aldriglikvid

Advanced Member-

Posts

683 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by aldriglikvid

-

What makes you say I've quoted 2023 information? This is 2024 9M (Jan-Sep) as explicitly stated in my text. I don't understand why have to be condescending to my "argument". Nevertheless, yes - it's my best and current opinion that - at this moment - Thailand will not conduct a tax offensive on foreigners in Thailand. It's my best and current opinion, at this moment, that the law will be used to catch the big fish that transfers +20m up annually (thais & foreigners) and/or a law that will be used whenever they want it to be used: as with minority shareholders in "companies" that own houses and normal businesses. Which is not allowed by the law, but goes around everywhere to everyones knowledge. However, when the police or the government want to oust someone - they cancel and confiscate said "company". 5 or 10 years out, perhaps something more efficient and far better communicated to residents and long term tourists. Judging by your language, your on the opposite side of this take I supposed? Well, I'm only quoting the minister about the 49% or 60% ownership - so I'll not engage in an argument there.

-

In the first nine months of the year, foreigners acquired condominiums in Thailand for a total of 51 billion Thai baht, with an average unit price of approximately 4.6 million baht. Foreign buyers account for 20-25% of the total condominium purchase volume nationwide, making them a significant—arguably essential—group for sustaining the overall market. While discussing these statistics, the minister reiterated that the relaxation of ownership quota rules is under consideration, emphasizing their intention to attract increased foreign investment into the Thai real estate market. As you’re all aware, every condominium purchase requires an international FX transfer document to be presented at the land office. It is estimated that 70-80 billion Thai baht will flow into Thailand through such transactions in 2024 alone. For those who believe in "realpolitik," one might argue that it will not only be administratively cumbersome to audit these buyers, determine whether they are tax residents, and calculate their tax liabilities for these transfers but also counterproductive to the government's goal of encouraging foreign investment.

-

Essentially all societies (Europe, Japan, Canada, Korea, etc.) that have built a rigid social safety net (healthcare, education, elderly care, etc.) tax fixed assets as it's impossible to move and low administration to tax. Also, since it's an actual piece of the land in the aforementioned country it also makes sense on a philosophical level. To continue not taxing fixed assets, and to continue only taxing 4 out of 37 million working people - just to make it all up by the very burdensome route of taxing foreigners international transfers just doesn't make any sense to me. That's why I believe either this will be a "nothingburger" (i.e. self reporting with very few controls) or an absolute smash to Thailand as an expat destination. Rest assured, not a single Russian, Chinese or Indian (their 3 top tourists) will self report any tax on international transfers this coming spring. Not one.

-

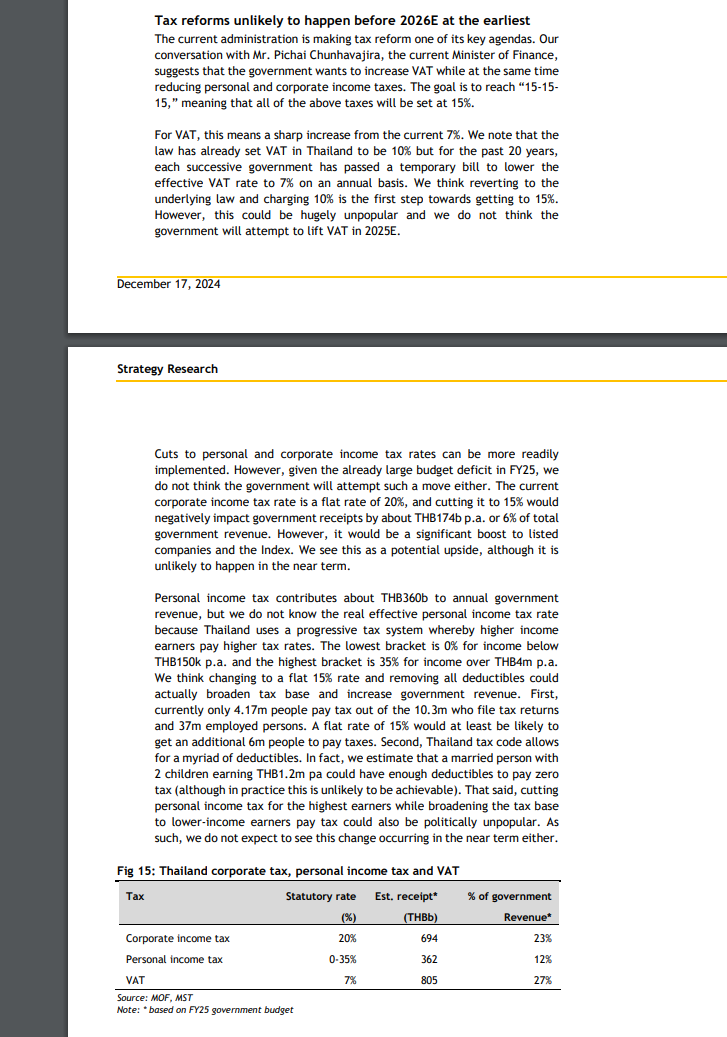

Somewhat interesting stats this morning from Maybank: Of 37 million employed approx. only 4 million pay tax. Furthermore, the real estate tax here is only symbolic in nature and almost doesn't contribute to the total revenue. These are two low hanging fruits, in my opinion, rather than going on a convoluted chase of foreigners international transfers.

-

Talked to a local realtor that has been making decent to good money the last years: business slowed down somewhat earlier this year and the remittance tax was said the reason by the customers; now the market has come to an halt. She tells me that 80-90% of customers enticed to buy use the remittance tax to not go ahead.

-

That's very helpful. I'll contact Wise and see if they can provide me with documents to verify it has indeed been international transfers. Also, I'll visit my Bangkok Bank branch and see if they can produce the aforementioned letter; most reasonably I can't be the only one in this situation. Thanks all!

-

Hi, I've made a couple of transfers to Thailand this year - not a single big one - and I wonder if the bank would still be able to create a Bank Letter of the aforementioned transfers that the Land Office accepts? The first unit I was about to buy earlier this year fell through, and the second unit I'm about to buy is somewhat more expensive. All in all three (3) transfers. It would save me a decent buck if I wasn't forced to FX it out of the country, and then FX it back again. Bless.

-

Ford, as many other auto manufacturers, decides to pull the plug on their EV ambitions: canceling several models and taking a $1.9billion write-off. They are instead going hybrid. Ford Steps Back From EVs—and Says Hybrids Are the Future The automaker is killing its electric three-row SUV, delaying a next-gen pickup, and committing to future gas and diesel vehicles, citing a lack of consumer interest in full-EV cars.

-

Are there any known long term negative effects of 2.5mg Cialis daily?

-

Hi, I need to send my passport and another set of sensitive documents from Rayong to Bangkok. What courier services would you recommend for this purpose? A friend "lost" his Passport using Grab, so I'm a bit hesitant on that one. Thanks!

-

Hi, I'm looking to buy a new (as in new) car from a official Mazda distributor, but the color I wanted wasn't available in the province that I live. The distributor in question, however, "confirmed" to me that they: - Can send it to my province - Register it in my province - Use Mazda service in my province So, it seems totally fine. I just wanted to double check with you guys, any immediate cons to do this? Thanks!

- 1 reply

-

- 1

-

-

New study breaks the age old myth that EV's require less maintenance: "Automakers have typically said that EVs are generally less problematic and require fewer repairs than ICE vehicles because they have a smaller number of parts and systems. However, J.D. Power's study with newly incorporated repair data shows EVs, as well as plug-in hybrid electric vehicles (PHEVs), require more repairs than gas-powered vehicles in all repair categories. J.D. Power’s study tracks responses from nearly 100,000 purchasers and lessees of 2024 vehicles within the first 90 days of ownership, and for the first time in the study’s 38-year history, it incorporates repair visit data. Overall, internal combustion engine (ICE) vehicles averaged 180 PP100 (or 180 problems per 100 vehicles), while battery electric vehicles (BEVs) averaged a whopping 266 PP100, 86 points higher than ICE vehicles." - J.D Power 2024-06

-

Perhaps off-topic (and the mods can delete): two established realtors told me that they now have formal cancelations were the clients explicitly mentions the "new tax uncertainty" as the specific reason. In the context that Thailand launched a very sizeable stimulus package aimed directly at the real estate sector only a couple of months ago, I'm somewhat fascinated on how they let this uncertainty work against said stimulus.

-

From the looks if it, I probably made a big blunder earlier this spring transferring 6 million thb to my Thai bank account. Myself, and approx. 41% of the working total population of my country (incl. elders/retirees) invest in Stocks/Bonds/Mutual Funds (etc.) via a "Investment Account" (free translation). In short, I pay capital gains tax (that's how its presented on official statement from the RD) once per year - irrespective if I sold or bought anything. The tax doesn't take account if you made profits or losses (and you don't declare them in separate). It's simply a % of total value, and all deposits. Details: Taxation of ISK Accounts Annual Taxation on Account Value: ISK accounts are subject to a standardized annual tax based on the value of the account, rather than on the individual gains or withdrawals. This tax is calculated on the average account balance throughout the year. The tax rate is determined by the government and is typically a small percentage of the account value. This means that you pay tax regardless of whether you make withdrawals or realize gains. No Capital Gains Tax: One of the main advantages of an ISK account is that you do not pay capital gains tax on the profits from the sale of securities held within the account. Dividends and other returns are also not taxed individually but are instead included in the annual tax calculation. Withdrawals from ISK Accounts Tax Treatment of Withdrawals: Withdrawals from an ISK account are not taxed separately at the time of withdrawal. The taxation is already accounted for through the annual tax based on the account's value. This means that you can withdraw money from your ISK account without incurring additional tax liabilities. Implications for You Any withdrawals you make from this account should be seen as already taxed under the ISK's annual taxation regime. This means you do not need to pay additional taxes on the withdrawals themselves. // End of Details. The 6 million thb sent to my Thai bank earlier this spring is a withdrawal from the aforementioned investment account. Add to it, all the deposits into this investment account was made pre 2024 and no deposits in 2024 (reminder: we're taxed on all deposits on top of the annual tax on the balance average). I figured this would be protected under the DTA (as my country classify it as capital tax on the annual statement). Would you agree or how do you all see about it? Thanks 🙂

-

As my post was written in the context of eighty (80) billion thb International transfers that is forecasted to come in to Thailand this year, from condo purchases alone; of which approx. twenty (20) billion thb already deposited and exchanged into thb this Q1 - I'm very much delighted you both agree on this part. The default of remitannce can't be, practically, that it is assessable income and thus we end up with, practically, a honor system of self declaration. IMHO. Now, a part of this eighty (80) billion might very well be assessable, and thus taxable - but the essence of my post was that RD have a petty convoluted and difficult task if they choose to use remitannce data as the main point of assessing income.

-

I appreciate that anecdote, but perhaps the essence of my comment was lost in translation. If you're considered a tax resident all remittance into Thailand is to be declared and, absent of a DTA and supporting documents, taxed as income. I continue to argue that taxing remittance will be very difficult, and was using condo purchases as a single example. The 20 000 000 000 THB that foreigners bought condos for in Q1 2024, and the 60 000 000 000 THB that will be bought for in Q2-Q4, might very well be earned pre 2024 and thus not assessable. Nonetheless, 80 000 000 000 of international transfers, from condo purchases alone, will hit Thailand this year and it illustrates how big the space of international transfers really is. Whereas a SGP stamp-duty is crystal clear in its presentation and implementation I would argue that very few of the aforementioned buyers of Thai condos are unaware of the current change in Thai tax, and how it will affect them. Not even local RDs can answer if a international transfer in the amount of 5 million should be declared or not taxed. Thailand really needs to clear up things in regards to remittance, as I believe it will hurt the economy from here and onwards. Just to give you a example: I was about to transfer 1.5m thb to buy a car - but I've now put it on hold. A good friend of mine had decided to buy the condo he was renting, and had received a price that he accepted - but now backed out of it because he's unclear if the remittance will hurt him further on. I/We can't be alone in this. Anyways, end of rant. I hope Thailand increase the transparency and motives of their actions later this year.

-

Last year foreigners bought 14 449 condos in Thailand, at the average price of 5 million thb and to the total sum of 73 billion baht. As the current rules stand, you need to make an international transfer to THB and show that receipt of currency conversion - to be able to finalize your purchase. First quarter of this year this massive transaction volume, by foreigners, is up +5.2% YoY; approx. 75-80 billion thb to be transferred into this country this year alone. With this in mind, will the RD chase European €900 euro pensioners? Or even degenerates as myself? I still believe, perhaps naively so, that this will be a honor system where actual follow up and scrutiny beyond what you self report, will be very little. I'm still in the camp that the arbitrary tax on gross remittances will be very, very difficult. In what country is it actually enforced? Are there any examples?

-

@Mike Lister Here's a tough one for you to take a stab at. My main and only form of income the last couple of years have been Capital - and more specific capital gains and dividends inside of a tax wrapper called "ISK". Taxation of ISK Accounts Annual Taxation on Account Value: ISK accounts are subject to a standardized annual tax based on the value of the account, rather than on the individual gains or withdrawals. This tax is calculated on the average account balance throughout the year. The tax rate is determined by the government and is typically a small percentage of the account value. This means that you pay tax regardless of whether you make withdrawals or realize gains. No Capital Gains Tax: One of the main advantages of an ISK account is that you do not pay capital gains tax on the profits from the sale of securities held within the account. Dividends and other returns are also not taxed individually but are instead included in the annual tax calculation. Withdrawals from ISK Accounts Tax Treatment of Withdrawals: Withdrawals from an ISK account are not taxed separately at the time of withdrawal. The taxation is already accounted for through the annual tax based on the account's value. This means that you can withdraw money from your ISK account without incurring additional tax liabilities. Implications for You Any withdrawals you make from this account should be seen as already taxed under the ISK's annual taxation regime. This means you do not need to pay additional taxes on the withdrawals themselves. For all the obvious reasons, this wrapper is really comfortable. There's no doubt, domestically at least, that all withdrawals done now in 2024 have already been taxed for previous year(s). I have substantial amounts of accumulated gains that have been taxed for pre 2024 - but without making actual withdrawals. This begs the question, do you think Thai RD will have objections to the actual withdrawal date or do you think they have the professionalism and understanding to interpret said tax wrapper correctly? I did transfer five million earlier this spring, somewhat confident I could show previous tax records of it being taxed. Confidence has been eroded a bit of late, thus my Q. Thanks again for all your help, Bless

-

Well - both, actually. I do have +2 million in capital gains that already have been taxed pre 2024; but my question was more akin to going forward (as I would still pay same, and higher, taxes back home - while considered a tax resident here as well). This is the conundrum in my point of view: how do I proof to Thai RD that my capital gains from 2022, comingled to my personal accounts in 2022 and 2023, are the "same" money I'm sending this year. I can produce my tax fillings from 2022, but it will be difficult to "draw a connection" to money sent in 2024. Even though it's the same money. Oh well, money has already been transferred so I'll make the best of it coming spring 2025.