pluto_manibo

Advanced Member-

Posts

1,097 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by pluto_manibo

-

I got Tinnitus in 2020. I also went to ENTs in the beginning. They are useless, don't waste your money. Manage your exposure to loud environments, work places, concerts etc....Protect your ears with ear plugs if exposed to loud noises. You will be fine, it takes adjusting to in the beginning. They will do endless tests, try to prescribe you ototoxic drugs like klonopin or its cousin, for you to be able to deal with it....don't go down that road! Lead a healthy life and spend your time and money on more worthwhile things. It sucks at first but your body will adjust and your brain will learn to live with it and not be aware of it at times.

-

What happens if not pay a speeding camera fine?

pluto_manibo replied to Keith5588's topic in Thailand Motor Discussion

You pay and then you can renew your tax. You pay the amount on the ticket not double. -

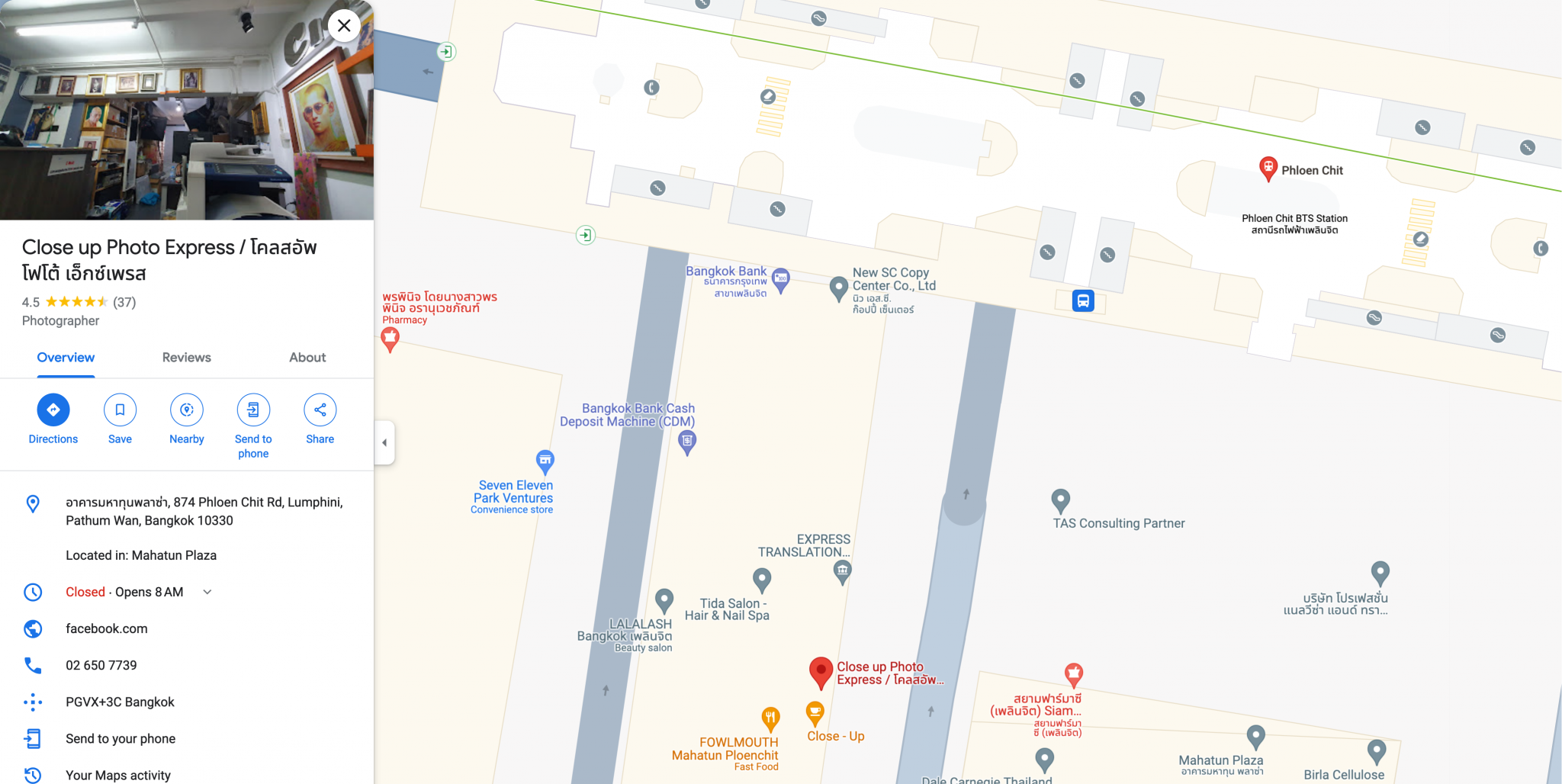

It can be a total nightmare, especially if you are flying in and have to run around town to get the pictures redone several times. Yes, they have the requirements you must download(size, no filters, no retouching, type of file, face position, background color, no more than 400 dpi etc....). However in my experience, some Photo shops like to retouch or get it all wrong and you must go retake them. The little stand out front, 10 yrs ago, was great! I imagine some Photo shops in the area know all the specs and are used to the business and requirements needed from the embassy. Hence, my original question.

-

Make take on the new tax laws and panic

pluto_manibo replied to wmlc's topic in Jobs, Economy, Banking, Business, Investments

As Buddhist doctrines say, all is impermanent and suffering. -

Make take on the new tax laws and panic

pluto_manibo replied to wmlc's topic in Jobs, Economy, Banking, Business, Investments

https://www.tatnews.org/2022/04/letape-thailand-by-tour-de-france-phang-nga-2022-cycling-event-set-for-mid-may/ https://www.businesseventsthailand.com/en/event-calendar/detail/93-letape-thailand-by-tour-de-france -

New Tax Rules for Expats in Thailand Spark Concern

pluto_manibo replied to webfact's topic in Thailand News

Maybe it is just a ploy, that will not pass as a law. Scaremongering, to make you thankful for just having to pay the new remittance tax on income brought into Thailand, regardless of when it was earned. Either way, one should consider an exit plan or stay only 179 days. Government funds are depleted, economy is not performing, tourism mainly attracts war refugees, quality of services are abysmal(atleast in the Southern region), inflation is at an all time high, etc....Yet, all we hear is tax this, tax that, tax now. Laws are amended without warning, there is another amendment to tax on worlwide income. Could be a tactic to make everyone grateful for just a remittance tax or it could be real. The fact is Thailand has lost its shine a long time ago. They should incentivise foreign investment not penalise it. Instead of following the Western model, which has become a total failure. -

TMI

-

Don't get frustrated! Just dump all your items on the counter and walk out! They will catch the drift.

-

Animal cruelty is a punishable offence. Discussing your intentions to break the law(premeditation) and cause harm to animals in a country in which you are a guest is not a very intelligent move! Tough guy, maybe you should do everyone a favor and take the poison yourself!

-

List of Foreign source income tax free country for Expat Angola Anguilla Belize Bermuda Bhutan Bolivia Botswana British Virgin Islands Costa Rica Democratic Republic of the Congo Djibouti Eswatini Georgia Guatemala Guinea-Bissau Hong Kong Lebanon Libya Macau Malawi Malaysia Marshall Islands Micronesia Namibia Nauru Nicaragua Palau Palestine Panama Paraguay Saint Helena, Seychelles Singapore Somalia Syria Tokelau Tuvalu Zambia

-

Without allowances calculated; [email protected] baht= Baht 2,892,800 First Million( 5% for 150k-300k, 10% for 300k-500k, 15% for 500k-750k, 20% for 750k-1M)= Baht 115k Second Million(25% for 1M-2M) = Baht 250k 892,000(30% for 2M-4M) = Baht 267,600 Tax to be paid= Baht 632,0000 Baht 632,[email protected]/$= $17,494

-

The article is a bit misleading and xenophobic. The law is not only aimed at foreigners, all the Thai people who work abroad, invest abroad and want to remit funds, trying to survive in this difficult economic climate are the main targets. Unfortunately, foreigners are caught within the net. The majority of Thai people are not concerned about this law, their income is domestic, falls below the "heavy Tax " brackets or as most is not declared(numbers hover around 10% of population paying taxes). The foreign elements on fixed incomes/pensions seem to feel sheltered by the DTA(Double Tax Agreement) they might have and most fall to under the category of the heavier tax brackets. However, what the higher ups have not considered is that there is a whole economy reliant on these foreign remitted incomes which have been repatriated under the full structure of the law(income remitted not within the same year earned is not taxable, not a loophole!). To impose such drastic changes, while the world is still suffering from important inflation, market volatility, declining investment possibilities, repercussions of the "Epidemic", loss of confidence in the economic, political climate and societal views; will not inspire confidence in the future. Neither will it induce spending! Some might fall in the ranks, complain and just accept it. However, many will look for greener pastures, value for money, more stable environments and better investments abroad. It will destroy families, communities which have developed an ecosystem from these remitted incomes, which outweighs by far any of the perceived benefits of future taxation of these foreign injected funds.

- 325 replies

-

- 43

-

-

-

-

-

I am planning on sucking it up for a few years and bring in the minimum in an acceptable tax bracket to add to the funds in Thailand. However my plans for the future have drastically changed. Having lived here since 1995, it will be a painful adjustment. I have been to all the neighboring countries and they do not appeal to me at all. I would hate to live there on standby for 183 days.

-

I think this might cause; Thai investors to not repatriate their funds Foreigners to limit their time and spending in the country. More importantly forego any big expenditures(cars, surgeries, house purchase, medical expenses etc...) Foreigners to abandon their applications for LTR or Elite visa(as has been testified on Reddit by a handful of people) Real estate market to suffer However, this has not been elaborated on and they might want to instill a sense of urgency in repatriating funds before the Tax comes into effect, to boost the economy. I think this will discourage future investments and spending.

-

The scenario changes if you have a normal life with wife and family, pets, etc... Jumping around from country to country does not become a viable option. In the event of big purchases such as a new car, home repairs, a medical emergency outside the realms of your health insurance policy, etc....These would easily bring you into the 20-35% bracket(1 million-5 million) if funds were to be brought in from abroad.

-

For Cambodia and the Philippines you will have to make adjustments to your living conditions, imported products are more expensive. You must also factor the costs of health issues. You probably will need to fly to Thailand or abroad for treatment. In regards to Mexico, residents are liable to Mexican income taxes on worldwide income.