digital

Member-

Posts

156 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by digital

-

I've posted similar in Phuket forum for local recommendations , but can anyone share any experience of having this done to a new car, was it worth the cost, does it need very regular top ups etc - thanks

-

Anyone had this done in Phuket on a new car? Had a couple of quotes one was about 13K the other 6K ish Any recommendations or feedback if you've had it done? - Thanks (Phuket Town area most convenient)

- 1 reply

-

- 1

-

-

Skype is now only doing monthly subscriptions

digital replied to stubuzz's topic in Mobile Devices and Apps

No Samsung running Android 14, actually although it said can't install it, I noticed its icon was on the screen anyway and it seemed to open ok. I'm not sure if the Localphone account is unavailable because I put Thailand or if it's doing it because it detects my location is Thailand, I'll try again sometime. -

Skype is now only doing monthly subscriptions

digital replied to stubuzz's topic in Mobile Devices and Apps

Localphone looked good, but the app would not install onto my android phone, I signed in online and it says "We’re sorry This service isn’t available in Thailand. Change your country". I don't mind changing the country but not much point if I can't install the app. -

Yes this will be an issue for those with income levels under the UK personal threshold, they may pay no tax in the UK, but will end up with a tax liability in Thailand due to lower allowances, and with no tax paid in the UK theres nothing to credit against Thailand tax It may be an issue with capital gains from a property sale also, IF taxed on bringing into Thailand. In the UK there is (a now smaller than before) annual exempt amount 3000GBP, but more importantly if you have rented out your UK home to move to Thailand the UK gives PRR relief for the time you lived in the property +9 months, and if you owned the property for a long time and you are UK Non Resident > 5 years you can rebase the purchase price to April 2015, so gains are only calculated from April 2015 to sold date in the UK.

-

K bank E-mail with Tax Forms attached ?

digital replied to offset's topic in Jobs, Economy, Banking, Business, Investments

It says "The CRS aims to combat tax evasion by individuals residing outside Thailand", if you are only a tax resident of Thailand I wouldn't have thought you need to mention any other country. For the UK you can check your tax resident status here https://www.tax.service.gov.uk/guidance/check-your-UK-residence-status/start/choose-tax-year A non resident may still have to do a UK tax return for some forms of income arising in the UK,, but still remain a UK non tax resident which is what I think they are asking. I doesn't ask where you pay or complete tax returns it asks where you are a tax resident. -

As you say many things are might, could, or possible, in the DTA I have been advised very differently to what the 2 very heavily promoting advisors are saying, who are promoting their filing and obtaining a TID services, especially around the DTA for capital gains property (real estate). Even if there is liability it's not easy to understand what the Thai tax liability may be, as regards deductions or how the gain is calculated, again I have seen different ways of working it out, A visit to the TRD is ok but they really won't understand the fine details of all the DTA, but it needs to be clearer before a taxable event not after it, how can there be any planning without knowing.

-

What fx rate is used when working out gains on sales of a foreign asset? Example: An asset is bought for 50,000 GBP in the UK, the exchange rate on that day is 64 It is sold some years later for 100,000 GBP, the exchange rate on that day is 44 Is the exchange rate used for the day of the transactions? So buy at 50,000 GBP = 3,200,000 THB @64 Sell at 100,000 GBP = 4,400,000 THB @44 Gain = 1,200,000 = 27,272 GBP Or is everything on the current exchange rate (44 in this example) Buy at 50,000 GBP = 2,200,000 THB) @44 Gain = 2,200,000 =THB = 50,000 GBP Also are the any other allowances etc beyond the normal personal allowances and 0% band? Like the expenses to acquire the asset? Or in the case of land/houses mortgage interest, expenses, capital improvements? Category 1,2,3 income has a 50% max 100,000THB deduction (salary, pension, goodwill etc) Cat 4 (interest), Cat 5 30% (rental property 10% other property), Cat 6 10-30% (professional services), Cat 7 60% (construction services), Cat 8 60% (business, commercial, farming). Could a capital gain come under Cat 5 30% if its property (a house/land) or 10% for other property (a painting for example) 10%, or is it Cat 8 business 60%)? Thanks,

-

Thanks, Yes, the stomach is less today, and the nausea has gone also. Both of these I think are down to the antibiotics I don't have a strong headache or fever or any of the other meningitis symptoms I read. Neck is mostly from the bottom of ear straight line down and then at the base of skull. It's not very painful I'm just aware of it. I am still thinking of ear infection, but the antibiotics should be helping that as well as the throat, or would it normally take longer than this to work? Mission is my usual hospital, but the ENT there is the same DR as the clinic, they told me only have 1 ENT. Mahogany after hours clinic of Vachira does not list ENT, not been able to call to check it. Bangkok Hospital said 2,500+ for consultation so will avoid that. Can't really get until the weekend, obviously if something changes and becomes urgent I will go earlier but will maybe try the after hours clinic.

-

Not really feeling any better since the ENT Dr visits, not sure if its the Cefuroxime (since Sun eve) or Methycobal (Mon eve). The ear buzzing (left ear) is not the main thing now, I still have it but not all the time and not too disturbing, I noticed this ear is also more noisy when I block it. I'm generally feeling unwell since starting the meds. Have a stiff neck at back/ sides, both ears (earlier right only) feel 'strange' not exactly very painful but a feeling like when you have congestion, and a minor pain both sides under the ears. Still have sore throat, seemed a bit better Sat/Sun but worse a bit Tue/Today, again not very painful but if I had a bacterial throat infection shouldn't the antibiotics be helping a bit by now? Slight nausea at times, wake up every morning with blocked or runny nose. Some stomach pain shortly after the antibiotics. The ENT didn't say I have ear infection only throat (ear is nerve problem unrelated), but I read you can't diagnose inner ear infection by looking anyway, and he only looked very quickly. My right ear feels/sounds slightly squishy inside when I press it, left side less so. Could I have an undiagnosed ear infection? If its no better by the weekend I may just go to my usual general Dr for another opinion.

-

Thanks again Sheryl. The Methycobal is supposed to be to promote nerve healing. Not found much about nerve problems in the ear, only Gabapentin has been mentioned. The tinnitus in L ear has improved a bit yesterday and today, I don't hear it at all over normal background sounds, I keep blocking the ear to check and its not been there as often as it was. (I am quite sensitive to sounds generally, unusual sounds once I hear them distract me). The tinnitus is quite small and is not causing much problem today. My main issue is now is my right ear, I think it hurts underneath but can't pinpoint it exactly, sometimes ear sometimes neck around that area. This is probably the throat infection? Maybe this Dr is right, maybe not. But not sure if he was listening when I told him yesterday about the right ear and the appointment seems very rushed with no questions or explanations.

-

Tested C19 Negative again. Just back from the ENT. I said the test result was good he said its not. He said my left ear is a bit lower than my right. (Yes I saw this as did the hearing test people but its well in normal range). He said its not about my throat infection its the nerve. My appointment was no more than a minute, he asked no questions, didn't examine me and barely looked up from the computer. He gave me Methycobal (B12) 500ug 3 times a day, come back in a week. (+ the antibiotics from yesterday). I'll try it for the week, but not really sure what to do after that.

-

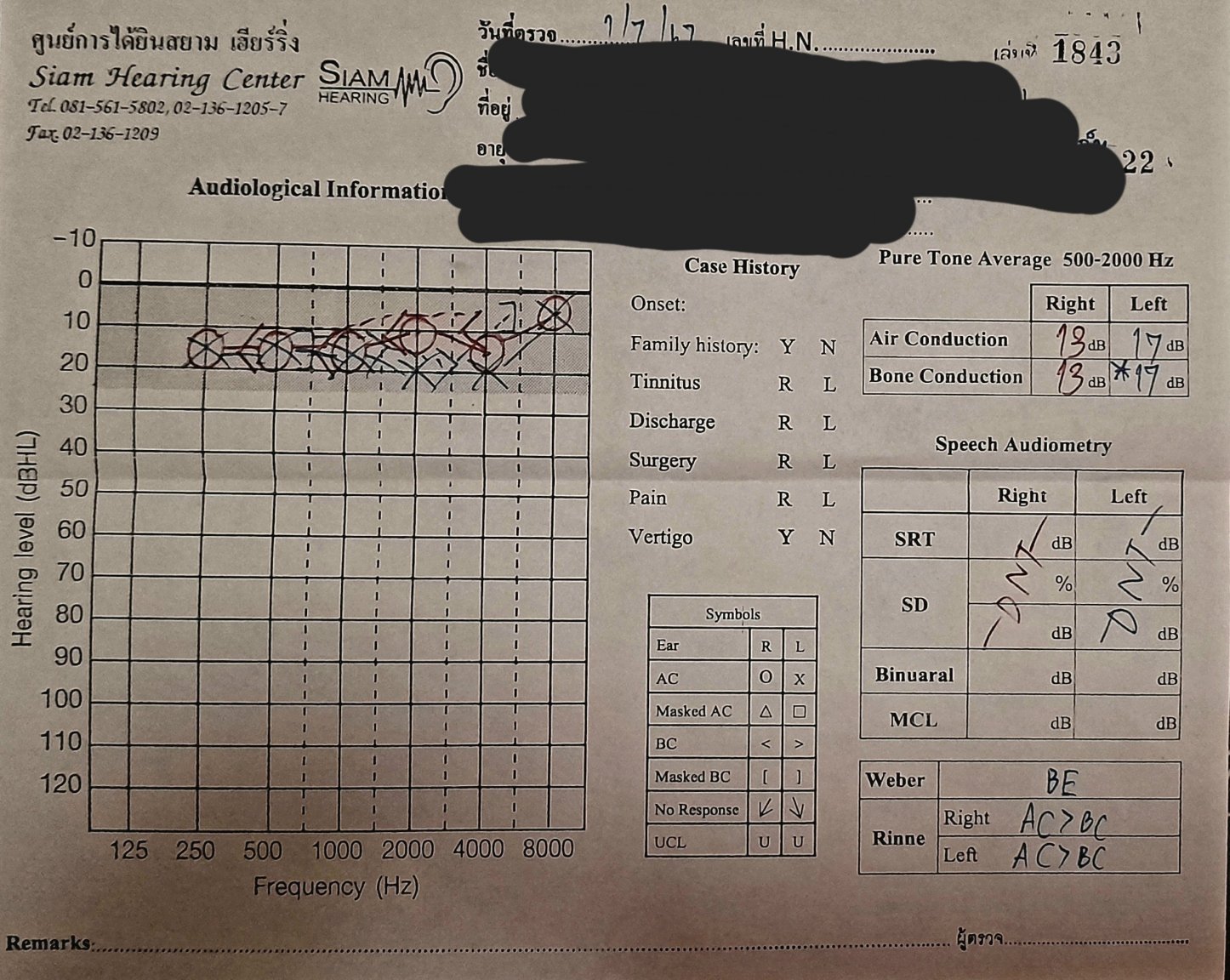

Thought for what It cost I would go and do the audiogram. No problems with my hearing, they said if anything it was too good and that's perhaps why I was picking up on this buzzing. "I have the hearing like a 5 year old" I'm now supposed to go back to the ENT this evenig.

-

Thanks. Covid is a possibility. About a week after the buzz started my wife had covid, I then started with some symptoms and tested 3 times last was Thu/Fri I think all were negative. It's possible I had covid first but with no symptoms. If it was covid related how long would you expect it to last?

-

Thanks Sheryl. The left ear buzz started first, then after a week the other symptoms including pain around the other right ear, at a similar time my wife had covid. Quite a coincidence if they aren't connected. I've not noticed any hearing loss. Do you think better to just go and do the tests now, or wait until the throat infection has gone first?

-

Not really sure if I should be rushing to get this hearing test done and going back to the ENT Dr tomorrow, or to wait until the course of antibiotics is finished?

-

Today I'm a bit better than yesterday, the left ear buzz is not there all the time and again only really noticeable if I close my ear. My sore throat has improved my other ear still feels a bit blocked and hurts a little underneath. Anyway, I found another ENT that was open today. He took a very quick look in my ears and then my throat and said I have a throat infection. Didn't feel like he was really listening was in and out very quick. He referred me for a Audiogram test to another place tomorrow and then go back to him after (ENT Dr only opens in the early evening, hearing place in the day). I asked if the throat infection was causing my minor ear buzz and he said he didn't know. Prescribed Cefuoxime 500mg twice daily for a week.

-

Because I have some symptoms of a cold (blocked or runny nose, sore throat and the pain in the other ear) and my wife having covid I thought it likely to be due to congestion or similar. Most of the time it's fairly mild and I don't hear it over other noises unless I block my ear. The Betahistine is supposedly for tinnitus, been taking that since last Sun evening. I prefer a clinic to a hospital. I was going to go to my general Dr on Monday but maybe an ENT is better, there's one I have used a very long time ago (Dr Kongkrit) don't remember if it was good or not, closed until Monday evening now. Phuket, town area is preferred. - Thanks

-

For almost 2 weeks now I've had a high pitch buzzing in my left ear, If I am watching tv or something where there is some other noise its not really noticeable, if I am reading in a quiet room its more noticeable especially once you know its there. If the ear is closed by laying on that side or covering it the buzz is there. I don't think my hearing is affected. It there most of the time but sometimes just stops for a while. At first tried some hydrogen peroxide to clean the ear out in case its wax. Been taking daily Merislon - Betahistine Mesailate since last Sunday I think. Also tried Pseudoephedrine - only for 3 days on/off. Oxymetazoline nasal spray - just a couple of times. Acetylcysteine again just a few times. Paracetamol. Saline rinse of nose starting today. My wife has had covid after this started and is mostly better, I've checked myself 3 times and its negative. I have had a sore throat come and go over last week after the buzzing started, both ears feel a bit congested, blocked or runny nose. For 2 days my other ear (right) was painful to touch under the ear where it meets the jaw but that seems better now. Tried a few things so not really sure which if any are really the correct ones. Should I try some ear drops or something else? Thanks

-

Legal Strategies to Reduce Thai Tax

digital replied to Mike Lister's topic in Jobs, Economy, Banking, Business, Investments

Only Thai People ?