Liquorice

Advanced Member-

Posts

4,883 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Liquorice

-

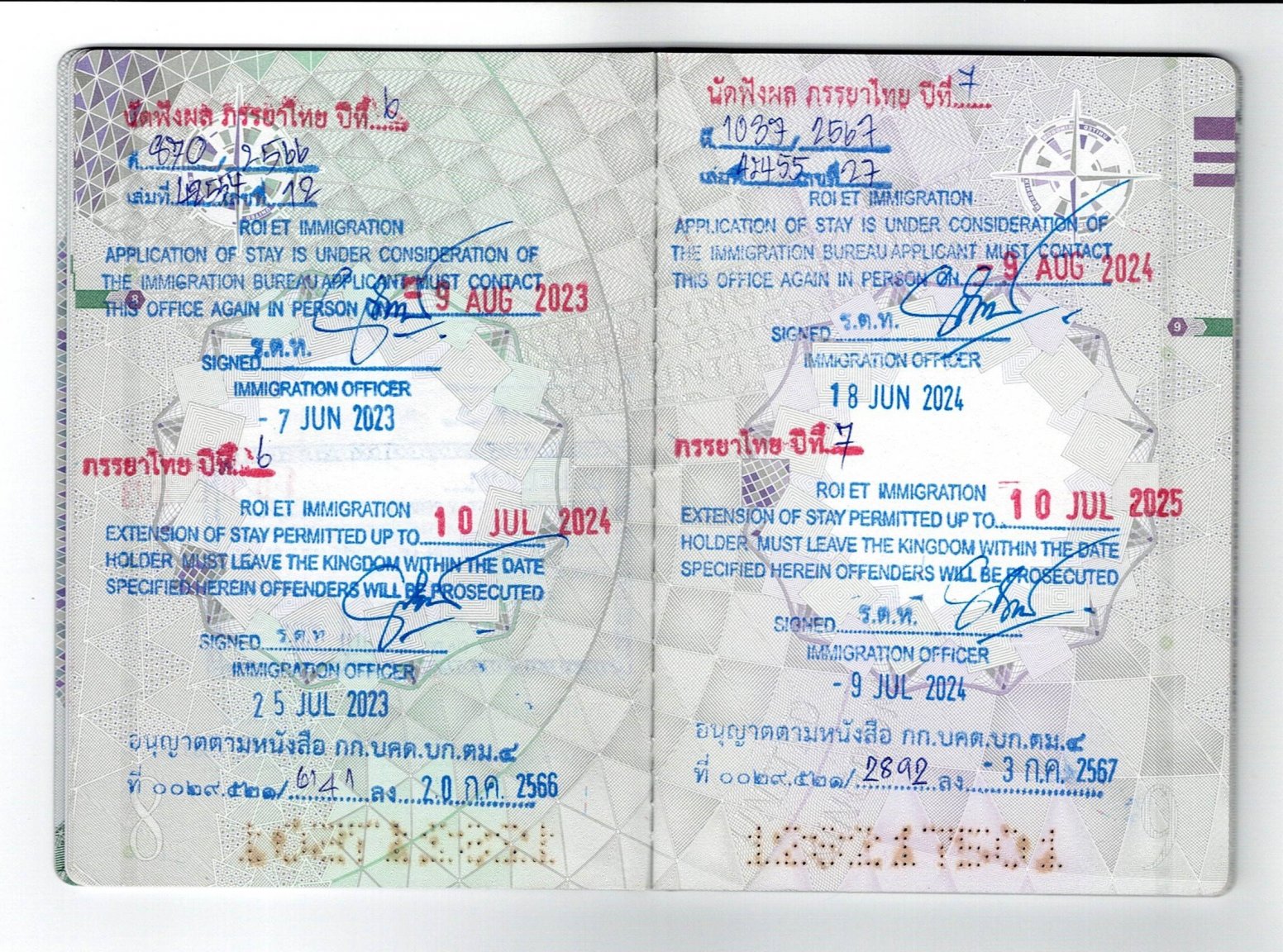

The 400K needs to be in a Thai bank account in your sole name for 2 months prior to the date of submitting the application. Extensions of stay based on Thai spouse have to be approved by the regional office. Once your IO accept your application, they will give you a 30 day 'under consideration' stamp, to cover the processing time, which includes a return date to receive the 1 year extension stamp. It is only 'advised' you keep the 400K in your account until you receive the 1 year extension stamp. If your local IO accept your application, the chances of it being refused for some obscure reason by the regional office is less than 0.001% IMO. Certain IO's date the 30 day 'under consideration' period from the date you submit the application, whilst others date it from the end of your current permission of stay. How long it takes to process can vary from 3 to 10 weeks. Examples; My extension renewal date is 10th July. In 2023, I submitted my application on 7th June, (33 days prior to my current extension expiring) I received a 30 under considerations stamp dated from 10 th July to 9th August (the date to return). My IO called me on 25th July to advise my application had been approved. You cannot be on overstay with a 30 day under consideration stamp as the new extension is backdated, in my case to 10th July. Total processing time, 7th June to 25th July (7 weeks). In 2024, I submitted my application on 18th June, (23 days prior to my current extension expiring) I received a 30 under considerations stamp dated from 10 th July to 9th August (the date to return). My IO called me on 4th July to advise my application had been approved, however I didn't call at the IO until 9th July for the 1 year stamp. Total processing time, 18th June to 4th July (17 days).

-

A friend once had his application accepted by the local IO, but returned by the regional IO two weeks later, requesting he resubmits with a new set of improved quality copies that they could read without straining their eyes. Had he withdrawn any of that 400K he'd have been in a pickle! Good advice to keep it in the account until the application is approved.

-

Mail in is an option if Koh Samui accept mailed reports. Only if you first filed a TM30 with that office. You could just pay the fine on return.

-

Can someone help please

Liquorice replied to Shannoblic's topic in Thai Visas, Residency, and Work Permits

@Shannoblic At least 30 days prior to its expiry, 45 days prior at many IO's. How you proceed depends on a few factors. From your previous experience, does your IO date the 30 day 'under consideration' stamp from the date of the application, or from the expiry date of your current extension? How long do you intend to stay in the UK for? Depending on the answers to the above questions, you may have options; 1. A re-entry permit to cover the 'under consideration' period. 2. A 60 day extension, if you haven't previously applied for one since your last entry. 3. Apply for a new Non Imm O visa whilst in the UK, to re-enter Thailand if 1, or 2 above are not feasible. As @DrJack54 stated, also speak to your IO. This year, my extension based on marriage was approved prior to my current extension expiring, which would be the ideal solution to your scenario. Extension due 10th July. Submitted application 18th June. 30 day 'under consideration' stamp dated until 9th August. (30 days from expiry date). Thursday 4th July received a call advising my application had been approved. Away for the weekend so advised IO I would visit Tuesday 9th July - no problem. 1 year extension stamp issued on 9th July, 1 day before my current extension expired, extending stay to 10th July 2025. -

Why would you think Immigration could inform you of what documents would be acceptable at a Thai Consulate for a visa application. Two entirely different entities. https://phnompenh.thaiembassy.org/en/publicservice/destination-thailand-visa-dtv?page=5d73b14415e39c46f40076a1&menu=5d73b14415e39c46f40076a2

-

Only when I was out of Country between a due 90-day report. When out of Country when a 90-day report was due and missed, then counting the first day of re-entry as day 1 of the next due 90 day report, it was rejected online, and I had to file in person. Just an assumption, but if you miss a 90-day report due to being out of the Country, you have to apply in person for the IO to manually reset the calendar clock for your future due dates. It appears the online 90 day is not in any way connected to the entry/exit system.

-

From my own experience, I've observed if you go out of Country in-between a due 90-day report, then on return you can complete online as normal. If however you are out of Country and miss a 90-day report, then the first online report counting 90 days from entry will be rejected, and you have to file in person. I believe that's because by missing the due date the system was expecting a report, you're now out of date sync because the system is not aware of your exit and re-entry dates.

-

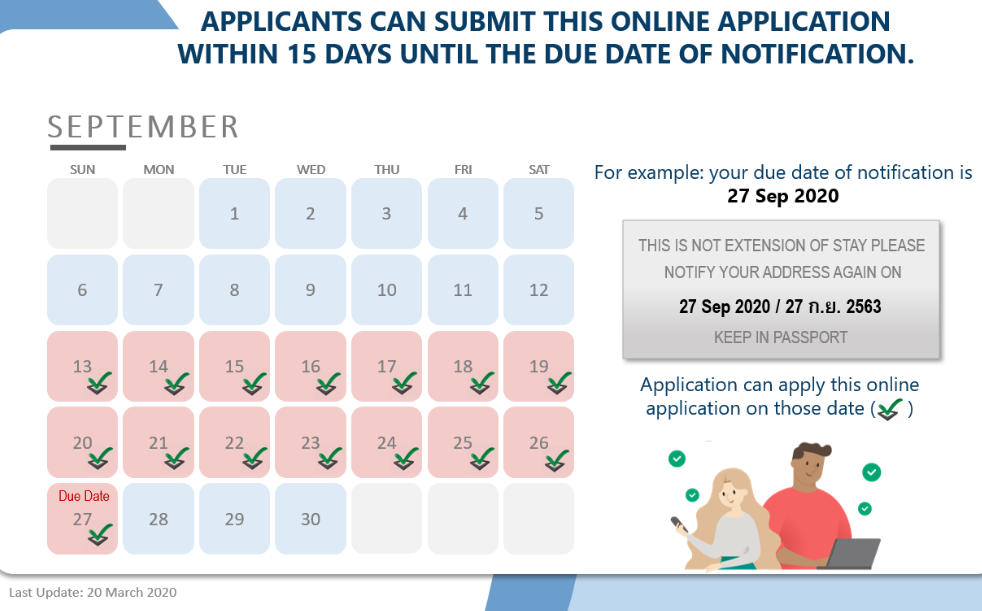

I've filed online 90 day reports since it's introduction, anywhere from 14 days before up to the due date, without issue. This year after the new system was introduced, for the first time submitting 12 days before the due date, my application was refused stating the details did not match those on file. 🤪

-

According to the new TM30 regulation, if returning to the previous registered address, entering with a re-entry permit, then a further TM30 isn't required. Regulation of Royal Thai Police on notification of a householder, owner or possessor of dwelling place or hotel manager, who takes in, as a resident, an alien permitted to temporary stay in the Kingdom. It is deemed expedient to amend the regulation of Royal Thai Police on notification of a householder, owner or possessor of dwelling place or hotel manager, who takes in, as a resident, an alien permitted to temporary stay in the Kingdom dated May 25, 1979 (B.E. 2522) in order to conform with the directions of national development and strategies for transforming government sector to digital government as well as to facilitate aliens staying in Thailand under the maintenance of national security standards. By virtue of Section 38, Paragraph 3 of the Immigration Act B.E. 2522 (A.D. 1979) the Commissioner General of Royal Thai Police herby issues the regulation prescribing notification of a householder, owner or possessor of dwelling place or hotel manager, who takes in, as a resident, an alien permitted to temporary stay in the Kingdom as follows: 1. Repeal the regulation of Royal Thai Police on notification of a householder, owner or possessor of a dwelling place or hotel manager, who takes in, as a resident, an alien permitted to temporary stay in the Kingdom dated May 25, 1979 (B.E. 2522); 2. Notification of a householder, owner or possessor of dwelling place or hotel manager, who takes in, as a resident, an alien permitted to temporary stay in the Kingdom must proceed as follows; 2.1 Notify a competent official at an Immigration office located in a locality in which the house, dwelling place or hotel is located within twenty four hours from the time an alien has taken residence. In case that house, dwelling place or hotel, where an alien has stayed, is located in Bangkok Metropolis locality, such notification shall be made to a competent official at Immigration Division 1 of Immigration Bureau. 2.2 After a householder, owner or possessor of dwelling place or hotel manager already made a notification according to 2.1, then the alien goes to occasionally stay somewhere else and return to stay at the original place within the notified period of stay tahat has not yet ended, such householder, owner or possessor of dwelling place or hotel manager is not required to make a notification again. The alien mentioned in paragraph 1 shall include any alien receiving a multiply entry visa who departs the Kingdom and returns within the validity of visa and any alien permitted to re-enter into the Kingdom with a valid re-entry permit. 3. Subject to the article 2, a householder, owner or possessor of dwelling place or hotel manager may make notification in person or assign others to submit a letter of notification or send it by registered mail or via the electronic notification system of Immigration Bureau. 4. Notification of receiving an alien to stay as a resident according to the article 3, shall be in accordance with the criteria, conditions and supporting documents as prescribed by Immigration Bureau. 5. A competent official who receives a notification shall issue an evidence of notification for those who notified. 6. The notification form attached to this regulation shall be used in case of making a notification in person or assigning others to submit a letter of notification or sending it by registered mail. An evidence of notification and receiving a notification via the electronic system shall be in accordance with the form prescribed by Immigration Bureau. This regulation is effective from June 30, 2020 onwards. Issued on June5, 2020 Police General Chakthip Chaijinda Commissioner General of Royal Thai Polic

-

As long as you have evidence of the purpose of your visit, you should be good to go. However, there will be those with many other purposes in mind As I've stated before, I don't read 'unlimited' as 'back to back' entries as some are. The average tourist will only stay 2/3 weeks, perhaps twice a year.