Asiantravel

-

Posts

5,760 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by Asiantravel

-

-

15 hours ago, TonyClifton said:

Are the safety deposit boxes like those in America and Europe or any other country not full of half-thinking nitwits? You know the kind, I get a key, they get a key and you need both keys to open it.

yes it's an entirely separate area in the bank.

you enter the reception and you sign a card and you show your key tag number and they accompany you through the huge safe door and into one of about five rooms which each contain a row of safety deposit boxes. then they use their key to open the top lock and then you use your key with the second lock and then they leave you alone in private and you can sit at a small desk while you go through your box.

-

1 hour ago, Lovethailandelite said:

when I saw these two vessels this morning I just assumed they were for the proposed new services to Koh Chang and I am stunned to read they will be added to what can't possibly be a profitable route.

the service to Koh Chang would be very attractive particularly now that there is no big bus anymore from Pattaya to Trat so I would pay a premium not to have to go by minivan.

that is provided passengers have a cost-effective way of travelling between Sattahip port and Pattaya and would not be held ransom by the taxi Mafia

-

5 minutes ago, TonyClifton said:

I want a deposit box to put my gold. I don't want to deposit 5 million baht anywhere. There must be a proper bank that provides boxes. Why is this country so far behind the modern world?

I know for a fact right now they have boxes available at Thappae Gate branch of SCB in Chiang Mai because I was there last week and asked the question.

-

1 hour ago, bamukloy said:

I also cannot understand how people can think buying is a good idea.

One guy says "live there a year or so first", but any idiot can move in anytime and make your life hell or endless issues about living here could arise at any time.

The cost/buying price of my condo represents approx 18 years

worth of rent.

Id be crazy to buy considering i would not want to stay in one place that long and probably wont live that long anyway.

Not to mention, trying to sell in what will always be a saturated market.

Cant imagine wanting the hassle of selling in my 90s anyway id probably just walk away or have to sell at a loss

" will always be a saturated market."

-

2 hours ago, Farang hunter said:

there is no comparison between rent and buying, rent is like bad blood (you keep paying in order to have your own place) whereas buying is a guarantee future property.

yes and there is no comparison between renting and buying when you hear the television next door all the time through the wall and it drives you crazy. When you rent you can simply move out somewhere else

-

4 hours ago, newnative said:

Even at 3 to 5 years I think buying can be an option to consider. If you buy wisely the condo should be worth at least what you paid for it. At the end of the period you have the option of selling it or you could keep it and rent it out. Some large condo projects like Lumpini have on-site rental offices that will handle the rentals for you. The ace in the hole if you decide to keep it is the low monthly condo fees--even if the condo isn't rented all the time it's just costing you peanuts and you have something you own as possibly a retirement pad down the road.

" If you buy wisely the condo should be worth at least what you paid for it"

but you don't have a crystal ball and there is no guarantee of that and not everyone is in the mood to speculate on real estate right now.

If property values can decline in a place like Singapore (a regional financial hub) which has a much more diverse group of people looking to rent why can't it happen anywhere else including Thailand?just wait and see what happens to the market when the rent guarantees all run out

Singapore Home Prices Slide by Most in More Than Seven Years

-

40 minutes ago, NormanW said:

Needed opening yesterday. Gridlocked due to the long weekend traffic chaos.

Again the coaches reducing the roads from 4 to 2 lanes and at some junctions where there was traffic lights utter standstill due to people jumping the lights with nowhere to go.

Top tourist destination!!

I have never seen it as bad as it was yesterday ever before.Bali Hai Pier was organised chaos and the traffic jam started at the beginning of Walking Street

-

I noticed there are many pages of information but in Thai posted on the entrance door of the small office / marketing building next to the development and it looks as though the office building itself ihas been closed.

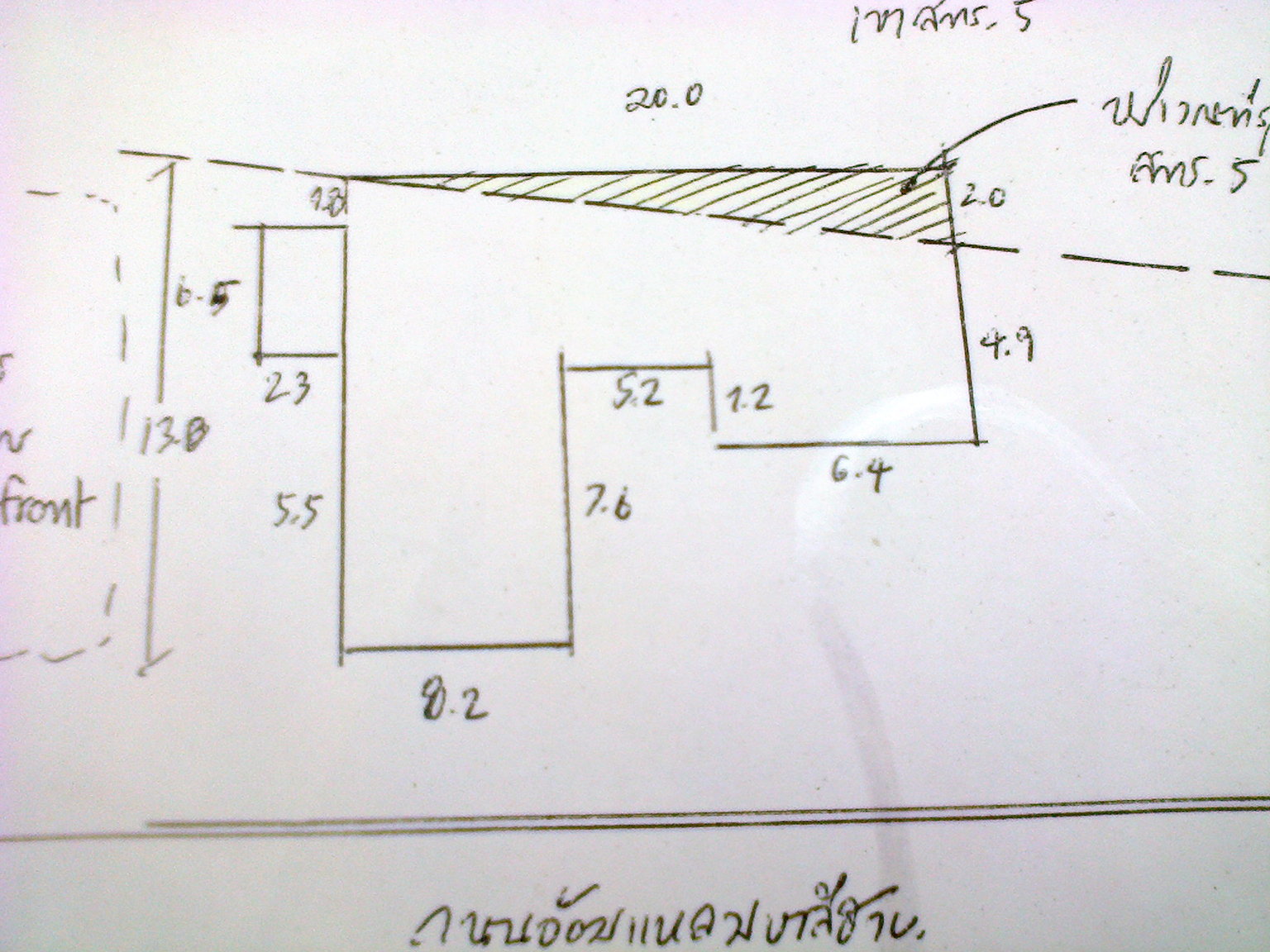

There is also this sketch plan. What this is the shaded part? does this mean the office building has also encroached onto public land?

-

10 minutes ago, JSixpack said:

Only when it's directly relevant.

directly relevant.

Quote

QuoteNew technologies like robotics, 3D printing and cloud will take jobs from low-skilled workers in developing Asian countries, according to a new study by the Asian Development Bank.

In South East Asia, Thailand will suffer the most with about 26% of currently stable jobs at high risk of being lost to technology

https://govinsider.asia/innovation/robots-3d-printers-and-cloud-will-take-low-skilled-jobs-says-adb/

-

2 minutes ago, JSixpack said:

Still not aware you're in Thailand I see.

you still have a chronic inability to extrapolate I see

-

2 hours ago, pentap said:

Not surprising at all.

Thai tourism is increasing...

Thai economy is growing...

Future economic forecast looks positive...

Was that not the recent reports, over the past few weeks?

Maybe I'm in the wrong place?

It's no wonder debt is increasing. It takes a glance to see the true state of affairs and not much grey matter to work it out that people need money plus employment with decent salaries.

Sent from my iPad using Thaivisa Connect" that people need money plus employment with decent salaries. "

but the trend for that doesn't look too good

Chinese firm halves worker costs by hiring army of robots to sort out 200,000 packages a day

QuoteAn STO Express spokesman told the South China Morning Post on Monday that the robots had helped the company save half the costs it typically required to use human workers.

They also improved efficiency by around 30 per cent and maximised sorting accuracy, he said.

“We use these robots in two of our centres in Hangzhou right now,” the spokesman said. “We want to start using these across the country, especially in our bigger centres.”

-

24 minutes ago, pentap said:

Not surprising at all.

Thai tourism is increasing...

Thai economy is growing...

Future economic forecast looks positive...

Was that not the recent reports, over the past few weeks?

Maybe I'm in the wrong place?

It's no wonder debt is increasing. It takes a glance to see the true state of affairs and not much grey matter to work it out that people need money plus employment with decent salaries.

Sent from my iPad using Thaivisa Connect" Future economic forecast looks positive..."

the General's might like everyone to believe that but the World Bank and IMF certainly don't believe it

-

2 hours ago, elgordo38 said:

???????????????? really. An increase in consumer debt indicates confidence??

they felt confident so they went out and bought more durable goods, such as cars, motorcycles, and homes which resulted in consumer debt increasing further. But it doesn't say anything about when those durable goods wear out and will need replacing. Like hamsters on a wheel.

-

42 minutes ago, Farang hunter said:

ok I will sell this condo but how can I test sound proof wall before I buy another one?

simply engage the services of an acoustics engineer before you buy

http://www.bangkok-noisecontrol.com/noise_control_consulting.php

-

3 hours ago, JSixpack said:

Another rational post! :) My experience with ownership has been positive. I rented a couple of years in my building before I bought. Got all my stuff here, got it fixed up as I like it. Very quiet & safe w/ double-glazed balcony windows & airtight bombproof security door (highly recommend http://www.scorpiondoors.com/). And, contrary our Glutters' predictions, my place has doubled in value since I bought it; I've even have had an unsolicited offer to sell. But I bought to live in long-term, not as an investment, and have no desire to move or leave our beloved cesspool. Ownership is never perfect but guess I'm man enough to deal with problems and overcome or work around them.

I don't talk up real estate here but would be in fact be glad of a CONDO CRASH as I'd buy another unit or two. My issue w/ the Glutters & doomsters is simply all the hot air, fallacious and tendentious arguments, silliness, ignorance, BS, and rationalizations. Makes for much amusement. Remember, it was I who codified the shrewd, street-smart TVF Poster Three Primal Laws Of Survival In Thailand. :)

" would be in fact be glad of a CONDO CRASH as I'd buy another unit or two "

maybe you will get your wish sooner than you think

-

1

1

-

-

5 hours ago, thaibeachlovers said:

Nothing "fallacy" about wives kicking husbands out, etc, and there was that long thread about a Phuket guy that was taken by the lawyer, and thought he could use the "law" to regain his property.

The only way to be 100% certain a Thai wife will not one day decide to take the husband's money, property etc is never to get married, and if determined to marry, to not "invest" more than one can walk away from.

As for karaokes, we had one over the swamp that went on and on and on. Luckily the bedroom was on the other side of the house.

" that long thread about a Phuket guy that was taken by the lawyer, and thought he could use the "law" to regain his property."

and it doesn't even end there(and in fact there are two different foreigners with their own different stories) because they are effectively prisoners in Thailand with their passports having been taken from them just for trying to fight fraud and to get their properties back!

Any potential investor in property in Thailand should read the following full transcript of a documentary the BBC prepared where they interviewed these guys.if this doesn't put you off nothing will.

QuoteI asked him what he would say to those considering retiring and buying property in Phuket.

"Don't. Don't come here. The system of law is nowhere near as strong as you think it is going to be, there is no protection for you, and there are gangs of people victimising you. The lawyers have very little in the way of ethics or professionalism." -

23 hours ago, galt67 said:

Why? will this supposed 'crash' happen...?

Simple 'oversupply' is NOT the answer in Pattaya where the majority (most?) of the residential properties are owned 'mortgage/debt' free.

Having lived in cities with (and read about) other 'property crashes' going back to the 1920s the common element is 'leverage' (mortgages/debt) which is NOT the case in Pattaya.

Bottom line: What's going to 'force' multitudes of property owners to 'suddenly' sell?

You say you have lived in cities that have experienced property crashes. Were those cities commercial centres with a sizeable foreign working population who can afford the higher rents or were they just a holiday resort like Pattaya?if so can you actually name them?

And when you ask “What's going to 'force' multitudes of property owners to 'suddenly' sell? “

Here is one example of that scenario in a city which has considerably better rental demographics than Pattaya from young working foreigners

QuoteA condo oversupply red flag for investors exists when unit sales prices are growing faster than the money flows and returns on investment that underpin those units’ values. This uncertainty around secondary markets for the large new supply of condos set for release is worrying some investors.

Many condo developments are offering a guaranteed rental return for a period of time. The lower end of these returns represents 6-7% per year, and some are as high as 20%. These returns are generally guaranteed for 3 years by the developer – meaning, regardless of whether or not the property is rented, the developer is obliged to pay the returns to the buyer.

When the guaranteed rental yields for the incoming glut of condos expire, owners might decide to sell, having found that tenants are in-fact unavailable given the huge supply at the time available in the market. This lack of rental income could lead to buyers forfeiting mortgage repayments with no option but to sell the units.

The concern is that if too many of these guaranteed rental periods expire in the same period of time, as they appear ( given that the majority of units will be released into the market between 2018-2020 ), this could result in a fall in condo prices as the market is flooded with resales.

http://realestate.com.kh/news/condo-oversupply-concerns-what-investors-need-to-know/

-

2

2

-

-

5 minutes ago, JSixpack said:

It's too late, even were it possible . . . and would spoil so much fun. :) It's been tried before with no success.

like biting into cotton candy.......................

-

3 minutes ago, JSixpack said:

Which in turn leads to cause for concern among your disciples that you're basing your ace Pattaya property market forecasts on such figures without actually knowing what the figures represente.

no I'm also carefully looking at what is happening simultaneously in adjoining countries such as Cambodia, Vietnam, Malaysia, Indonesia, Taiwan, South Korea and Singapore (where prices have actually fallen quite noticeably)where there are also huge oversupply problems.

-

33 minutes ago, Pattaya46 said:

You fully distorted the article.

It was an article from the 14 Nov 2016 on the property.bangkokpost.com, so I can't put the link here but Google will help you if you search for "Excess supply, tepid demand dent sales in Pattaya"

- The 17'000 number was about the number of units "available" including all projects "launched", even if nothing has been build yet, and thousands in this case...

- Excluding the "projects" and the 5'000 units under construction, there would be less than 10'000 units really available to buy

- The article also said that "the total number of condo units in Pattaya was 70'577" so I really doubt that 60'000 could be available or Pattaya would be in serious trouble

No the figures were taken directly from the reports of the two property consulting companies.

But the very fact there is such a huge disparity and that the methodology and indeed what each set of figures clearly represents is cause for concern in itself.

-

49 minutes ago, JSixpack said:

Or there might not be a sudden uptick in values, if that is someone's definition of boom. Instead prices might increase slowly over a long period of time so that the benefit owning any asset under those conditions would be unquantifiable as there would be no way of knowing where is the top.

As according to you I don’t know much about the market can you please help me understand exactly which economic fundamentals right now would contribute to conditions that would result in result in continued slow price increases over a long period of time? I’m really looking forward to being educated by you on this matter.

and I previously posted a number of links showing this same phenomenon is happening in a number of countries neighbouring Thailand.

Bottom line is should we ignore the warnings issued by the likes of the Organisation for Economic Co-operation and Development (OECD).?

Fears of a 'massive' global property price fall amid 'dangerous' conditions and market slow-down

-

40 minutes ago, JSixpack said:

But as you're not an investor and don't know much about the market, then let's let the real investors decide for themselves, as they know their own tolerance for risk. If you can't tolerate any, then just stuff your cash under your mattress, man. Who cares?

No, that "we" was a little too subtle for you. That assumed the consensus viewpoint of our ace TVF economists and their large contingent of renters. Yes, that's exactly the view propounded in all the CONDO GLUT threads for the last decade or more. Now it's easy to feel there's a condo glut, and I have myself since the Russian market fell, but then as I noted earlier, adjustments take place. Now the Russians are coming back, more Chinese are buying, and one report noted developers were going to hold back a bit in Pattaya. If they do then the uptake should dry up the excess if there really is any, but the implication is then that prices won't fall.

Addressed above.

1. Yes, or last, but before putting down the money. 2. Not necessarily, and depends on resources available, as KittenKong explained for you earlier. Simple-mindedness, timidity, tea leave reading, and mistaking one's own ignorance for expertise means inevitably missing out and later complaining about bar fines and prices of rooms over on Soi Buakhao and dreaming that a Condo Crash will lead to the opportunity buy a cheap penthouse Just Any Day Now.

In your first sentence you declared I am not an investor so obviously I’m not talking about myself and yes indeed let other investors decide regarding their own risk profile themselves. But where is the evidence that there has been any dramatic change to the oversupply figures published by two leading property consulting companies ? so that would suggest that such other investors are erring on the risk averse side also at the moment.

-

14 minutes ago, scubascuba3 said:

Crashes do happen, remember in 1997 baht went from 37 to 90 to the pound.

My feeling about property in Pattaya is its on the way down if people want to sell. If you want to sit on it for years don't drop the price. I doubt people are buying for an investment anymoreindeed there might not be a sudden drop in values if that is someone's definition of a crash. Instead prices might decrease slowly over a long period of time but I still see no benefit owning any asset under those conditions particularly when there would be no way of knowing where is the bottom.

-

44 minutes ago, JSixpack said:

Yep, still waitin' for the great currency crash as predicted in 1973 by the great currency guru, Dr. Franz Pick, based on thorough research. This will be a wonderful time for those holding baht and assets in baht, which suggests one should buy Thai real estate ASAP. It's gotta happen sometime, right? You gonna trust Dr. Pick or an ace TVF economist (excluding member midas, who's still with Dr. PIck)?

No doubt Dr. Pick made a fortune from his scaremongering, even had his own publishing company to churn it out. Similarly our old keyboard warriors get a lot of cred from the peanut gallery for discovering some empty shop houses or abandoned projects (which have always existed in Pattaya), surfing the internet for global doom signals (never lacking), knockin' back a few Changs and pecking out their Pattaya Perpetual Death Spiral prognostications, comforting room renters and giving themselves an illusory sense of expertise & importance. And waiting in gleeful anticipation of that golden "I told you so" moment, which may come in the next 20 years, hopefully before Wat Chai receives their old carcasses anyway.

In the meantime, if you've got the dosh, are going to live here long term, maybe permanently, and want to enjoy having your own place, then, after due diligence, any time's a good time to buy.

If you're a speculator, you've got the dosh and know the risks. If you're an idiot, then nothing's going to protect you anyway.

If you're a speculator, you've got the dosh and know the risks. If you're an idiot, then nothing's going to protect you anyway.

These were your own infamous words some time ago in a different thread but regarding the same subject

“ we don't actually know how many unsold condos there are, we know there're too many for what we've determined as optimal “

hardly a great recipe for prudent “investing “ is it?

the best we can estimate is 17,000 condominiums as being available which was quoted in a research report by Colliers International. and at worst 60,000 was quoted by Knight Frank in their research report .

Quite simply many people right now might consider the reward isn’t worth the risk to buy property i.e do nothing and rent and simply wait on the sidelines until there are far more signs of political and economic stability in Thailand. And what’s wrong with that?

Rational individuals always consider their potential downside first. Fear of loss should be far greater than the fear of missing out.

-

1

1

-

Renting a bank safe deposit box?

in Jobs, Economy, Banking, Business, Investments

Posted

only the deposit amount which was peanuts-about 3500 baht. You are not liable for any further amount than that