Rajab Al Zarahni

-

Posts

1,272 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by Rajab Al Zarahni

-

-

Earlier today I accessed the DWP website. I detail below the relevant extract for the perusal of contributors to this thread:

DWP benefits that we can recover overpayments of under social security legislation

(S71 of the Social Security Administration Act) and that we can take compulsory

deductions from.

Attendance Allowance

Bereavement Benefit

Carer’s Allowance

Disability Living Allowance

Employment and Support Allowance (ESA)

Incapacity Benefit

Income Support

Industrial Death Benefit

Industrial Injuries Disablement Benefit

Jobseeker’s Allowance

Maternity Allowance

*New style Jobseeker’s Allowance

**New style ESA

Pension Credit

Personal Independence Payment

Pneumoconiosis, Byssinosis & Miscellaneous Disease Benefit

Reduced Earnings Allowance

Retirement Pension

Severe Disablement Allowance

State Pension

Universal Credit

Widows Benefit

Widowed Mothers Allowance

Workers Compensation (Supplementation) Benefit -

1 hour ago, bert bloggs said:

As the pension is not a benefit,you could not be done for benefit fraud if you claimed the rises abroad could you?

Section 71 of the Social Security Administration Act grants the DWP the power to make compulsory deductions from State Pensions in order to recover over payments.

-

1

1

-

-

1 hour ago, nontabury said:

I’m not too sure about that. I would have thought that they would have to be very carefully, in reducing a persons pension. As it might take them below a level to sustain themselves.

Further more see the first part of post 3792 from “ alterbob”

The recovery of a past over payment from future payments does not reduce the "correct " payment of the pension at all.

-

21 minutes ago, evadgib said:

Another advantage of following the consortium is that you can expect less drivel as they're less likely to be anonymous.

Whom God would ruin, he first makes mad.

-

1

1

-

-

4 minutes ago, nontabury said:

Perhaps they volunteered to repay the amount they had over claimed. If they had refused to pay back those over payments, then they would have been prosecuted.

But as far as we are aware, the U.K government has never attempted to prosecute those individuals I wonder why?

They don't need to instigate court proceedings to get their money back. They simply treat it as an over payment and recover the overpaid amount from future pension payments

-

1

1

-

-

Anything for a quiet wife.

-

Ah he was a trouble maker ! Then it might be murder but this is clear justification for it.

-

I guess they must have used attack helicopters to root them out.

-

6 hours ago, bert bloggs said:

Moral of story ,dont use an address where someone is liable to die .

Moral of the story, if you retire abroad make sure you die before your mother.

-

2

2

-

-

I have not experienced this problem but I suspect that it arises from poor staff training.

I regularly encounter the problem of staff expecting an immediate order, without giving you the chance to look at the menu, but generally they can be made to shove off through the use of gestures or your facial expression.

I get annoyed by the use of those bloody tissues that crumple into nothing the moment you touch them and that a careful note is taken of how we would like our steaks but when they arrive they are all cooked exactly the same.

There is no point in complaining unless it; likely to bring about change. I went in one bar where they had a cat sleeping alongside the food inside the display cabinet. What would have the point of complaining here. If it makes you angry then remember that you are in Thailand not Switzerland.

-

5 hours ago, hackjam said:

Here is my story.

I am 55 and have just received confirmation from Newcastle that I have 30 years contributions. I finished contributing about 4years ago.

So my question's are:

Do I need to contribute any more?

What age will I be able to claim pension at and how much is it right now?

Start by asking them for a forecast and then you will know their answers to the same questions. Then look carefully at details they hold such as your name, your DOB, your NI number and your contributions record and ensure they are correct. Most errors arise from the input of incorrect data. Advise them of any errors then ask for a new forecast. The forecast will include answers to the questions you have posed.

-

The government in the People's Democratic Republic of the Congo will be furious. They held the top spot for many years. This, having been falsely accused of not being democratic will be just too much to take.

-

2 hours ago, dick dasterdly said:

In other words, the govt. should be more honest and integrate tax and N.I.?

In principle, so they should. The risk for pensioners is that they will do this without making any special provision for those who are past state pension age and no longer make NI contributions.

-

9 minutes ago, scottiejohn said:

I qualify for pension in March next year (2018) and am just working out the Maths for claiming on due date or waiting till the 3% increase date which you have now confirmed for me. My understanding is that I am locked in to the rate on the date that I ask for my pension to start and not my actual pension qualification date.

Thanks again

I am assuming that you are residing in Thailand or another country where annual pension increases are not paid. If this is the case then you are correct in assuming that the date you first receive the pension payment will determine the rate at which it is paid rather than your pension qualifying date. Even if you reside in a country where UK pension increases are not paid, providing you don't apply for your pension, it's value will continue to increase annually as a deferred status pension until such time as you draw it.

-

1

1

-

1

1

-

-

8 minutes ago, scottiejohn said:

Thank you for the date and can you also confirm please if it will be 3%?

A 3% overall increase applies to everyone who reached state pension ago after April 2016. People who retired earlier than that are paid according to the old system of "basic" and earnings-related pension. For this group, the basic pension will also increase by 3pc in April 2018, to £126 a week. The "additional" element of the old state pension is only increased by CPI inflation, not the full triple lock.

-

59 minutes ago, scottiejohn said:

I understand that the Annual "triple lock" increase will be 3% next year, is that so and when do the increased payments start? Is it the 7th of April 2018 or some other date?

The effective date for the increase will be the 06.04.2018.

-

2 hours ago, bert bloggs said:

I would not be surprised if May cuts the triple lock so that pensioners do not get the full 3% ,not that this would effect any over here as i am sure you all have told the pension service that you live here and would never use a UK ADDRESS .

A high proportion of pensioners use their vote. Of these. a high proportion are thought to vote Conservative. The conservatives do not have a majority and only cling to power through their coalition with the DUP. They yearn to ditch the triple lock but these three factors are compelling reasons why they probably won't

-

1

1

-

-

- Popular Post

- Popular Post

How do you propose to get these changes introduced ?

-

3

3

-

Nan Laew:

So, just checking my understanding of your Australian language tutorial.

If I am told by an indigenous Australian to piss off what he means is that I should go away and drink some good, fresh, cold, beer , or were you just taking the piss?

-

2 hours ago, Flustered said:

RAZ, if you do not stop posting sensible and to the point comments you will be reported.

One day, I may get you to agree about overseas pensions but I doubt it and it is your right (as is mine) to have a point of view.

On behalf of His Imperial Majesty I am delighted to receive your most gracious comment and for the restoration of normal diplomatic relations between the Sultanate and the Kingdom of Yorkshire.

-

1

1

-

-

- Popular Post

- Popular Post

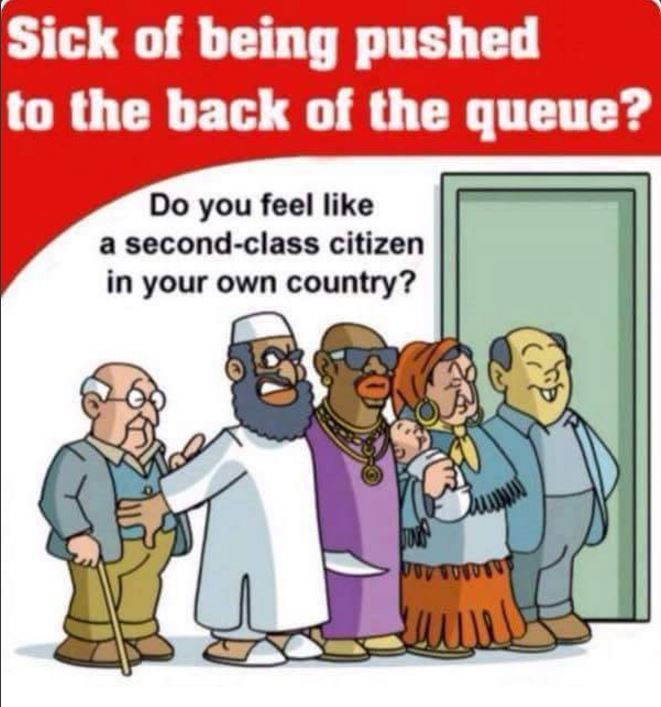

Oxx: I agree with much of what you say, however:

1) If you choose to avoid pork, pray five times a day, dye your hair purple or wear a ring through your nose and if that is the reason you can't find a job then that's your problem not mine.

If you are poorly educated then the assistance provided by the state should be to help you correct that deficit.

Employment is not a right. Unemployed people have a job and that job is getting a job. They are really no different to the self employed. What they don't have is a salary.

2) There is no problem with immigration, the problem is our dismal failure to exercise any form of control.

Why do we still hear of colleges for foreign students where you can buy a degree, a masters degree, a passport and a driving licence ?

They will even visit your home to provide a VIP bespoke service if you have the money.

The first rule of immigration should be that it is of benefit to the country and of no detriment to its indigenous population.

On returning to the UK, why have I been able to walk through customs and immigration without even seeing a single official on duty ?

Why do I come across such a high number of people from ethnic minority areas of the UK who are not employed and who can not speak more than a few words of English ? How did they get here and what tests did they pass for entry ?

Why does the Border Agency appear to be full of officials with Asian and African names ?

Why is anyone who highlights these uncomfortable truths called a racist ?

3) I am immensely proud of the UK benefits system and pleased that my taxes go to pay for it. Where I am angry is when I see it being used to prop up those who have chosen fraud and laziness as a lifestyle and who defend themselves with accusations of racism.

-

7

7

-

- Popular Post

- Popular Post

Oxx: The benefits system is too elaborate and too generous. There are many countries who don't have such a generous benefits system yet their populations don't starve. People of working age, of sound mind and physically fit should not be the recipients of long term benefits. It isn't the Government who pays for these benefits it is we the taxpayers who have provided for our own future, through careful planning and hard work, and who are then made to support the feckless and the lazy through paying an onerous level of taxation.Our overly generous benefits system is one of the strongest pull factors in encouraging unwanted and often illegal migration to the UK. Look at the size of the typical immigrant family in the UK and ponder the demands they put on our schools and hospitals, all paid for out of taxation. The first priority of any country is to first look after its own people.

-

6

6

-

- Popular Post

- Popular Post

2 hours ago, bert bloggs said:no they get social security instead and if your lucky a million pound apartment in Kensington , if not just an ordinary free flat in London or wherever .

Thats the problem with a system that pays pensions to those who have made NI contributions and pays benefits to those who have not.

-

8

8

-

8 minutes ago, dexjnr555 said:

Do Arabs get UK pension too?

Sent from my Pixel using Thailand Forum - Thaivisa mobile app

8 minutes ago, dexjnr555 said:

Do Arabs get UK pension too?

Sent from my Pixel using Thailand Forum - Thaivisa mobile app

Only if they have paid the requisite number of National Insurance contributions.

-

1

1

-

UK pensions

in Home Country Forum

Posted

Game, set and match I believe.