-

Posts

37,055 -

Joined

-

Last visited

-

Days Won

5

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by CharlieH

-

Netanyahu rejects claims accusing Israel of genocide in Gaza

CharlieH replied to CharlieH's topic in The War in Israel

Post with a link to a questionable source has been removed. Please take a little more care with the source you choose to use. A questionable source exhibits one or more of the following: extreme bias, consistent promotion of propaganda/conspiracies, poor or no sourcing to credible information, a complete lack of transparency and/or is fake news. Fake News is the deliberate attempt to publish hoaxes and/or disinformation for the purpose of profit or influence https://mediabiasfactcheck.com/council-on-american-islamic-relations-cair/ Note that in many instances Al Jezeera falls into this category and is best avoided to ensure your post remains. -

The cost of war on Gaza's civilians is "far too high", US Secretary of State Antony Blinken has said. Mr Blinken said Israel needed to remove barriers so more essential aid could be allowed into Gaza. But he said Israel faced a huge challenge in fighting an enemy in Hamas which had embedded itself within the civilian population. Mr Blinken was speaking after meeting Israeli leaders on his fourth trip to the country since the conflict began. America's top diplomat told a press conference in Tel Aviv that leaders in the region shared US concerns about the "dire humanitarian situation" on the ground. But he said he had heard a new and powerful message from Israel's neighbours over the last three days. They are willing not only to live with Israel but to integrate the region in a way that makes everyone secure, including Israel, Mr Blinken said. In other words, talk of diplomatic normalisation with Israel - which had appeared to be derailed by the 7 October Hamas attack on Israel - is on the table. That, he said, would require some hard decisions and hard choices - which include Israel agreeing to a "clear pathway to the realisation of Palestinian political rights and a Palestinian state" which he said was vital for long-term peace. Mr Blinken would not be drawn on whether this was something Israel would consider. Israel's Prime Minister Benjamin Netanyahu has previously voiced his staunch opposition to such a state, citing security concerns. Israel launched its offensive in Gaza in response to a cross-border assault by Hamas - designated a terrorist organisation by Israel and many western nations including the US. 1,300 people were killed in the attacks. Since then, more than 23,200 people - mostly women and children - have been killed in Gaza, according to the Hamas-run health ministry. Israel's border residents in fear of invasion from north Saudi Arabia interested in Israel deal after war When asked about whether there was any evidence that Israel was de-escalating its military campaign in Gaza, Mr Blinken answered that no one in the region - including the Israelis - wanted the conflict to escalate. That may be reassuring for many worried about the conflict spreading, but he gave no indication that Israel told him it was winding down its military operations anytime soon. In recent weeks, Hezbollah, a Lebanon-based organisation designated a terrorist group by the US, has increased rocket fire into northern Israel. Yemeni Houthi rebels have also attacked commercial shipping in the Red Sea - one of the world's most important trading routes. The Houthis, Hezbollah and Hamas are backed by Iran. Mr Blinken's meetings in Israel on Tuesday were not entirely without tangible results. He announced that the US and Israel agreed on a plan for the UN to conduct an "assessment mission" that would be the first step toward allowing Palestinians to return to the areas of northern Gaza that have been devastated by the Israeli offensive. FULL STORY

-

Bitcoin jumped briefly on Tuesday after a post on the US markets regulator's X account (formerly Twitter) said it had approved so-called exchange-traded funds (ETFs) in the cryptocurrency. The Securities and Exchange Commission (SEC) later deleted the post and said its account had been "compromised". Bitcoin jumped to almost $48,000 immediately after the erroneous post before falling back to around $46,000. US regulators are expected to make an announcement on the new ETFs this week. The false post appeared on the SEC's official X account shortly after 16:00 Washington time (21:00 GMT). It said the regulator "grants approval for #Bitcoin ETFs for listing on all registered national securities exchanges". The post was immediately picked up and quoted by social media users and business news outlets. Within minutes the SEC's chair Gary Gensler posted a message refuting the erroneous announcement on his personal X account: "The @SECGov twitter account was compromised, and an unauthorized tweet was posted. The SEC has not approved the listing and trading of spot bitcoin exchange-traded products." Investors are hotly anticipating an SEC announcement on the potential approval of spot bitcoin ETFs, which is expected this week. It would mark a key milestone for the cryptocurrency market in gaining acceptance to mainstream financial markets. Several asset management firms have applied for SEC approval for spot bitcoin ETFs. ETFs are portfolios that allow investors to bet on multiple assets, without having to buy any themselves. Traded on stock exchanges like shares, their value depends on how the overall portfolio performs in real time. Some ETFs already contain Bitcoin indirectly - but a spot Bitcoin ETF will buy the cryptocurrency directly, "on the spot", at its current price, throughout the day. FULL STORY

-

- 1

-

-

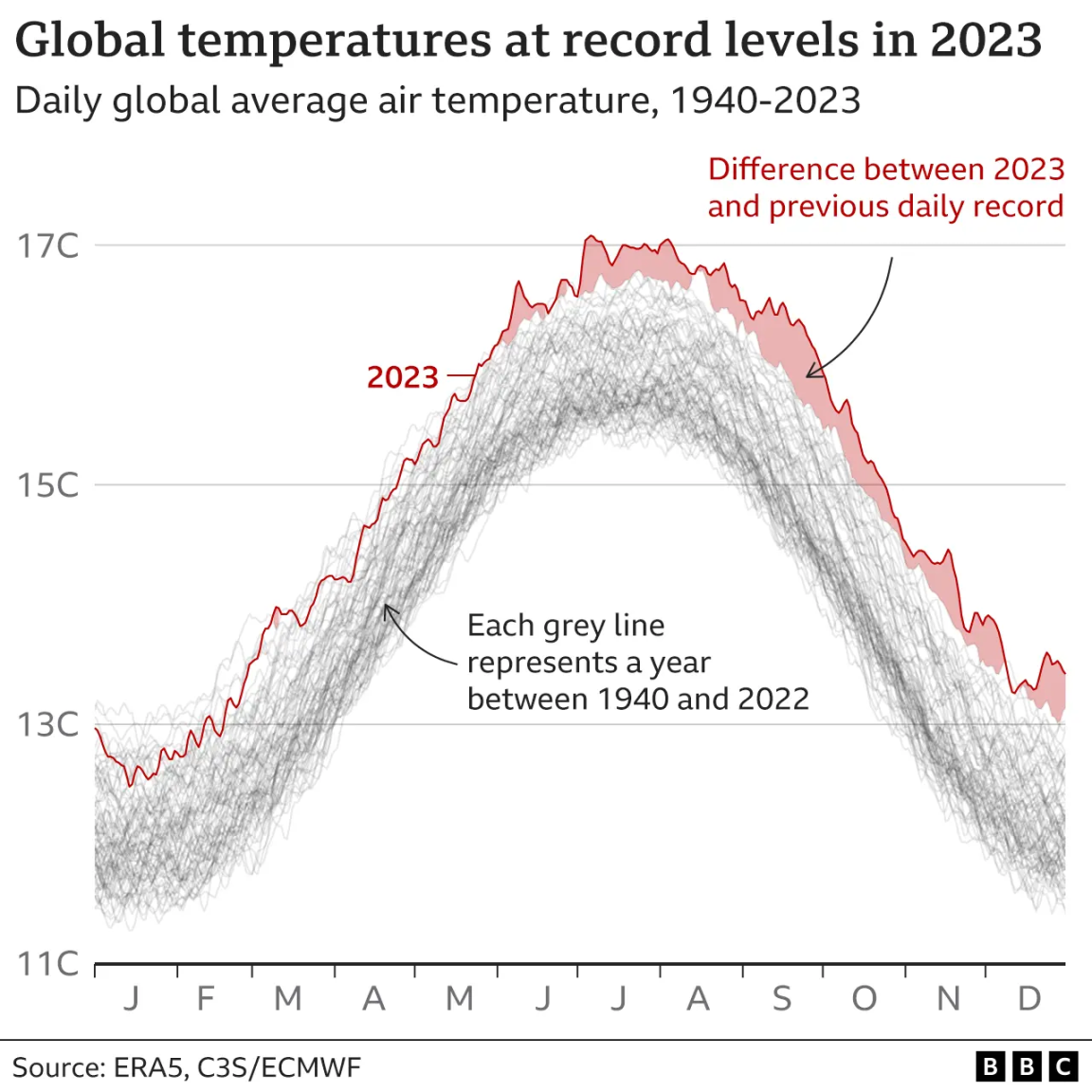

The year 2023 has been confirmed as the warmest on record, driven by human-caused climate change and boosted by the natural El Niño weather event. Last year was about 1.48C warmer than the long-term average before humans started burning large amounts of fossil fuels, the EU's climate service says. Almost every day since July has seen a new global air temperature high for the time of year, BBC analysis shows. Sea surface temperatures have also smashed previous highs. The Met Office reported last week that the UK experienced its second warmest year on record in 2023. These global records are bringing the world closer to breaching key international climate targets. A simple guide to climate change "What struck me was not just that [2023] was record-breaking, but the amount by which it broke previous records," notes Andrew Dessler, a professor of atmospheric science at Texas A&M University. The margin of some of these records - which you can see on the chart below - is "really astonishing", Prof Dessler says, considering they are averages across the whole world. FULL ARTICLE

-

Something very wrong here. In general terms, Registered mail will show show OE outward. at swampy in the tracking, and then nothing is listed until it arrives in its destination country when it re-enters the mail system. It would help if the OP had some clarity to his post.

-

Former President Trump said in an interview that aired Monday that he predicts the U.S. economy will crash and that he hopes it does so within the next year. In the interview with Lou Dobbs, Trump, the current front-runner in the GOP presidential primary race, explained that, if he were elected again, he would not want to serve a term similar to President Hoover’s — who took office when the economy was stable but later oversaw the start of the Great Depression. Trump railed against the economy but conceded that there were some good aspects of it and took credit for those successes. “We have an economy that’s so fragile, and the only reason it’s running now is it’s running off the fumes of what we did,” Trump said. “It’s just running off the fumes.” Trump added: “And when there’s a crash — I hope it’s going to be during this next 12 months because I don’t want to be Herbert Hoover. The one president I just don’t want to be, Herbert Hoover.” The U.S. economy, however, has defied economists’ predictions and closed the 2023 year with high marks on a wide range of criteria: Inflation was down, job growth remained high, and the unemployment rate stayed low. “What we’re seeing now I think we can describe as a soft landing, and my hope is that it will continue,” Treasury Secretary Janet Yellen said in an interview on CNN on Friday, shortly after the release of a surprisingly strong jobs report for December. The U.S. added 216,000 jobs in the final month of 2023 and kept the unemployment rate at 3.7 percent, far exceeding the expectations of economists. The annual inflation rate also dropped from 9.1 percent, a four-decade high, in June 2022 to 3.1 percent in November, according to the Labor Department. FULL STORY

-

Apple has begun making payments in a long-running class action lawsuit over claims it deliberately slowed down certain iPhones in the US. Complainants will receive a cut of a $500m (£394m) settlement which works out to around $92 (£72) per claim. Apple agreed to settle the lawsuit in 2020, stating at the time it denied any wrongdoing but was concerned with the cost of continuing litigation. A similar case under way in the UK is seeking £1.6bn in compensation. The US case dates back to December 2017, when Apple confirmed a long-held suspicion among phone owners by admitting it had deliberately slowed down some iPhones as they got older. It said that as batteries aged, their performance decreased, and so the "slowdown" lengthened the phones' lifespan. But it was accused of throttling the performance of certain iPhones without telling its customers, and the uproar resulted in Apple offering a cut-price battery replacement to fix the problem. It led to the US legal action. At the time of the settlement, it was estimated that each person might receive as little as $25 each but the actual pay-out appears to be almost four times that sum. In the UK, Apple lost a bid to block a similar mass action lawsuit last November. The case, first brought by Justin Gutmann in June 2022, represents an estimated 24 million iPhone users. FULL STORY

-

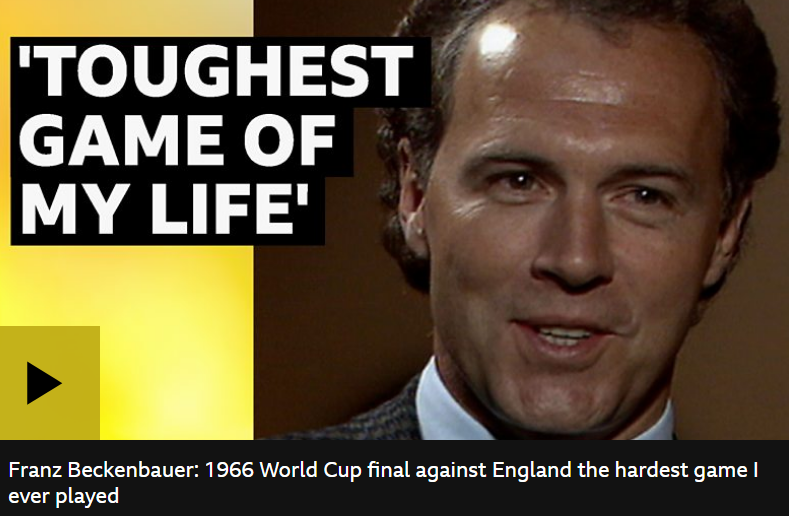

German legend Franz Beckenbauer, widely regarded as one of football's greatest players, has died aged 78. He won the World Cup as captain of West Germany in 1974 and lifted the trophy again as manager in 1990. Beckenbauer, who was primarily a defender, played 582 times for Bayern Munich and won the German top flight as both a player and a manager. Nicknamed 'Der Kaiser', as a player he also won the European Championship in 1972, as well as the Ballon d'Or twice. A statement from his family to German news agency DPA read: "It is with deep sadness that we announce that my husband and our father, Franz Beckenbauer, passed away peacefully in his sleep yesterday, Sunday, surrounded by his family. "We ask that you allow us to grieve in silence and refrain from asking any questions." Obituary: Legend Beckenbauer was one of football's most important figures Recap: Tributes and reaction Football Daily podcast: Remembering Beckenbauer Bayern, Germany's most successful club, said: "The world of FC Bayern is no longer what it used to be - suddenly darker, quieter, poorer." They added that without Beckenbauer "Bayern would never have become the club it is today". Playing as a midfielder, Beckenbauer man-marked Sir Bobby Charlton in the 1966 World Cup final, which England won 4-2, before shifting to his iconic position as a defensive sweeper. He also scored four goals at the 1966 World Cup, aged just 20, and won the award for the tournament's best young player. He went on to play 103 times for West Germany. FULL STORY

-

The Lebanese group Hezbollah says one of its commanders has been killed in a strike in southern Lebanon believed to have been carried out by Israel. Wissam Tawil was reportedly a member of the group's elite Radwan Force, and one of the most prominent Hezbollah figures to be killed in the current violence. Israel's military did not comment, but it did say it had hit Hezbollah targets in response to cross-border attacks. The clashes have raised fears of a wider regional conflict. Hezbollah is an Iran-backed group that wields considerable military and political power in Lebanon. It is designated as a terrorist organisation by Israel, the UK and other Western powers. Its fighters have exchanged fire with Israeli forces almost every day along the border since the start of the war between Israel and the Palestinian group Hamas in the Gaza Strip on 7 October. Israel's prime minister told soldiers stationed on the border with Lebanon on Monday that he was determined to "do everything necessary to restore security to the north". 'We are not afraid of war' Hezbollah warns Israel Hamas leader's assassination sparks wider war fears Lebanon's state-run National News Agency reported that two people - whom it did not name - were killed in an Israeli air strike that targeted a car in the al-Dabsha area of Khirbet Selim at around 10:15 (08:15 GMT) on Monday. The strike caused the vehicle to veer off the road and catch fire, it added. Pictures from the scene showed the burned-out wreck of a car on a roadside. Lebanese security sources said one of those killed in the strike was Wissam Tawil and that the other was also a Hezbollah fighter. Three sources told Reuters news agency that Tawil was the deputy head of a unit within Hezbollah's Radwan Force, whose well-trained members are considered the group's special forces. FULL STORY

-

Netanyahu rejects claims accusing Israel of genocide in Gaza

CharlieH replied to CharlieH's topic in The War in Israel

Getting very tedious repeating the same things to the same people. Any more unsubstantiated "from anyone" type videos from social media and expect to lose your ability to post. -

Watching the terrified faces of the four bloodstained teenage girls being paraded by Hamas gunmen was beyond their parents' worst nightmare. The haunting images were taken just hours after they were kidnapped and Liri Albag, Karina Ariev, Daniela Gilboa and Agam Berger appeared shadows of their former selves. Three months have passed since that recording of them lined up against a wall in Gaza, their hands bound behind them – and still they are in captivity. With negotiations stalling following the collapsed ceasefire, the parents of the youngest female hostages are today sharing the heart-wrenching pictures as they demand their immediate release. They are appealing to mothers and fathers around the world to speak up as horrific new details emerge that some female captives have been raped at gunpoint or had limbs amputated. 'Imagine if it was your daughter, your little girl in their hands,' Daniela's mother Orly, 38, said. 'What would you imagine?' Liri's father Eli, 54, said: 'Think for one day that you don't have connection with your daughter and you know they are in the hands of bad people. Then tell me what you would say after 90 days. This is killing us. Every minute is like an hour.' The girls were snatched from Nahal Oz, near the Gaza border, in the first hours of the Hamas attack on October 7 in which 1,200 died and scores of women were raped. FULL STORY

-

Former President Trump warned Friday that there will be “big trouble” if the Supreme Court does not rule in his favor on his eligibility for the 2024 presidential ballot. The Supreme Court is set to hear the Colorado case after the state’s Supreme Court determined last month that Trump should not be on the state’s primary ballot due to his involvement in the Jan. 6 insurrection. “I just hope we get fair treatment,” Trump said at an Iowa rally Friday. “Because if we don’t, our country’s in big, big trouble. Does everybody understand what I’m saying?” Trump also complained of Democrats casting doubt on the court because Trump appointed three of its justices, claiming that they are attempting to put undue political pressure on the court’s decisions. “They’re saying, ‘Oh, Trump owns the Supreme Court, he owns it. He owns it. If they make a decision for him, it will be terrible. It’ll ruin their reputations,’” he said. “‘He owns the Supreme Court. He put on three judges. He owns the Supreme Court. If they rule in his favor, it will be horrible for them. And we’ll protest at their houses.’” “That puts pressure on people to do the wrong thing. What they’re doing is no different than Bobby Knight,” he continued, referring to the legendary college basketball coach famous for raucous arguments with referees. FULL STORY

-

Three months ago, speaking to citizens rocked by a horrific day of attacks by Hamas, Israel’s Prime Minister Benjamin Netanyahu made a promise. “The IDF will immediately use all its strength to destroy Hamas’s capabilities,” Netanyahu said. “We will destroy them.” Now, the Israel Defense Forces (IDF) is shifting to a new phase of its war on Hamas in Gaza – and there are signs its objectives are changing too. “The record is not very friendly to military campaigns seeking to eradicate political military movement that are deeply rooted,” Bilal Y. Saab, an associate fellow in the Middle East and North Africa at Chatham House, told CNN. “IDF leadership understands very well that the most they can do is severely degrade the military capabilities of Hamas,” Saab said. Israel has seen some successes in that regard; its forces claim to have killed thousands of Hamas fighters, including some high-ranking members, and have dismantled some parts of the group’s vast tunnel network under the enclave. But challenges remain and an endgame is far from sight. Few countries at war set deadlines. Israeli officials have warned of a lengthy war that could stretch through the entirety of 2024 and beyond. It will unfold in front of an international community that is increasingly aghast at the extraordinary humanitarian crisis and spiraling civilian deaths in Gaza. And as international pressure increases, so too could domestic unease towards Netanyahu – an embattled prime minister eager to point to tangible victories. “There is a race against time,” said Saab, outlining the key questions facing Israel’s leadership. “At what price is this tactical success going to come, and how much time do the Israelis have to achieve that tactical success without suffering from more significant international outrage?” A ‘new combat approach’ The destruction of Hamas – the goal that Netanyahu touted on October 7 – was lofty, elusive and, according to many analysts, impossible. “This kind of mission cannot be completed – we’ve seen it fail over the years many times,” Saab said. Hamas’ influence extends far beyond Gaza, meaning a total defeat of the group is at least highly ambitious for Israel, if it can be achieved at all. In a speech marking the anniversary of the attacks, Netanyahu reiterated his goals for the conflict: “To eliminate Hamas, return our hostages and ensure that Gaza will no longer be a threat to Israel.” But it remains unclear whether IDF leadership places eliminating Hamas atop its priorities. IDF intelligence chief Maj. Gen. Aharon Haliva left out the destruction of Hamas when listing military goals in a speech on Thursday, Israeli media noted. And also on Thursday, Israeli Defense Minister Yoav Gallant unveiled plans for the next phase of the war in Gaza, emphasizing a new combat approach in the north and a sustained focus on targeting Hamas leaders suspected to be present in the enclave’s southern territory. FULL STORY

-

Former President Donald Trump on Saturday suggested the Civil War could have been avoided through “negotiation,” arguing that the fight to end slavery in the US was ultimately unnecessary and that Abraham Lincoln should have done more to avoid bloodshed. “So many mistakes were made. See, there was something I think could have been negotiated, to be honest with you,” Trump said at a campaign event in Newton, Iowa. “I think you could have negotiated that. All the people died. So many people died.” The former president’s comments come a little over a week before the first-in-the-nation caucuses in Iowa, where he has a significant lead in the polls over his closest rivals, Florida Gov. Ron DeSantis and former South Carolina Gov. Nikki Haley. The Civil War has emerged as unlikely talking point on the GOP primary trail. More than a week before Trump’s comments, Haley answered a question about the cause of the Civil War without mentioning slavery – the driving force behind the war. She has since backtracked, repeatedly saying she thought the fact went without saying. Trump’s remarks were not made in response or reference to Haley’s. FULL ARTICLE

-

Thanks to @Mike Lister for the contribution of this article. A SIMPLE GUIDE TO PERSONAL INCOME TAX IN THAILAND 10 January, 2024 Version 5, Rev E 1. This purpose of this guide is to provide foreigners living in Thailand with the simplest possible overview of Personal Income Tax (PIT) in Thailand. The scope of this document is limited to PIT. 2. You may have heard that new tax laws came into effect on 1 January this year. In fact, that is not true! The old tax rules still exist and remain valid, albeit just one minor change to them was made in November last year. Previously, anyone who earned money overseas and remitted it to Thailand in a different tax year, received that money free of Thai tax. That loop hole in the Revenue Department (RD) tax code has been exploited by wealthy Thai’s and is now closed. Money earned overseas after 1 January 2024 and remitted to Thailand in any year, is now potentially liable to Thai tax and must be assessed via a tax return, subject to a minimum income threshold . The purpose of the new rule is to reduce tax avoidance and to help detect tax evasion. Unfortunately, it now means that overseas funds transfers by foreigners living in Thailand, also have an increased risk of being taxed. 3. This guide is an overview of the core parts of the PIT system. It is not designed to be exhaustive and it doesn’t cover all aspects of PIT, nor is it intended to override anything produced by the Thai Revenue Department or specialist tax companies such as Sherrings or Mazzars. This guide also does not address all types of income or the rules relevant to people from every country. What this guide will provide is a starting point for readers to manage their own tax affairs and it will also provide most of the answers for those with simple tax affairs, especially the average pensioner. 4. There are also certain types of visa that fall outside of the RD tax code. The LTR visa for example is one of them, it received its tax exempt status by royal decree hence visa holders will not to be assessed for Thai tax and they are specifically excluded from this explanation. 5. Terminology: this document uses the word “assessable” often. Assessable in the context of this document means income that is liable to tax which must be included on a Thai tax return. Not all income is assessable, some is excluded from tax assessment by its very nature or because of the terms of a specific tax agreement. There is assessable income that is taxable and assessable income that is exempt from tax, but "non-assessable" income does not really exist as an entity within the Thai Revenue Code. Consequently, readers should not think that some of your income is non-assessable. Taxable income = Assessable income minus exemptions, deductions, allowances. 6. Dual Tax Agreement/Double Tax Agreement (DTA): is an agreement between two countries that sets out which of the two countries has the right to tax specific types of income and all the associated rules. It’s purpose, in part, is to ensure that the same funds are not taxed twice by two different countries and provides a means by which tax that is paid twice, can be recovered, how and from where. Note: If the taxpayer income is sourced in one country but the tax payer is resident in a second country, use of a DTA can result in increased tax being paid, if the second country has a higher rate of tax on the type of income in question, than the other. 7. This document is being drafted in January 2024. Tax returns are due between now and 31 March 2024 which cover the period, 1 January 2023 until 31 December 2023. The tax changes affecting foreigners in Thailand came into effect 1 January 2024 which means this years income activity is not reportable until at least 181 days from the start of the year. For year round residents, a tax return will be due 1 January next year, 2025. 8. If you stay in Thailand for more than a cumulative 179 days, between 1 January and 31 December each year, you will be and always were considered to be Tax Resident in Thailand during that year, almost entirely regardless of the type of visa you have (special tax exempt classes of visa excluded). It doesn’t matter that you may be Tax Resident in your home country or elsewhere or that you pay tax in those countries, Thailand will still regard you as Tax Resident. Tax Residency and Immigration status (and the visa you hold) are different things. Tax residency is based solely on the number of days you spend in Thailand and where you are at midnight on each day. 9. It should be noted that there always was an obligation on the part of foreigners who were tax resident in Thailand, to report assessable income every year, provided they met the minimum income threshold. This law was not actively enforced in the past and many remained unaware of their obligation. Very little has changed today, that obligation remains unchanged albeit the scope of income that must be reported has now increased and tax collection has taken on a higher profile. 10. Because you are Tax Resident, YOU must review your income each year to determine if it is regarded as assessable to tax in Thailand, nobody else will do this for you. If your income does not exceed 120,000 baht per year, you do not need to file a tax return (60,000 baht if your only income is bank interest paid to you by a bank in Thailand). If your income is over 120,000 baht per year, you must file a Thai tax return between 1 January and 31 March. 11. Your income in Thailand is defined as any money paid to you inside Thailand, as well as, any money you receive from overseas, both types are potentially assessable income for Tax Residents. There are many types of income that can be classed as assessable, the Thai RD lists some of them and is linked below, however, the list is not exhaustive: https://sherrings.com/personal-income-tax-in-thailand.html#:~:text=Section%2040%20of%20Thailand's%20Revenue,Pensions%3B%20and 12. There are also classes or types of income that the RD regards as exempt from assessment and these are also linked below. Note: it is assumed that if the income is not listed as exempt, that it is regarded as assessible: THIS IS A PLACE HOLDER FOR THE CORRECT LINK 13. The definition of income that is derived from within Thailand is fairly clear, if you work and have a job and you are a Tax Resident, the payment you receive is assessable for tax. Interest that is paid to you on Thai bank accounts is regarded as income, as is income from investments such as stocks and bonds within Thailand. As a general principle, any payment you receive for work that arises within Thailand is regarded as income. You should note that if you are generating income by working while staying in Thailand, it is (and has always been) irrelevant where that money is paid and whether you bring the money into the country or keep it offshore. That money arises in Thailand hence it is taxable here. 14. It is not possible to give the same blanket rule to everyone to determine whether income is assessable or not because of the variable factors involved. Overseas income has to pass several tests to determine if it is assessable to Thai tax or not. It is still early days and all the rules are not yet clear. It has been said that tax residents who import funds from countries that have a DTA with Thailand, will not be effected. Exactly how that will work leaves many questions unanswered hence this document attempts to look at only the most popular types of income based on what is known at present. This document does not speculate as to what may happen in the future, other than in the segment at the end concerning likely future Immigration rules. 15. First and foremost, only income that is remitted to Thailand is assessable in Thailand, funds that remain outside Thailand are not. If we take the simplest type of income and say that you transfer personal savings from overseas to Thailand and those savings were earned before 1 January 2024, those funds are not assessable. But savings earned after that date are, hence the date when the income is earned is extremely important. A word of caution, you may be asked to provide proof that savings were earned before 1 January 2024 hence it will help if you store statements of each of your accounts showing valuations that are effective as of 31 December 2023. 16. The way in which the income is received in Thailand does not change its definition. Bank transfers, cheques, cash, overseas ATM and credit card transactions can also be income, the last two because overseas funds were imported to pay for goods or services in Thailand. 17. Another common type of income is pensions, which can be complicated, depending on the type of pension and the country that it comes from. The country of origin is important because there are over 60 different types of Dual Tax Agreements, sometimes called Double Taxation Agreements (DTA’s), between Thailand and those 60+ countries and each one is different. As a general rule, most private or company pensions from most countries appear to be assessable here but YOU will need to confirm that yours is or is not. If that is true, private and company pension income IS assessable income in Thailand. 18. US Social Security payments, a form of pension paid to some older people, can only be taxed by the US under DTA rules and Thailand is forbidden from taxing them, this means those payments are NOT assessable income. UK State pension on the other hand is not covered by a DTA so it is assessable income in Thailand whilst UK Government or Civil Service, Armed Forces and some NHS pensions are not. 19. The proceeds from the sale of a capital item such as overseas property, where funds are remitted to Thailand, is one popular source of expat funds, the sale of some investment products such as stocks, shares and bonds is another. Those proceeds typically comprise two parts, capital and profit. If the capital was acquired before 1 January 2024, it is free of Thai tax. One way to separate capital and profit may be to have an official valuation or statement that is dated 1 January 2024 since anything earned before that date, is not assessable. Also, if the profit has been the subject of a Capital Gains return in the home country, that also may be free of Thai tax but this cannot be guaranteed at this time, until things are made more clear and are once again subject to the terms of any DTA. YOU will need to review the DTA between Thailand and your home country to fully understand what particular clauses affect you. 20. It appears as though most property rental income that is remitted to Thailand is considered to be assessable income and is taxable here, unless of course it has been taxed in the home country and/or the DTA prohibits its taxation (which seems unlikely). 21. YOU are responsible for determining if your assessable income in Thailand exceeds the threshold and means you must file a tax return. That assessable income might comprise, pension payments, investment income, rental income or any of the other types of income listed in the link above. If you have assessable income of over 120,000 baht per year, you must file a tax return (60,000 baht if your sole source of assessable income is bank interest paid in Thailand). 22. Before you can file a tax return in Thailand, you need to acquire a Tax Identification Number or TIN from the RD offices in your area. You will need your passport, a valid and current visa or extension and in many areas, a Certificate of Residency from the Immigration Department. 23. Who must file a tax return? The English language translation of the RD rule says that, "You have to file a return on the income that you received if you meet one of the following conditions: (1) Your total income exceeded 120,000 baht in the tax year. (2) You were married and your income combined with that of your spouse exceeded 220,000 baht in the tax year." This is understood to mean assessable income. https://www.rd.go.th/fileadmin/download/english_form/030265guide91.pdf 24. Completing a tax return is a simple affair for most people, if you have difficulty, the Revenue Department staff are extremely helpful. Tax returns must be filed between 1 January and 30 March each year, if you file later than that, penalties will apply. 25. Thai tax is layered in bands and is payable based on the amount of assessable income that falls within each band and are shown and linked below: Taxable Income per year(Baht) Tax rate 0 – 150,000 Exempt 150,000 – 300,000 5% 300,000 – 500,000 10% 500,000 – 750,000 15% 750,000 – 1,000,000 20% 1,000,000 – 2,000,000 25% 2,000,000 – 4,000,000 30% Over 4,000,000 35% https://www.mazars.co.th/Home/Insights/Doing-Business-in-Thailand/Payroll/Personal-Income-Tax 26. The Thai tax system contains a series of Allowances, Deductions and Exemptions that will help you reduce your tax bill and they are very generous. It is easily possible for the average expat foreign retiree to reduce their taxable income by 500,000 baht or more each year. For example, a retiree aged 65 years of age, married and living here full time, supporting a Thai wife who has no income and doesn’t file tax return, is allowed the following: a. Personal Allowance for self - 60,000 b. Personal Allowance for wife - 60,000 c. Over age 65 years exemption - 190,000 d. 50% of pension income received, up to 100k - 100,000 e. In addition, the first 150,000 of assessable income is zero rated and free of tax 27. Additional deductions and allowances exist for health or life insurance premiums paid in Thailand. A complete list of deductions, allowances and exemptions can be found here https://www.rd.go.th/english/6045.html or from Sherrings below. https://sherrings.com/personal-tax-deductions-allowances-thailand.html 28. The Thai Revenue tax filing system is on-line but only available in Thai language at present. The tax forms are however available in English and they can be downloaded from the link below. https://www.rd.go.th/english/63902.html 29. A simple sample completed tax form for a person aged over 65 years is shown below as a guide. 30. https://aseannow.com/topic/1312534-taxation-of-ex-pats-pensions-etc/?do=findComment&comment=18532562 31. Tax filing in Thailand is based on the honour system, it relies on you declaring all the right information every year and there are severe penalties for evading Thai tax. It would be foolish and a gross under estimation of RD capabilities to think that doing nothing and keeping a low profile means you should ignore Thai taxation. Very few sane people in the US and UK ignore the tax authorities who tend to have a long reach. It cannot be ruled out that at some point, a link may be established between tax filings and visa extensions. A law already exists that requires foreigners to apply for Tax Clearance Certificates before being allowed to depart the country but it is not being enforced currently. These things are possible because similar things have been adopted in several countries in the past, including the US. 32. The RD tax return requires taxpayers to report assessable income, the tax rules even list some types of income that are not assessable to help in this. In addition, some types of income, from some locations, for some nationalities, are also known to be exempt. 33. If a taxpayer is certain that some of their income is not assessable, they may not want to declare it on their Thai tax return. Alternatively they may wish to ask the RD or employ specialist tax advisor's. It should go without saying that some taxpayers may try to suggest that some of their income is not assessable when really they don’t know for sure, or, they know that it is and say it that it isn’t, a sort of, chancing your arm and hoping you wont get found out. In that situation, the RD will not look favourably on such people and penalties are likely. 34. There are several sources of detailed tax information and these web sites are linked below: https://www.rd.go.th/english/6045.html https://sherrings.com/personal-income-tax-in-thailand.html https://www.mazars.co.th/Home/Insights/Doing-Business-in-Thailand/Payroll/Personal-Income-Tax UNRESOLVED ISSUES LIST Oz Old age pension taxable in Thailand? - being researched by T&G

- 357 replies

-

- 91

-

-

-

-

-

-

Why does God >insert your grievance here<....?

CharlieH replied to Sunmaster's topic in ASEAN NOW Community Pub

Surely, to insert anything would be an acceptance of the presence or existence of such an entity. -

Roojai.

-

It can also depend on what flights and how many need to transfer etc. I have personally known where the flight I was on was behind schedule and as a result they actually announced on the flight that the connecting flight was going to be held up so that passengers needing to transfer would not miss it.

-

Arrival and departure times in most cases or unless stated otherwise. MOVED to Travel Forum

-

Netanyahu rejects claims accusing Israel of genocide in Gaza

CharlieH replied to CharlieH's topic in The War in Israel

Or maybe, people dont actually "support" any side and watch with interest at developments and just want the killing to stop.