-

Posts

35 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by oceanbluejewell

-

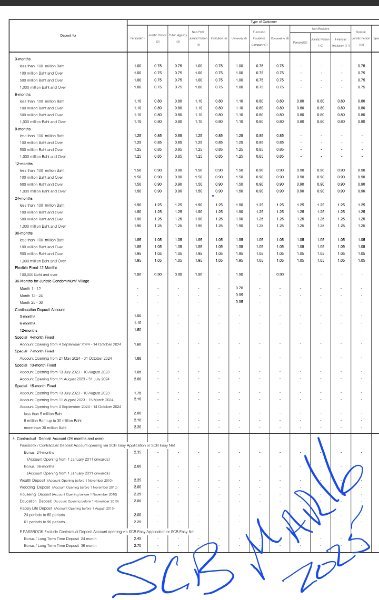

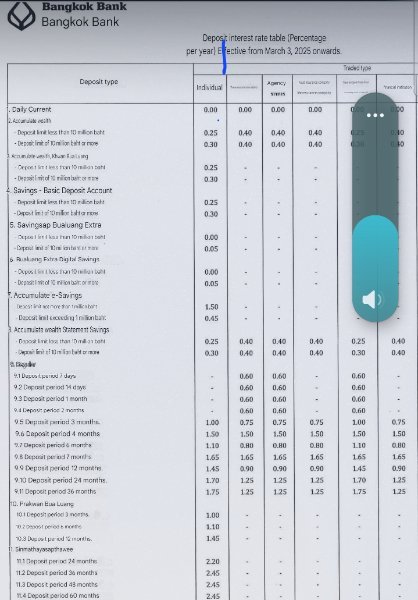

RE: What is the best % per annum? A very good question Packer. The banks here in Thailand pay very low rates for fixed term deposits. Attached is BBL.bk Mar 3/25 updated rates. If you don't read thai just pay attention to the first column (unless your a government agency or non-profit or insurance company). To get the higher rates and products like # 10, 11, 12 you will need TIN and a good relationship with your bank. -> I will not comment on your method or the mechanics, other than it creates risk to you. Being a landlord in a third world country is likely unwise and has made lawyers like Advanced Adjusting Associates Co. Ltd a lot of money. (They specialize in collections). Personally I invest in the stock market, generate 4.050% after withholding tax (2024). Not interested in chasing yield, more interested in satainable long term yields. But, if you need the money because the IM officer wants to see it and the market is in a downturn then your fudged. In the end Packer it will come down to your risk tolerance and understanding. I am not an investment professional; consult your professional investment advisor and/or legal counsel and/or professional accountant before making any investment decision. While all reasonable effort is made to ensure the accuracy of information and data contained herein, accuracy cannot be guaranteed. Past performance is not a good predictor of future performance. Results are not guaranteed and I assume no liability whatsoever for any material losses that may occur. No compensation for suggesting particular securities or financial advisors is solicited or accepted. The information in this document is not intended to be educational, nor does it constitute financial advice nor is it a suggestion or recommendation. Investing is risky and may result in substantial losses.~ Terry W Jewell

-

Scottish holidaymaker’s scooter disaster in Koh Pha Ngan

oceanbluejewell replied to webfact's topic in Koh Samui News

My thoughts exactly, saw it last week in soi choi chai 4 - some big foreigner riding/driving with 1 hand and filming with the other ... crazy 🤪 What the fu&k is he doing live stream while driving?? Can't afford a helmet or gopro? -

Hi Thaiinnomad3 Congratulations on meeting a nice (fertile) thai lady. I strongly recommend you read the comments made here. But, as a Canadian married to a Thai National (who works for thai government) I will share my limited experience: 1) SinSod = mothers milk is money & gold that is negotiated with the mother & father of the bride. It represents their investment in the woman and considers: education, upbringing, social status in community, abilities and even if her virginity is intact. The gold portion is security for the wife; incase you run away before ceremony. Thai woman are obliged to help support their parents in thai culture, in marriage her ability to help support them is lessened as she must focus on her new family. I too was told if a thai woman was previously married NOT to pay sinsod. (Prior to my current wife I dated a woman previously married and with 2 children. Our relationship goto the point of discussion about possible marriage. At no time did she or her family bring up sinsod) 2) Marriage in Thailand can be informal meaning not registered at the local Ampuer office or registered. If registered each can declare assets not brought into the marriage as well as other conditions. 3) Now days sinsod is most often returned 3 days later by the parents as capital for your new family. 4) Now days sinsod is often rented as a symbol used in the ceremony as well as many young men don't have the capital to pay it. Your question, description and language used is cause for concern. And, raises some questions/concerns: a) In her previous marriage was it registered? If so there will be marriage contract and divorce contract. b) Getting married either informal or registered is easy, getting divorced in Thailand is not easy, can take 3 or more years and is expensive. Have you spoke to a Thai family law lawyer? According to my Thai family lawyer if her previous marriage is unregistered you could become financially responsible for the 2 previous children too. https://www.samuiforsale.com/ The above link is translation of law in Thailand. Goto the family law section, read and reread. If your marriage is to obtain a visa, you will annually be at her mercy as her signature is required on one document for the marriage visa renewal at the immigration office Best of luck to you.

-

-

I'm sure more news will come but a step in right the direction; my sense is a retinal scan is better & more exclusive, meaning less likely to be tapered with. THAILAND already takes your picture and prints so what's the difference. I've had this E- Gate in UAE now since 2017. Very fast, very effective, they allow people opt in or opt out. I'm sure no-one here would disagree there is room here in Thailand for improvement. The cues here are the worst (meaning waste lots of time) and thus I no longer check luggage. I'm heading to Vietnam next month and the agent says entering will take ~2hrs The above humorous comment is another point why I like retinal scans. Anyway, let's see what happens.

-

Thaksin Shifts from Cheerful Power Broker to Cautious Strategist

oceanbluejewell replied to webfact's topic in Thailand News

สวยแต่รูป จูบไม่หอม I've watch this drama now since his initial demise and feel sad for Thailand that he is back but ขว้างงูไม่พ้นคอ they say a bad penny always comes back. Educated thai have expression for him I can't exactly remember it but the "gist" is to "becareful as that he says is sweet and kind while holding knife to your throat" Anyhow, time will tell ... ระยะทางเป็นเครื่องพิสูจน์ม้า กาลเวลาเป็นเครื่องพิสูจน์คน -

Its too expensive I may leave

oceanbluejewell replied to georgegeorgia's topic in ASEAN NOW Community Pub

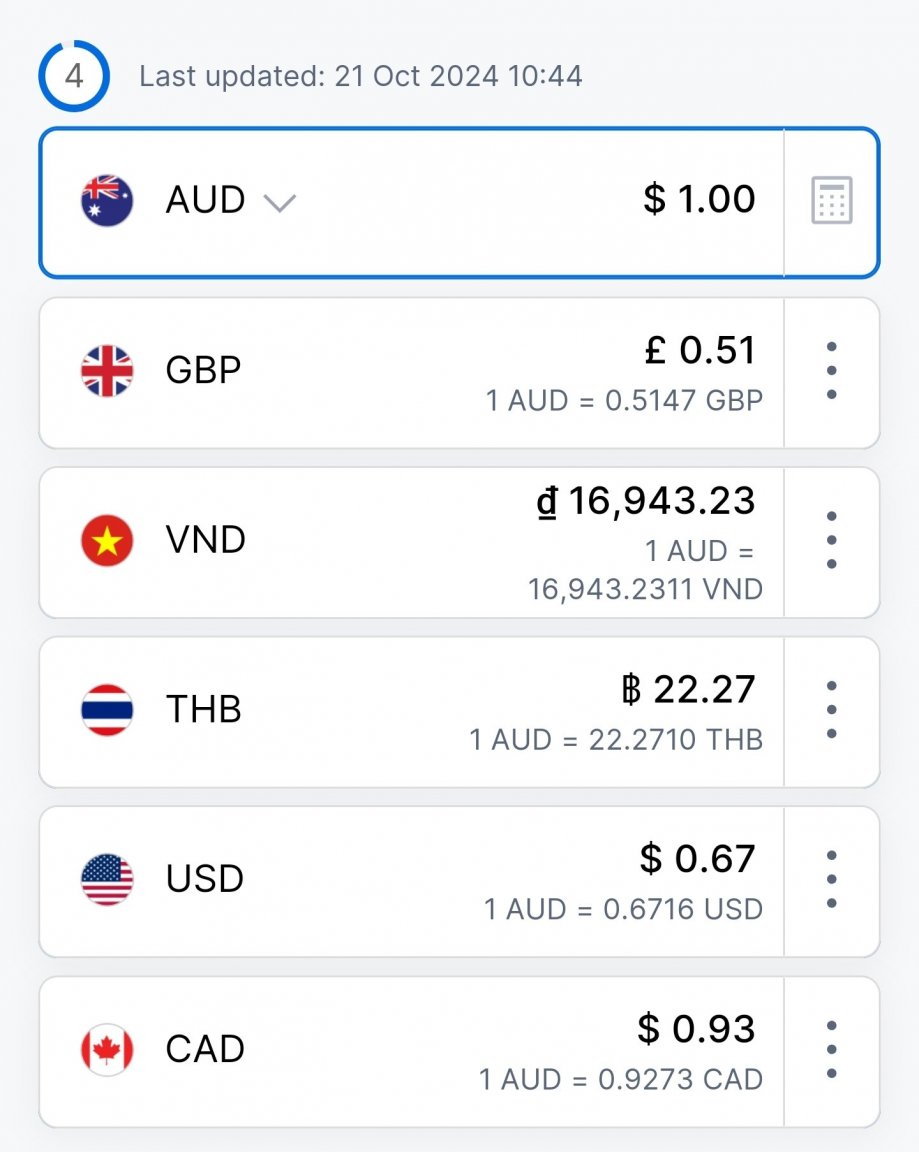

Hello George, Attached are the exchange rates for your "meagre Australian pension". I can't even imagine where you are shopping in Thailand. BUT, look how many Vietnamese "dong" dollars you will get for your Aussie buck ... wow ... think of the buying power you "might" have.🤭 {Tongue in cheek comment here.} I do hope you can find some solutions to your retirement funding issues. Take much care. -

I like your points ... thank you and have a fully diversified portfolio. I currently have earnings in THB yields 3.9% after tax THB GICs @1.6% CAD dividend income yields 3.5% tax free to $55,002.00CAD and AMT (Alternative Minimum Tax) kicks in on the excess. 🙃 USD dividend income yields 2.2% after withholding tax. I use wise as you indicate but not to hold any currency as the lack of return seems erosionary. Keep emergency funds in all three currencies in laddered GICs equal to 3years living expenses regardless where I live. BTW your English very understandable thanks 😊

-

Portfolio Tracking

oceanbluejewell replied to 1FinickyOne's topic in Jobs, Economy, Banking, Business, Investments

Free investment tracking tools I have and still use: 1) Yahoo Finance Pros: Will provide price data for most Asian equities. Earnings announcements. Price alerts. Allows for region and currency changes. Cons: Poor historical data on asian equities. No option, no portfolio tracking without email account setup. 2) MS excel Pros: Incredable flexibility. Security of data. Can pull equity data from various sources. Lots of templates/tutorials are available on www. Portable. Cons: Calculation errors can cause grief to users who have low understand of excel. 3) Wealth Connex (Thailand) Pros: Research, tracking, news, investor events, public events. Cons: Need BLS investment account. Need be able read Thai language. (Recent changes give english language support) Fee based investment/portfolio tracking tools I have and still use: 1) Fund manager https://www.fundmanagersoftware.com/ - I've used this program now for > 14yrs now to track my USD, THB, CAD securities/equities, bonds, GIC, from the various brokerage accounts. Pros: Does everything: equity, bonds, options, cash accounts ... etc. Active speedy technical support via forum. Complete video, html tutorials. Good broker & institution interfaces. Currency support, custom reports, ROI, TWR, adjusted cost base tracking. Allows for pulling historic data from many sources around the world. If your broker is not interface supported, the program allows for importing of transactions via cvs file downloaded from your broker. Cons: Requires 1 time fee for license. The mobile interface is not useful. -

Vayupak fund - any opinions?

oceanbluejewell replied to Lorry's topic in Jobs, Economy, Banking, Business, Investments

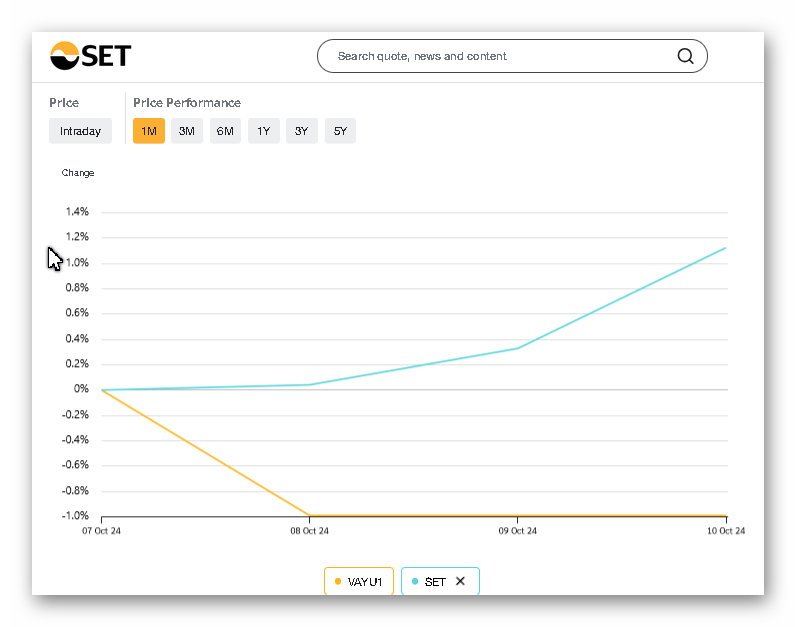

VAYUPAK FUND 1 CLASS A symbol VAYU1 If a brokerage reserved shares on you behalf you would have been able to buy. Generally this process is to help the asset manager https://www.ktam.co.th/search.aspx?q=vayu1&btnSubmit=&form_submit=SUBMIT determine interest in the market. The "Fund" will have two(2) classes of shares A/B and despite my research can not determine what the defined definition or difference will be. I suspect the fee and/or voting rights but can not confirm. The prospectus and fact sheets are still in Thai language but primarily the government backed fund is designed to invest in SET 100 https://www.set.or.th/en/market/information/securities-list/constituents-list-set50-set100 and other infrastructure and top rated ESG companies. Link here as it pdf document: https://www.set.or.th/en/market/news-and-alert/newsdetails?id=84240400&symbol=SET click the download document in right upper corner. The SEC.TH filing documents are here: https://market.sec.or.th/public/mrap/MRAPView.aspx?FTYPE=M&PID=0681&PYR=2546&lang=en The prospectus in Thai can be found here: https://www.ktam.co.th/search.aspx?q=vayu1&btnSubmit=&form_submit=SUBMIT scroll down to the pdf documents. Stated goal of the fund: 1.Invest in liquid securities such as government bonds and short-term debt instruments.2.Invest in active and/or passive securities, focusing primarily on securities listed on SET, including SET100 equities, infrastructure funds, real estate investment trusts, and non-SET100 equities with the top two highest ESG ratings (such as AA rating or higher).3.Invest in other securities not exceeding 10% of the Net Asset Value (NAV), such as unlisted securities, non-investment grade debt instruments, gold, and crude oil. Dividend Policy Dividend payment shall be made at least twice a year only in the event that VAYU1 has net profit and/or retained earnings and/or unrealized gain from investments (hereinafter collectively referred to as the "profit of the Fund") and/or dividend provision. The dividend shall be paid according to the actual rate of return of VAYU1 but not less than the minimum rate of return at 3.0% per annum and not exceeding the maximum rate of return at 9.0% per annum, which is set at a fixed rate for 10 years. The asset management company will calculate the dividend for the Class A Unitholders by multiplying such rate of return by par value of the Class A Units. Liquidity thinly traded https://www.set.or.th/en/market/product/stock/quote/VAYU1/historical-trading Like all things new a pinch of caution is always advisable. .I am not an investment professional; consult your professional investment advisor and/or legal counsel and/or professional accountant before making any investment decision. While all reasonable effort is made to ensure the accuracy of information and data contained herein, accuracy cannot be guaranteed. Past performance is not a good predictor of future performance. Results are not guaranteed and I assume no liability whatsoever for any material losses that may occur. No compensation for suggesting particular securities or financial advisors is solicited or accepted. The information in this document is not intended to be educational, nor does it constitute financial advice nor is it a suggestion or recommendation. Investing is risky and may result in substantial losses.~ oceanbluejewell -

Baht going down!

oceanbluejewell replied to Celsius's topic in Jobs, Economy, Banking, Business, Investments

-

Bank of Thailand Intervenes to Manage Baht's Exchange Rate

oceanbluejewell replied to webfact's topic in Thailand News

Thank you for the comments everyone. I have simple question as a Non-Thai National who lives in Thailand, how can I hedge my exposure to currency fluctuations in Thai currency? Note: My primary income is CAD & USD. Your suggestions will be appreciated & if any additional information is needed please let me know. -

@gearbox Your question & topic is worthy of discussion. Please not take any of this comment as investment advice, I simply sharing what I have learnt often with some cost to myself. If anything I have mentioned/posted here is not correct please let me know, I am not done learning. Investing in any market whether is be North America, UK, Canada or Japan all come with risk. Not meaning to say that there is not value in any of the markets but each has a built in risk premium. From Professor Aswath Damodaran https://aswathdamodaran.blogspot.com/2024/07/country-risk-my-2024-data-update.html or https://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/ctryprem.html To some of the comments: a) Anyone who comes to Thailand and visits or lives; whether they own or rent, they are in real way investing in Thailand. Each persons choice is a reflection of risk tolerance, bias and understanding, which is true in any market. b) Doing what one knows is often safest but then does not address the need to learn, or at times is not practical. In my case, I found security analysis interesting so I pursued a CFP designation which in the end was not helpful for my desire to learn more about security analysis. c) Understanding the local jurisdictional issues, currency fluctuations, 3rd party law related to G/F & or wife, rights and benefits like stock classifications (full or NVDR), liquidity are important. Some stocks (FULL or NVDR) are thinning traded; meaning not much volume. NVDR = Non-voting dividend receiving. My friend here lost 3 condos and all his investments to his G/F and his legal recovery process, distress and legal legal fees resulted in a zero sum game - not to mention his heart was broken. As a foreign national I am entitled to invest in Thailand if I so choose, placing those investments in my wife's name would in my mind be foolish (my opinion), not to mention the added risk assumed in such an action. Note: Thai nationals also must pay taxes on income earned. So depending on the investment choice having that investment vehicle in my wife or g/f name does nothing from a tax point of view and only adds exposure to family law in Thailand. Caveat: My wife works as a CCA (Certified Charted Accountant) for the Thai government auditing high wealth Thai and foreign companies. (she doesn't even understand the dividend tax credit), thus her ability to manage investments is nominal at best, not to mention her extreme risk aversion would have her only buying GICs and gold. In the period of 2015 to late 2018 her colleague said multiple times (direct translation) "the stock market is like rice cooker for making money" When COVID hit she lost all her gains and she no longer wanted to talk much about the stock market. Lesson here is: for someone to win there needs be someone to loss. d) Using a trading app in one own country seems ludicrous to me but I do know such people who trade foreign equities and absorb the trading fee, currency exchange premium fee the brokerage charges. Not to mention the lack of data or information about the equities. I found becoming a SET member was very helpful and with the BBL referral opened a BLS cash trading account. The result was access to stock screening, multiple trading platforms, local market analysis from BLS investment professionals. All of which was helpful in my learning process. e) Leaving my wealth in my home country is maybe a good/safe option but does not address that one must pay the bills in Thailand in THB currency. This results is exposure to currency fluctuation and depending on your tax status in Thailand it results in tax exposure. The impact of the new tax law yet to be fully understood will not be seen until 2025. This post by @webfact can possibly help some people navigate the new structure. An interesting 2 part thread here: f) Dividends in Thailand are taxed at 10% - somewhat better than the USA which is 15% see attached link for whole world https://www.spglobal.com/spdji/en/documents/additional-material/withholding-tax-index-values.pdf So having a 10% tax burden on dividend income in Thai currency is very good, not to mention that capital gains are not taxed in Thailand. https://taxsummaries.pwc.com/thailand/individual/income-determination Again, until early 2025 we will not fully understand the implementation of Thailand's new tax law. g) Not all listed securities/equities on any exchange are to be considered invest-able, meaning they are not created equal; thus the need for index ETF or funds which provide mechanisms/investment tools for people who wish to invest but not want the headache of choosing what is good and what is bad. The result is a blanket approach where an investor follows the market chosen and holds winners and losers equally. The issue here is that Thai tax law only mentions "Mutual funds" and I have no ruling on ETFs yet. Thus I choose individual stocks to avoid any problems/ better to know my exposure than not to know my exposure. Please not take any of this comment as investment advice, I simply sharing what I have learnt often with some cost to myself. If anything I have mentioned/posted here is not correct please let me know, I am not done learning. I am not an investment professional; consult your professional investment advisor and/or legal counsel and/or professional accountant before making any investment decision. While all reasonable effort is made to ensure the accuracy of information and data contained herein, accuracy cannot be guaranteed. Past performance is not a good predictor of future performance. Results are not guaranteed and I assume no liability whatsoever for any material losses that may occur. No compensation for suggesting particular securities or financial advisors is solicited or accepted. The information in this document is not intended to be educational, nor does it constitute financial advice nor is it a suggestion or recommendation. Investing is risky and may result in substantial losses.~ oceanbluejewell

-

Investment options in Thailand ?

oceanbluejewell replied to mja1906's topic in Jobs, Economy, Banking, Business, Investments

See this thread https://aseannow.com/topic/1330756-what-is-the-best-way-to-invest-money-in-thailand/?do=findComment&comment=19285624 -

Stock Exchange Thailand

oceanbluejewell replied to stupidfarang's topic in Jobs, Economy, Banking, Business, Investments

See here: -

I opened a BLS trading account in 2018 mostly b/c we (my family) banked with Bangkok Bank (BBL) over period of 3 years I built a small dividend portfolio which covers my living expenses in Thailand. Most investment platforms will assign you an advisor - which is useful when we encountered technical issues. I don't use the advisor other wise. Foreigners can have cash investment accounts, margin accounts (requires a lot of paper work) and special ETF and bond buying options if you are well funded. We keep it simple and have enough dividend income cover living expenses after the 10% thai tax. BTW I'm CFP designated without the international designation so I do my own research. Tips: become member of SET to access financial statements in English. Disclaimer: I am not an investment professional; consult your professional investment advisor and/or legal counsel and/or professional accountant before making any investment decision. While all reasonable effort is made to ensure the accuracy of information and data contained herein, accuracy cannot be guaranteed. Past performance is not a good predictor of future performance. Results are not guaranteed and I assume no liability whatsoever for any material losses that may occur. No compensation for suggesting particular securities or financial advisors is solicited or accepted. The information in this document is not intended to be educational, nor does it constitute financial advice nor is it a suggestion or recommendation. Investing is risky and may result in substantial losses.

-

How do you pay?

oceanbluejewell replied to garygooner's topic in Jobs, Economy, Banking, Business, Investments

In BKK and Hua Hin most of the business & merchants including market and street shops/food are cashless since covid. Personally i pay via qr code or scan. Just ask if they have qr or scan? Surprising most do qr or scan EXCEPT: taxi, motorbike, some massage shops, toktok and small back soi vendors I pay direct from my thai bank and prompt pay. Noticed last week a lady pay the bus fare too, but I usually have some coin. Cashless is very handy too as most banks allow you to make notes/classify items bought to identify what your buying like food, supplies, desk & sofa from homepro etc. -

9000thb will get you full time, skilled cleaner in BKK 1 x wkly or 2 x month will range from 300thb to 500thb per time. I would be more concerned in finding a trust worthy cleaners & once found pay them well.