-

Posts

562 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by AndreasHG

-

I am very late to this post. I apologize. Non inverter compressors run at two speeds only, one of which is the maximum speed, and the second one is off. It's either they run at full capacity, or they shut off. It's therefore no surprising that they achieve a lower temperature faster. They start from the very beginning running at full speed. Inverter units on the other hand modulate among a wide range of rpms. Usually, they start from a low rpm and they ramp up gradually as the pressure builds up in the refrigerant circuits. This prevents water hammer and thermal shocks. When they achieve the temperature set point, inverter units slow down and try to keep it as constant as possible. This greatly improves efficiency and comfort. But this is true especially for good quality inverters, having a wide modulation range, i.e. the capability of running at very low and very high rpm. There is plenty of cheap inverters in the market place which have a very narrow modulation field and seldom deserve more than one EGAT star. Non-inverter units, a.k.a. fixed-speed units, on the other hand cannot adjust their output to the thermal load. Either they run at full speed or they shut off. Therefore, when the temperature set point is achieved, they start cycling between OFF and ON. This is inefficient and particularly annoying when the unit is greatly oversized compared to the thermal load of the room in which it is installed. It is worst during cool days or during the nights, less so on very warm days. Every time the compressor starts pushing at full rpm, the refrigerant circuit suffer a water hammer and thermal shocks. And it wastes a lot of energy too, since the start up is the phase during which energy is consumed without any significant benefit in terms of comfort. If we compare compressors to a vehicle engine the fix-speed compressor would in essence be an engine running always at full speed with no accelerator. The only way to limit the speed is to shut the engine off, and then fire it up again when the speed falls below a certain threshold. The inverter compressor on the other hand is equipped with an "accelerator" controlling its rpm and adjusting it according to the desired temperature. Now you can chose between inverter and fixed-speed.

-

Hey genius, maybe it's because they voted for a president and a party that they assumed would reduce the debt. Don't you think so? Where do you think the 77,302,580 popular votes came from? Do you really believe they were all rednecks?

-

I don’t know how Democrats may be voting for Musk. He is seen as a right-wing extremist, which is not surprising given his white South African upbringing, at the time when apartheid went into crisis. I also don’t see many MAGA supporters voting for Musk. The most hardcore MAGA supporters never liked him and are still furious about his support for the H-1B immigration visa (Steve Bannon, for example). Tesla, however, is one of the most widely held stocks by retail investors and Elon Musk has an almost cult following. I assume he will take it from there, and from the "Proud Boys", from the "Oath Keepers" and from other neo-nazis groups like them. Those groups are always in search for a messianic leader to kill and die for and Musk fits the bill perfectly.

-

All of Elon Musk’s ventures depend on public funding to stay afloat. Back in 2024 and until weeks ago, Musk believed he had bought the Republican Party with $250 million in campaign contributions and secured many more years of EV tax regulatory credits for Tesla, plus a friendly boss at NASA and favorable contracts with the Pentagon. But he was mistaken. He mistook the United States of America for South Africa. $250 million in the United States is just pennies and not enough to buy anything in politics. In an article published today by WaPo, Maegan Vazquez lists 6 challenges that the new party will have to face to become a significant political force in the United States and break the back of the Republican Party. And let's make this clear from the beginning: money is not one of them. 1. Institutional barriers and ballot rules 2. Historical headwinds and recent challenges 3. Scope and strategy 4. Divisions among his potential audience 5. Garnering political allies 6. Patience You can read more following this link to the WaPo: 6 of the biggest challenges facing Musk’s new political party - The Washington Post

-

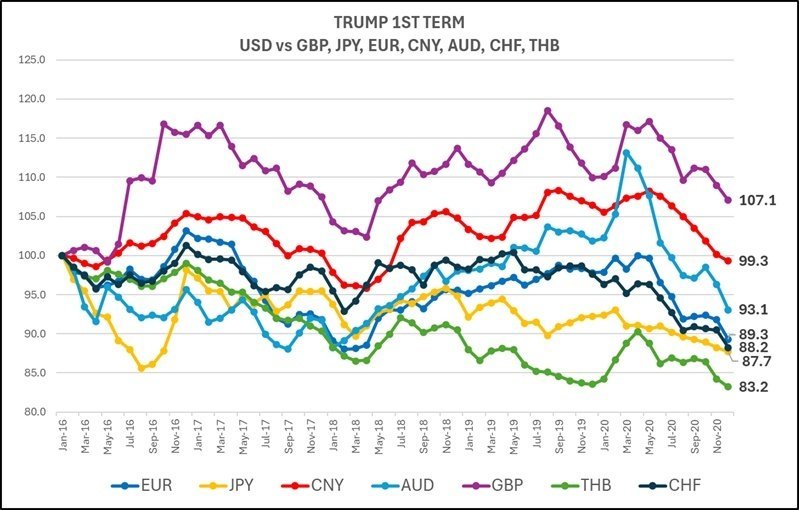

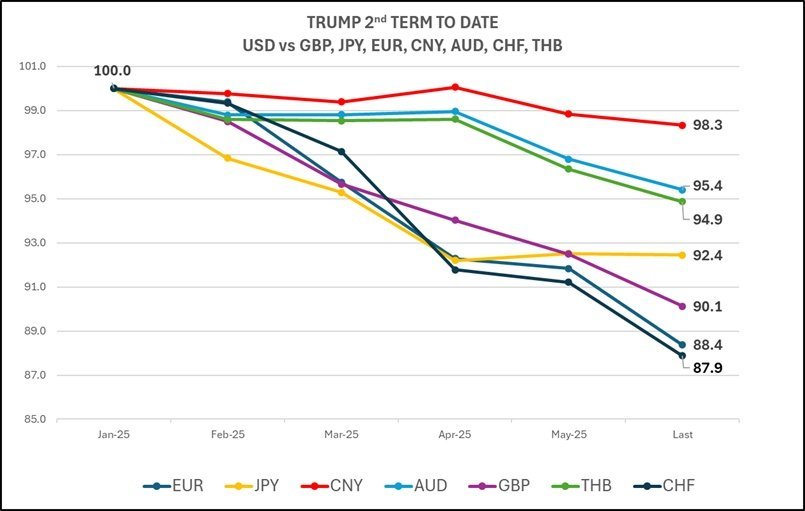

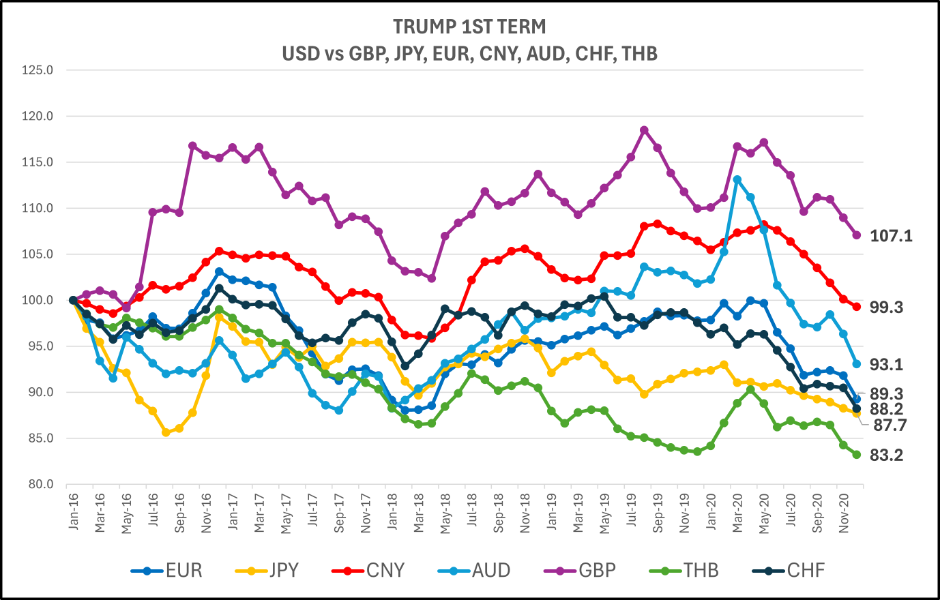

Maybe a little less than a crash, but still a significant depreciation. This is what happened during Trump's presidency. The dollar was indexed to 100 at the beginning of his presidency. Only the pound of Brexit Britain, which was led in quick succession by Theresa “Brexit means Brexit” May, BoJo “oven ready deal” Johnson, Liz "Lettuce" Truss and, finally, the best of them all Rishi Sunak, did worse.

-

-

-

-

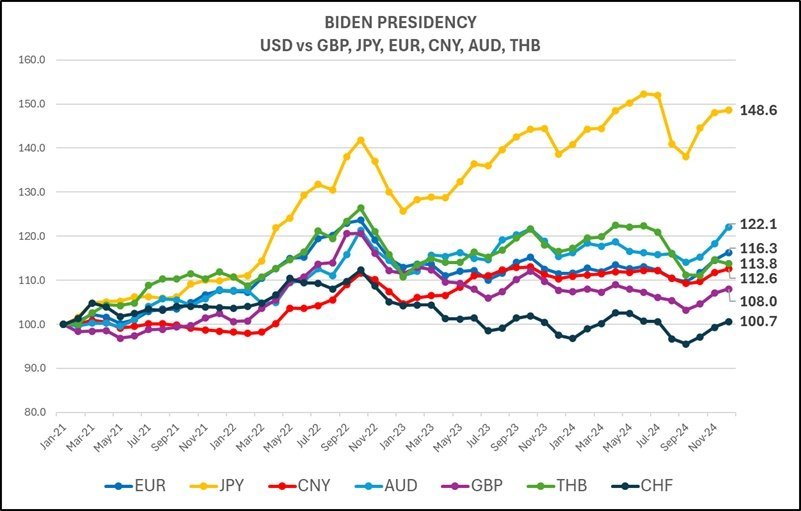

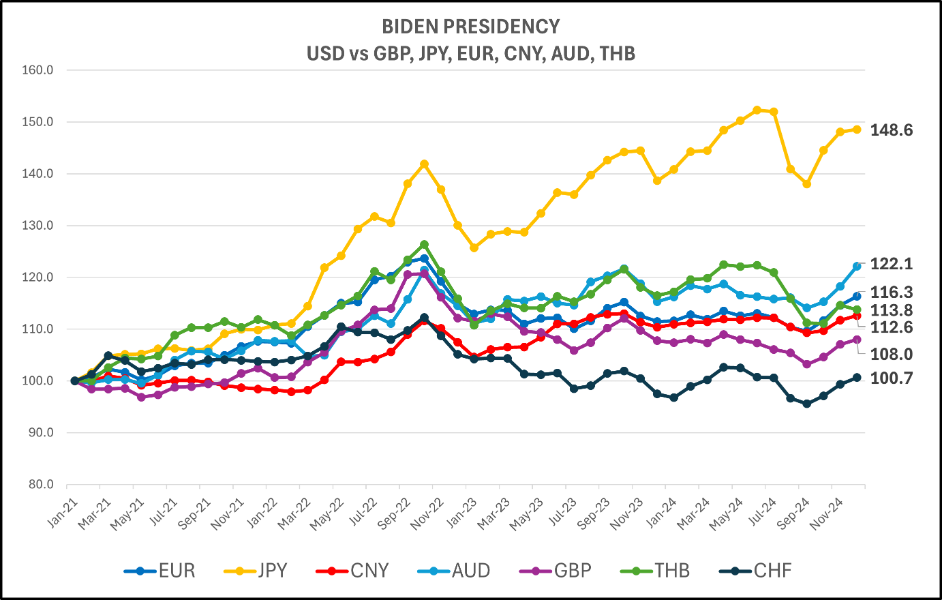

This is the dollar performance during the Biden presidency. Not that this makes of him a good president. He wasn't and I am glad he was sent to a retirement house. But good for the dollar he was.

-

I'm sorry: I'm not so much old to remember those distant times. But I'm glad you made it this far.

-

There are people who are aware of the times they live in. And then there are those living in Lala Land. To each his own. Today FT first page.

-

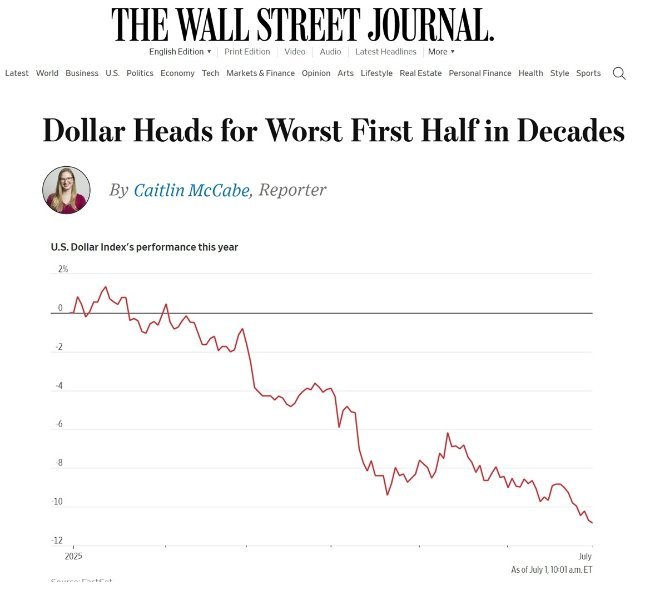

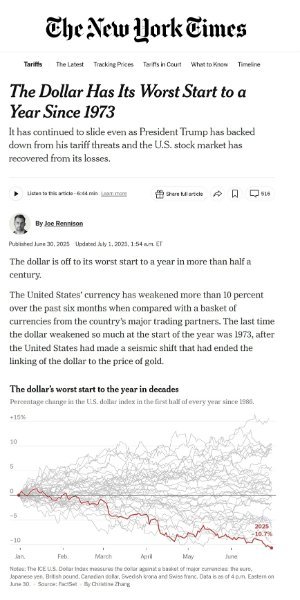

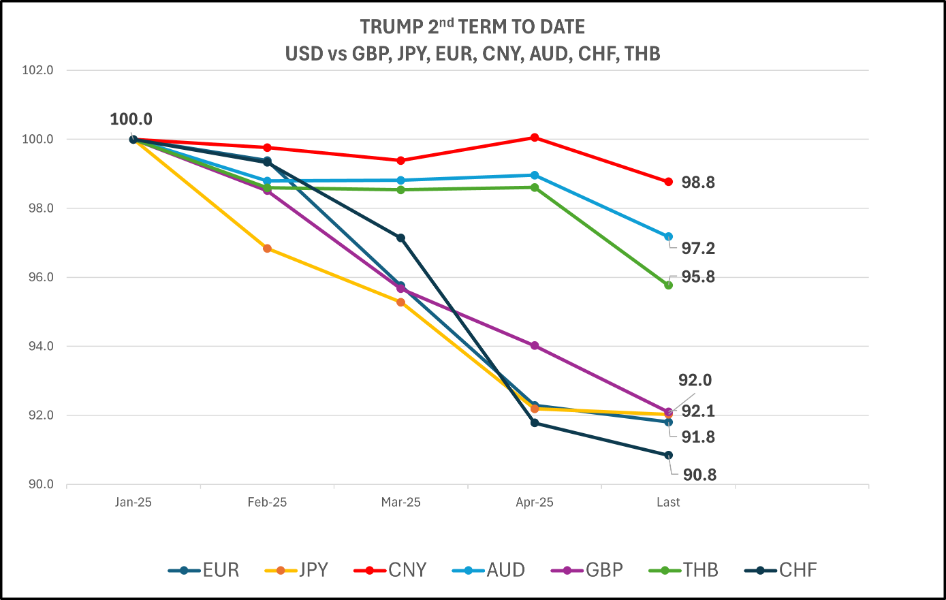

The dollar continues its run to new lows. Just five months into the Trump II administration, the U.S. dollar has already lost against major foreign currencies as much as it lost in four years during the Trump I administration. Fortunately for our American friends living in Thailand, the Thai baht is going through a bit of a weakness. That’s why the dollar’s depreciation against the Thai baht since the start of the Trump II administration is relatively small: just 5.1%. But with 3.5 years left, Trump II is well on his way to achieving his MAPA (Make Americans Poor Again) goal, beating his remarkable first term feat, when the US dollar depreciated 16.8% against the Thai Baht.

-

LOL. This post did not age well! What Trump's "mistake" highlighted is how China and especially Russia are powerless in face of America's might. Russia literally threw Iran under the bus and then went to hide. If anything good comes out of President Trump's resolve, it will be the end Iran's trust in its "Axis of Upheaval" friends.

-

The Ayatollah's Iran has violated international law for decades, starting with the taking of American hostages in 1979 and continuing with the creation and financing of Hamas, Hezbollah, Houthis responsible for indiscriminate attacks against the Israeli population and commercial traffic in the Red Sea. They have financed the criminal Assad regime in Syria and attempted to destabilize the monarchies in the Gulf by playing on sectarian divisions between Sunnis and Shiites. The time has come to present the bill to that bunch of incompetent, fanatical, ignorant mullahs who have been oppressing the Iranian people for 45 years.

-

LOL. The Iranian parliament is a rubber-stamp, puppet council devoid of any real power. The only real power holder in Iran is an arteriosclerotic octogenarian mullah who has spent 74 of his 86 years of life chanting "Death to America, Death to Israel", consistency being his only remarkable achievement. His unpopular, criminal, sectarian regime has been circling the drain for a while. It is time for the United States to form a coalition, finish the job, and free the Iranian people from the yoke that oppresses them. I have had the privilege of doing business with Iranians. Wonderful, educated, well-mannered people. They deserve much better than a government of fanatics and illiterate mullahs. Long life to Israel, Long life to Ukraine, Long life to the USA!

-

It's hard to say who was more stupid: the trillionaire who spent $288 million to get a pedophile elected to the White House, or the president who put a "poor guy" who's gotta a ketamine addiction "problem" in charge of DOGE and of the future of millions of American families. To give such a public display of utter stupidity would be unforgivable in any civilized country, starting from Thailand. It is the demonstration that to Make America Great Again we shall not start from Washington DC but from the American voters. More specifically from the education they have received and still receive in schools, colleges and universities. Third world education produces third world citizen-voters. And the result is for everyone to see.

-

Musk calls Trump’s big tax break bill a ‘disgusting abomination'

AndreasHG replied to BLMFem's topic in Political Soapbox

LOL Accusing Trump to appear in Epstein files a difference in opinions? This is not opinion. This is a damning indictment. Trump accused by Musk of being a pedophile. Is this what an intelligent man does when experiencing a "difference of opinion"? What kind of "intelligent men" are you used to hang out with? -

Make America Great Again and the US Dollar as Small as Possible

AndreasHG replied to AndreasHG's topic in Political Soapbox

No, thanks, but I'd like to see your face right now... ...start tightening your belt, my friend: that's what happens when an idiot gets elected to the highest office in the land. -

-

Make America Great Again and the US Dollar as Small as Possible

AndreasHG replied to AndreasHG's topic in Political Soapbox

LOL, since you like graphs what do you think about these ones? Unlike the USDX, which is calculated on a basket of currencies (euro (EUR), Japanese yen (JPY), Canadian dollar (CAD), British pound (GBP), Swedish krona (SEK), and Swiss franc (CHF)), some irrelevant to US trade, heavy weighted on the euro (57.6% of the basket) and missing the Chinese yuan and the Thai Bath, my graphs show the exact evolution of the USD against some major currencies. During Trump first term, during Biden term, and during Trump second term to date. For each term, 100 is the value of the currency in USD on the starting day. Are you still laughing? Well, I am. LOL -

In articles published by the Financial Times and other financial publications, authors highlight how the US Dollar just had its worst week "since President Donald Trump’s “liberation day” tariffs announcement rocked markets at the beginning of April." In the five days ending yesterday the US dollar lost over 2% of its value, 0.9 per cent on Friday alone, against a basket of peers including the euro, the yen and, crucially for our American friends living in Thailand, against the THB. This should not come as a surprise. Given the current administration fixation with the trade imbalance, and the tools available to rectify it, the safest way to achieve tangible results is to reduce the spending power of the American people. And what better way to reduce imports and boost exports if not the depreciation of the US dollar? As I posted before, the first Trump term saw the US Dollar lose a staggering 13 to 15% of its value against major currencies and a staggering 20% against the THB. But this second term is different because the decline in the value of the US dollar is happening faster and more dramatically than ever before. "“Lingering fears over the quality of US asset markets and the threat of de-dollarisation are continuing to weigh on the dollar,” said Chris Turner, global head of markets research at ING", writes the Financial Times. And "“Renewed investor concerns over the US fiscal outlook, alongside speculation that the Trump administration is seeking to weaken the dollar in discussions with other countries, have contributed to the sell-off,” said Lee Hardman, senior currency analyst at banking group MUFG.". Concluding by writing "Analysts at RBC BlueBay Asset Management said they expected the dollar weakening to continue as investors look to hedge their exposure to the greenback in the short term and rethink a “structural overallocation” to the US in the longer term." And while our American friends in Thailand prepare for a future of belt-tightening, there’s bad news for our Americans friends back home too. With 20- and 30-year treasuries interest rate exceeding the 5% mark for the first time in 18 years and with a total value of outstanding US Treasury securities of $27.089 trillion, a 0.1% change in the interest rate costs the American taxpayers a staggering $27.1 billion. Soon however, Americans will start assembling the popular iPhones locally and, who knows, maybe exports to Thailand, China and Vietnam will start too. Everything, in order to Make America Great Again. Dollar notches biggest weekly drop since tariffs sell-off over US debt fears (https://www.ft.com/content/04deb2ec-5bb1-4c7c-94bb-6f62582a0032).

-

Writes the Washington Post "President Donald Trump lashed out Wednesday morning at increasingly dim economic forecasts that have cast his policies in a harsh light and clouded what he had hoped would be a valedictory marker of his 100 days in office. He has blamed the Federal Reserve. He has expressed anger at what he has described as unfair trade policies of the past, and bluntly said that Americans may have to stomach paying more and getting less. And, more than anything, he has blamed his predecessor. “You probably saw some numbers today,” he said at the start of a Cabinet meeting at the White House. “And I have to start off by saying, that’s Biden; that’s not Trump.” In the meanwhile, the Global Times (a daily tabloid newspaper under the auspices of the Chinese Communist Party's flagship newspaper, the People's Daily) mocks the Trump administration publishing an article stating "There is really no need for China to waste time until the US takes substantial actions. But if the US wishes to engage with China, at this stage, it is not necessarily a bad thing for China either. [...]. Moreover, judging from the current game, China remains calm and clear-headed, always firmly in control of the initiative in both dialogue and confrontation". Adds The South China Morning Post (a daily newspaper published in Hong Kong and subject to the strict scrutiny of the Chinese Communist Party) "Trump’s claims that trade negotiations are under way have been repeatedly denied by Beijing, including most recently on Monday when Chinese Foreign Ministry spokesman Guo Jiakun said “there have not been any calls between the two presidents recently”." "Treasury Secretary Scott Bessent told ABC News last week that engagement with Beijing continued, then suggested that China’s denial was intended for its domestic audience. “I think they’re playing to a different audience,” Bessent said. “We have a process in place and, again, I just believe these Chinese tariffs are unsustainable." "Last week, Chinese Finance Minister Lan Foan criticised the trade war during a Group of 20 ministers meeting in Washington. But Lan concluded his trip without an official dialogue with any US counterparts." "Last week, The Wall Street Journal reported that the Trump administration was considering reducing tariffs on some Chinese imports to a level of 50 per cent to 65 per cent." In the meanwhile, the Chinese Ministry of Foreign Affairs published the video below as a message intended primarily to the foreign audience in all countries hit hard by Trump's tariffs. That Trump, a wannabe master of the deal, has put himself against the wall is, at this point, an understatement. https://www.washingtonpost.com/politics/2025/04/30/trump-economic-policies-criticized/ https://www.globaltimes.cn/page/202505/1333227.shtml https://www.scmp.com/news/china/diplomacy/article/3308635/trump-believes-good-chance-china-trade-deal-us-envoy-says-no-talks-under-way

-

Xi Jinping is not satisfied with winning the trade war

AndreasHG replied to AndreasHG's topic in Political Soapbox

That was then. In today's America social media feed people with s**t they end up believing. Harrisfan is a typical product of X Corp. (née Twitter). He and his ilk are products that will cost America dearly, not realizing how brainless, zealot and manipulated they are. Social media have made mainstream what was once the preserve of sectarian, fanatical, antisocial and marginalized groups: indoctrination. I am proud to say that I still pay for most of the information I read, and have no X account. In exchange for my money I demand to get quality information (starting from having access to "both sides of the story").