-

Posts

2,668 -

Joined

-

Last visited

Profile Information

-

Location

On A VPN

Previous Fields

-

Location

On A VPN

Recent Profile Visitors

4,451 profile views

RSD1's Achievements

-

A bunch of off-topic replies. The point of this topic was not to marvel at the shockingly overpriced weed in Bangkok’s tourist traps. Yes, we all know it is there. Yes, it is all overpriced. Nobody with a brain shops in any of those places. We all know that. Been like that since decriminalization in June 2022. No groundbreaking revelations there. The point though, apparently lost on many, is that nothing has really changed in terms of cannabis sales and distribution in the high visibility tourist areas of Bangkok since the laws were changed this past June 23rd. Laws for medical use cannabis are still being enforced with all the vigor and urgency of a sloth on sedatives, if at all. That was my takeaway after a quick stroll down Sukhumvit last night. But why focus on that when we can just restate the obvious.

-

I did another quick late night crawl around lower Sukhumvit to see if anything had changed with the weed distribution scene. Nothing has. All the shops are still there. You can still catch the smell drifting out into the street at times, maybe just a little less than before, but I spotted at least three weed trucks selling in Sukhumvit Soi 11. Weed trucks in Soi 11, that is for medical use, is it? With the shops you can at least argue they are legitimate and only selling for medical purposes, but the trucks? That is a hard one to dress up. Anyway, if you ever want to meet Mary Jane for yourself, you can find her on the corner of Soi 4. She never takes a day off.

-

New data link cannabis use and heart disease: Who paid for this?

RSD1 replied to RSD1's topic in Thailand Cannabis Forum

It's not bad news for me and you've made various other baseless assumptions above as well. Gaslighting. Though, I don't mind Huberman, but I've always considered him an anecdotal bro-science guy. A Rogan type. He also uses anabolic steroids and puts various chemicals and other things into his body that I never would. So I would say he is pretty conflicted. The only thing that would scientifically support the "THC" is a dangerous chemical theory would be a controlled study, not funded by some lobbyist groups, and then pier reviewed by the medical world. And so far I haven't seen anything like that. Otherwise, it's all just conjecture. -

New data link cannabis use and heart disease: Who paid for this?

RSD1 replied to RSD1's topic in Thailand Cannabis Forum

It depends on whether you see complacency as a problem. Some people might, especially over time. Others embrace it and enjoy drifting into a kind of complacent bliss. I think it’s actually better for retired people and worse for young people. If you’re young and supposed to be out in the world fighting for your place, that’s harder to do as a heavy weed smoker. But once you’re retired, there’s nothing to worry about. -

New data link cannabis use and heart disease: Who paid for this?

RSD1 replied to RSD1's topic in Thailand Cannabis Forum

I agree. Any amount of alcohol is actually toxic to the body. But I don't want turn this into another one of those threads that's turns into a debate about how unhealthy alcohol is. -

New data link cannabis use and heart disease: Who paid for this?

RSD1 replied to RSD1's topic in Thailand Cannabis Forum

That is a fact. The euphoric feeling can push you towards more hedonism. But it's not severe. People with low self control and an addictive personality will definitely suffer as a result of their diet choice since they already struggle with maintaining good eating habits. -

New data link cannabis use and heart disease: Who paid for this?

RSD1 replied to RSD1's topic in Thailand Cannabis Forum

If I had to smoke it to use it I would definitely be reporting downsides. Throat irritation, phlegm, etc. But the way I consume it, I don't feel that there are any downsides for me. -

New data link cannabis use and heart disease: Who paid for this?

RSD1 replied to RSD1's topic in Thailand Cannabis Forum

The problem with this study is that there’s no way to know how much people were actually consuming. Moderation matters. I don’t think any alcohol is good, but some doctors say a glass of wine a day can help the heart. Ten glasses, though, is clearly harmful. Same goes for cannabis. If you’re using too much, the risk goes up. So if the people in the study were heavy users, the findings might not apply to the average user. -

I see a number of people talking about smoking weed, and as I've mentioned before, I don’t actually smoke it. I only use a dry herb vaporizer. Occasionally, if I’m in a social setting where a joint is being passed around, I might take a small hit or two just to go along with it, but honestly, I don’t enjoy how the smell sticks to you or how the taste messes with your mouth. I don't mind the smell of other people smoking a joint, but I don't like it on me. I’m also not a fan of consuming anything that’s been burned, and I really don’t like how the smell lingers in my hair and clothes for hours when I smoke it, so that's part of it. But yesterday, I decided to give smoking a proper go just to get a better sense of it. I didn’t expect to really enjoy it, but I wanted to see how I’d feel after taking four solid hits off a joint. So, I went outside, took my time, fired up a cone that had about 1g of flower in it and smoked about a third of the joint, though afterward, I didn’t feel so great. I used some weed I have which has a strong lavender terpene profile, thinking it might taste pleasant when smoked, but it wasn’t anything like that. It just tasted like any other typical flower in a joint. It didn’t taste anything like cloves or other herbs that are known for their good flavor. I didn’t cough, but my mouth felt irritated, especially inside my cheeks and throat, and the aftertaste was pretty awful, so I rinsed with some Listerine, which helped a bit. As for the high, it wasn’t anything special. In fact, it felt weaker than the high I usually get from vaping about 0.2g (4-5 hits) in my vape. Well, live and learn. After about an hour, the high was pretty much gone, and this is some pretty strong flower I was using. With the vape, I normally get a much stronger high from that amount of weed. At least I can say I gave smoking a fair shot though. On the topic of consumption quantities, I see people here talking about using multiple grams per day. I honestly don’t see how that’s really possible though. Yes, I do use less in a vape because you’re able to extract more THC from smaller amounts of cannabis compared to when smoking, but even on a heavy day, I don’t think I ever exceed 1g. My average is probably around 0.75g per day (or less), and that’s just from vaping, so no smoke, ash, or tar entering my lungs. Meaning, vaping is also much less risky in terms of health, so I could probably do more in a day if I wanted to, but I just don’t feel the need. I guess I really don’t understand how people can go through so much in a day, knowing how unhealthy it is to regularly inhale tar and ash of any kind. Even medical cannabis prescriptions typically average around 1g per day, so I’m curious why some people seem to go through so much more than that. Anyway, that’s just my two cents. I don’t mean to sound judgmental. I’m just sharing my thoughts, observations, and experiences.

-

I’ve got some proper indoor-grown weed that I picked up back in early June. It had a strong terpene profile right from the start. As soon as I transferred it from the Ziploc bags into mason jars, the smell filled my place for two days, and that was just from handling it briefly. Now, nearly eight weeks later, every time I open the jars, which I do regularly, I still get blasted with that same rich aroma. It’s incredible. You never get that with any of the eVap or semi-outdoor tent or greenhouse stuff from those online sellers though. The heat in those grow setups just doesn’t let the THC or terpenes develop and mature properly like they do in a full indoor grow with controlled temps and lighting. Whenever I’ve bought that eVap stuff in the past, there were no visible trichomes and barely any terpene smells, if any at all IMHO. When it’s grown indoors with air-conditioning, you also tend to get a lot more purple in the flowers. Most of that eVap stuff has lighter green tones mixed with orange and brown, but indoor-grown weed usually has a richer, deeper forest green color along with petals that look almost black. They’re actually purple, but once dried, they darken even more and take on that blackish hue.

-

Will Health Minister, Somsak Thepsuthin be shown the door? Yes, no, maybe? https://www.bangkokpost.com/thailand/general/3078633/pro-cannabis-group-wants-somsak-axed Pro-cannabis group wants Somsak axed Bangkok Post A cannabis policy advocacy group, Writing Thailand's Cannabis Future Network, submitted a petition to the Government Complaints Centre at the Prime Minister's Office on Wednesday, calling for the dismissal of Public Health Minister Somsak Thepsutin. The group claimed that Mr Somsak's crackdown on marijuana favoured certain cannabis business groups while causing widespread harm across the industry. The petition referred to the Notification of the Ministry of Public Health on Controlled Herbs (Cannabis), which the group said marked a major departure from previous regulations in effect since 2022. For example, the new notification removed protections for vulnerable groups such as youth, effectively making cannabis more accessible to them -- despite claims that a medical certificate would still be required. The regulation also introduced new standards for cannabis cultivation and distribution without clearly informing the public. Under the new rules, cannabis must come from sources certified by the Department of Thai Traditional and Alternative Medicine, yet no official certification standard has been announced. The regulation was enforced immediately without a grace period, leaving nearly 20,000 licensed producers unable to sell their products through the existing system. This abrupt change, the group said, has caused millions of baht in financial losses. The network also criticised the opaque implementation of the GACP (Good Agricultural and Collection Practices) standard, which they claim was applied selectively. Only certain groups were trained and certified, resulting in discriminatory practices that allowed a limited number of businesses to continue operating. The group accused Mr Somsak of violating the ethical code for politicians, citing alleged misconduct such as disregarding principles of justice, repeatedly meeting with specific cannabis business groups, withholding key information on licensing standards, and fostering division among licensed operators by favouring some. "The network and members of the cannabis community urge the PM to consider replacing the minister by appointing someone with knowledge, competence, and a commitment to good governance -- to restore public trust and end the harm to cannabis entrepreneurs," the group said.

- 1 reply

-

- 5

-

-

-

Cannabis - Medical Use Certificate - What's Your Plan?

RSD1 replied to RSD1's topic in Thailand Cannabis Forum

I don't see the connection, as many people can do both; use cannabis while also doing some good in the world. Plus many cannabis users don't smoke it to consume it. I for one don't. This topic is also about legal medical cannabis use and not about quitting, so you're off-topic. There are other discussions about quitting cannabis that might be a better fit for your viewpoint. -

Cannabis - Medical Use Certificate - What's Your Plan?

RSD1 replied to RSD1's topic in Thailand Cannabis Forum

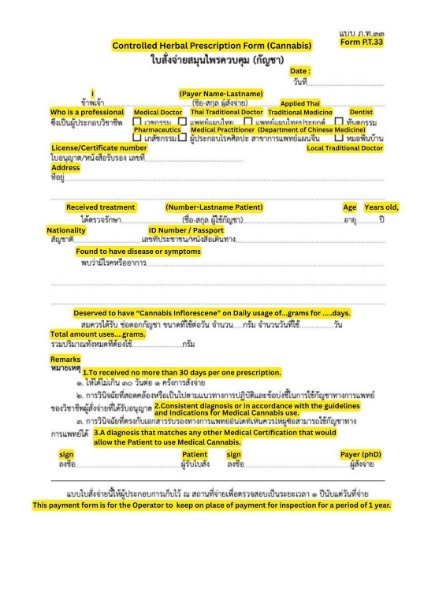

For anyone unfamiliar with what a standard P.T.33 medical cannabis certificate/prescription form looks like, see the sample form below. This example is in English, but many versions are entirely in Thai, often with the form number also in Thai appearing at the top right. Regardless of the language, all forms serve the same purpose. While this specific form was likely designed with foreigners in mind, most cannabis users in Thailand are Thai nationals, so the majority of forms are issued in Thai. I’ve obtained both a medical cannabis card and a certificate/prescription myself from a clinic which is all in Thai, though I haven’t yet used it to purchase cannabis, as I still have an adequate supply that I purchased before the laws changed. However, I wanted to have the document on hand in case I’m ever questioned about my cannabis use by authorities or the building management where I reside. For personal convenience, I’ve taken a photo of both my medical cannabis patient card (which includes my photo) and my certificate/prescription, and I keep them both in my phone for easy access. I don’t plan on renewing my medical certificate every 30 days as indicated, but rather every 60–90 days. When I carry cannabis outside, I make sure to never have more than about 10 grams total on me at any given time. While it’s possible that these precautions may not be necessary in the future, I’m just playing it safe for now. If you'd like to view a higher-resolution copy of the sample P.T.33 form, you can click the link below: https://i.postimg.cc/L84618QD/P-T-33.jpg -

THC Content has Increased 5X in Cannabis Since 2000

RSD1 replied to save the frogs's topic in Thailand Cannabis Forum

If you get your weed from a reliable source who consistently has good quality stuff, then there’s no need to worry about THC percentages. And if you use a dry herb vape like I do, taste becomes the most important factor. I don’t even pay attention to strain names anymore. There are a few terpene profiles I just can’t stand, so my main goal when buying is to avoid those. Other than that, I’m not too concerned with the rest. That said, I only buy from suppliers who offer indoor-grown flower. No eVap or any other semi-outdoor stuff.