OJAS

Advanced Member-

Posts

8,601 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by OJAS

-

And whether to the TRD or their counterparts in her late husband's home country may be dependent on the terms of the relevant DTA. EDIT: For example, my Thai wife will be entitled to a small pension based on my UK Government occupational pension after I've popped my clogs - which, according to the UK/Thailand DTA, wlll be taxable by the TRD (and not by HMRC back in the UK).

-

That can actually get you banged up in the Bangkok Hilton for defamation. The OP will probably find the food served up there much more to his liking.

-

I would respectfully suggest that you take the trouble to purchase a suitably reliable crystal ball in order to provide what you consider to be satisfactory answers to your various questions. If and when you have succeeded in making the necessary purchase, please then share the details of how you went about this with us since I can see no lists of suitable balls for sale on Lazada.

-

Thai customer complains about buffet restaurant staff service

OJAS replied to snoop1130's topic in Thailand News

Looks like Miss D will soon be heading to the Bangkok Hilton for a lengthy stretch there, then. -

Thai Tax on UK pensions

OJAS replied to Humpy's topic in Jobs, Economy, Banking, Business, Investments

@sometimewoodworker What you have said also appears to apply to the State Pension in the case of those countries where relief from UK taxation is available through the relevant DTA. But Thailand clearly ain't one of them, I'm afraid. However I certainly don't consider a "one size fits all" approach to the alleviation of double taxation across the board (in terms of both individual countries and individual income categories), as you seem to be advocating, to be approriate. This must surely all turn on what is said in individual DTA's (or not as the case may be when it comes to the UK/Thailand DTA and the State Pension). But at the end of the day we may well just have to agree to disagree between ourselves on this particular matter. -

Thai Tax on UK pensions

OJAS replied to Humpy's topic in Jobs, Economy, Banking, Business, Investments

So what do the statements on pages 3 and 34 of HMRC's Digest of Double Taxation Treaties that State Pension "relief from UK income tax is available under the terms of many, but not all, double taxation treaties" and "Also, no relief for State Pension or ‘trivial commutation lump sum’" in the case of Thailand mean then? What you have said only appears to apply to the various income types specifically referred to in individual Articles of the DTA - which, with one notable exception, we all agree does NOT include the State Pension. In other words, upon which higher authority is HMRC's Digest of Double Taxation Treaties being subverted? -

Thai Tax on UK pensions

OJAS replied to Humpy's topic in Jobs, Economy, Banking, Business, Investments

So precisely "what services of a governmental nature rendered to that (Contracting) State or subdivision or local authority thereof" have been provided by State Pensioners as a prerequisite to their receiving the State Pension? I await your reply with bated breath! -

Thai Tax on UK pensions

OJAS replied to Humpy's topic in Jobs, Economy, Banking, Business, Investments

In the case of the State Pension I don't believe that there is (unfortunately) any way of avoiding double taxation through UK offsets of Thai tax. In support of this view, I would refer to this statement in relation to the State Pension at the top of page 3 of HMRC's Digest of DTA's: "..relief from UK income tax is available under the terms of many, but not all, double taxation treaties." and then to this one specifically relating to Thailand on page 34: "...no relief for State Pension.." https://assets.publishing.service.gov.uk/media/5b05425fed915d1317445ed2/DT_Digest_April_2018.pdf When it comes to @Humpy's military pension I would have thought it unlikely that the issue of Thai taxes would arise since this is non-assessable income which, as things stand (i.e. subject to any clarification issued by the TRD in due course, along with (presumably) their 2024 forms), would not need to be declared in any TRD return. This is certainly the line I'm currently, at least, planning to take in the case of my Civil Service pension. -

Thai Tax on UK pensions

OJAS replied to Humpy's topic in Jobs, Economy, Banking, Business, Investments

I strongly suspect that the most valid reason on why the UK State Pension would not be covered by the DTA is that there is no Article specifically mentioning it in the DTA! -

Ex BBC Presenter Huw Edwards Pleads Guilty Over Child Indecency Charges

OJAS replied to Social Media's topic in World News

A "household" face of paedophilia. -

If IMM home visits and witnesses aren't practicable in your case, then your only option, as I see it, would be to stick with retirement as the reason for your annual extensions . A further consideration which you might need to bear in mind in this connection is that, if your wife's condo unit is located within the catchment area of another immigration office to the one you deal with at the present time, you might need to deal with that office on all IMM-related matters from now on - a key prerequisite to which would, of course, be the submission of a fresh TM30 to them by presumably your wife in your case.

-

Just beware, though, that your first marriage extension will last 12 months from the date you apply for it and not from when your current permission of stay granted under your previous retirement extension expires. As stated by both @DrJack54 and the late ubonjoe in this 2022 thread: https://aseannow.com/topic/1266697-married-extension-appointment

-

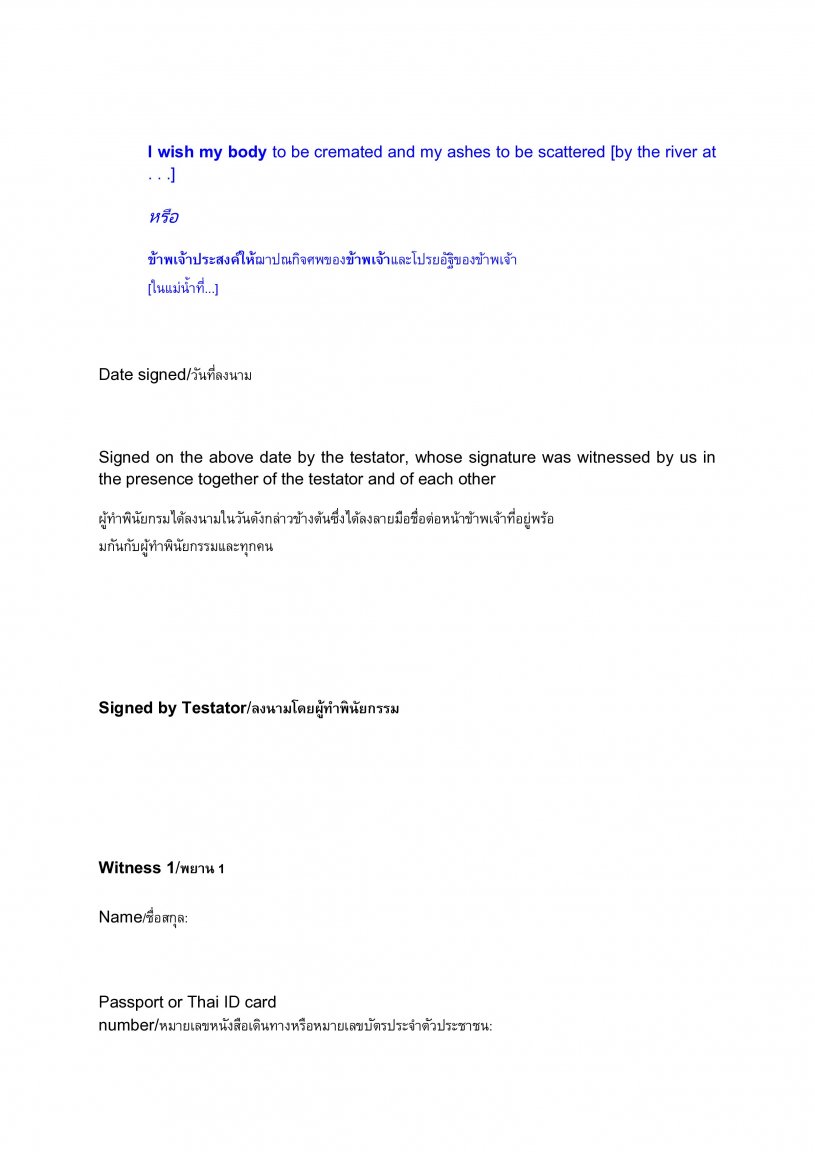

Dunno why we can't attach Word docs on here. Nor even PDF ones! 🤬 Anyway, here are 7 JPG conversions of the Word template I've used for my Thai will - in English and Thai as specified by the OP. One page per converted file, I think. EDIT: I now see that the text of my JPG attahments has somehow been displayed sequentially (presumably). Why, you learn something new about attaching files on AN every day, it seems!😄

-

And 3 pages further on that's still the case.

-

I am not aware of any other office which requires hand-drawn maps to your residence to be provided in support of - and, consequently, home visits to be performed in connection with - non-O visa conversion and annual extension of stay applications for retirement. So in this particular regard CW can justifiably be considered a rogue office IMHO.

-

And things got worse: https://www.bbc.com/news/articles/cmj2r1403jpo Didn't realise that the organisers had employed Joe Biden to announce the teams!

-

By the same token, if Somchai in the local TRD office decides that 'rich Falang' who does not file a tax return (even though his total assessable income is in excess of the relevant threshold) should be punishable not by a 2,000 THB fine but instead a lengthy stretch in the Bangkok Hilton, again said Falang has "very little (none really) legal recourse to challenge that decision", even if he owes no tax, it seems to me.

-

Is Anutin Thailand's Prospective Next Prime Minister?

OJAS replied to webfact's topic in Thailand News

Plus taxing us to the hilt. -

Suggest that you put this question to IMM when you visit them. If, in the light of what they tell you a non-O conversion for retirement might prove necessary in due course, the following link contains info as to how you go about seeking one: https://www.immigration.go.th/wp-content/uploads/2022/02/9.FOR-RETIREMENT-PURPOSES-50-YEARS-OLD-NON-O.pdf

-

There is also the option of applying for a non-O visa conversion at Bangkok as set out in the following link:- https://www.immigration.go.th/wp-content/uploads/2022/02/9.FOR-RETIREMENT-PURPOSES-50-YEARS-OLD-NON-O.pdf For this purpose no 2-month seasoning of the 800k in your Thai bank account would be needed. However, assuming that your initial permission to stay would be granted on the basis of a 60-day visa exemption, you would still need to provide evidence of an onward/return flight (as stated by DrJack54 in the context of a single-entry non-O visa obtained in your home country) when checking in for your flight to Bangkok at your home country airport.