-

Posts

37,086 -

Joined

-

Last visited

-

Days Won

6

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by TallGuyJohninBKK

-

You haven't clearly shown that it was... other than an anecdotal claim from your contact with one Thai pharmacy chain... But beyond that, as to your "safest" claim.... "Several countries initially used chloroquine or hydroxychloroquine for treatment of persons hospitalized with COVID-19 (as of March 2020), though the drug was not formally approved through clinical trials.[58][59] From April to June 2020, there was an emergency use authorization for their use in the United States,[60] and was used off label for potential treatment of the disease.[61] On 24 April 2020, citing the risk of "serious heart rhythm problems", the FDA posted a caution against using the drug for COVID-19 "outside of the hospital setting or a clinical trial".[62] ... In 2020, the speculative use of hydroxychloroquine for COVID-19 threatened its availability for people with established indications (malaria and auto-immune diseases).[54]" https://en.wikipedia.org/wiki/Hydroxychloroquine

-

I'd imagine, both medications remained available throughout the pandemic from hospital pharmacies with the specific prescription by doctors for legitimate uses.... But to whatever extent the two were removed here from general pharmacies, where no doctor's order or prescription is required to purchase, it presumably was to both protect their supply and prevent their rampant misuse and abuse.

-

Because both medications listed above have legitimate human medical uses -- hydroxychloroquine as an anti-malarial and treatment for several other conditions, and ivermectin as an anti-parisitic... But neither of them have been shown to have any benefit in treating or preventing COVID, which is where they came to widespread public attention and demand during the pandemic, because of numerous bogus and misinformation claims made about them.

-

In my experience, the default on the Agoda website is to quote room rates that DO NOT include the standard Thai VAT and service charge, which together will always end up adding about 17+% to the originally quoted rate. I also believe, I think in their app (not sure about their website), that there's the ability to change that so the originally quoted rates DO include the VAT and service charge add ons. In my experience, the end result real AGODA rates here in Thailand generally seem to be below the comparable rates that hotels themselves list on their websites or thru their own booking schemes.

-

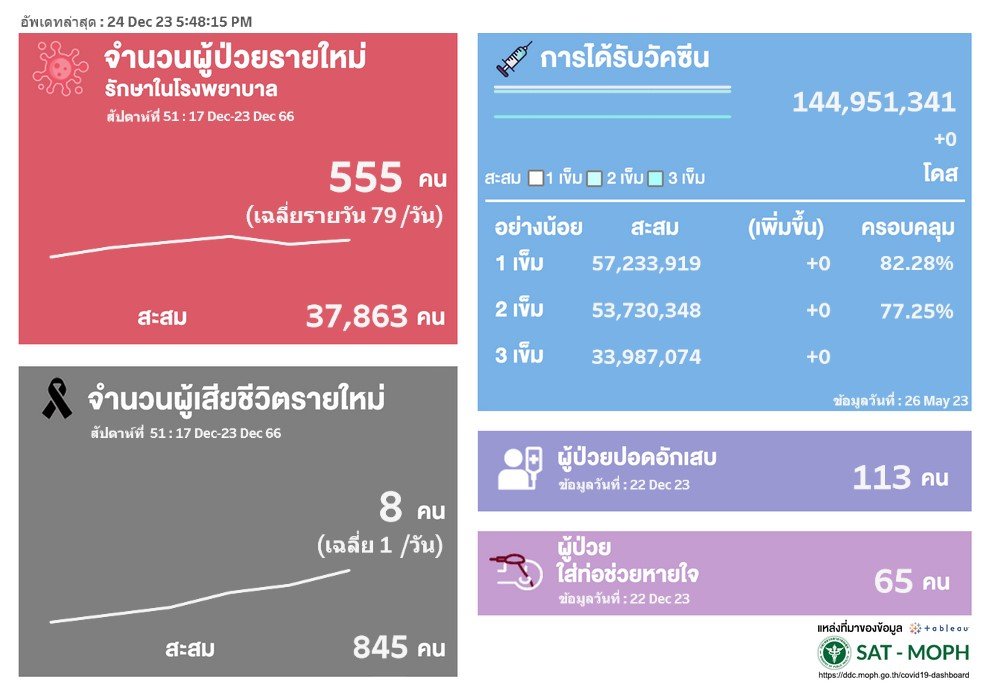

Thailand MoPH Weekly COVID report for Dec. 17 - 23: --555 new COVID hospitalizations, up 41 from the prior week --8 new COVID deaths, up 2 from prior week --113 COVID patients hospitalized in serious condition, down 1 from the prior week --65 COVID patients hospitalized requiring intubation to breathe, up 7 from the prior week https://ddc.moph.go.th/covid19-dashboard/?dashboard=main

-

Mail forwarding services for Americans

TallGuyJohninBKK replied to wornoutcowboy's topic in General Topics

My USA2Me account / address in Houston runs a flat $10 a month for their plan that I selected, plus typically about $40 per FedEx or DHL economy intl envelope at that price containing 6 or so forwarded envelopes, or slightly more for heavier weights. Have had very few issues over the years using their address with any U.S. financials, but I tend to stay away from the US mega financials for other reasons. Some retailers won't send purchases / packages to them, but I only use them for letter mail anyway, as I use a much more affordable service provider for my shopping purchase mail forwarding. -

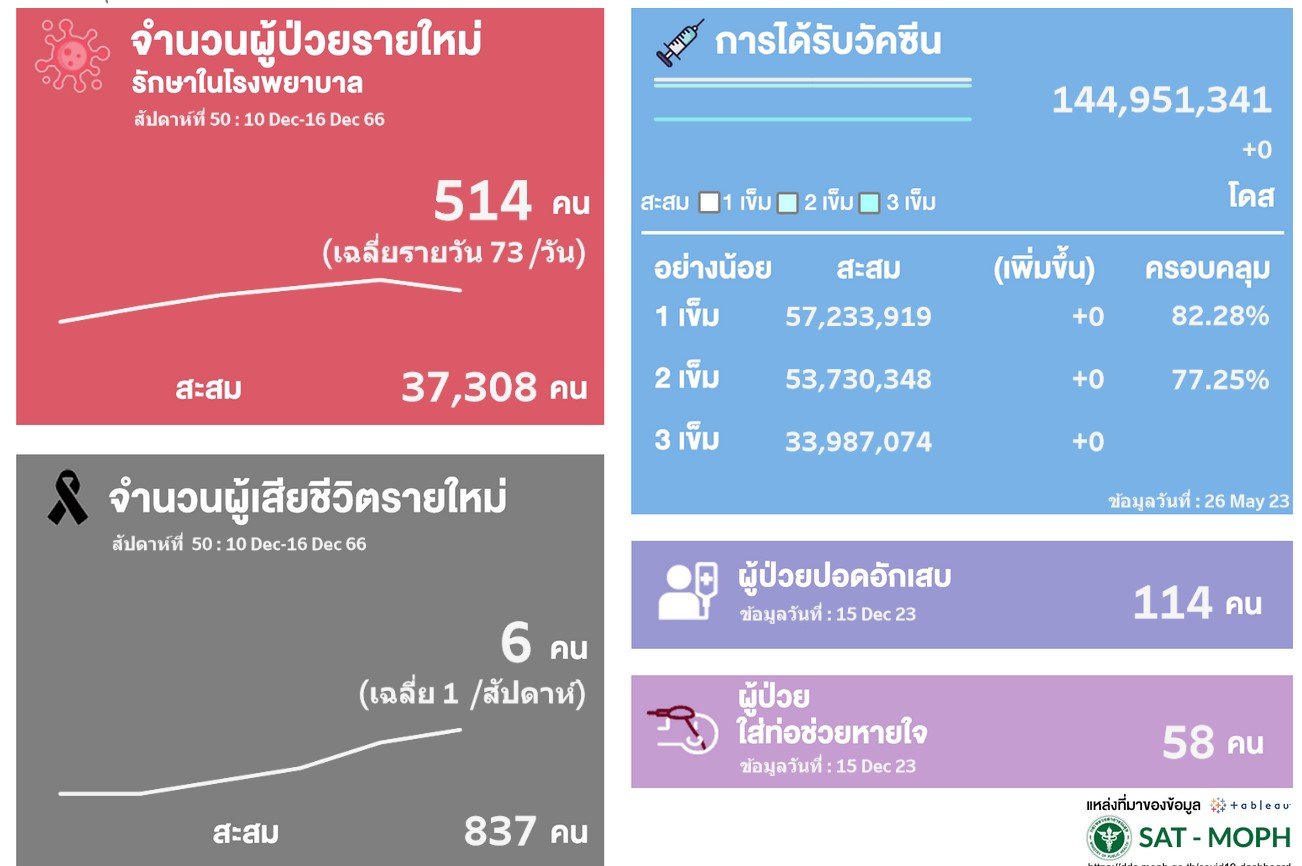

New COVID hospitalizations took a big dip to 514 this past week Dec. 10-16, down from 590 the week prior and only the second weekly decline in the past nine weeks. But the latest weekly tally remained more than four times higher than the recent low count of 124 in mid-October. Meanwhile, according to the latest weekly update from the Thai Ministry of Public Health, there still were weekly increases in reported new COVID deaths (6), COVID patients hospitalized in serious condition (114), and those requiring intubation in order to breathe (58). The tally of newly reported COVID deaths rose by one from the prior week, and at six was the highest number of new weekly COVID deaths since six also were reported for the week ending at the beginning of September. The tally of 114 hospitalized COVID patients in serious condition exceeded 100 for the first time since late September, when the tally was 106. It also was the first time the count of 58 intubated COVID patients in hospital exceeded 50 since the same week in late September, when the count was 72. https://ddc.moph.go.th/covid19-dashboard/?dashboard=main

-

Thailand MoPH Weekly COVID report for Dec. 10 - 16: --514 new COVID hospitalizations, down 76 from the prior week --6 new COVID deaths, up 1 from prior week --114 COVID patients hospitalized in serious condition, up 20 from the prior week --58 COVID patients hospitalized requiring intubation to breathe, up 9 from the prior week https://ddc.moph.go.th/covid19-dashboard/?dashboard=main

-

Funds that a now married person had prior to their current marriage (meaning the current spouse isn't entitled to a community property share in the event of a future divorce), or otherwise legally exempt from community property status funds, such as inheritances, which always stay 100% with the inheritor.

-

Mail forwarding services for Americans

TallGuyJohninBKK replied to wornoutcowboy's topic in General Topics

I think you're overgeneralizing a bit... I've used the same Texas mailhouse for the past 15 years, and during that time, have used it to open numerous new U.S. bank and credit union accounts, and had to update many more existing accounts of all kinds when they relocated once a few years back... And in all that time and all those contacts, I think I've only had one instance where I was declined on the basis of the address, and that was once as an existing Capital One account holder where I applied online to open a new savings account with them, and they challenged me over the address for that, but not for the other existing accounts I already had with them at the time... Other than that, over the past 15 years, all of my financial and other encounters have not had any problems with acceptance of the TX address, including multiple new bank and credit union accounts opened over the past couple years. Though I think it does help in such matters if you have a state driver's license with an address that matches the one you're using for mailing purposes. -

The current increase in COVID-19 infections is seasonal, like other respiratory diseases, and will continue until the end of January, returning to normal between February and May, according to Dr. Yong Poovorawan, head of the Centre of Excellence in Clinical Virology at the Faculty of Medicine of Chulalongkorn University. He added that a new wave of infections will begin in June and last until September, dropping again by November. Like many respiratory conditions, such as flu, COVID tends to peak during the rainy season. (more) https://www.thaipbsworld.com/uptick-in-covid-19-infections-is-seasonal-will-drop-in-february/

-

Mail forwarding services for Americans

TallGuyJohninBKK replied to wornoutcowboy's topic in General Topics

So while you pretty much endorsed America's Mailbox service in South Dakota above, were you also suggesting/implying that you'd also run into some complications with some U.S. financial entities not accepting their addresses??? -

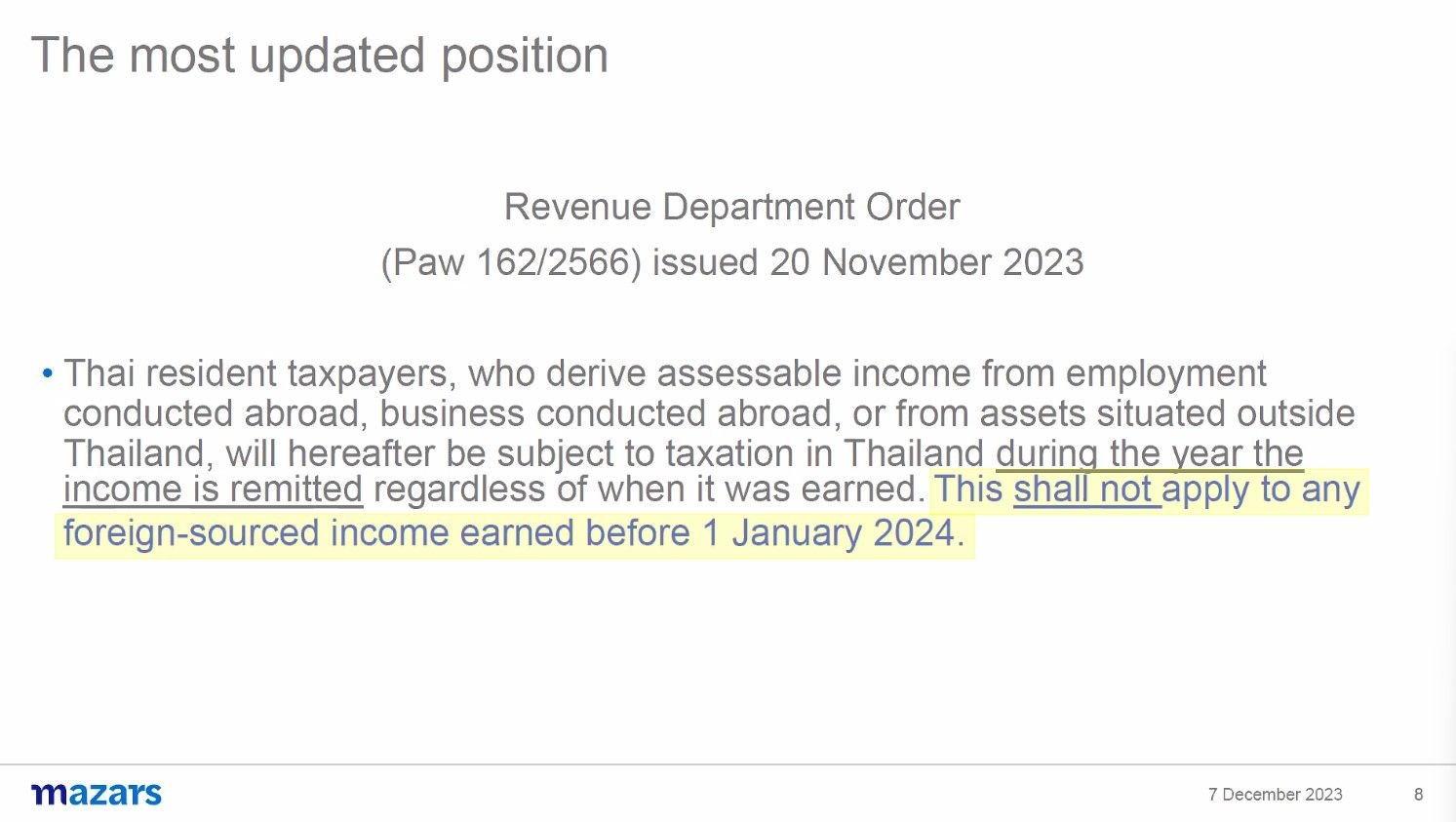

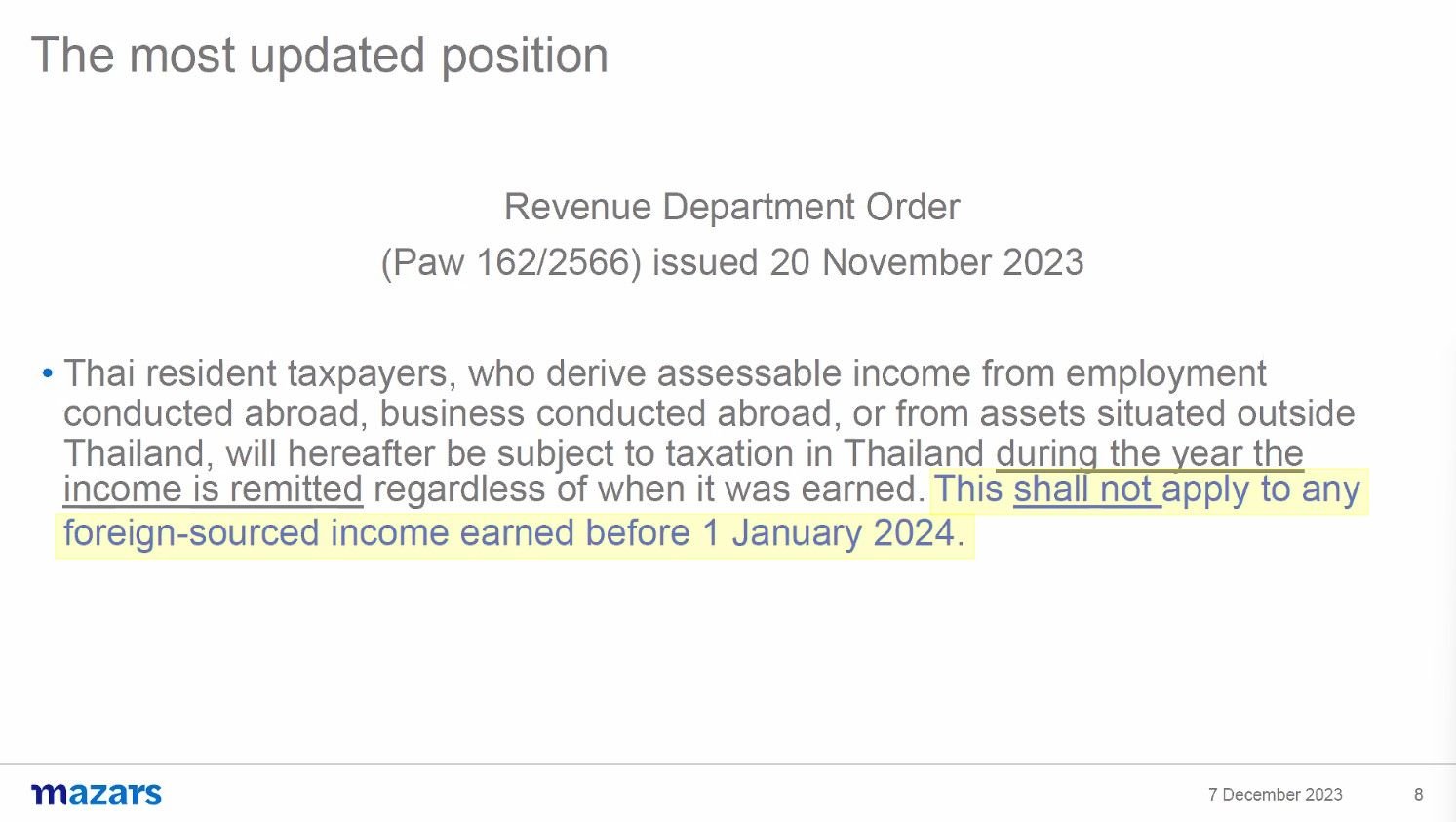

Lots of details and issues remain very unclear, both in terms of the policy itself and how it will actually be implemented. It also was unfortunate that even though the webinar was presented by the American Chamber of Commerce, the presenters gave almost no info on how the longstanding U.S.-Thai double taxation agreement likely will limit/curtail the new policy for Americans.... Such as the expected result that U.S. Social Security payments made to American citizens AND U.S. government pension payments are likely to be excluded from Thai taxation under the terms of that particular agreement, and can only be taxed by the U.S.

-

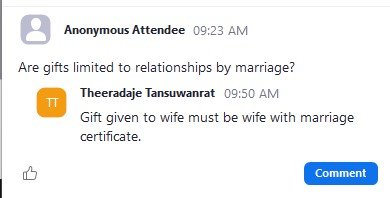

There's another interesting wrinkle to that whole area which would be credit card cash advances taken here using a foreign credit card. Normally that is a very expensive transaction because of cash advance and foreign currency conversion fees that most foreign banks charge.... But a few banks do allow those fee free. A wrinkle because loan proceeds apparently are not likely to be considered importing income. And when someone does a credit card cash advance, they're basically borrowing money from the card issuer that later has to be repaid.... Thus presumably, not likely to be considered importing foreign income into Thailand. At least, in theory. And then the other interesting wrinkle is a provision in Thai tax regs that allow spouses to gift to their own LEGAL spouse up to 20 MILLION baht per year without that being subject to taxation, which if it stands would seem to be another way of moving foreign funds here without being subject to taxation (though those would have to be non-community property funds).

-

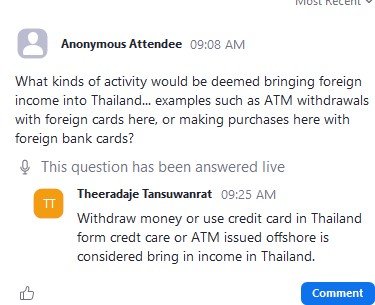

The expat tax advisors who did the presentation also indicated they expected that foreign card ATM withdrawals and even foreign card (debit or credit) purchases made in Thailand likely will end up being considered importing foreign income -- though they acknowledged the Rev. Dept. hasn't specifically opined on that issue as yet. The above comment is from a Thai tax attorney and chamber member who was answering participants' posted questions online during the presentation. Though even if that ultimately were to become the Revenue Department's ultimate position, many of us remain skeptical about their ability to actually track and trace what clearly would be a huge number of such transactions, and separate out those belonging to expats vs. tourists -- especially since the current bank info sharing agreements internationally seem more aimed at tracking and sharing info on EARNINGS as opposed to SPENDING.

-

As mentioned above, the American Chamber of Commerce did host a webinar on Friday regarding the foreign income taxation scheme, and there were several clarifications / updates provided, including that there now will be a "grandfathering" clause to exclude foreign sourced income earned prior to Jan. 1, 2024. I posted an audio file of the entire hourlong session, as well as copies of several of the info graphics that were presented, in a different thread on the topic here, as linked below:

-

I asked about that IRA issue on a slightly different kind of income, inheritance income, which is flatly exempt from Thai taxation. One of the panel members this morning confirmed that the inheritance amount itself would be tax exempt, but that the subsequent EARNINGS from the original sum would still be subject to Thai tax, assuming the recipient was a Thai tax resident, etc etc.