- Popular Post

-

Posts

2,976 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by Sophon

-

-

- Popular Post

Two weeks ago I went to the local Revenue Department office here in Lamphun where I live. I showed the clerk/officer the document from the Revenue Department head office (pasted above in motdaeng's post), and explained to her that I wanted to file a tax return including my foreign pension. Unsurprisingly she had no idea how to do that, as they had received no guidance from Bangkok on the matter. Consequently, I was handed off to her boss who also knew nothing about this, but could see from the official document that I was in fact expected to file a tax return for my foreign pension.

Over the next hour or so, I explained my circumstances (through translation by my wife) to the boss-lady, we looked at all my documentation and together managed to file my tax return electronically. Everything was conducted in a very cordial and service minded fashion. I have just checked my tax return online, and it has been accepted and finalized by whoever does the post-file processing.

The problem people have had when trying to file their tax return, is that the provincial offices have received no guidance from Bangkok, and culturally when Thai people don't know how to handle a situation, they often revert to the "no need" response, even when that is not true.

Some people here ask, why on earth anyone would voluntarily go to the Revenue Department and file a tax return. Everyone's situation is different, but personally I have several reasons for filing:

Firstly, living in a foreign country where I have no absolute right to live, I try to do things by the book, which includes filing a tax return when i am obligated to do so. I don't want any risk of being accused of tax evasion (however small that risk might be) and jeopardize my future here. Especially since I don't actually have to pay any tax on my pension. The tax I pay at source is far more than any tax Thailand would potentially be entitled to, and I would get a credit for the tax paid at source.

Secondly, I am entitled to claim back the 15% withholding tax on my bank interest. It is not a fortune, but I still want it back. It's a nice little bonus to get the annual check from the Revenue Department.

Thirdly, avoiding having to file a tax return in Thailand by not transferring your foreign income, or simply ignoring the obligation to file for income you have transferred, could be counterproductive. The new tax rules say that any assessable foreign income earned in 2024 and later, becomes taxable in Thailand in the tax year you transfer the money to Thailand. So you have a potential future tax burden hanging over you by not transferring the income. By filing a tax return for that income, you clear that potential future tax burden. And because of the progressive nature of the Thai tax system, and the quite generous annual deductions, it's generally better to get the taxes out of the way annually, than to wait and combine income from several years into the same transfer.

Example:

A fictional foreigner (65 years old) living in Thailand, has an annual foreign pension of THB 1 million and pays tax in his home country to the tune of THB 100k. The double taxation agreement between his home country and Thailand allows both countries to tax that pension.In scenario one, this fictional foreigner transferred the full amount of the pension to Thailand in 2024, and will do the same in the future.

Tax in Thailand on a pension of THB 1 million is THB 50k, but because he will receive credit for the tax paid in his home country, he doesn't actually have to pay any tax in Thailand.

In scenario 2, the same person decided not to transfer any money to Thailand in 2024, because he first wanted to see how things developed. However, in 2025 he for whatever reason wants/needs to transfer his pension from both 2024 and 2025 to Thailand. Because he transfers the money in 2025, the income becomes taxable in Thailand in 2025.

Tax in Thailand on THB 2 million is THB 277,500, from which he can deduct the tax he paid in his home country in 2024 and 2025. That still leaves him having to pay THB 77,500 in Thailand.

But as i said, everyone's circumstances and reasoning is different, these are just the reasons why I have decided to file. You do you, and I will do me.

-

3

3

-

4

4

-

7

7

-

4

4

-

These devices have their uses. We use them when we take our dogs to the vet, as we lay down the back rest of the rear seats to give enough room for the dogs. When the dogs stand/lay on the back rest, it puts enough pressure on the seat base to set off the seat belt alarm. We also use them when buying dog food, 80 kg of dry food on the back seat is more than enough to set off the alarm.

Obviously, we don't use them when people are actually sitting in the seats.

-

2

2

-

-

-

On 2/18/2025 at 11:31 PM, drbrit said:

You accused me of asking because I was trying to fill time instead of filling a bar stool. Disgusting

Projection?

I was invited by the school as a former national league volleyball player and frequent speaker at schools in the region on technology and business

That was the insult you directly instigated

Try reading his comment again. He wasn't accusing you, on the contrary he was defending you against those thinking you might have unsavory motives. Before flying off the handle, it would be a good idea if you read peoples replies slowly and understand what was being said.

-

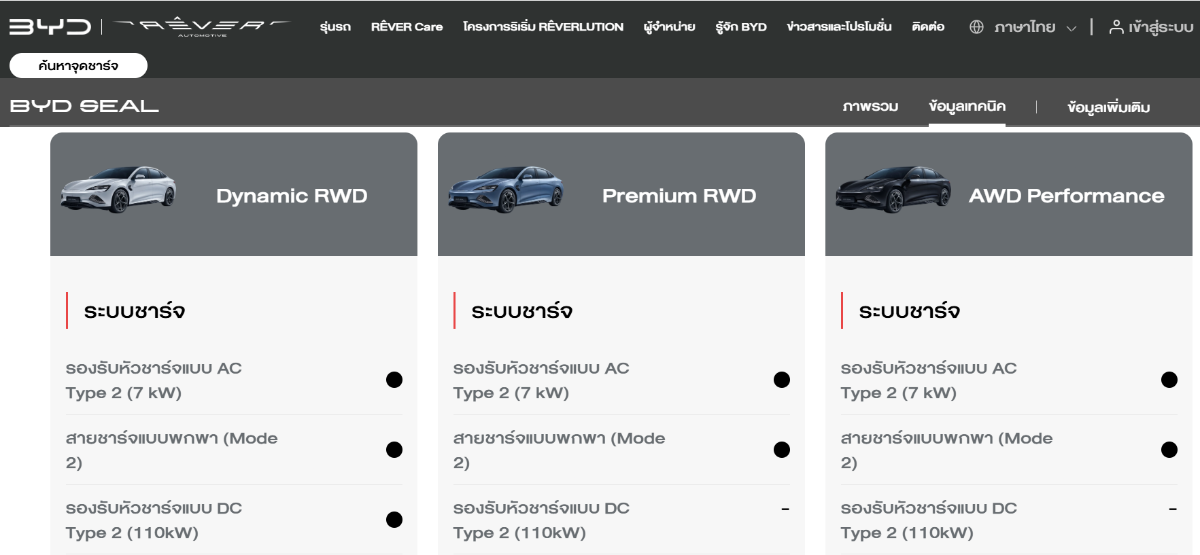

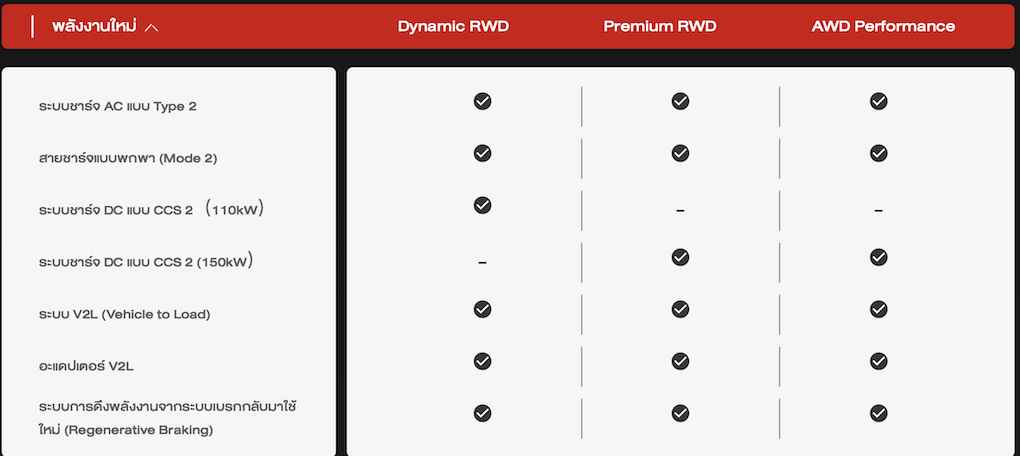

22 hours ago, sathornlover said:

The information is there in Thai as well:

Don't go to "Overview", instead select "Technical information" and the information is there.

-

1

1

-

-

12 minutes ago, MangoKorat said:

According to this website, personal items are furniture are tax free.

https://siam-shipping.com/importing-personal-effects-thailand/

However, they also say you can import a car (taxable) which you can't so they might well be out of date and the rules might have changed as per the post by @Johno57 above.

That's not what the website says. It says that you can ship household items without paying tax if:

QuoteYou are able to ship used household and personal belongings into Thailand without having to pay custom tax if :

- you have a Thai passport and can prove you lived one year outside Thailand

- you have a work permit issued within 6 months

So you have to move here for work or be a returning Thai citizen who have been living outside Thailand. If you do not fall into one of those two categories everything is subject to tax. An experienced shipper can often negotiate the tax down for you.

-

1

1

-

18 hours ago, Crossy said:

Do you have a link for that heater?

It looks like it might be suitable for a kitchen sink installation for which I need one.

I think this is the one:

https://www.lazada.co.th//products/i5205794979-s22120856344.html?urlFlag=true

-

1

1

-

-

- Popular Post

- Popular Post

PEA just delivered our December bill, so that completes our first full calendar year with solar and EV.

Total consumption for the year 5,660 kWh, so an average of 472 kWh per month or 15.5 kWh per day. Before we bought the EV we averaged 12 kWh per day.

Total imported from PEA for the year 32 kWh, so 5,628 kWh or 99.43% of our consumption covered by solar.

-

2

2

-

1

1

-

1 minute ago, jwest10 said:

Thank you but why does my SCB work so well at GSB but not recently in the 2 village SCB ATMs in Danmakhamtia ie CJ and Seven Eleven and the former only in the last few years and maybe the machine

No-one here can answer that, you will have to ask your bank what the problem is.

-

It's very difficult to understand what it is you are asking in this (and your previous) topic. But if you are wondering about the fees, then yes there are fees for using other bank's ATMs.

What are the fees associated with using debit cards?

Withdrawal from an SCB ATM within the same clearing zone No fees Withdrawal from SCB ATMs outside the clearing zone 15 baht per transaction Withdrawal from other banks' ATMs within the same clearing zone - First 4 transactions per month: Free

- From the 5th transaction onwards: 10 baht per transactionWithdrawal from other banks' ATMs outside the clearing zone 20 baht per transaction Transfer from an SCB ATM to an SCB account within the same clearing zone No fees Transfer from an SCB ATM to an SCB account outside the clearing zone - First transaction per month: Free

- From the 2nd transaction onwards: 10 baht per transactionTransfer from an SCB ATM to another bank account within the clearing zone: - Transfer up to 10,000 baht: 25 baht per transaction

- Transfer 10,001 – 50,000 baht: 35 baht per transactionTransfer from other banks' ATMs within the clearing zone - Transfer up to 10,000 baht: 25 baht per transaction

- Transfer 10,001 – 50,000 baht: 35 baht per transactionDeposit to an SCB account from an SCB ATM within the same clearing zone No fees Deposit to an SCB account from an SCB ATM outside the clearing zone: - Network service fee: 10 baht per transaction

- Transfer fee: 0.1% of the amount (minimum 10 baht), total minimum fee of 20 baht per transactionWithdrawal from ATMs in foreign countries: 100 baht per transaction plus a 2.5% exchange rate fee on the withdrawn amount Balance inquiry at ATMs in foreign countries 100 baht per transaction -

1

1

-

-

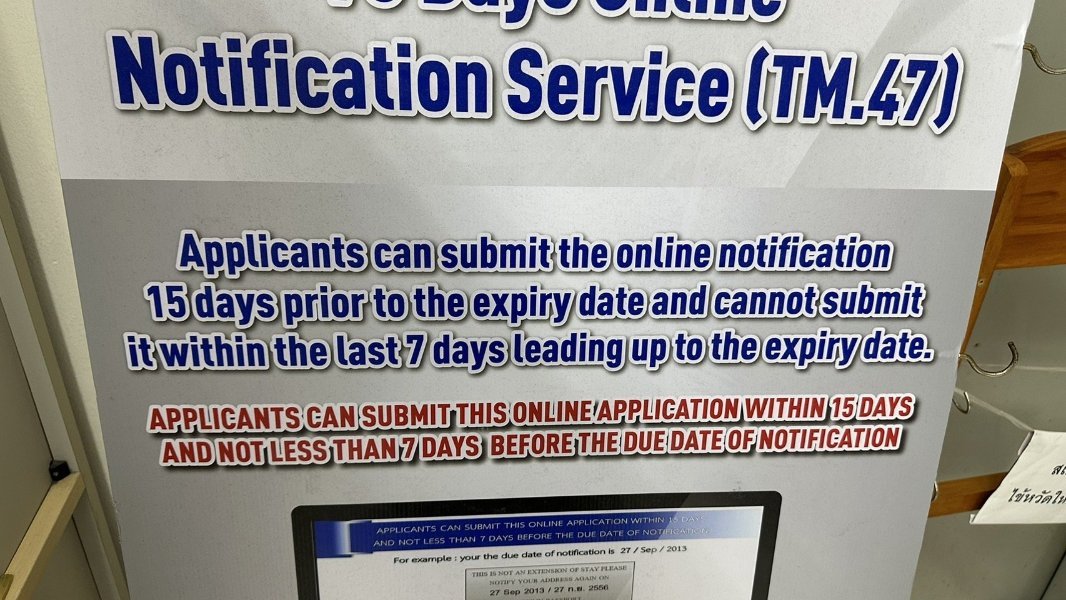

5 hours ago, TPDH said:

Upon divorce, I thought you got like 7 days to leave the country or to apply for a new visa? And that you have an obligation to notify immigration about the divorce?

Just wanna make sure I do this right so I don’t mess up my chances getting a new visa. Unfortunately retirement visa is not an option due to my age.Your extension ends on the date of your divorce. If you qualify, you can apply for a new extension based on e.g. retirement, or you can apply for 7 days to leave the country but you do not get the 7 days automatically.

-

1

1

-

-

- Popular Post

- Popular Post

On 10/24/2024 at 6:22 AM, Henryford said:"environmental advantages" tell that to the child slaves mining cobalt in the Congo.

As others have mentioned, plenty of EVs use LFP batteries that don't contain cobalt. On the other hand, cobalt is used when refining crude oil, so everyone driving an ICE car are contributing to the problem of "child slaves mining cobalt in the Congo".

-

3

3

-

1

1

-

That link doesn't work either.

-

1

1

-

-

- Popular Post

- Popular Post

41 minutes ago, webfact said:They were granted bail and must submit documents to clarify their actions within seven years.

Surely, this must be a misprint?

-

1

1

-

7

7

-

12

12

-

2 hours ago, dingdongrb said:

I had the exact same issue when I installed the mobile app just last month.

I had to actually go into the branch to get the app to work and going home shortly thereafter I attempted to login on my PC like I had done many times before successfully and I couldn't.

I can't recall the exact cause but a quick call to Customer Service resolved the issue. Both have been working like a champ since.

I suggest to call CS despite having previous poor service.

I had the same experience a couple of years ago, when I first installed the app on my phone. Like you cannot remember exactly what the issue was, but it was quickly resolved with a call to customer service.

Just to add, I have always had very good experiences when calling Bangkok Bank customer service, perfect English and a good grasp of the issues and what is needed to resolve the problem.

-

2

2

-

-

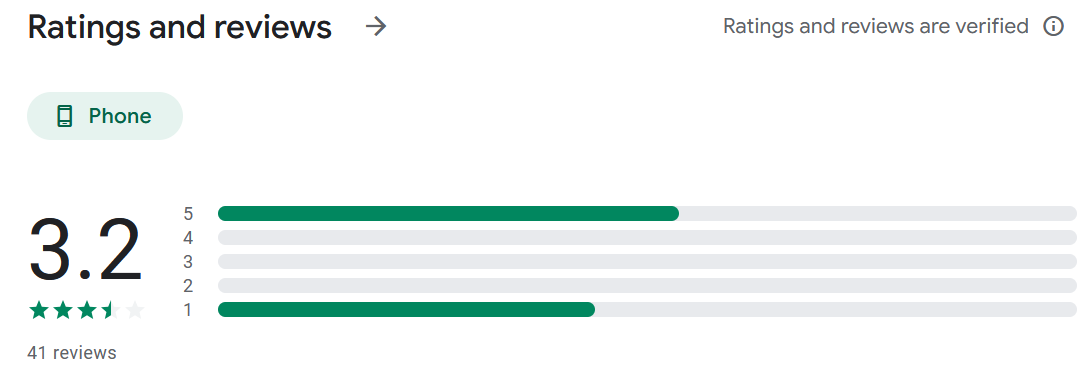

15 hours ago, henrik2000 said:

JamJang app on Google Play, last update August 21, 1000+ downloads, I see no review

There are reviews on Google Play, I don't know why you don't see them

Overall doesn't sound too promising, many one star reviews by users that couldn't get the app to work. Also bad comments about support.

On the other hand the app seems to work fine for some people, so I guess you just have to try it for yourself.

-

1

1

-

-

On 10/4/2024 at 11:57 AM, walailak said:

nothing has changed since the last time ,middle of june2024, when my online TM47 was successfully submitted.

Something is not correct here. If you really submitted your latest 90 day report mid June, then your next report would be due sometime in September, and it would now be to late to report.

Did you mean middle of July?

-

1 minute ago, Liquorice said:

Is that a Fixed term account or a Savings account.

A FTD account will only have two entries to update, any added interest and the balance.

Savings account could have multiple deposit and withdrawal transactions.

I'm also with BBL and can assure you if you haven't updated the passbook for a period of time and only have availability of 3/4 lines for printing on that page entered into the ATM, it will consolidate those transactions bringing the balance up to date. If you manually flip the page and re-enter in the ATM, it will spit the book out, as it's already up-to-date.

The operative words here are "for e period of time". I have updated my Bangkok Bank accounts at the machine many times, and unless it has been more than three months (or so) since my last update, the machine will spit the book out and ask me to turn to a new page and reinsert the book.

-

22 minutes ago, Liquorice said:

Which bank and have you tried it?

In my experiences, the ATM is unaware you wish all transactions printed and will therefore consolidate transactions with the given space on the page.

Which bank have you had that experience at? I have accounts at Bangkok Bank, Krungsri, SCB, Kasikorn Bank and Krung Thai and none of them work like you describe.

Of course, if you don't update regularly transactions will be consolidated (although Krungsri doesn't seem to do that).

-

- Popular Post

- Popular Post

12 minutes ago, koolkarl said:The US printing press is wasting its time on Ukraine. Russia does not want a NATO member on its border. Besides has anyone accounted for all the billions sent there already? Swiss accounts and his wife shopping on 5th Ave., for starters.

Russia already has four NATO members bordering it, so are you saying that Russia will invade Norway, Finland, Estonia and Latvia next?

-

2

2

-

2

2

-

1

1

-

2

2

-

1

1

-

51 minutes ago, FruitPudding said:

I see.

That's not what you said here, hence the miscommunication.

You are quoting two different posters.

-

1

1

-

-

6 hours ago, kaipua said:

Aloha, John!

I'm into outrigger canoe paddling and I was looking for OC1 and yours came up. Are you still doing it? If so where in Thailand?

John hasn't been active on the forum since 2014.

-

- Popular Post

- Popular Post

When this topic was originally posted, the Neta V was the only really low price EV option. Recently, the Wuling Binguo an even lower priced alternative for a small city runabout was introduced in the Thai market:

-

2

2

-

1

1

-

Pension Tax Filing Report - Rejected

in Jobs, Economy, Banking, Business, Investments

Posted

Yes, I had assessable income in 2024 and included it on my PND90 filing.

No, I didn't end up paying any tax, as my income is under the sum of deductions and exempt income that I am entitled to:

THB 100,000 expenses deduction

THB 60,000 personal allowance

THB 60,000 spouse allowance

First THB 150,000 of net taxable income is taxed at zero %.

So a total of THB 370,000 that is not taxed.

When I turn 65, which is when my main pensions start to pay out, I get an additional THB 190,000 deduction, but I am not quite there yet.