JB300

-

Posts

1,624 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by JB300

-

-

My apologies to the other people watching this thread for having contributed to irrelevant posts being added, and also for posting my latest dividend, that was inappropriate.

Hopefully the next posts will (again) be about JAS/JASIF — I’ll be sure to revisit the company in the future, cause it will be interesting to see how the 4G adventure turns out.

As for the 33% dilution of the stock, they say that what everyone knows is already in the price, so probably the stock won’t suffer too much, it might even go up a little, once the uncertainty has been lifted.

WT, quick question, if the warrants are being offered on a basis of 2 (& a little bit) for 1, isn't that a dilution of 50%???

I.e let's say there's 200 (& a bit) shares in circulation & 100 shares issued under warrant, the net result is that there would be 50% (100) more Shares in circulation than there were before.

EDIT: Apologies, I just realized that you might have been "short circuiting" the "Maths", by taking into account the 35% discount you would get a dilution of somewhere between 31-33%...

-

Meaning???It is interesting to notice that topics in which I make a few posting turn usually to HOT topics. I think that is a good sign.

I actually take offense at the implication, but carry on in LaLa land if that's what floats your boat...

Several posts in this thread have offered a reasoned opinion, your's have been "I am rubber, you are Glue" so carry on promoting your investment course in that manner...

Edit:summary of the last 3 Mac posts....

-

But that feels more like speculating than investing...

They could be right but the JAS stock was up over 4% again today. Perhaps the stock does not know about that SELL recommendation. Hm..., time will tell if trader boys are right, they could be, sometimes they get it right. Mostly they get it wrong. If it went back to 9 baht what would they say? It might.

"Trade/Sell"feels the right call on this one...

Investors are not selling. Just trader boys do. All the way to financial death as is usually the case with most trader boys.it seems the investors who sell JAS are fairly rational.

From http://inv4.asiaplus.co.th/web_research/doc/2015/03/JAS150320.pdf

Jasmine International

1 unit of JAS-W3 for 2.04 shares of JAS

The Board of Directors’ Meeting No. 3/2015 of JAS approved the issuance and allocation of up to 3,497 million units of JAS-W3 Warrants to the existing shareholders in proportion to their shareholding at a ratio of 2.04 ordinary shares of JAS for one unit of JAS-W3 Warrant. In this regard, the unit price of JAS-W3 Warrant is B0; the term of the warrants is five years from the issuance date; the exercise period is the last business day of each quarter (the first exercise date is the last business day of the first quarter following the issuance date of JAS-W3 Warrants). The conversion exercise ratio is one unit of JAS-W3 Warrant for one ordinary share of JAS at an exercise price of B4.30/share. JAS is going XW on June 25, 2015.

High dilution. New business unlikely to generate profit promptly

It is very likely that shareholders who are given JAS-W3 Warrants will exercise their conversion rights since the first year (probably 3Q15) because the exercise price is 35% lower than the market price of JAS. Based on a conservative assumption that JAS-W3 Warrants are entirely converted in the first year, there will be a dilution effect of 33% while JAS will gain B15bn for investing in a new business, 4G mobile service, which may be a joint venture with overseas partner (under a negotiation process now), hoping to encourage JAS home internet and mobile internet use and rival an integrated service of ADVANC and TRUE. However, we have a negative view on the strategy. Since a mobile business will need massive investments for nationwide network expansion and license bidding, JAS will have high fixed expenses in early years of operation. Furthermore, the company will be able to generate add-on revenue only from its existing customers (while it has to compete with other mobile operators in the market to seek new subscribers). Accordingly, we believe JAS would face massive loss at the beginning of the business. We are likely to revise down our profit forecast when JAS’s business plan is clear. Yet, JAS is ready for the new business in terms of investments, given its net cash after JASIF establishment and increasing capital from JAS-W3 Warrants conversion.

Sell when price rebounds

Earnings in the long run can be dampened by the mobile business, which is already dominated by three major players. In addition, new fair value in case that JAS-W3 Warrants are entirely converted in 2015 is B6.3. Accordingly, we downgrade our recommendation to SELL. The fair value has still not included B1.29/share theoretical value of JAS-W3 Warrants; there can be speculation in the short term. The share price may also rebound after falling sharply yesterday because JAS has explained that it would decrease its paid-up capital from 142.7 million repurchased shares and would not sell the repurchased shares to the market as concerned. Nevertheless, due to changes in fundamental factors, we recommend selling JAS when the price rebounds.

From my (very) brief & limited research

As a Speculator, I might be interested as I know that if I bought shares now...

1) They're reasonably low in price to what they have been previously.

2) I get the "Right" on 25th June to increase my holding by almost 50% at a 35% discount (Rights Issues being one of my favorite "Punt" signals & interests me more than a seemingly low stock price).

3)The point about the joint-venture with an overseas telecom is interesting as this could lead to a buy out (of the 4G infrastructure/licenses) at some point which would see a sharp increase in the price (I can't see this happening, but you never know).

However, as an Investor, I'd be concerned about...

1) The Company has already raised capital once so not only is it not the same Company as it was when the share price was higher (holdings have been diluted) it doesn't seem to have done what was expected with the proceeds (buy back & cancel shares to reduce the dilution) but seems to have used it to prop-up its dividend (in itself a worrying sign)

2) The 2nd raising of capital (another red flag) is to be invested in infra/licenses that are going to take years (of low returns/dividends) to payback & at best put them where their competitors are today, during which time they will struggle to attract new customers (not having a 4G offering) and probably lose some to the competition.

As I said, I've only (very very) briefly looked into the Company & there's no doubt a lot that I don't know about, but the red flags above would be enough for me to pass on investing or speculating in it

Good Luck, will be interesting to see what happens to the stock price around the ex-warrant date (25th June) & the date the warrants 1st become exercisable.

-

"Trade/Sell"feels the right call on this one...

Investors are not selling. Just trader boys do. All the way to financial death as is usually the case with most trader boys.it seems the investors who sell JAS are fairly rational.

From http://inv4.asiaplus.co.th/web_research/doc/2015/03/JAS150320.pdf

Jasmine International

1 unit of JAS-W3 for 2.04 shares of JAS

The Board of Directors’ Meeting No. 3/2015 of JAS approved the issuance and allocation of up to 3,497 million units of JAS-W3 Warrants to the existing shareholders in proportion to their shareholding at a ratio of 2.04 ordinary shares of JAS for one unit of JAS-W3 Warrant. In this regard, the unit price of JAS-W3 Warrant is B0; the term of the warrants is five years from the issuance date; the exercise period is the last business day of each quarter (the first exercise date is the last business day of the first quarter following the issuance date of JAS-W3 Warrants). The conversion exercise ratio is one unit of JAS-W3 Warrant for one ordinary share of JAS at an exercise price of B4.30/share. JAS is going XW on June 25, 2015.

High dilution. New business unlikely to generate profit promptly

It is very likely that shareholders who are given JAS-W3 Warrants will exercise their conversion rights since the first year (probably 3Q15) because the exercise price is 35% lower than the market price of JAS. Based on a conservative assumption that JAS-W3 Warrants are entirely converted in the first year, there will be a dilution effect of 33% while JAS will gain B15bn for investing in a new business, 4G mobile service, which may be a joint venture with overseas partner (under a negotiation process now), hoping to encourage JAS home internet and mobile internet use and rival an integrated service of ADVANC and TRUE. However, we have a negative view on the strategy. Since a mobile business will need massive investments for nationwide network expansion and license bidding, JAS will have high fixed expenses in early years of operation. Furthermore, the company will be able to generate add-on revenue only from its existing customers (while it has to compete with other mobile operators in the market to seek new subscribers). Accordingly, we believe JAS would face massive loss at the beginning of the business. We are likely to revise down our profit forecast when JAS’s business plan is clear. Yet, JAS is ready for the new business in terms of investments, given its net cash after JASIF establishment and increasing capital from JAS-W3 Warrants conversion.

Sell when price rebounds

Earnings in the long run can be dampened by the mobile business, which is already dominated by three major players. In addition, new fair value in case that JAS-W3 Warrants are entirely converted in 2015 is B6.3. Accordingly, we downgrade our recommendation to SELL. The fair value has still not included B1.29/share theoretical value of JAS-W3 Warrants; there can be speculation in the short term. The share price may also rebound after falling sharply yesterday because JAS has explained that it would decrease its paid-up capital from 142.7 million repurchased shares and would not sell the repurchased shares to the market as concerned. Nevertheless, due to changes in fundamental factors, we recommend selling JAS when the price rebounds.

-

Have just read in the DM that the UK spends £5Billion pa on benefits for Migrants, £30Million of which is Child Benefits for migrants children living overseas & I'll bet that that's not "Frozen"

JB300, you'll never pass as a child migrant, so don't even go there.

It's your pubic hairs that give your age away.

Lol, those & the grey chest hairs... A (full body) shave might be in order

-

Turns out 12bn of the Q1 profit came from selling their fiber (they will now lease it from JASIF)

So I guess that could explain where the generous dividend came from, but what about the next one?

-

Have just read in the DM that the UK spends £5Billion pa on benefits for Migrants, £30Million of which is Child Benefits for migrants children living overseas & I'll bet that that's not "Frozen"

-

OP why limited yourself to Thailand?

Look for opportunities in Singapore, Hong Kong, Tokyo etc... Earn a 1st World salary & visit Thailand as often as you like...

[Yes more expensive to live in than Thailand but more higher paying careers & (certainly in the case of Singapore) much lower tax]

Finance/IT would be good disciplines to go for, if these don't float your boat then look into Oil & Gas, it's going through a tough patch at the moment but will bounce back & those guys seem to have a great lifestyle plus earn a reasonable amount of money.

-

Under Thai Tax Laws only income received in Thailand from employment Overseas is taxable.

Pensions from overseas are not employment related and are not subject to taxation

Are you sure about that? I thought it was taxable unless you waited until the following year to bring it into the country.

Not that they'd know/be able to find out but just trying to confirm my understanding.

-

1

1

-

-

1 If it's a "House" it would need to be in a Company or Thai Citizen name, good luck getting a mortgage in either case, if you do find one that's "Zero Down" can you please give me 6 numbers for next weeks lottery.

It may be a bad idea but it's done throughout the world ! Zero down is everywhere I'm afraid ! In a country that has rules designed for foreigners not to own housing/land and you are sceptical about your teeraks feelings for you , the sensible man would get a mortgage that she couldn't afford ! It's a win win , you get pride of ownership without a large layout and if the relationship goes south you keep the house .

a bad idea is to think you can get a mortgage in Thailand (and most other countries) with less than 25% down. keep on dreaming!10 years would shorten the interest paid on the loan . I can't see why putting 25% down on the place would be a good idea ? If you can't own the thing you may as well get a mortgage ,if it's possible ?? ... If you're missus plays up just saddle her with the debt [emoji6]

2 You wouldn't get to "Keep The House" unless you carried on paying the mortgage... Same Same no matter what darling terrak does.

3 If it's a Condo, no chance of getting "Zero Down" (minimum 10-15%) but again, dark-ling terrak doesn't come into play... Unless you buy it in joint names, then the bank will still come after you for the cash...

-

Meanwhile, back towards the original topic (apologies as I know this is slightly off the original question asked by the OP)...

Any recommendations where to stay within the centre of Chiang Mai? Looking to maybe spend a year or 2 there to see what it's like & don't want to have to own/rent a car or a bike.

Want to be close to the restaurants, shops, bars etc... & either somewhere with a reasonable gym or somewhere close to one.

Any suggestions of areas with example Condos greatly appreciated...

Thanks

JB

-

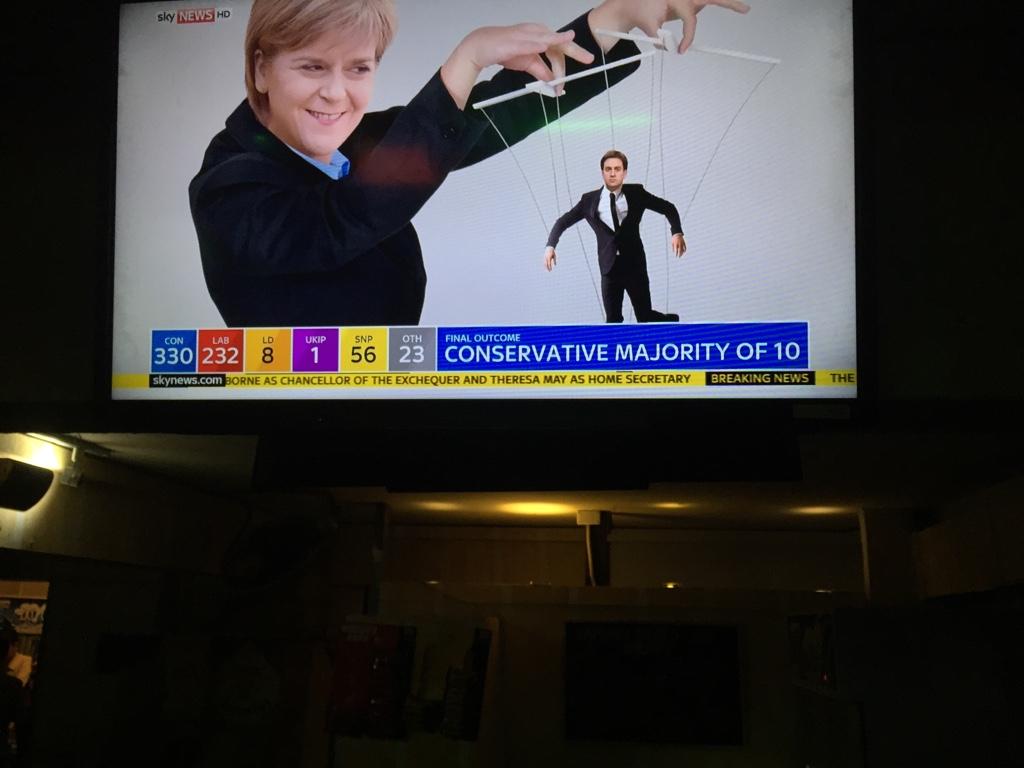

So which of the other boxes are wrong as it adds up to 650?

Ahhh... Must be the 1 UKIP Vote [emoji15]

Edit:Sorry the above was in response to Kurt's post

#UKRules: that's what I'm claiming but sky still have the Tories at 330, even if the Speaker of the House was excluded, they'd still have a Majority of 11 (He'd be excluded from both sides)

-

Thanks fella, but I asked a pretty simple question (the answer to which the BBC & Sky don't seem to be able to agree upon).....

Can anybody give me a simple... 330 or 331 answer ( yes I have a bet on the Tories scoring #more# than a 10 majority) or point me at the official results (Google brings just brings back the rags...)

-

-

Long overdue and there should be another 10 to 20% to come. The sad part as a saver (my curse to bear as I did not enjoy my money during my productive years. I should have spent it and could now run to the bank and borrow money for almost nothing) I will loose out as the banks here will hammer interest rates. Thailand has finally joined the currency race to the bottom. Its more than just currency racing to the bottom its morale values as well.From April 30 to this morning the baht has taken a hammering.

All the more reason to take the measly return we get nowadays & enjoy it all the more [emoji106][emoji106][emoji106]

-

I can't help but think exercise of this duration and freuency is in fact more likely to cause ill health. For one thing it will lower immunity and for another cause repetitive stress injury.

You are correct that there are risk of injuries, but it's not because of the load of those exercices, it's related to how much time you give your body to be able to handle it.

...

Ok. I assumed you were running for 3-4 hours a time, a few times a week. I see now you mean 3-4 hours a week. Yes, there are no implications here.

I meet one guy who has been running that long (3-4H/day) and that frequently for a long time, but weight was definitely not an issue for him.

He was preparing for a big challenge, crossing the USA from West to East Coast, running on average 66KM per day.

Amazing what you can do with your body.

Obviously, not recommended for everyone. It takes years of practice and preparation to be ready for such challenge.

Wow!!!

I've seen documentaries on "The Marathon Monk" & remember Eddie Izzard (more known for wearing a skirt/heels than for being particularly athletic/fit) running a number of consecutive 26 Mile/42KM marathons (quick Google shows it was 43 over 51 days http://news.bbc.co.uk/2/hi/8256589.stm) but to run 66KM is like running 1 1/2 Marathons a day & to be able to keep it going over approx 4,800KM is amazing!!!

-

no never been stupid with money, wont be buying a lady a house here any time soon, lol, i was told (not officially) that i could not top up my prem bonds or get an ISA as i would be classed as a non-uk resident, any thoughts on this please, i do have a uk address, where mail is sent to, ? do they know where i live ?? Halifax might be suspicious as i send money from my current account to Thailand ??? thanks

Correct, you cannot add additional funds into an ISA if you're a non-UK resident for tax purposes.

Whether you choose to ignore this or not is up to you, personally I "Follow the Rules" even though my ISA Provider writes to me every year encouraging me to top-up... Including the disclaimer in the small print that says I can't :|

-

25+ trips here over the past 6 1/2 years living in Singapore & still trying to work out why I love coming to Thailand so much, I know it can't be 100% down to the women as I actually prefer Fillipinas...

Left Singapore at the end of Feb on a "Study Tour of Asia" to see where I do want to relocate too, 6 weeks in Malaysia was a bit dull but 3rd week in Thailand & still have a huge grin on my face

Next stop 2 weeks in the Philippines to see the gf (well it is our 5 year anniversary & she's none too pleased about my plans), then on to Bali for 4 weeks which although another place I love, I know I'll be itching to get back to Thailand.

-

It is usually always possible to open a Thai bank account somewhere in a bigger city like Pattaya anyway where there are so many branches and so many are foreigner friendly. The OP has stated he is already sorted with a Thai bank account. He would want to bring current proof of his balance (bankbook, etc.) to the Thai embassy or consulate. Not sure if he would need an immigration letter from the bank as we get for bank balances to show Thai immigration in Thailand though.

...Snip...

3. - Go to Thai embassy in Laos or the consulate in Malaysia and apply for a single entry O visa based on intent to get a retirement extension in Thailand, assuming over 50 by that time. Evidence of financial qualification showing of the Thai bank account will be needed. If trying this, post questions here for specific advice on that.

This is the part that confuses me, how can you evidence money in a Thai bank account before you get the long term visa that enables you to open one?

Yes I know you used to be able to open accounts on Visa Exempt & maybe some branches will still let you, but assuming you're outside of Thailand with no Thai account (& no income but more than enough in non-Thai accounts to meet the 800k THB ) & looking to go through the retirement process, how do you meet the Financial requirements?

No you can't open a Thai bank account outside Thailand.

As far as timing for people arriving without a Thai bank account, they can arrive, open the account, then transfer the money in. The money seasoning rule for FIRST TIME extensions is two months, not three, so it can be done if rushed.

For the conversion step in Thailand (or at outside embassies) the money does not need to be seasoned yet ... the seasoning rule applies to the retirement EXTENSION applications.

So if I've understood correctly, you can get a Non-O for reasons of researching Retirement outside of Thailand without having a Thai bank account, then when you get to Thailand you open an account, seed the funds & convert to an extension of stay based on Retirement once these have been seasoned for 2 months.

-

...Snip...

3. - Go to Thai embassy in Laos or the consulate in Malaysia and apply for a single entry O visa based on intent to get a retirement extension in Thailand, assuming over 50 by that time. Evidence of financial qualification showing of the Thai bank account will be needed. If trying this, post questions here for specific advice on that.

This is the part that confuses me, how can you evidence money in a Thai bank account before you get the long term visa that enables you to open one?

Yes I know you used to be able to open accounts on Visa Exempt & maybe some branches will still let you, but assuming you're outside of Thailand with no Thai account (& no income but more than enough in non-Thai accounts to meet the 800k THB ) & looking to go through the retirement process, how do you meet the Financial requirements?

-

Interesting posts....I landed a few days ago and got pulled aside after the counter officer asked if I had visa and I said no. The senior officer asked why I come here a lot and what work do I do and why I not get a visa. My replies were my girlfriend lives here, I like it here, I don't want to get married and I work on a computer, the laptop and internet is my office, trading currency and stuff. She also asked how much cash I had on me and how much in my accounts, I said I was a millionaire in USD and showed her all my cards and Amex gold card and she laughed. I said I never had problems before with coming in and out of Thailand and never overstayed ever for 7 years....she said the law had changed from last year that on 30 day exempts then the person can only stay a maximum of 90 days per year. I totally exceeded that off course since for years I have been coming here, stay 30 days plus extension and then go HK or Tokyo or Singapore for a few weeks then come back and stay another 30 days plus extensions......

The officer was really nice though and she said ok I let you through this time but next time please get a visa. So now I don't know how easy it is to get tourist visa since my passport is full of stamps. Has anyone been in a similar situation like me and had no issues getting a tourist visa after all these exempt stamps that are only a few weeks apart? Or was I just unlucky with the immigration officer?

Last year I was seriously thinking about the 15k USD Thai Elite Card....I guess I have to take that option now? Or whatever options do I have if I don't want to get married and 10 years off retirement age? I really like it here!!

Was it not a little dodgy to tell the officer that you effectively had your office with you so could work from anywhere (including Thailand)!

-

The offical line is that taxes and bank levies are too high.

And of course there is the endemic corruption and continuing scandals.

Banking scandal: 'the rot was widespread, the corruption endemic'Last week's banking scandals demolished a convenient myth: that the banking crash was all the fault of a few colourful rogues like Fred the Shred of RBS and Adam Applegarth of Northern Rock. We have been reminded, instead, that the rot was far more widespread. Incompetence, corruption and greed have been endemic in British banking. The RBS/NatWest computer failure illustrated the incompetence. Millions of households and firms now have to clean up the mess caused by accidental missed payments, bounced cheques and cash shortages.

The Libor scandal demonstrated deeply corrupt practices at the heart of Barclays Capital, our leading investment bank, and at others too. The public cannot understand how a corporate fine – which will be passed on to customers and shareholders – begins to address the problem.

http://www.theguardian.com/commentisfree/2012/jun/30/vince-cable-banking-scandal-coalition

and dont forget all us travelers that have been swindled by the currency fixing,what about the USA giving some of the record $2.5billion they fined a german bank last week to us poor customers,who have been at the mercy of them -ankers.And if you were on the side benefiting from the FX rate fixing (which is just as likely as losing from it), will you be giving it back?

they fixed it for their benefit not ours.

I know but some individuals will also have benefitted from them keeping the $, ¥, £, € etc... artificially high/low.

-

I use a HRM (Heart Rate Monitor) watch on the treadmill when doing "Intensity" training, my routine is...

1 - 1 lap (250m) Warm up walk (I do warm up before this)

2 - 1 lap "Run" at 12kph

3 - Put treadmill on an 8 slope at 7.1kph & sprint (at 12kph) until Heart Rate goes over 170

4 - Walk (on an 8 slope) at 7.1Kph until heart rate drops below 160

5 - Repeat 3 & 4 until I've done 3km (plus the 1/5km warmup/"Run")

6 - Repeat 3 & 4 on the flat (sometimes, if I'm tired, I'll do it on a 1.5-2 slope as it feels easier) for another 3km

Though I quote figures for the Heart Rate, it's more a case the watch will blink Red when I exceed 170, Blue if I drop below 160 & Green the rest of the time so just need to keep an eye on what color is flashing.

P.S. Never been able to jog (bores the crap out of me) but used to be/am an avid walker so the "Sprint" & walk method has worked well for me over the years.

-

Or use a WIFI enabled one... http://www.sandisk.co.uk/products/wireless/flash-drive/The Air does not have enough ports and no slots for a CD - but you can get an external thingie that - natch - costs.....

Apple do not do anything that they can't soak you for.

Have you ever seen an Air? It's an ultrabook (thin, light, designed for maximum portability) - no-one buys an ultrabook to sit on a desk with a bunch of USB peripherals plugged in

If you are going to tether your notebook to a desk, buy a macbook or a macbook pro, which have more ports. Or, if you really don't need a portable, buy an iMac, Mac Mini or a Mac Pro.

Get the right tool for the job, as they say

All that said, what USB peripherals would you actually want to use with it?

It has a keyboard and mouse built right in, and if they aren't enough, go get bluetooth ones that are actually convenient to pack-up and unpack as you move. Buy a printer/scanner that supports Airprint and the only thing it ever needs to be connected to is power. For gaming, again just use bluetooth controllers. Maybe you want to use an external DAC? Well, here's the good news - all Apple's have awesome sound quality, so go ahead and sell it - or buy an AVR that supports Airplay and send the raw digital audio stream from your PC to it over wifi.

What are we down to now? Flash drives? Just plug it in to the supplied USB port

Best meal deals in town where they feed you well with quality under 300 baht?

in Pattaya

Posted

I've had a fair few decent meals at the Devonshire (Soi Lengkee) for around 200-250, typically British food (so doesn't really give a WOW factor, more comfort food) but very nice & within the budget mentioned

I love Korean food (in particular Beef Bibimbab), AKA (5th Floor, Central Festival Mall) do a decent one (IIRC, it's around 230Baht) & have extra chillies/sauce on the table to add more flavour (I love it really spicy, when I lived in sg, I used to buy the Korean Pepper Sauce & put it on everything I made ).

).