-

Posts

6,766 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by jerrymahoney

-

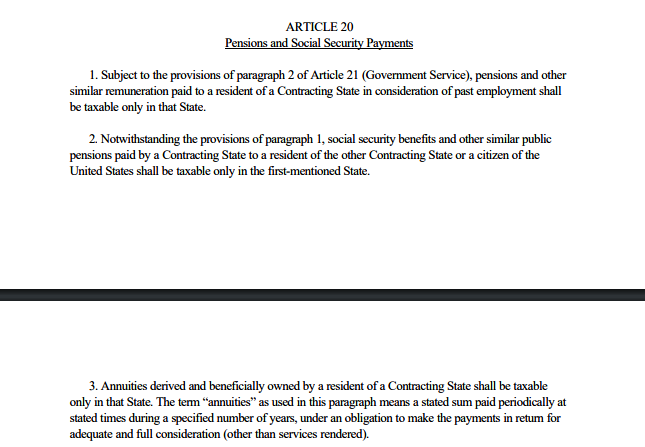

Yes, I am only interested in Article 20.2 of the US-Thailand Convention. And in my case I will presume a hard-copy of my annual Social Security statement showing my 65K+ baht monthly distribution will suffice. (Article 20) 2. Notwithstanding the provisions of paragraph 1, social security benefits and other similar public pensions paid by a Contracting State to a resident of the other Contracting State or a citizen of the United States shall be taxable only in the first-mentioned State.

-

Maybe. But this is what the Thais say: . What is the method for elimination of double taxation provided in the agreement? - In a double taxation agreement, there are credit and exemption methods. https://www.rd.go.th/english/23520.html And the official word is 'Convention' not Agreement: TAXATION CONVENTION WITH THAILAND

-

That's all.

-

Moderator.

-

Ever hear of KataBeachBum?

-

At this point on page 64 of the topic I will key in the late Donald Rumsfeld from 2002: Reports that say that something hasn't happened are always interesting to me, because as we know, there are known knowns; there are things we know we know. We also know there are known unknowns; that is to say we know there are some things we do not know. But there are also unknown unknowns—the ones we don't know we don't know. And if one looks throughout the history of our country and other free countries, it is the latter category that tends to be the difficult ones. https://en.wikipedia.org/wiki/There_are_unknown_unknowns

-

The Thai Revenue Department Sept. 18 posted online Order No. P.161/2023, clarifying personal income tax on income from work duties or business conducted abroad, or arising from assets located abroad. The clarification explains that, effective Jan. 1, 2024, income of residents earned or attributable to assets abroad is subject to personal income tax in Thailand for the year of assessment in which the income is brought into Thailand. [Thailand, Revenue Department, 09/18/23] Reference: View Order No. P.161/2023. https://news.bloombergtax.com/daily-tax-report/thailand-tax-agency-clarifies-payment-of-personal-income-tax-on-income-from-abroad

-

The 2 links above KPMG and Sherrings as well as multiple other reports I have read from various sources reference Section 41 Par.2 of the Thai Revenue code. However, for those +/- 70 age expats staying 180+ days in the Kingdom, most if not all their income would be under Par. 3 Section 41 namely: (3) Fee of goodwill, copyright or any other rights, annuity or annual payment of income derived from a will, any other juristic act, or court decision. ... which at least for US citizens is excluded under Article 20 Par. 1-3 of the Dual Tax Agreement. Or at least as my simplistic reading would show.

-

Blackpink’s Lisa dazzles at ‘Crazy Horse’ in Paris

jerrymahoney replied to webfact's topic in Thailand News

Since the Crazy Horse cabaret in Paris was started in 1951, maybe the other way around. https://en.wikipedia.org/wiki/Crazy_Horse_(cabaret) -

Strictly as a hypothetical: On another topic there was a post: If they start taxing transfers in the 65ks will be the first hit, meant to be income Similar posts in other topics. Well presuming that any of this is ever enacted, I don't know if that will be the case. Most simply, someone on retirement extension via 65k or 40K monthly transfer method (retirement or marriage) could bring their US Social Security annual statement to show sufficient monthly distributions from SS and off-limits via DTA. If someone has 800K or 400K in the bank for extension, the IMM Officer might ask: That's nice. What and where is the money that you actually live on?

-

Trump co-defendant pleads guilty in Georgia election case

jerrymahoney replied to Social Media's topic in World News

No. It does not put one in the clear. -

Trump co-defendant pleads guilty in Georgia election case

jerrymahoney replied to Social Media's topic in World News

Possibly. -

Trump co-defendant pleads guilty in Georgia election case

jerrymahoney replied to Social Media's topic in World News

That was a quote from Raw Story as to one reason a plea deal was offered. It doesn't say their was no agreement to turn state's evidence. -

Trump co-defendant pleads guilty in Georgia election case

jerrymahoney replied to Social Media's topic in World News

She is already likely un-indicted co-conspirator #3 in the WASHDC federal case. -

Trump co-defendant pleads guilty in Georgia election case

jerrymahoney replied to Social Media's topic in World News

At least in this case, the Judge has made it clear to the Prosecution that if at all possible he wants the DA to whittle down the case due the sheer logistics of it all. “The Fulton County Courthouse simply contains no courtroom adequately large enough to hold all 19 defendants, their multiple attorneys and support staff, the sheriff’s deputies, court personnel, and the State’s prosecutorial team. Relocating to another larger venue raises security concerns that cannot be rapidly addressed,” the judge wrote. https://www.politico.com/news/2023/09/14/judge-delays-trial-for-trump-others-in-georgia-2020-election-prosecution-00115903 -

Trump co-defendant pleads guilty in Georgia election case

jerrymahoney replied to Social Media's topic in World News

From that Raw Story article: It's not clear whether Chesebro or Powell will be asked to cooperate with investigators as part of their plea agreement, which prosecutors could be offering to avoid showing some evidence in the case ahead of trials for the other defendants. -- or no spill-a da beans. -

Trump co-defendant pleads guilty in Georgia election case

jerrymahoney replied to Social Media's topic in World News

It says in the full article that what he mainly would have to offer would testimony against Ms. Powell.