JB300

-

Posts

1,624 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by JB300

-

-

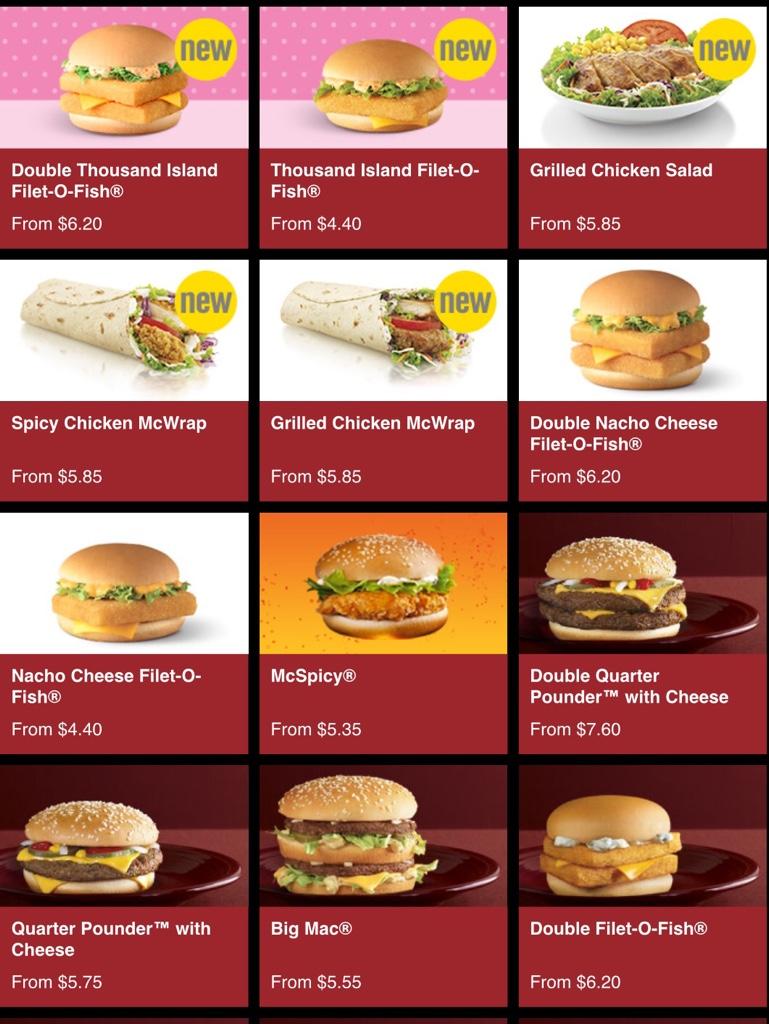

Couldn't agree more about Macdonalds, plenty of reasonably priced food options to eat that cr4p [emoji106][emoji106][emoji106]Don't seem to be able to attach an image to the above post so here it is...

Expensive and shetty taste. Even hawker centre foods are getting more expensive.

-

I thought 25% could be taken Tax Free or would this be added to your other income & so effectively taxed (if that takes you over the Personal Allowance).Without getting into the precise detail -- It would appear that there's very little advantage in cashing in a pension pot, unless you have some capacity in your personal allowances. But if you have a a pension pot worth talking about - maybe giving £4k per year - that's your allowances used. So if you cash in 15% of the pot -- say £5k - you'll get taxed on the £5k payout, and then the pension will pay less as well -- sounds like a lose-lose situation ?

Or am I not reading this correctly?

No..........The 25% tax free allowance is just that. Its NOT part of any annual income...............Its a "stand alone" tax free allowance for want of a better expression.

On an aside any tax you do pay on your pension pot can be reclaimed against your personal allowance IF THAT ALLOWANCE IS NOT COMPLETELY USED.......In my Case I will be able to use the entire £10,600 personal allowance as I have zero taxable income.......(my income comes from Spreads accounts which fall under the auspices of Gambling when it comes to taxation)

Thanks, that's my understanding also.... Let's hope it stays that way [emoji106][emoji106][emoji106]

-

-

Lol, don't know where you get your information from but it's tosh... Don't eat Macdonalds but know they're less than s$8 , don't smoke but know ciggies are around s$16 for the premium brands & you can pay anything from s$6 for a 600ml bottle of beer in a hawker centre to s$25 for a pint in a hotel bar (possibly more in places like Kudata)

It is super expensive! 12 US dollars for a McDonald Hamburger---truly the most prices are outrageous! 40 bucks for ciggs!-----18 US for a beer! why go there?Dude, every single damn thing is expensive in Singapore. Just choose Thailand and you will be much happier.

Cars are f'ing ridiculously expensive but you simply don't need one there as public transport & taxis are cheap & abundant.

It really does depend on how much you earn, the higher your salary, the more money you save by living in Singapore & so the cheaper it is (I'd estimate I was paying around 1/4 of the direct income tax in Singapore vs UK, then there's 7% GST vs 20% VAT, no council tax, tv license etc...)

Edit: posted Macdonald prices (in SGD$) below

-

Dude, every single damn thing is expensive in Singapore. Just choose Thailand and you will be much happier.

As Braddockrd as said, it all depends on how much you earn & how much tax you pay, for me the difference in tax I was paying in Singapore vs Tax (& NI) in UK paid for the rent on my condo (& much more, the savings in not having to run a car covered everything else).

Was paying around 11% income tax there (that's it, no other tax to pay, not even tax on overseas income), don't know what the equivalent would be in Thailand...

-

It's been a long time since I looked into this, but here's a couple of links that may help...

- http://therealsingapore.com/content/mom-simplifies-employment-pass-singapore

Nb the visa for your Fiancé would now be a Long Term Visitors pass which (as far as I can tell) doesn't allow her to work unless she finds a job with a work/employment pass.

-

1

1

-

-

Without getting into the precise detail -- It would appear that there's very little advantage in cashing in a pension pot, unless you have some capacity in your personal allowances. But if you have a a pension pot worth talking about - maybe giving £4k per year - that's your allowances used. So if you cash in 15% of the pot -- say £5k - you'll get taxed on the £5k payout, and then the pension will pay less as well -- sounds like a lose-lose situation ?

Or am I not reading this correctly?

I thought 25% could be taken Tax Free or would this be added to your other income & so effectively taxed (if that takes you over the Personal Allowance).

-

-

<<<SPOILER post deleted>>>

But once you've seen the cat, you can't un-see it

-

What are the long(ish) Visa options like for Vietnam?

-

Wasn't a lot of homelessness caused by the so called "Care in the Community" for people with mental issues

-

Outside of rent, Singapore is not that expensive & I'm sure your Filipina would prefer it there (I know mine does).

With an Employment Pass (NB not Work Permit/S Pass), she can get a Dependents Visa even if you're not married as long as you can show evidence of cohabiting.

Have you calculated the difference in take-home pay (Tax is very low in Singapore, check out http://www.iras.gov.sg) to see if the difference is really as much as you think it might be.

-

2

2

-

-

I know you'll need (more accurately better to have) a Thai bank account for day-2-day use, but couldn't you use evidence of funds in your own country for your marriage extension?

-

Investment Visa 10Million THB, might sound like a lot but the money can be used to purchase a Condo & remains yours should you wish to leave Thailand or use in your retirement (after converting to a retirement visa obviously)

-

I actually found Boracay to be cheaper than Manila & Cebu and had no problem with noise from bars despite staying meters away from the beach at Station 1 (stayed here http://www.agoda.com/the-sun-villa-resort-and-spa-beachfront/hotel/boracay-island-ph.html, was around £60/$90 US per night).

Samal Island (Davao) is nice but no nightlife outside of the resorts & pretty basic accommodation will set you back at least 2-2,500PHP per night, Palawan is next on my list (grateful for any tips on where to stay), though Phatbeets pics of Bantayan & Siquijor are making me rethink that [emoji106])

Edit: If you do go to Boracay, try to get a flight into Caticlan as its a 2 hour transfer from Kalibo (recommend http://www.southwesttoursboracay.com/ for transfers)

-

1

1

-

-

So if I've read the above document correctly (many thanks for the link), I could use the "value" of my Stocks & Shares ISA as "Savings", but could not use the "Value" of my other portfolio despite them both being with the same company (Barclays), both containing the same mix of stocks & both having the same liquidity (if anything I could maybe get the money faster out of my MarketMaster account & would look to take it out of there 1st for tax reasons).

Crazy [emoji15]

-

^^^ from the reviews, it seems "Run all night" is even better so I will be adding to Liam's pension fund this weekend & going to the cinema to see it [emoji106]

-

2

2

-

-

^^^ I think you'll see the difference between the predominately Hindu/Tourist nature of Bali coming to the fore more when you see how things like the clampdown on 7/11s selling alcohol is (not) enforced there.

Indonesia feels like Malaysia to me, yes it is 1 country but each state/sultan has their own interpretations of the "Rules" (Damn, that sounds a lot like the US

)

) -

^^^ Bali & Jakarta are two completely different places, not least because of the completely different religious & economic (Business Vs Tourist) influences

Edit:Worked in Jakarta for 6 months & loved it, visit Bali a couple of times a year & love it more [emoji106][emoji106][emoji106]

-

^^^ Mr WW... Fwiw, I thought your 1st post was spot on & this one even more so [emoji106][emoji106][emoji106]

-

righto...... Sorry what was your point?

If you took the time to read his post you'll see that $75k pa is what he has available for his early retirement, nowhere does it say that it's his salaryA forty something year old lawyer working across the Atlantic on $75/pa? Our senior paralegal get that sort of of money. A qualified lawyer (average one ) is around 180-200k p/a. Since when $75k is classified as "high income"? For a lawyer is the bare bottom. Me thinks he's a daydreamer. After a holiday here he maybe thinking I can do this for good. On that note not worth giving advice. ps at 26 I was earning that kind of money. By the time u factor house payment etc I hardly had anything left and never considered myself as a big shot high earner. I still don't.

Oh & at 26 (23 years ago) I was earning £50,000 (approx $80,000) & just retired (at 49 in case the maths hurt) from a salary 2 1/2 times that & can "only" manage a monthly budget of 1/2 that amount so I'm guessing his salary must have been a damn sight more impressive than mine.

No "Point" fella, you acknowledged you'd misinterpreted the OPs position & I for one admire that (probably because I've done it dozens of times myself).

All posts & viewpoints are welcome (that's how we learn) unless they're just spiteful (which, for the avoidance of doubt, yours was not).

Cheers

JB

-

If you took the time to read his post you'll see that $75k pa is what he has available for his early retirement, nowhere does it say that it's his salaryA forty something year old lawyer working across the Atlantic on $75/pa? Our senior paralegal get that sort of of money. A qualified lawyer (average one ) is around 180-200k p/a. Since when $75k is classified as "high income"? For a lawyer is the bare bottom. Me thinks he's a daydreamer. After a holiday here he maybe thinking I can do this for good. On that note not worth giving advice. ps at 26 I was earning that kind of money. By the time u factor house payment etc I hardly had anything left and never considered myself as a big shot high earner. I still don't.

Oh & at 26 (23 years ago) I was earning £50,000 (approx $80,000) & just retired (at 49 in case the maths hurt) from a salary 2 1/2 times that & can "only" manage a monthly budget of 1/2 that amount so I'm guessing his salary must have been a damn sight more impressive than mine.

-

Apologies, I must have missed that & would mention that I'm no expert but learnt this fact from another thread on this site so had that link saved away should a miracle happen & my UK stocks start returning anywhere near putting me in the upper tax bracket.

(I'm one of those "Fortunate" souls who's had to do a Tax Return since he was 18 (31 years ago), I put it down to my 1st serious girlfriend being a Tax Inspectors daughter

)

)-

1

1

-

-

Withholding tax in UK is 10% & this cannot be claimed back irrespective of your Tax status or whether you're below the Personal Allowance.

However the good new is that this is all you have to pay irrespective of whether the income from dividends takes you above the higher rate thresholds.

That 10% tax isnt really a withholding tax at all, which is why it cant be reclaimed.

But you are wrong about the liability for higher rate tax payers:

Not if you're a non-UK resident for Tax purposes http://www.hmrc.gov.uk/manuals/saimmanual/saim1170.htm

"The effect is that the liability of a non-UK resident in respect of savings and investment income is limited to the income tax deducted from it or treated as deducted or paid in respect of it (at the savings rate, dividend rate, or basic rate, as appropriate - SAIM1080), or the tax credit it carries".

Marriage to a Filipino

in Thai Visas, Residency, and Work Permits

Posted

Lol, we're talking about working there not visiting for a holiday...

Fact is if you earn £100,000 pa then in the UK you'll pay around £35,000 in tax (http://www.uktaxcalculators.co.uk/), if you earn £100,000 in Singapore, you'll pay around £10,500 tax (https://www.easycalculation.com/tax/singapore-income-tax-calculator.php)... That £24,500 (approx s$49,000) difference, more than covers annual rent on a very nice condo & a fair few nights out.

If you're earning a lot less than that or just visiting then yes it's very expensive (thats why when I stopped working there at the end of Jan, I moved to KL at the end of Feb) but the OP has a choice of where to work so again, all depends on his salary