-

Posts

1,948 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by Gaccha

-

-

- Popular Post

26 minutes ago, Jingthing said:Pasta for your thoughts?

You have just stumbled upon an important phenomenon called "the pizza effect".

-

1

1

-

2

2

-

3 minutes ago, sungod said:

thanks, what browser did you use?

Opera browser. There is a Kaptcha on the page so it could be sensitive to the browser type.

-

1

1

-

-

14 minutes ago, sungod said:

Wow! That worked.

The App version has no "register" button after the acceptance of conditions. Amazing.

I managed to register on your link and then log-in.

-

16 minutes ago, sungod said:

I got as far as trying to register the password, and it all stopped there!

That's actually one step more than me. What did you press to get beyond the page I'm showing?

-

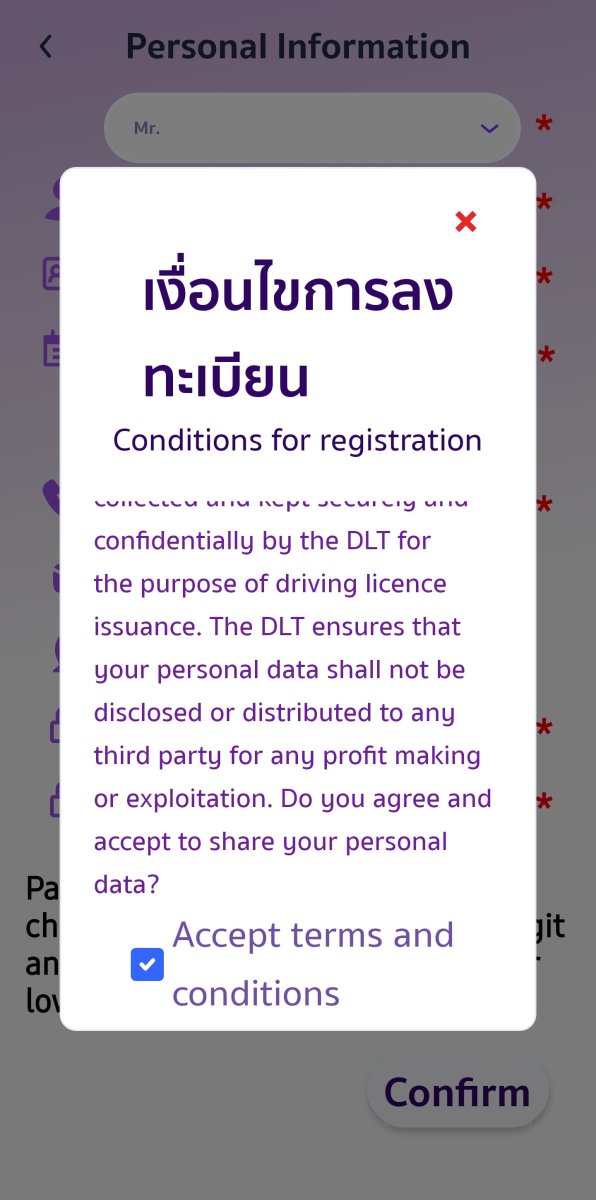

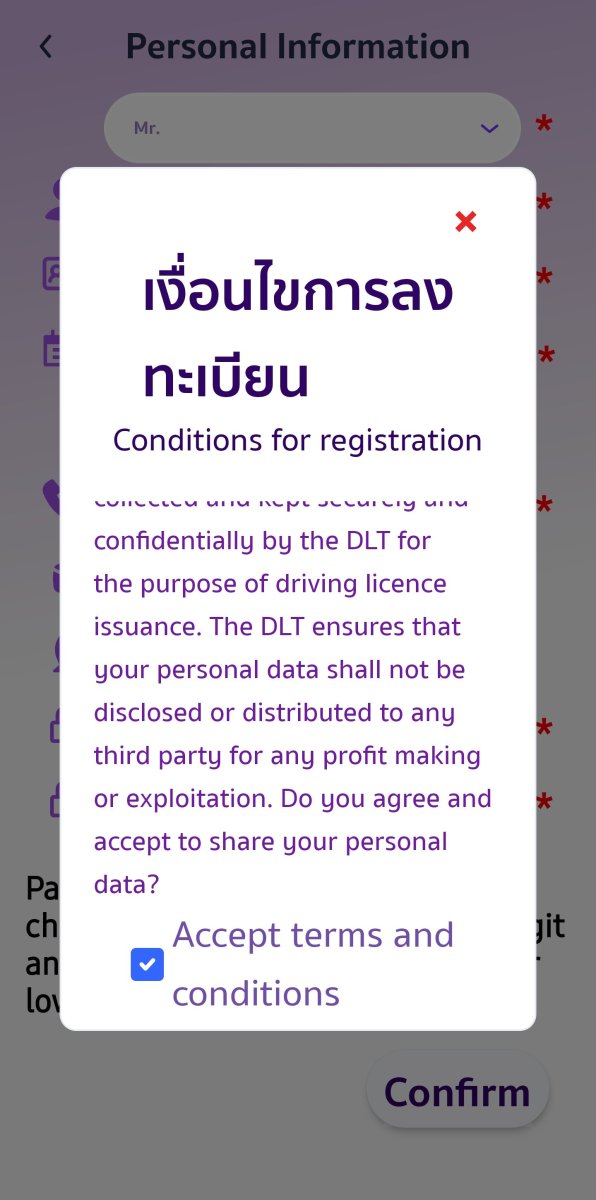

To piggyback off your post, I have been trying to use the queueing app, but found it impossible to get beyond the registration page. Has anyone managed to do this recently? Obviously if the App worked then I wouldn't need to worry about having a walk-in option.

I also would like to know if there any walk-in options across Bangkok, particularly the DLT2 in west Bangkok.

Here is the problem with the app:

There is no way to get past this. It just goes into a loop.

-

-

9 minutes ago, saintdomingo said:

I would only be looking at the lower end of income - basically savings, no more than £25,000 p.a.

That's one of the higher tiers.

25% on income between THB 1,000,001 and THB 2,000,000

-

1

1

-

-

- Popular Post

- Popular Post

2 minutes ago, Ralf001 said:go to hospital and have the Optomerist there exam my eyes and give me the prescrition.... then buy glasses from Zenni.

This is best practice. The highest quality and yet cheap.

The OP, if they're in Bangkok, should attend Rutnin Eye Hospital. They have a large area for eye examinations for a simple fee.

Then get the prescription and order it online with Zenni.

-

1

1

-

2

2

-

1

1

-

2

2

-

7 hours ago, PattayaParent said:

That's the bank I use.

Excellent bank

I'm intrigued by its practical functionality.

Obviously it's in Pound Sterling. But as an offshore account is it linked to the free ATM usage network (the name of which escapes me) of the UK or are you charged on your bank card withdrawals (assuming you have one)?

Did onshore institutions allow payments to be made to it? For example, law firms sending funds or government institutions sending payments etc.

Is it on the Swift network or are movements treated as international from and to the UK? Are transfers to and from the UK free of charge?

What other differences?

-

2 hours ago, TallGuyJohninBKK said:

but oddly NO ratings or reviews whatsoever.

It got 2,000 reviews and has a score of 4.0 on my Google Play.

Is your Google selected for the Thai region? An outside region can cause them to hide reviews.

-

- Popular Post

- Popular Post

1 hour ago, webfact said:The newly launched app

I've had a Tourist Police App on my phone for well over a year. It does all the functions they describe above. It's called the "Tourist Police i lert u".

There is also a separate but functionally identical general police app. I've had that one for around 5 years.

If you have a problem. You take a photo, upload it to the App. They read the message, see the photo, know your location, and respond. Handy for accidents and disturbance.

The problem for many AseanForum members is many of them are the problem, and are the disturbance. So they should refrain from using this App.

-

1

1

-

1

1

-

5

5

-

4 hours ago, sandyf said:

Not my problem,

I have deducted 10 points from your Social Credit Score.

-

1

1

-

-

- Popular Post

- Popular Post

The article is talking about acting authentically in the face of existential boredom.

Heidegger's remarkable "The Fundamental Concepts of Metaphysics: World, Finitude, Solitude" are the best lectures on the topic of boredom. Heidegger is famous for seeking to identify how to act authentically.

The lectures strangely manage to make you bored but also excited as you read them. Recommended.

But honestly I suspect most AseanForum members would be better off just buying a Leo, and not thinking too much.

-

2

2

-

1

1

-

5

5

-

38 minutes ago, sandyf said:

Google not aware yet.

Report the new location to Google Maps App with photo proof. They are very quick to accept changes.

-

I have never been stopped by customs in any country, except Japan. But with Japan, I've been stopped around 80% of the huge number of times.

They always select foreigners. Always. The last several times I entered on a business trip, wearing a suit, and I still had my bag carefully checked.

A foreigner trying to smuggle drugs into Japan is so unlikely to succeed.

-

5 hours ago, BritManToo said:

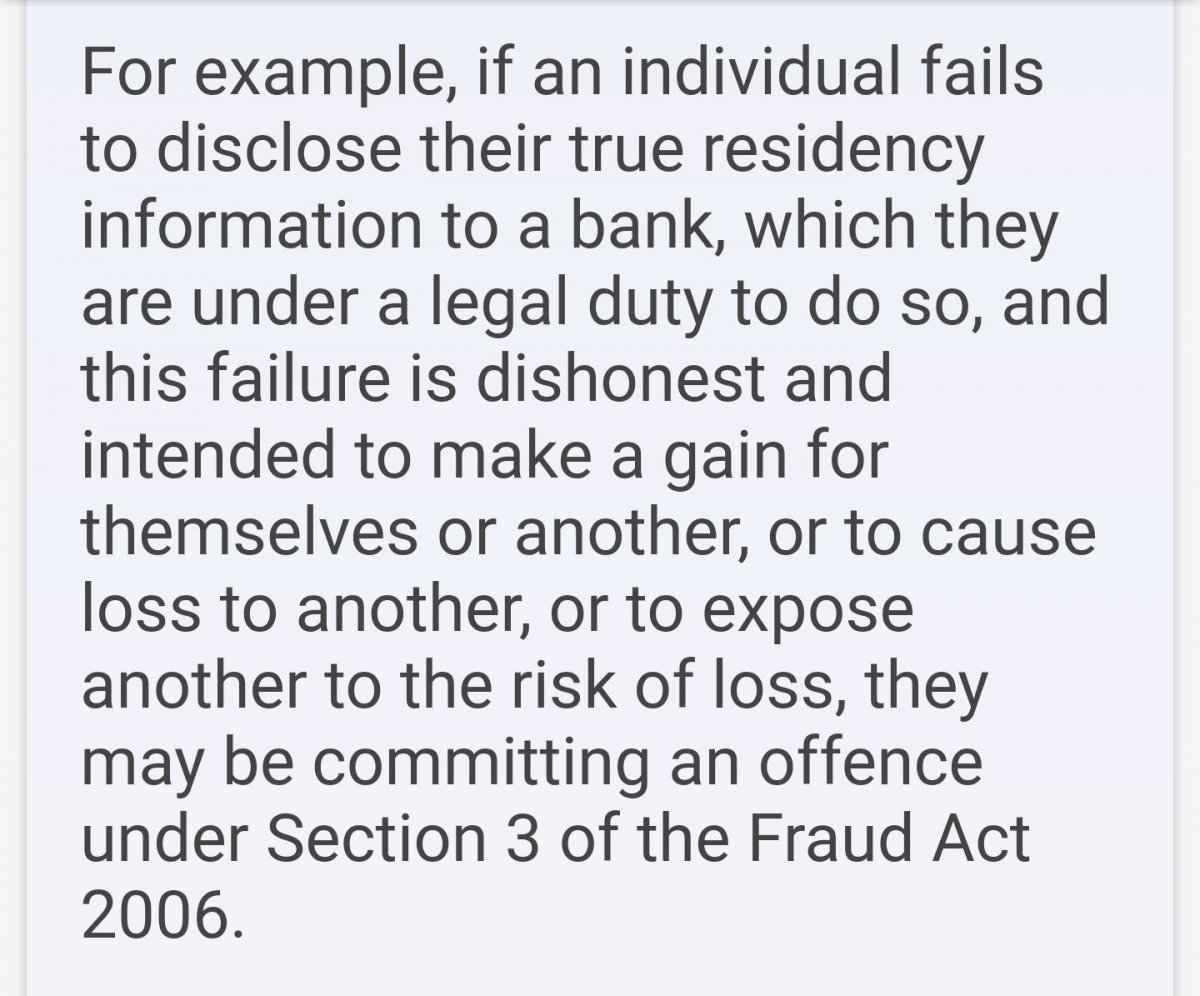

Did you read the "make a gain" bit?

Did you miss the "or" and the "or" and the "or"?

-

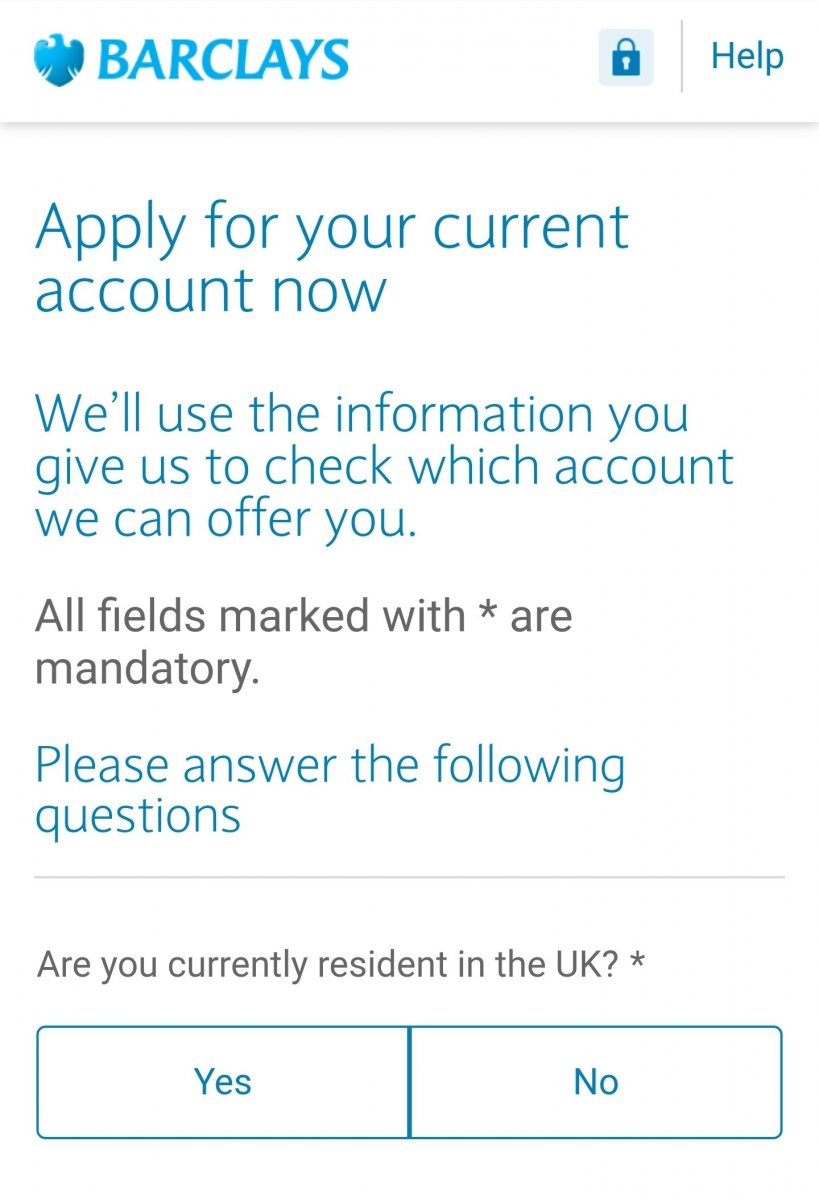

2 hours ago, BritManToo said:

That's actually not true

It's literally the first thing they ask.

Whether it amounts to a crime obviously will depend on the circumstances, but the government's own explanatory guidelines even offer up this very scenario:

You'll notice this is much wider than stealing from another. You don't even need a victim. Obviously using the account to enact tax evasion is to cause loss to another party.

-

There is an ongoing conflation of domicile and residence. If you were born in the UK it is almost certain that you will remain domiciled in the UK for the rest of your life. It is notoriously difficult to lose that position. What you are almost certainly talking about is residency for tax purposes.

And I still don't get the OP's position:

15 hours ago, stubuzz said:I don't actually live in the KSA i work here. My home in Thailand is in my wife's name.

Where is "here"? My assumption is Thailand. And what do you mean by live? More than 180 days so you are clearly a resident in tax matters. You mentioned earlier that you spend most of your year in KSA, which means that you live there, not "here".

In any event, you can easily open a pound sterling offshore bank account in the Isle of Man etc.

If you attempt to open a British onshore bank account then they will not allow it unless you lie about your place of residency. That is, as I explained earlier, a crime. The bank will ask you for your tax ID. What are you going to do?

The money might not be taxed in the UK or Saudi Arabia, as you've pointed out, but that does not mean that Thailand cannot tax it if it enters Thailand such as via an ATM withdrawal, should you at any point be resident of Thailand.

-

I don't understand. You want to tell them you live in Thailand when you really live in KSA? I cannot understand the aim of your scheming and this may affect the unraveling of the consequences.

In any event, it will be fraud by false representation under the Fraud Act 2006. There will then be a cascade of further problems as you appear to be considering tax evasion.

-

21 hours ago, scubascuba3 said:

teeth get nicely stained

Not if you make use of 'Airflow' for your routine dentist visits.

-

I can't believe no one is mentioning the best tea bags in Thailand: Marks & Spencers' "Extra Strong tea bags".

-

1

1

-

-

In Thai Law it does seem that if at time of death if you are living then you are a "legatee" and your inheritors will receive the entitled amount at time of distribution.

But was your friend's Will written under English Law? If so, that typically has a survivorship clause where you must outlive him by a certain amount (around a month) to inherit the funds from the estate. This also raises the question of if it will be recognised by the Thai courts.

There's not much you can do now but sit and wait.

-

1

1

-

-

As an aside, AirAsia's self check-in machines at Don Muang do not work for anyone with middle names.

You can easily imagine that government-created machines will have more problems than machines created by commercial organisations. Let's wait and see...

-

1

1

-

-

It might be that the app is locking you out for security reasons. Please do the following:

Go to "settings"--> "accessibility"--> "installed apps", and make sure all the listed apps are turned off.

Thai driver cites health issue after killing 6 year old boy in Bangkok

in Bangkok News

Posted

Is this a reference to the law in England of death by dangerous driving?

I ask because I don't believe such a law exists in Thailand. That law in England, from memory, is up to 14 years imprisonment.