-

Posts

11,830 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Everything posted by khunPer

-

More COVID cases in Surat Thani?

khunPer replied to phetphet's topic in Koh Samui, Koh Phangan, Koh Tao

Yes, I saw 4 young farang couples - well one of the chicks looked black - on Maenam Beach today. The boys were playing ball of some kind, the girls were just sitting looking gorgeous in their bikinis, so seems like some tourists are coming...???? -

Probably only if you book a room with both a bed and a sofa...????

-

More COVID cases in Surat Thani?

khunPer replied to phetphet's topic in Koh Samui, Koh Phangan, Koh Tao

29th september Samui, no new cases Phangan, no new cases Koh Tao, no new cases 30th september Samui, no new cases Phangan, no new cases Koh Tao +2 new cases -

"Why on earth should that happen? It simply doesn't make sense", is exactly what the Danes thought, but if you read the tax rules and the DTA, it makes sense. The DTA between Denmark and Thailand for example says in article 18 that "pensions and annuities may be taxed in both Contracting States". In principle you still need to report your income, and then either be exempt from tax, or having the tax refunded. Denmark claims it's right to tax pensions as "source Country". The DTA between USA and Thailand is for example more specific in USA's right for taxation as source country, it says that "pensions and other similar remuneration paid to a resident of a Contracting State in consideration of past employment shall be taxable only in that State" (Article 20). Therefore you cannot generalize, each country might have separate rules about double taxation, even that the so-called "standard agreement" says that pensions are taxable in the state of residence, which is mention in posts above to be used by Norwegians...???? A country can also have different type of DTAs with other states, for example it was before a tax heaven for retired Danes to settle in France or Spain, as the DTA said that their pension should be taxed in the state of residence - just like for the Norwegians in Thailand - and as both France and Spain have very beneficial low tax for retirees, they became "tax heaven" combined with in general also little lower living costs in the areas, where retired Danes would settle. However, Denmark cancelled both DTAs and suddenly all the "tax heaven"-Danes were subject to double taxation ...????

-

Totally different from what I hear and find in published studies, but science and experts often seems to disagree...????

-

Thai Court rejects dual pricing case from expat in Hua Hin

khunPer replied to webfact's topic in Hua Hin and Cha-Am News

I would presume that it's part of "amazing" Thailand...???? -

Thai Court rejects dual pricing case from expat in Hua Hin

khunPer replied to webfact's topic in Hua Hin and Cha-Am News

That is true - "...good for the nation" - the major question is merely how much more an alien shall pay? If the balance is right - i.e. minor or acceptable surcharge - then almost nobody would complain. Another fact is that if you cannot afford - or by other means can get - a health insurance, you are on you own, i.e. on your own money. This means that if you cannot afford to pay for your health, then you shall consider if Thailand is the right place for you to stay as an alien. It's not a matter of opinion - or a question about equality or discrimination - it's pure facts. -

I've always been told from dietitians that olive oil should be avoided for frying, while it's excellent in cold food, for example in salads. The dietitians I know all says that palm oil and coconut oil are the best for frying, both are available here at affordable prices, however the coconut oil is two-three times as expensive as palm oil, but seems to have a number of health benefits, so might be well worth the money.

-

Not at all "neglected to advise some relevant information but there is something distinctly peculiar in your account of this incident" - there are 21 other Danes on the tax-list besides me on the island where I live, so it's about all Danes, furthermore numerous Danes further up north have shared about it in a Danish-language forum, many are retirees with no other income than their government pensions - so please don't speculate in something you have no knowledge about, and make accusations based on your speculations. The basics of a DTA is to share tax-information between the two states...???? I have based on this incident been in contact with the Danish tax authorities, who confirms in writing that they share tax-information with Thailand...

-

The comments to the Danish DTA says that the so-called "standard DTA" states that taxation of retirement pensions are due in the state of tax-residence, however a state can claim taxation right as source of income, which is a deviation from the standard DTA. This might result in that an income is taxable in both states, but will be refunded, or partly refunded, due to a DTA. Your Norwegian example is according to what follows from the standard DTA, whereas your US example follows state of source (I havn't checked if US' DTA says anything about taxation in both states, like the Danish DTA says). The most easy way to avoid double taxation is the Thai exemption-method, i.e. (1) Exemption method The country of residence does not tax the income which according to the DTA is taxed in the source country. -however, the exemption method is up to the Thai authorities' decision, it's not up to the taxpayer...????

-

The source is "the taxman" - i.e.that's what the kind people from the tax authorities have told not only me, but also other Danes in Thailand. They are mainly looking for income that might not have been taxed abroad, i.e. the data they have obtained is us retiree's net-income after home country taxation, and they say "money that the Danish government had not taxed", so we need to show that tax has already been paid. In Denmark all communication with authorities is digital, so we Danes can for example only print an income tax-statement ourselves - i.e. no official letterhead, and no rubber stamps, and no signature - luckily, they seems to accept that...????

-

If I remember correct, then the GB and Thai DTA specific mention that pensions paid by government are only taxable in GB for GB-nationals, I'm not sure if private pensions are specific mentioned. You need to carefully read your home country's DTA. Some states might also have a further explanation to what has been agreed in the DTA, and how it works in practice. I'm not at all specialist, I just wished to care about my own income taxation and fully legal ways for "tax planning"...????

-

I've been looking for it since more than 15 years ago - I never found any, but I do remember somebody posted that it was available a few places - I ended up buying my own safe...???? Now I'm saving up little money every month, so I one day might have something to put into my safe...????

-

You said "...I never ever heard of anyone being taxed for bringing money into LOS to live on as a retiree as you propose to do." Then you will hear about the first case right now - and I'm just one of several - the Thai tax authorities has begun to check retirees for retirement pension taxation. I, and many of my fellow Danish countrymen (and women) have had visit of the kind taxman (often a pair of ladies) that already have full statements about income from our home country. We need to prove that we have paid income tax in our home countries, and that the income tax is higher than it would be in Thailand (no problem when one's country is number one in the World). Mind you that the base of a DTA is that the two states share tax-information. According to the Thai taxman, retirees from Denmark and Finland, are only the beginning; however, you might not need to pay tax in Thailand, but they do wish to know about your income, in principle you are tax-resident and fully income taxable...????

-

That is unfortunately not correct. A DTA is just a way to avoid paying tax twice of the same income, you might still be income taxable both in your home country, and at the same time full tax-resident in Thailand, if you stay more than 180 days in Thailand during a calendar year. I would love to pay income tax in Thailand of all my income instead of in my home country, which has a DTA with Thailand, unfortunately I'm stuck with the World's highest taxation on my retirement income, even that the DTA says that it's "taxable in both states"...

-

In principle you are tax-resident when staying in Thailand more than 180 days within a tax-year, which is a calendar year, i.e. you shall pay income tax. Income from abroad is first of all depending of your home country's DTA (Double Taxation Agreement) with Thailand, and the the sources of income. Some income might be taxable in both countries, but one of the countries will repay tax, if they charge it. Thailand has two ways to eliminate double taxation... C. Elimination of double taxation The focus of a DTA is the elimination of double taxation. Each DTA may prescribe different methods of elimination of double taxation of a person by the resident country: (1) Exemption method The country of residence does not tax the income which according to the DTA is taxed in the source country. (2) Credit method The resident country retains the right to tax the income which was already taxed in the source country. It calculates its tax on the basis of the taxpayer's total income including income from the other country which according to the DTA is taxed in that other country. However, it allows a deduction from its own tax for the tax paid in the other country. Only about 6 percent of Thailands population is registered for income tax, and circa 4 percent actually pays income tax (according to news articles); most foreigners with retirement pension as the only income, or living from savings, don't register for income tax - it might even be difficult to be registered without having any Thai income (I talk from experience) - but in principle you are eligible for income taxation. In principle all foreign income brought into Thailand is income taxable; however, only if the income is transferred during the same calendar year as it's earned. The next calendar year, and any following calendar years, the income is considered "savings", which are free from income tax when transferred into Thailand. Dividends from foreign stocks and interest from foreign bonds are only eligible to be taxed in Thailand at the same rate as Thai dividend and interest, i.e. 10 percent and 15 percent, so if you pay higher withheld dividend tax at source of income, you shall not pay tax in Thailand, or the Thai-tax will be repaid. Foreign capital gain is income taxable, but I only hear about people that leave the capital gain offshore until next calendar year...???? When using the 800,000 baht bank deposit for applying of annual extension of stay, the source of fund is not asked for; i.e. you could have change from having a work permit to be retired, and use previous Thai income for the deposit. Only when using the income method of minimum 65,000 baht each month, you need to prove it's a foreign transfer, normally marked as FTT in your bankbook and bank statements (Foreign Telegraphic Transfer). Any Thai income as interest from you bank accounts, or other investments, will be withheld tax - 15 percent from interest, and 10 percent from dividends - if you accept that tax, then you don't need to do any further. However, you might be able to reclaim your withheld tax, if your total taxable Thai-income is under the tax limit, but do consider if it's worth the paperwork depending of the size of money; i.e. 800,000 baht might in best years pay around 1.5 percent interest that equals 12,000 baht, of which 15 percent tax is 1,800 baht. You can find you home country DTA in the link HERE. Depending of you home country's DTA and source income, you might have some tax-benefits from dividend tax when residing in Thailand, which can be 15 percent flat rate - which for example is eligible for US dividends paid to non US citizens (I dont know if US-citizens are also eligible) - or Thai 10 percent tax, if the dividend is transferred into Thailand during the same calendar years as it's earned, but only eligible for the actual transferred dividend sum...????

-

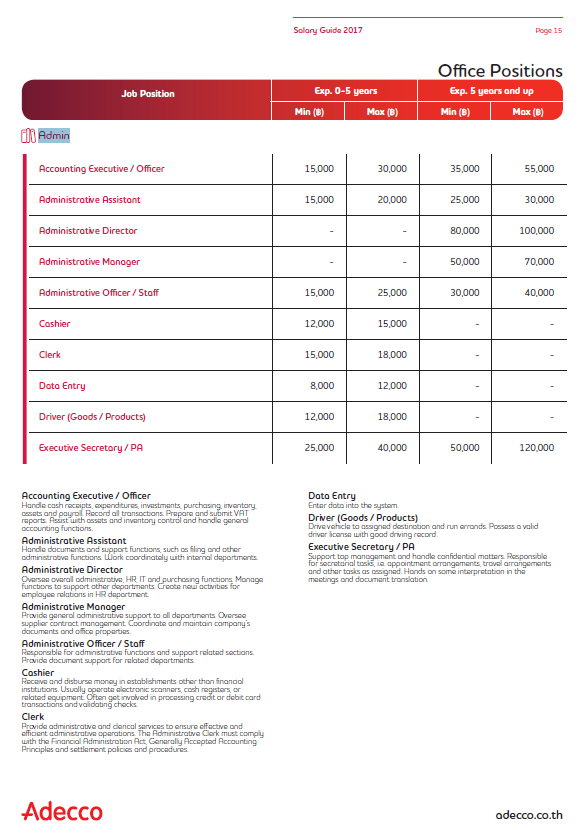

Be aware of box jelly fish - by some mentioned as the most poisonous creature on Earth - especially in calm weather and after rain, or during soft rain, some experts warns. Sadly, a 9-year-old Israeli boy has died after he was stung by a box jellyfish while swimming at Haad Rin beach on Koh Phangan even he was given immediate first aid and rushed to hospital... You can read more in Thai language at Mathicon Online'a article (29th August 2021) HERE. 7 years ago we there was a similar sad accident with a French boy, The Guardian article from August 2014 is HERE. In case of being stung by Box Jelly Fish, some beaches on the islands have emergency posts with vinegar - looks for example like in my photo hereunder - vinegar is the best instant cure while waiting for an ambulance... Here is an emergency first aid guide in both Thai and English... Samui Rescue might also be a source for instant ambulance help, their phone number is 077 421 444. This is what a Box Jellyfish looks like in Wikipedia...

-

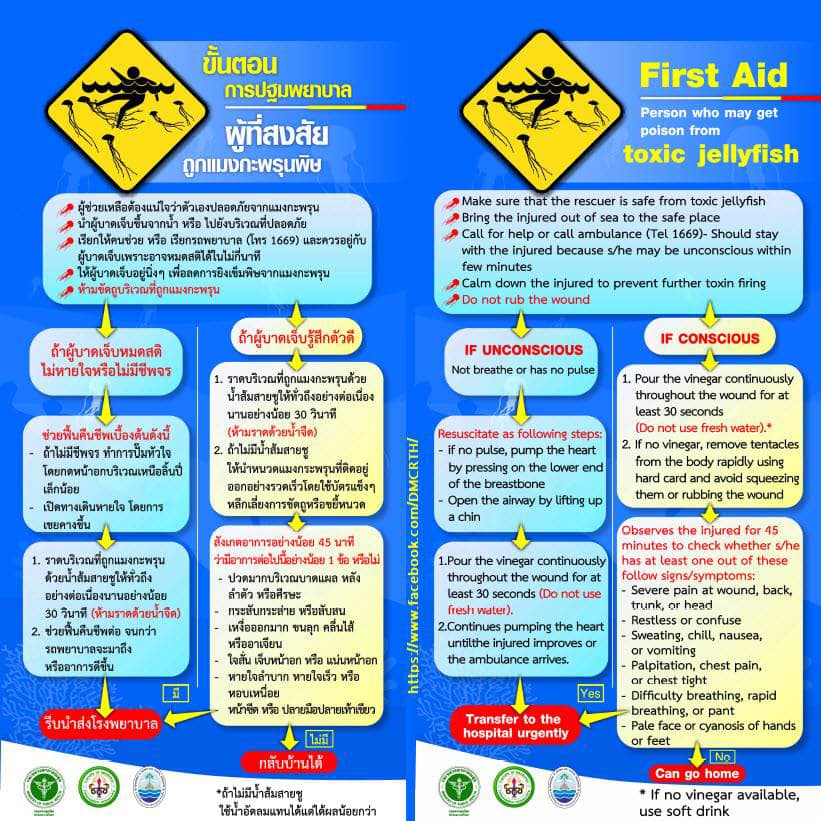

This thread is ment to share information about Covid-19 vccinations on the islands, perhaps a moderater would pin the tread, so we only have one place to share information about vaccination, making knowledge distribution, questions and answers more easy. Please note that "the Ministry of Public Health affirmed that all people who reside in Thailand, regardless of their nationality, are eligible to receive the vaccine under the government’s plan." PR Thai Government says... The Government has ensured that Thailand will begin a mass COVID-19 vaccination campaign, starting 1 May 2021, by prioritizing people aged 60 years and older, as well as people having certain underlying diseases or conditions, followed by citizens aged 18-59 years. During the CCSA meeting, the Ministry of Public Health affirmed that all people who reside in Thailand, regardless of their nationality, are eligible to receive the vaccine under the government’s plan. The first phase of COVID-19 vaccination campaign will start with Thai people aged 60 years and older, as well as people who have certain medical conditions: (1) chronic obstructive pulmonary disease (COPD), (2) chronic kidney disease (CKD) in 5th stage, (3) coronary artery disease (CAD), (4) stroke, (5) obesity, (6) diabetes, and (7) cancer patients receiving chemotherapy. These groups are required to register to receive the vaccine, with a choice of three methods. Registrations may be done on (1) the Mor Prom ("Doctors Ready") app, a new platform that was specifically designed to facilitate the Government's vaccination program, (2) a nearby hospital, or (3) a village health volunteer or health promotion hospital in your area. The registration opens on 1 May 2021 and vaccinations will begin on 7 June. Other groups will be vaccinated in another phase. The registration for citizens aged 18-59 will be open in July 2021, and they will start to be vaccinated in August. PR Thai Government sources: 1. https://www.facebook.com/fanmoph 2. https://www.facebook.com/ddcmophthailand

-

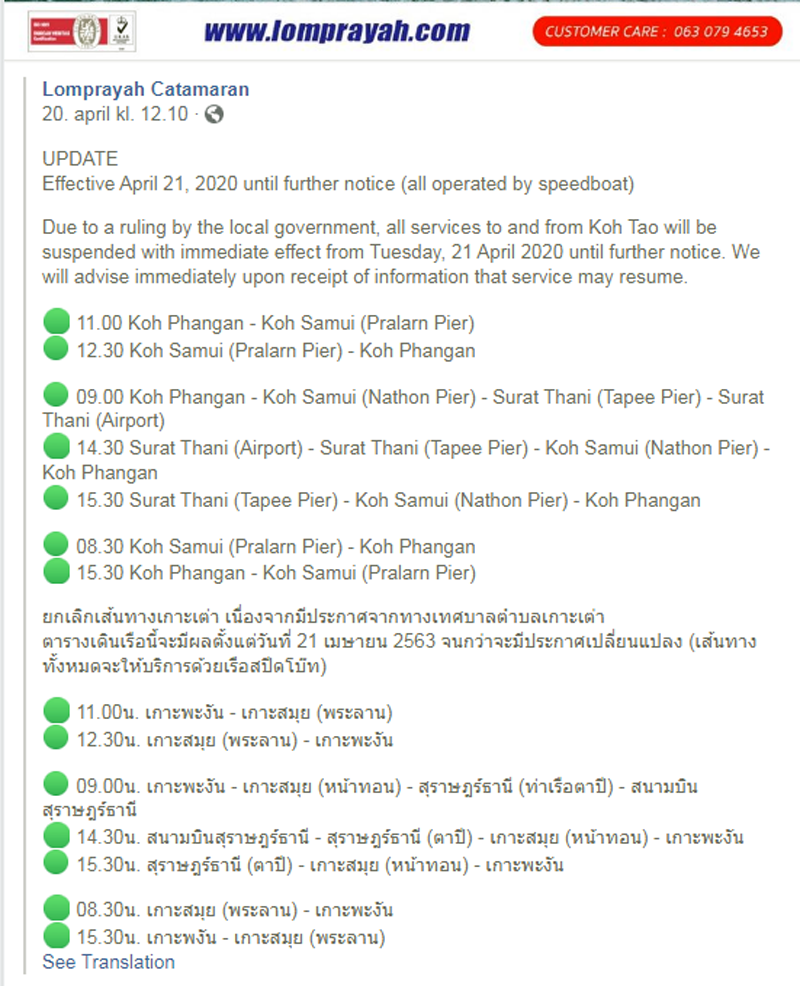

I kindly suggest that we during the coronavirus pandemi period make a pinned thread with transport from/to the islands – Phangan, Tao and Samui – as the normal timetables and transports are cancelled; and when restarting, they might be only with limited departures. Lomprayah has been mentioned earlier in another thread, and the question about their 12:30 catamaran departure from Samui to Phangan, which I haven't seen, but however seemed like some passengers did make the tour. The reason could be, that there are so few passengers that it's operated by a speed boat. Here is the latest update from Lomprayah...

.png.3b3332cc2256ad0edbc2fe9404feeef0.png)