-

Posts

6,761 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by jerrymahoney

-

In the linked OP Nation article it says: "The complainants said the evidence and the statement used to file charges against them had been obtained illegally by the senior officer, who was appointed deputy chief of the investigation committee." so at least currently the 48 Khon Kaen officer complainants are only objecting to the provenance of the evidence, not that the evidence is bogus.

-

If the US Embassy in Bangkok were pressed as to why they do not provide income verification services to US citizens for Thailand exension of stay, they might simply say: Notary and Affidavit services and policies are determined on a world-wide basis. We do not and cannot adapt such policies to individual country requirements.

-

A group of 48 police officers from the Immigration Bureau on Friday filed a complaint with the new National Police chief, Pol General Torsak Sukwimol, claiming that a senior officer of the Metropolitan Police Bureau (MPB) had falsely accused them of malfeasance and taking bribes. The bureau's senior officer reportedly accused 48 officers of violating sections 149 and 157 of the Criminal Code by filing a complaint at a police station in Khon Kaen province in the northeastern region. Section 149 prohibits the accepting of bribes by state officials while Section 157 covers malfeasance in office. https://www.nationthailand.com/thailand/general/40031661 Khon Kaen ??? Say it isn't so.

-

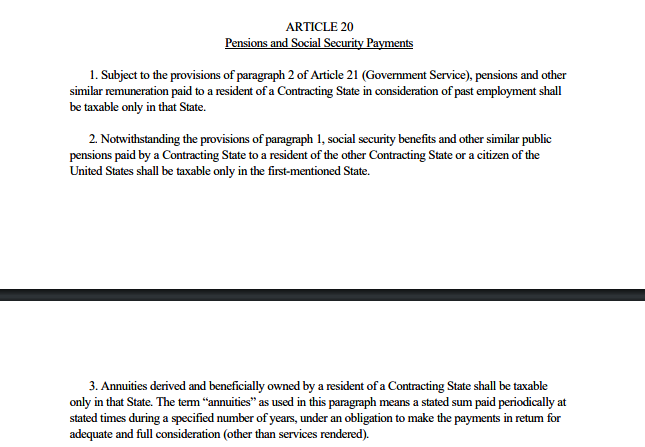

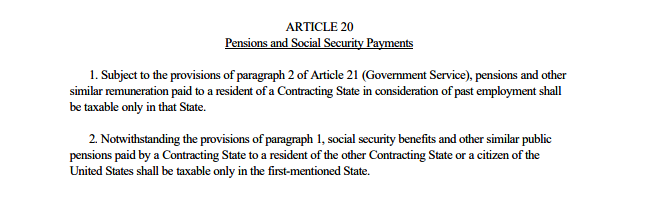

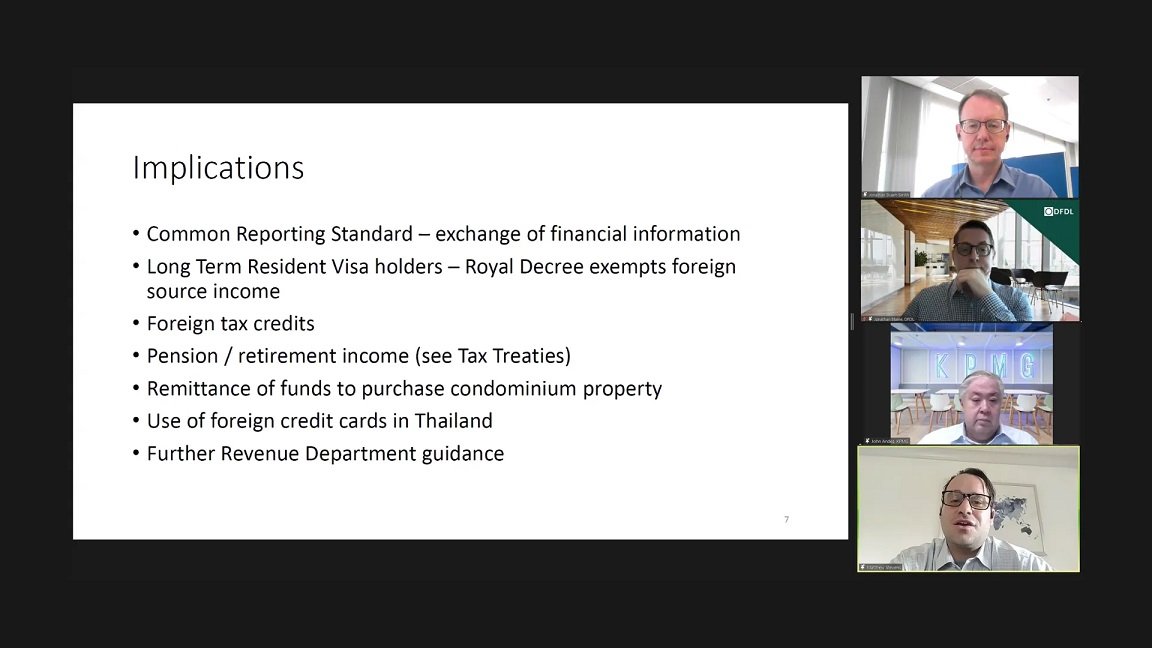

From the AMCHAM post above: - Any transfers into the country will need to be declared. To avoid double taxation, you will need to file taxes in Thailand yearly and claim exemption. https://www.reddit.com/r/Thailand/comments/16zh3k4/amcham_meeting_on_taxation_of_foreign/ However for Social Security et al under Article 20 US-Thailand DTA, not sure why you need to 'avoid' double taxation as those items can only be taxed in the country of origin whether taxed there or not.

-

Trump co-defendant pleads guilty in Georgia election case

jerrymahoney replied to Social Media's topic in World News

Most likely, yes. But the evidence is not the only thing at issue in a trial like this. -

When I read this as regards US-Thailand DTA I thought of the dialog from Bridge Over The River Kwai: Nicholson (Sir Alec Guinness) Now sir, you may have overlooked the fact that the use of officers for manual labor is expressly forbidden by the Geneva Convention. Saito: Is that so? Nicholson: I happen to have a copy of the Convention with me and would be glad to let you glance through it if you wish. Saito: That will not be necessary.

-

Trump co-defendant pleads guilty in Georgia election case

jerrymahoney replied to Social Media's topic in World News

A Trial in Trump’s Georgia Elections Case Will Start Soon — Without Trump Oct. 4, 2023 The first trial may also provide clues as to how the former president will fare when his turn before a jury comes. And Mr. Trump’s Atlanta lawyer, Steven H. Sadow, will be watching closely. (un-affiliated attorney) Mr. Adams said that in cases with many defendants and staggered trials, defense lawyers like him have the advantage of getting a preview, in the first trial, of the prosecution’s strategies. “I’m sitting in the back of the courtroom, I can see what’s presented, I can see what the witnesses have said, I can see what their arguments are,” he said. “I get to tailor my defense and my arguments for when we strike up trial No. 2.” https://www.nytimes.com/2023/10/04/us/trump-wont-be-on-trial-in-georgia-case-this-fall-but-his-presence-will-be-felt.html https://archive.ph/wib1i -

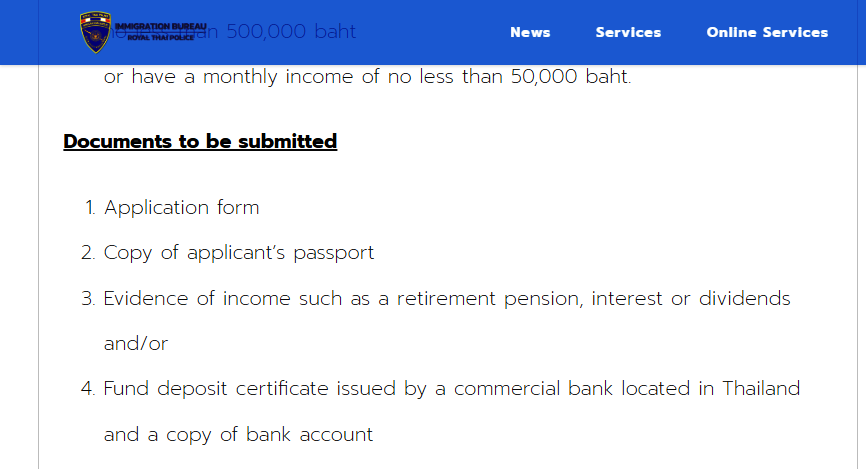

For me, at least, my next extension of stay via retirement using the 65K method is in December 2023. So I will have a whole year before my following extension to observe the body count. Thanks for the heads-up. And once again this from the RD folks themselves: 9. What is the method for elimination of double taxation provided in the agreement? - In a double taxation agreement, there are credit and exemption methods. https://www.rd.go.th/english/23520.html

-

(US) TAXATION CONVENTION WITH THAILAND ARTICLE 24 Other Income 2. The provisions of paragraph 1 shall not apply to income, other than income from immovable property as defined in paragraph 2 of Article 6 (Income from Immovable (Real) Property), if the beneficial owner of the income, being a resident of a Contracting State, carries on business in the other Contracting State through a permanent establishment situated therein, or performs in that other State independent personal services from a fixed base situated therein, and the right or property in respect of which the income is paid is effectively connected with such permanent establishment or fixed base. In such case the provisions of Article 7 (Business Profits) or Article 15 (Independent Personal Services), as the case may be, shall apply. **************** Now I could see where -- if there is to be disagreement between an expat resident and the ThaiRevDept -- given the documentation likely required to take advantage of this article/paragraph. But these kind of complex arcane questions are likely not to involve the run of the mill persons on pensions or social security who are unlikely at best to end up in a tax court in Thailand over DTA disagreements.

-

Yes, I am only interested in Article 20.2 of the US-Thailand Convention. And in my case I will presume a hard-copy of my annual Social Security statement showing my 65K+ baht monthly distribution will suffice. (Article 20) 2. Notwithstanding the provisions of paragraph 1, social security benefits and other similar public pensions paid by a Contracting State to a resident of the other Contracting State or a citizen of the United States shall be taxable only in the first-mentioned State.

-

Maybe. But this is what the Thais say: . What is the method for elimination of double taxation provided in the agreement? - In a double taxation agreement, there are credit and exemption methods. https://www.rd.go.th/english/23520.html And the official word is 'Convention' not Agreement: TAXATION CONVENTION WITH THAILAND

-

That's all.