- Popular Post

JB300

-

Posts

1,624 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by JB300

-

-

- Popular Post

- Popular Post

Julius Caesar walks into a bar & orders a Martinus... Bar tender says "Don't you mean a Martini", Julius replies "If I wanted a double I would have ordered one"

-

3

3

-

- Popular Post

- Popular Post

The Past, Future & Present walked into a bar. Things got a little Tense

-

4

4

-

I live alone so all the money I make is mine, MINE, MINE!!!

Money is worthless without women.

Money becomes worthless with women

Men are worthless to women without money...

-

I went to the US Consulate in Chiang Mai at the end of May of this year to get a "pension letter" from them to give to immigration. I went to some trouble to get the documents from my pension fund. I filled out a form and tried three times to show my "proof".

They never once looked at it. I just had to swear an oath and pay them $50.00.

God bless America!

I think there's a big difference between the UK & U.S. when it comes to "Evidence", but that's probably for another thread

Lol, joking aside, it seems the U.S. accepts the word of it's citizens to be good enough, whereas the UK wants to see "Evidence" as they don't trust those Limey/Pomme chancers...

[bTW, I'm a Brit (English) before anybody has a go at me for having a go at them/us]

-

1

1

-

-

I won't have any retirement pension as this is for the lucky baby boomers.

instead I have stocks and bonds but as it can become zero income in case of a economic crash or war , how can i prove I have some income?

I didn't think you could use income from stocks as, for the reason you've given, it isn't "Regular", so I think you need to go down the 800k in the bank route.

-

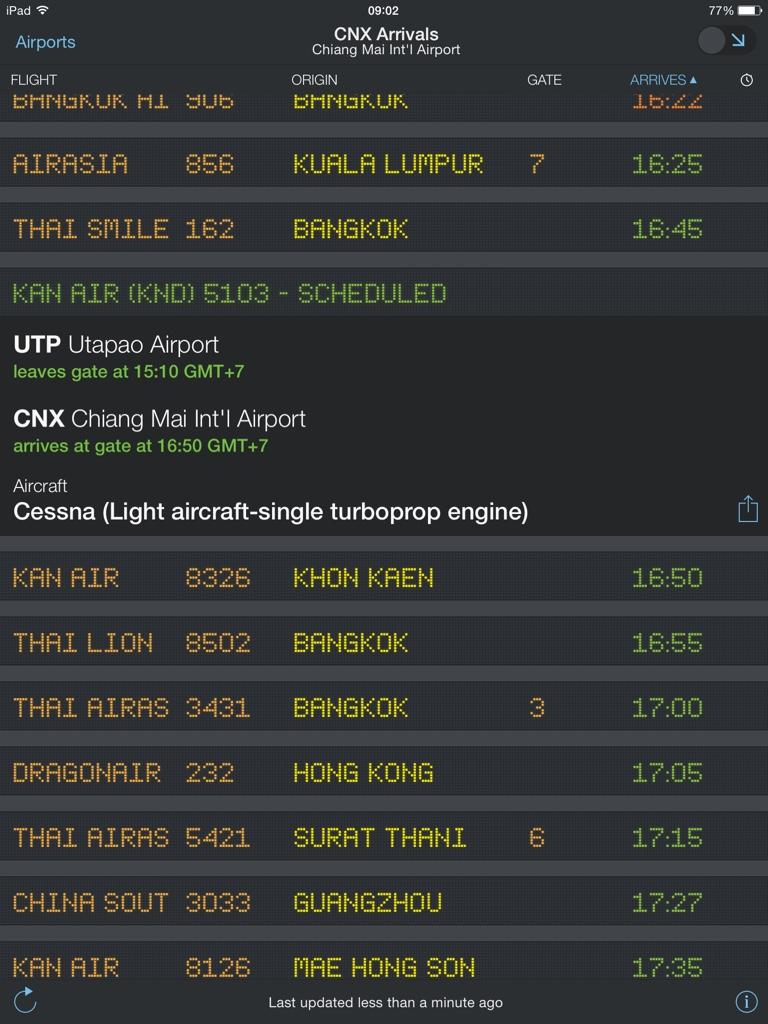

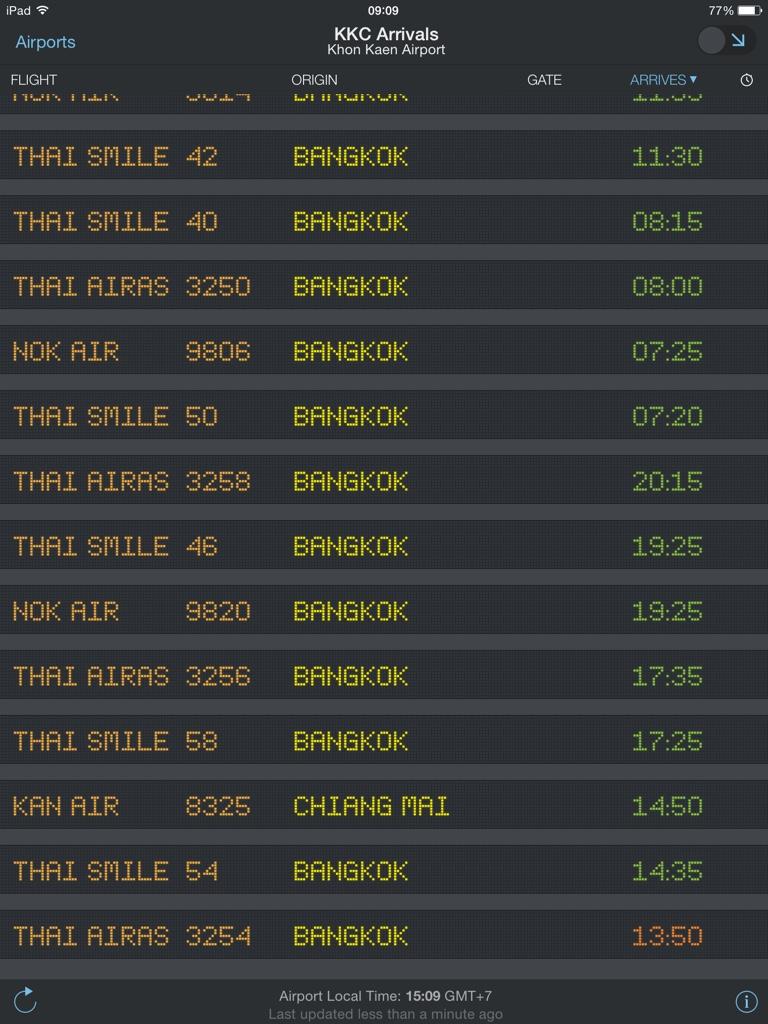

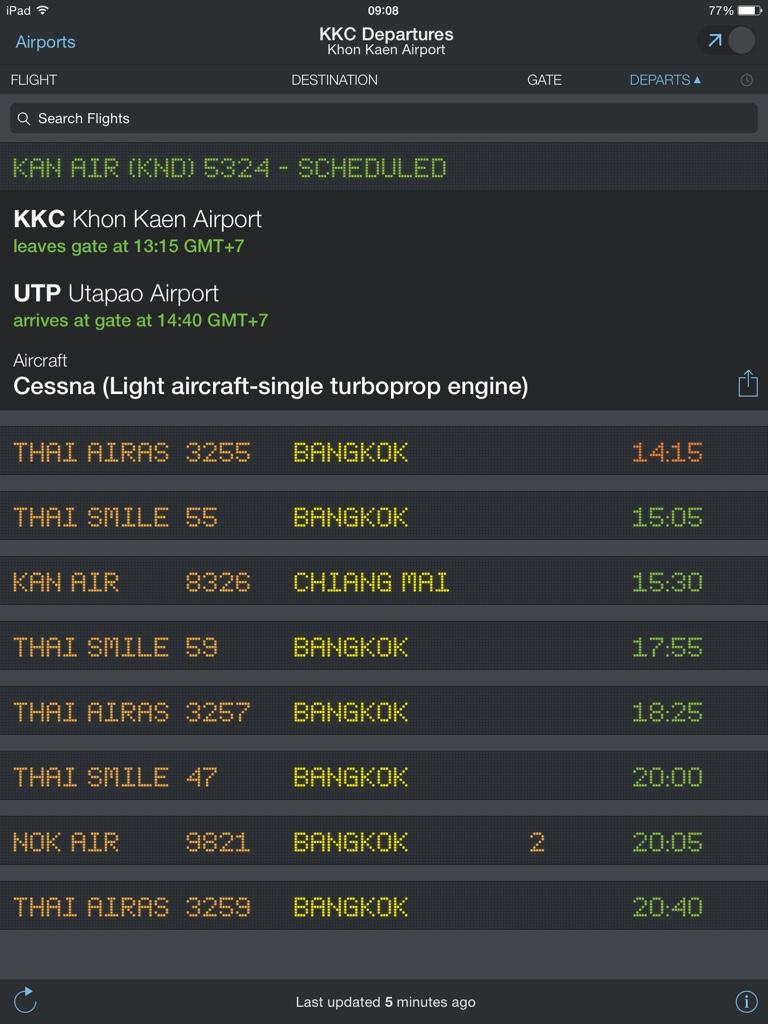

Yep, per my edited post above, I agree with you that the app is wrong & they're not flying out of UTP anymore.To answer my own question:

on the usual flight status sites you also see outdated flight info with status "unknown" (http://www.flightstats.com).

They didn't even manage to get their cancelled flights out of the databases

many such apps, including flightstats, are outdated and still show "phanthom-flights" that have been discontinued long ago

Shame really as the Apps are very useful (I also use FlightRadar24) but it seems for the more obscure Airlines/Airports, you need to double/triple check.

Would still recommend both apps (especially FlightRadar24 if current flight status is important/of interest to you).

-

To answer my own question:

on the usual flight status sites you also see outdated flight info with status "unknown" (http://www.flightstats.com).

They didn't even manage to get their cancelled flights out of the databases

Yep, per my edited post above, I agree with you that the app is wrong & they're not flying out of UTP anymore.

-

App is called FlightBoard & is usually very accurate, but if they've got it wrong,they've also got the corresponding arrivals wrong at CNX

Though no arrival at KKC...

Though they're still showing a departure from KKC...

I'm in agreement with you, App is wrong & Kan Air are not flying to/from UTP anymore...

-

-

As the OP has stated that they don't have an income to cover the 65,000 THB requirement (which is obviously less than the £1,550 UK requirement), if he doesn't have £62,500 in savings, he'll be doing a lot of extensions unless he brings his wife back via the EU route.When you get to the point of doing extensions instead of getting new visas, immigration prefers that you extend for retirement if you qualify.

The OP stated that he didn't want to "officially" retire to Thailand - meaning that the question of extensions probably won't arise in his case.

-

Had the same in the uk, not being able to travel long haul even if passport is valid for the entire trip think its a bloody liberty, so basically everybody has lost 5 % of the length of the passport x.that by ?? No' s of passport holders and cost and u are talking a shed load of money. Bloody daylight robbery

rijit

You don't lose anytime as you're credited up to 9 months if you renew the passport early...

E.g. I renewed my passport last Year after only having it for a couple of years (Was full of visas as I was doing a lot of traveling with work), the issue date of my new passport is October 2014 & the expiry date is July 2025... So it's valid for 10 years & 9 months (though I'm 12 pages in already so am expecting it to last closer to 4 years

).

). -

An interesting proposition. But the huge downside is if similar things pop up or this deal goes sour. Then, all Elite Visas including those done separate from this scheme may get reviewed, changed, canceled, or who knows what. Typical of Thailand, one things gets copied over and over until it becomes no good. This has many bad potential affects for Existing Elite Visa holders

Can you cite an example or 2 of Thailand materially changing the T&Cs of an existing visa?

-

I've asked this question before but didn't get any replies, does anybody have any experience/comments to make about learning a non-Thai language at Walen (I'm especially interested in any thoughts about learning Chinese/Mandarin there).

-

You won't get anyone here to admit that that there is no visa for you. The Thailand Elite is a waste of money and could be reset at any moment like its last incarnation.

Don't talk BS. It can be stopped as anything can, but who has bought will continue to use it for as long it has paid for. Thailand has not interest in getting into a loosing battle for petty money.

I may be mistaken (I often am) but I seem to remember the 1 time the Thailand Elite Visa got "Suspended", the threat/worry of civil action against the Department that issued them was enough to get things back to normal in weeks rather than months....

Would also point out that any changes to other Visa Classes (e.g. Increase to minimum bank balance for Retirement "Visas" (extensions of stay for the pedants) have Grandfathered existing users rights, so for me, Thailand has a good track record of honoring what people have signed up for...

Cue the flames

-

Foreign quota is calculated per building and not per project.

I had assumed it was the whole of the development as you can have "Condos" that include some villas which can be owned in a foreign name but will confess I've never actively looked to confirm this so if I'm wrong then I've learnt something new

Edit: seems it's not even the number of units, it's the size "Foreigners may only own 49% of a single condo development. This is calculated based on the area of the condo units. The total area of the condo units owned by foreigners cannot exceed 49% of the total area of all saleable condo units."... http://usa.siam-legal.com/property-thailand/buying-condo-thailand.php

But with language as wooly as "single condo development" (which to me is everything that's part of the same named condo), it's hard to work out what's what...

-

^^^ slight correction, 183 days in the UK is the "Magic Number" (leaving 182 outside, assuming not a leap year) & if it's anything like where you are for Tax purposes, it's where you are at midnight that counts (I know guys who would land in UK at 11:30 & hang around airside until past midnight so it wouldn't count as a day in the UK).

-

1

1

-

-

You've lost me a little bit as the 49% quota applies to the 665 units, not per building, so let's call this 330 units available in a foreign name, if every single one of the 234 units sold has already gone to a foreigner then there's still 96 available.Ok, for the last time, I don't think Southpoint is 70% sold--at least not the building that is available for individual condo sales. And, there should be foreign quota available. For simplicity, let's say a developer is building 2 buildings, each with 500 condos each. Building A is completely sold to one buyer to use as apartments or a hotel. The condo developer can say that the condo development is '50% sold!!!', which is technically true, but in reality he has not sold 1 condo in Building B, the one individuals are buying into. Saying 50% of the condos are sold gives the impression of success but Building B has 0 buyers. In the case of Southpoint, I think the building that was sold to one buyer for apartment or hotel use was probably sold in Thai name. If that is the case, there should still be foreign quota condos available in the building being marketed to individual buyers. Several condos, such as Amari, are selling part of the condo to a hotel in Thai name as that allows them to sell more of the remaining condos in foreign name.

For the last time, Southpoint mailed me that 70% of the project is sold, so you consider they are lying about that figure but not about other things like for instance the Elite Visa?

To put the figures straight.

There are 2 buildings, with building one 431 units and building two 224 units for a total of 665 units

If 70% is sold as they claim that mean 458 units sold, from which 224 in building 2 so leaving 234 units sold in building 1.

To me 234 is more than the allowed 49% foreign quota of 431 units.

You gonna claim now that all those 234 units are sold to Thais?

-

Another alternative is to split your time across different countries. E.g. easy (& cheap) to stay for a month or 2 in Bali, where you can get a triple-entry Tourist Visa (you'll need confirmed flights out of Thailand for when you want to activate the next entry at approx 90 & 180 days) to last you 9 months then rinse & repeat.

Or go to Malaysia where you'll probably (don't know your nationality) get 90 days visa exempt, Penang (not KL) for a double-entry Tourist Visa (good for 6 months with no confirmed flights required) and again, rinse & repeat.

Or Vietnam, Cambodia, Philippines... The worlds your oyster...

-

Oulaaaa, now it is you, Anthony, who seem to not want to react to my reply (to your trolling).Elite visa holders are queuing more than any other visa holders.

But of course the main advantage of having a retirement visa is that for your 90 day reports, you don't have to travel to the Elite office 8 times a year. 4 times to bring your passport and another 4 times to go pick up your passport.You do it all online from the convenience of your own desk while posting on Thaivisa.

I have the 5-year TE card, I made a short single visit to Elite offices once when I first made my application. After that, I have been required to go to the local police office for a 3-month stamp. I show the Officer my elite card and passport, he inserts a piece of paper with the date of my next 3-month stamp. There is no fee for this stamp. They do not keep my passport. There are no eight trips anywhere. Just one short local trip every 3 months, and no leaving/collecting passports.

When going to the main immigration, you are escorted by a friendly TE staff member, who does the paperwork on your behalf and fast-tracks you as much as possible to avoid waiting.

So I make 4 trips a year, and never leave my passport with anyone. It is very easy, especially after trying all the alternatives for many years. I am posting this because I am very happy with this service, and because you are bold-red writing things which have never happened to me in my time as a TE card holder.

Congratulations, you have been able to reduce the number of 8 to only 4 trips. Did you notice that I with my retirement extension make only 1 trip a year, and don't have to wait for anyone to escort me?

Thailand Elite members CAN do the 90 day report online.

I am sure that this is making you happy and will make today be a bright and highly positive day

To summarize the great Kingdom Property promotion.

You buy a condo at the Pattaya development concerned, in the price you get a 20 years full Thailand Elite membership, which allows you benefit of highly convenient long term PE visas, 1 year stamps, warm welcome in the country, no immigration queues, and much more... Including the online 90 day report, which was discussed by Anthony (who mislead readers with wrong facts). Great promotion.

If I was in need of a comfortable visa, I would think about buying one of these condos, get the PE visa, and then rent out the condo... That could be interesting.

You should tell Yunla that, not me, since he is a elite member and wasn't informed by the so helpful elite staff that he could do his reports online.

So the so generous Elite staff force a disabled elite member to travel to the police station for his 90 day reports, while he could do them online?

I think that is very cruel from the

charmingelite staff.In fairness online reporting only came in on 1st April (no joke) & even then wasn't available countrywide so it could be that both are true with Yunla having had to visit the office in person when doing his last report but online reporting for TE holders is now available so won't need to go for his next one (would be interesting Yunla if you could call TE & confirm this personally).

Back to the Condos themselves, one of the benefits of bundling a TE visa in with them is that the criminal background checks on TE visa & higher unit price should deter some of the people you'd rather not have as your neighbor & hopefully raise the overall "Tone" of the complex.

Not being "Elitist" (no pun intended) here, just stating a fact that where you have an area of expensive housing, you generally have a better neighborhood.

Edit: Just to add, it's this last point that's of most interest to me, but as things stand I wouldn't buy into this complex until there was clear evidence that it was going to complete, until then that (& not the TE component) is the biggest risk/scam...

-

Better reflect on the next 12 billion pound reduction mini budget next month,with more than a slight hint at pensioners. My guessing the tax free allowance for overseas client be it in EU or anywhere is finishing.

The frozen pension issue is so far dead and buried it is not worth even considering for a decade or two

Old age pensions should (but are not) given out universally,no strings attached,where one lives is no concern to the govt.Of course they want to stick their nose in,up to them,they get different answers to different questions.

And how spectacularly wrong the doomsters got it,they always have been.....don't ask,look it up, read it yourselves LOL

I think scrapping the tax free allowance for pensioners living outside of the UK would be strongly challenged as discriminatory and a violation of human rights. They would have to introduce legislation to include in an Act first.

It may be one of their considerations, but it's a no goer in my opinion.

They have much easier targets to aim at for additional savings.

Scrapping of Personal Allowance for expats was considered as part of last years full budget & rejected in last years Autumn budget (http://www.telegraph.co.uk/finance/personalfinance/expat-money/11272572/Expats-will-keep-their-tax-break.html)so I can't (touch wood) see them announcing that it's being scrapped in the next one.

Even if they did do it, it's likely that they would stick with the "Strong economic Ties to the UK" exemption of being a "UK resident for Tax purposes", which a lot of OAPs probably are.

-

1

1

-

-

I only used to spend s$8,000 (approx $6,000US / 200,000 THB ) when I lived in Singapore & 1/2 that was for rent, so my budget for Thailand (as a single guy who likes to travel around) is 1/2 that at 100,000 THB (or 105,542 THB to be precise

Being expensive is the least of your issues. You might want to work on that vanity affliction you possess. But on the other hand, say hey, whatever flips your fern.It's expensive to be me. I have a personal trainer 2x every day... yoga stretching after swim and strength training in the afternoon. I download books. I read one every day. I don't care about cheese and wine but I eat out one meal per day. I get a massage almost every day. My puppy has her groomer once a week. I have a maid and a gardener 2x per week. If you add HOA and lawyer fees I spend $5,000 US every month.I am not counting rent. I scuba dive so that costs money to get a dog sitter, fly to Phuket and take a boat. If this is your life style, you save on food and trainers but spend on air fare.

I don't spend $5,000 per month at my home in the US. And when living at my home in Thailand it is far less as food is far less expensive, and I rarely eat anything apart from Thai food and only drink Thai booze with soda water. I reckon I live comfortably for just under $1,200 per month. And that is including my housing and vehicle costs extended over time as well.

).

).Edit: Echo the comments about having an emergency nest egg so have a reasonable amount of money stashed away in my bank account in Singapore for a rainy day & help offset some of the currency risk with my income currency (GBP £)

-

Thailand Elite still hasn't responded to my email asking for clarification on what they consider to be "property" (with regards to the Thailand Individual Membership for Property Co-Project - http://www.thailandelite.com/factsheet/Property%20Co-Project_Factsheet_English.pdf program option).

Somehow I don't think I'll ever actually get an answer any ways.

So according to this article, it looks like they are selling 2 million baht condos (their cheapest units) for 3 million and including the TE card (with it's 1 million baht membership fee) in the price. It also sounds like they have either agreed to pay the 20,000 baht annual fee or have made a deal with TE to have it waived (most likely it will be recouped through the condo maintenance fees).

(Remember - the "Thailand Individual Membership for Property Co-Project" option is only a 1 million baht membership fee.)

2 million baht for a 30 sqm studio condo plus 1 mil more for the TE card. (Add in whatever the monthly/yearly condo maintenance fees will be.)

Hmmmm, 2 bedroom house (128 sqm) on the Darkside - 1.5 mil. Throw in another 500k for the "Easy Access" TE card. Put the extra mil in the bank - should be able to earn enough interest to easily cover the 20k annual fee.

(Of course the difference is you probably can get the condo in your name, unlike the house, as long as the 49% rule hasn't been reached yet.)

There isn't an annual fee for the 500k/5 year Easy Access card

-

Really? Can you come with me to immigration & tell them that only last time I tried they had this irksome little requirement about being over 50 or something but I'm sure that you can put them straight on this minor little detail.

If you leave 800 kb in a Thai bank and get a new visa (or extension of stay) every year, you could save lots of THB. Up to everyone if he prefers to get around the lazy way.Gerry 1011 wrote:

>>To come back to the subject, I don't think that any Thailand Elite member on this forum has ever said anything negative about the program.

Great program and interesting offer from the developer... <<

In the post you replied to, this Elite Card member wrote: A complete waste of money............

Just a little negative ?? Or ??

-

Just to be perfectly clear, do you need to report every 90 days w a TE Easy Access?

Yes, of course you do, every foreigner in Thailand does this. If you're in Bangkok there's a TE service where they will do it for you but it still gets done every 90 days.

If you enter Thailand on any kind of visa and are staying longer than 90 days then you or someone operating on your behalf needs to do a 90 day report or there will be a fine.

Not true! You can enter on a 60 day multiple entry and stay longer than 90 days without reporting.

How exactly??? Since every other Visa class needs to report at (the latest) 90 days?

Worst Joke Ever

in Jokes - Puzzles and Riddles - Make My Day!

Posted

Descartes walks into a bar & the bartender asks "Weren't you in here last night, wearing a pink tutu & high heels".

Descartes looks down his nose in disgust & says "I think not" & whoosh... Disappears...