-

Posts

63 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Eudaimonia

-

Dividends only tax return.

Eudaimonia replied to turgid's topic in Jobs, Economy, Banking, Business, Investments

You can probably use tax credits if withholding tax was deducted from your European dividends. -

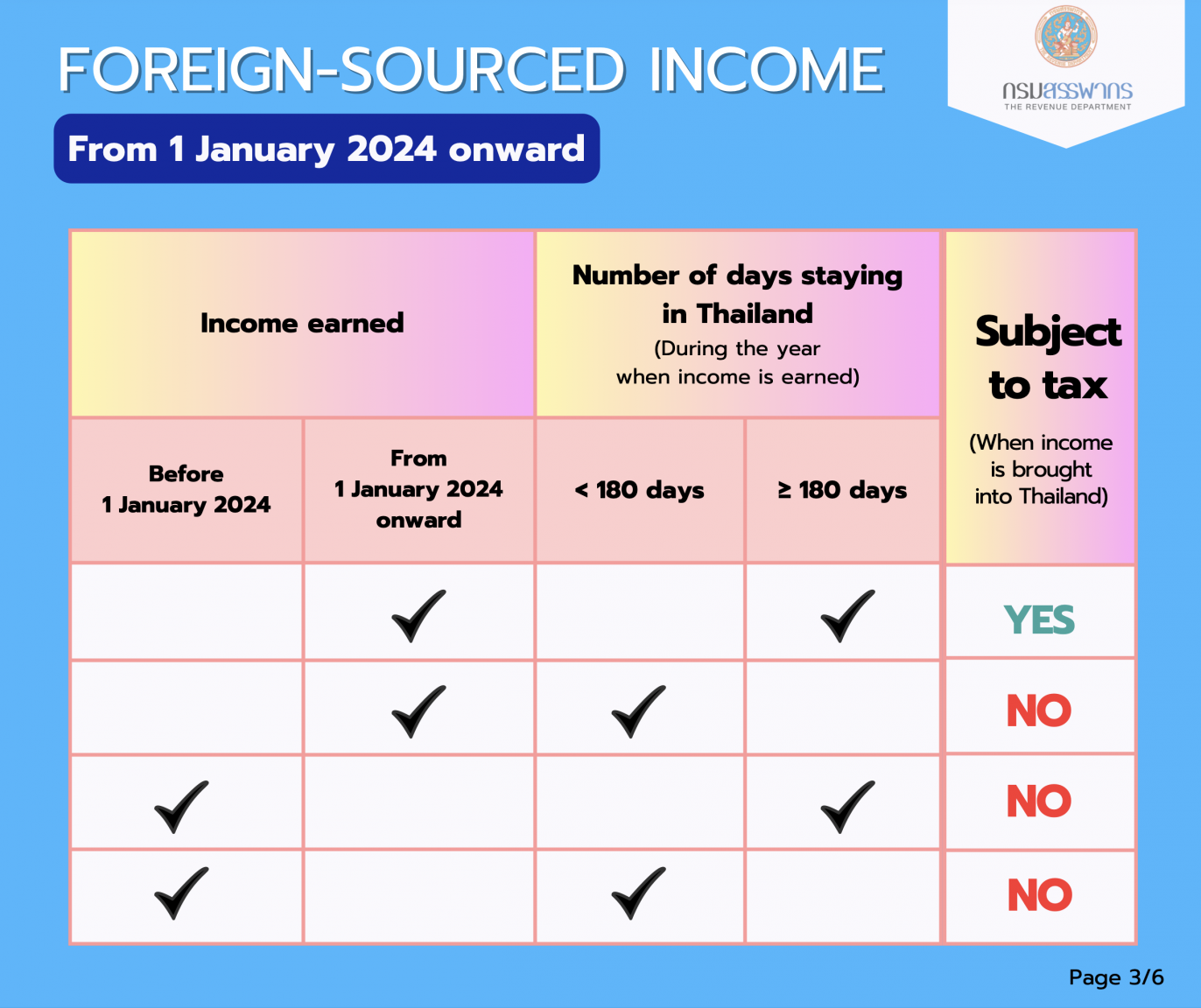

Order 162/2566 clarified that the notorious order 161/2566, effective from January 1, 2024, does not apply to income earned before January 1, 2024. This meant that income derived before January 1, 2024, would still be subject to the previous rule: it would only be taxed if brought into Thailand within the same tax year it was earned. Ergo, foreign-source income earned in 2023 is only assessable if brought into Thailand in 2023. And this is why it was not a good idea for people to rush to send money in late 2023 from foreign accounts that already had income deposited earlier that year. (Not that I expect anyone to start asking questions about that now.)

-

Just a side note: the amount of people who rushed to remit money in the final months of 2023 and thus created a tax liability in 2023 is astonishing. Income remitted in the year of earning it has always been assessable, including in 2023. After the announcements, folks could have simply waited until January 2024 and remitted their money officially tax-free as 2023 savings, but no, they just had to do it all in 2023. 🤷♂️ But you have the best visa (LTR) and tax exemption in your specific case, so no harm was done. Congratulations. You will be OK until they introduce worldwide taxation regardless of remittance (if ever).

-

Thailand to tax residents’ foreign income irrespective of remittance

Eudaimonia replied to snoop1130's topic in Thailand News

PwC has published an updated Thai Tax 2024/25 Booklet. A valuable free resource. https://www.pwc.com/th/en/tax/thai-tax-booklet-2024.html -

I'll withdraw my comment as HMRC claims, "There is no legislation on this, but you have to be resident somewhere for tax purposes," and "you would revert to your citizenship." https://community.hmrc.gov.uk/customerforums/sa/f139bcb8-1018-ef11-a81c-002248c88d50 I think the HMRC support person is wrong there, but these can be complicated cases that require careful planning. It's certainly safest to always be a tax resident in some friendly jurisdiction.

-

Have you registered as a tax resident in Cambodia, then? 😅 Many people reading this are now considering staying 186+ days per year outside Thailand and having no tax residency at all. It might work for some, but it is not a viable strategy for everyone. Some countries (not the UK) even have laws defining default tax residency, so citizens living abroad may be considered tax residents there if they fail to establish and prove tax residency in any other country.

-

It's the year when you realized gains or earned/received income that matters. You cannot keep collecting income abroad for years while living in Thailand and then move out for six months in 2030 to remit it all tax-free. However, with investments, it might be possible to move from dividend-paying stocks and distributing funds to accumulating funds that just keep growing in value and realize all those gains while not a tax resident.

-

The earlier poster's question and scenario was about 2023 and 2024 commingled funds: ☺️ This is a very common scenario. Few people have pure 2023 savings in ring-fenced accounts that do not generate any further interest. We should be able to figure out how such funds are treated. I think any interest earned after 1/1/2024 will be assessable, as already detailed above. I might be wrong.

-

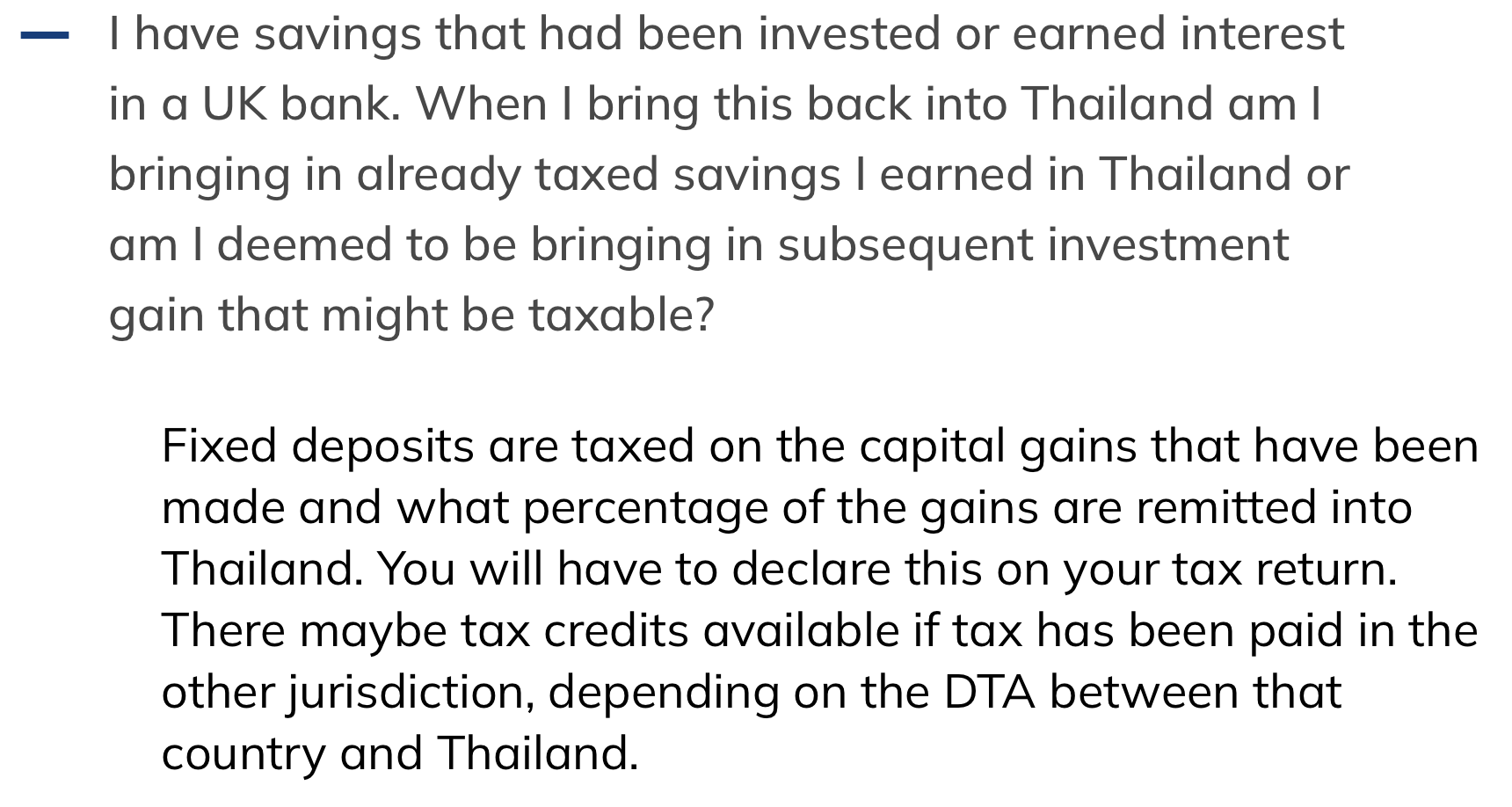

Thank you for your comment. I used the capital gains formula because the interest should be taxed similarly. "Savings" comprise 98.75% of the remitted amount in the example. The rest is income from 2024. According to the Revenue Department's guidelines, "If foreign-sourced income is remitted partially, the taxable amount shall be apportioned accordingly." As you told me that my reply is "incorrect," I suppose the accounting method for interest-bearing bank accounts fundamentally differs from other income-generating assets. Do you have a source you could share? Compare my answer with that of Expat Tax Thailand's FAQ:

-

Compare the balance now with that of 31/12/2023. If the bank balance was £10,000 at the end of 2023 and you have received monthly interest payments in 2024 (and nothing else), the balance might now be £10,220. 10000/10220 = 97.85% is from pre-2024 220/10220 = 2.15% is from 2024. You transfer £1000. Of that amount, 2.15%, or £21.53, was earned in 2024.

-

Thailand to tax residents’ foreign income irrespective of remittance

Eudaimonia replied to snoop1130's topic in Thailand News

A news story claims that "all expats living in Thailand for more than six months in 2024 will be required to file an income tax return." "New tax requirements for long-term residents begin January 2025, with first filing deadline March 31." https://www.thaiexaminer.com/thai-news-foreigners/2024/10/30/new-citizenship-path-for-foreign-residents-in-thailand-agreed-by-cabinet-interior-ministry-to-frame/ My take: This article is mostly about citizenship, not taxation, so this part is likely to be the journalist's own (and possibly incorrect) interpretation rather than something actually communicated by the government spokesman. -

I'd like to propose a change based on new PwC guidance that is also in line with Baker McKenzie's earlier information. Tax residency in the year of remittance is irrelevant, it's the earning year that counts. From: 80) Income that was earned and remitted in a year when a person was a Thai tax resident is assessable under Thai tax rules. There is now a growing body of opinion from TRD sources to suggest that overseas income earned whilst Thai tax resident but remitted to Thailand whilst not, is free of Thai tax but this remains uncertain. Some care should be exercised before considering this option, readers may wish to obtain professional tax advice to confirm this point, before using this approach. To: 80) Income that was earned when a person was a Thai tax resident (in 2024 or later) is assessable under Thai tax rules regardless of tax residency status in the year of remittance. Overseas income that was earned when a person was not a Thai tax resident will likely not be assessable even when remitted later while they are a tax resident. Some care should be exercised before considering this option: readers may wish to obtain professional tax advice to confirm this point before using this approach. https://taxsummaries.pwc.com/thailand/individual/significant-developments

-

The way I see it, foreign-source income of a tax resident of Thailand earned after 1.1.2024 will be taxed when remitted, regardless of tax residency status during the year of remittance. The original guidelines by the Revenue Department did not explicitly state this, but PwC is not the first to point it out. Focusing on tax residency during the year of remittance would create an enormous loophole: Rich Thais could stay in Thailand and keep collecting millions offshore, then move abroad for 186 days every 5 or 10 years to remit it all tax-free. Logically, the Revenue Department wants to prevent that. But from a taxpayer's perspective, this is getting complicated.

-

It looks like PwC has updated their website yesterday. The new tax summary for Thailand includes one significant paragraph with vast ramifications: "If a Thai resident earns foreign-sourced income in 2024 and brings it into Thailand in the same year or any subsequent year, they will be subject to PIT on that income, regardless of whether they are resident in Thailand at the time." (emphasis mine) https://taxsummaries.pwc.com/thailand/individual/significant-developments

-

Don’t kill the golden goose! Tax reforms may drive away expats

Eudaimonia replied to webfact's topic in Thailand News

Oh, Thailand will be way worse than any country in the EU. At least for those of us financing our retirement with investments. Normal countries allow you to use capital losses to offset capital gains. This means that if you lose money on one investment, you can subtract that loss from your profits on other assets, lowering the amount of tax. For example, if you make 10,000 EUR in profit but lose 6,000 EUR on another investment, you would only pay taxes on the remaining 4,000 EUR, which is your net gain. In Thailand, if you lose money on one investment, you cannot use losses to reduce the taxes you owe on profits from other investments. If you make a profit of 1 million baht on one investment but lose 950,000 baht on another, you still pay tax on the entire 1 million, as if no loss occurred. Because of this, the effective tax rate in Thailand can easily be over 35%, 50%, or even over 100%. -

Not salary, but foreign-sourced income such as dividends and capital gains. I suppose these are not classified as "earnings," as I erroneously wrote, but passive income. The 100,000 euro flat tax in Italy or Greece becomes cheaper than the progressive Thai tax when one has around 12 million baht yearly income. For those not willing to cough up 100k every year, there are many discount countries, such as Monaco, with no income tax at all.

-

Don’t kill the golden goose! Tax reforms may drive away expats

Eudaimonia replied to webfact's topic in Thailand News

When retirees bring in money from abroad, it has a much bigger impact on the local economy than it might seem at first glance, thanks to the multiplier effect. That money doesn't just stop at the initial spending, whether it's rent, healthcare, or leisure. Each dollar spent circulates through the local economy, generating income for businesses and workers, who in turn spend it again. This creates a chain reaction of increased consumption, amplifying the economic impact. So, while retirees' remittances may seem small compared to GDP, their effect can be much larger due to this repeated spending cycle. -

There is little incentive, really. Countries such as Italy and Greece offer non-doms a cheap lump-sum tax regime where one pays only 100,000 euros in income tax per year regardless of earnings. Elsewhere, it's even more affordable. Thailand's tax rates are not competitive.

-

Thank you for bringing up this critical point. I had overlooked it when considering the LTR visa as a backup plan. Indeed, if Thailand moves to worldwide taxation but LTR visa benefits remain, one would need to remit all income. Not that easy or convenient. Can we even transfer some of it back out again without suffering multiple currency exchange losses?

-

Thailand to tax residents’ foreign income irrespective of remittance

Eudaimonia replied to snoop1130's topic in Thailand News

In separate posts on both Instagram and Facebook yesterday, the Thailand Privilege company (the state enterprise formerly known as Thailand Elite) urged potential new members to 'relax': "The introduction of new tax laws in Thailand have caused undue worry for many foreigners. What income is taxable? How much do I owe? But there’s reason to relax: all income earned and kept outside of Thailand is tax-free; and any income earned prior to 2024 is also tax-free," the Facebook post reads. The advertisement credits the Revenue Department as its information source. The Instagram post is worded a bit differently. https://www.instagram.com/p/C-VFGklNjQl/ While this is correct as of now, it also seems to imply that the situation continues. Would it be too bold to assume that before urging everyone to relax (and join), they have actually discussed this with the Revenue Department and have been reassured that worldwide taxation is not just around the corner? -

Thailand to tax residents’ foreign income irrespective of remittance

Eudaimonia replied to snoop1130's topic in Thailand News

Thank you, I guess, although I did not understand your comment. The existing laws are pretty clear. Remitted foreign-source income will be taxed using the same progressive rates as domestic income, up to a 35% marginal rate. My point was just that Thais returning from abroad will now get a discount and pay up to 17%. https://www.reuters.com/world/asia-pacific/thailand-approves-17-personal-income-tax-ceiling-returnees-2024-07-30/