-

Posts

6,766 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by jerrymahoney

-

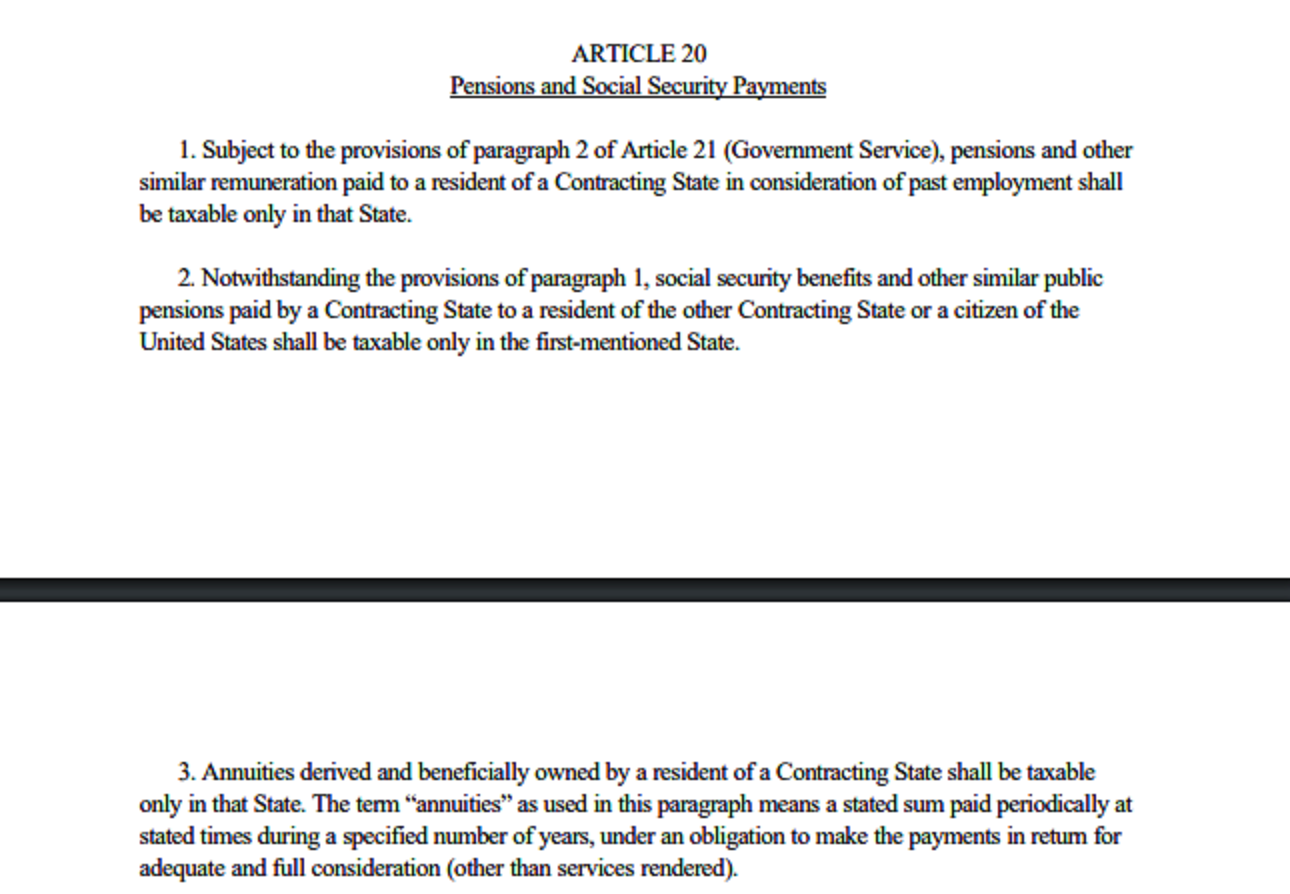

Well maybe there will be some reaction from the US Embassy - Bangkok if/when the Thai RD says NUTS! to your US-Thailand DTA and we will be taxing all the US Social Security monies brought into Thailand regardless of SS being specifically exempted (only can be taxed in issuing country) in Article 20 of that silly DTA.

-

PSA: Tips for finding long-term Thai health insurance

jerrymahoney replied to lsemprini's topic in Health and Medicine

'Questionable insurers' is being polite. Some insurance that some use on here has been frequently and recently been referred to as a scam or an unsustainable business plan. In my case at least, I have a life insurance policy in Thailand that has a very nice medical rider available which can kick in up to the age of 90. ... such is part of my due diligence. -

PSA: Tips for finding long-term Thai health insurance

jerrymahoney replied to lsemprini's topic in Health and Medicine

A large component of regularly posting knowledgeable people are 'self insured' i.e. they have no insurance. -

ARTICLE 20 Pensions and Social Security Payments Article 20 deals with the taxation of private (i.e., non-government) pensions, annuities, social security, and similar benefits. Paragraph 1 Paragraph 1 provides that private pensions and other similar remuneration paid in consideration of past employment are generally taxable only in the residence State of the recipient. The phrase “pensions and other similar remuneration” is intended to encompass payments made by private retirement plans and arrangements in consideration of past employment. https://www.irs.gov/pub/irs-trty/thaitech.pdf

-

Well non-state employment related pensions are on the US-Thai DTA as I noted in case some Yank was casually reading this and not aware of the minutia. But as long as there is some hiatus here, I would just like to note I have been on the receiving end of 2 doomsday scenarios: 1. Immigration Officer: "You farang -- you have retirement income of 65k per month. Show me your Thai tax return for your visa extension of stay showing that you paid tax on income of 65k monthly. 2. Be careful mate. That will bring you to their (RD) attention. ... and it is always better to not get noticed by any Thai Govt person or office. I wish you scaremongers were better coordinated.