Thailand J

-

Posts

1,449 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Posts posted by Thailand J

-

-

On 2/10/2024 at 12:39 PM, Kwaibill said:

Clear to where? I need to deposit the funds to my BKK account, not having access to any fungible accounts in the U.S.

Wire from Schwab to BKK, or use the Schwab ATM card.

-

-

10 minutes ago, Dante99 said:

now all you have to do is get us all Schwab accounts too

I believe I can also deposit US checks on Interactive Brokers app but I haven't try.

Schwab and Interactive Brokers will accept your Thai address and phone number to open a new account.

-

1

1

-

-

To deposit a US check, I open the Schwab app on my phone linked to my US brokerage account.

Enter amount of the check.

Take a pic of the front and back of the US check.Submit.

Done.

Check will clear in one or two days.

-

1

1

-

1

1

-

-

-

1 hour ago, GypsyT said:

If Jomtien office;

Skip "asking".

It take just a little more time to get paper TM30 -:)

That way no worries and stress getting extensions. Specially when they give them "1-2 days prior to expiration date".

It was simple and fast since I had reported TM30 online. Wiith the online reporting screenshot printout, no copies of prove of address documents were required since I had uploaded them online. The worst part was the line getting the queue number, depending on your luck.

-

TM30 or not ? the best place to ask is your immigration office. While we all know the rules the enforcement varies. I was required to get a new TM30 receipt in Jomtein for going out side of Thailand and returned to the same house with re entry permit.

-

1

1

-

-

My post was to point out Thai tax code section 42 (10) or (12) , inherited fund is easy to prove, and how to maintain a Roth account in US . I was hoping it may be helpful.

-

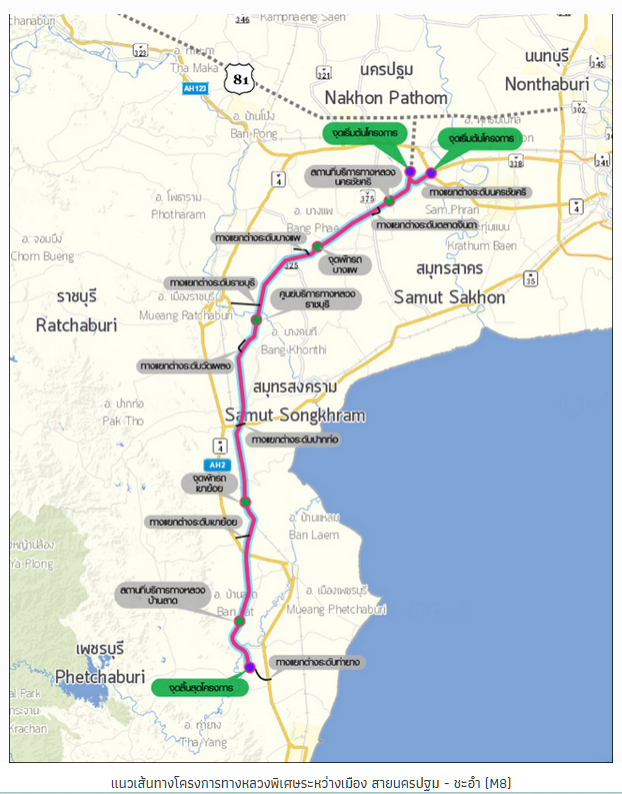

just I googled "M8 motorway Thailand" :

http://www.doh-motorway.com/motorway-project/southern-route/m8/

-

On 12/2/2023 at 8:27 AM, mudcat said:

A few notes about ROTH inheritance; the account can be 'assumed' by your wife but she also is subject to the same conditions as any ROTH holder including penalties (especially withdrawals before 59 1/2-years old). My recommendation to my wife who is already here in Thailand is to cash out the ROTH and transfer the balance to her U.S. checking account and wire most or all of it to her accounts in Thailand

Looking at Thai Tax Code Section 42 (10) and (12), inherited income should be tax free here. She will need to show that the money originated from inherited ROTH. I don't know about joint ROTH accounts but if it is your individual ROTH, the account name will change to " Inherited ROTH" once she inherited it from you, and the statements will show " inherited ROTH", so it's not difficult for her to show it's inherited.

If she would like to keep the inherited ROTH in US but worries about the bank may close her account for not having a US address, consider Schwab or Interactive Brokers brokerage accounts which accept Thai addresses.

-

1

1

-

-

baking soda.

Vinegar.

Bar Keeper's Friend. Oxalic acid in powder form order online if you know how to use it, it's what you find in Bar Keeper's Friend.

-

4 hours ago, Pib said:

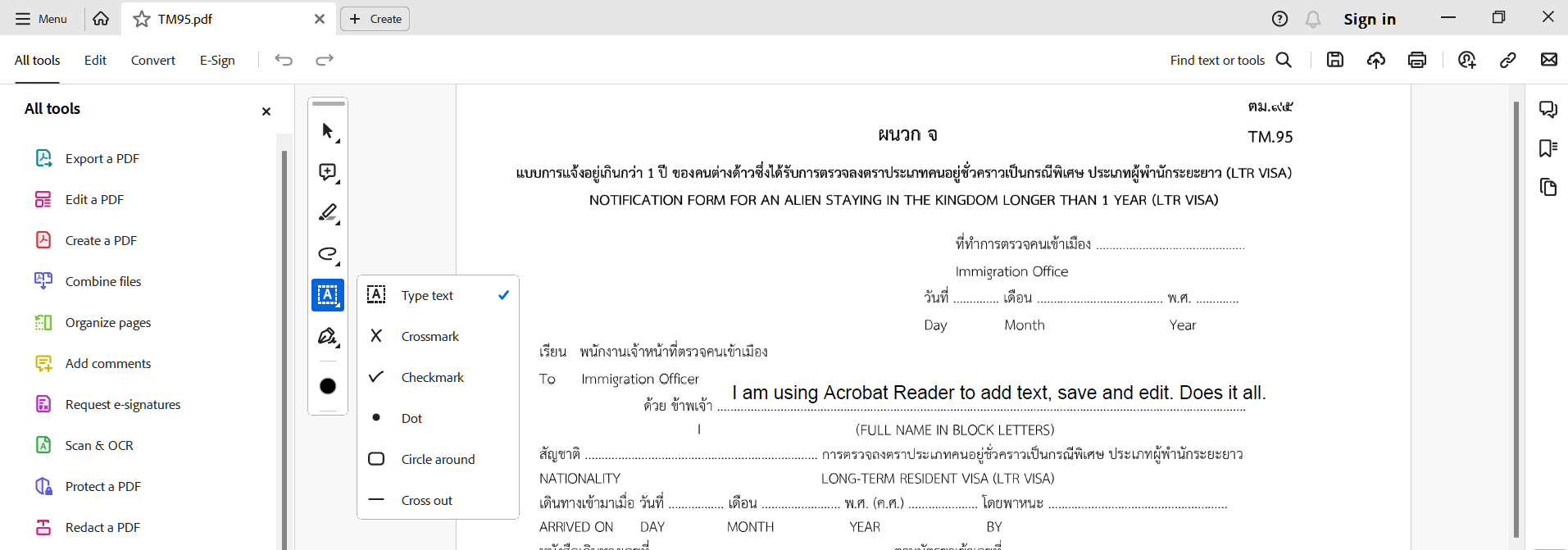

That's the very same free Adobe Reader version I have but when opening the TM95 (attached) it is not fillerable

I have downloaded your file and with the same setting it is fillable, do you get the tool bar as I do? by the way I am on win 11 if it matters.

I did not have to register to download Nitro 5, I don't remember from which website, I am using Acrobat Readers mostly for obvious reason.

-

1

1

-

-

-

17 hours ago, oldcpu said:

I hope you are correct ... but I am not yet certain this will be the case.

The RD 743 is clear the LTR foreign income is non-taxable (for LTR visa holders), but it is not clear from what I can read that income tax returns are not required. If it specifically states exempt from 'income tax returns' (and not just 'income tax') I would like to read such as I must have missed such clear statement (and I looked). I am not keen on submitting more income tax returns than I have to so I would like to read such.

There are countries in the world (Canada for example) which want all INCOME reported and not just income that is clearly not-taxable. The revenue department of Canada likes to make their own judgement on such matters on a case by case basis.

Will this be the case for Thailand? I don't know. I hope not and I hope you are correct, but when I read the translations of the Royal Decree and the relevant Thai tax chapters, at best I can say is that it is ambiguous.

Again - I would like to be proven wrong and have a clear statement from authorities that no tax return is required.

Tax code may have some clue but Tax form is what you should look at to answer your question do you need to fill tax return with only one type of income. If you have not look at Thai tax forms it's time you do. You won't find any section or any line to report non-taxable income, the like kind as those in Section 42. Top of form PND 91 clearly stated section 40 income only. Every section on tax form PND 90 is clearly under subtitle correspond to 8 parts of section 40. Would you submit a blank tax form with your personal data and signature?

The threshold of 60,000B or 120,000B income to file tax return is also section 40 income, it cannot be exempted income, again, where do you enter the 60,000B/120.000B exempted income on the tax form?

Also my opinion :)

-

1

1

-

-

15 hours ago, Pib said:

The real issue is what people want is a fillerable TM95 from the get-go....can fill it in right using a free PDF reader like free Adobe Reader that probably most ever person who uses a computer has on their computer.

If some one could convert the non-fillerable TM95 to a fillerable TM95 that would work on free Adobe Reader that would be great.

Is the whatever software you use free to download....what it is it?

-

-

3 hours ago, oldcpu said:

However the RD743 notes the LTR foreigner is exempt to pay "income tax" under "Section 5 - Part 2 of Chapter 3 of the Revenue Code". It does not say "income tax return" is exempt.

"Section 42 The assessable income of the following categories shall be exempt for the purpose of income tax calculation:"

SEction 42 is a list of nontaxable income, do not have to be reported.

Section 5 of RD 743 exempts foreign income earned in the previous year and remitted into Thailand.

This foreign income became non-taxable income,the same as those listed in section 42 , in Part ii of Chapter 3 of the Revenue Code.

None of these non-taxable income needed to be included in your tax return if you had to file one for whatever reason. There is no line on tax form 90 or 91 for these non-taxable incomes and it's not correct to add them to taxable income.

My opinion.

-

I knew my monthly payment when I sign in to My SS account and downloaded the letter in late Nov 2023. My January payment already shows COLA.

-

1

1

-

-

7 hours ago, oldcpu said:

" In order to be granted exemption under paragraph one and two, the foreigner shall file a tax return reporting assessable income which is exempted from having to be included in computation of income tax. "

Does that refer to an LTR-WP ? I would like to think not, but the translation to English language is not clear to me.

paragraph one and two of Section 4 RD 743 do not apply to my foreign income . There is no requirement to file income tax on my foreign income exempted by Section 5 RD 743.

-

-

https://maps.app.goo.gl/TPCBTn9y8YYqeH3A8 RS Terminal is behind PP Autosport. Insurance paid for the job and increased the premium, the reason why I changed insurance company, and pay out of pocket for small jobs.

Been here many times, Mongkol Jaroenyont Garage, cheap and good work. https://maps.app.goo.gl/9n4d3TYMbFcfC3nE8

G Car is a big shop but will take small jobs. https://maps.app.goo.gl/pi7Ygsjz5quRaSdH7

My car was here for 3 months after a serious accident, drives like new after the repair, don't know if they accept small jobs : Ch P Garage https://maps.app.goo.gl/rSeUfkQacMyG275M8

-

2

2

-

-

https://yardeni.com/charts/presidential-cycles/

Since 1929, 3rd yr of the presidency terms were the best for stock market, average 14% gain. Whatever that means.

-

-

- Popular Post

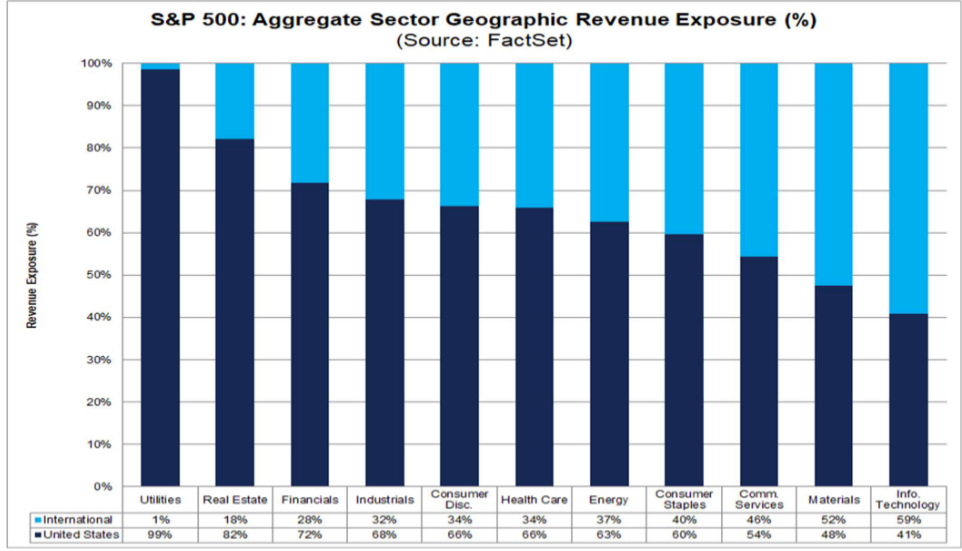

The Investing Year Ahead

in Jobs, Economy, Banking, Business, Investments

Posted

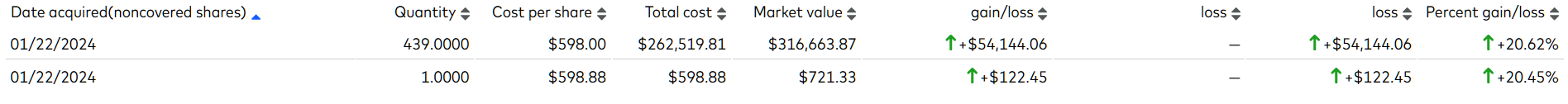

My best performing investment in in MSFT, up 400% in about 9 years.