-

Posts

6,830 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Dogmatix

-

Consumer injured by glass in spaghetti at Thai pizza chain

Dogmatix replied to snoop1130's topic in Thailand News

I had a similar experience with a larger piece of glass I found when I bit into a piece of bread made by a well company that also has a chain of budget restaurants with the same name. Luckily I was not injured but I emailed the company with photos and they didn't deign to reply. After that I had a letter published in Bkk Post about it and still no response, not even a criminal defamation suit. I can only suppose that glass found in their loaves of bread was such a common occurrence and accepted by Thai consumers that they didn't feel it worth replying. Thailand's food safety is close to rock bottom and exacerbated by criminal defamation laws and Thai Chinese owned businesses that simply don't give hoot about their customers, as long as they get richer and richer. -

Totally agree it is not CP's thing. The damage to their image in the places you mention would not be worth the incremental profits.

-

The best way for Thailand to go, given that some sort of regulation is required for political reasons, would be something like California when medical marijuana was first legalised. You would need a doctor's prescription allowing you to buy what you wanted valid for a year or something. Hopefully tourists would also be eligible for these prescriptions and they would be available from licensed herbal doctors as well as regular doctors, who might not be keen to issue prescriptions.

-

Thai court delivers justice: Cyanide serial killer sentenced to death

Dogmatix replied to snoop1130's topic in Thailand News

Public hanging and flogging and deportation to the colonies. That should bring law and order back to merry England. -

Thailand set to ‘stir up’ the economy with juicy stimulus carrot

Dogmatix replied to snoop1130's topic in Thailand News

"Thailand is gearing up to dangle a glittering economic carrot". With this effusive imagery about dangling glittering carrots the AI program seems to be stuck on the settings for its last assignment which may have been to write the screenplay for a porno movie. No specifics about these glittering carrots. So we are none the wiser about what the government has announced. -

UK Pensioners in Thailand Face New Scrutiny Over Pension Fraud

Dogmatix replied to webfact's topic in Thailand News

The proper way to resolve this is not to harass pensioners who are being defrauded of their pension increments by the British government. despite having made NIC contributions their entire working lives, but to pay the increments to everyone regardless of residence. There is no justification for paying increments to someone in the Philippines but not to someone in Thailand or paying someone in the US but not someone in Canada. My brother lives in the US and gets the full UK triple lock, having continued to pay in voluntarily after leaving the UK, and US social security and medicare. -

Yes; Your 30 million baht investment is all gone once your 30 year expires. It's not really an investment, it is paying rent for 30 years up front. In addition, if the land owner dies or sells the land, the new owner is not bound by the lease because it is a contract between two parties and not automatically binding on new owners. It might say that it is in the agreement and it might also say you have an option to renew but the Land Department is not empowered to enforce anything but the basic Land Code provisions and what is registered at the Land Dept and written on the title deed. The Land Dept is not allowed to register the lease agreement or any details over and above the provisions of the Land Code. This all means that you cannot go to court and get the Land Dept to enforce provisions like registering a new lease for you, based on an option to renew or bind a new owner to the terms of the lease agreement. What you can do, is sue in the civil court for financial damage caused by the other party reneging on the lease agreement. So you have to present evidence of the financial damage, e.g. the cost of new lease. However, if the land owner is dead or is a company that is bankrupt or dissolved, it will be difficult to sue. Basically lease law needs to evolve a lot more before it is an attractive alternative to freehold, not just extend the time period allowed. However, their are loads of farangs who have chucked away their money signing 30 year leases. I know someone who bought the family home, a nice condo right in the CBD with about 25 years to run on a 30 year lease on the basis that the owner, a prominent institution in Thailand, had given verbal assurances that the leases could be renewed for another 30 years. The units were sold at auction and the sellers came up with that tall story . Friends advised not to buy or accept that it would not be renewable. Anyway the long and the short is that the lease expires next year he is now looking for a new family home.

-

Canna-bust: British student’s drug-filled dreams go up in smoke

Dogmatix replied to snoop1130's topic in Thailand News

Makes sense. Saves a lot of trouble and expense. Thailand's prisons are overcrowded enough. I think the crime is quite minor in Thailand anyway - exporting a legal substance without an export license. -

Canna-bust: British student’s drug-filled dreams go up in smoke

Dogmatix replied to snoop1130's topic in Thailand News

I think a German court might have been more lenient on the smuggling charge because possession of certain amounts is now legal there. He should have taken a direct flight to Frankfurt. I guess the Thai authorities don't want to bust these guys for illegal exports because it is still export business for them nonetheless. -

Israelis in Thailand on Alert After Security Warning

Dogmatix replied to webfact's topic in Thailand News

555. That's right. The motorcyclist was a hero for being clipped by the truck, even though he probably would have scooted off pronto, if he knew he was dealing with a huge truck bomb. I don't remember any consequences for the plods who were too lazy to inspect the contents or the truck that had been abandoned in suspicious circumstances by a Middle Easterner and left it for days with the potential to blow up and the whole cop shop plus some surrounding buildings, including the Israeli embassy. A few years later there was an incident where Iranians who had set up a bomb factory in a house in Ekkamai on behalf of their government had a shoot out with police. I think someone had reported them as acting suspiciously in that house. One of them tossed a home made bomb at police and instead of harming police blew off his own private parts. The Thai police managed to arrest a few of them on that occasion but the government decided to exchange them for trade benefits with Iran after short spells in prison. Thai police and government performance have been very comforting for Israelis on both occasions. -

Israelis in Thailand on Alert After Security Warning

Dogmatix replied to webfact's topic in Thailand News

Duplicate deleted. -

Israelis in Thailand on Alert After Security Warning

Dogmatix replied to webfact's topic in Thailand News

Israelis should have full confidence in the Thai plods ability and willingness to protect them from any dastardly plots from nefarious Middle Eastern characters. Some years back there was a plot to blow up the Israeli embassy in Bangkok. Some malefactors rented a house in the suburbs of Bangkok and prepared to make a huge truck bomb using a large metal tank on the back of a pick-up truck. A large quantity of liquid bomb making chemical was ordered and the plotters took the precaution of murdering the delivery man, who was probably suspicious when he saw the order was from a group of Middle Easterners with no obvious commercial use for it, and dumped his body in the tank, so the evidence would be blown to smithereens. Once the bomb had been prepared and armed one of the plotters was tasked with driving it into town to look for a convenient spot to park it in close vicinity to the embassy. He decided to stop off in Central Department Store, Ploenchit on the way. But, as luck would have it, he collided with a motor bike taxi as he was exiting the car park onto Chidlom. Some minor damage was done to the bike's paintwork and within seconds a crowd of motor cycle taxi drivers surrounded the truck demanding compensation. The driver apparently panicked and said he would go to an ATM to get cash to pay for the damage but ran off, leaving the truck blocking the exit and never came back. The plods were called and drove the truck bomb to Lumpini Police Station and parked it not far from where the Israeli embassy was at that time. They didn't bother to inspect the truck or its contents but just waited for the driver to come back with a wad of cash to reclaim the truck. After 10 days still no one came and someone complained there was foul stench coming from the truck. So the plods finally decided to investigate it and discovered the body of the hapless delivery man inside a huge truck bomb they had parked outside their own cop shop and within possible striking distance of the Israeli embassy. All the plotters had by this time fled the country and no one was ever arrested. -

Pattaya Official Seeks Justice in Sea Urination Row

Dogmatix replied to snoop1130's topic in Pattaya News

They are pumping raw sewage into the sea. So why not? -

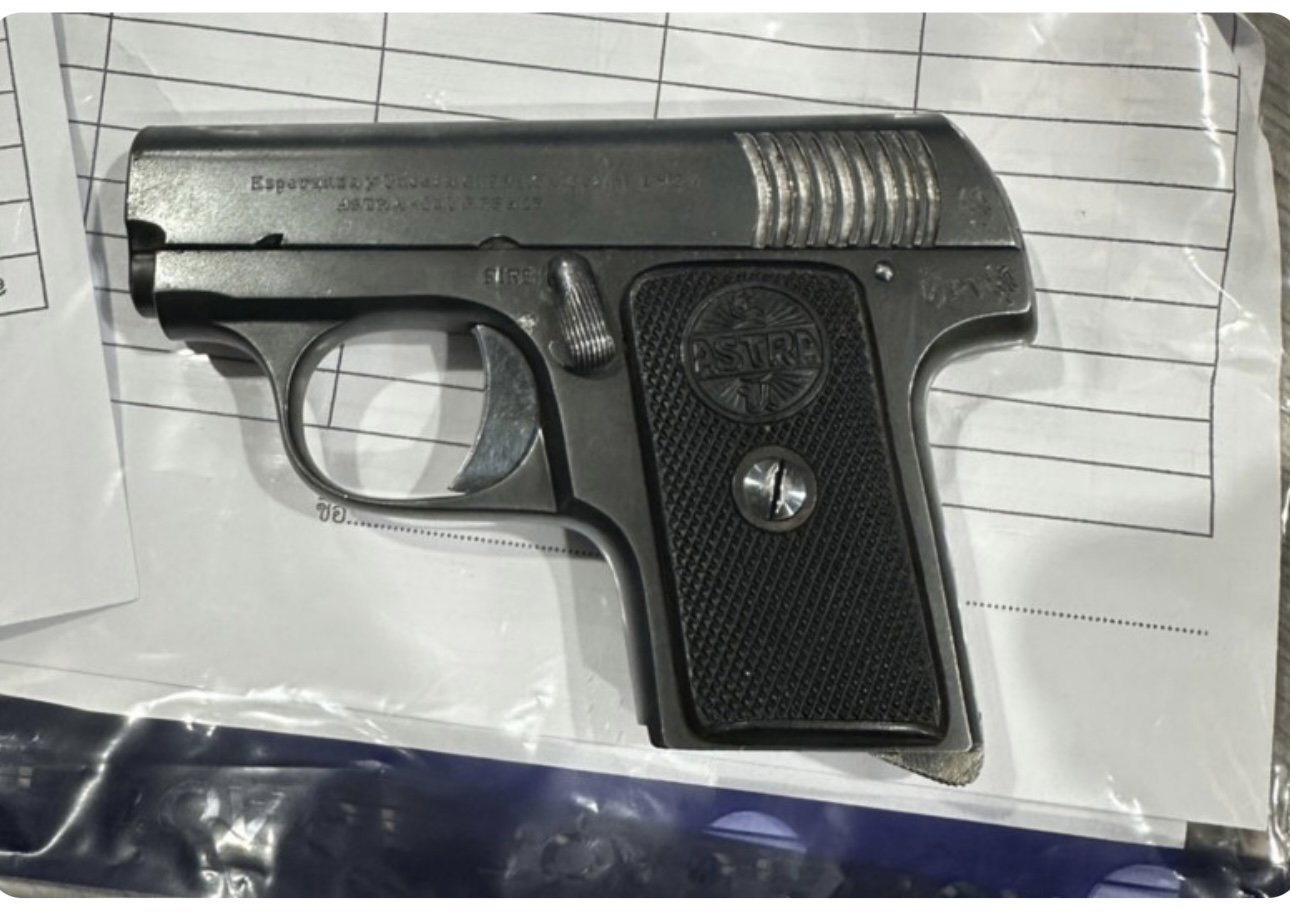

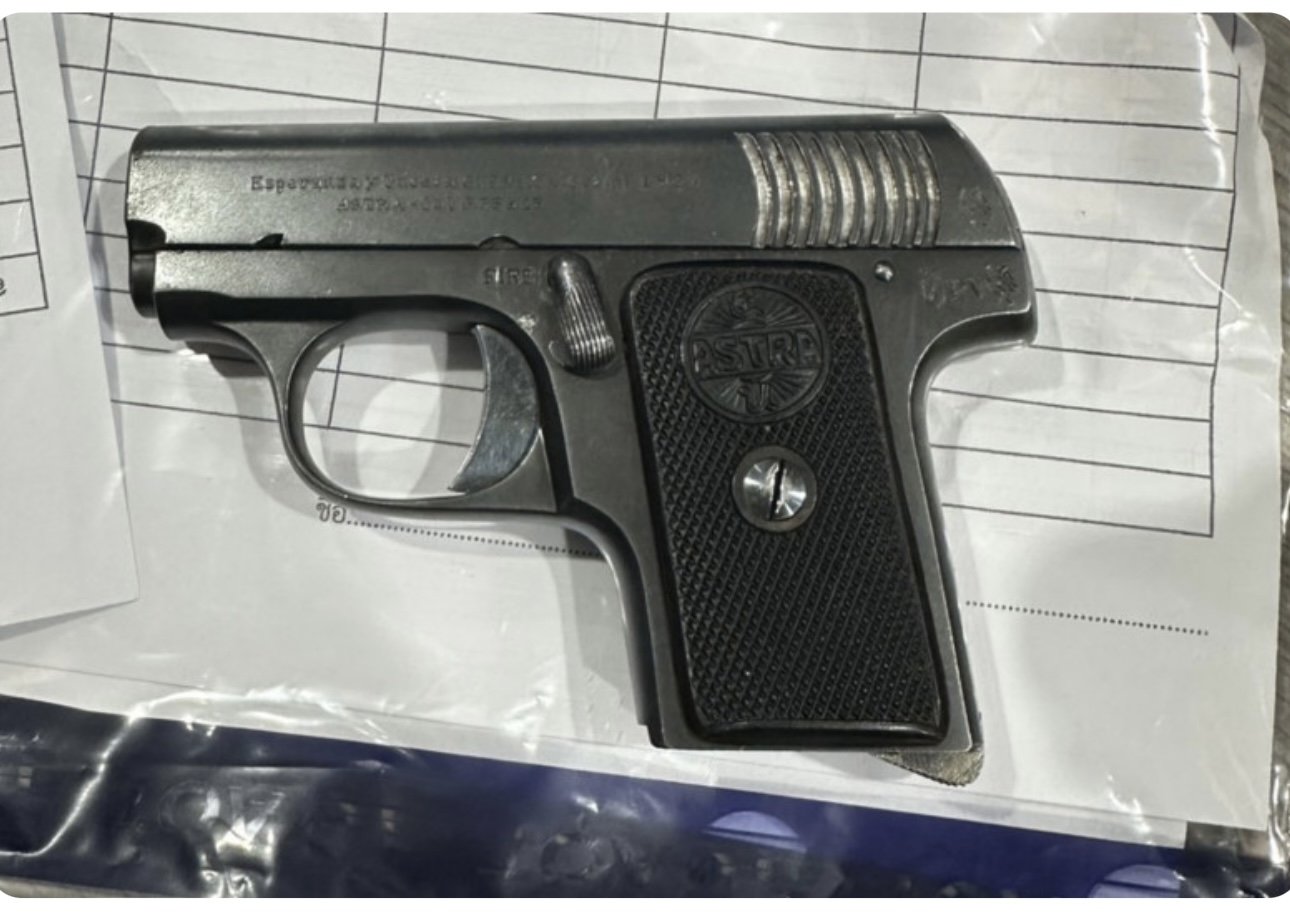

Elderly Swiss man busted with gun at Phuket Airport

Dogmatix replied to snoop1130's topic in Phuket News

The Firearms Act doesn't say you have to be Thai and, until only 3 or 4 years ago, it was quite easy for foreigners living in Bangkok to get permits for guns, if they had PR or at least a WP. As a PR I got 5 going way back without any difficult questions asked. There are still many foreigners with legally owned guns, quite apart from the embassy guards and DEA and other foreign agency types on secondment. It all got very difficult after the Paragon incident, even thought that was nothing to do with legally owned guns. Now it is virtually impossible for anyone with anything about them that the racists in the gun licensing office consider foreign. Thai includes Thai look krung and naturalised Thais. -

Elderly Swiss man busted with gun at Phuket Airport

Dogmatix replied to snoop1130's topic in Phuket News

It's possible. I think the Astra 5.35 25A went out of production in the late 60s. So perhaps he bought it here new and has had it ever since. But I couldn't see a Thai serial number on it and the writing on the slide is wrong for the original Spanish made Astras. Might even be a blank gun. -

I remember Patong in the early 80s when there were just a few friendly bars along dirt streets and duck walks were put down in the rainy season to avoid the mud. I went back 10 years ago and found it was totally unrecognisable - a totally hideous and nightmarish place.

-

Illegal land occupation

Dogmatix replied to w94005m's topic in Real Estate, Housing, House and Land Ownership

Another idea might be to use it for collateral with a gold shop or someone and let them foreclose and deal with it themselves. -

Illegal land occupation

Dogmatix replied to w94005m's topic in Real Estate, Housing, House and Land Ownership

Been involved with 2 encroachment cases. In the first one a family known to the missus built part of their house on a part of our land. They came up with many excuses over two years not to negotiate. Eventually the missus shocked them with a court summons. They showed up and mediation was ordered by the court. We offered to sell them the whole piece of land they had encroached part of. If not, the court would issue an order to evacuate our land, involving demolition of part of their house. Eventually they agreed to buy our plot for about 50% more than we paid for it. We gave some time to pay and a daughter was able to borrow from a bank to pay. So it was relatively easily solved once we took them to court. They still talk to the MIL in the village which is a surprisingly positive bonus. The second one is much nastier and involves a 20 odd rai plot acquired through sale with the right of redemption. The owners borrowed money to do funny business in local elections, as learned later, expecting to get a relative elected and be able pay back the debt with corruption money but were outbid in the election and have never been able to pay back all the money they borrowed or redeem sales with right of redemption. Our sale or redemption contract was for only one year and they never paid any agreed interest but asked for it to be extended which the missus for a year out of kindness, even without any payment. They kept saying they were just about to get the money to redeem but never did and came out with tricks like please transfer the title before payment because the bank will only lend after transfer 555. They asked to rent the plot and signed an agreement and paid the rent for one or two years. But then stopped paying and squatted on the land. After a couple of years of them squatting, the missus hired someone to plant trees on it but they wouldn't let him on to our land. We sued for eviction and the case is ongoing. The missus has to fly up for the court hearings and they usually send a lawyer to say they can't make it to waste her time and money. But now the court has ordered that they can't delay any longer and, if they can't agree to buy the land at market price acceptable to the missus or enter into a new rental contract, an eviction order will issued. Since it is a Nor Sor Sam Kor green title deed, their plan was obviously to claim squatters rights after using the land for 10 years claiming the owner had abandoned it. However, the court case frustrates that because it is evidence that the owner wanted the land back and they were squatting illegally with no rights to claim the land in future. We will take it to the village headman to persuade them to leave the land and let our guy work on it, if we get an eviction notice. If we can plant timber trees there, it will be useless for their rice growing and timber trees will make it look like it is in constant use by the owner. Then we can sell it and get out of the situation. But at least we hope to get a court order to frustrate their squatter rights. We have incurred about 100k in lawyer fees so far but the market value of the land is over 3m today which we don't want to write off. In the OP's case, with a 80k investment and 30k in lawyer fees that could rise higher, I would suggest it is better to put it down to experience. -

Thai sister-in-law signs. She is a company director. Signs with the company stamp.

-

Elderly Swiss man busted with gun at Phuket Airport

Dogmatix replied to snoop1130's topic in Phuket News

The gun in the plastic envelope posted above is the one found at Phuket. The slide is a genuine Astra slide made in Spain. The one found by cops has the wrong writing on it. Looks like something inn Russian. Maybe a BB gun or a fake. -

Elderly Swiss man busted with gun at Phuket Airport

Dogmatix replied to snoop1130's topic in Phuket News

-

Elderly Swiss man busted with gun at Phuket Airport

Dogmatix replied to snoop1130's topic in Phuket News

-

Elderly Swiss man busted with gun at Phuket Airport

Dogmatix replied to snoop1130's topic in Phuket News

-

Elderly Swiss man busted with gun at Phuket Airport

Dogmatix replied to snoop1130's topic in Phuket News

You have to look at what are most likely the original Thai sources for these stories before thay are put through the AI blender to understand what happened. Arrested at Phuket Airport, Swiss man hid gun in bag, preparing to board a plane, denied having bullets, did not think it would be a crime. On October 8, Pol. Col. Salan Tantisankun, Superintendent of Sakoo Police Station, revealed that Sakoo Police Station arrested an 82-year-old foreign suspect. Pol. Lt. Kornphumphon Phongpaiboon, Deputy Chief of Investigation, Sakoo Police Station, Phuket Province, was notified by Ms. Phakhanat Dumlak, who was on duty as a search officer for 4 INLINE team leaders at the check-in baggage room at Gate 81, International Passenger Terminal, Phuket International Airport, Village 6, Tambon Mai Khao, Amphoe Thalang, Phuket Province, that On the night of October 7, while on duty, Ms. Ainah Pang-nga, an OSR image analyzer, was notified that while she was sitting watching the screen analyzing the passenger's baggage X-ray images, she noticed an object that looked like a handgun, so she informed him. and sent the baggage to the baggage registration room at Gate 81, International Passenger Terminal, to search the baggage. It was later discovered that it belonged to Mr. Kurt Fritz Loliger, 82 years old, from Switzerland. The officers therefore searched the bag to examine it. From a detailed search of the suitcase, they found a handgun, ASTRA-CAL 6.35mm. The arresting officers were then notified to arrest Mr. Kurt Fritz Loliger along with the firearm and charged him with possession of a firearm without permission, in order to proceed with legal action. From questioning the foreigner, he did not provide any information, only saying that carrying a firearm without bullets or magazines was allowed on the plane and that he would bring it back to his country. He did not think it was illegal. Not mentioned where he obtained the gun.