-

Posts

37,239 -

Joined

-

Last visited

-

Days Won

6

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by TallGuyJohninBKK

-

-

2 minutes ago, janclaes47 said:

Why would the fact that he decade ago did or not did walk around with his johnny out of his pants have anything to do with the current state of affairs?

Yes, you used the correct term of reference in regards to Trump... the current state of AFFAIRS!

It's kind of funny, there used to be a time in the U.S. when you couldn't get elected as president if you were Jewish or Catholic or black. Being any of those ruled you out as being a candidate for president because too many voters wouldn't accept it.

But nowadays, a lot of those same Americans who didn't want blacks, Catholics or Jews as president (and I'm not one of them) suddenly are OK with a President renowned for lying, infidelity, corruption, and abusive behavior toward woman, among Donald's many sterling traits. It's a very strange world out there.

-

18 minutes ago, janclaes47 said:

So why is it anyone's business what the current president of the usa did in his personal life a decade or more before he became president?

It becomes clear from your last comment that you consider it your business.

You seem to be forgetting a few things:

1. He's probably repeatedly lying about that and other things now. And while being a blatant and pathological liar may not be illegal, it's not what you'd wish for in your president. But more to the point, future voters have the right and obligation to judge him on his overall conduct, as a lying president, and before. And to judge him fairly, the truth needs to be known.

2. The payoff to Daniels, coming on the eve of the last election and not a decade ago, to keep her quiet by Trump's lawyer may well have been an illegal campaign expenditure. And that may figure into the special counsel's current investigation of the election.

3. And lastly, I'm an American, so yes, what my (I use that term reluctantly) president does and has done are things I consider to be my business as a U.S. citizen and voter.

-

2

2

-

-

2 hours ago, MaeJoMTB said:

So this thread is essentially guys living in Thailand bashing a guy in America for using hookers?

You gotta laugh!

That's a nice attempted cheap shot and deflection.

Except, not all, nor probably most, of the married guys living here use hookers once married, and of the married guys who do, I suspect many of them don't have their wife at home caring for a newborn/young child while they're out prowling the streets (or penthouses in Donald's case).

To the contrary, lots of guys living here in Thailand manage to lead normal lives without cheating on their wives or hanging out with porn stars or hookers, and we're not even TV stars or future presidents of the U.S.

-

1

1

-

-

4 minutes ago, Thakkar said:

Hey, I don’t blame the man. With those tiny, tiny hands, he has to try on a lotta gloves to find ones that fit.

Well, as he's already told the world, he certainly knows where to grab in order to get his scores....

-

Opinion piece from the NY Times yesterday...

(Love the headline!

)

Quote

)

QuoteStormy Daniels Spanks Trump Again

Michelle Goldberg MARCH 26, 2018

Because there is broad consensus that Donald Trump is a lewd degenerate, nothing Stormy Daniels, the pornographic film actress and director, told “60 Minutes” about their alleged 2006 sexual encounter was particularly astonishing. (Though the mental image of Trump dropping his pants at Daniels’s command for a spanking will likely dampen libidos throughout the land.)

Everyone knows Trump is a disloyal husband, so it’s no shock that he slept with Daniels — and, at about the same time, with the former Playboy model Karen McDougal — while his wife, Melania Trump, was caring for their new baby.

Everyone also knows that Trump has a repulsive compulsion to sexualize his daughter Ivanka — he once happily concurred with Howard Stern that she was a “piece of ass” — so it’s not surprising that he told Daniels she reminded him of his child before he slept with her. (According to McDougal, Trump said something similar to her.)

-

2

2

-

-

6 hours ago, goldenbrwn1 said:

I landed here in Bangkok last week and straight away noticed my padlock had been removed from the joining zipper and locked again on just one zip. This has happened 3x now but only when travelling to Thailand. Luckily I only pack my clobber and no valuables as I’m sure they would of gone walkies on those three occasions.

How was it removed? The lock broken, the suitcase clasp broken or opened with a key.

The problem with that kind of situation is you can never be sure whether it was attempted thieving or airport security wanting to inspect something. In the U.S., the TSA is supposed to leave a note inside if they open your suitcase. But here, I don't think that's done.

I came back from the U.S. to BKK on China Southern a couple years back. Upon arrival in BKK, found my main suitcase had the TSA padlock removed/missing, both metal clasps on the suitcase zipper tabs broken off, and the contents inside tossed. Who did it???

-

12 minutes ago, Thakkar said:

This reminds me of a relevant joke:

while le most people go on Facebook to see what their old girlfriends are up to, Trump goes on Pornhub.

And those are just the two we KNOW about. The guy's been around a long time. If anyone thinks they're the ONLY two, they're dreamin!

-

1

1

-

-

22 minutes ago, JimmyJ said:

Just call me Daddy....

-

12 minutes ago, Justfine said:

You get takeaway deliveries every night? Given they are ripping off restaurants be good if they folded too.

So that's why UberEats probably has a roster of 100+ restaurants all over BKK who deliver their food, from the cheapest street stall Thai places to expensive 1000 or 2000 baht sushi places?

Again, your argument falls flat. There are taxi drivers on the streets because they've chosen it as their way of earning a living. And there are restaurants that sign up with UberEats and continue to use them for the long term because they obviously calculate they're making money, one way or another. If they weren't, they wouldn't continue affiliating with a delivery service.

Take-out/delivery has its advantages from a restaurant's point of view -- expand your geographic customer base, find new customers for eat-in based on delivery business, produce meals without the same kind of service staff and clean-up/dish washing expenses, etc etc.

-

Quote

the Grab platform that will take over ride-sharing in two weeks and food delivery in late May.

It would be nice if some of the reporting on this was more clear what's going to happen with UberEats in the short term.

The taxi handover to Grab is supposed to be early April, and the regular Uber taxi app is to stop working then. So what happens with UberEats between early April and late May -- do they continue in the interim until late May, or just go dead between early April and late May.

So far, I haven't seen anything that addresses that inbetween period for UberEats, and their customer service staff have been totally MIA for the past two days.

-

3 hours ago, Justfine said:

35,000 less

22,500 fuel

5,000 car finance

2,000 maintenance

5,000 commercial insurance

Net 500 baht

If that were accurate, then the streets of Bangkok wouldn't be flooded with thousands of cabs, including many who won't take a fare even when offered to them.

-

1

1

-

-

7 hours ago, MaxLee said:

The Taxi Mafia will be happy........

I'm guessing, from the OP, that that's exactly who is the Grab franchise holder for CM.

-

8 hours ago, Skeptic7 said:

No one holding guns to the heads of the drivers. They choose to be a GRAB or Uber driver. Can part ways anytime. Big difference 'tween exploitation and underpaying. If they are, indeed, the same...well hell, most of Thailand's workforce is being exploited.

For all the Uber drivers I've encountered here in BKK, they've been very polite and not grumpy or snarky.

So if they're feeling abused and exploited, they're doing a darned good job of hiding their feelings.

I would assume they're driving in that manner because they feel, or know, they can earn a better living doing that than the other things that might be available to them.

BTW, on a parallel issue, UBER the company based in the U.S. is a TERRIBLE company along with the guy who founded it. Just read up on all the B.S. they've been involved in, and a lot of terrible human relations issues involving treatment of their employees (not drivers, but the company staff members). That's part of the reason there's a newish CEO now presiding over the selling off of their various geographies.

-

2

2

-

-

- Popular Post

- Popular Post

9 hours ago, Skeptic7 said:Well this sucks. I like GRAB alot, but used Uber as price compare and backup. Last month found Uber to be the better deal by B100 on one occasion. Also, GRAB has been very slow to find a driver lately...and none available has become quite common.

Competition and choice are good for the customer. Sad to see Uber go.

As I posted in the other thread, every time I've tried to use Uber for a taxi trip in Central BKK, it's been no problem to get a driver, and the rides have been smooth, the drivers unfailingly polite, driving in their own personal cars.

Every time I've tried to use Grab for a taxi trip in BKK, usually the 4-6 km variety, the app shows a dozen plus taxis available in my neighborhood, and not a single one willing to take the trip.

To me, Grab is just the same old taxi mafias with a smartphone app front end.

And then I read something like this in the OP article, and it just reinforces that perception:

QuoteGrit Sripaurya of Jed Yod Brothers, Grab Taxi Chiang Mai’s franchise owner,

-

3

3

-

25 minutes ago, bkk6060 said:

99% of the population cares less about any of this.

At least in central BKK, you're clearly wrong about that.

My own house aside, in the evenings, I'm constantly seeing Food Panda, ChefsXP and UberEats drivers coming and going with deliveries.

-

Almost every weekday for the past few months, UberEats BKK has had a promotion on their smartphone app -- free delivery (normally 30 baht) for up to 4 orders from 5 - 9 pm that day, if you went to the app and clicked for the promotion. That's been a very nice deal, in addition to the various other promotions they've offered, such as 30-40% off food prices on Thursday orders each week.

And perhaps not surprisingly, the Food Panda service ended up matching that with a similar offer during the past month -- free delivery from all the BKK restaurants in Food Panda's inventory during the month of March.

But yesterday, oddly, UberEats BKK suddenly had no 5-9 pm free delivery promotion -- the day their sale to Grab was announced. And again today Tuesday, no 5-9 pm free delivery promotion from UberEats.

So I'm wondering, is this just a lull in the action while the Grab-Uber buyout gets worked thru? Or they're done offering those kinds of promotions? Food Panda, ChefsXP, Line Man and others still exist, so it will be interesting to see how the food delivery aspect of all this plays out.

-

Took the trash outside today at 4:45 pm, and left my PM2.5 sensor outside for a while... on my quiet Asoke-Nana area soi with very little vehicle traffic at 500+ meters away from the main road.

Outside: 56 mcg - 151 red/unhealthy on the AQI scale

Inside with the Air Purifier on: 8 mcg - 33 green/good on the AQI scale

Good to see that my sensor reading pretty well matches the various official 150+ AQI readings around BKK this afternoon. Bad that anyone has to breath that air.

-

1

1

-

-

8 hours ago, JOC said:

Am I the only one that sees the irony....In charge of the anti-graft commission is a Police General.....

And no doubt, there's a very particular reason for that.... as you might imagine.

-

4 hours ago, nikmar said:

Don't you DARE mess with us, or we'll be coming after you big time!!!

-

12 minutes ago, NutsMango said:

The difference in how West does business vs how Asia does it

Copy everything invented in the West and make it worse with government protection in place so you win.

Well, the whole point of this sale is to end or diminish competition in the SE Asian territories served by these two companies. Apparently, so the Japanese company that's the major investor in both can make more money when only one of the two companies is left standing.

When there's less competition, in this case for app-based taxi ride ordering, it's the consumer who's going to lose and be less well served.

-

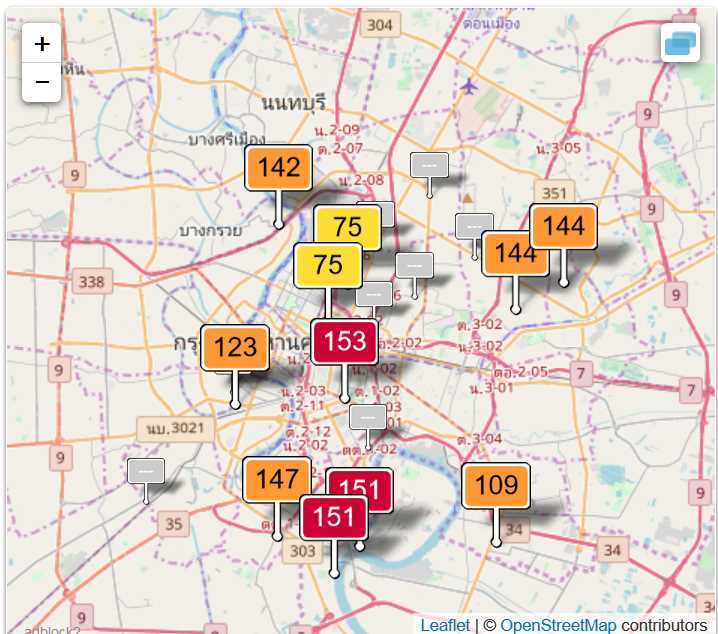

The earlier map I posted was readings as of 11 am. Now this one below is at of 2 pm. I don't think it's raining in these areas now or lately... that would account for the variations below.

I mention it because I've been watching these readings for weeks now, and rarely see this large a level of divergence within BKK. And oddly, it comes right on the heels of the big kerfuffle in the news yesterday about the smog levels in Chiang Mai.

BTW, the day has gotten a lot worse outside heading into this afternoon.

The red 153 now is the Chula Hospital sensor, current as of 2 pm.

One of the yellow 75s is listed as being the Govt Public Relations Office, current as of 1 pm.

That variation between those two locations and their reported readings is not a function of any rain early this morning.

-

4 minutes ago, wedders said:

The review in question was also posted to the FB food review group Thailand Wine And Dine.

Here is their take on this issue

Thanks for posting that... Useful info to know.

-

2 minutes ago, Mattd said:

The majority are in the dark, some know but are yet to say anything.

The argument back has been to name the restaurant, so that people can avoid it.

Sorry to hear that. I do hope the word gets around.

Under the circumstances, I certainly can understand people who know being reluctant to publicly post explicitly about that particular place and its threats.

But that doesn't mean the word can't end up circulating thru other means.

-

1 minute ago, 007cableguy said:

I just read about his verdict which made the news all over but haven't seen it on Thai visa!

Seems strange as it made international news!There's a thread on it here. Been active all morning.

-

1

1

-

Porn star says she was threatened to keep silence on Trump - TV interview

in World News

Posted

Kind of sadly funny, the other day, I saw the headline of a news article wherein the First Lady (through a spokeswoman) was issuing her first public statement on the whole Stormy Daniels affairs, literally. I believe it was just in the wake of the 60 Minutes interview airing on TV.

And I was wondering, what the heck can the First Lady possibly say on the topic? And then when I read into the article, basically, the gist of the statement was to chide the news media to not keep mentioning her son by name in the various articles about Trump's affair with Daniels, which occurred when the wife was at home with the recently born (anonymous) child.

And I guess my thought about that issue is, perhaps she should have addressed the concern to her husband, since he's the one who put her and her son into that somewhat humiliating situation.