Lorry

Advanced Member-

Posts

3,477 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Lorry

-

It is ok

-

You do not produce O2, plants produce it. It's then in the air. In your lungs, the O2 from the air moves into your blood, and your pulse oximeter measures this oxygen in your blood. Maybe you knew it anyway, and just used a technically incorrect verb.

-

Bus Companies Lament Over Suspension of School Field Trips

Lorry replied to webfact's topic in Thailand News

Thx for a staightforward answer. Honestly didn't know that. -

New ‘Dee-Delivery’ regulation to combat COD fraud epidemic

Lorry replied to snoop1130's topic in Thailand News

Very stupid, indeed. One of those very stupid people is a retired German law professor, criminologist, former minister of justice. You can watch his account on YouTube. Fortunately, this would never happen to you, as you are much smarter than this very stupid guy. -

New ‘Dee-Delivery’ regulation to combat COD fraud epidemic

Lorry replied to snoop1130's topic in Thailand News

In theory, yes. In reality, I have seen a package sender "Micky Mous", Adress of sender "Changwat Pattaya" without street address, ZIP 1234567, package actually came from Bangkok. (I changed the details) -

New ‘Dee-Delivery’ regulation to combat COD fraud epidemic

Lorry replied to snoop1130's topic in Thailand News

Similar experience here. Lazada not trustworthy at all, money lost. Solution for me: only buy cheap stuff online, under 1000. Or from a real company that I have used for years already (Illy). But even this isn't 100% safe (Thai Airways) -

Bus Companies Lament Over Suspension of School Field Trips

Lorry replied to webfact's topic in Thailand News

Hm, thinking of it, I once watched "Freddy (?) the Eagle", so maybe there is some snow. I stand corrected. Thx -

Bus Companies Lament Over Suspension of School Field Trips

Lorry replied to webfact's topic in Thailand News

In the UK??? They do it on the continent, because of ice and snow. I thought there is no snow in England, maybe some sludge. Am I wrong? -

Bus Companies Lament Over Suspension of School Field Trips

Lorry replied to webfact's topic in Thailand News

Could you please explain how the climate of the UK affects the life of a vehicle? -

Thailand's Cashless Leap: Ahead of the Asean Pack by 2028

Lorry replied to webfact's topic in Thailand News

It's about avoiding surveillance. Since Starbucks started tracking every single cup of espresso I buy, I don't go there anymore. I consider my espresso my private life. Plus: If Starbucks wants to collect (and sell for good money) my data, they should pay me for them. Data are not cheap. -

k japanese government bond 6mj fund

Lorry replied to CallumWK's topic in Jobs, Economy, Banking, Business, Investments

You will get very close to the estimate. It may not be 2.0000% like on a term deposit, there will probably be a different number in the second decimal. This is a fixed-term (automatic redemption after about 6 months, they are always a bit flexible about the maturity date) fixed-income (fund holds only a certain set of fixed-income papers, in this case Japanese government bonds, see the fact sheet, they won't buy or sell) foreign (fund holds only Japanese papers) fund. These funds are very safe. They usually hold papers from Qatari banks, big Indonesian banks, big Chinese companies, stuff like that. It's all short-term paper, will mature soon, so very little risk - they are always currency-hedged. Return is usually a bit higher. Risk is usually given as 4/10 (because foreign). In this case, they only hold Japanese government bonds, so even safer, 3/10, (the risk is that the Japanese government will go broke within 6 months), but less return. Return of these funds is always a tiny bit more than a fixed-term deposit, and tax-free. But they always run only a short time (6 or 12 months is typical), and then you have to get active again. For a well-off Thai (minimum investment is typically 500,000) who pays income tax and who would not be able to claim back the withholding tax, this is a way to get a tax-free return even on rather high sums invested. -

I found it on a website from Singapore... Sounds good.

-

Thanks for all the posts and especially for this one. It explains a lot. It's a 12y.o. Daikin, obviously no inverter. I've tried dry mode last evening and the only effect was - none at all. The air coming out of the unit was a little bit colder than in cool mode. The wind coming out was just as strong as cool mode. Dry mode obviously is just a nice digital icon, something that one has to have in the digital age where everything needs to have many nice icons and buttons So last night I ran it in cool mode, 1° colder than usual and that was okay, until it got warm outside in the morning It's hot outside now, so I just set it one more degree colder ( I never understand why these things work according to the outside temperature, not the room temperature. Heating in my home country is the same)

-

I am sorry, but I don't know where in the many threads they are buried, i don't even remember in which one. The latest post was very long and, I think, max 1 week ago. Even if you only peruse the tax threads, you couldn't have missed it. Just go through all the posts of the poster ballpoint and you will see them all. The first one was quite old (one year plus?), but, as I said, the latest one was very recent.

-

Good idea. I tried to read up on this, but stopped when a a/c site from Singapore recommended to use dry mode "in the early hours of the morning, when humidity is highest". So, set my alarm to 5a.m. to switch on dry mode, and go to bed again??? Sorry, maybe this fits a Singapore lifestyle, but not me.

-

This only makes sense if dry mode makes the air even dryer than cooling mode. Is this really the case?

-

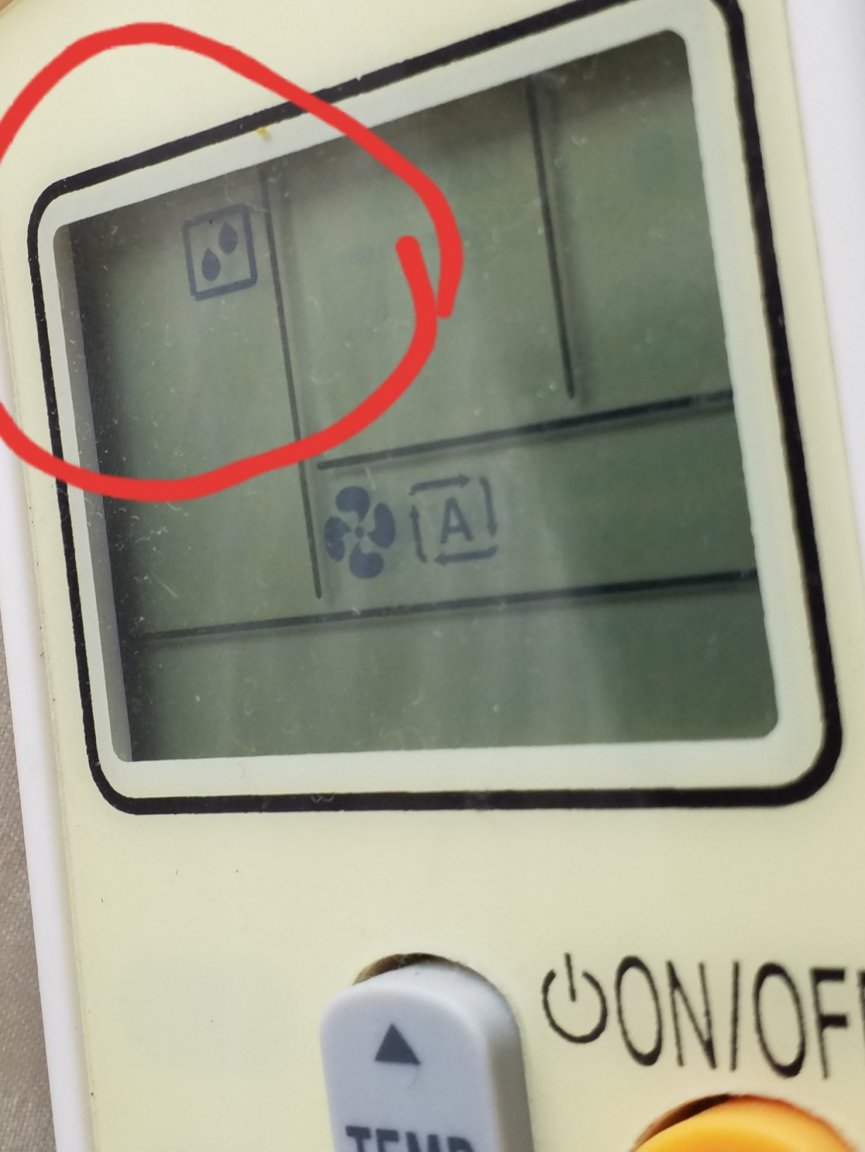

Thx for the answers, but just as I thought: Remote has a button " MODE" Pressed it > can scroll 3 icons: a snowflake, I guess it means cooling mode a fan blade, I guess it means fan-only mode an almost invisible icon in an unlit dark corner of the screen, it could be water drops??? TGF when asked what this is, said "mai lu ". Is this how Daikin says "dry mode"? (Or is it to make the a/c start dripping? Or is it something completely different?)

-

This morning, outside was colder then inside, so a/c switched itself off (my experience with many brands). Air in the room got very stuffy and humid. Opening the window, not possible, too noisy. Fan, too windy, cannot sleep. I have seen the word "dry" on many remotes, does it have a meaning? I have very poor experiences with a/c remotes and their buttons. Never seen understandable instructions, never seen anybody who understood them (including Mitsu staff). Any ideas? Daikin, 12y.o.

-

Frozen in time: British expats losing out on pensions in Thailand

Lorry replied to webfact's topic in Thailand News

Good post. Bacolod was the place in Negros I meant. Of course, keep in mind: Someone I know in Europe suffered a heart attack in the countryside and got a stent within 45 minutes. That's the standard in his country. There is nowhere in the PI or in Thailand that comes close. Someone else I know moved to Thailand and suffered a heart attack upcountry. He died. A stent would have taken days. If I were to live in Bacolod, I would know whom to call and how to pay for an air ambulance to Manila. But most things, they can handle there very well, at very decent prices. -

Frozen in time: British expats losing out on pensions in Thailand

Lorry replied to webfact's topic in Thailand News

Thailand has a shortage of doctors (and nurses), and the medical association works very hard to keep it that way. The ratio of doctors to inhabitants is low. Furthermore, the private sector you mentioned (including medical tourism) is draining resources from the care of most Thais. Even middle class Thais cannot compete with the prices foreign insurance are willing to pay (like many foreigners without foreign insurance, who can't afford these prices either). -

Frozen in time: British expats losing out on pensions in Thailand

Lorry replied to webfact's topic in Thailand News

A Thai doctor (who is always from a well-off or at least middle class family BTW) is at the top of the pecking order here. Even the money isn't much better in the UK. The money is much, much better in the US - but you can easily find Thai doctors who came back to Thailand from the US.