khunjeff

-

Posts

1,750 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Posts posted by khunjeff

-

-

11 hours ago, Crossy said:

Since I do not wish to be "targeted" I hope one can opt out of this system.

If this is like what's been set up in the US, then no - it's a national emergency warning system, and you can't opt out other than by turning off your phone. There was a test of the US system on Wednesday - the first in two or three years - and all phones sounded an alarm and gave a message at 2:20pm Eastern Time.

-

7 hours ago, Bangkok Barry said:

150ml size toothpaste, only 100 allowed. The fact that it was 3/4 empty and therefore was far short of 100 and even further short of 150 was irrelevant.

That was actually a correct enforcement of the rule, even if we might not agree with it, or would hope that the screeners might be more flexible (as the ones at your origin airport evidently were).

"If your liquids are stored in containers larger than 3.4 ounces, even if there’s only 3.4 ounces left inside the bottle, you can’t bring them through security."

https://www.afar.com/magazine/the-tsas-3-1-1-rule-for-liquids-in-carry-on-luggage

-

- Popular Post

- Popular Post

41 minutes ago, Bangkok Barry said:What has a Thai restaurant owner throwing a Thai out of his restaurant got to do with the Icelandic government? And what does the Thai government expect that government to do (apart from laugh, that is). Expel him? Idiotic.

We see this lack of understanding of the distinction between governments and individuals again and again here.

A restaurant in the US displays a Buddha image in a way that some Thai thinks is disrespectful? Complain to the mayor or the state governor! A UK newspaper says something "insulting" about a prominent Thai? Send a complaint letter to the British embassy!

Each time, the complainers seem mystified when their entreaties are ignored or laughed at. (The US Embassy has regularly refused to accept letters complaining about the actions of George Soros and other private citizens, suggesting that the aggrieved parties might want to send their complaints directly to the person whose behavior had bothered them.)

-

1

1

-

2

2

-

4

4

-

10 hours ago, webfact said:

Some individuals took issue with the 26 year old Lisa’s bold and risqué stage attire

10 hours ago, webfact said:Sui He did not mince words in her disapproval of the performance of Lisa BLACKPINK, alleging that it objectified women.

Oh, give me a break! The Crazy Horse is a burlesque venue famous for its nude dancers, and they're complaining that Lisa's "bold attire" "objectifies women"??

-

1

1

-

-

Holding a visa for Thailand has no effect on European entry requirements. Whether you need a Schengen visa will depend on your nationality - if you're a US citizen (not clear from your post), you can enter the Schengen area without a visa.

There were plans to institute a mandatory online pre-registration system for visa-exempt travelers to Europe in 2024, but that's now been postponed until mid-2025 at the earliest.

-

1

1

-

-

22 hours ago, dddave said:

At DMK, It is in an office just past security, sharing space with the overstay office.

That office is actually immediately past passport control, but before security.

-

- Popular Post

- Popular Post

"the committee plans to send the complaint document to Iceland, urging the government to acknowledge the inappropriate actions of its residents."

Iceland is a free country - I'm pretty sure they don't discipline their citizens just because a foreign official thinks they've been insufficiently deferential.

"Additionally, the committee intends to pursue legal action against the restaurant owner under Thai law, regardless of whether Porntip chooses to pursue legal remedies."

So Thailand now has extraterritorial jurisdiction over rudeness in European restaurants? Fascinating. Perhaps they can take the case to the International Court of Justice in The Hague while they're at it.

-

4

4

-

1

1

-

12

12

-

- Popular Post

- Popular Post

1 hour ago, webfact said:Police chief Torasak Sukwimon revealed plans for a merit-based system for appointing and transferring police generals

1 hour ago, webfact said:Torasak stated that all positions would be open to all based on seniority. He further explained that each rank would be given the opportunity to choose their preferred role, starting with the most senior

I'm not sure I follow this. So will appointments be based on merit, or seniority?

-

7

7

-

1

1

-

1

1

-

1

1

-

17 hours ago, webfact said:

The hotel’s full name was withheld due to an ongoing fire investigation. Upon receiving the report, firefighting personnel from Pattaya City were dispatched to the scene

They didn't withhold the name of the hotel from the firefighters? How irresponsible! ????

-

1

1

-

-

-

6 minutes ago, sirineou said:

However, such pension shall be taxable only in the other Contracting State if the individual is a resident of, and a national of, that other State. "

So if the Thai goverment wanted to get at foreign pensions , extensions to stay could be replaced with a residency program.

You missed the part that says "and a national of...".

This clause was written to cover, for example, a Thai who lived and worked in a foreign country long enough to qualify for a pension, and then moved back to Thailand for retirement. It doesn't apply to citizens of that same foreign country who retire in Thailand.

-

1

1

-

-

7 hours ago, Northwest87 said:

I understand that some people on this thread have been able to get BOI to accept US military Tricare as a medical plan, but has anyone been able to do the same with an FEHB federal plan (Aetna, Foreign Service/AFSPA, GEHA)?

NW

Yes, I think they changed their view on all of those US Government plans at the same time. They didn't accept my FSBP/AFSPA when I applied a year ago, but when my friend applied with exactly the same policy this past April, BoI took it with no problem.

-

1

1

-

1

1

-

-

- Popular Post

- Popular Post

9 hours ago, Middle Aged Grouch said:many house owners from Europe, the UK, the US who have not declared their real estate in Thailand are going to be in some serious hot soup......mainly in France and the USA

I can't speak for France or other countries, but the US has no requirement to "declare" foreign real estate holdings - only bank and financial accounts have to be reported. Any capital gains on sales of overseas property would have to be declared as income, but there is no Federal property tax.

-

3

3

-

3 hours ago, huangnon said:

So is the taxpayer is shelling out for this ?

It appears that Swiss taxpayers are paying for it as a way of getting carbon credits.

https://www.southpole.com/blog/article-6-and-electric-buses-in-thailand-speed-up-net-zero-transition

-

1

1

-

-

-

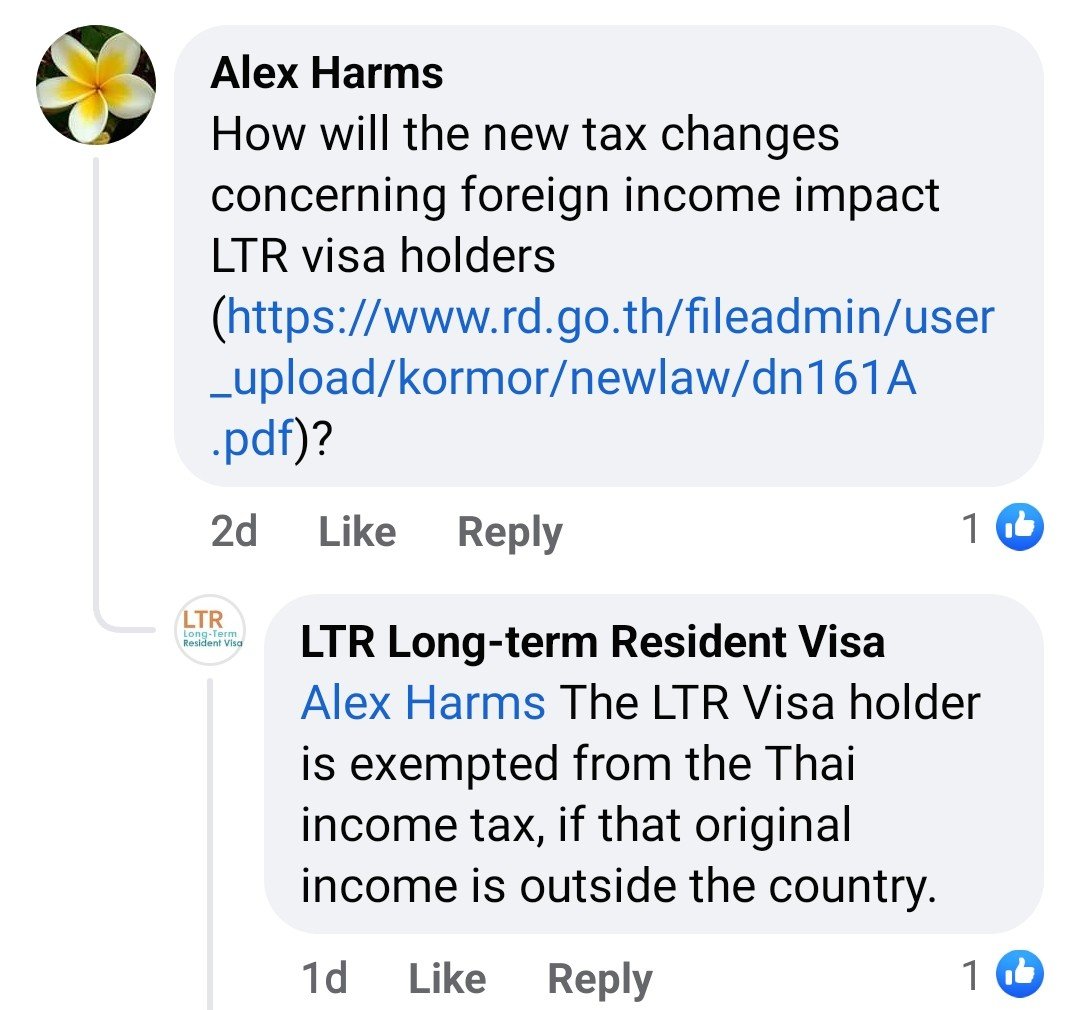

12 hours ago, K2938 said:

Well, on Fb somebody asked the BOI about the taxation of money remitted in view of the new tax legislation and they refused to comment, only saying that non-remitted money is tax-free. So I guess the honest answer is that nobody knows at present

Thanks, that's interesting. Of course, non-remitted overseas income hasn't been taxable for anyone in the past, so the LTR exemption would have been meaningless if that's what was really meant. I guess we'll hear more over the next few months.

-

14 hours ago, RafPinto said:

Do you know someone who is retired at 50 and is drawing a pension?

I retired with an immediate pension at age 51, and could have done so the day I turned 50 if I had wanted to. So it does happen. (I didn't get my LTR until age 59, but that's only because the program didn't exist before that.)

-

1

1

-

-

4 hours ago, rice555 said:

He lied when he filled out the "form" to purchase the gun being a drug addict.

He did not tik the box on the form, that is the crime.

The facts of what he did aren't in dispute - what his lawyers intend to argue is that a 2022 Supreme Court decision rendered the law under which he's charged unconstitutional. It's not a far-fetched notion, either; multiple cases under that statute have been thrown out by district and appeals courts using precisely that reasoning.

-

1

1

-

1

1

-

-

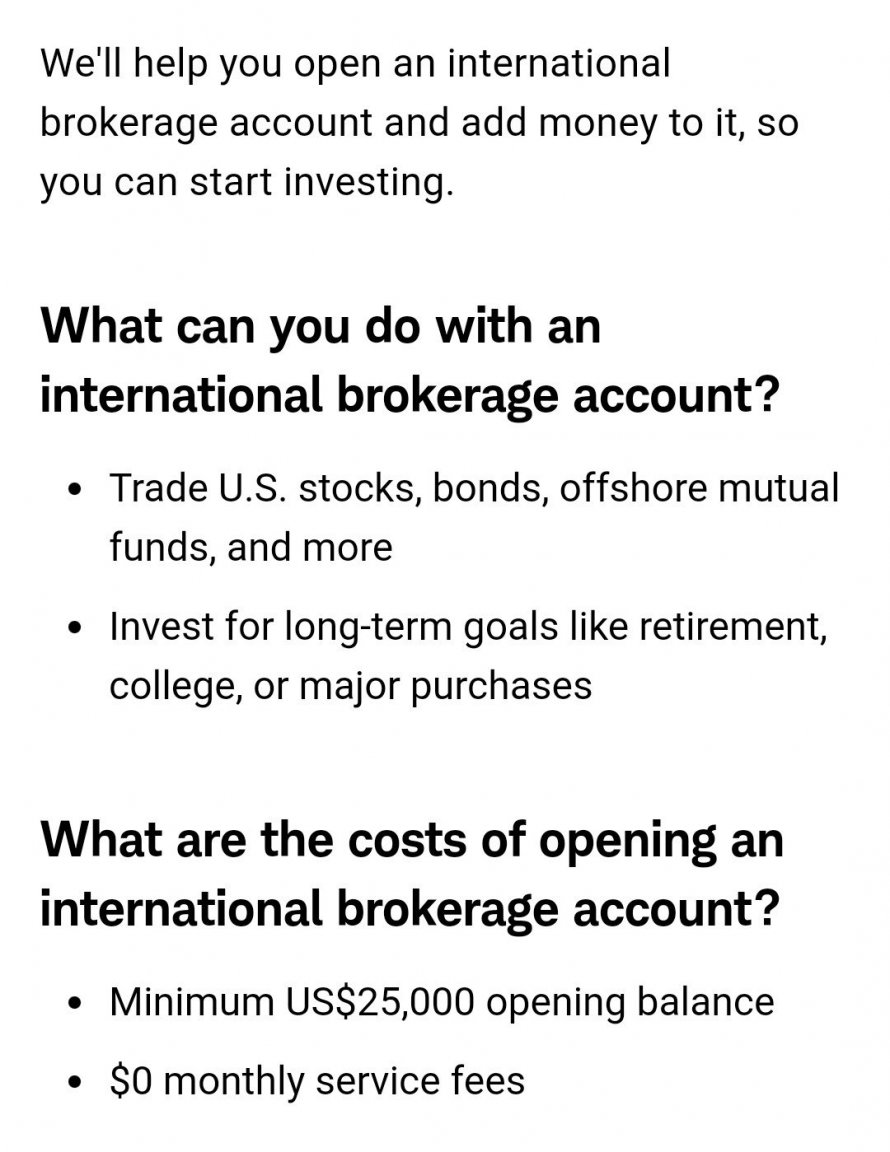

5 minutes ago, Gknrd said:

Kills me, people can conjure up 25K to put in a Thai bank. But, cannot come up 25K to fund an investment account. And people wonder why people are in such bad financial shape..

The conversation was about getting a Schwab account in order to have a debit card that reimburses ATM fees, not for the purpose of investing in US securities. It wouldn't make much financial sense to tie up 25k USD just to get free ATM usage, even if that money was readily available. (The US version of the Schwab checking account requires you to open a brokerage account as well, but you don't have to fund it.) If someone actually wants to invest in the US market, of course, the math would be completely different.

-

1

1

-

-

On 9/18/2023 at 2:24 AM, mrmagyar said:

The commentary in the second related article suggests this is designed to be aimed at Thai's, but it seems LTR visa holders would be caught in the net

I'm not sure why you think that. The tax benefits for LTR holders weren't some kind of loophole - they were formally and legally implemented even before the first visa was issued. Royal Decree no. 743, gazetted on 23 May 2022 and titled "Decree Issued in Accordance with the Revenue Code Concerning the Reduction of Tax Rates and Exemptions (No. 257)" made the provisions official, and there's no indication that this new decree changes that in any way.

-

1

1

-

1

1

-

-

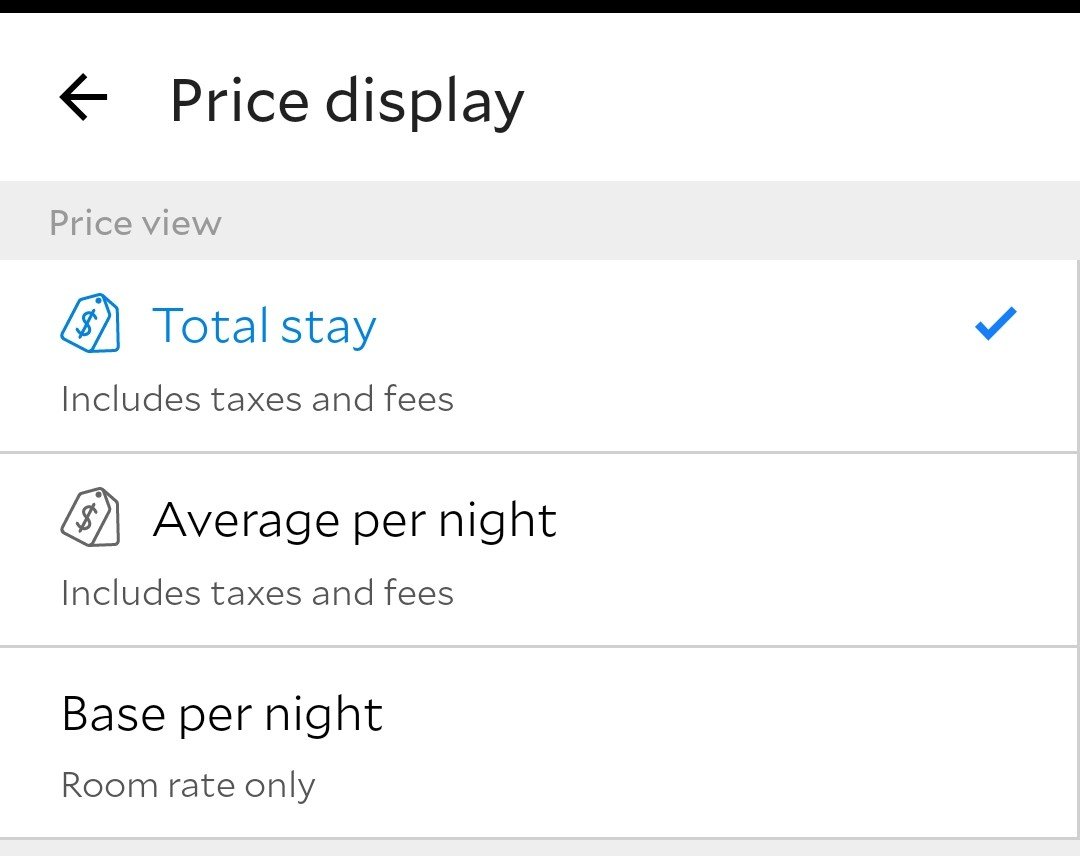

5 hours ago, rabas said:

Go here https://international.schwab.com/open-account-intro

Click the [open account] button in the upper right.

Go down to [Select country/region] and choose Thailand. Enjoy.

The brokerage account you can open through that link does, at least for expatriate US citizens, come with the much-loved Schwab debit card that refunds all ATM fees. Unlike the version for US residents, though, it requires that the account be funded with at least $25,000, which makes it of marginal utility for most people.

-

- Popular Post

7 hours ago, webfact said:In less than 20 minutes! Thai Immigration Department is gearing up to welcome an influx of Chinese and Kazakh tourists

Hour-plus waits were fine earlier this year, but now OH MY GOD the Chinese are coming, can't keep 'em waiting!

-

1

1

-

3

3

-

1

1

-

2

2

-

8 hours ago, Ben Zioner said:

Maybe, but the LTR/WP differs from other visas such as Thailand Elite in that tax exemption is advertised as one of its main benefits.

It's not just advertised as a benefit, it was also legally implemented - Royal Decree no. 743, gazetted on 23 May 2022 ("Decree Issued in Accordance with the Revenue Code Concerning the Reduction of Tax Rates and Exemptions (No. 257") made the exemption official.

-

2

2

-

-

"Exceeding the target" is quite different from a "surplus" - they will still need to borrow money to cover the government budget.

.png.3b3332cc2256ad0edbc2fe9404feeef0.png)

Social Security Direct Deposit, Does Credit Advice Indicate Foreign?

in Thai Visas, Residency, and Work Permits

Posted

All Thai banks are FATCA-compliant, since it's required by the Bank of Thailand. The Thai government signed a bilateral agreement with the US about this many years ago, so individual banks have no choice but to comply.

The funds aren't converted. The US Treasury - which has holdings in pretty much every currency in the world - sends the payments in baht, using its own exchange rate to determine the THB amount.