-

Posts

7,277 -

Joined

-

Last visited

-

Days Won

21

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by ballpoint

-

Worst Joke Ever 2025

ballpoint replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

Worst Joke Ever 2025

ballpoint replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

Worst Joke Ever 2025

ballpoint replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

Worst Joke Ever 2025

ballpoint replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

Worst Joke Ever 2025

ballpoint replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

Worst Joke Ever 2025

ballpoint replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

Worst Joke Ever 2025

ballpoint replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

Worst Joke Ever 2025

ballpoint replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

Worst Joke Ever 2025

ballpoint replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

Worst Joke Ever 2025

ballpoint replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

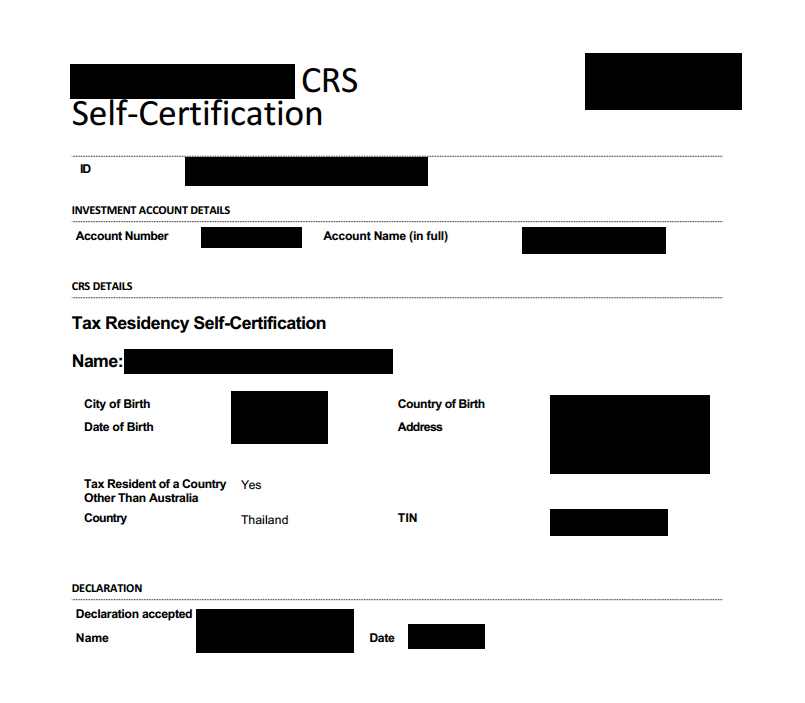

A good summary is found here: "The CRS seeks to establish the tax residency of customers. Under the CRS, financial institutions are required to identify customers who appear to be tax resident outside of the country/jurisdiction where they hold their accounts and products, and report certain information to our local tax authority. They may then share that information with the tax authority where you are tax resident." Frequently asked questions | Common Reporting Standard (CRS) | HSBC The TRD has no right to directly contact your overseas financial institution. It may request information from the Revenue Department, or equivalent, of the country that institution is located in. I find it strange that all countries where I have bank or brokerage, or fund accounts asked me to declare my tax status, including the TIN, some years ago. This one was sent to me by a funds management company in Australia back in 2018, and I had similar from other accounts there, in Singapore, and the Isle of Man, around the same time: However, none of my banks in Thailand have requested this information, which makes me wonder how do they know if we are tax residents of Thailand or elsewhere, and, if the latter, where? And how do they report our account and tax status details to the TRD so it can fulfil its obligations under the CRS?

-

Worst Joke Ever 2025

ballpoint replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

Worst Joke Ever 2025

ballpoint replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

Worst Joke Ever 2025

ballpoint replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

Worst Joke Ever 2025

ballpoint replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

Worst Joke Ever 2025

ballpoint replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

Worst Joke Ever 2025

ballpoint replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

Worst Joke Ever 2025

ballpoint replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

Worst Joke Ever 2025

ballpoint replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

Worst Joke Ever 2025

ballpoint replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

The City of New York Department of Sanitation formal uniform. This guy must have really seen some sh*t to earn those medals! -

Worst Joke Ever 2025

ballpoint replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

Worst Joke Ever 2025

ballpoint replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

Worst Joke Ever 2025

ballpoint replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

The earth didn't change. People did. Aluminium has always been by far the most abundant metal in the earth's crust, making up about 8% of it, but is never found naturally in pure elemental form. The vast majority of it is tied up in aluminium silicates. Therefore, until a relatively efficient way of extracting it from these compounds was developed, pure Al metal was indeed very rare - it was only confirmed as an element in 1808, and the first solid bar created in 1855, but now, due to its large number of uses, it's one of the most abundant metals we have.

-

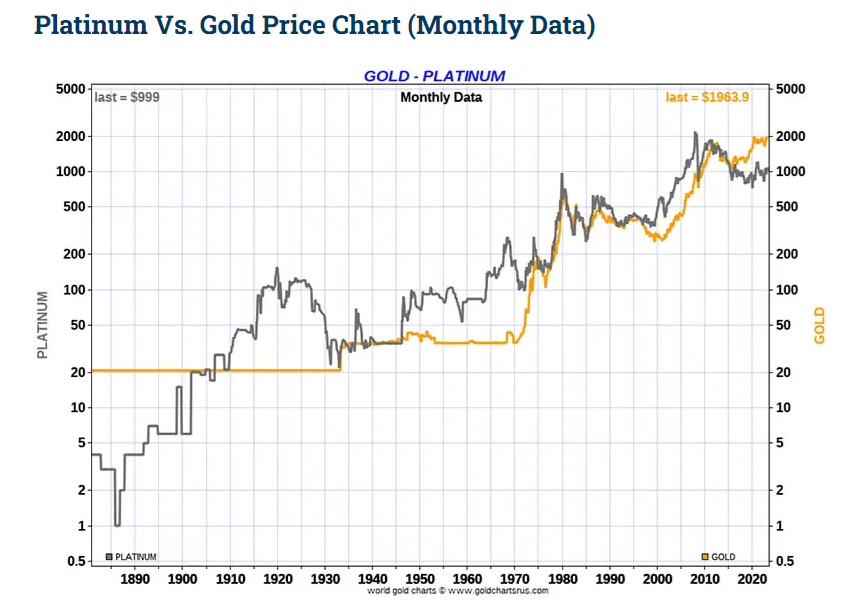

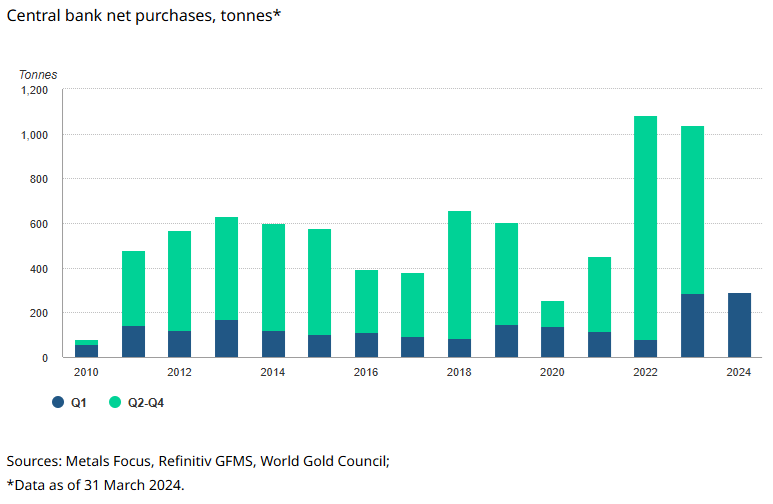

It's really only since the early 20th century that platinum was valued higher due to its rarity, but, perversely, the relative abundance of gold vs platinum was what made gold the historically accepted currency - it was far more practical to mint gold coins than platinum ones. Gold has retained that status, and continues to be seen as a safe haven in times of uncertainty, which we are definitely in today with BRICS wanting to establish a commodities backed (predominantly gold) reserve currency, and the US at the point where annual interest owed on debt is equal to military spending. Something is going to give, and gold is seen as the place to be when it happens. Central banks certainly see it that way, and their buying is in part what is fuelling the rise in price: Central Banks | World Gold Council The historical comparison of gold vs platinum also tells the story. For the 19th, and much of the first half of the 20th, centuries, when the British controlled the world reserve currency, gold was artificially pegged in order to prevent volatility. (While platinum was virtually valueless during the 19th). It then found its own level during and after WW2, as Britain lost hegemony. It achieved parity with platinum during WW2, and again during the inflationary period of the 1970s. The 2008 GFC saw the beginning of its rise above platinum, and the uncertainty caused by Covid sealed its higher position. With the Ukraine war, the now accepted use of gold as a petrocurrency, and continuing US financial uncertainty, it is expected by many to keep rising. On the other hand, platinum, having no such financial safe haven value, continues to be priced according to its demand for jewellery, electronics, and other minor uses. Platinum Price vs Gold Price Ratio | 125 Year Chart (sdbullion.com)