lkn

Advanced Member-

Posts

1,747 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by lkn

-

Thailand going cashless. Are you for or against it?

lkn replied to bob smith's topic in ASEAN NOW Community Pub

Those complaining that “cashless” is slow: That is the QR-code implementation. Using NFC is instant, and you don’t need to search for the app first or bypass the latest ad banner from your Thai banking app. Unfortunately PromptPay is the main system here, with NFC mainly offered by the big chain stores (Tops, Central, Big-C, 7-Eleven, Rimping, etc.) and the more expensive eateries. This is likely due to the higher fee for accepting VISA/MasterCard/UnionPay instead of PromptPay. In Europe the interchange fee has been capped at 0.11% and 0.13% for debit and credit cards respectively. Which means that payment cards (in most countries) are ubiquitous, which also means that restaurants pretty much always bring the portable payment terminal together with the bill, and stores have the NFC-enabled terminal mounted so it faces the customer, and is ready to accept your card as soon as the “total amount” is displayed on the cash register. Also most self-service kiosks and similar take your card / contactless payment. I think I have used “self checkout” in a handful of European countries paying with my phone, it is a convenience that I would love to see available everywhere. -

Thailand going cashless. Are you for or against it?

lkn replied to bob smith's topic in ASEAN NOW Community Pub

If you worry about being tracked: Install an ad blocker like uBlock Origin. Also disable third party cookies / use a privacy respecting web browser. And avoid joining any of the membership programs offered by pretty much all the big chain stores in Thailand. Though personally, I use The 1 card in Thailand, but with notifications and emails disabled, so it just means I get discounts on my purchases and accumulate points that can be used for cash vouchers. Only downside I see is that I have to give them my phone number or let them scan a barcode prior to each purchase. Here I actually like how I am being “tracked” in Europe: My grocery stores have their own apps where I can add my payment cards, and they then give me personal discounts, as long as I pay with one of these cards. The total amount is updated, once I wave my card in front of the payment terminal. All the store want is, to get me to buy more or nudge me toward more expensive products. So if I haven’t bought ice cream in a while, but their profile shows that I used to spend a lot on Ben & Jerry’s, they may give me a 50% off on Ben & Jerry’s to remind me of this product, is that really so bad? I think the stores have figured out how to not annoy their customers with spam and instead just do this gentle nudging via discounts. I actually have to open the app to look at what personal discounts I have this week/month. -

Understanding the fee structure makes it easier to figure out the pros and cons of each option. For example Revolut charges 1% for EUR/THB currency conversion, so it is never better than Wise (which charges 0.60%), no need to send $100 to “test it out”. And when you send such low amount ($100) there is a good chance that majority of your fee is the flat fee. As I told you, Wise will always charge 31.70 baht, regardless of the amount, so sending $200 with Wise is cheaper than sending $100 twice. Anyway, you do you, and maybe someone else can provide us with the general xe.com fees, rather than “how much cheaper it was to send $100 compared to Wise at the end of November 2022” ????

-

That assumes the difference is 5×68 baht for $500. There might be some flat fee involved, that is why I gave it as percentage (0.60%) + flat fee (31.70 baht). E.g. if 31.70 baht of the 68 baht difference is the flat fee Wise charges, already your “savings” are down from 17k to 11k, and if you did it once a month, you save another thousand baht… You started the thread to get feedback on xe.com: I would like to know their fees. Did you get a fee breakdown of the $100 you did transfer?

-

Man buys gold bars with 120,000 baht in ten baht coins

lkn replied to webfact's topic in Thailand News

Last I was in the bank, someone withdrew what looked to me as around one million baht in bills and then put it in their bag. Must confess, I did bat an eyelid ???? But actually, I think I once withdrew a few hundred thousand baht in cash myself, that is, I closed an account with SCB, I think it had 300,000 baht, I wanted to transfer it to another bank, but the daily max was 50,000 baht, so I just got the money in a big envelope, went to Krungthai, made a deposit, and no-one there bat an eyelid for my large cash deposit, maybe I should have requested the withdrawal be in 10 baht coins so I could get on TikTok… -

Thai bank account reporting abroad

lkn replied to Sergach's topic in Jobs, Economy, Banking, Business, Investments

And when it does, it is not unlikely that some countries will request “statement for the last 10 years” for their citizens. Maybe less likely with Thailand, but I know this was done for e.g. Luxembourg, once they joined the CRS system. So if you have something to hide, close your bank account before Thailand reports you. -

Wise charges ~0.6% for a currency exchange (EUR/THB). That is compared to “their rate” which ATM is 0.05% worse than Google. Furthermore, they charge 31.70 baht to “withdraw to a Thai bank account”. Currently xe.com has almost the same rate as Wise, but I cannot see what fee they charge (I also get the “not supported in your country”). Though currently it is Sunday, so currency markets are closed, they probably all use Friday’s closing price. Be aware though that there are multiple exchanges to trade currency, so there is no one rate. All that said, I use Wise because they support limit orders. So I decide on the rate I would be happy with, and that I think there is a chance we will see in the foreseeable future, and then I just wait until my auto-conversion is triggered… But I am not sure it is really worth it, probably “saving” ±1,000 baht/month.

-

Using Thai Banking App on a US Sim

lkn replied to kokesaat's topic in Jobs, Economy, Banking, Business, Investments

If at all possible, get dual SIM. I use eSIM so that I can have my Thai number when abroad. Not only may there be issues where your bank will have to send you an OTP code, e.g. online purchases (“3D Secure”) or some special actions like transfer money to new accounts, but you may also have things tied to your Thai phone number, and in Thailand, updating such information generally require physically visiting various places. Furthermore, inactive bank accounts will be closed, and inactive phone numbers will be closed. What I have done is to set up an automatic “top up” via my bank’s app (I think they all support this), just top up with 20 baht/month, this should ensure that both your phone number and bank account does not get automatically closed. A friend of mine had his bank account closed due to lack of activity, as he was not in Thailand during COVID-19, and now they refuse to let him open a new account… Edit: Also, if you do take your phone number with you abroad, make sure that international usage is enabled. It is free to receive SMS messages when abroad (at least with dtac), so just avoid using it. If you have not enabled international usage, you might find it a challenge to get this enabled when abroad. -

Using Thai Banking App on a US Sim

lkn replied to kokesaat's topic in Jobs, Economy, Banking, Business, Investments

But you need to visit a branch to get a username / password, right? For the records I opened an account with Kasikorn earlier this week, though I did not get online access, with the explanation given that it was due to the long holiday, apparently whoever handles this was shut down, and I could come back after the holiday (Tuesday next week). -

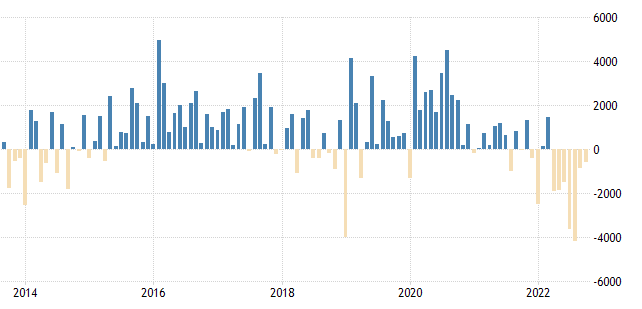

They currently have a trade deficit (has had for the last 7 months) and export is decreasing. So it would seem beneficial to allow the baht to weaken. On the other hand, historically Thailand tends to have a trade surplus, and the deficit might be related to current world affairs (their main export being manufactured goods, like electronics and cars), so a weaker baht might not improve their export, but would for sure increase the cost of imports, and they do import energy. So this might be why they are (presumably) using their reserves to keep the baht at the current level, effectively subsidising their energy imports. I’m not really following Thai affairs, but they are definitely not hesitant to provide economic relief to “voters”, and presumably Bank of Thailand has a mandate (like most other central banks) to “ensure price stability”, so under that mandate, it would make sense to keep the price of energy imports at their current level (and use some of their reserves to support the baht). Here I assume the inflation experienced in Thailand is due to external factors, so increasing the interest rate to limit consumption would not have a significant effect on prices. Disclaimer: I have done no research on this topic, just got curious when I googled their trade balance and see that baht is effectively unaffected by their current deficit.

-

Virtual Thai Bank Account

lkn replied to lpw997's topic in Jobs, Economy, Banking, Business, Investments

My advice would be to look into another way to receive the money, because even when you are in Thailand, getting a bank account is not easy. It seems the rules have been tightened significantly. How much money are we talking about? And who are paying you? Ideally the person would wire the money to you, but this could also be a challenge if it is a larger amount, as that will require extra documentation. The easiest way is probably something like opening a Revolut account (for yourself) and then use the “request money” where you can get a payment link, allowing the sender to pay with VISA/MasterCard/etc. but there might be some some “fair use” limits. -

Bitcoin Family in Phuket

lkn replied to Neeranam's topic in Jobs, Economy, Banking, Business, Investments

Main difference is that startups are not allowed to market themselves as investments to the public. When you sell “investments” (going by U.S. law here) you are under strict regulation, for example there are limits on what you can (legally) say, how you should do your quarterly finances, etc. Elon Musk has gotten into trouble because he seems to have made incorrect statements on how far Tesla is with self-driving vehicles, even the MoviePass founders have gotten into trouble because they were a subsidiary of a public company (i.e. shares sold to the public), and they had made statements indicating that they could become profitable by utilizing AI to analyze customer data etc., which was all just BS, so they were misleading investors. And for those who may not know MoviePass, it was a subscription service where you paid $9.95 per month and could then see at most one movie per day. MoviePass themselves bought your ticket at retail price, so it was so obviously a failed business model, as they would lose money on any customer who saw just 1-2 movies per month. -

Bitcoin Family in Phuket

lkn replied to Neeranam's topic in Jobs, Economy, Banking, Business, Investments

Maybe it’s a rhetorical question, but if not, most schemes work by issuing new tokens. So they are increasing the number of total tokens and therefore, if a token actually represented ownership in something, that would be diluted, i.e. token should decrease in value, of course since a token represents zero ownership or rights, the “value” of the token is arbitrary, and until about a year ago, it seemed possible to fool people into thinking that value was actually being generated by these schemes. There is an infamous Odd Lots episode where Matt Levine (experienced finance guy) asks Sam Bankman-Fried (FTX founder who was valued at $32 bn. and today he is left with around $100k and a potential jail sentence) to explain yield farming, and it left the hosts stunned, as SBF basically explained a ponzi scheme, and even went further, suggesting lending against this scheme and defaulting on the debt, losing the (worthless) collateral, but keeping the real money borrowed. He also seemed to not understand, that his “magic box that generated money” was (at best) a zero sum game. It seems very much like this is actually what FTX / Alameda Research were doing, as majority of their assets on the balance sheet were tokens they had made up themselves and sold to the public, but they also had very real liabilities (i.e. they had taken out debt) that could not be covered by these assets, as the market value of these assets (i.e. tokens they made themsevles) is now closer to zero than the $8 bn. (or thereabout) that they owe. -

It’s called shrinkflation. As for inflation though, while it is easy to compare grocery shop items; hotels, transportation, fruits, eating out, Thai massages, etc. have so much variance that it’s hard to nail down one price for these things. It depends on where you are, time of year, and sometimes even who you are or how good you are at negotiating. But when prices go up in Thailand, for places that deal in handwritten receipts and cash payment, it will often be high percentages, as they will increase the price to the next round number, so a dish sold for 40 baht will increase to 50 baht (25%), or a massage will go from 200 baht to 250 or 300 baht (25-50%). It would be weird to see noodles sold for 41.20 baht (3% increase from 40 baht) and the cashier would quickly run out of change…

-

How do you guys deal with top-ups for prepaid dtac? I know for postpaid, one can set up automatic debit, but for prepaid it seems the best option is to set up a weekly or monthly top-up via your bank’s app, this is a bit annoying though, as you can only select preset amounts, e.g. 400 baht, and I have a dtac package which is not a round number (few of them are), nor is it paid “monthly” but instead every 30th day. I generally want to keep a zero balance because if I don’t have a package, background internet activity on my phone will quickly use up whatever balance I have, likewise, I have dual SIMs, and it happens that I accidentally answer incoming Thai phone calls while outside Thailand, which will also burn through my balance.

-

Opening a bank account on a tourist visa

lkn replied to Dan O's topic in Jobs, Economy, Banking, Business, Investments

It’s normally just an ATM card up-sell. Not sure it has any effect on how easy it is to open an account, but some clerks may want to stear you toward one of the more expensive ATM cards because it has these extra “benefits” like accident insurance and stuff. VISA/MasterCard also have card tiers with stuff like this. -

I just bought $200,000 of Bitcoin

lkn replied to Pravda's topic in Jobs, Economy, Banking, Business, Investments

Furthermore, trading coins on an exchange is not really “adoption”. Four days ago the Financial Times did an interview with the CEO of Coinbase, this is how it starts: “Ahead of my lunch with crypto exchange chief Brian Armstrong, his team tell me they had tried to find a decent restaurant in San Francisco that accepted crypto as a payment. But alas, no luck”. So the PR team at CoinBase can’t find a decent restaurant in San Francisco (filled with tech startups) that accepts crypto? Oh right… still early, it has only been 13+ years… Also, look at how much of the coins are actually just sitting on the exchanges. Yes, we have seen adoption, but among gamblers, libertarians, and former goldbugs! -

I just bought $200,000 of Bitcoin

lkn replied to Pravda's topic in Jobs, Economy, Banking, Business, Investments

Here’s Tim Bray’s story about Amazon looking into offering blockchain-related services back when it was all the hype: https://www.tbray.org/ongoing/When/202x/2022/11/19/AWS-Blockchain The short version is that despite their best efforts, and visiting blockchain-related startups and fin-tech businesses, they just couldn’t find any problem that it actually solved. Even one of the demos they got, the presenter answered that yes, it could all be done without a blockchain component. His article was prompted by the Australian Stock Exchange’s abandonment of their long-ago announced blockchain project. Really amazing just how many people have been fooled over the last seven or so years. -

I just bought $200,000 of Bitcoin

lkn replied to Pravda's topic in Jobs, Economy, Banking, Business, Investments

To elaborate a bit about your points: A lot of coins are paid for by stable coins, this could e.g. be USDT issued by Tether. Tether have repeatedly claimed they were backed, i.e. that the coins are not just made out of thin air. Granted, everything Tether has said and done indicates they are, but SBF was actually one of the few people who vouched for Tether, and FTX / Alameda did buy and redeem Tethers. In practice this would mean sending USD back and forth between Tether and FTX / Alameda, but here is an Alameda representative being asked the simple question: “What bank are you using to wire the money?”, judge for yourself if you think any actual money was ever sent between the two entities: If Tether is a fraud (which it most likely is) then there is another $69 bn. worth of value about to collapse. Then add all the other stable coins. Another thing is the Binance Blockchain. A lot of tokens are “wrapped” and used in this ecosystem, but recent revelations seems to indicate that these might also not be fully backed. A giant house of cards… but who could have foreseen that you can’t just create money out of thin air with no underlying economic activity? ???? -

Another advantage of “cashless” is that many shops in Europe now have “self checkout” where you can scan and pay for your stuff. Granted, I think some self checkout terminals do accept cash, but a few stores have taken the next step, and allow people to scan items (with their phone) while they are shopping, and then just pay, this eliminates the need to wait in line, and I absolutely love it! Makes me much less hesitant to shop during rush hour.

-

Have you worked as a cashier? I have, when we accepted larger bills, we had to ensure they were not counterfeit (yes, there are people circulating fake bills), and after each shift, we had to count all the cash in our register, often it would be slightly off with what should actually be in the register, probably because someone gave back incorrect change, or miscounted the amount received, multiply that by the number of cashiers and also add the expense of paying your cashiers for counting cash at the end of their shift, and then someone needs to go and deposit this in the bank… Cash is a pain to deal with if you are a business. Also for employers, for example even though I have set up bank transfers / automatic debit / etc. for all the expenses of our building that support this, our building manager still goes through 30-50,000 baht in cash each month, for which there are only paper receipts, that I then have to pay an accountant to check… would be so much nicer if he could just get a debit card and pay everything with that, and then we would have an exact digital record of the money he spent. In Europe we even have shops that support issuing a digital receipt based on the payment card used. So when I go to the local shop, wave my phone in front of the payment terminal, I receive the itemized receipt on my phone. Even for my private economy this can come in handy, for example a few days ago I had to return an item because I bought the wrong one, and the receipt was there on my phone…

-

All those fearful of big brother: I really wouldn’t fear this in Thailand. Look at how bad they are at producing meaningful statistical data about pretty much anything, and for the banks, have you looked at your bank statement? Worst I have seen is SCB, every line item was just a long seemingly random number, maybe a vendor ID for where I used my card? This was actually one of the reasons I stopped using SCB, not that KTB is that much better, I still see many “descriptions” which are just some long alpha-numeric identifier, rather than a shop or business name. If you were to get ahold of my bank statement, you would have no idea about 90% of my expenses.