omnipresent

Member-

Posts

119 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by omnipresent

-

I've found that Grab is quite expensive so would like to try other platforms. Bolt looks interesting. How have your experiences been with these?: AirAsia Cabb Robinhood Muvmi The government had also offered one didn't they?

-

In Phuket it seemed that a massive tip is already included in the prices quoted by Grab (e.g. over 400 THB for a short distance).

-

Is there any progress with a common ticketing system for all mass transit networks in Bangkok / Thailand (like there is in other countries e.g. Japan)? Mangmoom?

-

What are some good web sites or apps for food deals? I've tried Eatigo and more recently Hungry Hub, and they've been OK. Eatigo offer time-of-day based % discounts. Hungry Hub offer package deals e.g. fixed discounted price for a particular number of items.

-

I see a lot of cheap prices on Lazada for high quality brand ear buds e.g. JBL, Bose, Jabra but the risk is that they could be fake, and it can take a bit of effort to check each listing. Sometimes customers say it's fake in reviews. I came across Samsung Galaxy Buds+ for just 990 THB on Banana IT, and I would've got this one but it's out of stock: https://www.bnn.in.th/en/p/smartphone-and-accessories/headphone-smartphone/earbuds/samsung-galaxy-buds-black-8806090198656_z787l8 What other avenues are there to get good deals?

-

Exorbitant payment processing fees for AirAsia flights

omnipresent replied to omnipresent's topic in Thailand Travel Forum

If it was round trip for 2 people that fee becomes over 400, which is unfair, as processing of a payment doesn't require more resources if there are more people or legs in the itinerary, right? It's still a one-time transaction of some THB, so why charge 4x? -

Electric Vehicles in Thailand

omnipresent replied to Bandersnatch's topic in Thailand Motor Discussion

Is there any news about solar roof cars in Thailand? Thailand certainly gets some powerful sun. -

Exorbitant payment processing fees for AirAsia flights

omnipresent replied to omnipresent's topic in Thailand Travel Forum

You can't always assume that... Nok Air (and other budget airlines like Lion Air, VietJet etc.) are often competitive, and when you factor in AirAsia's 400 THB payment processing fee, flights with those other airlines may turn out to be cheaper in total. -

Exorbitant payment processing fees for AirAsia flights

omnipresent replied to omnipresent's topic in Thailand Travel Forum

Yes, it makes it more difficult to compare prices between many different airlines. We have to add 400 THB to payment processing fees to the AirAsia prices shown on SkyScanner. Other airlines don't charge anywhere near as much for payment processing, so we didn't really have to consider it. -

Exorbitant payment processing fees for AirAsia flights

omnipresent replied to omnipresent's topic in Thailand Travel Forum

For one-way and 1 person? It seems that AirAsia now charges per leg and per person, so round-trip for 2 people would make the payment processing fee around 400 THB, even though the actual payment is still done in 1 transaction. I recall in the past this was the case only with card payments. But it seems it's now done for payments via internet banking too. -

For my latest booking payment processing fee was almost 20% of the ticket costs - before payment it was around 2k THB for 2 people round trip, then payment processing fee was around 400 THB. I recall it used to only be expensive like that if I chose card payment, whilst internet banking had much lower fee. But now every payment method is expensive. Is there any way to pay less? I think with AirAsia BIG card the payment processing fee is waived, but only Malaysian citizens are eligible for the card, right?

-

New Cannabis Measures Aprroved to Protect Children at Risk of Abuse

omnipresent replied to snoop1130's topic in Thailand News

OK. How about caffeine products? -

GBP/THB rate sharp dive

omnipresent replied to omnipresent's topic in Jobs, Economy, Banking, Business, Investments

It was very steep, as you can see in the chart, so "sharp" (as opposed to "large", which you might have mistaken me as expressing) is accurate. -

I want to convert USDT to GBP fiat currency on a crypto exchange and then withdraw the GBP to my Wise account. Which exchanges can do the USDT to GBP conversion and would be accepted by Wise? I'm worried that Wise would freeze my account if they find that the GBP came from a crypto exchange. But they say Source: https://wise.com/help/articles/2932118/incompatible-accounts-and-payments

-

GBP/THB was doing quite well this year until diving sharply since a couple of days ago. What's going on? https://www.xe.com/currencycharts/?from=GBP&to=THB&view=1Y

-

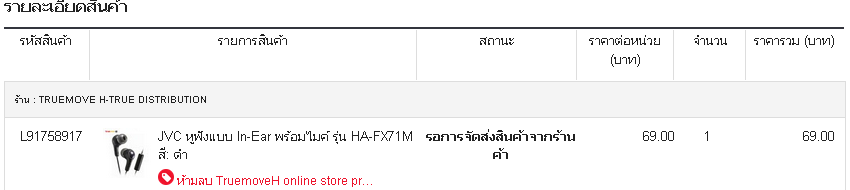

I'm not so sure about judging only by price as I have caught big bargains online in the past, e.g. last year I found earphones worth around 400 THB everywhere else that was selling at a discounted price of 69 THB at https://www.wemall.com/d/L91758917. That's around an 80% discount. Delivery was even free! Here's a screenshot of my order: I love these earphones as the bass is great, matching the good reviews I had read. I wanted to buy more pairs but there were only white ones left, then even they got sold out soon after.

-

This one is just 299 THB and got a lot of reviews: https://www.lazada.co.th/products/jbl_live-pro-tws-30-bluetooth-earbuds-i3642589878-s13683025070.html. The seller seems to be reputable with high rating and 5.5k followers. Not all items in his shop are dirt cheap. Maybe old models are heavily discounted for clearance. Can you guys spot anything suspicious?

-

I've been looking for wireless earbuds and came across many JBL ones under 500 THB on Lazada. Normally they can cost around 100 to 200 USD elsewhere. Some of the listings have a lot of reviews with pictures. Are the cheap ones on Lazada genuine? Has anyone had experience buying cheap JBL earbuds on Lazada?

-

There are high interest bank savings account products that give 1.5% per year, so are there insurance policies that give higher? The high interest rate of those bank accounts apply to a limited amount in the account (e.g. 2M or 3M THB) though. But it's still suprising to see the enormous difference between the 18M THB put into life insurance and only 286k THB in bank accounts.

-

Can anyone explain why Move Forward Party (MFP) leader Pita Limjaroenrat has 18M THB (21% of his wealth) in life insurance policies (whilst keeping only 0.3% of his wealth in bank accounts)? Are life insurance policies really a better place to park money?

-

The breakdown of Pita's wealth is quite insightful. Here it is in a table: Description Proportion 14 rai of land in Pran Buri 21% 5 life insurance policies 21% loans to younger brother 18% condominium 18% 10 watches 7% van, motorcycles and 3 electric bicycles 3% eight Buddha amulets 2% cash 2% 28 equipment and electrical appliances 2% Royal Bangkok Athletics Club membership 2% 65 investments 2% 16 suits 1% 2 cameras 1% Bank accounts 0.3% copyright for 4 books 0.3% 76 neckties 0.3% 28 shirts 0.2% three mobile phones 0.2% 21 pairs of shoes 0.2% furniture 0.1% 39% of his wealth is in real estate (land and condo), which makes sense for growing wealth in the long-term and possibly earning rental income. The loans to his brother is a big proportion of his wealth; I guess he trusts his brother greatly. I wonder what the terms are, e.g. interest rate. The tiny amount (0.3%) in 27 bank accounts is strange, but maybe he parks his money in life insurance policies that give payback with interest instead. The 65 investments is a bit strange... it seems like extreme diversification for such a small proportion of his wealth (whereas the real estate is concentrated in only 1 land plot and 1 residence). What do you guys think of his wealth portfolio?

-

Will changing to blue line at Lat Phrao require a separate fare?