jfchandler

-

Posts

6,978 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by jfchandler

-

-

Karen... what kind of prices/price range at Omaru??

and what kind of sakes are they stocking?? Otokoyama???

-

KK, your math is pretty far off, regarding the cost of international wire transfers...

Most U.S. banks are charging anywhere between $40 and $60 for international wire transfers, regardless of the amount sent, apart from the smaller fees the receiving Thai banks here charge.

Given that the current 150 baht fee works out to about $4.25 U.S., that means you'd have to do more than 10 ATM transactions, at the maximum amount allowed each time, before a wire would become more cost effective.

There are exceptions, such as some banks that dont charge so much or at all.. But those are the exception, not the rule, when it comes to international wires from the U.S.

And then, there is the ability to do low cost online transfers to the BKK Bank branch in New York... But that only works for U.S. folks who know about it and how to do it (I suspect most people don't), and hasnt always been dependable in the past.

The simple question remains... why pay BKK, SCB or the others 150 baht for every foreign card ATM withdrawals when you can avoid the fee entirely by using Kasikorn, Ayudhya or GSB ATMS????

If you like to blow 150 baht every time for no reason, I'd be happy to take the cash off your hands....

-

By way of comparison, I made identical U.S. ATM debit card withdrawals Thursday and Friday nights at Kasikorn with no Thai ATM fee, but the usual 1% Visa cut.

I got a 35.18 rate on Thursday and a 35.08 rate today/Friday...

-

Folks, I'm excited to hear the news about this...

But... 1] I couldn't find any mention of this channel addition or the timing on the True UBC web site...

And 2] no one has mentioned whether this will be a standard addition to the Gold and Platinum packages, or is True going to try to sell it as a premium, extra charge per month channel.

-

crazy ? .. i am a foriegner , i live/work in thailand , i use a local debit card in thailand from my thai bank , no charges at ATM for cash withdrawls.

most people who live in thailand WILL have thai bank accounts and debit cards , therefore no 150 baht charge for them in Thailand,

crazy ? .. i am a foriegner , i live/work in thailand , i use a local debit card in Thailand from my Thai bank , no charges at ATM for cash withdrawals.

most people who live in thailand WILL have Thai bank accounts and debit cards , therefore no 150 baht charge for them in Thailand.

But, most non-Thais who live in Thailand also will have ATM cards from their home countries, and would be foolish to spend 150 baht on every withdrawal when they don't have to...

-

Here's the background from the news release last fall about the network's plan to launch this new channel...

ASN will offer exclusive coverage of North America's biggest sportsleagues in HDTV (high definition television), including the NHL (National

Hockey League), the NFL (National Football League), NCAA basketball and

football, March Madness and the Final Four. ASN will also offer coverage in

Asia for the top college conferences in the USA including the Big Ten, Pac 10,

SEC and ACC, including basketball, baseball, tennis, swimming, golf, football,

soccer, track and field and gymnastics. Additionally, there will be extensive

coverage of motor sports and extreme sports such as snowboarding, surfing, and

skateboarding. ASN is expected to generate revenue through subscriptions,

advertisings and sponsorships.

-

PCCW adds All Sports Network to now TV

16.01.09

Hong Kong telco PCCW has added the All Sports Network (ASN) to its IPTV service 'now TV', featuring 24-hour broadcasts of American sports action including games from the National Football League (NFL) and National Hockey League (NHL).

The full content lineup also includes NCAA college basketball and football, March Madness, motorsports including Formula Drift, Touring Car and GT racing, plus Extreme Sports, Pro Bull Riding and more.

ASN is the second sports network from Yes Television (Hong Kong), a pan-Asian media company focusing on the production and distribution of premium sports channels. The channel broadcasts over 35 live sports games each week, including four NFL and five NHL games along with leagues, pre- and post-game analysis, highlights, news, reviews, updates and magazine shows.

"The value of sports content, particularly North American sports, is growing rapidly across Asia," said Thomas Kressner, CEO of All Sports Network. "ASN aims to become the home for fans who love the hard-hitting action of American sports and for viewers who demand the highest production and picture quality in their sports entertainment. ASN is also available in HD and the service is expected to be rolled out in Asia later this year."

The All Sports Network was launched on now TV yesterday (January 15th) and is available for HK$ 80 (US$ 10.30) per month. Existing subscribers to the Mega Sports Pack can also access the channel for a special rate of HK$ 40 per month.

PCCW rolled out now TV over its broadband network in 2003, and has enjoyed such strong subscriber growth thanks to a number of exclusive content deals, including coverage for the English Premier League football rights, that it is now challenging for the position of the largest pay-TV provider in the country. According to its latest figures, PCCW had expected now TV to account for at least half of Hong Kong's TV homes, or around one million IPTV subscribers, by the end of 2008.

-

XFMedia buys a stake in All Sports Network

By: Cass Lam, Hong Kong

Published: Sep 30, 2008

Hong Kong- XFMedia has invested $US2 million in All Sports Network (ASN), with U.S. sports coverage scheduled to be aired on Hong Kong-based Yes TV this month.

Yes TV owns TVB Pay Vision network, which operates the soccer channels GOALTV1 and GOALTV2 on now TV.

XFMedia now owns 15.5% stake in ASN and has been granted exclusive distribution rights to broadcast North America's sports content including National Hockey League, National Football League and NCAA basketball.

Thomas Kressner (pictured), CEO of Yes TV, said there will be significant and growing demand for sports content in all major markets, especially in China.

Fredy Bush, CEO of XFMedia, said international sports content is one of the top commercial opportunities in the China media field today.

"It is a very efficient way to make contact with the upwardly mobile and high net worth demographic that is at the heart of XFMedia's strategy."

-

A bit more about ASN....

Hong Kong's All Sports Network nabs NHL distribution rights in much of Asia

by Darren Murph, posted Sep 28th 2008 at 5:45PM

The NHL may not have the viewership in America as, say, the NFL, but that doesn't mean it can't find fans elsewhere. In a rather unexpected move, Hong Kong-based All Sports Network (ASN) has signed a multi-year deal to posses rights for broadcasting NHL matchups throughout much of Asia (India, South Korea and China included). Over 130 upcoming regular-season games will be televised on ASN's Yes TV along with the All-Star game, playoffs and the Stanley Cup Final. The good news? The broadcast rights include "all forms of television, including HDTV." The bad? Japan, Australia and New Zealand have been excluded from the agreement.

-

Call the airline and explain your situation, and ask for their advice...

The general policy discussed above is correct. But folks on TV have reported in the past being able to get around it through various means, including signed notes and such...

It's really up to the discretion of the individual airline, and how strict or flexible they are about the policy.

-

Sex Addicts & Men that can't socialise with Women, & sometimes Men of their own Race IE Social Misfits, amongst other things

I didn't know Tesco Lotus was stocking those kinds of items these days... How's the market for those in Samui??? Did you sign up for the buy two for the price of one offer they often have???

-

I believe with Capital One, you need to call them by phone. I've never seen any online link for reporting travel plans on their web site.

-

The average Asian, and especially Thai woman, is slimmer and more athletic in build and generally more youthful in appearance than a Western woman. While some Thai women are profoundly hot, I think the top models from the West are still more attractive.

I find some Asian movie stars and models to be much hotter than Western ones. Despite my advanced age, my hormones go into overdrive when I see those angelic faces, tight bodies and some lovely exposed skin.

Glad to hear it, UG... Same for me!!! Chiefly when I see my GF...

-

No-ATM fee banks at present:

Kasikorn (green), Ayudhya (yellow), and Government Savings Bank (pink).

-

To Pattaya_Girl above, you're welcome!... I'm sure if Kasikorn does adopt the 150 baht ATM fee (and I'm certainly hoping they don't), we'll hear plenty about it here... If a month or two passes and they're still fee-free, then they'll probably stay that way. Right now, it's too soon after the change to know the future with them.

By the way, reportedly, Government Savings Bank (the one with the PINK signs and gold seal) supposedly also remain fee-free, though I can't vouch for that personally. They have 500+ branch offices across the country, including in all the cities outside BKK, and who knows how many ATMs.

In that regard, can anyone update on Government Savings Bank and Bank of Ayudhya, which also was fee-free last time I heard????

To Priceless, re your question, at the Kasikorn end of things, it shouldn't matter what foreign ATM/debit card you are using with them, as long as it belongs to one of the banking networks they accept (like Cirrus, Plus, Star, etc...). Right now, as long as their ATMs accept your foreign ATM/debit card, you won't get a Kasikorn fee.

That's not the same, of course, at your home/foreign bank's end of things. Some (probably most) home country banks charge their customers a fee when you use their ATM/debit cards in a foreign country.

So whether you are a tourist or an expat living here, you want to aim for two things:

1. a home country bank that doesn't themselves charge you any fees for using a foreign ATM.

2. a Thai bank that doesn't charge you any ATM fees for using a foreign card, or alternatively, a home country bank that fully reimburses you for any foreign ATM fees that you incur.

PS - To all the many U.S. BofA "fans" out there (and I count myself at the top of the list), they've just announced a change to begin charging much higher monthly maintenance fees on their standard checking and MyAccess checking accounts, effective June 5, 2009.

For MyAccess checking accounts, the monthly fee will be $8.95 unless you maintain an average daily balance of at least $1,500 or have a qualifying direct deposit. For their Standard checking accounts, the monthly fee will be $9.95 unless you maintain a $1,500 daily balance (no break for direct deposits).

At least, however, they appear to be honoring one prior commitment. Many folks in the last couple of years have been able to open MyAccess checking accounts with them through an ONLINE promotion in which they promised the accounts to be FREE of monthly fees. It appears from their announcement that if you already have an absolutely free MyAccess account with them now (meaning regardless of direct deposit or minimum balance) then you won't be hit with the new fee.

I had a prior branch-opened MyAccess account with BofA that I'd never paid any monthly fees for, because I'd always avoided what then was a $4.95 or $5.95 fee by virtue of direct depositing my U.S. paycheck. But that stopped when I moved to Thailand. Yet at that time, they were offering the FREE MyAccess checking for new accounts opened online. I asked them if they could simply change over my old account to the new status. They said absolutely NO. So I ended up having to close the old branch-opened BofA account to avoid the monthly fee, and then opening the new FREE checking account with them online, which I still have today. I'm so fed up with them, I may eventually end up canceling the FREE account as well....

In case anyone was wondering, guess who is really paying for all the trouble the big banks got themselves into??? Ultimately, it's the everyday folks who have accounts with them... and more broadly... the U.S. taxpayers.

-

Yes, Kasikorn is the "green" bank and they have NOT, by all reports, begun charging the 150 baht fee as yet. My own last fee-free ATM transaction with them was 2 days ago...

-

The result of the new charge has been that I have opened a new (additional) account at Bangkok Bank so as to gain one of their ATM cash cards (which I have not previously held) and have dumped a few tens of thousands of Baht in that new account by way of a working float. So, although my regard for Kasikorn Bank has been improved as a result of the fact that they have chosen not (yet) to implement the charge, it is Bangkok Bank which has gained extra business from me.

That above is a pretty senseless decision. If the poster wanted to do something like that, why not open the new account with Kasikorn and use THEIR ATM card for local withdrawals... Or maybe you'd prefer to send your extra business to banks that choose to rip off farangs.

However, this really is a risible storm in a teacup. Why is it assumed that any bank has any obligation to provide any free or subsidised service to any person who is not their banking customer?For anybody to suggest that these new charges are a sign that Thailand in general is engaged in some kind of anti-tourist or anti-farang conspiracy is ludicrous and paranoid.

Speaking of ludicrous comments, this one above tops the list. For the poster's info, BKK Bank and all the others who have adopted the new fee ARE charging the 150 baht even to their own customers. Like many others here, I have Thai accounts at various of the fee-charging banks. I AM their customer. But I still would get hit with their fee when I use any of my U.S. cards.

But then again, I'm not stupid and careless with my money. I don't choose to fritter away 150 baht every time I use the ATM. So for now I'll use Kasikorn and the other fee-free Thai banks.

-

Capital One is a good U.S. credit card to have for those living or traveling abroad, because they are indeed one of the few that doesn't charge foreign currency transaction fees.

I've had a generally good experience with them for some years. There are two limitations, however...

1. Lots of small places here simply don't take credit cards, apart from those that will, but tack on an added charge. So using their card hardly is a complete replacement for ATMs or cash.

2. Capital One, more than other U.S. card issuers, is fussy about the location of your purchases for anti-fraud reasons, if they show up away from the address you have on record with them. So, if you live in the U.S. and suddenly travel to Thailand without telling them, and then use your card here in LOS, you're liable to find your card locked after a couple of purchases. (And the only way you'll find out is when you go to make a purchase and suddenly your card is declined). Then you'll have to call their fraud section, and jump thru some hoops to get it reinstated.

There is a solution to this, however. For example, if you live here, just call them and ask them to place a note on your file that you're living/working/visiting, etc. in Thailand (or wherever) for XX amount of time. I think the longest period they'll keep the note for is one year. So ex-pat residents may have to renotify them every year or so in order to avoid problems. For travelers, just tell them the duration of your trip before you leave home.

-

It won't generate more revenue for the fee-charging banks if their expat customers, including myself, cease being their customers and move our business to non-fee banks, or use non-ATM alternatives such as in-branch transactions that actually will end up costing those banks more.

But more broadly, these kinds of moves do indeed contribute to an anti-tourist, anti-foreigner impression in the country that is just about the last thing it needs right now. The Thai Bankers Assn. couldn't have been worse in their timing.

"By adopting the 150 baht fee, the Thai Bankers Assn. was obviously trying to generate more revenue for the banks...The whole thing makes no practical sense."Of course it does, and you mentioned it in your very first sentence: the fee is to generate more revenue for the banks. With an average of 20,000 affected transactions per day, it's an extra 3 million THB/day

-

I'm happy the OP likes to carry around "wads" of cash in his wallet. I prefer to carry small amounts and then replenish at a local ATM every couple days...and to keep the bulk of my funds in U.S. insured banks, alongside my Thai bank accounts.

150 baht to use the ATMs here is a rip-off. At least for now, I'm glad that Kasikorn Bank, Government Savings Bank and some others haven't implemented the fee.

As an ex-banker, maybe the OP can remember when ATMs first came out and banks encouraged/pushed customers to use ATMs INSTEAD of going into branches because, of course, ATM transactions are much cheaper for a bank to process than teller-based ones.

By adopting the 150 baht fee, the Thai Bankers Assn. was obviously trying to generate more revenue for the banks. Instead, what they're doing is pushing angry ex-pat customers away from the charging banks to non-fee alternatives or pushing those same customers to switch to in-branch transactions that don't currently have that fee.

The whole thing makes no practical sense.

-

is kasikorn still 150bt fee free?

YES!, at least as of today/Wednesday...

-

Which bank companies said NO... Cloud???

I'm assuming it was a Visa or MC logo debit card???

-

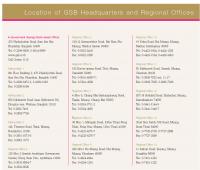

Folks were asking about info re Government Savings Bank locations, and yes, their web site list of branch locations is only in Thai... But...their annual report in English does include their main and regional office locations in English. And their web site says they have 595 branches across the country.

Here's the screen shot of their main and regional office locations:

And here's some background about the bank, which appears to be basically an arm of the Thai government

-

In reading the posts here about Thai OTC withdrawals, I'm wondering if people using the phrase/words "cash advance" with the Thai banks is contributing to the exchange rate problem (at least in the case of SCB)....

In my world of U.S. banking, "cash advance" means drawing money off your credit card, and at least for U.S. cards, getting hit with a 3% transaction fee and paying interest from day 1 to your home bank. Again, in my world, no one talks about doing "cash advances" using debit cards.

I'm wondering whether the transaction and rate offered by SCB (or others who may be doing the same as SCB) would be different if the person walks in and says, "I want to withdraw/transfer money from my home account using my debit card, and a) take it as cash or

put it into my Thai bank account."

put it into my Thai bank account."PS - I'm clear from KhunJake's posts above that he was talking about using a debit card at SCB, not using a credit card. But he still used the terminology of "cash advance", and perhaps to the bank agent handling the encounter, that meant giving him the credit card/cash advance exchange rate???

150 Baht Atm Withdrawl Fee.. Does It Matter?

in General Topics

Posted

There have been lots of posts and threads here about the BKK Bank transfer capability.... You can do a search to read more...

But basically, it's pretty simple. Go into your U.S. online banking account, do a search to add Bangkok Bank as one of your linked banks. That should produce the ABA # for BKK Bank's New York Office... (You can also find the ABA # on various of the pertinent threads here and even on BKK Bank's web site.

Use the ABA # and your BKK Bank Thailand account number... just like you would to link a U.S. account. That typically will lead your U.S. bank to do a trial deposits verification. Wait a couple days, then call BKK bank's customer service hotline here, and ask them to give you the U.S. dollar amounts for the two small deposits that have showed up into your Thai account (in baht).

Then, take those two small $ amounts, go back into your U.s. online account, and enter the trial deposits amount to verify your link. After that, you should be able to do transfers from your U.s. account to the bkK bank New York office just like you'd do any ACH. The only difference will be once they arrive at the New York Office, they then use your Thailand account number to route to your thai account here.