a play of the mind.

Cf. following clarifying post:

1 hour ago, retiree said:On 20 March 2019, the Government published the Act to Amend the Revenue Code (No. 48), 2562 B.E., in the Government Gazette. This Act became effective on 21 March 2019.

Under this Act, the following entities have the duty to report information about a person who made certain types of transactions during the previous year to the Revenue Department by March of the following year:

...

1. Depositing or accepting transfers of money in all bank accounts 3,000 times or more in the previous year.

2. Depositing or accepting transfers of money in all bank accounts 400 times or more, for a total amount of THB 2 million or more in the previous y

Flying under the radar with less than THB 2m annual account turnover may remain an appropriate strategy for easy living in Thailand. I expect that workable solutions are also in the interest of Thai RD and doubt they will link IO extensions to tax filing.

-

1

1

-

Taxation of Ex-Pats pensions etc.

in Thai Visas, Residency, and Work Permits

Posted

Unless it is a gift up to THB 20m annually.