-

Posts

37,239 -

Joined

-

Last visited

-

Days Won

6

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by TallGuyJohninBKK

-

The numbers always look small when you look at them one week at a time vs. an entire country's population base. But not so small when you look at the broader picture. Cumulative since the start of the pandemic in Thailand -- 34,641 COVID deaths and 4.77 million COVID hospitalizations, including 1,882 new ones just in the past week. https://ddc.moph.go.th/covid19-dashboard/?dashboard=main

-

I'll feel better when Thailand doesn't have 588 COVID cases currently hospitalized in serious condition (as per the OP post here) -- a number that's its highest since at least the start of 2023 and four times the number (144) occurring at the start of 2024 (shown in purple below). Week of Dec. 31, 2023 to Jan. 6, 2024: https://ddc.moph.go.th/covid19-dashboard/?dashboard=main And as the OP in this thread reported: "Thailand is experiencing a significant but underreported surge in COVID-19 cases, with both public and private hospitals feeling the strain as outpatient and inpatient admissions rise. ... Governments worldwide, including Thailand, are often downplaying the severity of this surge, with some manipulating COVID data. Despite claims from health authorities that new KP variants are not more transmissible or immune evasive, the increasing severity and hospitalisation rates suggest otherwise."

-

Yes many, and yes.... Most public health agencies -- including the Thai MoPH -- still recommend mask wearing and social distancing as effective measures to reduce the risk of catching COVID. "For safety sake, he suggested the wearing of face masks in crowded places, on public transport and in hospitals and nursing homes for the elderly. Washing hands often is also recommended, as are rapid antigen tests if flu-like symptoms develop, he added."

-

You might try asking your regional MoPH office there... or calling the MoPH COVID hotline at 1422... Last time I checked with them a month ago, the MoPH folks in BKK didn't know of any specific availability outside of BKK.... But, private hospitals now DO have the ability to obtain the new COVID vaccines and provide them for a fee -- if they want to... Even if the Thai government isn't doing so. Bumrungrad and Praram 9 hospitals are doing so in BKK.

-

I suspect so: Heart problems from vaccines are extremely rare. Heart problems from COVID itself are not "The truth is that COVID infections are quite dangerous to the human heart. A study last year by the Department of Veterans Affairs found that people reinfected with COVID were twice as likely to either die or have a heart attack as people only infected once. Similarly, a different study last year from the scientific journal Immunology revealed that the SARS-CoV-2 virus (which causes COVID) damages cardiac muscle." ... By contrast, the 2022 CMAJ study cited by conspiracy theorists who insist myocarditis is a common side effect of the vaccine ignore that it also clearly says "although observed rates of myocarditis were higher than expected, the benefits of vaccination against SARS-CoV-2 in reducing the severity of COVID, hospital admission and deaths far outweigh the risk of developing myocarditis." (Emphasis added. https://www.salon.com/2023/07/27/heart-problems-from-vaccines-are-extremely-rare-heart-problems-from-itself-are-not/ AND ‘Died suddenly’ posts twist tragedies to push vaccine lies February 5, 2023 "Rigorous study and real-world evidence from hundreds of millions of administered shots prove that COVID-19 vaccines are safe and effective. Deaths caused by vaccination are extremely rare and the risks associated with not getting vaccinated are far higher than the risks of vaccination. But that hasn’t stopped conspiracy theorists from lobbing a variety of untrue accusations at the vaccines." ... An AP review of more than 100 tweets from the account in December and January found that claims about the cases being vaccine related were largely unsubstantiated and, in some cases, contradicted by public information. Some of the people featured died of genetic disorders, drug overdoses, flu complications or suicide. One died in a surfing accident. https://apnews.com/article/vaccine-died-suddenly-misinformation-a8e3a80a015ba9bf78b6bd4f3c271f58

-

Think again... the issue already has been addressed earlier in this thread: Study: COVID Still Deadlier Than the Flu -- But the Gap Is Narrowing "...5.7% of patients with COVID-19 died within 30 days of admission versus 4.24% of patients with influenza, reported Ziyad Al-Aly, MD, of the VA St. Louis Health Care System, and colleagues. "After adjusting for variables, the risk of death in people hospitalized for COVID-19 was 35% higher (adjusted HR 1.35, 95% CI 1.10-1.66), the authors detailed in a research letter in JAMA. ... "...there were nearly twice as many hospitalizations for COVID-19 compared with the flu for the 2023-2024, according to CDC surveillance data." https://aseannow.com/topic/1327600-study-covid-still-deadlier-than-the-flu-but-the-gap-is-narrowing/

-

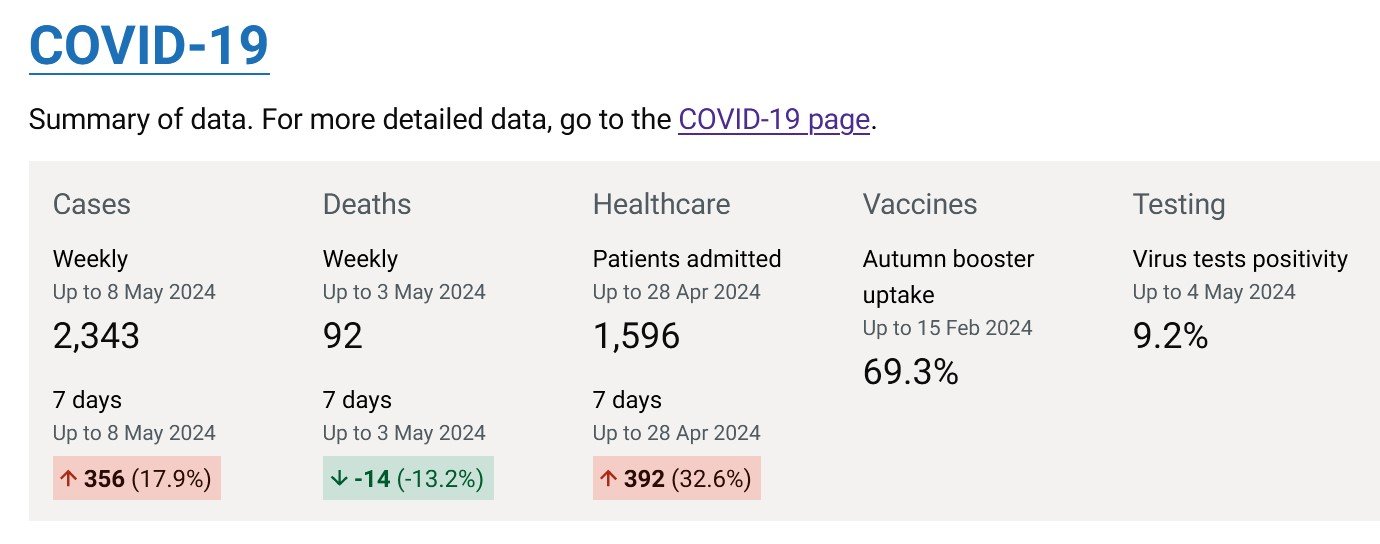

Guess that depends on how much you follow the news, and what sources you follow. UK still running almost 100 COVID deaths per week: Surge in Covid cases prompt fears of a mini-wave Proportion of people testing positive for the virus has jumped from 4.6 per cent to 7.1 per cent in the space of a week May 2, 2024 https://inews.co.uk/news/politics/surge-covid-cases-prompt-fears-mini-wave-3037684?ITO=newsnow NHS in England facing ‘storm of pressure’ as flu and Covid cases surge Average of 3,631 patients in hospital with Covid during Christmas week, data shows, a rise of 57% in a month Dec. 2023 https://www.theguardian.com/society/2023/dec/29/nhs-england-storm-of-pressure-flu-covid-cases-surge UKHSA current info: https://ukhsa-dashboard.data.gov.uk/

-

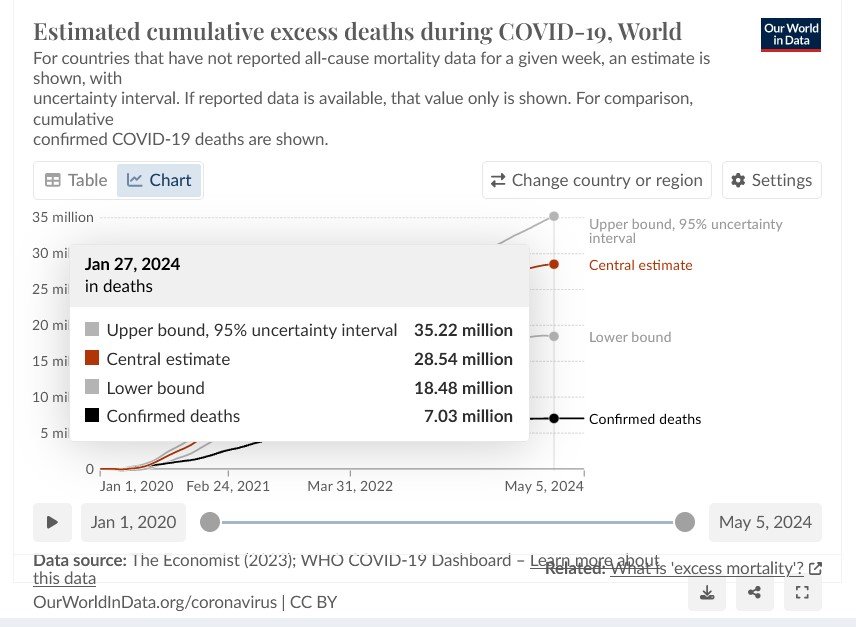

Much discussion of the reasons for this in the news over time. For example: Over 330,000 excess deaths in Great Britain linked to austerity, finds study Research comes as government signals fresh round of public spending cuts "More than 330,000 excess deaths in Great Britain in recent years can be attributed to spending cuts to public services and benefits introduced by a UK government pursuing austerity policies, according to an academic study." https://www.theguardian.com/business/2022/oct/05/over-330000-excess-deaths-in-great-britain-linked-to-austerity-finds-study What can explain the excess mortality in the U.S. and Europe in 2022? "With the threat of the disease appearing to diminish, COVID-19 stopped hitting the headlines and most countries lifted their restrictions on daily life. But this gradual return to normalcy belies the fact that excess mortality has continued to persist in many countries well into 2022. This observation has surprised many commentators and journalists. ... But we do know that there were certain notable events in 2022 that could explain, at least in part, the persistent excess mortality. This Insight article aims to discuss these events and how they could have increased the mortality rate in the second half of 2022. Contents of this article The summer of 2022 showed a noticeable excess mortality, but this was lower than in 2020 and 2021 COVID-19, heat waves, healthcare backlogs: several potential contributors to excess mortality COVID-19 vaccines aren’t responsible for the excess mortality of 2022 https://healthfeedback.org/what-can-explain-the-excess-mortality-in-the-u-s-and-europe-in-2022/

-

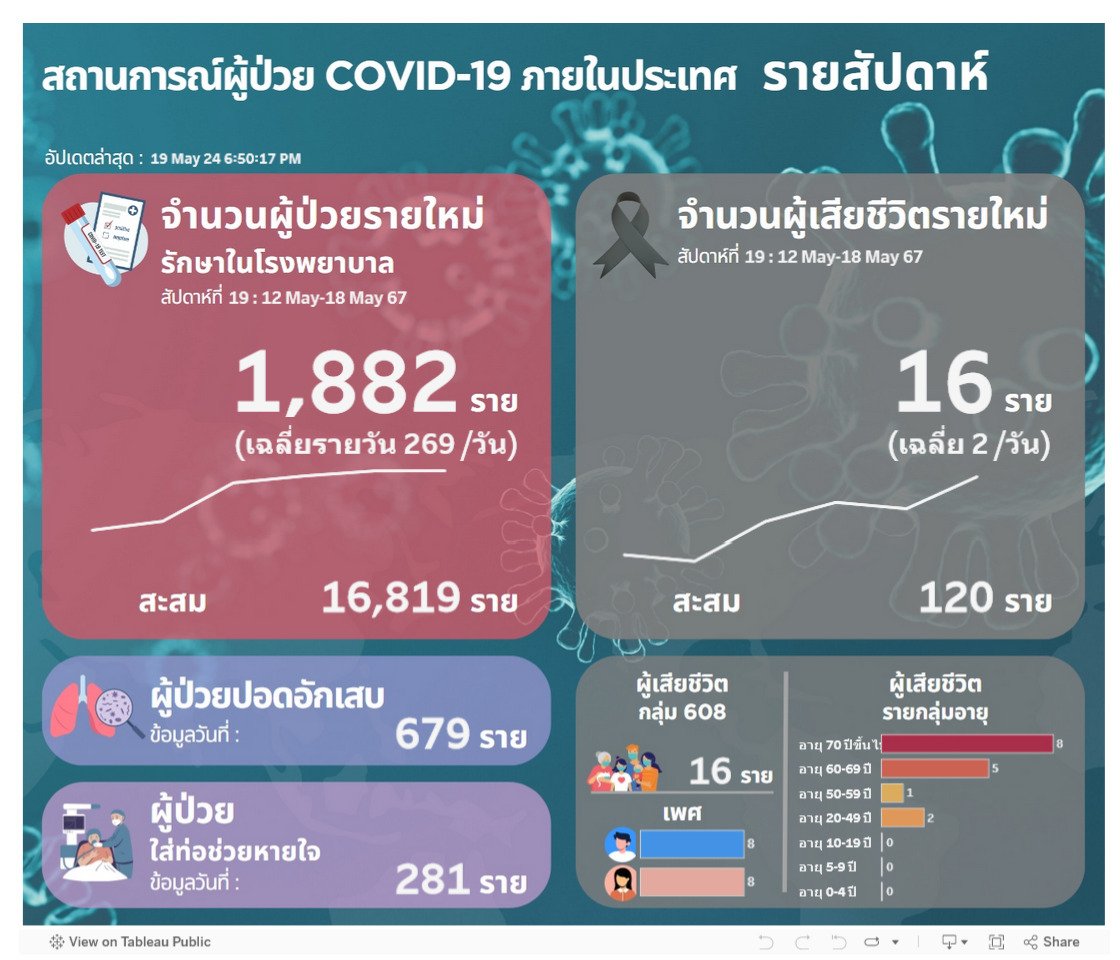

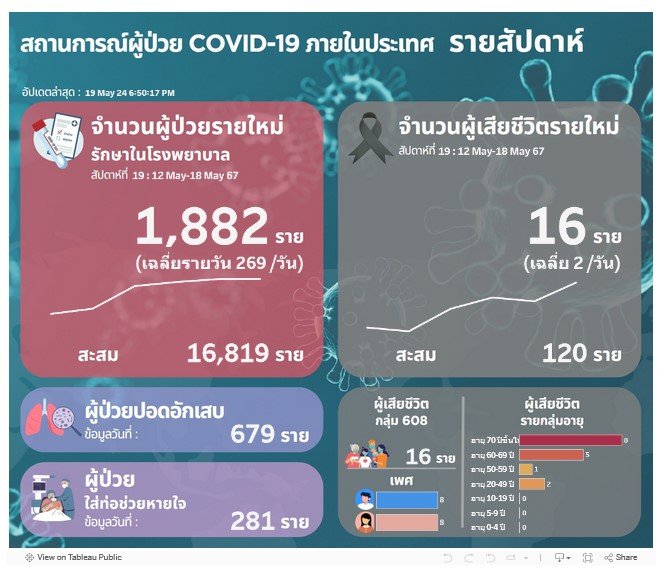

As posted above: Thailand MoPH Weekly COVID report for May 12 - 18, 2024: --1,882 new COVID hospitalizations, averaging 269 per day, up 2 from the prior week --16 new COVID deaths, up 5 / 45% from the prior week --679 current COVID patients hospitalized in serious condition (pneumonia symptoms), up 91 / 15% from the prior week --281 current COVID patients hospitalized requiring intubation/ventilation to breathe, up 44 / 19% from the prior week The latest weekly COVID deaths tally is Thailand highest since 25 were reported for a week in early July 2023. The tallies of COVID patients hospitalized in serious condition and those needing ventilation are the highest since at least the start of 2023. And for some broader context beyond that: "By comparison, at the start of 2024, the number of serious condition COVID hospitalized patients was 144, meaning the current number is more than four times higher. And the number of hospitalized COVID patients requiring ventilation to start 2024 was 89, meaning the current number is more than three times higher. COVID deaths for that week were four." The weekly COVID new hospitalization counts reported by the MoPH during the past ten weeks have been as follows, with the spring surge beginning well before this year's mid-April Song Kran holidays, but then climbing rapidly until the slowdown for this latest week: March 16 -- 501 March 23 -- 630 March 30 -- 728 April 6 -- 774 April 13 -- 849 April 20 -- 1,004 April 27 -- 1,672 May 4 -- 1,792 May 11 -- 1,880 May 18 -- 1,882 https://aseannow.com/topic/1326140-hospitalizations-climb-in-thailands-spring-2024-covid-surge/?do=findComment&comment=18927200 But the current weekly new COVID hospitalizations number remain below the peaks of mid-2023, when they topped out at over 3,000 per week before declining again.

-

COVID is expected to rank 10th among causes of death in the U.S. for 2023 when the final counts are released later this year -- well ahead of the flu and pneumonia. "Based on preliminary data, COVID-19 still ranks as the 10th most common cause of death in the U.S. for 2023, a drop from 3rd in 2020 and 2021 and 4th in 2022." https://www.cdc.gov/ncird/whats-new/changing-threat-covid-19.html AND Study: COVID Still Deadlier Than the Flu -- But the Gap Is Narrowing "After adjusting for variables, the risk of death in people hospitalized for COVID-19 was 35% higher (adjusted HR 1.35, 95% CI 1.10-1.66), the authors detailed in a research letter in JAMA. ... "...there were nearly twice as many hospitalizations for COVID-19 compared with the flu for the 2023-2024, according to CDC surveillance data." https://aseannow.com/topic/1327600-study-covid-still-deadlier-than-the-flu-but-the-gap-is-narrowing/

- 130 replies

-

- 11

-

-

-

Yes, there are several locations in BKK where the newer COVID XBB vaccine from Pfizer have just recently become available for a fee, including Mahihol University's travel clinic [see the link below]. But none of those very limited offerings are being run by the Ministry of Public Health, and none of them are free of charge as the government sponsored mass COVID vaccine programs were in 2021 and 2022. Nor has the MoPH actually promoted any of them. So the overall uptake by the general public thus far is virtually nill. Mahidol only began offering the Pfizer XBB COVID vaccine just in the past few months, and with a very limited supply/availability per week. When I spoke with them about it for the linked report below, they said they typically were ordering about 10 doses per week. They definitely recommended anyone interested make an advance booking thru their website, with full details in the link below: https://aseannow.com/topic/1323285-new-pfizer-covid-xbb-vaccines-finally-become-available-in-thailand-–-for-a-price/

- 130 replies

-

- 13

-

-

-

-

It's a dubious claim that Sweden did well during the pandemic: Scathing evaluation of Sweden's COVID response reveals 'failures' to control the virus "As a result, Sweden had a higher COVID death rate than the surrounding Nordic nations. "The Swedish response to this pandemic was unique and characterised by a morally, ethically, and scientifically questionable laissez-faire approach, a consequence of structural problems in the society," the team wrote. https://abcnews.go.com/Health/scathing-evaluation-swedens-covid-response-reveals-failures-control/story?id=83644832 Claim: "No-lockdown Sweden fared better than the UK" Verdict: It's true that Sweden has had a lower Covid death rate than the UK, but it has fared significantly worse than its neighbours, all of which had tighter initial lockdown restrictions. Many people opposed to Covid restrictions point to the example of Sweden, a country which at the beginning of the pandemic avoided introducing a compulsory lockdown, and instead issued voluntary distancing advice. ... When compared to other Scandinavian countries with similar population profiles, Sweden has fared much worse and recorded a significantly higher number of deaths than its neighbours, all of which have had tougher restrictions during much of the pandemic." https://www.bbc.com/news/55949640

-

Also worth noting to put those numbers in greater context: COVID thus far has killed more than 232,000 people in the UK. https://www.worldometers.info/coronavirus/country/uk/ And, COVID vaccines are estimated to have saved about 400,000 lives just in England. https://ukhsa.blog.gov.uk/2024/04/16/whos-eligible-for-the-2024-covid-19-vaccine-or-spring-booster/

-

You might try asking your regional MoPH office there... or calling the MoPH COVID hotline at 1422... Last time I checked with them a month ago, the MoPH folks in BKK didn't know of any specific availability outside of BKK.... But, private hospitals now DO have the ability to obtain the new COVID vaccines and provide them for a fee -- if they want to... Even if the Thai government isn't doing so. Bumrungrad and Praram 9 hospitals are doing so in BKK.

-

Here's a bit more context on what to make of the Ministry of Public Health's latest weekly COVID report -- new COVID hospitalizations were almost flat compared to the prior week with only a tiny increase, but COVID deaths, serious condition hospitalizations and ventilations all rose substantially from the week before -- now 10 straight weeks of increased COVID hospitalizations. Thailand MoPH Weekly COVID report for May 12 - 18, 2024: --1,882 new COVID hospitalizations, averaging 269 per day, up 2 from the prior week --16 new COVID deaths, up 5 / 45% from the prior week --679 current COVID patients hospitalized in serious condition (pneumonia symptoms), up 91 / 15% from the prior week --281 current COVID patients hospitalized requiring intubation/ventilation to breathe, up 44 / 19% from the prior week The latest weekly COVID deaths tally is Thailand highest since 25 were reported for a week in early July 2023. The tallies of COVID patients hospitalized in serious condition and those needing ventilation are the highest since at least the start of 2023. https://aseannow.com/topic/1311049-weekly-thai-ministry-of-public-health-covid-reports/?do=findComment&comment=18927054

- 130 replies

-

- 17

-

-

-

Note that one month ago, one prominent Thai doctor estimated that just COVID infections in Thailand (not hospitalizations) likely were approaching 10,000 per day (doing a projection based on the reported hospitalization numbers.) The officially reported COVID new weekly hospitalization numbers are just the tip of a bigger, broader COVID iceberg that's currently running through its seasonal spike here in Thailand.

- 130 replies

-

- 17

-

-

-

-

Thailand hasn't had any nationwide COVID vaccinations campaign since 2022. The Thai population in general is long out-of-date for COVID vaccinations, and virtually none of them have received the latest XBB-focused vaccine rolled out in the West last fall, since the Thai government as yet hasn't offered those here to the general public. As for your first comment above, note this excerpt from the OP report above: "with both public and private hospitals feeling the strain as outpatient and inpatient admissions rise." AND "Private hospital data indicates higher COVID admission rates than official reports"

- 130 replies

-

- 32

-

-

-

-

-

-

Thailand's spring 2024 COVID surge continued for a tenth consecutive week last week, with only a slight increase in new COVID hospitalizations to 1,882, but much larger increases in new COVID deaths and COVID patients hospitalized in serious condition. The 16 newly reported COVID deaths last week, up 45% from 11 the prior week, is Thailand's highest weekly COVID deaths total since 25 were reported in early July 2023. The latest numbers of serious condition COVID patients (679, up 15% from the prior week) and COVID patients requiring ventilation (281, up 19%) both were the highest weekly totals since at least the start of 2023. By comparison, at the start of 2024, the number of serious condition COVID hospitalized patients was 144, meaning the current number is more than four times higher. And the number of hospitalized COVID patients requiring ventilation to start 2024 was 89, meaning the current number is more than three times higher. COVID deaths for that week were four. The only good news in the latest weekly COVID report from the Thai Ministry of Public Health was the rate of rising new COVID hospitalizations slowed markedly last week compared to earlier in the spring, with the latest 1,882 new COVID hospitalizations showing a tiny increase of only two from the prior week. Still that total was Thailand's highest new hospitalizations tally since mid-June 2023. The Thai government does not publicly report the total numbers of all current COVID hospitalizations, but instead only breaks out the subtotals for those in serious condition and requiring intubation, and then the new COVID hospitalizations each week. With the latest update for the period May 12 to 18, Thailand's weekly new COVID hospitalizations at 1,882, averaging 269 per day, have more than tripled from the 501 weekly count recorded in mid-March when the latest COVID surge began. Thailand had a similar COVID surge in spring 2023, when weekly COVID new hospitalizations rose from a few hundred to a peak of more than 3,000 by early June 2023 before eventually subsiding. So thus far at least, the spring 2024 new hospitalizations have remained below the spring 2023 peak. Among the 16 new COVID deaths reported for the past week, the MoPH said 8 were male and 8 female. By age, 8 were 70 and above, 5 were 60-69, 1 was 50-59, and 2 were 20-49. The MoPH only recently resumed publicly disclosing the broad age ranges for Thailand's reported COVID deaths, something they had ceased many months prior with the end of COVID's declared emergency status in Thailand. With the latest weekly report, Thailand since the start of 2024 has now seen 16,819 COVID hospitalizations and 120 official COVID deaths, according to the MoPH. The weekly COVID new hospitalization counts reported by the MoPH during the past ten weeks have been as follows, with the spring surge beginning well before this year's mid-April Song Kran holidays, but then climbing rapidly until the slowdown for this latest week: March 16 -- 501 March 23 -- 630 March 30 -- 728 April 6 -- 774 April 13 -- 849 April 20 -- 1,004 April 27 -- 1,672 May 4 -- 1,792 May 11 -- 1,880 May 18 -- 1,882 The MoPH's weekly COVID reports for Thailand are available at the following MoPH website: https://ddc.moph.go.th/covid19-dashboard/?dashboard=main They also have been posted each week in the following AseanNow forum thread: https://aseannow.com/topic/1311049-weekly-thai-ministry-of-public-health-covid-reports/

-

Thailand MoPH Weekly COVID report for May 12 - 18, 2024: --1,882 new COVID hospitalizations, averaging 269 per day, up 2 from the prior week --16 new COVID deaths, up 5 / 45% from the prior week --679 current COVID patients hospitalized in serious condition (pneumonia symptoms), up 91 / 15% from the prior week (dark purple) --281 current COVID patients hospitalized requiring intubation/ventilation to breathe, up 44 / 19% from the prior week (light purple) Cumulative figures since the start of the current year are COVID new hospitalizations (16,819) & COVID deaths (120). Of the 16 new official COVID deaths, the MoPH below is reporting that 8 were male and 8 female. By age, 8 were 70 and above, 5 were 60-69, 1 was 50-59, and 2 were 20-49. https://ddc.moph.go.th/covid19-dashboard/?dashboard=main Reported weekly COVID new hospitalizations have now risen for the past 10 consecutive weeks since mid-March, despite the very small latest increase in the past week, and have more than tripled over that period, as follows for the weeks ending: March 16 -- 501 March 23 -- 630 March 30 -- 728 April 6 -- 774 April 13 -- 849 April 20 -- 1,004 April 27 -- 1,672 May 4 -- 1,792 May 11 -- 1,880 May 18 - 1,882 The latest weekly new COVID hospitalizations total is Thailand's highest since mid-June 2023, when the total hit 2,158. Thailand's weekly new COVID hospitalizations peaked last spring at 3,085 in early June amid a similar run-up that began in mid-April.