IsaanT

Member-

Posts

258 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by IsaanT

-

With respect, I disagree. Many will be caught with their pants down (Bitcoin 'investors' are probably near the front of the queue; meme coin holders even closer...). Warren Buffett's Berkshire Hathaway investment company had a $334 billion cash pile at the end of last year. If the markets are so profitable, why wasn't he trading them? He's 94 and he's seen plenty of frothy markets in his time. The writing is on the wall for those that can see it. However, some people are not old enough, experienced enough or have short memories and think the good times will just continue for the foreseeable future, and are greedily invested accordingly.

-

Sunday's futures closed at 36,850. You decide (it's a 50/50 right now but I'd put my money on the trend). The above chart illustrates two things: a) evidence of gap closure b) why you shouldn't interpret anything I said as trading advice Firstly, you should be able to see a gap created about a third of the way across from the left. The futures markets are continuous (24hrs) during the trading week but do close on Friday night until Sunday evenings. Thus, gaps can only form on a Sunday night. This gap occurred on the Dow Futures on 13th June 2022. However, you will see that the market continued down further for another five days before it went up and closed the gap on the 11th day, so closure isn't necessarily immediate but does occur relatively quickly. As another example the gap on 28th August 2022 was closed the next day. Scan any futures chart for more examples.

-

The Dow futures opened last night at 37,250 and went as low as 36,499. That's your first support level breached. However, as I suggested last week, the markets are very likely to rise this week, albeit slightly. I had other reasons for stating it last week but do you see the gap in the chart between Friday night's close and last night's open? The markets, like nature, abhor a vacuum so this gap MUST be closed before the trend down can be resumed. To be even more specific, the Futures opened considerably lower than Friday night's close - this shows the market's underlying sentiment (remember, sentiment is what drives markets). The gap created, however, must be closed so the Futures chart must rise to at least 38,219 (Friday's close) to close the gap (it might rise slightly higher but doesn't need to for gap-filling purposes). Shortly afterwards, the downtrend will resume because that's what the sentiment is showing us (and for so many other reasons, but they are beyond the scope of this thread). N.B. This is not an indication to trade - markets are volatile and yu risk losing your shirt, blah, blah. Regard it as a simple lesson.

-

That is, indeed, the crux of this issue - anonymity. The popular phrase for such people is keyboard warriors. I have no reason to hide my identity and it would be a sad day for me if I did.

-

Some threads here can get confrontational, highly-charged and, sometimes, rude and insulting (I'm looking at you, @Don Giovanni). I speak to people on this forum the same way I would if we were face to face. There's nothing wrong with robust debate but it would be good if we could all keep it civilised.

-

1. Vance was elected to the Senate in 2022 in Ohio - he wasn't elected to be VP. He was hand-picked by Trump, along with all of Trump's other hand-picked top team member's, very few of which have any relevant experience or credentials for the roles they now hold. It is disgraceful for a VP to openly attack a visiting sovereign President of another country, especially on live TV. I'm not the only one to think this, hence the demonstrations when Vance attempted to have a quiet skiing holiday with his family shortly after. To provide a balance, Vance does appear to be a thinker and appears to have the capability to be responsible and presentable but, without trying to be sarcastic, he's not exploiting much of that potential at this time. Having to be a 'yes' man/woman to Trump is a constraint for all of Trump's top team so they are all operating under artificial circumstances. Will Vance run for the top job after Trump finally hangs up his hat? Very possibly, so he remains on my radar. 2. I don't hate Trump - I just disagree with many (but not all) of his policies. I also think he's been badly advised. I won't add value by commenting about Trump's personality traits which make him ill-suited for the role of the most powerful and consequential person on the planet - plenty of others already do that. My position is easier because I am English, not American, so I don't feel any need to take sides in US politics but I do recognise that his actions are having international repercussions that include my family and friends in the UK. 3. I don't believe I've ever watched MSM (again, I'm not American). 3. Ukraine's constitution prevents elections during times of war, so Zelenskyy's term has simply been extended because of the circumstances. And I think he's doing a fine job. Finally, I hope the biggest loser in all of this is Putin (Russia itself can continue on without him, hopefully in a less aggressive way). The Soviet Union portrayed itself as a superpower but perhaps were only giving the impression of being so. Russia has spent three years of full-on assault attacking Ukraine and claims five Ukrainian regions, many of which are not yet under its full control (the five regions total about 65,000 square miles - that's about the same size as Florida or Wisconsin, and a quarter the size of Texas. Not very impressive.). Russia used to have a good arms export market but, given the recent demonstration, I expect international buyers are looking elsewhere now (it also used to have a strong gas and oil export business but that's another story of self-imposed destruction...).

-

I started with £20K and came out with around £120K in tangible assets (cars, an aeroplane, other things) eight months later but, yes, I lost £210K (on paper) but I didn't lose my shirt. I feel it was a win. 😉 In a rising market (as that was), isn't it BLASH (buy low and sell high) which was my preferred approach? Although BHASL via shorting the indicies would have worked handsomely last week.

-

Really? Those that know will understand why it would be pointless to continue this discussion. This is a forum for expats, expat-wannabees and expat-havebeens to discuss things related to Thailand. This thread has gone way too far off track. Let's agree to disagree please.

-

The textbooks typically use simplistic chart patterns, chosen for their clarity. This is the real world.

-

Sentiment drives markets. And Time, but that's a whole different discussion. 🙂

-

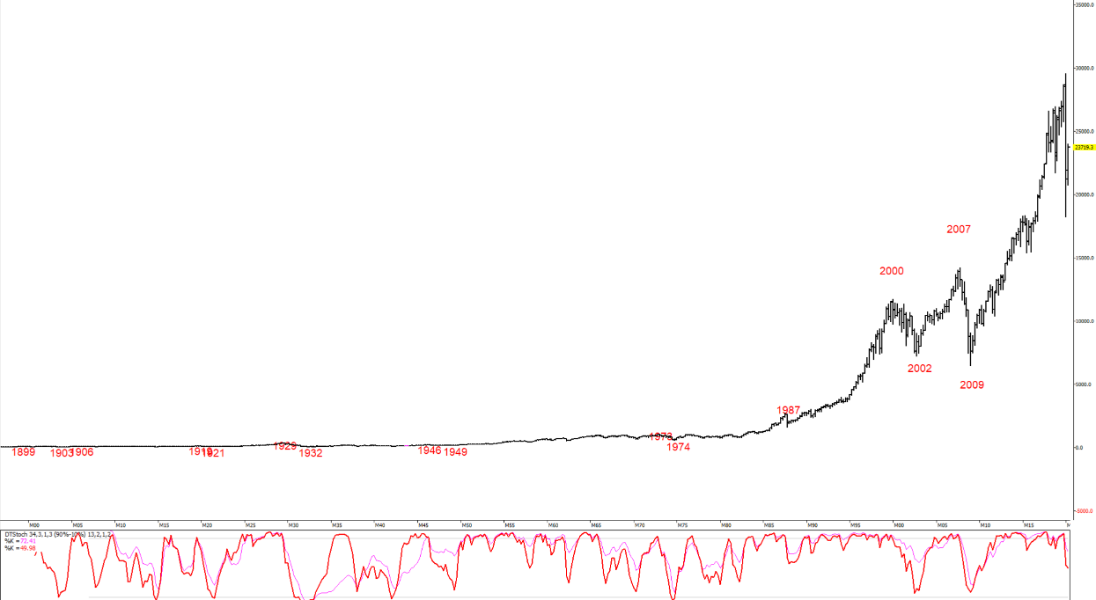

OK, I relent. Here it is, using quarterly bars. I haven't used this charting package for years and my Dow data only goes up to 2000 so doesn't show the recent meteoric climb but that doesn't matter for the purposes of this discussion. Look closely at the vertical scale on the right hand side and you'll see how logarithmic charts can extract detail out of relatively small movements (which are caused by the effects of inflation over time, i.e. a 25 point move 50 years ago would have been a big thing). I've added a few key dates. And, no, I won't be adding my EW interpretation because that will likely cause an interminable (and tedious) debate to which there is no definitive right answer. The point of posting this chart is to show you that there is, indeed, a very discernible characteristic visible in the chart for 1929 (not the flat line that a linear chart shows). p.s. I've added the linear chart of the same data underneath so any interested bystanders have a clue what we're talking about.

-

If you've seen it in logarithmic scale but can't see what I've described, there's not a lot of point in me showing you the same chart because I can anticipate that you'll still fail to see it. In fairness, as you may have stated, EW is an art of interpretation, less so a science (although there are many firm rules and characteristics which most ignore or overlook, at their cost). I'm happy to agree to differ on this. Thanks for making the effort to look.

-

OK, thanks for replying. From your earlier comments, do I understand correctly that you'll be concerned if the Dow goes below 30,000 (or the 28,244 support on the 12-year ema, as you stated)? I'm presuming you must have seriously long-term funds if you're looking for support on a 12 year average. Given the last three days' action, would it be better for you to sit it out on the sidelines in case it does, indeed, get worse? I'm happy to disclose that I learned a lot of lessons in the tech share boom of 1999/2000. I made a shedload of money (on paper) and lost most of it (on paper) hanging on from the peak in April 2000 while I waited for it to go back up again, which it never did. I started with £20K of my own money in September 1999 and I had £334K (on paper) in April 2000. The wife had a new Mercedes for Christmas, my kids had great presents, and I bought a new car and another aeroplane for myself in the spring of 2000 before what remained evaporated so I came out on top. However, I was following some forums at the time and I winced when I read some posters saying things like "I've mortgaged the house to be in on this - I'm going to be rich!". I know some lost more than just their shirts. FOMO is an insidious evil. Better to live to fight another day. I did say my risk appetite is lower now than it used to be... 😉

-

Serious question. I'm curious - do you have money at stake in the markets, which might explain your unconditionally bullish stance? FWIW, I don't. I'm retired so my risk appetite is lower than it used to be.

-

Really? A hillbilly vice-president (unelected to post) embarrasses a visiting sovereign president (elected to post) live in front of cameras, and then Trump joins in. Disgraceful. Trump also has this unexplained affection for the corrupt dictator Putin. Why hasn't Trump slapped Putin down for obvious obfuscation and delay when he was so quick to disrespect Zelenskyy? And why did he cut off supplies and intelligence for a week when Russia was reporting that it had nearly encircled the Ukrainian troops in Kursk? Despicable. I won't die a happy man if I don't find out what is behind the Trump-Putin affection. It will come out sooner or later.

-

You're right. Blame anyone but him for the current chaos. His facade of arrogant competence ("Trump was right about everything") has nearly run its course and he will eventually have nowhere to hide. Like karma, it is taking longer than some of us would like but it will get there eventually. The problem for so many is that the damage will already have been done.

-

I remember Black Monday. Conversely, after such a hard fall this week, I wouldn't be surprised to see a few relatively quiet days next week, going slightly back up again. If so, I expect many here to confidently proclaim something like 'a healthy correction has now been completed, and normal service has been resumed'. Then, very shortly after, perhaps around the middle of the month, they'll be caught out as the new trend down resumes... The majority of retail traders lose (71%, according to IG Index). Reading some of the inane statements in this thread reminds me why.

-

Thai Baht Plummets with US Tariff Blow: 34.50 per Dollar Test Looms

IsaanT replied to webfact's topic in Thailand News

You're right. For clarity, I wasn't implying that anyone should be trading this - I was just passing on the good news that it's likely that we'll get a bit more purchasing power as the year goes on, as the thread is about the recent Baht weakness. -

Thai Baht Plummets with US Tariff Blow: 34.50 per Dollar Test Looms

IsaanT replied to webfact's topic in Thailand News

Here are today's forecasts for the Thai baht for the rest of the year. N.B. These forecasts are dynamic and change on a daily basis but the general trend is clear. -

The Dow closed at 38,314 a few minutes ago. It lost 2,231 points, a 5.50% fall in one session (it is historically exciting times so I set my alarm to see where things ended at the final bell). Your failure to accept what is happening is undoubtedly your loss. I would prefer that you look at your own data on your own platform with your own eyes and draw your own conclusion with your own brain. I would hope that would remove any potential concerns you might have about possible misrepresentation or misinterpretation by some random guy you've never met spouting some fantastic nonsense. I think the rest of us can easily predict your response to any further information I offer. @Harrisfan also states that he knows about Elliott Wave theory. Perhaps you could get an independent second opinion from him. Lastly, of greater concern is your failure to actually understand my request. This now illustrates that you don't know as much as you would like to think you do. Only the strong survive. Be careful out there.

-

Put your chart in logarithmic mode and then look again. Linear mode (as used on your chart) is inappropriate for such a long period.

-

In actual fact, "Don Giovanni" is a reincarnation and has been here on this forum forever (or so it seems).

-

Yep, anything for a happy life. 🙂

-

Nope, I've done my own research. We're clearly not on the same page so I'm withdrawing from this conversation.

-

I tried...