chiang mai

Advanced Member-

Posts

26,698 -

Joined

-

Last visited

-

Days Won

6

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by chiang mai

-

Thai Tax on UK pensions

chiang mai replied to Humpy's topic in Jobs, Economy, Banking, Business, Investments

A poster asked if "they" would see their pension coming into their bank account. I replied yes, the BOT sees all remittances from overseas. And since the remittance is then in the remitters bank account, it's most likely earning some interest, against which tax is deducted and returned to the TRD, ergo, the TRD is potentially also aware of the account by virtue of the tax withholding. The remitter may then file an income tax return to recover that tax withholding. I see the last part of that as a natural extension of the posters question and not totally removed from the subject of income tax. -

Thai Tax on UK pensions

chiang mai replied to Humpy's topic in Jobs, Economy, Banking, Business, Investments

A 15% with holding tax on all savings interest is automatically deducted and forwarded to the TRD. -

looking for recommendations for a gastroenterologist

chiang mai replied to rumak's topic in Chiang Mai

The tricky part about seeing a gastro doc is in avoiding being sold a gastroscopy or endoscopy, "just to check and be safe", when the complaint doesn't really require it. At 36k for the pair, it's a real money spinner for the doctors and the hospital. -

looking for recommendations for a gastroenterologist

chiang mai replied to rumak's topic in Chiang Mai

If Dr Jeerasak is still at Rajavej, he would be a good choice. All the senior gastroenterologists in CM were trained by the same person and come from the same class, for anything serious I might consider Sriphat or travel to Bangkok. At Sriphat, Dr.nipphit Phrommee,M.D. has a very good reputation. https://sriphat.med.cmu.ac.th/find_doctor?lang=en&doctor_name=&spec_name=25&special_name=70 -

I didn't see that any tax news was due in July, where did you read that? As US interest rates fall this year, the value of USD will weaken and become less attractive to investors. That will benefit emerging markets and developing economies who import oil and are dependent on exports, aka countries like Thailand. Yes of course the Baht will gain value against USD this year, potentially to the low 30's. But that doesn't mean that THB will have strengthened by anything related to the Thai economy, the increase in Baht value will result from events that are completely outside of Thailand's control or influence.

-

The other point I forgot to add is that Canada started to reduce its interest rates long before the US with two cuts already under its belt, one in June and one in July.

-

I didn't write that very well! Every currency is valued against USD, directly or indirectly because USD is at the top of the forex tree. I don't know all the dynamics that drive CAD value but the price of oil is one major factor and the oil price has been falling in recent days.,,,Canada imports over 70% of its crude from the US plus the US is by far Canada's main import/export trading partner. Oil and exports are paid for in USD, this means that as the value of USD falls, other currencies such as THB can buy USD more cheaply. This means their cost of imported oil is cheaper and their exports earn more. Those currencies appear stronger because they have an economic advantage compared to when USD was very strong.

-

The Investing Year Ahead

chiang mai replied to Mike Lister's topic in Jobs, Economy, Banking, Business, Investments

It will be, once we see bottom, it's difficult to know how deep down that will be. -

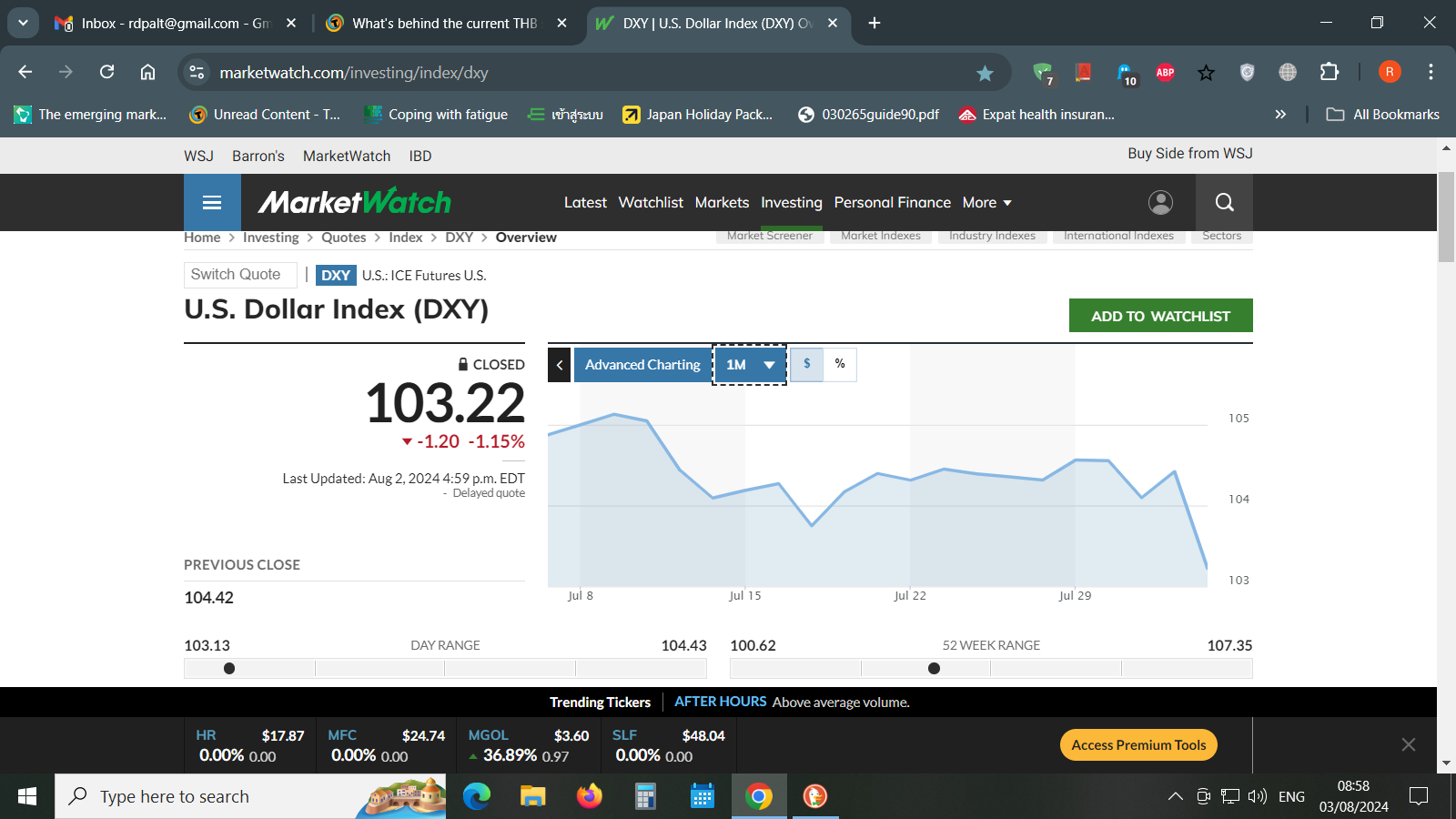

It is not that THB is increasing in value, it isn't, USD is losing value. Any currency that is valued against USD, appears to be strengthening as a result: https://www.marketwatch.com/investing/index/dxy

-

The Investing Year Ahead

chiang mai replied to Mike Lister's topic in Jobs, Economy, Banking, Business, Investments

For all you market watchers, a sea of red is flooding forward: https://www.investing.com/indices/major-indices -

I'm not sure that everyone understands the process involved, perhaps it's worth explaining. This is not a simple and straight forward matter of saying that no Thai tax is due, just because a tax return was filed overseas. In a simple and uncomplicated example....if a person earns say 13k Pounds in the UK, 12,570 of that will be covered by the UK Personal Allowance hence only the difference, 13,000 less 12,750 will be taxed at 20%, by the UK HMRC. If that 13k Pounds was then remitted to Thailand, the full 13,000k would need to be declared to Thai tax, assuming it was tax assessable income under Thai rules. The point here is that the UK Personal Allowance is not relevant to Thailand for tax purposes. Instead, Thai TEDA would have to be used to reduce the taxable amount and TEDA will vary from person to person based on age and circumstances. The other point to bear in mind is the GBP/THB exchange rate. The difference between 13k Pounds at 47 baht per Pound versus 13k Pounds at 40, may mean the difference Thail tax being due or not. If all of the above comes out to be that Thai tax is due and payable, the taxpayer will need to invoke the UK/Thai DTA in order to use the tax paid in the UK, to offset tax due in Thailand. By all accounts that is not a straight forward process and is complicated further by non-aligned tax years and tax credits that cannot always be carried forward.

-

Quite right too because it's nothing to do with them, it's all down to the MPC at the Bank of England to decide rates. The BOE contact details are below, in case you have spare time on your hands. 🙂 https://www.bankofengland.co.uk/contact

-

Historically, fair value against USD is around 32/33, which implies around 42 against the Pound, unless one side weakens or strengthens.

-

The problem is the value of USD and GBP are both falling, following expected rate cut news.

-

Thai Tax on UK pensions

chiang mai replied to Humpy's topic in Jobs, Economy, Banking, Business, Investments

All remittances from overseas are reported to the BOT, if tax is withheld on those remittances then that is reported to TRD. -

I believe this is a Fed rate issue. The Fed has indicated rates will fall, beginning September, markets have penciled in three rate cuts this year. That means USD value falls as the return on cash is less attractive and should mean that US equities will increase in value.

- 119 replies

-

- 13

-

-

-

-

.png.b885543f29d0967023dd5e32d1af52c7.png)