MeePeeMai

-

Posts

1,041 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Posts posted by MeePeeMai

-

-

What's strange is that the Thai Embassy in Washington DC states that 400k/40k insurance IS required for a Non-O retirement

https://thaiembdc.org/2020/11/17/nonoretirement/

...but no mention of it being required for a Non-OA

https://thaiembdc.org/2020/09/30/nonimmigrantoaox/

I realise that this is probably an error but it has been this way for many months now (uncorrected).

It's amazing how ass backwards things are here and how just a little consistency and clarity would surely go a long way in elevating the poor reputation/history of the visa rules and procedures here.

-

1

1

-

-

- Popular Post

- Popular Post

1 hour ago, scubascuba3 said:Feeble, he's looking for actual names of products

I thought he was hard up for some Old Spice. I was merely pointing out the fact that there's literally tons of it for sale here on Lazada. Why burden others to mule it?

1 hour ago, scubascuba3 said:-

10

10

-

2

2

-

- Popular Post

- Popular Post

Lazada (and Shopee) is your friend.

-

6

6

-

This article makes sense to me, but I'm sure many here will call it "rubbish".

-

1

1

-

-

2 minutes ago, Neeranam said:

Btc is up 86%. Gold is down. Some people don't move with the times. Gold is down about 10%. Like I said, bitcoin is going to take the gold market.

Right and it won't stop at gold either. It's a monetary black hole and it's going to eat everything in in it's path.

Most bitter FUD loving no-coiners will take their resentment and bitterness to their graves (rather than admit they were wrong and embrace this amazing new technology).

I just smile and wave goodbye to the lot of them.

-

1

1

-

-

1 hour ago, Freeduhdum said:

Just do a search... how many billionaires are buying bitcoin? They're not... they are buying land and gold. GO NOW AND DO A SEARCH.

You obviously don't follow the news and are still living in the past. Everything is changing very quickly now in this digital age and if you don't care to keep up with what's going on, then you will be left behind.

To each his own but maybe you should go do some bitcoin searches and get caught up on the latest news.

BTW, all caps are not necessary.

-

1

1

-

-

Have fun staying poor Grandpa!

-

I'm not sure what to think about that thing. I'd give it a test drive though!

-

1

1

-

-

We can revisit this thread later this year. Should be interesting!

-

1

1

-

-

Pullbacks are both necessary and healthy. Time spent in the accumulation phase between spikes builds support for the next pullback.

This bull market (party) is just getting started! .... ALL ABOARD!!!

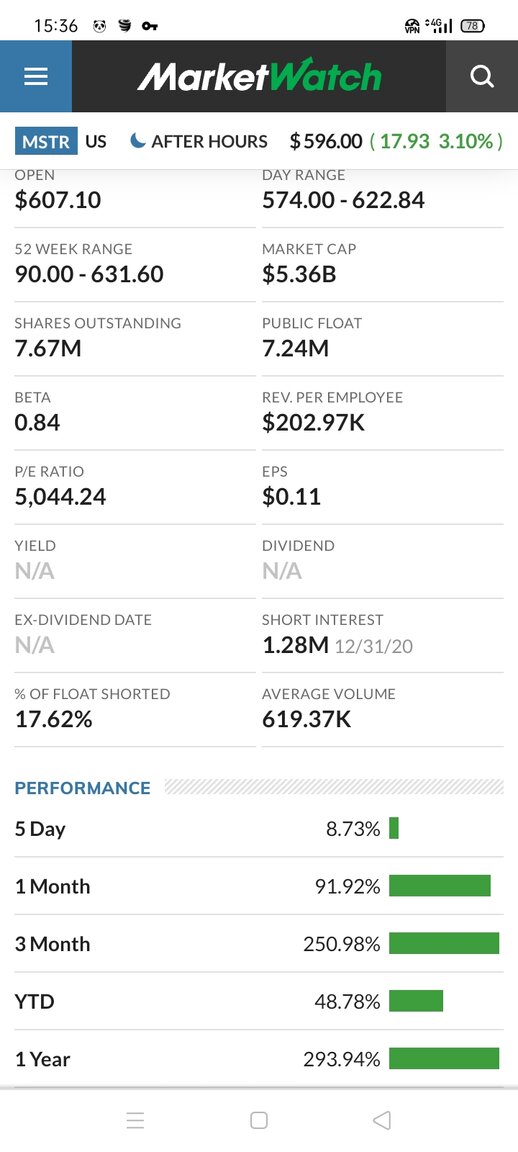

MSTR (Microstrategy) stock is up 251% in just 3 months since the CEO Michael Saylor bought 70,470 bitcoins to hold in their corperate treasury reserves. It's a great way to get exposure to bitcoin without buying it directly. No fees and no premium (or markup) vs buying Grayscale bitcoin trust.

-

I don't have a link handy but I recall reading an article that stated there is a 17% tax on crypto assets here in Thailand (plus VAT?).

Why not just sell on an exchange i your home country or elsewhere and pay the tax in your home country (if any) then transfer the money to your Thai bank account.

I don't know what country you are from but being from the USA, I certainly wouldn't sell any here as I would be taxed by the IRS, the State that I have a home in as well as the Thai tax authority.

It may make more sense to borrow the money you need at a low interest rate using your crypto as collateral. That way you won't have any tax liability and you won't have to sell an asset which is only appreciating in value over time (as in bitcoin for example).

I use Blockfi and Celsius.net for crypto loans on btc. Celcius has the lowest interest rates. 1% on a 25% loan to value for example but they go up to 50% loan to value.

-

Don't complain, take the free fiat and buy bitcoin with it. ✔️

-

1

1

-

-

4 hours ago, JeffersLos said:

It may hit 100k in 2-4 years, it will likely hit 20k before it hits 65k.

I'll take that bet!!

-

1

1

-

-

5 hours ago, advancebooking said:

My friend is intending to move to Thailand and not work. He is well off but asked me how much money to live here long term. ie how many millions of baht to retire here permanently. He has visited a few times as short term tourist but never long term

I told him he should have budget of 100k a month minimum. If he is aged around 50 and lives to 80 then he might need 36 million

Essentially I said to him he could easily spend a 100,000 a month in Bangkok living quite well.

Any thoughts on this. I expect this is the first time this kind of thread has ever been raised

4 Bitcoin should do it!

-

1

1

-

-

small supply vs H U G E D E M A N D

√ 40k

50k

65k

100k

-

1

1

-

-

-

4 minutes ago, bkk6060 said:

I got in around 30,000.

Could take a big dump whatever I will hang onto it long term.

In 10 years I bet it is much much higher

Congrats!

You won't have to wait 10 years!

-

1

1

-

-

6 minutes ago, Bender Rodriguez said:

the same that brought you 2008 credit rating A+ scandal that crashed the world economy and got even extra bonusses for the execs and a nice bail out and no jail ? those one's ?

That's right.

Those evil, corrupt, lying, cheating bastards are getting into crypto now too.

They smell opportunity I guess.

-

51 minutes ago, allanos said:

Only a couple of years ago, Jamie Dimon, of JP Morgan Chase, was so dismissive of Bitcoin that he threatened to fire any of his traders who were trading it, even if for their personal accounts. JP Morgan Chase is now one of the biggest "shills" for BTC in the market place.

That's right and now J.P. Morgan Chase is calling for an eventual bitcoin price of $146,000 plus.

Banks must now adapt or die. The old systems and old ways are dying and they are finally starting to see and accept that fact.

There are still many old die hard critics such as Warren Buffet, Jamie DImon, Peter Schiff (and the like) that are too proud and too close minded to ever admit that they might have been wrong about bitcoin, but that doesn't matter in the slightest as Bitcoin waits for no one.

We are going to see a 1 trillion dollar Bitcoin market cap soon and things should get real interesting.

Good luck to all no matter where or what you decide to invest in.

2021 will be one hell of a ride for us all (in more ways than one) that's for sure!

-

2

2

-

-

Microstrategy has made over $77,000,000 a DAY on their btc treasury reserves so far in 2021 (77,000 bitcoins x average $1000 dollar a day increase in bitcoin price = 77 million dollars a day)

His personal stash of over 17,000 bitcoins has made him over $17,000,000 a day so far this year (not to mention his MSTR. stock is skyrocketing too).

Is he a fool? I don't think so I think he is a genius, but only time will tell.

-

2

2

-

-

Risk vs potential reward $$$$$$$$

How much risk are you willing to take?

Portfolio allocation percentage & diversification?

It helps to do some research before investing in bitcoin too. Understand it and you will have confidence in investing in it.

I went 100 percent in on bitcoin back in spring/summer of 2017 (all my cash, my entire self-directed IRA and my entire self-directed ROTH IRA)

Since then I've been doing partial rollovers into my ROTH so that my entire net worth (in my IRA accounts) will be federal and state tax free in just a few years.

I rode out the Dec 2017 bull run, subsequent crash(es), 2.5 year bear market and I'm up over 1000 percent now.

I don't have weak hands, I have a high risk tolerance and my only regret is not getting in sooner.

-

1

1

-

-

2 minutes ago, Barnabe said:

"They will never try to make it illegal to convert to fiat."

"Fake news"

https://en.wikipedia.org/wiki/Executive_Order_6102The US Dollar is not currently backed by bitcoin. Totally different scenario.

-

1

1

-

-

8 minutes ago, Barnabe said:

WIshful thinking. As I said before, I am a fan of bitcoin, but I have my eyes open to the possible risks.

The US can't control bitcoin, but sure as hell they can control your ability to convert it into fiat.

If the US makes it illegal to turn bitcoin into fiat, the UK and EU will follow suit. What do you think will happen to the price of bitcoin?

And more importantly, never forget bitcoin is NOT anonymous. All transactions that you have ever done are recorded in the blockchain. This means you only really need to have one transaction where your identity was identified (such as converting to fiat in an exchange) to tie all your wallets and bitcoin together.

They will never try to make it illegal to convert to fiat. They are simply looking at new regulations to insure that they get their taxes on it. They want to know who has it and who's selling it so they can tax it.

There's no good reason to sell bitcoin for fiat anyway since the sale of Bitcoin generates a tax bill (Fed-IRS and possibly State taxes which will cost you at least 20 or 30 percent of your gains).

This is the reason that it is difficult to buy the dip and sell at a profit looking to buy the dip again. You'd have to get a dip at the same percentage of your tax bill just to break even when you buy back in (assuming that your timing is perfect). It is proven that it is better over the long run just to buy and hold even through the dips/corrections/flash crashes and bear markets.

You can simply borrow on it at as low as 1% interest rate (no sale = no tax bill) or buy gold/silver/platinum etc with it on ALL the online gold bullion dealers (taxes due), then you can always turn your gold (that you bought with bitcoin) into fiat at anytime too if you choose to do so (tax gain or loss).

The US government just wants to make sure they get their taxes from it. And yes, It would be wise to not run a fowl of tax reporting laws on your crypto trades so as not to end up in prison or with huge fines.

-

1

1

-

1

1

-

-

It's pretty obvious who here studies bitcoin and is paying attention to it.. and who is still quoting MSM FUD from years ago.

Even the MSM is changing their tune now with big financial banks and institutions calling for a 150,000 to 400,000 btc by dec 2021

Things are moving very fast and it is wise to pay attention or get left behind.

I bought Microstrategy stock (MSTR) after the CEO Michael Saylor bought 1 billion in bitcoin. I paid 350 for it at a peak or top and it's now at $522 (latest aftermarket trading price) and rising.

Bitcoin mining stocks and MSTR/Square/Paypal/Grayscale etc are great ways to benefit and get exposure to btc without actually buying btc.

Some btc mining stocks are up 1500 percent already in the last year.

BTW, Paypal, Square, Grayscale, Fidelity Digital Assets, MassMutual Insurance and others don't invest in ponzi schemes. Wake up and smell the coffee!

-

1

1

-

1

1

-

Question regarding pre-flight COVID-19 viral test required for traveling to the US

in Health and Medicine

Posted

I just came back to the USA on March 08. I used renewme skin clinic at The Hyatt Regency Bangkok Sukhumvit 2F 1 Sukhumvit Soi 13 Rd, Khlong Toei Nuea, Watthana, Bangkok 10110

Near Nana station.

They are trusted and will get the paperwork correct. If you leave at noon the you must go in for your PCR test the day before you leave. I would go in before noon (you can make an appointment on their website but they also take walkins).

I paid 3900 baht for an expedited test result but you won't need the expedited (more expensive) test as long as you go in early the day before your flight.

My flight left at 8:00 am so I had to be at the airport at 5:30am

They will give you the letter that you will need to show the airlines and Customs / Immigration to get home.

For convenience, I stayed at the Ambassador hotel (which is only a 5 minute walk to the clinic and was only 700 baht).

As long as you get tested the day before you leave (more than 24 hours before your flight is fine) but your test must be done sometime on the date right before your flight date.

Google Renewme skin clinic PCR test (for travel) and you will find their website. They do have several different locations but I chose the one near nana station in Sukhumvit as I am familiar with the area.

Bring your passport with you to get tested. They will call or email you when your test result and letter are ready. Then you just go to the clinic and get the letter (ask for them to print it for you/ vs them emailing it to you). You will need the printed original letter to board your flight.

Good luck and safe travels