aldriglikvid

Advanced Member-

Posts

683 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by aldriglikvid

-

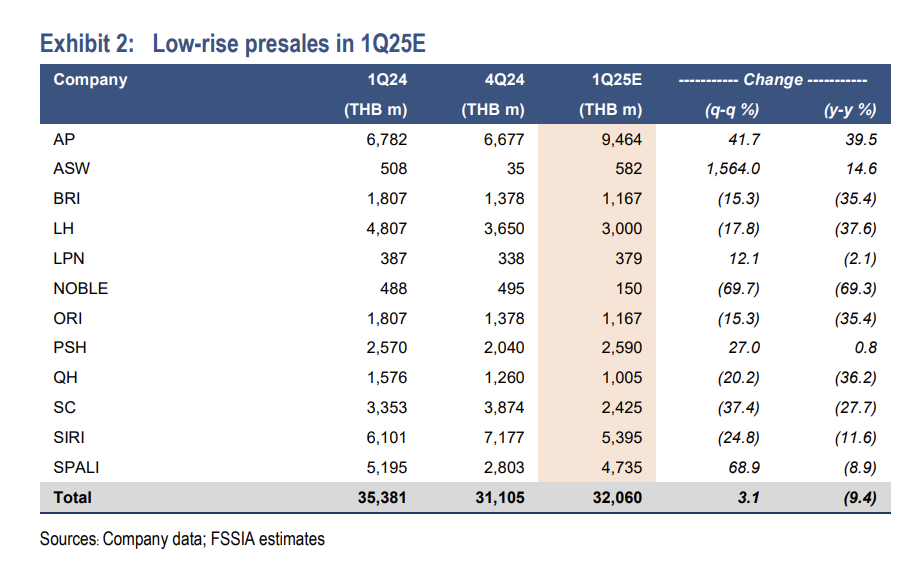

Well, at least I support my confidence in actual, objective, facts. If your of opposite view, which your condescending tone suggest, I'd appreciate if you could return the favor. On the topic of facts, here's a Q1 (First Quarter) summary up low-rise sales. To your benefit, I completely left out Condos which are in very much worse shape. Uptake is down double digits across the board, and if you read what the developers are saying in their communication to investors they are saying the demand is low from domestic as well foreign investors. Coming back to my first point: if foreign capital left it will not only hit condos, but also "housing" that only Thais can own. It all sticks together. I'm out, but you can continue swinging if you like.

-

I'm fairly confident the property market will take a hit if foreigners completely left. "We" represent 1/3 of every condo acquired. There are no similar stats available for land, as "we" can't own it. But, as you very well know, the amount of wife-owned properties, legit-leased properties and the company-owned properties are in the hundred thousands. Not really sure why we're debating if foreigners can sway the market or not - it's considered a fact by the developers and analysts themselves.

-

In the first quarter of 2025 of all condos transacted in Thailand, 29.3% were foreign buyers. Approximately one third of demand came from foreigners. What other market, globally, does foreigners represent such a big part of the overall demand? Mind you, the numbers are even higher when we account for the nominee company transactions and the "bought via the wife"-transactions. I don't subscribe to the idea that if ~30% of demand would disappear, market prices would remain flat. Furthermore, almost all the major developers are listed and they all were unable to meet their sales target in Q1 2025 - not to mention 2024.

-

Good news - let's hope it get passed! On a different note, doesn't this mean that some filings that were done recently - for income year 2024 - should be corrected/edited? I.e. if someone transferred money in 2024 - that was earned in 2024, and paid income tax on that. Or is this proposal only for 2025 and onwards? (point 2 in your table).

-

Thai Restaurant Industry Faces Crisis as Purchases Plummet by 40%

aldriglikvid replied to snoop1130's topic in Thailand News

What are these Chinese restaurants mentioned in the article? -

I had the prepared withholding tax document from my Thai bank and the withholding tax from my Thai broker with me. And a copy of my bankbook, TM30, visa and passport. I don't know how to make this much clearer: they wouldn't even entertain giving me or anyone else a TIN without showing my banking statements first. It was literally posted on the wall at several places. The post said: "Foreigner that want a TIN need to supply the following documents: Banking Statements 2024, TM30, Visa, Passport"

-

First, I want to send my appreciation for any thoughtful feedback provided. Thanks! But, perhaps I was a bit unclear in my original post. When I visited the tax branch I initiated the conversation, and asked for repeatedly, that I wanted to acquire a TIN and file my own taxes online. The very first words from the tax lady was: - "have statements? make transfers?" The entire tax office was filled with papers stating "you foreigner? want TIN? need bank statements". It was very, very confrontative from the first contact. I'm simply not confident to show this lady a transfer of 10m thb and then, hopefully, receive a TIN. They wanted nothing else but to see my banking statements, northing else was of their interests. So, appreciate your feedback - but I'm stuck at the "acquire a TIN" row as of now. With that said, I stumbled upon the Expat Tax Thailand" website and they can acquire a TIN on my behalf for a fee. If I acquire a TIN, would I be able to file online immediately - or do that new TIN need to be activated or any way greenlit by the local tax office in advance?

-

@Yumthai @NoDisplayName@petermik @Ben Zioner All very helpful. Thanks! Somewhat disconcerting situation altogether. To the best of my understanding, neither my transfers nor my local dividends (that has been taxed, and I seek no refunds/deductions), are assessable. What has been somewhat unclear to me, and what I essentially tried to settle today, is if it is an obligation to file altogether if no taxes are owned. The coming two weeks I'll try to get a better understanding if I need to file at all. I appreciate that link. If we assume Sherrings is correct here, that pretty much settles it. https://sherrings.com/dividend-income-personal-income-tax-thailand.html

-

Hi, Tax Situation: - Became a Tax Resident according to the 180 day rule late 2023 - Transferred a 8 digit number to acquire a condo in early 2024 - Said sum existed, and had been taxed, in 'home country' bank account and brokerage account pre-2024 (2020, 2021, 2022, 2023 etc.) - The only income in 2024 is dividends from Thai companies, held in a Thai brokerage - and which withholding tax has already been deducted From my understanding, there's no assessable income here. (there seems to be contradicting info: if the transfers are sizable enough, they need to be disclosed regardless earned pre-2024?) Anyhow. Went to the Tax Office today, in Jomtien (Chonburi). I was immediately asked for my banking statements to even process my filing or getting a TIN. She kept hitting this subject, aggressively so, about my banking statements for 2024. Furthermore, she asked if I owned property that I rent out - and if I traded crypto. Hadn't mentioned any of it. Very uncomfortable setting. Essentially, my experience mirrored the most cynical and satirical approach created on this forum. As I didn't have the banking statements printed (nor wanted to show them), the meeting was over. I'm now left with two options: - Not file at all. - Produce end-of-year banking & brokerage statements from my home country and hope that would be sufficient. My hesitation is rather large right now, after the meeting today.

- 195 replies

-

- 13

-

-

-

-

-

I had a look at the filing template - link: https://www.rd.go.th/fileadmin/download/english_form/2023/220367PIT90.pdf Circumstances: - Became a Tax Resident mid-2024 - Transferred xxx-sum in 2024 that was earned pre-2024 from my home country. Can proof end-of-year balance over this sum for 2020, 2021, 2022 & 2023 if necessary - Own a local thai brokerage account and received 200k in dividends from a Thai company - of which 15% immediately was taxed as per withholding tax. I'll ask for a TIN. If asked why, I'll say I became a tax resident last year and that I had dividend income throughout the year. From my point of view, my international transfers are not assessable and thus I will not bring them up or declare them when I file. I'll file that dividend has been received and taxed already. Complete? My "issue" is that - my remittance is not assessable (in my POV) and I don't want to bring it up, and "fight" that issue. Secondly, from my reading of the filing template dividends should only be filed if I want to deduct the already paid withholding tax with an income (an income which I don't have). My rather large remittance last year was to a condo purchase, and even though I can proof it as taxed pre-2024 I can't let go of the notion that the guy at the RD that will handle my application - would tax me a silly sum just out of convenience.

-

Thailand May Ease Overseas Income Tax Rules Amid Global Changes

aldriglikvid replied to webfact's topic in Thailand News

A bit out of the loop here. All remittances done in 2024 in the clear? -

Not expecting advice, but I'd appreciate your feedback on my situation: I transferred approximately 10m THB to my Thai bank in January 2024. All those funds came from my local bank back home, and have been taxed for already (via investing in equites and the such). The purpose for the transfer is probably not relevant for the RD, but I'm disclosing it here for context: purchase of condominium. Even though I earned this sum prior to 2024, and could produce documents to show it, I'm somewhat "scared" to file a 10 million remittance to Thailand - and then claim it non-assessable (from my understanding here, isn't really a viable option on the filing docs just yet). I'm afraid that they will be unable to properly understand my local docs, or interpret them to my disadvantage. Perhaps a controversial take, but, I'm probably going the route of not filing at all.

-

Tax without "sticker" ? (online/application)

aldriglikvid replied to aldriglikvid's topic in Thailand Motor Discussion

Very clear! Appreciate it. From memory, the symbol I've attached below indicates that the shop/center is able to renew road tax (and make inspections and other things). Is it your understand that they can sell a "new" road tax sticker as well? Would save me a trip out to the DLT. -

Hi fellas, I acquired Bike Insurance + "Compulsory Insurance" via Roojai and received, essentially, two different documents: 1 x Class 1 Bike Insurance @ ~3500 THB 1 x "Compulsory Insurance" @ ~650 THB Is the second one what's commonly called "road tax" (or similar)? I've not received any of those pink stickers and I wasn't sure if it was needed when I applied online, or if I simply acquired the wrong insurance. Thanks!

-

That's a misrepresentation of what I said. Of course records are being kept. What I am saying is that TRD staff doesn't have a list of every unique TINs international transfers (incoming and outgoing) as we speak, and using that as a basis to send out tax records. Could you enlighten me in which country this is a standard? What they have, however, is what I previously stated and you just confirmed: interest paid, dividends paid, year of end balance etc. I've reached out to all my previous colleagues: no one have heard of any country that have RDs that use incoming/outgoing international transfers as a basis on the annual tax declarations.

-

I sincerely doubt that TRD have any - and I mean any - remittances on their computers as we speak. We're talking about million of transfers per week into Thailand from abroad. If you look at CRS reporting, which Thai financial institutions now have implemented, the TRD gets: - End of year balance - Dividends & interest received - Investments (equity, bonds, mutual funds etc.) transactions I've worked in banking for a decade and I know not only my country's system very well: I know the adjacent countrys system as well. As per standard - international incoming or outgoing transfers are not reported to the RD. If the activity is suspicious or if the client is under investigation - it can be requested by the appropriate government agencies. I know of no country where the RD receives the clients incoming and outgoing international transfers on their final tax assessment. Happy to be corrected of which countrys that do.

-

Since the law has been in place for a long time now, and you strongly believe 2025 (i.e. today) will be the year of first rigid enforcement, when will the tax agents start to sending out the deferred tax liabilities? Is it your opinion that a progressive income tax on international remittances, on top of the stamp/transfer tax on the unit, will attract "more wealthy"? Are we even having a serious conversation here?