TerraplaneGuy

-

Posts

764 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by TerraplaneGuy

-

-

14 hours ago, ubonjoe said:

At documented foreigner means those with a certificate of entry that is only available for those that qualify to get one.

Some info is here. https://thaiembdc.org/2020/06/24/29717/

I see that today in the Bangkok Post they have the official CAA announcement which in section (4) allows entry to "Non-Thai nationals who hold a valid certificate of residence, or permission to take up residence in the Kingdom". Does anyone know for sure what such a "certificate" is and whether they might mean to include retirement visas and extensions of stay for retirement? Or could it be that they simply mean the certificate of residence that you get for things such as applying for a drivers licence (issued by Immigration on showing them your passport, visa, house book/lease, etc.)? If so it would seem that anyone who is still here in Thailand on an extension of stay could get such a certificate before leaving the country and thereby be confident of re-entry.

-

19 hours ago, DaveInSukhumvit said:

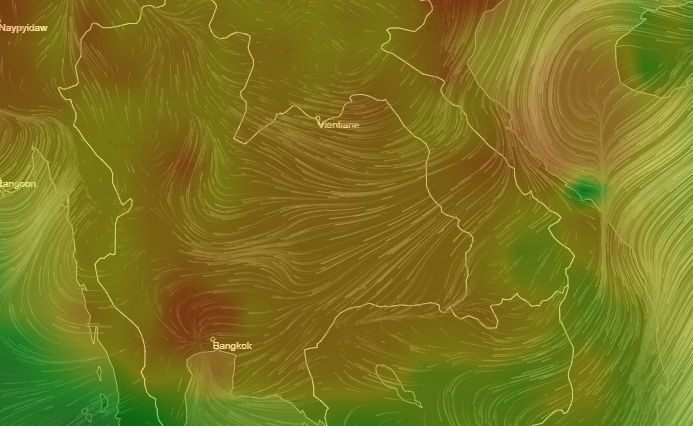

The wind direction and speed for yesterday and today is virtually the same. Pollution levels all over BKK were significantly higher yesterday than today. A pollution hot spot is shown in red near the Phra Nakhon Tai Power Plant. I think that plant was the difference in air quality. Otherwise, the wind off the ocean was pretty good for both days with little evidence of transboundary pollution.

I did read up on combined cycle power plants, and this plant in particular. Phra Nakhon Tha (AKA South BKK Power Plant) is a dual fuel design burning natural gas and diesel. Either fuel can be a large contributor to PM2.5 (the dominant factor in yesterday's high readings). I think they brought more generators online yesterday because other sources of power were offline ... or perhaps switched fuel sources one day to the next ... or a combination.

I don't think it was a bad meter in that location. I have 2 meters. Both read significantly higher yesterday than today. Also Air Visual numbers (shown above) are not perfect, but do generally represent fair readings in the areas shown. My meters confirm those readings and the government stations.

*Not a professional. Multiple heads are better than one.It was definitely a bad day on Tuesday, according to my monitor on Sathorn near BTS Chong Nonsi.

-

1 hour ago, DaveInSukhumvit said:

Yes it’s a drag just when we were getting used to clean air for a change (and one of the few good things these days given the lockdown etc). I just fired up my air purifier for the first time in at least a week.

-

51 minutes ago, WalkingOrders said:

I have taken to wearing a quality 2.5 mask if outside. It works wonders. I walk about 2 miles a day to gym and back. It works. I breathe full while walking, and do not feel sick when I get home, which has raised my mood in this horrible situation. I no longer feel angry, not wanting to venture out. I noticed difference right away.

Good to hear. How's the air in your gym?

-

OK I checked once again the effect of aircon on my Sndway PM 2.5 monitor readings. Results were consistent with earlier tests: the aircon increases particles. Details: Aircon is Daikin recessed wall units in each room with outdoor compressor. Purifier is the Hatari AP-12. Test was in my bedroom (not very big). I started with the Hatari at "2" for the whole night, no aircon. By morning the result was Sndway reading 0-1 at 67% humidity. Turned on the aircon (fan high, temperature 26) and within a few minutes the Sndway reading was 7. Humidity unchanged at 67%. Left if for another 5 minutes or so and the reading jumped to around 14 with humidity down to 62%. Conclusion: the aircon caused an immediate jump in particles with no humidity change. Then particles increased further while humidity went down (the drop in humidity was expected because in the cooling phase of the aircon it sucks up moisture. It may (see earlier post) blow moisture back into the room in the post-cooling fan phase but I didn't get to that). The fact that particles increased while humidity decreased suggests to me that the aircon is strongly pumping in real particles, because you would expect a decrease in the particle reading with decreased humidity (since the monitor can mistake water for particles). Why this happens I don't know. As mentioned above, I've had the aircon filters cleaned recently and as far as I know no outside air is supposed to get into the system. Ideas?

-

1 hour ago, MaxYakov said:

I would place money that's it's the change in humidity caused by the A/C affecting the Sndway monitor. (I would think reduction of humidity because evaporator units have a condensation water catcher and drain - typically to the balcony) a PDF article on this very subject is HERE.

Well don't bet too much. I've checked in past to see if the humidity on my Sndway goes noticeably up with the aircon and haven't seen that. I'll try it again though. But your thought that there would be a reduction in humidity caused by aircon seems contrary to my observation that particle count goes up with aircon. I have read that aircon can actually increase humidity, from blowback from the condensation and that's why they include a dehumidify mode on many (there is one on mine) which turns off the fan when the cooling process is not active (i. e. when temperature has reached the desired low level).

-

1 hour ago, Misty said:

... The exception is the big room - it's usually in the teens, and will go up to 35-ish if one of the central air con units is started up.

Went to HomePro today and requested a site survey from their technicians. My idea is to replace one of the central air units in the big room with a wall unit, and limit our use to just that one - and only when it's really hot.

Have you learned why using aircon increases the particle count? Earlier in this topic I mentioned that I find whenever I use my aircon my Sndway monitor shows an increase. I have modern Daikin units (one upper wall output for each room with compressors on the balcony) and my understanding is they aren't supposed to suck in dirty air from outside, just keep re-circulating the existing room air. I've had the filters cleaned by Daikin recently but the problem remains.

-

OP Update: On my second trip to CW (yesterday) I finally got my extension, a few days before expiry of my current one. It took a creative solution from Aetna and the intervention of an Inspector/Superintendent at Immigration. Not a solution that is going to apply in other cases, unfortunately. But Aetna is working with the TGIA (Thai General Insurance Association, which liaises with Immigration on this) to try to find a general fix.

-

1

1

-

-

2 minutes ago, codebunny said:

What do you think the chances are of the govt funding electronic air pollution monitoring systems?

They have some screens for traffic that I've seen, but nothing significant to monitor urban air pollution.

Zero if you mean anything much more than what they already have. There are some govt monitoring stations. But every indication is that the govt prefers to minimize information on the bad air, not publicize it. If more people get upset, they might actually have to do something about it. So no.

-

- Popular Post

- Popular Post

13 hours ago, pitrevie said:I completed the procedure in the morning but I have just checked my policy and in fact it is timed later that day so perhaps in hindsight I was lucky to get out of the building while being in the country uninsured with no medical cover for 4 hours.

You are indeed lucky and I can see you share my amusement at the idiocy of what they insisted on for me (and are still - I have Aetna talking to them and they still say the time is crucial). What they don't seem to realize is that if they care about the first few hours they should equally care about the final few hours (a year from now) but they don't. Their extension is not time-limited so it extends right through to the end of the last day. Nomatter how they do it, there will always be some uncovered hours. The only way around that would be to have the insurance policies timed at 0:00. But this is apparently beyond their grasp of arithmetic.

-

1

1

-

2

2

-

38 minutes ago, pitrevie said:

No thankfully it was just "come back tomorrow."

So you already got it? And what time did they issue your extension?

-

- Popular Post

- Popular Post

2 hours ago, pitrevie said:I went to CW 1 week before my NON OA extension expired naively thinking that the fact that I had a bank account with considerable more in it for several years than was required by their medical insurance and that I had been doing this for some 15 years would obviate the requirement for an insurance policy that I did not require. Nope bank book not even looked at medical insurance or out. A week later I was back 1 day before my extension expired only to be told that my medical insurance was dated the next day and although everything was in order as the medical insurance commenced on the day my new extension commenced I would have to return the following day to get my extension approved, yep just one day. ....

Welcome to the club. Tell us, when they said come back on the day of your expiry did they say anything about the TIME? As I've mentioned, with me they said they couldn't issue an extension before not only the day but the TIME that the new policy took effect, which is (I am told by Aetna) always, by law, 4:30 PM (check your certificate, you'll see) and therefore means extension is impossible unless they make a special accommodation to work with you past closing time which of course is 4:30 PM. I doubt even the North Koreans could get that stupid.

-

3

3

-

3 hours ago, thedemon said:

I agree with your assessment except that, if we're talking about greater Bangkok I think you might be underestimating the effects of seasonal weather patterns i.e. wind strength and direction and overnight temperature.

A week ago the PM2.5 was much lower that it is now and there is no other obvious reason for that.

Agreed. Earlier in this string we discussed the fact that ordinarily the air quality is worse at night than in the afternoon (not only in BKK but most major cities), probably owing to heating and inversion effects. But I notice recently that pattern seems to have broken. We've been getting almost uniformly bad air 24/7. Clearly there are many factors that influence this and again my take is that rather than try to analyze it we should (those of us who can) just get out. Stay for the rainy season if you don't mind the rain, at least the air is OK. But winter is dangerous. The depressing fact for those of us who like Asia is that this situation applies to almost all big cities. I was looking at Busan, Korea which is a beautiful seaside city and its historical AQ is worse than BKK. I'm now looking at spending winters in Europe or North America and maybe heading back here for summer, which from a climate perspective is a bit perverse but works for AQ.

-

1

1

-

-

5 minutes ago, TallGuyJohninBKK said:

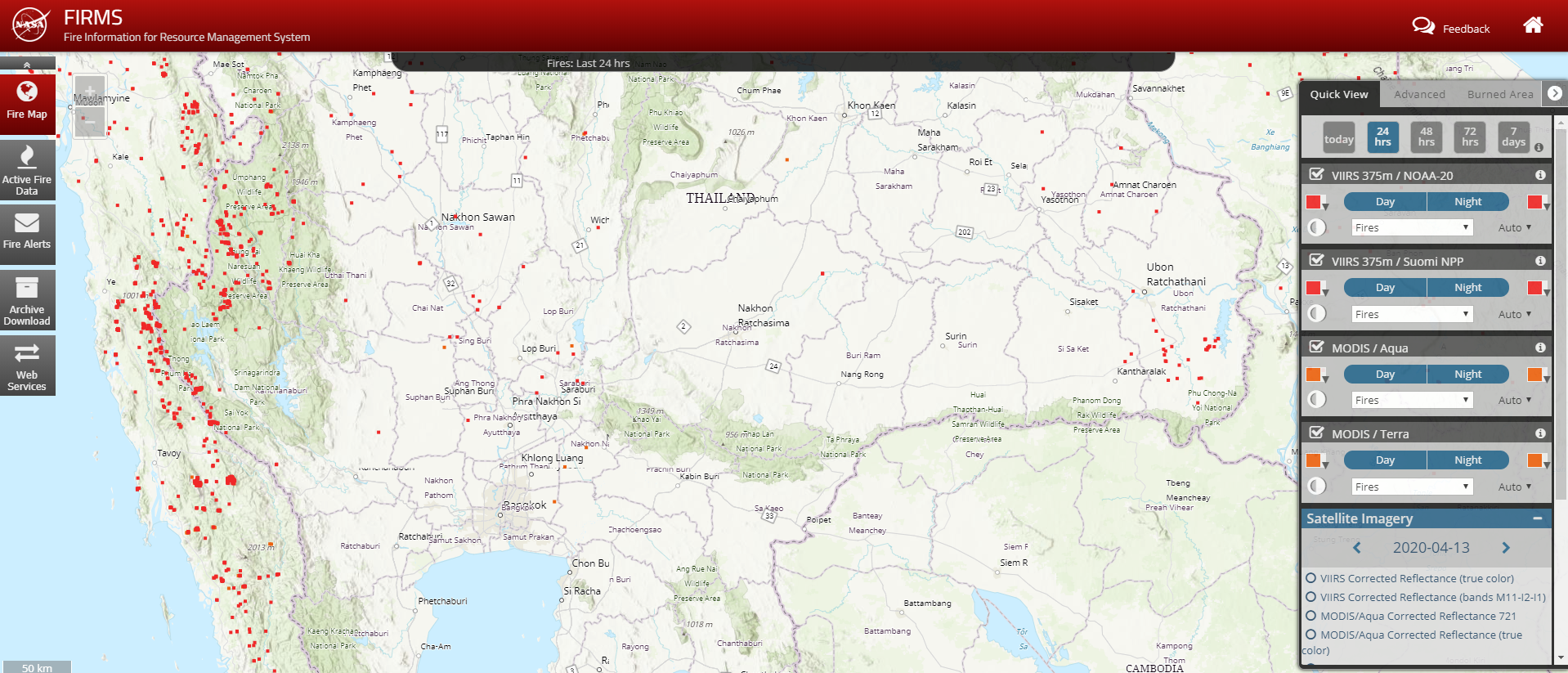

... When the morons out there are not burning their fields (whether it be Thailand or adjoining areas), the smog in BKK never gets to the levels like it is right now.

News reports suggest these people aren't actually morons, they're just trying to make a living in a market where the price of sugar (the main culprit crop) is very low owing to a global over-supply (and possibly Thai government pricing policies). Burning is the cheapest way to harvest and farmers can't afford a cleaner method. Personally I would favour strict prohibition of burning, and taxing sugar to help subsidize cleaner harvesting or switching to other crops. Thais consume far too much sugar anyway and a tax might help reduce that. But none of this and no other fix will happen. Incompetence, inertia and negligence are too deeply ingrained. We can analyze the problem all we want but what's the point ...

-

29 minutes ago, TallGuyJohninBKK said:

Right now, 99% certain, it's a burning thing more than a cars and vehicles thing.

Maybe that's true although I wonder how you come to that conclusion. I've read several reports where experts say that vehicles contributed 60%-70% of BKK's air pollution. Even if that's an exaggeration, I find it hard to believe vehicles aren't an important part. I suspect that vehicles create a baseline, call it maybe 50% of the pollution, which is fairly constant, and then other factors like burning and weather are what push us into the orange and red. In the end it hardly matters, the government is not going to fix either the vehicle or the burning problem (or any other factor) anytime in the next few years. I've decided I'm not spending another winter in this city. It's insane. Today I couldn't go anywhere to enjoy my Sunday. What's the point of all these great cafes and restaurants and malls if you have to wear a mask the whole time? Let alone the outdoor pool which is just a health risk ...

-

Well they were bragging that they pulled 200 smoky vehicles off the road. Good, except there are almost 10 million vehicles in BKK and something like 1,000 are added every day.

-

4 minutes ago, Martyp said:

I will just have to go to CW later in the year and have a discussion about what they will accept at that time. You seem to presenting a situation where no one can get an extension unless they are there at 4:30pm on the day it expires. Obviously that is not the case for many people who have obtained extension for the last couple of months.

Yes, that is exactly what I've been told repeatedly by Immigration escalating up several levels of seniority. Aetna was told the same thing when they inquired. I agree it makes no sense and I'd like to hear from anyone with a Non-OA who has recently extended at CW about their experience. Could it be that not many people have these visas anymore?

-

1 minute ago, Martyp said:

My Pacific Cross insurance begins January 1st. I originally got my PC insurance before the insurance requirement. If I understand the logic of what is happening to you then I think I will be OK in November if I can get my insurance renewed early enough before November 19th when my extension of stay expires. When I apply I will have an insurance certificate for this year in the database. I will have a certificate for next year, starting January 1, but not yet uploaded to the database. I may have to move my insurance back to December 1 if renewing early becomes a problem. In any case do you see this timing as a possible solution to your situation?

I don't. The problem is that when you go to extend, say on November 2, your new certificate, for the upcoming year, will not be uploaded. They will not accept it as proof of coverage. So they will say come back when it is uploaded. Changing your policy to December 1 won't change that.

-

OP UPDATE: I've had a lot of discussion with Aetna and they've talked to Immigration about my problem. Aetna offered to increase my coverage to the required B40,000 OPD for the stub period before my next extension (between now and February 12) so that I can go in advance and extend. But Immigration said it won't work because they will not accept even a signed certificate from Aetna confirming that. They will only accept an uploaded certificate as proof, and since Aetna had to upload the certificate for my upcoming extension year already, and the system only takes one per customer, there is no way to upload another. In other words, Immigration is saying that if I want to apply in advance (as per usual) I have to prove current coverage as well as coverage for the upcoming year, but that is impossible because the system can't show both! So Immigration is sticking to their position that the only day I can apply is my expiry day, February 12. And they are sticking to the time requirement, which means I can't apply before 4:30 PM (the time of my policy, and everyone's) when Chaeng Wattana closes. As a special accommodation, they say they are prepared to have the staff work a few minutes late to get my extension done. However, I will have to come back another day for my re-entry permit because that office will be closed by the time I have my extension. I have Aetna's legal team working on the possibility of moving the time of my policy to an earlier time (although the law normally requires 4:30 pm). I'm not optimistic on that. Meanwhile what I'm wondering is:

1. Will this happen again next year? If they continue with these rules, even though I will have proper coverage for the then-current year, when I go to apply again for an extension it seems I will run into the same problem: Aetna will have to upload my new certificate for the upcoming extension year and the previous one will be deleted. That will prevent me from applying in advance and force me to apply only on my expiry date at 4:30 PM. That is unless Immigration is smart enough to devise a system of recording or preserving previous year's certificates. Or doing the rational thing and relying on the fact that if you've already got an extension you met the requirements at that time. But they're not doing that now so I'm not holding my breath for next year. And if they don't change their rules, how can I expect them to make a special accommodation for me year after year? Obviously they won't, so they'll force me to overstay and apply late, breaking the law.

2. Why do I seem to be one of only a very few people having this problem? Are there not many holders of Non-Imm. O-A visas getting extensions? If there are, why are you all not having this problem of being unable to apply in advance for want of proof of current insurance coverage? I'd appreciate any input.

-

2

2

-

-

1 hour ago, Mike Teavee said:

But I didn't mention Malaysia as a) It's a lot more expensive than the Thai options & b) It comes with a requirement for Health Insurance (though I believe they will, on a case-by-case basis, wave the requirement & allow you to deposit a bond if none of the insurers will insure you).

More expensive in that you have to keep more money in a local account than in Thailand?Or ...?

-

2 hours ago, Alotoftravel said:

I have Pacific cross medical policy for my o a extension which also starts at 4:30 PM.

I wonder if I will encounter the Same problem here in chiang mai immigration; must have insurance Started prior to the expiry of my visa When i renew, I plan to go 45 days to apply before visa expiry?

I did ask Pacific cross if I should get insurance for “ additional time” before my visa expiry , they Can but there will be no certificate for the extra time which they cannot guarantee that immigration will accept.

Cannot seem to do the right thing nor know when or what is the right thing To do

I discussed this with Aetna and as you say they cannot give a certificate for the stub period coverage because the system only allows them to upload one certificate per customer to Immigration and of course we need the certificate for the extension coverage. Yet Immigration told me they would allow me to get my extension in advance if I could prove I have coverage in the stub period. The question is how could I prove that without a certificate? I didn’t get into that with them but I suspect if you brought your stub period policy and a letter from the insurer (signed original) confirming coverage they might accept that. If not they are really creating an impossible situation, demanding proof that cannot be given. I’ve asked Aetna to explore this further and I’ll post what I hear.

-

1

1

-

-

6 minutes ago, rhodie said:

Use an agent. That is what they want us to do. ????

20 minutes ago, Martyp said:I wish the same. Even if different offices have different requirements a clear up-to-date website would work wonders. It doesn't even have to be an Immigration website. It could be a 3rd party website that has close contacts with a particular Immigration office. A good project for some enterprising Thai web developers.

In my view it would have to be by the Immigration Bureau itself because any daylight between them and a third party would give them the excuse to depart from what is posted. It has to be official. What I think is needed is a concerted effort by expats to pressure Immigration, using formal letters but also newspaper and FB publicity, to do the right thing.

-

Back to the main point here, it is clear that Immigration imposes irrational requirements that are outside the law. What I wish is that at least they would publicize those requirements so we don’t have to go through the agonizing ritual of guessing each year and getting rejected. Why can’t they simply post on the website a clear list of documents for each visa class so, absurd or not, we will know what to obtain and bring? I’d like to see an expat movement pressing for that.

-

2

2

-

-

10 minutes ago, Vascoda said:

Are not all policies when for e.g. it says 12th Feb it means it starts when 12th Feb starts. That is 00:00 hour of 12 the february. Never heard of a policy starting at 4:30PM. Does it mean if you have an emergency before 4:30PM, e..g 10Am you cant go to the hospital and have to wait till 4:30PM?

See my earlier post. Aetna says by law all insurance policies of any kind in Thailand start and end at 4:30 pm. Others confirm that. So yes I expect you would not be covered prior to that time on the first day.

Can I return if I travel abroad now?

in Thai Visas, Residency, and Work Permits

Posted

Edit: Please note this new announcement refers to a "certificate of residence" which is clearly different from the "Certificate of Entry" in the COVID-19 regulations referred to in ubonjoe's above post.