Lorry

Advanced Member-

Posts

3,281 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Lorry

-

Yes, this is how CRS is supposed to work. But there have been reports of Thai banks planning to report all resident accounts of foreigners. Presumably, they would report to the country of the nationality of the account holder. The CRS rules maybe clear and simple. What reporting banks actually do, is much less clear and simple. I have personally seen some very messy "reporting", not only by Thai banks.

-

Farang, especially the kind of farang you find in Pattaya. And Thais who are interested in these farang

-

Kplus app forced me to update the app. The updated app wouldn't work as long as I didn't switch off all accessibility services, which were: ESET mobile security (makes sense, I should have as much malware as possible on the phone I use for banking) and Nova launcher (this one pïssed me off, I really like Nova launcher) A warning appeared on the phone, that these 2 apps would stop if I switched off accessibility services. I called them and they told me if I don't switch off all accessibility services I won't be able to use the banking app. As I am dependent on the app at the moment, I switched off the accessibility services. Funnily, the phone looks like before, it doesn't behave or smell or sound differently. I am a digital illiterate - anybody knows, what these accessibility services are?

-

Often. But I never heard a Thai say "I like Bangkok". Foreigners, on the other hand, say that often

-

The global minimum tax for corporations has nothing to do with CRS. 2 different things. CRS means common reporting standard, aka AEOI automatic exchange of information. It's not more than this, an exchange of information. Useful to find people with bank accounts abroad they don't tell the taxman. The global minimum tax aims at corporations who, using transfer prices and other accounting gimmicks, shift their profits into low-tax jurisdictions. They are very open about their bank accounts. No secrets, no AEOI needed.

-

Not sure this would help. As for tickets out of Thailand: someone (Guavaman?) earlier posted the British rules for non-doms, who have to pay taxes only for money remitted into the UK. Tickets out of the UK are taxable, no matter how and where they were paid for. In the AmCham webinar it was said: it is a remittance whenever you get the service or goods (that you paid for) in Thailand. Method and location of payment doesn't matter at all. This makes a lot of sense.

-

Hundreds of thousands forced to scam in SE Asia: UN

Lorry replied to Social Media's topic in World News

https://www.nytimes.com/interactive/2023/12/17/world/asia/myanmar-cyber-scam.html -

Many posts earlier someone posted the corresponding regulations of the UK (isn't that even your home country). In the UK, this would be a taxable remittance (for non-doms). Not so obvious at first sight, but if you think about it, there is some logic in it. Whether the Thai RD will copy UK regulations or not is anyone's guess. PS the fact that you flew into and out of BKK would be difficult to deny, easy to tax those flights PPS IIRC in the UK only flights out are taxable wherever they have been bought. Flights in are only taxable if bought in the UK. Makes sense.

-

It works the other way round : they don't have to check all ATM withdrawals done in Thailand. They will just have to ask all tax residents (ie people staying over 179 days) to list their ATM withdrawals. If they don't believe the answer they can ask the tax resident to provide the corresponding statements of all his foreign bank accounts, translated into Thai and stamped by his embassy in BKK and the MFA. They know from CRS which banks he has accounts with. If he won't provide this information, they may just estimate the withdrawals. All the people here who think all this is too much work for the RD, maybe have never filed taxes anywhere. It's generally not the RD, or his or her Majesty, the IRS or whoever, who does the work. It's the taxpayer who has to do the work. Unfortunately for the RD, a database of all people staying over 179 days does not exist yet.

-

aka "Little Pattaya" So, if you like Pattaya ...

-

AFAIK 120 dB. When playing music, less than this is illegal.

-

Did you notice that the baht appreciated quite a bit against, let's say, the pound during the last 20+ years? It has not been a bad investment to buy baht.

-

Suvarnabhumi Airport opens automated channels to foreign travellers

Lorry replied to snoop1130's topic in Thailand News

As of now, the RD determines tax residency (i.e. stay in Thailand of 180 days or more) by manually counting passport stamps of each year. 1. example: Entry Jan 1st, 2024 Exit Feb 2nd, 2024 via automated gate, no stamp Next Entry: Jan 1st, 2025 They will determine you were tax resident in 2024. 2. example: Entry Jan 1st, 2024 Exit Feb 2nd, 2024 via automated gate, no stamp Next Entry: March 1st, 2024 They will probably figure out that somehow stamps don't add up. They will not know why, they have never heard of an automated gate. How they will handle this? Up to them. -

That's a nice one. Do you happen to have the same in Thai?

-

At the entrance of the government complex, at the main road, there are motorcycles to building B (20 baht), and also buses (cheaper). You will probably be able to find motorcycles at the station, too.

-

A friend is shopping for cataract surgery, in Bangkok. Highest quote I heard from him was almost 250,000 (Rutnin). So, yes, your quoted price looks a bit excessive. He found a place for 120,000, quality unknown.

-

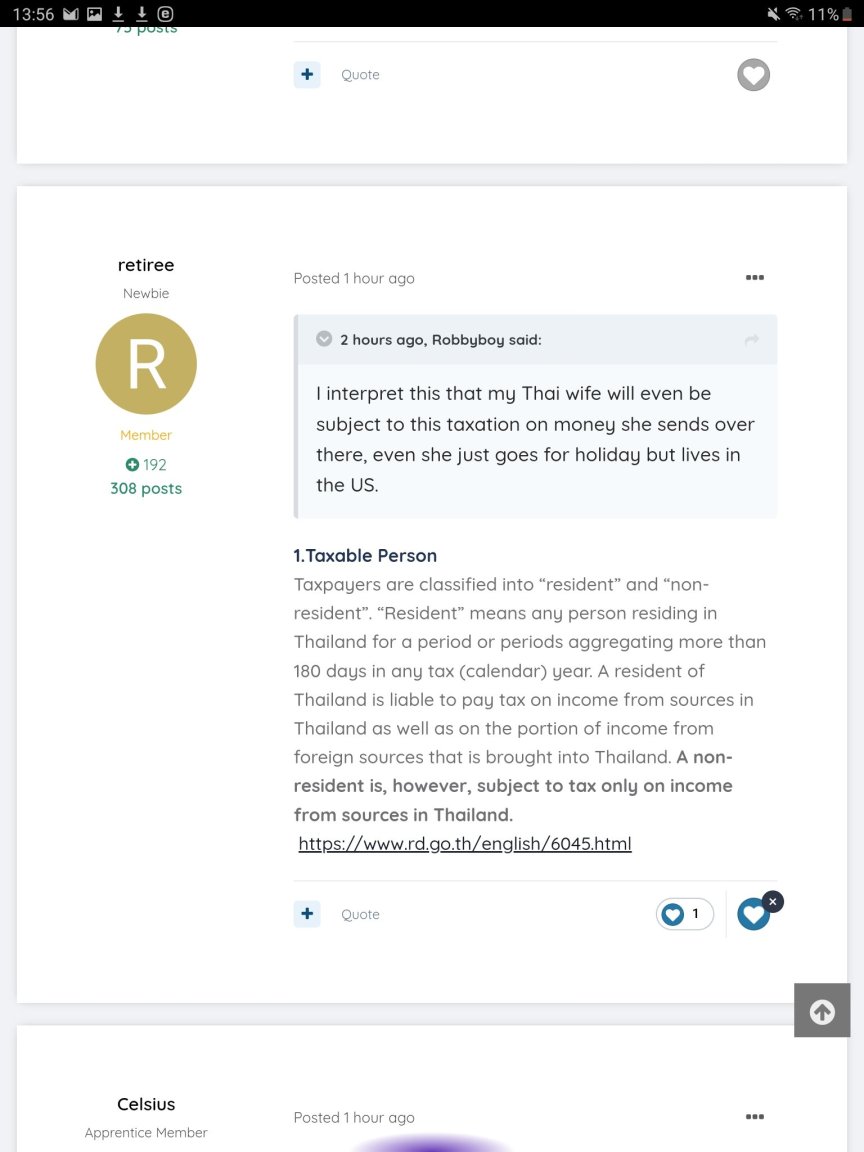

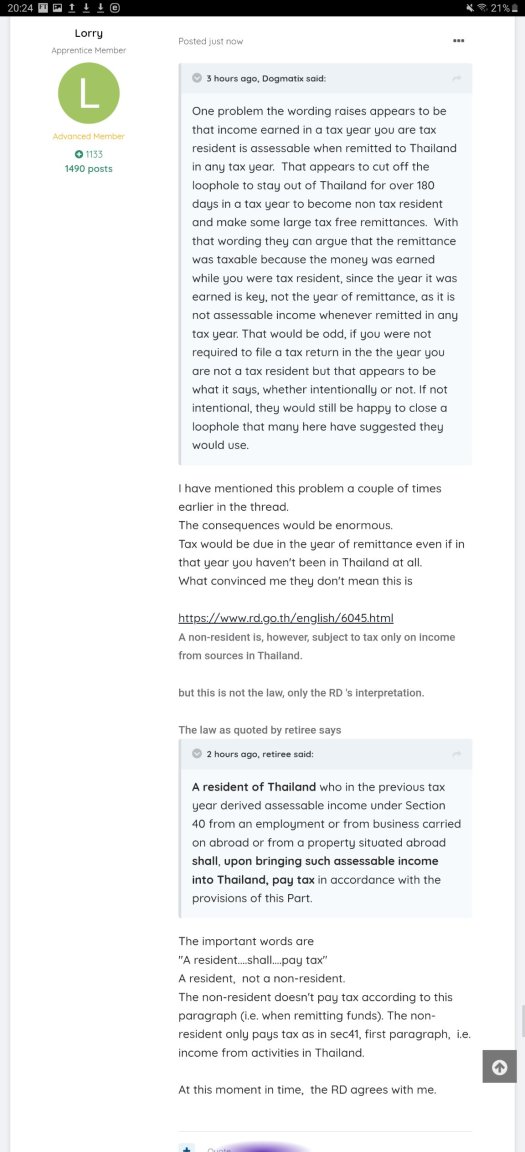

I think you are very wrong, nationally doesn't matter for Thai taxes (as in many other countries). But I understand why you feel this way, you earlier gave an example: if you remit money into Thailand in a year you are not a tax resident, are you supposed to file taxes ? As a non-tax resident? In English, order 161/2566 reads "a tax resident who has foreign income AND later brings this money into Thailand". My English is very limited, maybe a native speaker can help: doesn't this wording assume that this person is a tax resident in both years/always? My Thai is even worse than my English, I have no way to judge what the Thai version means. But it really doesn't matter, it means what the RD will say it means.

-

So, what does "Tax residency status in the year of remittance is irrelevant. " mean? I am very confused now. I don't think it makes a difference whether a tax resident in Thailand is Thai or foreigner. What some people write here is: if you receive income abroad in a year you are tax resident, and you then remit this money to Thailand in a year you are not a tax resident, in this case you have to pay taxes for this money in the year you remit it to Thailand even you are not a tax resident. This leads to the consequence that you may be liable for taxes in a year even if you weren't in Thailand at all. Mike has given an example. I find this absurd, even if I understand the logic. This problem has been discussed earlier in this thread, I attach 2 early posts which convinced me that tax residency in the year of remittance IS relevant. Obviously, Baker McKenzie is not convinced.