Raindancer

-

Posts

1,079 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by Raindancer

-

-

14 minutes ago, chiang mai said:

What the rules state and what appears to be common practise are two different things.

The rules state that a tax resident who receives in excess of 60k baht in assessable income, must file a tax return, the amount increases to 120k if the income is via employment and increases again to 220k if married..

There is no concrete evidence that TRD levies a fine of 2k baht for not filing a return, when they were supposed to, some take this to be accepted practice that TRD doesn't want a bunch of null returns clogging up their system. Some members will tell us that no AN/TVF member has ever reported being fined for not filing a return and this may or may not be correct. If you think that AN membership is representative of the entire foreigner community in Thailand, this may be a safe bet, if it is not, caution is needed.

You must decide which road you want to go down.

Thank you. I was reading your earlier post, whereby you advised/ said to a member, that he was within the threshold of his TEDA and therefore did not need to file a tax return.

That is why I sought clarification. I'm quite happy to complete a TIN if legally required to do so, but not file a tax return if that is not required as I am within TEDA and also DTA.

-

1

1

-

-

So, a person with assessable income within their TEDA, does not need to complete a tax return.

But if their assessable income is more than the 60/120/ 220k, they still have to apply for a TIN?

Seems rather pointless.

-

1

1

-

-

13 minutes ago, Mason45 said:

Hi there, I needed to renew my one year visa yesterday using the agent I've used for the past 10 years. When I attended the agents office I was informed that now I have to wait at the Bangkok Bank for around 4 hours before the transaction can proceed. I thought that this was rather strange as I've never had to do this before. The agent stated that if I have a Bangkok Bank app then this waiting time is drastically reduced. So I downloaded the Bangkok Bank app, it opens but I can't proceed as it states that there's another app on my phone which is preventing me from proceeding. I live in the Naklua area and I haven't got a clue where the nearest Bangkok Bank is as all the banks in Naklua road down towards the Dolphin roundabout end have closed down in recent years. I have time on my side as I won't require the app until this time next year. Thanks.

If you are using an add blocker, on your phone it can block the bkk app.

It also applies to an an app called SD Maid.

-

Just now, 4myr said:

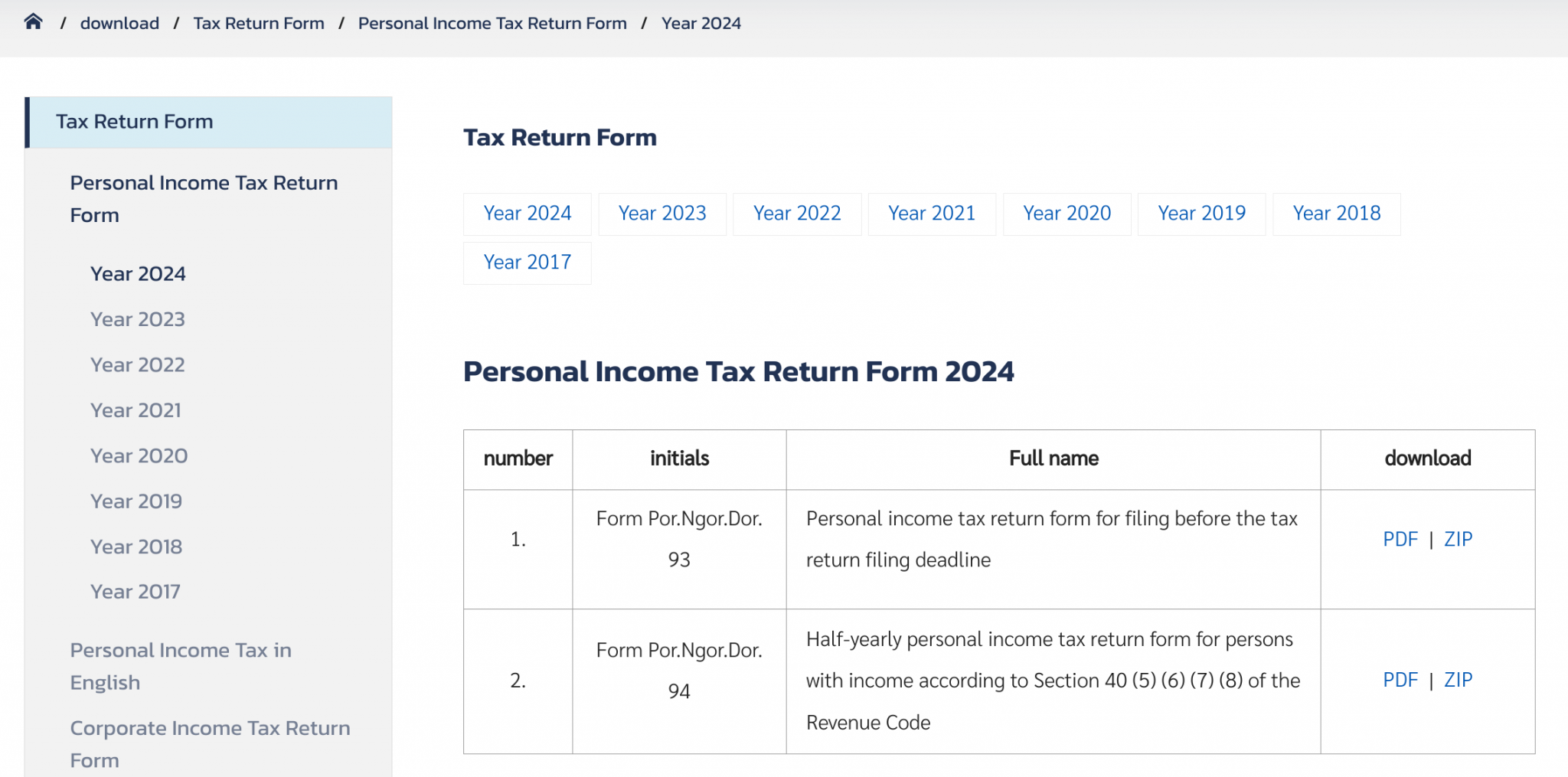

https://www.rd.go.th/fileadmin/tax_pdf/pit/2567/271266PIT93.pdf

One of the 2024 forms in Thai you can download.

Many thanks.

-

13 minutes ago, 4myr said:

https://www.rd.go.th/65971.html

Some 2024 tax return forms are already available for download.Cannot find specific details on 2024 remittance rule changes.

Very easy to fill in a nil return.That link just takes you to their website. Click English and it opens criteria and rules for income tax etc.

-

31 minutes ago, sometimewoodworker said:

For me the process is

request the transfer from Wise to a pre saved SCB account,

they ask from where I select my pre saved RBS account.

wise transfers me to RBS where I authorise the amount pre determined go through the RBS security and I am returned to Wise who have already received the RBS transfer and requested the transfer in Thailand.

Since I have filled in the required information to allow wise to request a transfer from RBS previously I only fill in the amount once in Wise and just check the amount and click which RBS account to pull from. This process and the U.K. banking process makes everything extremely fast and secure.

I suspect that my transfer is a couple of seconds faster than @Chivas as I have fewer steps. I used to do it his way but now let Wise fill in the amount. But they are both secure and fastInteresting procedure.

I will look into connecting my UK bank with wise.

Thank you for the info.

-

1 minute ago, Chivas said:

No I fill in the amount I want to send whether on app or desktop

Click through the "reason" for sending

Then app or desktop basically says "send us the money"

On to Royal Bank of Scotland....via the saved payee of Transferwise.....enter amount to send and then ping it to Wise

As I ping to Wise its landing already in 2-3 seconds into SCB

Many thanks..

-

1

1

-

-

2 hours ago, Chivas said:

Could well be yes. Although I've only "monitored" the last 23 transfer obviously I did many prior to that. I dont recall ever having a "next day" arrival of monies

Now I've always done it the same way. Money not on Wise accounts, no debit cards, no credit cards, but simple I send them the money and I do wonder if its that reason that all mine are instantaneous

So, to clarify your procedure.

Do you send the money from bank to wise first,or initiate a transfer from wise to Thsi bank, and then transfer the money from UK bank to wise?

-

11 minutes ago, Chivas said:

RBS as above poster to Wise to SCB is landing in seconds as always

Been tracking the last now 23 transfers since people started quibbling

22 landed instantly in few seconds and one took just over an hour

(Edited in.....transfers have been sent on every day of a normal week weekends/bank holidays make no difference)

I only posted this on one of the Wise FB groups yesterday

Initiate transfer laptop/app send via simple bank transfer from saved payee on RBS to Wise

Ping seconds later as money hits SCB before I even get the chance to click "I've sent my monies" icon on Wise app

I really dont understand what some people are doing I really dont

Well, I have been using wise for a few years now. And despite what amount, what reason I use for transfer, and transferring every time before 7am, it always arrives in BBK account at 14.13 hours same day.

But not at weekends, which always arrive on the Monday.

I have used " pulling from UK bank" and depositing money with wise, prior to transfer.

And every transfer shows, " should arrive in seconds" prior to confirming transfer.

But 6/7 hours is fine by me.

So, it must be a BBk bank issue.

-

Just now, brewsterbudgen said:

Maybe they're just blocking out spots for Work extensions then. Very frustrating.

Can't see any slots for retirement extensions for next 3 months at CM

-

1

1

-

-

1 hour ago, ThailandTimeZone said:

Another thing to note, is that it looks like some Immigration offices allow an appointment to scheduled one month in advance and some allow an appointment to scheduled three months in advance.

Sent an email to CM immigration. " Mail box full, cannot accept your email etc"

So, sent one to the Superintendent Colonel, whose email I happen to have kept.

Let's see what the response is.

-

1

1

-

-

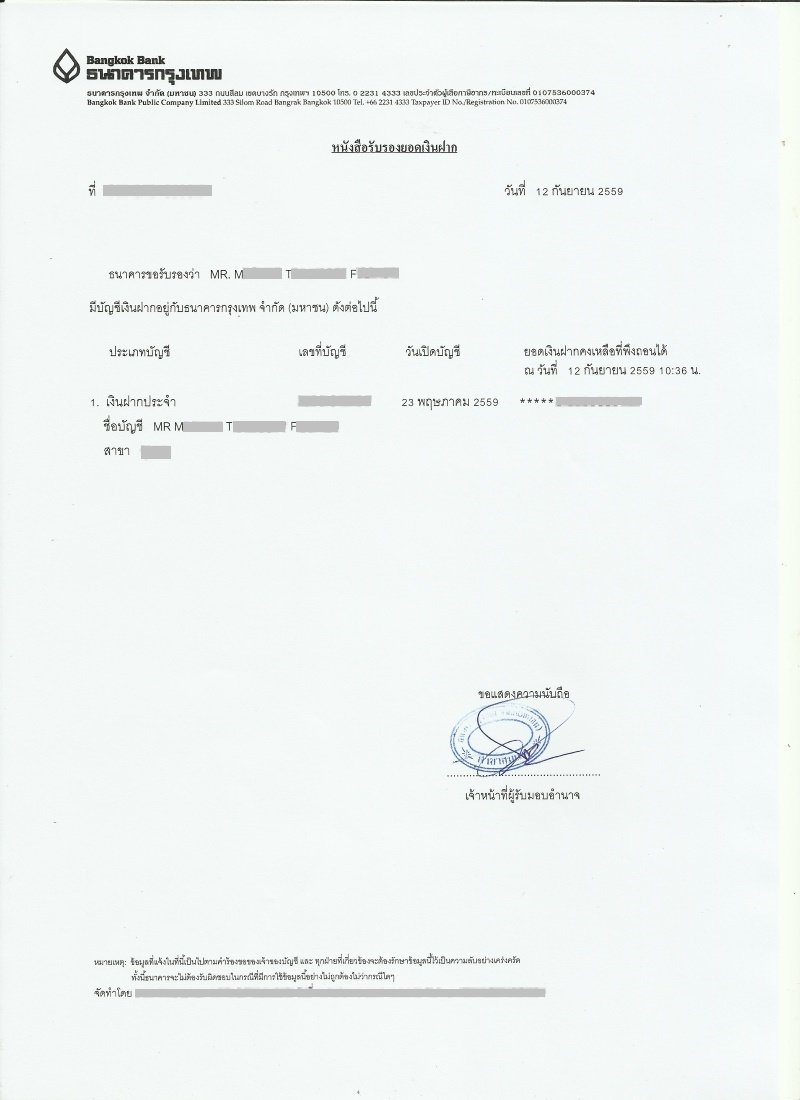

18 minutes ago, DrJack54 said:

No.

Appears that you are using fixed deposit account.

No 12 month bank statement required.

For those of us using funds in the bank method then immigration offices accept photocopies of bank book pages back to last extension.

Note that some offices are now insisting on 12 month bank statement.

This happened to me with recent extension as I had one month with zero transaction.

The standard bank letter I referred to is your second pic in earlier pic

Here is example.

Well I have had a fixed deposit account for years. And there is never any movement on the account, apart from interest being added every month.

CM immigration always insist on 12 month statements.

And I always do copies, back to front of the passbook.

-

5 minutes ago, campbell said:

Can anyone confirm if VFS will accept a rental agreement (lease) on my residence along with my most recent receipt of notification (90days) and TM 30 as proof of address when renewing my British passport.

Thanks in advance

Use your driving licence. Or use your phone bill statement. You can download a statement from your phone company app.

-

1

1

-

-

- Popular Post

1 minute ago, Celsius said:The question is does he have to file a tax return?

That is the question we are all asking. We will have to wait and see🙏🏻

-

2

2

-

2

2

-

13 minutes ago, Thaindrew said:

and if you use an agent who puts that 800k into you account for the visa application, what then? Thailand considers all deposits as potential income .....

Who mentioned agents and the use of 800k from them.

-

12 minutes ago, Thaindrew said:

thats true and very good level of allowance for may retirees, however your figure does assume your wife is not working or has no obligation to file a tax return and so use her own allowance rather than allocate it to you. Then there may be a small tax bill based just on the UK state pension.

If he was married, and his wife was not working, they could file jointly and claim her 60l pa as well.

Thus taking the total allowances to 560k per year.

As the maximum UK state pension is £220 per week, therefore £11440 per annum and at 44 baht to the £ = 503k, there would be no tax liability.

-

Just now, whiteman said:

you go and tell all the people to change then from 65k

Jeepers. Don't hijack my answer to someone who asked a question regarding his pension income.

Have a nice day

-

Just now, whiteman said:

Absolute rubbish. If you are referring to the 800k in the bank for extension renewal, that has nothing to do with the allowances and the OPs pension income.

I used the 800k as an example so what happens with the 65k per month coming in then that will have to be increase and taxed hence why they will increase the amount u need to stay here

Simple....don't use the 65k method.

If you bring in 800k, show it as savings, which are exempt.

-

Just now, Expat68 said:

But not 15 years ago!! Do not panic people

Thank you

-

Just now, whiteman said:

it has if you are a new retiree and have to bring money in to get your visa

Why raise this against there reply I gave the OP regarding his question. Nothing to do with my answer.

-

3 minutes ago, whiteman said:

I'm over 65 but not married, my State Pension is approx 8000 GBP

Then your allowances would be.

Over 65> 190k

Personal Allowance 60k

First 150k tax free allowance.

Up to 100k allowance offset against pension income

Total allowance: 500k

So at £8000 per annum @ 44 baht to the £ = 352k

So, you are still under your total all

Yet the pension allowance is 800k per year which currently the Thai government thinks is what you need to live here so tax will have to be paid on that 800 - 500 balance 300K TAXABLE

Post deleted by user

-

1

1

-

-

6 minutes ago, Badrabbit said:

Thanks mate, sorry I don't understand that at all, thanks for taking the time and effort to explain.

No problem:

Basically as an unmarried 65 year old, you have Thai income tax allowances of 500000 Thai baht per year,BEFORE you pay or are liable for any income tax here in Thailand.

Your £8000 UK pension equates to 352000 thai baht income per year.

Therefore you have no Thai income tax liability to pay.

Hope that explains it for you.

-

19 minutes ago, Badrabbit said:

I'm over 65 but not married, my State Pension is approx 8000 GBP

Then your allowances would be.

Over 65> 190k

Personal Allowance 60k

First 150k tax free allowance.

Up to 100k allowance offset against pension income

Total allowance: 500k

So at £8000 per annum @ 44 baht to the £ = 352k

So, you are still under your total allowances.

Hope that reassures you.🙏🏻

-

1

1

-

-

1 hour ago, Badrabbit said:

Yes I believe the UK has the double tax treaty so hopefully I have nothing to worry about but I still worry.

I wouldn't worry too unnecessarily.

If you are married over 65, you will have allowances of 560k, which includes the first 150k, ( non taxable).

As the max UK state pension is currently £220 per week (£11660) per annum, equates to 513k thai baht @ 44 baht to the £, you will be OK.

Even £ 11660 (@ 46 baht = 536k pa to the pound) is still under the 560k per annum allowances.

-

2

2

-

Thailand's Expats Urged to Register with TRD for Tax, Says Expert

in Thailand News

Posted

Thank you.